Mexico Hybrid Electric Vehicle Market Size, Share, Trends and Forecast by Propulsion Type, Configuration Type, Vehicle Type, Power Source, and Region, 2025-2033

Mexico Hybrid Electric Vehicle Market Overview:

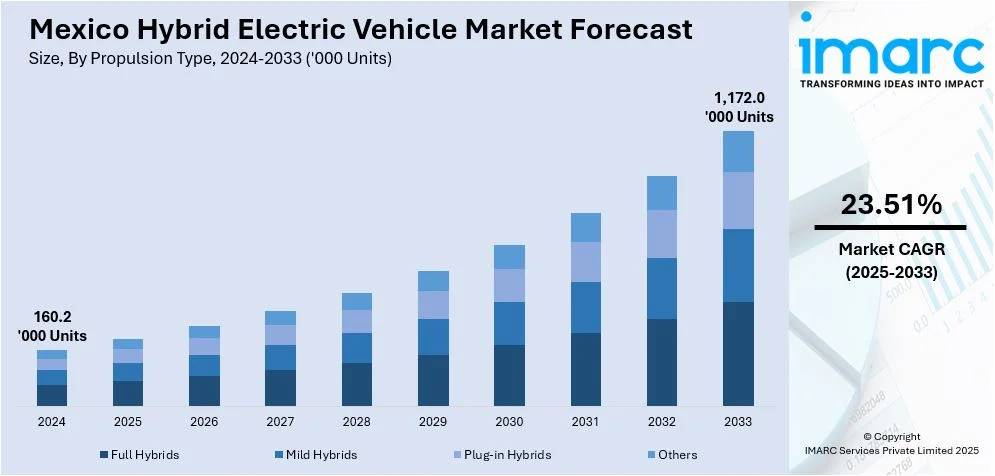

The Mexico hybrid electric vehicle market size reached 160.2 Thousand Units in 2024. Looking forward, IMARC Group expects the market to reach 1,172.0 Thousand Units by 2033, exhibiting a growth rate (CAGR) of 23.51% during 2025-2033. The market is fueled by enhanced capacity for production, favorable policies, and a rising emphasis on fuel efficiency and environmental sustainability, increasing domestic adoption and exports in all vehicle segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 160.2 Thousand Units |

| Market Forecast in 2033 | 1,172.0 Thousand Units |

| Market Growth Rate 2025-2033 | 23.51% |

Mexico Hybrid Electric Vehicle Market Trends:

Growing Urban Demand Driven by Environmental Regulations

Mexico hybrid electric vehicle market share is increasing as urban areas in country see growing demand for hybrid electric cars due to heightened awareness of air quality issues and the tightening of emissions standards. Metropolitan areas like Mexico City have had emissions-based vehicle restriction programs that promote take-up of low-emission options. Hybrid electric vehicles (HEV), providing a compromise between conventional fuel systems and electricity-based propulsion, have been appealing to urban commuters who want fuel efficiency without sacrificing range. Moreover, pollution-reduction government-sponsored inspections and incentive schemes have indirectly propelled this shift in demand. Consumer interest is converging with cars that not only consume less fuel but also with cars meeting evolving urban mobility standards. This trend is indicative of wider initiatives by municipalities to update transportation infrastructure and enhance public health impacts by lowering vehicular emissions. The intersection of policy enforcement and environmental awareness is gradually establishing HEVs as a solution of choice in urban areas.

Shift in Consumer Perception Toward Sustainable Mobility

Mexican consumer behavior is changing in the direction of sustainable transportation, with hybrid electric vehicles (HEVs) becoming recognized as viable and responsible substitutes for traditional automobiles. For example, in July 2024, Toyota manufactured 5,767 Tacoma HEVs in Guanajuato, and GM made 64,555 Chevrolet Blazer EV and Equinox EV units in Coahuila, supporting Mexico's increasing hybrid and electric vehicle manufacturing base. Furthermore, in contrast to electric-only cars, HEVs provide a traditional driving experience with the bonus of fuel efficiency and lower carbon emissions. Educational campaigns and growing media coverage of climate issues have driven purchasing decisions, particularly among youth and urban professionals. This change in perception is further driven by growing availability of HEV models across the different price levels, making broader participation in eco-friendly mobility feasible. The steady uptake of hybrids is no longer confined to the early adopters but is growing into mainstream contemplation. Moreover, increased driving comfort, quiet operation, and perceived cost benefits over the long term have helped transform how consumers make their vehicle choice decisions. This shift in mindset complements a gradual but steady shift towards cleaner transportation practices in the Mexico hybrid electric vehicle market growth.

