Mexico Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue, Type, Age Group, and Region, 2026-2034

Mexico Gaming Market Summary:

The Mexico gaming market size was valued at USD 2.8 Billion in 2025 and is projected to reach USD 4.3 Billion by 2034, growing at a compound annual growth rate of 4.61% from 2026-2034.

The market is driven by rising smartphone penetration, expanding internet connectivity, and a growing young population with increasing disposable incomes. The popularity of mobile gaming platforms and evolving digital entertainment preferences continues to reshape consumer behavior across demographics. Additionally, the proliferation of social gaming experiences, advancements in cloud-based gaming technologies, and the cultural acceptance of gaming as mainstream entertainment are fueling sustained expansion across the Mexico gaming market share.

Key Takeaways and Insights:

- By Device Type: Mobiles and tablets dominate the market with a share of 72% in 2025, driven by widespread smartphone adoption, affordable devices, accessible gaming applications, portability convenience, and free-to-play mobile games.

- By Platform: Online leads the market with a share of 68% in 2025, owing to improved internet infrastructure, cloud gaming accessibility, multiplayer gaming preferences, and growing demand for connected social experiences.

- By Revenue: In‑game purchase represents the largest segment with a market share of 60% in 2025, driven by microtransaction models, cosmetic item popularity, and seasonal content updates.

- By Type: Adventure/role playing games dominates the market with a share of 25% in 2025, owing to the engaging storytelling experiences, customization options, large virtual worlds, and storytelling gameplay mechanics.

- By Age Group: Adult represents the largest segment with a market share of 69% in 2025, driven by higher purchasing power, preference for complex gaming experiences, and maturation of audiences with digital entertainment.

- Key Players: The Mexico gaming market exhibits a fragmented competitive landscape, with international gaming corporations, regional developers, and mobile platform operators competing across various segments. Market participants focus on localized content, strategic partnerships, and innovative monetization strategies to capture consumer attention and loyalty.

The Mexico gaming market is experiencing robust expansion driven by multiple converging factors that create a favorable environment for sustained industry growth. The rapid proliferation of smartphones and affordable mobile devices has democratized access to gaming entertainment across diverse socioeconomic segments throughout the country. Improved internet infrastructure, including widespread mobile data availability and expanding broadband connectivity, enables seamless online gaming experiences for millions of users. According to reports, in September 2025, the Mexican government proposed that 8% of the IEPS tax apply to violent and adult-rated video games in the 2026 Economic Package. Moreover, the country's large and young population demonstrates strong affinity toward digital entertainment, with gaming emerging as a preferred leisure activity among various age groups. Rising disposable incomes and changing consumer preferences toward interactive entertainment further accelerate market momentum. Additionally, the growing acceptance of gaming as mainstream cultural entertainment, the influence of social media gaming communities, and the expansion of localized gaming content contribute significantly to market dynamics.

Mexico Gaming Market Trends:

Rise of Esports and Competitive Gaming Culture

The emergence of organized esports tournaments and competitive gaming leagues represents a transformative trend reshaping the Mexico gaming landscape. Gaming enthusiasts increasingly participate in and spectate competitive events, creating vibrant community ecosystems around popular titles. As per sources, in March 2025, OverActive Media expanded into Mexico’s Free Fire League with its Movistar KOI team, strengthening competitive mobile esports and fan engagement. Furthermore, educational institutions and cultural organizations recognize gaming competitions as legitimate sporting activities, driving broader social acceptance. The development of dedicated esports facilities and training centers reflects growing infrastructure investment.

Integration of Augmented and Virtual Reality Technologies

The gaming technologies provide a market solution to the limited interactive capabilities of the existing screen-based gaming systems in Mexico. Developers increasingly incorporate augmented reality features that blend digital elements with physical environments, creating novel gameplay mechanics. According to source, in October 2025, VRFESTMX 2025 showcased immersive VR and AR projects with 35 hackathon participants and Meta Horizon partnerships in Mexico City. Moreover, virtual reality adoption continues expanding as hardware becomes more accessible and content libraries diversify. Location-based entertainment centers utilize immersive technology to appeal to gamers in search of a social encounter.

