Mexico E-Pharmacy Market Size, Share, Trends and Forecast by Drug Type, Product Type, Platform, Payment Method, and Region, 2026-2034

Mexico E-Pharmacy Market Overview:

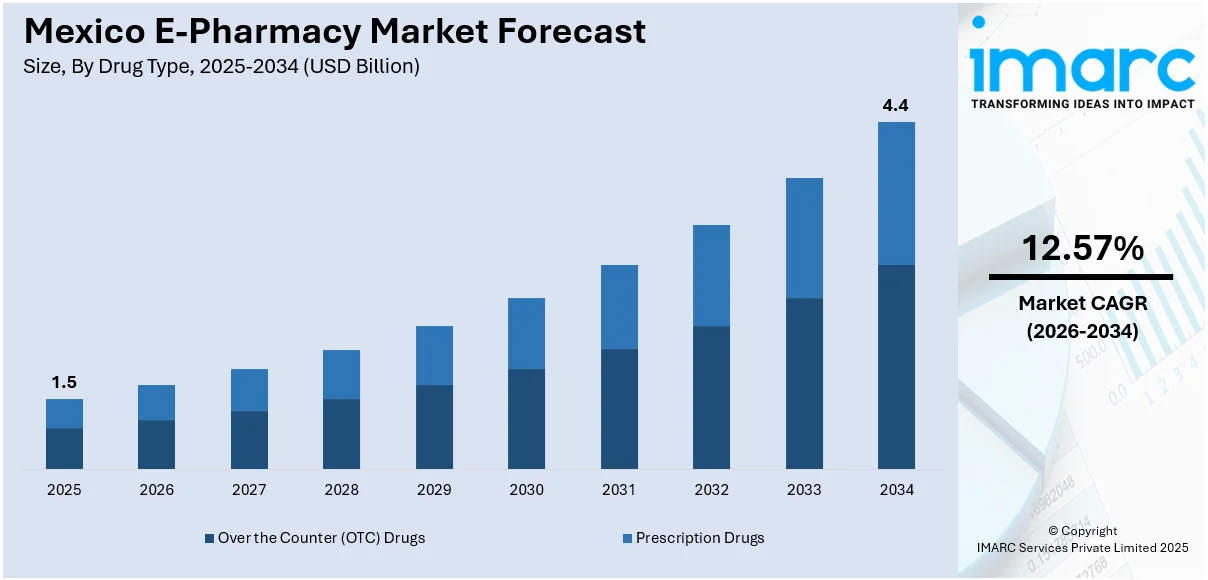

The Mexico e-pharmacy market size reached USD 1.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.4 Billion by 2034, exhibiting a growth rate (CAGR) of 12.57% during 2026-2034. Rising internet and smartphone access, surging demand for convenience, growing chronic disease burden, escalating telemedicine integration, increasing healthcare digitization, post-pandemic behavioral shifts, burgeoning investments in digital platforms, and broader e-commerce adoption are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2034 | USD 4.4 Billion |

| Market Growth Rate 2026-2034 | 12.57% |

Mexico E-Pharmacy Market Trends:

Rising Internet and Smartphone Penetration

The rapid increase in internet and smartphone usage across Mexico is a fundamental driver of the Mexico’s e-pharmacy market growth. A growing proportion of the population now has consistent access to mobile internet services, particularly through affordable smartphone devices. In 2024, Mexico launched a national platform for digital prescriptions as part of its ongoing healthcare digital transformation strategy. This initiative aims to enhance prescription legibility and streamline patient record management. This move is designed to improve prescription legibility and patient record management. E-pharmacy operators are increasingly optimizing their platforms for mobile users, ensuring that medicine purchases, prescription uploads, and consultations can be done seamlessly via apps. Additionally, telecom infrastructure improvements in Tier II and Tier III cities are narrowing the urban-rural digital divide, allowing for increased market coverage. As more consumers across age groups become digitally literate, the demand for convenient, app-based pharmaceutical solutions is expected to rise.

To get more information on this market Request Sample

Shift Toward Convenience-Based Purchasing Behavior

The consumer shift toward convenience-driven shopping habits is significantly influencing the growth of Mexico’s e-pharmacy market. Online pharmacies provide a solution by offering home delivery of medications, real-time stock availability, and digital payment options, all accessible from a smartphone or computer. This model aligns with evolving consumer expectations shaped by broader e-commerce exposure, particularly in sectors like food delivery and retail. The option to schedule refills or subscribe for regular deliveries of chronic care medications adds further appeal, especially among older adults and patients with long-term medical needs. Moreover, user-friendly interfaces and customer support chat functions make the purchasing experience smoother, which is another factor boosting the Mexico e-pharmacy market share. These features enhance customer satisfaction and reinforce the preference for digital pharmacy platforms, leading to repeat usage and strong word-of-mouth promotion in urban and suburban markets.

