Mexico Calibration Services Market Size, Share, Trends and Forecast by Service Type, Calibration Type, End-Use Industry, and Region, 2025-2033

Mexico Calibration Services Market Overview:

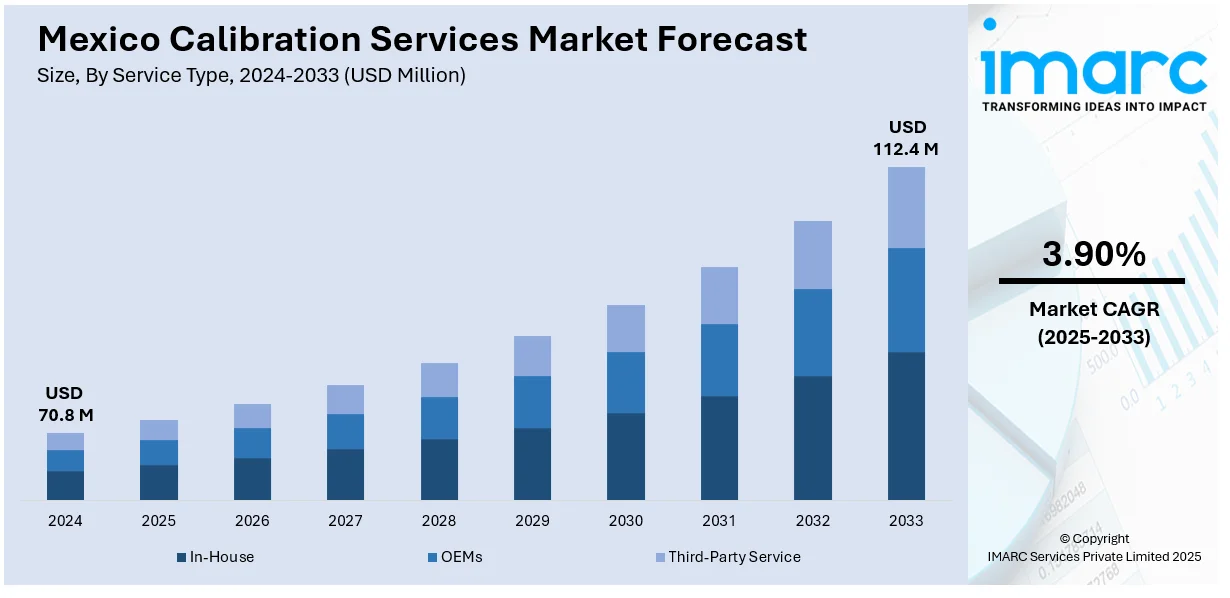

The Mexico calibration services market size reached USD 70.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 112.4 Million by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is witnessing significant growth driven by the increasing demand for calibration services in manufacturing and industrial sectors, and growth of accredited calibration laboratories and technological advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 70.8 Million |

| Market Forecast in 2033 | USD 112.4 Million |

| Market Growth Rate 2025-2033 | 3.90% |

Mexico Calibration Services Market Trends:

Increasing Demand for Calibration Services in Manufacturing and Industrial Sectors

The calibration services sector in Mexico has been on the rise, with a notable growth trend. This is owing to the call for accuracy and quality control in manufacturing as well as from industrial service sectors. Industries like automotive, aerospace, pharmaceuticals, and electronics are growing and there is an increased necessity for accurate measurement and testing instruments. For instance, in July 2024, SGS is expanding its Mexico labs with new testing solutions for automotive, furniture, and toys, including BIFMA, ASTM F963, and upcoming VOC testing for the automotive sector. Strict regulations and international quality standards, such as ISO/IEC 17025, have forced companies to invest in trustworthy calibration services for compliance and operational efficiency. New manufacturing techniques, including automation and integration into Industry 4.0, have further increased the need for high-precision calibration since even slight deviations in measurements can lead to product defects or operational inefficiencies. In Mexico, foreign multinationals demand accredited certified calibration services to comply with global supply chain standards, thereby ensuring uninterrupted international trade and competitiveness within the market. The growing importance of preventive maintenance and risk management has also led to an increase in calibration services as companies keep their equipment validated to minimize downtime and avoid major repairs. The modernization of industries indicates a bright future for calibration services in Mexico, with investments in metrology laboratories, on-site calibration solutions, and digital calibration technology increasing.

