Mexico Food Packaging Market Size, Share, Trends and Forecast by Packaging Type, Application, and Region, 2025-2033

Mexico Food Packaging Market Overview:

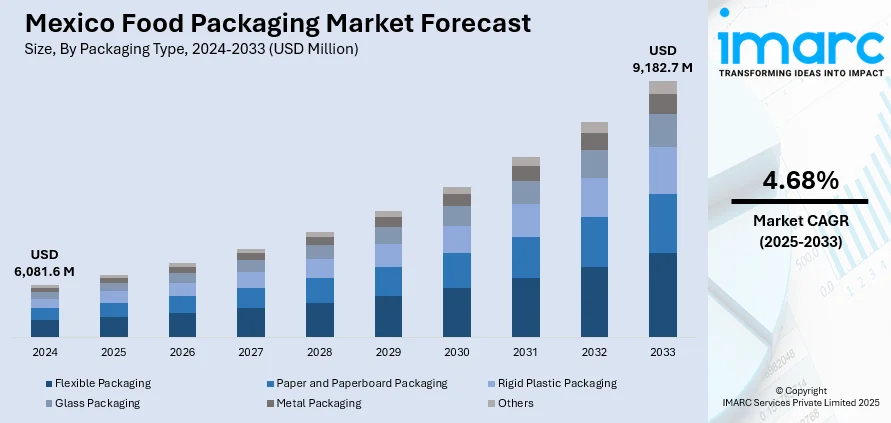

The Mexico food packaging market size reached USD 6,081.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,182.7 Million by 2033, exhibiting a growth rate (CAGR) of 4.68% during 2025-2033. The market is witnessing significant growth due to rising demand for convenience, sustainability, and shelf-ready formats across food categories. Moreover, growth in flexible packaging, eco-friendly materials, and e-commerce-ready designs is contributing positively to the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6,081.6 Million |

| Market Forecast in 2033 | USD 9,182.7 Million |

| Market Growth Rate 2025-2033 | 4.68% |

Mexico Food Packaging Market Trends:

Shift Toward Sustainable and Eco-Friendly Packaging

The push for sustainability is reshaping packaging strategies across Mexico’s food industry. In response to environmental concerns and evolving regulations, brands are increasingly adopting biodegradable, recyclable, and compostable materials directly contributing to Mexico food packaging market growth. Consumers are now more aware of packaging waste and are actively seeking products with minimal environmental impact, especially in urban centers and among younger demographics. Government initiatives to reduce single-use plastics are further accelerating the shift, prompting manufacturers to explore paper-based alternatives, bioplastics, and reusable formats. Industry players are taking concrete steps to align with sustainability goals through certifications and material innovations. For instance, in September 2023, Taghleef Industries Group attained ISCC Plus certification for its Altamira, Mexico, and Cartagena, Colombia facilities, reinforcing its commitment to sustainable packaging. This certification emphasizes the use of sustainable feedstocks and supports the company’s efforts in reducing its environmental impact and promoting a Circular Economy through its Dynamic Cycle™ platform. Supermarkets and food producers are adjusting supply chains to comply with these expectations, often highlighting sustainability credentials as a selling point. As this trend deepens, eco-friendly packaging is not just a compliance measure but a competitive advantage. The continued shift toward greener materials is expected to significantly influence Mexico food packaging market share.

Growth in Flexible Packaging Formats

Flexible packaging is becoming a preferred choice across Mexico’s food industry, especially in categories like snacks, dairy, bakery, and ready-to-eat meals. Pouches, wraps, and films offer clear advantages in terms of weight reduction, lower material usage, and ease of storage and transportation benefits highly valued by both manufacturers and retailers. These formats also allow for vibrant printing, custom shapes, and resealable features, enhancing shelf appeal and consumer convenience. With urbanization and busier lifestyles, demand for portion-controlled, on-the-go formats is growing, further boosting adoption of flexible packaging. Additionally, brands are using these packs to extend shelf life through barrier technology and modified atmosphere options. Local and multinational companies are investing in automated filling systems compatible with flexible formats to scale up efficiently. Major packaging companies are expanding their production footprint to meet growing demand for flexible solutions. For instance, in October 2023, PAC Worldwide opened a new 883,000-square-foot flexible packaging facility in San Juan Del Rio, Mexico, enhancing its manufacturing capabilities. The plant will produce various poly products, including Mailjacket® and Polyjacket® mailers. As innovations continue and consumer habits evolve, flexible solutions are expected to play a major role in shaping the Mexico food packaging market outlook.

