Mexico Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Mexico Duty-Free and Travel Retail Market Overview:

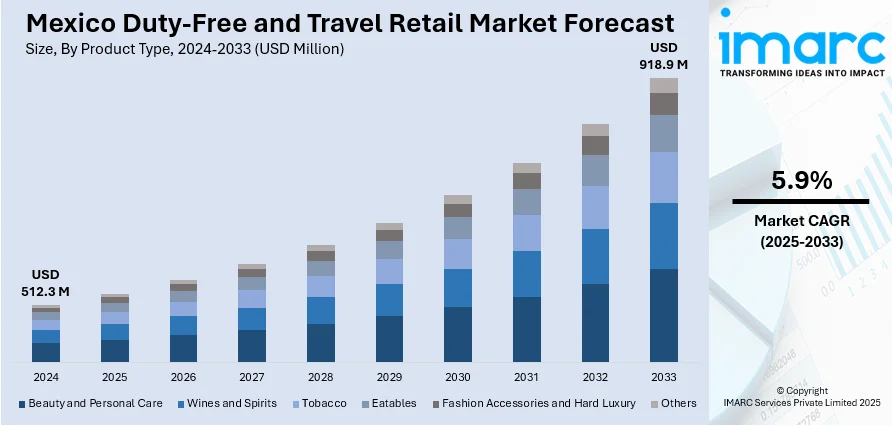

The Mexico duty-free and travel retail market size reached USD 512.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 918.9 Million by 2033, exhibiting a growth rate (CAGR) of 5.9% during 2025-2033. The market is growing steadily, supported by increased international travel, rising demand for premium products, and enhanced digital retail experiences. Beauty, luxury spirits, and fashion remain top-performing segments, with major airports like Cancún and Mexico City driving strong sales momentum.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 512.3 Million |

| Market Forecast in 2033 | USD 918.9 Million |

| Market Growth Rate 2025-2033 | 5.9% |

Mexico Duty-Free and Travel Retail Market Trends:

Rising Preference for Luxury and Premium Brands

Luxury and premium brands are playing a central role in shaping the Mexico duty-free and travel retail market. With the growing passenger traffic and increased spending by international tourists, high-end labels are expanding their footprint across major airports and border zones. The Mexico duty-free and travel retail market growth is being fueled by rising demand for exclusive, top-tier products ranging from designer fashion and watches to upscale beauty and skincare items. Luxury spirits, in particular, are gaining momentum as travelers seek more refined and authentic local experiences. For instance, in February 2024, Brown-Forman announced the launch of Herradura Legend tequila in travel retail, supported by a pop-up activation at Mexico City Airport. This premium añejo tequila, aged up to 14 months, caters to the growing demand for luxury spirits. The initiative emphasizes the evolving perception of tequila as a competitor to established luxury beverages. These brands are focusing on curated in-store experiences, limited-edition offerings, and personalized services to engage affluent travelers seeking status and quality. Flagship stores, pop-up boutiques, and branded lounges are becoming more common, particularly in key airports like Cancún and Mexico City. As premium spending continues to rise, the Mexico duty-free and travel retail market outlook remains optimistic, with luxury and prestige products expected to dominate retail strategies in the coming years.

Digital Integration and Omnichannel Retail

Digital integration is transforming how travelers engage with duty-free retail in Mexico. Operators are increasingly adopting omnichannel strategies offering online pre-order platforms, click-and-collect services, and mobile apps that let passengers browse and purchase before arrival. These tools not only simplify the shopping experience but also drive higher conversion rates by capturing intent early in the travel journey. Personalized promotions, real-time inventory updates, and loyalty rewards are becoming standard across major airports like Cancún and Mexico City. For instance, in March 2025, Patrón Cristalino, Bacardi's latest tequila innovation, debuts in GTR Americas, focusing on Cancun International Airport. It features an extensive omnichannel campaign, including OOH advertising and a sampling bar. Celebrating Mexican craftsmanship this smooth tequila showcases notes of vanilla and caramel, aiming to boost growth in the promising tequila market. Campaigns now extend beyond physical stores through QR codes, digital sampling, and interactive content. A notable example is Patrón’s launch of its Cristalino tequila, backed by an omnichannel campaign across key Latin American airports, including Mexico. This shift reflects how digital touchpoints are merging with in-store experiences to capture tech-savvy, high-spending travelers. These innovations continue to shape the Mexico duty-free and travel retail market share.

Mexico Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury and others.

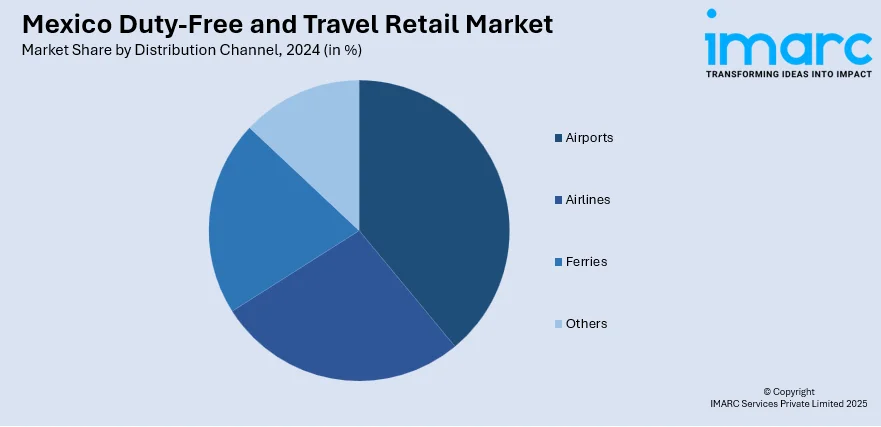

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Duty-Free and Travel Retail Market News:

- In March 2025, Avolta unveils a renovated 1,600-square-meter Duty Free store at Mexico City International Airport, enhancing traveler experiences with luxury brands and interactive digital elements. The company also launched new hybrid concepts with Turin and the “Agave World” in Cancun, emphasizing Mexico’s cultural heritage and improving its presence in the region.

- In March 2024, 3Sixty Duty Free launched operations at Tulum International Airport, which is projected to handle five million international passengers annually. The initiative, part of Mexico’s infrastructure development plan, enhances 3Sixty's presence in the Americas and includes over 7,000 square feet of retail space for departures and arrivals.

Mexico Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico duty-free and travel retail market on the basis of product type?

- What is the breakup of the Mexico duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the Mexico duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the Mexico duty-free and travel retail market?

- What are the key driving factors and challenges in the Mexico duty-free and travel retail market?

- What is the structure of the Mexico duty-free and travel retail market and who are the key players?

- What is the degree of competition in the Mexico duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)