Expansion of Cloud Gaming and Subscription Services

Cloud-based gaming platforms are transforming how Mexican consumers access and experience gaming content without requiring expensive hardware investments. Subscription-based gaming services offer extensive content libraries, enabling players to explore diverse titles through affordable monthly payments. In September 2025, Blacknut launched a cloud gaming promotion in Mexico via LG Smart TVs, allowing free trials and low-cost access to its full game catalog without extra hardware. The reduction of hardware barriers democratizes access to premium gaming experiences across income segments. Improved streaming technology and network infrastructure support seamless cloud gaming performance across various devices.

Market Outlook 2026-2034:

The Mexico gaming market is poised for sustained revenue growth throughout the forecast period, driven by technological innovation and evolving consumer preferences. Market revenue is expected to benefit from continued smartphone penetration, improved digital payment infrastructure, and expanding internet accessibility across urban and rural regions. The maturation of mobile gaming ecosystems and the emergence of next-generation gaming platforms will create additional revenue opportunities. Increasing investment in gaming content localized for Mexican audiences and the growing influence of gaming culture on mainstream entertainment consumption patterns will further support market expansion. The market generated a revenue of USD 2.8 Billion in 2025 and is projected to reach a revenue of USD 4.3 Billion by 2034, growing at a compound annual growth rate of 4.61% from 2026-2034.

Mexico Gaming Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Device Type | Mobiles and Tablets | 72% |

| Platform | Online | 68% |

| Revenue | In‑Game Purchase | 60% |

| Type | Adventure/Role Playing Games | 25% |

| Age Group | Adult | 69% |

Device Type Insights:

To get detailed segment analysis of this market Request Sample

- Consoles

- Mobiles and Tablets

- Computers

Mobiles and tablets dominate with a market share of 72% of the total Mexico gaming market in 2025.

The mobiles and tablets command the largest market share, reflecting the fundamental shift toward mobile-first gaming preferences among Mexican consumers. The widespread availability of affordable smartphones has eliminated traditional barriers to gaming participation, enabling millions of users to access entertainment applications effortlessly. According to reports, in 2025, Mexico had over 50 Million active mobile gamers, consolidating the country as Latin America’s largest mobile gaming market with widespread smartphone access driving engagement. Moreover, mobile gaming offers unparalleled convenience, allowing users to engage with games during commutes, breaks, and leisure moments without dedicated gaming equipment.

Game developers prioritize mobile platform optimization, delivering experiences specifically designed for touchscreen interfaces and shorter play sessions. The free-to-play model prevalent in mobile gaming reduces entry barriers while generating substantial revenue through optional in-app purchases. Social features integrated within mobile games facilitate community building and viral content sharing, amplifying user acquisition organically. The continuous improvement of mobile device processing capabilities enables increasingly sophisticated gaming experiences comparable to traditional platforms, further strengthening segment dominance across Mexican markets.

Platform Insights:

- Online

- Offline

Online leads with a share of 68% of the total Mexico gaming market in 2025.

Online dominates market revenue, driven by the fundamental transformation of gaming from isolated experiences to connected social activities. Mexican gamers increasingly prefer multiplayer modes, cooperative gameplay, and competitive online matches that require persistent internet connectivity. According to reports, in 2025, the Mexican online gaming market was estimated at USD 970 Million, driven by mobile adoption, high internet penetration, and growing interest in sports betting and iGaming. Furthermore, digital distribution platforms have replaced physical game sales, offering convenient instant access to extensive gaming libraries and seamless update delivery.

Social gaming features, including friend networks, chat functions, and community forums, create ecosystems that encourage extended engagement among players. The integration of streaming and content creation tools within online platforms transforms players into content producers, generating organic marketing through user-generated content. Live-service gaming models allow developers to continuously refresh content, sustaining interest over extended periods. The growing preference for connected entertainment experiences among Mexican consumers reinforces online platform dominance, with multiplayer and social features becoming essential expectations rather than optional additions.

Revenue Insights:

- In-Game Purchase

- Game Purchase

- Advertising

In‑game purchase exhibits a clear dominance with a 60% share of the total Mexico gaming market in 2025.

