Mexico Fast Food Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Mexico Fast Food Market Overview:

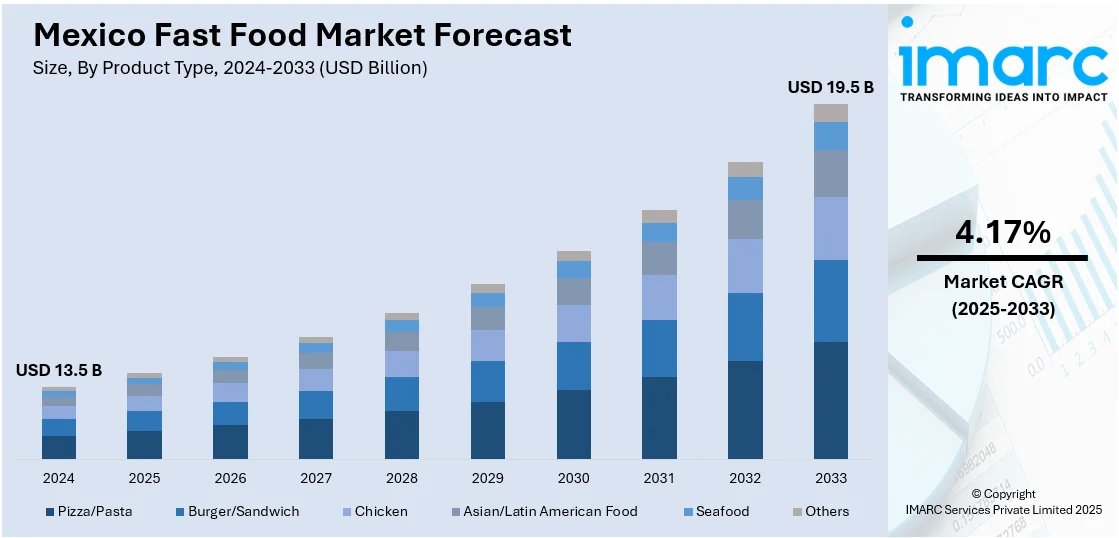

The Mexico fast food market size reached USD 13.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.17% during 2025-2033. The market is driven by rapid urbanization, rising disposable incomes, busy lifestyles, a growing young population, increasing tourism, expanding food delivery services, and a strong preference for convenient, affordable meals that reflect both global trends and local flavors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.5 Billion |

| Market Forecast in 2033 | USD 19.5 Billion |

| Market Growth Rate 2025-2033 | 4.17% |

Mexico Fast Food Market Trends:

Expansion of Online Food Delivery Services

The Mexico fast food market is experiencing robust growth in digital ordering and food delivery practices. In line with this, the growing use of smartphones along with wider internet access has made consumers prefer mobile app and website orders over traditional dining experiences. For example, in November 2024, Amazon partnered with Mexican grocery delivery startup Jüsto to offer grocery deliveries via its Mexican platform, enhancing digital access and signaling Amazon’s deeper move into Mexico’s food delivery space. Moreover, the rise of delivery-only kitchens received momentum from this trend, which is now transforming various restaurant business models. Besides this, fast food brands direct their efforts toward developing digital platforms that users can easily use, along with improved delivery operations and selection of delivery service partners. Furthermore, consumers now demand quick and easy delivery services and touchless transactions. Traditional fast food chains are also redesigning their food outlets and dedicating resources to technology development for better customer satisfaction with the growing delivery market. As a result, the fast food business is transforming swiftly to maintain a competitive advantage in the growing technology-based food environment, thereby boosting the Mexico fast food market share.

