Mexico Dropshipping Market Size, Share, Trends and Forecast by Product, Type, Application, and Region, 2025-2033

Mexico Dropshipping Market Overview:

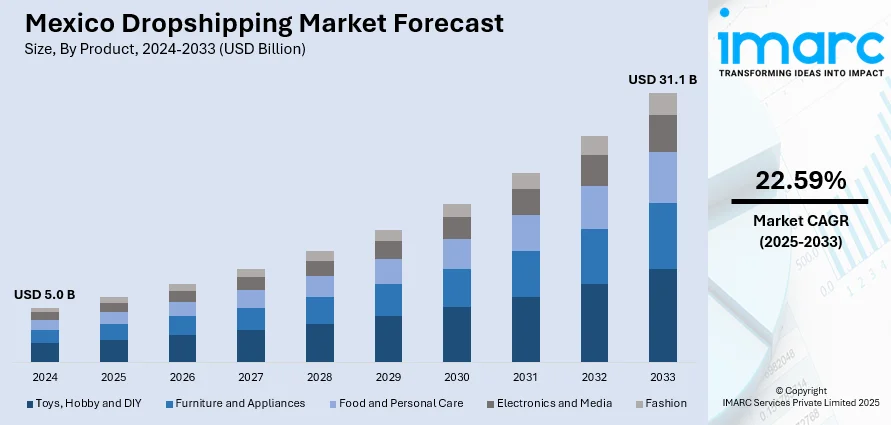

The Mexico dropshipping market size reached USD 5.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 31.1 Billion by 2033, exhibiting a growth rate (CAGR) of 22.59% during 2025-2033. Growing internet and smartphone usage, e-commerce penetration, customer preference for online shopping, social media influence, dropshipping models' affordability, small firms' ease of entering new markets, and developments in payment gateways and logistics are some of the major factors driving the Mexico dropshipping market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.0 Billion |

| Market Forecast in 2033 | USD 31.1 Billion |

| Market Growth Rate 2025-2033 | 22.59% |

Mexico Dropshipping Market Trends:

Rising E-commerce Integration Fuels Mexico’s Dropshipping Market

The Mexico dropshipping market share is witnessing robust expansion, driven by the rapid growth of e-commerce and increasing digital penetration across the country. The rise in smartphone usage, improved internet accessibility, and evolving consumer buying preferences have transformed the retail landscape, enabling dropshipping businesses to thrive. For instance, Mexico's digital economy has grown significantly as of September 20, 2024, with 97 million people using the internet, or 81% of the country's total population. Increased acceptance of e-commerce, which is expected to reach USD 63 Billion by 2025, and the emergence of fintech technologies, which are supported by laws that encourage them, have been the main drivers of this boom. The goal of government programs like the National Digital Strategy and the creation of the Digital Transformation Agency is to improve inclusion and digital infrastructure even more. As more consumers opt for online shopping due to its convenience and variety, sellers are increasingly leveraging dropshipping to reduce inventory costs and streamline operations. Local and international retailers are adopting dropshipping models to offer a broader product range without incurring warehousing expenses. The popularity of platforms like Mercado Libre, Amazon, and Shopify has further enabled small businesses and individual entrepreneurs to enter the market with minimal investment. Additionally, real-time data analytics and seamless logistics infrastructure are enhancing supply chain efficiency, supporting quicker deliveries and improved customer satisfaction. These factors collectively contribute to the growing acceptance and expansion of the dropshipping ecosystem in Mexico.