Expansion of Hybrid-Compatible Infrastructure and Support Services

Mexico's supporting ecosystem for hybrid electric vehicles has broadened in recent years as a reason for increased adoption rates. For example, in November 2023, Geely Auto commenced formal operations Mexico with the launch of Coolray 2024 and Geometry C 2024 SUVs, aiming to set up 100 distributors by 2025 and DHL taking care of auto parts distribution. Furthermore, infrastructure investments by the public and private sectors—e.g., service facilities hybrid technology trained and HEV component retail networks—have improved convenience in owning HEVs. This infrastructure investment, while initially focused on large cities, is intensely reaching secondary cities and regional markets, enhancing access and diminishing maintenance issues for prospective purchasers. Automotive technicians are highly being certified in hybrid systems, and availability of parts has become more reliable, decreasing perceived risks of transition. Whereas charging infrastructure is more vital in the case of all-electric vehicles, hybrids gain from enhanced fuel-efficient driving circumstances and ancillary services such as eco-driving training and niche insurance products. As this ecosystem develops, it is reinforcing customer confidence and building a more stable context for hybrid car adoption, cementing hybrids' position in the nation's mobility transformation.

Mexico Hybrid Electric Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on propulsion type, configuration type, vehicle type, and power source.

Propulsion Type Insights:

- Full Hybrids

- Mild Hybrids

- Plug-in Hybrids

- Others

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes full hybrids, mild hybrids, plug-in hybrids and others.

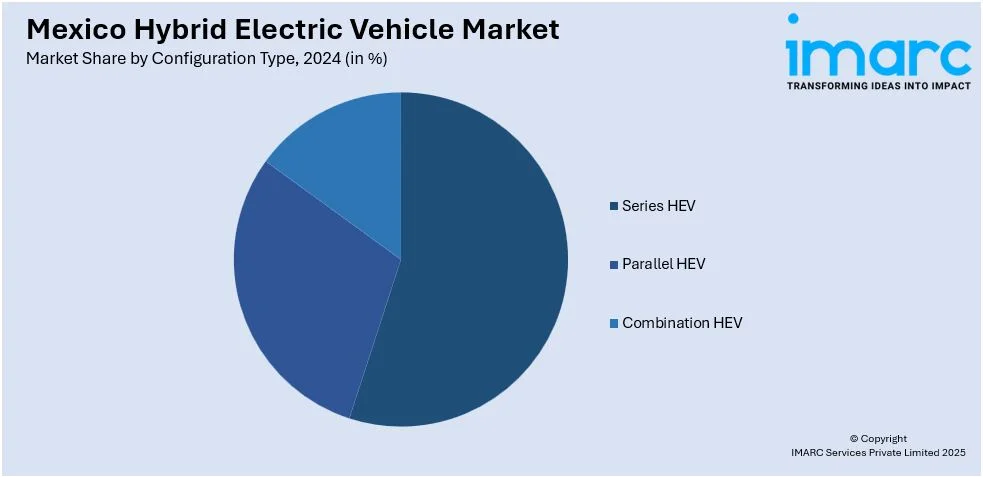

Configuration Type Insights:

- Series HEV

- Parallel HEV

- Combination HEV

A detailed breakup and analysis of the market based on the configuration type have also been provided in the report. This includes series HEV, parallel HEV and combination HEV.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, commercial vehicles, two-wheelers and others.

Power Source Insights:

- Stored Electricity

- On Board Electric Generator

A detailed breakup and analysis of the market based on the power source have also been provided in the report. This includes stored electricity and on board electric generator.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hybrid Electric Vehicle Market News:

- In December 2024, Dongfeng Motor broke into Mexico's hybrid electric car market, launching several HEV models, such as the Huge HEV SUV. The automaker is investing in hybrid technologies to drive Mexico toward fuel-efficient mobility. The expansion is in sync with increasing demand for low-emission vehicles due to tighter environmental regulations.

- In April 2023, MG Motor rolled out its first plug-in hybrid SUV, the eHS, in Mexico. Equipped with a 1.5L turbo engine and an electric motor, it has a power of 280 horsepower and 47.5 km/l efficiency, hoping to sell 1,000 units and capture a 5.5% market share increase by the end of the year.

Mexico Hybrid Electric Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Propulsion Types Covered | Full Hybrids, Mild Hybrids, Plug-In Hybrids, Others |

| Configuration Types Covered | Series HEV, Parallel HEV, Combination HEV |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers, Others |

| Power Sources Covered | Stored Electricity, On Board Electric Generator |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hybrid electric vehicle market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hybrid electric vehicle market on the basis of propulsion type?

- What is the breakup of the Mexico hybrid electric vehicle market on the basis of configuration type?

- What is the breakup of the Mexico hybrid electric vehicle market on the basis of vehicle type?

- What is the breakup of the Mexico hybrid electric vehicle market on the basis of power source?

- What is the breakup of the Mexico hybrid electric vehicle market on the basis of region?

- What are the various stages in the value chain of the Mexico hybrid electric vehicle market?

- What are the key driving factors and challenges in the Mexico hybrid electric vehicle?

- What is the structure of the Mexico hybrid electric vehicle market and who are the key players?

- What is the degree of competition in the Mexico hybrid electric vehicle market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hybrid electric vehicle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hybrid electric vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hybrid electric vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)