Mexico Ice Cream Market Size, Share, Trends and Forecast by Flavor, Category, Product, Distribution Channel, and Region, 2026-2034

Mexico Ice Cream Market Summary:

The Mexico ice cream market size was valued at USD 1.1 Billion in 2025 and is projected to reach USD 1.4 Billion by 2034, growing at a compound annual growth rate of 2.65% from 2026-2034.

The market is driven by rising disposable incomes, increasing urbanization, and growing consumer preference for indulgent dessert options among the Mexican population. Expanding retail infrastructure, evolving flavor innovations, and the influence of Western consumption patterns further accelerate demand. Additionally, the warm tropical climate sustains year-round consumption, while premiumization trends encourage product diversification across various consumer segments, contributing to the expanding Mexico ice cream market share.

Key Takeaways and Insights:

- By Flavor: Chocolate dominates the market with a share of 31.08% in 2025, driven by strong cultural associations with traditional Mexican cocoa beverages and extensive product innovation combining chocolate with local ingredients.

- By Category: Impulse ice cream leads the market with a share of 59.65% in 2025, owing to widespread availability at convenience stores, affordable pricing appealing to spontaneous purchases, and on-the-go consumption patterns.

- By Product: Cup represents the largest segment with a market share of 25.89% in 2025, driven by portion-controlled servings offering individual convenience, family-friendly packaging options, and ability to incorporate multiple flavors and toppings.

- By Distribution Channel: Ice cream parlors dominate the market with a share of 39.02% in 2025, owing to experiential shopping environments, the strong tradition of paleterías in Mexican culture, and preference for freshly prepared artisanal products.

- By Region: Northern Mexico leads the market with a share of 33% in 2025, driven by higher per capita income in industrial cities, extreme summer temperatures driving demand, and well-developed retail infrastructure.

- Key Players: The Mexico ice cream market exhibits a moderately consolidated competitive landscape, with established multinational corporations competing alongside regional artisanal producers and traditional paleterías across premium, mid-range, and value segments, fostering continuous innovation and market expansion.

The Mexico ice cream market is experiencing robust growth propelled by several interconnected factors that collectively enhance consumer demand across diverse segments. Rising disposable incomes among the expanding middle class have enabled increased spending on premium frozen desserts and innovative flavor combinations that cater to evolving taste preferences. The country's predominantly warm climate creates sustained year-round consumption patterns, unlike seasonal markets in temperate regions where demand fluctuates significantly. Rapid urbanization has facilitated the proliferation of modern retail channels, including supermarkets, convenience stores, and specialty ice cream parlors, improving product accessibility nationwide. According to reports, in 2025, Grupo Herdez completed the spin-off of Grupo Nutrisa, which debuted on the Mexican Stock Exchange with 663 stores, marking a structural shift in Mexico’s organized ice cream retail landscape. Additionally, changing lifestyles and the influence of global food trends have encouraged Mexican consumers to explore novel flavors, healthier alternatives, and premium artisanal offerings.

Mexico Ice Cream Market Trends:

Growing Demand for Artisanal and Premium Offerings

The Mexico ice cream market is witnessing a pronounced shift toward artisanal and premium products as consumers increasingly prioritize quality over quantity. This trend reflects a broader movement toward authentic, locally sourced ingredients and traditional preparation methods honoring Mexican culinary heritage. Artisanal producers are capitalizing on this preference by incorporating regional fruits, indigenous flavors like mamey and guanabana, and traditional recipes passed through generations. As per sources, Nutrisa and Moyo launched innovative seasonal flavors like grapefruit and rosemary‑pineapple ice creams across Mexico, reflecting premium handcrafted product demand and expanding artisanal offerings nationwide.