Product Diversification and Logistics Innovation Drive Market Evolution

The Mexico dropshipping market is becoming increasingly diversified, with product categories such as fashion, electronics, and personal care gaining momentum due to their high demand and fast-moving nature. The fashion segment, in particular, has emerged as a key contributor, supported by frequent trends and low capital requirements. Electronics and home appliances are also seeing considerable traction owing to their wide appeal and compatibility with online selling models which in turn is positively influencing Mexico dropshipping market outlook. On the logistics front, the emergence of faster delivery options like same-day and regional parcel carriers is reshaping consumer expectations and influencing buying behavior. Retailers are partnering with third-party logistics providers to enhance fulfillment capabilities and reduce delivery timelines. Furthermore, the adaptability of dropshipping to both B2B and B2C applications has expanded its utility across various sectors. Mexico’s strategic geographic location also facilitates efficient cross-border trade, giving international sellers a logistical advantage. These developments are reinforcing the market’s resilience and setting the stage for sustained long-term growth. For instance, Airwallex stated on January 15, 2025, that it had completed the acquisition of MexPago, a payment service provider based in Mexico, and obtained a payment institution license from Banco Central do Brasil as part of its planned expansion into Latin America. Due to these advancements, Airwallex will be able to provide services like local accounts, card issuance, and payment acquisition in Brazil. In 2025, the company intends to introduce more services. With the acquisition of MexPago, Airwallex will be able to access Mexico's rapidly expanding cross-border e-commerce industry, which makes up 22% of all e-commerce activity and is expanding at a compound annual growth rate of 44% on average.

Mexico Dropshipping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, type, and application.

Product Insights:

- Toys, Hobby and DIY

- Furniture and Appliances

- Food and Personal Care

- Electronics and Media

- Fashion

The report has provided a detailed breakup and analysis of the market based on the product. This includes toys, hobby and DIY, furniture and appliances, food and personal care, electronics and media, and fashion.

Type Insights:

- Same-Day Delivery

- Regional Parcel Carriers

- Heavy Goods Delivery

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes same-day delivery, regional parcel carriers, and heavy goods delivery.

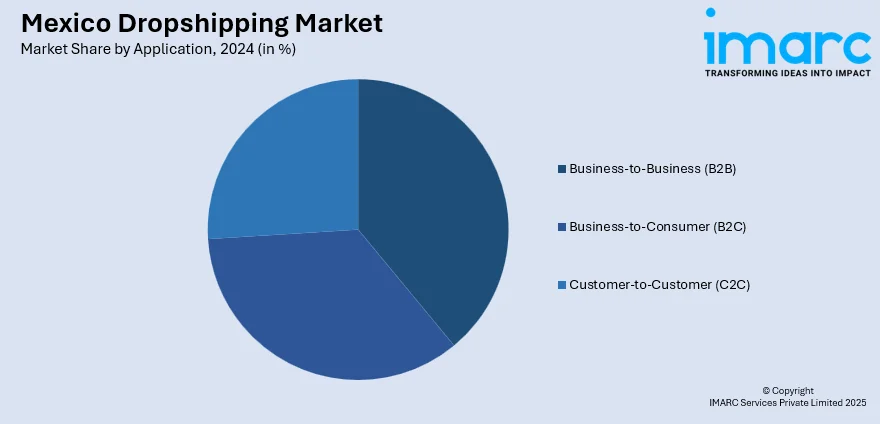

Application Insights:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Customer-to-Customer (C2C)

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes Business-to-Business (B2B), Business-to-Consumer (B2C), and Customer-to-Customer (C2C).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Dropshipping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Toys, Hobby and DIY, Furniture and Appliances, Food and Personal Care, Electronics and Media, Fashion |

| Types Covered | Same-Day Delivery, Regional Parcel Carriers, Heavy Goods Delivery |

| Applications Covered | Business-to-Business (B2B), Business-to-Consumer (B2C), Customer-to-Customer (C2C) |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico dropshipping market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico dropshipping market on the basis of product?

- What is the breakup of the Mexico dropshipping market on the basis of type?

- What is the breakup of the Mexico dropshipping market on the basis of application?

- What is the breakup of the Mexico dropshipping market on the basis of region?

- What are the various stages in the value chain of the Mexico dropshipping market?

- What are the key driving factors and challenges in the Mexico dropshipping market?

- What is the structure of the Mexico dropshipping market and who are the key players?

- What is the degree of competition in the Mexico dropshipping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico dropshipping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico dropshipping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico dropshipping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)