Mexico Beauty Products Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Mexico Beauty Products Market Size and Share:

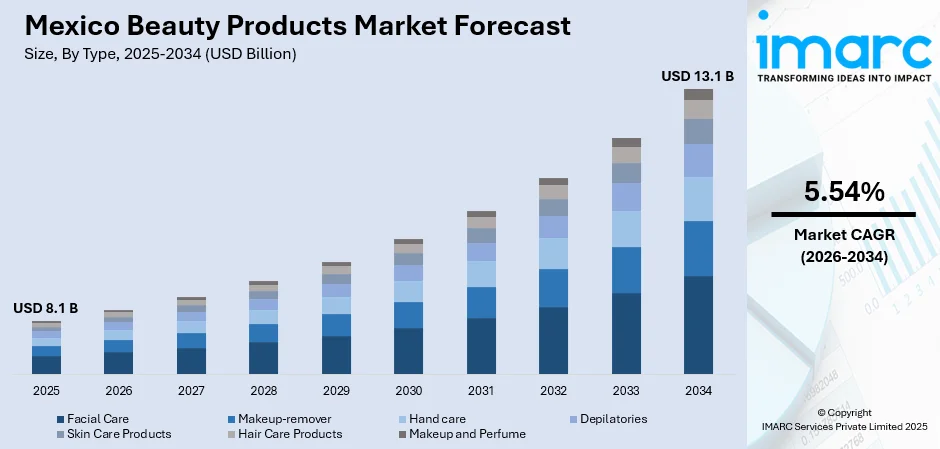

The Mexico beauty products market size was valued at USD 8.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 13.1 Billion by 2034, exhibiting a CAGR of 5.54% from 2026-2034. The market share is propelled by rising consumer awareness about skincare and beauty trends, increasing demand for natural and organic beauty products, a growing middle-class population with higher disposable income, expansion of e-commerce platforms, and the influence of social media and beauty influencers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 8.1 Billion |

|

Market Forecast in 2034

|

USD 13.1 Billion |

| Market Growth Rate (2026-2034) | 5.54% |

The growth of the Mexico beauty products market primarily stems from the high demand for natural and organic beauty products. This has, hence, encouraged both domestic as well as international beauty brands to introduce a wide range of natural beauty solutions. Additionally, the growing e-commerce and digital marketing is also driving industry expansion. According to the IMARC Group, the Mexico e-commerce market is projected to exhibit a CAGR of 12.40% during 2024-2032. With the rising internet penetration and smartphone usage, online shopping has become the preferred channel for buying beauty products. Also, easy online shopping, along with discounts and offers, have become the factors to fuel growth in the market for Mexico.

To get more information on this market Request Sample

Other than this, international beauty brands are also expanding the market, through strategic partnerships with local retailers as well as through the launch of region-specific products. These brands have a wide variety of products suitable for the preferences of the Mexican consumer that align with their natural or cultured tones. Besides this, urbanization has also changed lifestyles, including personal grooming and wellness. As per industry reports, 87.9% of the total population in Mexico lives in urban areas in 2025. As urban dwellers are more exposed to global beauty trends, they increasingly take up skincare and cosmetic routines, which fuels the demand for beauty products.

Mexico Beauty Products Market Trends:

Increasing demand for personalized beauty solutions

An important driver of the Mexico beauty products market growth is the increased demand for individualized beauty solutions. The trend today is toward customization. Skin type, hair texture, and even individual preference are the most pressing requirements from a consumer perspective. Such individualized beauty needs have, therefore, fueled a booming market in customized beauty products targeting specific skin tones, complexions, and hair types. Brands are answering these demands by launching products with much more targeted formulations and improved benefits. Hair care brands similarly offer products suitable to different types of hair textures, including straight, curly or wavy ones. Personalized beauty solutions appeal to the trend of individualism and self-care, particularly among the youth of Mexico, thereby contributing to the growth of the market.