The in-game purchase generates the largest revenue share, reflecting the successful implementation of monetization strategies that align with consumer behavior patterns. Free-to-play games with optional purchases have proven remarkably effective at converting engaged players into paying customers without imposing upfront costs. As per sources, 88% of gamers in Mexico made in-game purchases, while 48% believe real brands enhance authenticity, highlighting the impact of microtransactions and brand integration in gaming. Moreover, cosmetic items, character customizations, and visual enhancements represent significant purchase categories that enhance personal expression without affecting gameplay balance.

Seasonal content, battle passes, and limited-time offerings create urgency that encourages purchase decisions and maintains recurring revenue streams consistently. The psychological satisfaction derived from exclusive content ownership and collection mechanics drives continued consumer investment in gaming experiences. Game developers continuously refine monetization approaches based on behavioral analytics, optimizing conversion rates while maintaining positive player experiences. The alignment between consumer desires for personalization and developer monetization objectives creates sustainable revenue generation models that benefit both parties within the Mexican gaming ecosystem.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Simulation

- Others

Adventure/role playing games leads with a market share of 25% of the total Mexico gaming market in 2025.

Adventure/role-playing games capture the leading segment share through immersive storytelling and deep gameplay mechanics that foster emotional investment among players. These genres offer expansive virtual worlds where players embark on epic journeys, developing characters and experiencing narrative-driven content over extended play periods. The cultural appeal of fantasy themes, heroic narratives, and exploration resonates strongly with Mexican gaming audiences seeking escapist entertainment experiences. Character progression systems create satisfying advancement loops that reward continued engagement and skill development throughout lengthy gaming sessions.

Multiplayer role-playing games combine social interaction with adventure elements, building communities around shared gaming experiences effectively. Mobile adaptations have expanded genre accessibility, allowing players to engage with complex role-playing mechanics through convenient touchscreen interfaces anywhere. The emotional connections formed with game characters and stories generate powerful loyalty that sustains long-term player retention and monetization opportunities. Rich world-building and compelling narratives distinguish adventure and role-playing titles from other genres, attracting dedicated player bases willing to invest significant time exploring virtual environments.

Age Group Insights:

- Adult

- Children

Adult exhibits a clear dominance with a 69% share of the total Mexico gaming market in 2025.

The adult dominates market share, reflecting the maturation of gaming as entertainment spanning generational boundaries rather than targeting exclusively younger audiences. Adult consumers possess greater disposable income enabling premium content purchases, subscription services, and substantial in-game spending compared to younger demographics. Gaming preferences among adults often include more complex strategic experiences, mature storytelling, and sophisticated multiplayer interactions requiring developed cognitive skills. Nostalgia plays a significant role as adults who grew up gaming continue their entertainment habits into later life stages consistently.

Work-life balance considerations make gaming an attractive relaxation option that fits flexible schedules and provides effective stress relief for working professionals. Social gaming experiences facilitate connections among adult friend groups, replacing traditional entertainment activities with interactive digital alternatives. The normalization of gaming as adult entertainment has reduced stigma and expanded market participation across professional and family demographics significantly. Adults demonstrate higher engagement with premium gaming content and willingness to invest in quality experiences, making this demographic segment particularly valuable for market revenue generation.