Expansion of Healthier and Functional Ice Cream Variants

Health consciousness among Mexican consumers is reshaping product development strategies within the ice cream industry, driving manufacturers to introduce healthier alternatives maintaining indulgent taste profiles. In April 2025, Profeco tested 27 packaged ice creams in Mexico, highlighting brands like HOLANDA Cremissimo and AMOR COKETO with the lowest sugar content, reflecting rising consumer demand for healthier options. Furthermore, plant-based ice creams utilizing coconut, almond, and oat milk bases are gaining traction among younger demographics seeking sustainable consumption choices. Additionally, functional ice creams fortified with protein and probiotics are emerging as popular choices among fitness enthusiasts seeking guilt-free indulgence.

Integration of Mexican Cultural Flavors and Traditional Ingredients

The ice cream market is experiencing a cultural renaissance as manufacturers and artisanal producers increasingly incorporate distinctively Mexican flavors and traditional ingredients into their product portfolios. In May 2025, Braum’s introduced six Mexican-inspired ice cream flavors, including mango con chamoy and sopapilla cheesecake, reflecting growing consumer interest in traditional, culturally authentic frozen desserts. Moreover, this trend celebrates the country's rich culinary heritage through ice cream variants featuring tamarind, chamoy, mango with chili, cajeta, and other iconic flavors resonating with local palates. Seasonal offerings during festivals like Día de los Muertos demonstrate the industry's cultural integration.

Market Outlook 2026-2034:

The Mexico ice cream market is poised for sustained revenue growth throughout the forecast period, supported by favorable demographic dynamics and evolving consumer preferences. The expanding middle-class population with increasing purchasing power will continue driving demand for premium and innovative frozen dessert options. Strategic investments in cold chain infrastructure and retail expansion will enhance product accessibility across underserved regions. The market revenue trajectory will benefit from continued premiumization, healthier product innovations, and digital commerce platforms facilitating home delivery services, while the warm climate sustains baseline consumption levels. The market generated a revenue of USD 1.1 Billion in 2025 and is projected to reach a revenue of USD 1.4 Billion by 2034, growing at a compound annual growth rate of 2.65% from 2026-2034.

Mexico Ice Cream Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Flavor | Chocolate | 31.08% |

| Category | Impulse Ice Cream | 59.65% |

| Product | Cup | 25.89% |

| Distribution Channel | Ice Cream Parlors | 39.02% |

| Region | Northern Mexico | 33% |

Flavor Insights:

To get detailed segment analysis of this market Request Sample

- Vanilla

- Chocolate

- Fruit

- Others

Chocolate dominates with a market share of 31.08% of the total Mexico ice cream market in 2025.

Chocolate commands the leading position in the Mexico ice cream market, reflecting the deep cultural affinity Mexican consumers have with cocoa-based products. Mexico's historical significance as the birthplace of chocolate cultivation creates a strong emotional and cultural connection with chocolate-flavored desserts. In July 2024, Magnum® launched a limited-edition Chocolate with Chili ice cream in Mexico, combining local cocoa and chili flavors to celebrate Mexican heritage, available nationwide in stores and convenience outlets. Manufacturers offer dark, milk, and spiced Mexican chocolate variants, blending tradition with modern flavors to appeal across all consumer demographics.

The dominance is further reinforced by continuous product innovation incorporating popular confectionery elements such as brownies, chocolate chips, and caramel swirls. The versatility of chocolate as a base flavor enables manufacturers to create sophisticated taste profiles appealing across age groups, from children seeking classic cocoa experiences to adults preferring premium dark chocolate variants with bitter notes. This adaptability ensures chocolate remains the preferred choice for both everyday indulgence and special occasion celebrations throughout Mexico.

Category Insights:

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

Impulse ice cream leads with a share of 59.65% of the total Mexico ice cream market in 2025.

Impulse ice cream maintains dominance in the Mexico ice cream market, driven by the extensive network of convenience stores, street vendors, and informal retail channels characterizing Mexican consumer culture. Single-serve products including ice cream bars, cones, and cups positioned at checkout counters and freezer displays capitalize on spontaneous purchase decisions influenced by immediate consumption desires. Affordable price points accessible to diverse income groups further strengthen this category's appeal among consumers seeking refreshing treats during daily activities.

