Mexico Fintech Market Report by Deployment Mode (On-premises, Cloud-based), Technology (Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, and Others), Application (Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, and Others), End User (Banking, Insurance, Securities, and Others), and Region 2026-2034

Mexico Fintech Market Size, Share & Trends

Mexico fintech market size reached USD 22.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 67.2 Billion by 2034, exhibiting a growth rate (CAGR) of 12.93% during 2026-2034. The increasing number of tech savvy individuals across the country is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 22.5 Billion |

| Market Forecast in 2034 | USD 67.2 Billion |

| Market Growth Rate (2026-2034) | 12.93% |

Access the full market insights report Request Sample

Fintech involves incorporating technology into financial services to enhance, modernize, and refine traditional financial processes. Its primary goal is to increase the efficiency, accessibility, and user-friendliness of financial operations. Fintech encompasses a range of applications, including online banking, mobile payments, investment management, and insurance. It influences diverse areas, such as peer-to-peer lending, crowdfunding platforms, robo-advisors for investments, applications related to cryptocurrency and blockchain, etc. Fintech contributes to financial inclusion by providing cost-effective services, empowering a broader segment of the population through mobile apps and platforms. The integration of technology into finance represents a dynamic evolution aimed at making financial services more adaptive to contemporary needs and preferences.

Mexico Fintech Market Trends:

The Mexico fintech market is witnessing substantial growth, driven by a confluence of key drivers. Primarily, the country's increasing digital penetration and the widespread adoption of advanced technology have paved the way for fintech innovations. Besides this, the rising prevalence of smartphones and internet connectivity has encouraged consumers, fostering a conducive environment for the expansion of fintech services. Furthermore, the inflating need for financial inclusion is acting as another significant growth-inducing factor. Apart from this, fintech platforms, offering low-cost and accessible financial services, are instrumental in reaching previously underserved segments of the population. This democratization of financial services aligns with the government's initiatives to promote financial literacy and inclusion. Additionally, changing consumer preferences and the demand for streamlined financial processes contribute to the market growth across Mexico. Fintech solutions, including online banking, mobile payments, and investment management, resonate with consumers seeking convenience and efficiency in their financial transactions. Moreover, the emergence of alternative lending platforms and blockchain applications has disrupted traditional financial models, fostering innovation and competition within the fintech sector. In line with this, regulatory support and a dynamic startup ecosystem are expected to fuel the market growth over the forecasted period.

Mexico Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

To get detailed segment analysis of this market Request Sample

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes banking, insurance, securities, and others.

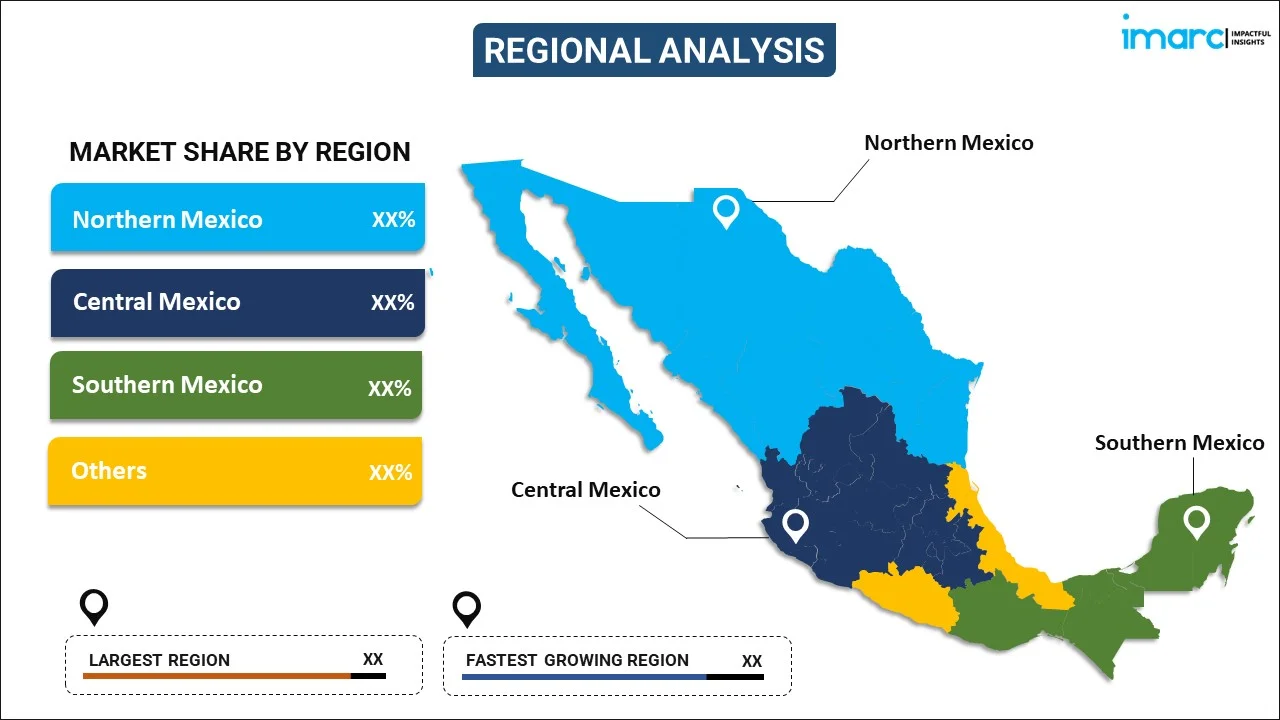

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fintech market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Mexico Fintech market?

- What is the breakup of the Mexico fintech market on the basis of deployment mode?

- What is the breakup of the Mexico fintech market on the basis of technology?

- What is the breakup of the Mexico fintech market on the basis of application?

- What is the breakup of the Mexico fintech market on the basis of end user?

- What are the various stages in the value chain of the Mexico fintech market?

- What are the key driving factors and challenges in the Mexico fintech?

- What is the structure of the Mexico fintech market and who are the key players?

- What is the degree of competition in the Mexico fintech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fintech market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)