Emphasis on Healthier Fast-Food Options

The Mexico fast food market outlook is transforming and moving toward providing balanced nutritional options for its customers. In addition to this, fast food brands are readjusting their menu selection to meet health-oriented customer demands because consumers have become more aware of nutritional wellbeing. Concurrently, fast food chains in Mexico now offer more plant-based options combined with grilled proteins, while providing menu items with reduced sugar content, fat content, and sodium levels. For instance, in 2024, Taco Bell expanded its vegetarian offerings by introducing a customizable Veggie Build-Your-Own-Cravings-Box, allowing customers to choose from items like the black bean crunchwrap supreme and spicy potato soft taco, aligning with the trend towards plant-based fast food options. In confluence with this, the fashion for better eating habits, along with cultural changes, drives this movement further. The food industry is also providing customers with ways to eat mindfully alongside convenient, quick service. Additionally, the growing demand for nutritious and swift eats encourages international and domestic fast food enterprises to introduce healthier options for their menus. Apart from this, the ongoing transformation involves product enhancement while companies work to redefine their brand image according to health-focused and sustainable values, which is driving the Mexico fast food market growth.

Mexico Fast Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Pizza/Pasta

- Burger/Sandwich

- Chicken

- Asian/Latin American Food

- Seafood

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes pizza/pasta, burger/sandwich, chicken, asian/latin american food, seafood, and others.

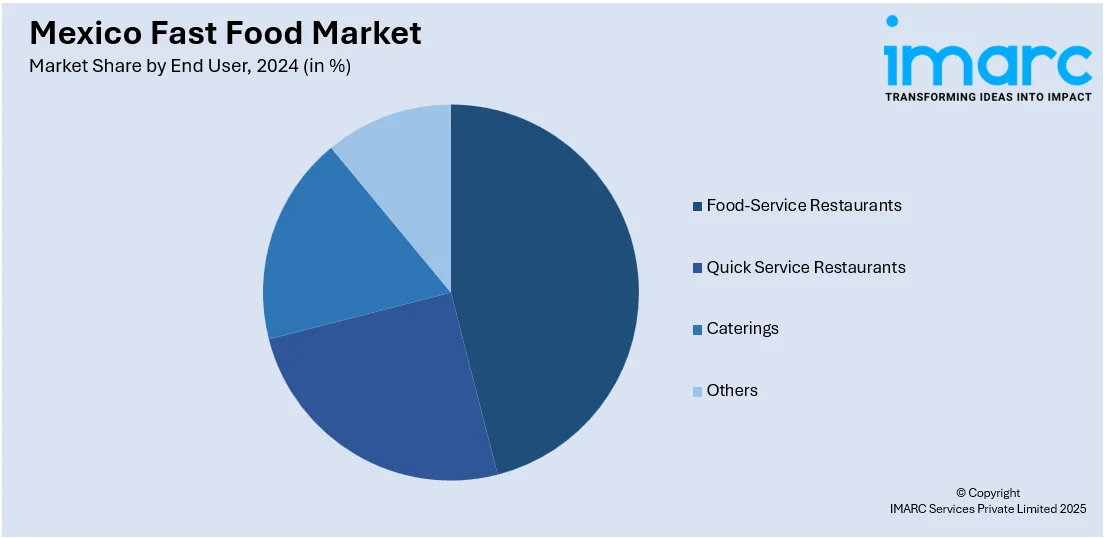

End User Insights:

- Food-Service Restaurants

- Quick Service Restaurants

- Caterings

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food-service restaurants, quick service restaurants, caterings, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fast Food Market News:

- In January 2025, PepsiCo acquired Siete Foods for $1.2 billion. This acquisition allows PepsiCo to diversify its product offerings and cater to the increasing demand for Mexican-American cuisine, thereby broadening its consumer base.

- In December 2023, Alsea announced plans to invest MX$550 million to expand its Domino's Pizza chain in Mexico, aiming to reach 1,000 stores nationwide. This expansion is set to create approximately 2,000 new jobs, enhancing the brand's market presence and accessibility.

Mexico Fast Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pizza/Pasta, Burger/Sandwich, Chicken, Asian/Latin American food, Seafood, Others |

| End Users Covered | Food-Service Restaurants, Quick Service Restaurants, Caterings, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fast food market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fast food market on the basis of product type?

- What is the breakup of the Mexico fast food market on the basis of end user?

- What is the breakup of the Mexico fast food market on the basis of region?

- What are the various stages in the value chain of the Mexico fast food market?

- What are the key driving factors and challenges in the Mexico fast food?

- What is the structure of the Mexico fast food market and who are the key players?

- What is the degree of competition in the Mexico fast food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fast food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fast food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fast food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)