The category benefits from Mexico's warm climate encouraging on-the-go consumption patterns and the cultural tradition of street food purchases prevalent throughout the country. Manufacturers continuously refresh product portfolios with limited-edition flavors, licensed character packaging appealing to children, and innovative formats designed to create excitement and encourage trial purchases. This dynamic approach to product development ensures sustained consumer interest while capturing spontaneous buying behavior among younger demographics seeking immediate refreshment options.

Product Insights:

- Cup

- Stick

- Cone

- Brick

- Tub

- Others

Cup exhibits a clear dominance with a 25.89% share of the total Mexico ice cream market in 2025.

Cup leads product categorization in the Mexico ice cream market, offering consumers portion-controlled servings that balance value, convenience, and consumption flexibility effectively. As per sources in 2025, Mexican ice cream shops increasingly adopted biodegradable paper cups as eco-friendly alternatives, reflecting rising consumer demand for sustainable and responsible packaging. Furthermore, cup products range from single-serve individual portions to larger family-size containers enabling shared consumption experiences during gatherings and celebrations. The versatile cup format suits quick individual treats or elaborate desserts, fitting diverse social occasions and personal indulgence throughout daily routines.

These cups particularly resonate with health-conscious consumers seeking controlled portions and the ability to combine multiple flavors or add toppings without mess or waste concerns. The format supports premium positioning through sophisticated packaging designs and incorporation of layered ingredients including fruit compotes, cookie pieces, and sauce ribbons creating visual appeal. These enhanced textural experiences throughout consumption attract discerning customers willing to pay higher prices for superior quality and presentation standards.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Ice Cream Parlors

- Online Stores

- Others

Ice cream parlors lead with a market share of 39.02% of the total Mexico ice cream market in 2025.

Ice cream parlors represent the dominant distribution channel in the Mexico ice cream market, reflecting the enduring cultural significance of paleterías and neverías in Mexican society. These specialized retail establishments offer experiential shopping environments where consumers explore diverse flavor options, customize orders with fresh toppings, and enjoy freshly prepared products in social settings. The format supports premium pricing through perceived freshness and artisanal quality that packaged alternatives cannot replicate for discerning customers.

The channel's strength derives from Mexican traditions emphasizing family outings to local ice cream shops and the social dimensions of the frozen dessert consumption. Modern ice cream parlors are evolving beyond traditional formats to incorporate café-style seating, Instagram-worthy presentations, and expanded menus featuring waffles, smoothies, and complementary offerings. These enhancements extend customer dwell time, increase average transaction values, and create memorable experiences that foster brand loyalty and repeat visitation patterns.