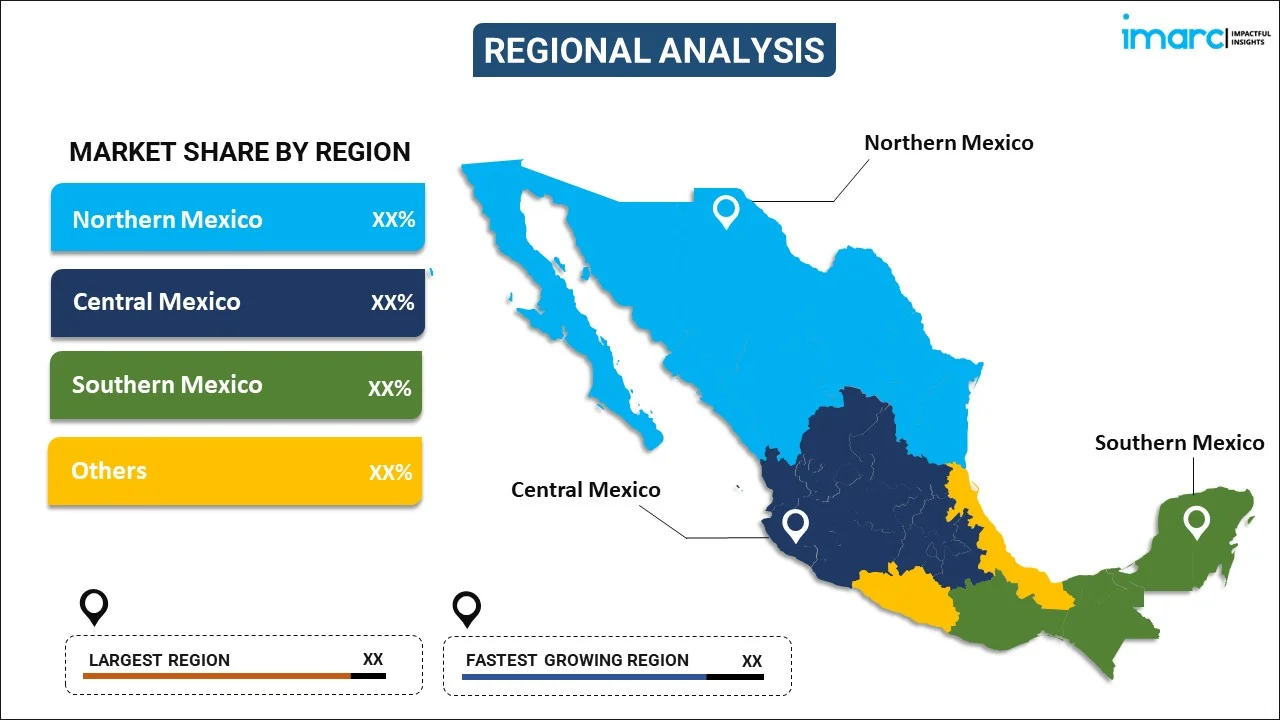

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico demonstrates strong gaming market activity driven by proximity to United States influences, higher average incomes, and robust telecommunications infrastructure. Industrial economic development supports consumer spending capacity while cultural exchange promotes gaming adoption. Urban centers feature developed retail and entertainment ecosystems facilitating gaming hardware and software distribution.

Central Mexico represents the largest regional market, anchored by Mexico City's massive population concentration and economic dominance. Dense urban environments support extensive gaming retail networks and community venues. High internet penetration rates and smartphone ownership enable widespread mobile and online gaming participation across diverse socioeconomic segments throughout the region.

Southern Mexico presents emerging market opportunities as infrastructure development expands internet accessibility and smartphone penetration increases. Tourism-influenced economies create seasonal gaming engagement patterns while cultural traditions shape entertainment preferences. Growing educational attainment and youth populations drive increasing digital entertainment adoption despite currently lower average income levels.

Others in Mexico regions contribute collectively to market growth through gradual connectivity improvements and increasing device affordability. Rural communities demonstrate mobile gaming adoption patterns as smartphones become primary internet access points. Regional economic development initiatives support infrastructure expansion that progressively enables gaming market participation across previously underserved populations.

Market Dynamics:

Growth Drivers:

Why is the Mexico Gaming Market Growing?

Expanding Smartphone Penetration and Mobile Internet Accessibility

The continuous growth of smartphone ownership across Mexican demographics creates expanding addressable markets for mobile gaming applications. Affordable device options from various manufacturers enable gaming access among populations previously excluded due to hardware costs. Mobile network operators continue infrastructure investments that improve data speeds and coverage reliability throughout urban and increasingly rural areas. In 2024, 46 % of Mexicans played video games one to three hours daily, with casual gamers mainly on smartphones and tablets, and participation nearly equally split between men and women. Furthermore, the combination of device proliferation and connectivity improvements creates optimal conditions for mobile gaming adoption.

Rising Youth Population and Digital Entertainment Preferences

Mexico's demographic profile features a substantial young population inherently comfortable with digital technologies and entertainment consumption patterns. Younger generations demonstrate strong preferences for interactive entertainment over passive media consumption, favoring gaming experiences that offer agency and engagement. Cultural attitudes toward gaming have shifted positively, with parents increasingly accepting gaming as legitimate recreational activity. Educational applications of gaming and gamification principles further normalize gaming technologies across age groups. Social media integration amplifies gaming culture visibility, creating aspirational content that attracts new participants.