Growth of the female workforce and changing lifestyles

Growing female workforce and lifestyle changes of the Mexican consumer are also driving the Mexico beauty products market demand. According to the Organization for Economic Co-operation and Development (OECD), from January to March 2024, the percentage of women in the workforce in Mexico was 51.7%. With an increased female workforce, women have limited time and demand beauty products that can easily match their schedules. There is an increase in demand for multi-tasking products such as tinted moisturizers, one-step skincare regimens, and long-lasting makeup formulas. In addition, changing priorities among contemporary Mexican women who have succeeded in their professional careers and take care of their personal well-being has created room for diversity and expansion of the beauty market.

Rising influence of social media and beauty influencers

The Mexico beauty products market trends indicate that the rise of social media applications, such as Instagram, YouTube, and TikTok, has really transformed the industry. Beauty influencers and content creators have become quite powerful voices in shaping consumer behavior, driving the discovery of products, and influencing purchasing decisions. These influencers give tutorials and reviews and also partner up with beauty companies to advertise any new products. Their reach, as well as credibility, help the companies gain consumer trust so that they go out and try these beauty products. Social networking sites also help the consumer to keep up-to-date with the latest news on beauty hence creating a want for new ideas of beauty goods in Mexico. The digital content creator has empowered the new generation of consumers to use beauty products and invest in their personal grooming, creating a positive Mexico beauty products market outlook.

Mexico Beauty Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Mexico beauty products market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Facial Care

- Makeup-remover

- Hand care

- Depilatories

- Skin Care Products

- Hair Care Products

- Makeup and Perfume

Facial care products have a majority share in the Mexico beauty products market, led by the rising awareness about the importance of skincare routines. The products that cater to most skin-related issues include cleansers, moisturizers, serums, and masks, all with anti-aging, acne, and pigmentation solutions. With a rise in demand for natural ingredients, Mexican consumers are seeking products that offer hydration, nourishment, and protection against environmental damage.

The market for makeup removers is rapidly growing since users feel it is vital to cleanse the skin deeply. Moreover, rising knowledge of skincare damage by residual remains of cosmetics prompts a higher demand for nonabrasive but efficacious removal. Such products include Micellar water, wipes, and oil, which are easy to apply and are harmless to the skin to ensure deeper removal.

The hand care category is also experiencing high growth, specifically due to growing hygiene awareness before and during COVID-19 in Mexico. High demand can be observed among creams, hand sanitizers, and lotions for their capacity to keep hands protected, nourished, and hydrated. Owing to high-frequency washing among individuals, moisturizing and softening hand care items have now emerged as essentials of regular beauty regimens.

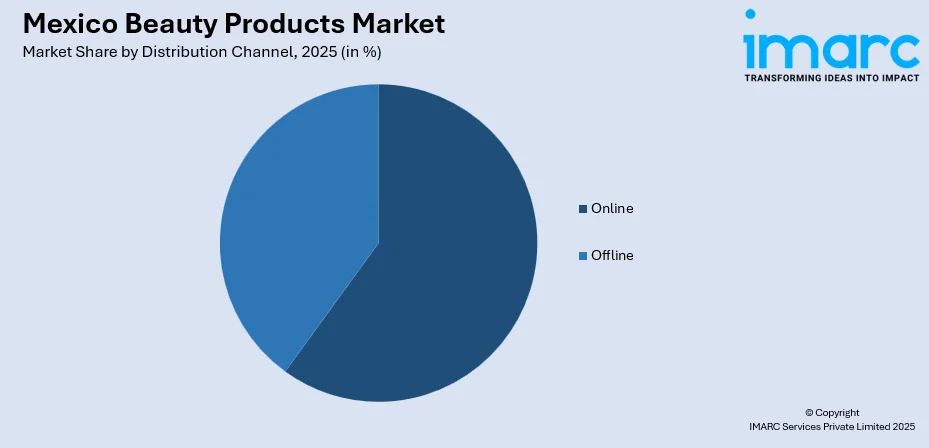

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

- Supermarket and Hypermarket

- Specialty Stores

- Drug Stores

The online segment in the Mexican beauty products market is expanding due to the high growth of online platforms. It is easier to shop from home, as customers get a lot of products in one place, along with reviews and recommendations. Social media and influencer marketing also fuel online sales. Promotions and discounts attract more digital shoppers.