Mexico Food Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on packaging type and application.

Packaging Type Insights:

- Flexible Packaging

- Paper and Paperboard Packaging

- Rigid Plastic Packaging

- Glass Packaging

- Metal Packaging

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes flexible packaging, paper and paperboard packaging, rigid plastic packaging, glass packaging, metal packaging, and others.

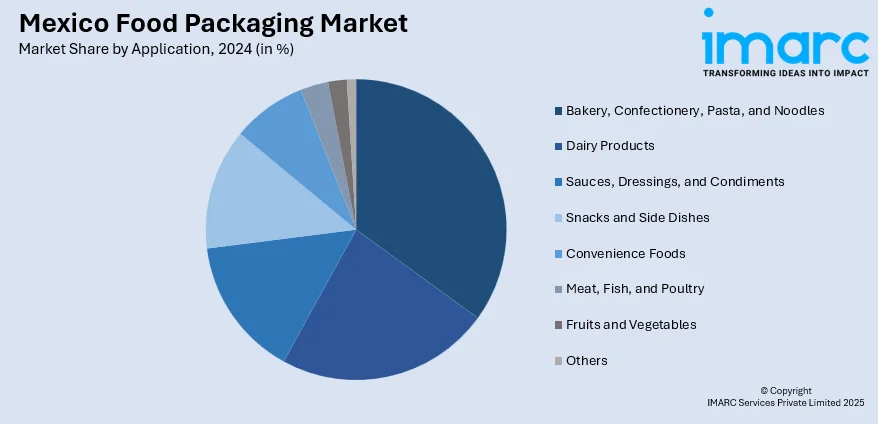

Application Insights:

- Bakery, Confectionery, Pasta, and Noodles

- Dairy Products

- Sauces, Dressings, and Condiments

- Snacks and Side Dishes

- Convenience Foods

- Meat, Fish, and Poultry

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery, confectionery, pasta, and noodles, dairy products, sauces, dressings, and condiments, snacks and side dishes, convenience foods, meat, fish, and poultry, fruits and vegetables, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Food Packaging Market News:

- In April 2025, Berries Paradise launched 'Sweet Bliss™' blueberries and eco-friendly packaging, debuting first in Mexico. The premium berries, containing 14 Brix or higher, boast vibrant packaging made from 100% recyclable materials. The company aims to expand globally while promoting sustainability practices, including solar power use.

- In December 2024, Biocup, a Mexican eco-packaging company specializing in biodegradable food and catering packaging, launched in the U.S., under MileOne's guidance. CEO Fernando Huerta highlighted the company's growth and commitment to sustainability, aiming to expand its eco-friendly products across Texas and New Mexico.

- In August 2023, GPA Global merged with Foli de México, a prominent packaging and printing company known for its innovative designs in the spirits and chocolate sectors. Foli has worked with brands like Mars, Hershey's, Ferrero, and Diageo. This partnership strengthens GPA's position in sustainable packaging solutions across Latin America.

Mexico Food Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Flexible Packaging, Paper and Paperboard Packaging, Rigid Plastic Packaging, Glass Packaging, Metal Packaging, Others |

| Applications Covered | Bakery, Confectionery, Pasta, and Noodles, Dairy Products, Sauces, Dressings, and Condiments, Snacks and Side Dishes, Convenience Foods, Meat, Fish, and Poultry, Fruits and Vegetables, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico food packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico food packaging market on the basis of packaging type?

- What is the breakup of the Mexico food packaging market on the basis of application?

- What is the breakup of the Mexico food packaging market on the basis of region?

- What are the various stages in the value chain of the Mexico food packaging market?

- What are the key driving factors and challenges in the Mexico food packaging?

- What is the structure of the Mexico food packaging market and who are the key players?

- What is the degree of competition in the Mexico food packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico food packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico food packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico food packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)