Growing Esports Ecosystem and Gaming Community Development

The emergence of organized competitive gaming structures creates professional pathways and community engagement opportunities that elevate gaming culture throughout Mexico. Tournament organizations, streaming platforms, and content creators build interconnected ecosystems that sustain interest and participation among diverse audiences. In March 2025, Mexico’s esports federation FENAVIDE partnered with World to implement World ID verification in official competitions, professionalizing competitive play and supporting fair, authentic participation. Further, educational institutions highly offer esports programs and facilities, legitimizing gaming as both recreational and professional pursuit. Community gaming centers and cafes provide social gathering spaces that facilitate in-person gaming experiences.

Market Restraints:

What Challenges the Mexico Gaming Market is Facing?

Digital Payment Infrastructure Limitations

Despite improvements, significant portions of the Mexican population maintain limited access to digital payment methods required for online gaming purchases. Banking penetration gaps and preference for cash transactions create friction in monetization conversion processes. Concerns regarding online payment security deter some consumers from completing in-game purchases through digital channels, affecting overall revenue potential.

Internet Connectivity Disparities Across Regions

The geographic and economic disparities create uneven internet access quality that affects online gaming experiences for substantial population segments. Rural and underserved communities face connectivity limitations that restrict participation in bandwidth-intensive gaming applications. Network reliability issues cause frustrating experiences during competitive or cooperative gameplay requiring stable connections throughout gaming sessions.

Content Localization and Cultural Relevance Gaps

International game developers often inadequately localize content for Mexican audiences, limiting engagement among consumers preferring native language experiences. Cultural references and narrative elements may not resonate with local preferences, reducing emotional connection with gaming content. Limited representation of Mexican characters, settings, and stories in mainstream titles creates market opportunity gaps.

Competitive Landscape:

The Mexico gaming market features diverse competitive dynamics characterized by international publishers, regional developers, mobile platform operators, and emerging cloud gaming services competing across various market segments. Market participants employ differentiated strategies including exclusive content development, localized marketing campaigns, strategic partnerships with telecommunications providers, and innovative monetization approaches. Competition intensifies around user acquisition and retention, with companies investing significantly in community management and player engagement initiatives. Platform holders maintain influence through hardware ecosystems and exclusive title agreements, while mobile application stores serve as critical distribution gatekeepers.

Recent Developments:

- In April 2025, Neosurf launched its cash-to-digital payment solutions in Mexico’s regulated online gambling market, marking its Latin American debut. The platform enables secure transactions for players and provides compliance tools for operators, with initial partnerships including Fun88, aiming to enhance payment efficiency and improve the overall player experience.

- In March 2025, Mobile Streams Plc launched Estadio Gana in Mexico, offering an online casino and sportsbook platform. Targeting Mexican sports fans, it provides live match updates, betting options, and a secure gaming environment, marking the company’s expansion into the country’s rapidly growing sports betting and online gaming market.

Mexico Gaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenues Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, Others |

| Age Groups Covered | Adult, Children |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico gaming market size was valued at USD 2.8 Billion in 2025.

The Mexico gaming market is expected to grow at a compound annual growth rate of 4.61% from 2026-2034 to reach USD 4.3 Billion by 2034.

Mobiles and tablets held the largest market share, driven by widespread smartphone adoption, affordable device availability, accessible gaming applications, portability convenience, free-to-play gaming models, touchscreen interface optimization, and the seamless integration of gaming into daily mobile device usage among Mexican consumers.

Key factors driving the Mexico gaming market include expanding smartphone penetration, improving internet infrastructure, rising youth population, growing esports culture, increasing disposable incomes, cultural acceptance of gaming entertainment, and proliferation of accessible free-to-play gaming applications.

Major challenges include digital payment infrastructure limitations, regional internet connectivity disparities, content localization gaps, competition for consumer attention, data privacy concerns, regulatory uncertainties, and economic fluctuations affecting discretionary entertainment spending across various demographic segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)