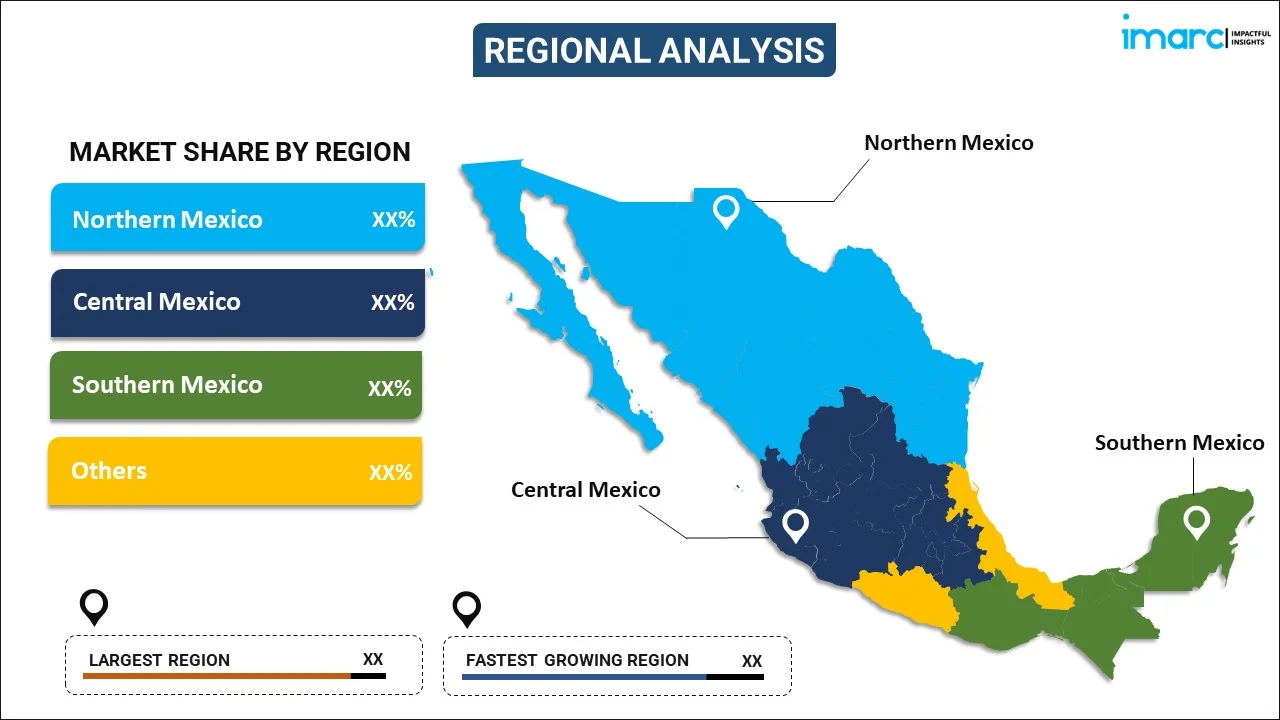

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico dominates with a market share of 33% of the total Mexico ice cream market in 2025.

Northern Mexico commands the largest regional share in the ice cream market, driven by several economic and climatic factors collectively enhancing consumption intensity. The region's industrial development, particularly in cities like Monterrey, Tijuana, and Ciudad Juárez, has created substantial middle-class populations with higher discretionary spending capacity. Proximity to the United States border influences consumption patterns toward premium products and international flavor preferences, encouraging manufacturers to introduce sophisticated offerings targeting affluent consumers.

The region's extreme summer temperatures create an intense seasonal demand peaks while maintaining a substantial baseline consumption throughout the year in urban centers. Well-developed retail infrastructure including modern supermarket chains, convenience store networks, and specialty ice cream parlors ensures comprehensive product availability across urban, suburban, and semi-urban markets. This accessibility combined with higher purchasing power positions Northern Mexico as the primary revenue contributor within the national ice cream market landscape.

Market Dynamics:

Growth Drivers:

Why is the Mexico Ice Cream Market Growing?

Rising Disposable Income and Middle-Class Expansion

The sustained expansion of Mexico's middle class represents a fundamental driver propelling ice cream market growth across value and premium segments. Economic development has progressively elevated household income levels, enabling consumers to allocate greater portions of their budgets toward discretionary food purchases including frozen desserts. According to sources, in 2024, Mexico imported over $70 Million of frozen desserts, with rising disposable income and demand for premium and artisanal ice creams boosting opportunities for international dairy suppliers. Moreover, this income growth has particularly benefited the premium ice cream segment as consumers increasingly seek quality ingredients, innovative flavors, and superior taste experiences.

Warm Climate Sustaining Year-Round Consumption

Mexico's predominantly tropical and subtropical climate creates uniquely favorable conditions for sustained ice cream consumption throughout the calendar year, distinguishing the market from seasonal patterns observed in temperate regions. The consistent warmth across most Mexican states maintains baseline demand levels even during winter months while creating intense consumption peaks during summer periods. According to reports, in 2025, Tulum ice cream shops reported a 20 and 30 percent sales increase during intense heat above 39 °C, showing how Mexico’s warm climate fuels year‑round ice cream demand. Furthermore, this climatic advantage enables manufacturers to maintain consistent production schedules and distribution logistics without dramatic seasonal fluctuations.