Growth of Telemedicine and E-Consultation Services

The integration of telemedicine and online consultation services with e-pharmacy platforms is reinforcing the growth of digital pharmaceutical channels in Mexico. Healthcare providers are increasingly offering virtual consultations, enabling patients to receive medical advice without visiting a clinic. Once diagnosed, patients can directly upload digital prescriptions to e-pharmacy platforms for prompt medication delivery. This streamlined, end-to-end service model is proving especially valuable for those managing chronic conditions, mobility limitations, or living in remote areas. Partnerships between e-pharmacy operators and digital health startups are accelerating this trend, with platforms now bundling consultations, prescriptions, and medicine delivery into a single, app-based service. In urban regions, tech-savvy users are quickly adapting to this model, while awareness campaigns are being deployed to expand adoption in other demographics, which is creating a positive Mexico e-pharmacy market outlook.

Mexico E-Pharmacy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on drug type, product type, platform, and payment method.

Drug Type Insights:

- Over the Counter (OTC) Drugs

- Prescription Drugs

The report has provided a detailed breakup and analysis of the market based on the drug type. This includes over the counter (OTC) drugs and prescription drugs.

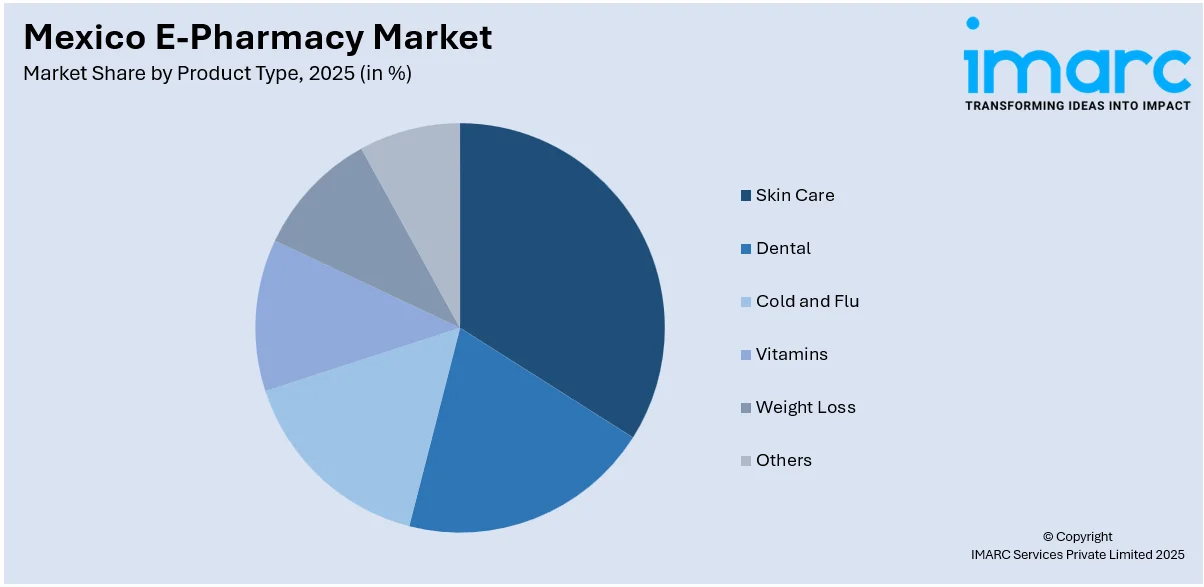

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Skin Care

- Dental

- Cold and Flu

- Vitamins

- Weight Loss

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes skin care, dental, cold and flu, vitamins, weight loss, and others.

Platform Insights:

- App-Based

- Web-Based

The report has provided a detailed breakup and analysis of the market based on the platform. This includes app-based and web-based.

Payment Method Insights:

- Cash on Delivery

- Online Payment

A detailed breakup and analysis of the market based on the payment method have also been provided in the report. This includes cash on delivery and online payment.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico E-Pharmacy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Over the Counter (OTC) Drugs, Prescription Drugs |

| Product Types Covered | Skin Care, Dental, Cold and Flu, Vitamins, Weight Loss, Others |

| Platforms Covered | App-Based, Web-Based |

| Payment Methods Covered | Cash on Delivery, Online Payment |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico e-pharmacy market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico e-pharmacy market on the basis of drug type?

- What is the breakup of the Mexico e-pharmacy market on the basis of product type?

- What is the breakup of the Mexico e-pharmacy market on the basis of platform?

- What is the breakup of the Mexico e-pharmacy market on the basis of payment method?

- What is the breakup of the Mexico e-pharmacy market on the basis of region?

- What are the various stages in the value chain of the Mexico e-pharmacy market?

- What are the key driving factors and challenges in the Mexico e-pharmacy?

- What is the structure of the Mexico e-pharmacy market and who are the key players?

- What is the degree of competition in the Mexico e-pharmacy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico e-pharmacy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico e-pharmacy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico e-pharmacy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)