Mexico Fruit Juice Market Size, Share, Trends and Forecast by Product Type, Flavor, Distribution Channel, and Region, 2025-2033

Mexico Fruit Juice Market Overview:

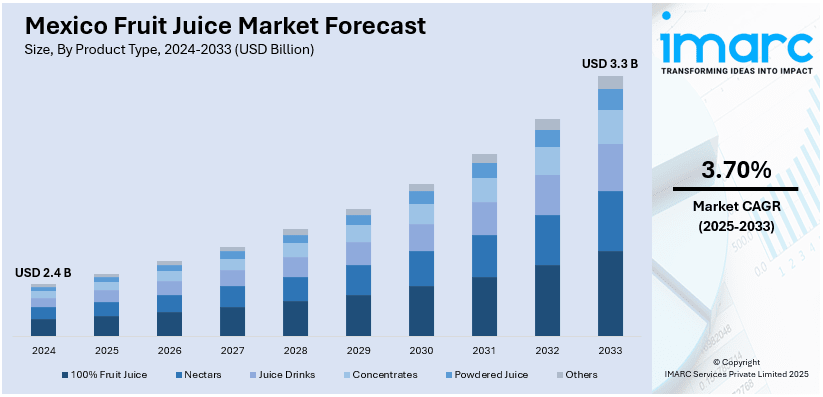

The Mexico fruit juice market size reached USD 2.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.70% during 2025-2033. The market is driven by rising health consciousness, increasing disposable income, growing preference for natural beverages, expanding retail channels, government initiatives promoting healthier drinks, ongoing technological advancements, and strong demand for exotic and locally sourced fruit varieties.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.4 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Market Growth Rate 2025-2033 | 3.70% |

Mexico Fruit Juice Market Trends:

Growing Demand for Natural and Sugar-Free Juices

The growing demand for natural and sugar-free juices is boosting the Mexico fruit juice market share. Public health concerns about obesity and diabetes, along with other medical problems, have caused Mexican consumers to replace carbonated drinks with juice products containing natural ingredients and no added sugars. Government regulations that impose taxes on sugary beverages motivate manufacturers to either use natural sweeteners or concentrate on producing 100% fruit juice products because of this market shift. Moreover, the clean-label movement impacts consumer buying behavior because people choose to understand all ingredients present during product processing. Manufacturers now add "no added sugar," "organic," and "cold-pressed" labels to their products as health-concerned buyers seek these features. For instance, in March 2025, PepsiCo acquired Poppi, a prebiotic soda brand known for its low-calorie, natural ingredients, further expanding the company's portfolio of healthier beverage options. Furthermore, the market demand for healthy beverages runs strongest in cities because residents show greater interest in fitness-related lifestyle choices. As a result, the market for healthy juice options shows growing potential, which encourages brands to develop new products containing functional components, including probiotics and vitamins.

Expansion of Ready-to-Drink (RTD) and On-the-Go Packaging

The Mexico fruit juice market outlook is experiencing an increasing consumer demand for ready-to-drink (RTD) products due to the expanding urban workforce in the region. Single-serving portable packaging that matches fast-paced living patterns drives the market adoption for polyethylene terephthalate (PET) bottles, tetra packs, and resealable pouches. In confluence with this, the consumer trend aligns with the rising market need for health-conscious soft drinks as people demand drinkable, nutritious products that fit their active lifestyles. Companies are also using innovative packaging approaches that combine extended preservation with fresh product maintenance through aseptic and cold-pressed packaging solutions. Furthermore, the market embraces sustainable materials because eco-friendly cartons combined with recyclable bottles are actively gaining popularity. For example, in October 2024, Arca Continental and PetStar invested 14 million pesos to open a new PET collection center in Los Cabos. This facility, along with an existing center in La Paz, aims to increase PET recycling capacity to 110 tons monthly, equivalent to 5 million bottles, supporting sustainability in beverage packaging. Apart from this, the RTD fruit juice sector is driving the Mexico fruit juice market growth, as consumers prioritize convenience and premium functional juices.

Mexico Fruit Juice Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, flavor, and distribution channel.

Product Type Insights:

- 100% Fruit Juice

- Nectars

- Juice Drinks

- Concentrates

- Powdered Juice

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes 100% fruit juice, nectars, juice drinks, concentrates, powdered juice, and others.

Flavor Insights:

- Orange

- Apple

- Mango

- Mixed Fruit

- Others

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes orange, apple, mango, mixed fruit, and others.

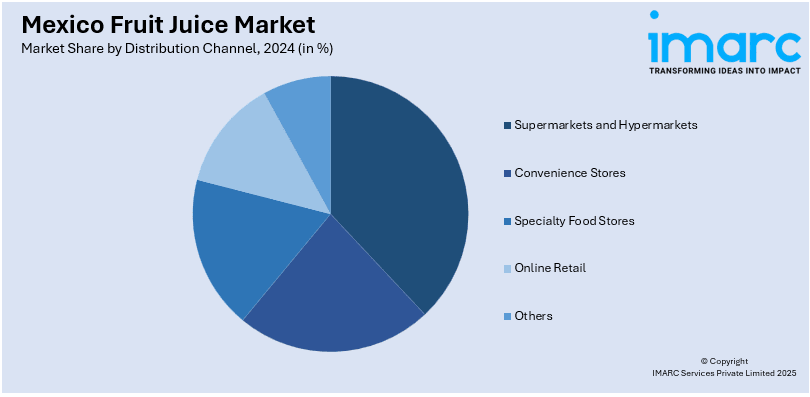

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty food stores, online retail, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fruit Juice Market News:

- In January 2025, Grupo Jumex, Odwalla® announced a new line of juices and smoothies, including Mango, Strawberry-Banana, and Berries smoothies, as well as 100% juice options like Orange-Guava-Ginger and Green Juice with pineapple, apple, and nopal. This reintroduction aims to meet the growing demand for health-conscious beverages in the Mexican market.

- In July 2024, Fresh Farms and Driscoll's Mexico collaborated to offer grape and strawberry combinations at special prices, simplifying consumer choices and enhancing the availability of premium fruits. This partnership aims to transform the fine fruit market by providing innovative and value-driven options to consumers.

Mexico Fruit Juice Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | 100% Fruit Juice, Nectars, Juice Drinks, Concentrates, Powdered Juice, Others |

| Flavors Covered | Orange, Apple, Mango, Mixed Fruit, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fruit juice market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fruit juice market on the basis of product type?

- What is the breakup of the Mexico fruit juice market on the basis of flavor?

- What is the breakup of the Mexico fruit juice market on the basis of distribution channel?

- What is the breakup of the Mexico fruit juice market on the basis of region?

- What are the various stages in the value chain of the Mexico fruit juice market?

- What are the key driving factors and challenges in the Mexico fruit juice?

- What is the structure of the Mexico fruit juice market and who are the key players?

- What is the degree of competition in the Mexico fruit juice market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fruit juice market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fruit juice market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fruit juice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)