Expanding Modern Retail Infrastructure

The proliferation of modern retail formats across Mexico has significantly enhanced ice cream accessibility and visibility, driving consumption growth through improved distribution reach and shopping convenience. Supermarkets, hypermarkets, and convenience store chains have expanded their frozen dessert sections, offering consumers diverse product selections ranging from economy brands to premium artisanal options. In October 2025, Häagen-Dazs entered Mexico’s ice pop category, representing nearly 30% of the national ice cream market, expanding distribution through supermarkets, convenience stores, Oxxo outlets, and its own artisanal shops. Moreover, this retail evolution has particularly benefited impulse purchases through strategic freezer placement near checkout areas.

Market Restraints:

What Challenges the Mexico Ice Cream Market is Facing?

Seasonal Demand Fluctuations in Certain Regions

Despite Mexico's generally warm climate, certain regions experience seasonal demand variations creating operational challenges for manufacturers. Highland areas and northern border regions encounter cooler winter temperatures temporarily suppressing consumption levels, requiring adjusted inventory management. These fluctuations complicate production planning and cold chain logistics, potentially leading to inventory imbalances during demand troughs.

Health Concerns Regarding Sugar and Fat Content

Growing health awareness among Mexican consumers presents challenges for traditional ice cream products perceived as high in sugar, fat, and calories. Increasing media attention to obesity rates and diabetes prevalence has encouraged some consumers to reduce conventional ice cream consumption. Manufacturers must balance reformulation efforts while maintaining taste profiles satisfying indulgence expectations.

Infrastructure Limitations in Rural Areas

Despite significant retail expansion, rural and remote areas across Mexico continue facing cold chain infrastructure limitations restricting ice cream distribution and consumption growth. Unreliable electricity supply, inadequate refrigerated transportation networks, and limited retail presence in smaller communities constrain market penetration. Addressing these infrastructure gaps requires substantial capital investments beyond commercial prioritization.

Competitive Landscape:

The Mexico ice cream market features a dynamic competitive environment characterized by the coexistence of large multinational corporations, established domestic producers, and numerous regional artisanal operations competing across distinct market segments. Leading players leverage extensive distribution networks, substantial marketing investments, and continuous product innovation to maintain market positions while responding to evolving consumer preferences. The competitive landscape has intensified as manufacturers pursue premiumization strategies, health-focused product development, and authentic Mexican flavor innovations to differentiate offerings. Private label products from major retailers add competitive pressure in value segments while artisanal producers challenge established brands in premium categories through authenticity positioning and local sourcing narratives that resonate with quality-conscious consumers.

Recent Developments:

- In May 2024, The Coca-Cola Company’s Helados Santa Clara revealed plans to expand its Mexican operations from 312 stores to 400 branches, seeking franchisees for investments up to 350 million pesos. The company will open 88 new outlets and introduce lactose-free ice cream products by year-end.

Mexico Ice Cream Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavors Covered | Vanilla, Chocolate, Fruit, Others |

| Categories Covered | Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream |

| Products Covered | Cup, Stick, Cone, Brick, Tub, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico ice cream market size was valued at USD 1.1 Billion in 2025.

The Mexico ice cream market is expected to grow at a compound annual growth rate of 2.65% from 2026-2034 to reach USD 1.4 Billion by 2034.

Chocolate held the largest market share, driven by Mexico's deep cultural connection with cocoa-based products as the birthplace of chocolate cultivation, the versatility of chocolate combinations with local ingredients, and continuous product innovation appealing to diverse consumer preferences across all age groups.

Key factors driving the Mexico ice cream market include rising disposable incomes among the expanding middle class, the country's warm climate sustaining year-round consumption, expanding modern retail infrastructure, premiumization trends, and growing interest in artisanal and culturally authentic flavor offerings.

Major challenges include seasonal demand fluctuations in cooler highland and northern regions, growing health concerns regarding sugar and fat content driving some consumers toward alternatives, cold chain infrastructure limitations in rural areas, competitive pressure from numerous market participants, and rising ingredient costs affecting manufacturer margins.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)