Growth of Accredited Calibration Laboratories and Technological Advancements

The growth of accredited calibration laboratories and the proliferation of advanced calibration technologies are pertinent trends that shape the Mexico calibration services market. Within the context of increased demand for accuracy and compliance with international metrology standards, calibration laboratories are increasingly opting for accreditation as ISO/IEC 17025 to validate the technical competence and reliability of their calibration laboratory operations. Accredited laboratories will thus be exposed to higher standards of traceability as well as quality and regulatory requirements that make them especially attractive for businesses in the health, automotive, and aerospace sectors. For instance, in December 2024, UL Solutions expanded its Mexico lab to enhance testing for consumer tech, automotive, and cable products, becoming a certified Volkswagen de Mexico partner for automotive component testing. Additionally, technological advancements in calibration, including automated calibration systems, wireless calibration tools, and digital documentation solutions, are revolutionizing the industry by improving efficiency, reducing human errors, and enhancing traceability. The integration of Internet of Things (IoT) and artificial intelligence (AI) in calibration processes has enabled real-time monitoring and predictive maintenance, helping companies optimize their operational workflows. Remote and on-site calibration services are also gaining traction as businesses seek flexible and cost-effective solutions to minimize equipment downtime. Besides this, increased government and private-sector investments in research and development are driving innovation in calibration methodologies, enhancing measurement accuracy across various industries. As the demand for precision and compliance continues to grow, Mexico’s calibration services market is expected to expand, with a strong focus on technological advancements and accreditation standards.

Mexico Calibration Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on service type, calibration type, and end-use industry.

Service Type Insights:

- In-House

- OEMs

- Third-Party Service

The report has provided a detailed breakup and analysis of the market based on the service type. This includes in-house, OEMs, and third-party service.

Calibration Type Insights:

- Electrical

- Mechanical

- Thermodynamic

- Physical/Dimensional

- Others

A detailed breakup and analysis of the market based on the calibration type have also been provided in the report. This includes electrical, mechanical, thermodynamic, physical/dimensional, and others.

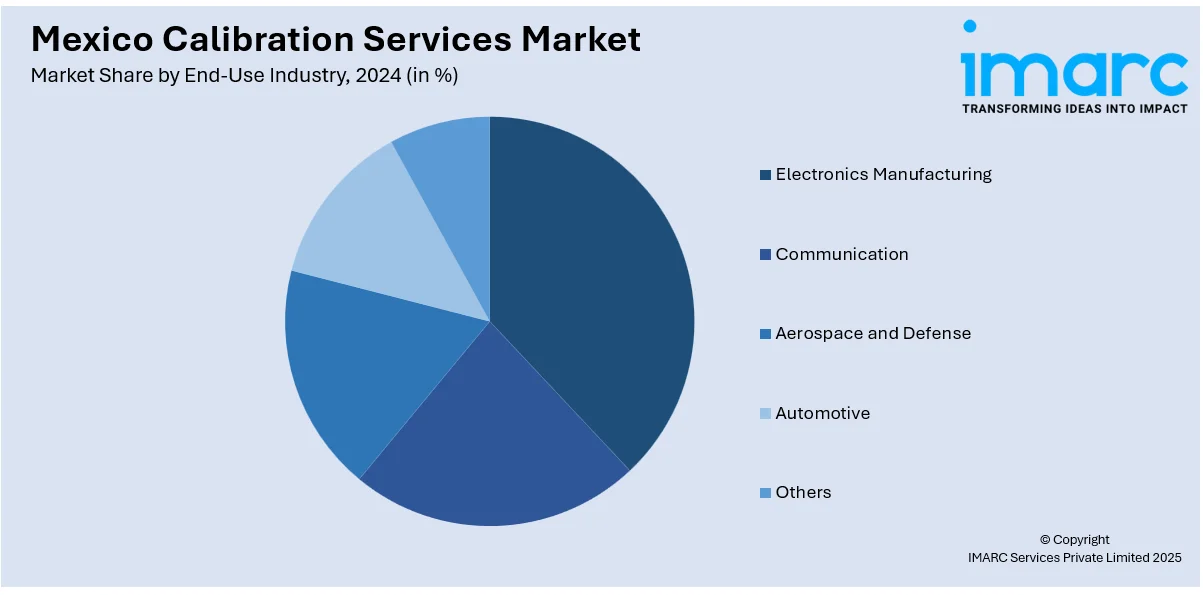

End-Use Industry Insights:

- Electronics Manufacturing

- Communication

- Aerospace and Defense

- Automotive

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes electronics manufacturing, communication, aerospace and defense, automotive, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Calibration Services Market News:

In February 2025, IndySoft, a leader in calibration and asset management software, has partnered with ADS Mexico to expand its presence in the growing Mexican market. This collaboration enhances local expertise, ensuring seamless implementation, customer support, and training. Businesses in Mexico can now optimize operations, improve compliance, and achieve their goals with high-tech solutions.

Mexico Calibration Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | In-House, OEMs, Third-Party Service |

| Calibration Types Covered | Electrical, Mechanical, Thermodynamic, Physical/Dimensional, Others |

| End-Use Industries Covered | Electronics Manufacturing, Communication, Aerospace and Defense, Automotive, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico calibration services market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico calibration services market on the basis of service type?

- What is the breakup of the Mexico calibration services market on the basis of calibration type?

- What is the breakup of the Mexico calibration services market on the basis of end-use industry?

- What is the breakup of the Mexico calibration services market on the basis of region?

- What are the various stages in the value chain of the Mexico calibration services market?

- What are the key driving factors and challenges in the Mexico calibration services?

- What is the structure of the Mexico calibration services market and who are the key players?

- What is the degree of competition in the Mexico calibration services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico calibration services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico calibration services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico calibration services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)