Offline sales remain quite prominent in the Mexico beauty products market, wherein brick-and-mortar stores, such as department stores, specialty beauty shops, and supermarkets, are often preferred. Some consumers prefer touching and feeling various beauty products before finally choosing them in a store. In-store offers personal suggestions and the convenience of buying it on the same day, which are major reasons why offline sales continue to be prevalent in the beauty segment.

Regional Analysis:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico has a significant market share in the beauty products market, as it is close to the United States and has a high-income consumer base. The region has a strong demand for premium and international beauty products, with an inclination toward advanced skincare, cosmetics, and personal care items. The urban population in cities further drives market growth in this area.

Beauty product demand is seen at the largest in Central Mexico and its capital city, Mexico. The region houses the country's economic and cultural hub, experiencing a high level of demand for all categories of beauty products due to its wide varieties. The trend in wellness and self-care among the growing middle class also drives demand for more skincare, haircare, and makeup.

Gradual growth has been observed in Southern Mexico's demand for beauty products, driven by the increasing awareness about skincare and personal care practices. Consumer spending is generally lower in this region compared to the northern and central regions, but there is a growing interest in beauty products that are more affordable. The cities of Oaxaca and Chiapas have seen an increase in beauty product consumption through urbanization and increased involvement of the youth with various beauty-related trends.

Competitive Landscape:

To drive market penetration, leading players in the Mexico beauty products market are currently working on enlarging their portfolios and increasing their online and offline presence. Organically and naturally produced beauty product lines are gaining more attention in the market from key brands that want to take advantage of this new consumer behavior and growing trend. To increase the sale of such products, more investment is made in digital marketing and collaboration with beauty influencers who have a broad audience reach. Global beauty brands are also increasing their retail presence in Mexico, opening flagship stores and partnering with local retailers to make their products more accessible. These actions, along with attractive promotions and tailored product offerings, are positively driving market growth.

The report provides a comprehensive analysis of the competitive landscape in the Mexico beauty products market with detailed profiles of all major companies.

Latest News and Developments:

- 9 December 2024: Brazilian cosmetics brand Natura & Co. intends to expand into Mexico in 2025 with the launch of a franchise model. According to the corporation, the expansion is a component of the overall strategy to bolster its sales across the region.

- 28 November 2024: Givaudan, a leading international fragrance and beauty products brand, has announced the opening of its newly renovated manufacturing facility at the Pedro Escobedo location in Mexico. The expansion of this plant is part of its 2025 plan “Committed to Growth, with Purpose” and strengthens its market position in Latin America.

- 9 October 2024: e.l.f. Cosmetics has launched its products in Mexico for the first time, where it will be available in Sephora Mexico’s online and in-store spaces. Starting October 2024, e.l.f. Cosmetics will offer its luxurious cosmetic experiences in Mexico that are vegan, clean, cruelty-free, and certified by PETA, Leaping Bunny, and Fair Trade Certified.

- 19 March 2024: Ulta Beauty has formed a strategic partnership with Grupo Axo, an international retailer giant in Mexico, Peru, Chile, and Uruguay, to expand its presence internationally and launch products in Mexico in 2025. With over 1400 stores across the US, the beauty brand has entered into an “asset-light” alliance with Grupo Axo to strengthen its Mexico launch.

- 4 February 2024: Leading beauty and skincare brand Glow Recipe has made its debut in the Mexico market, launching its products at 38 Sephora locations. The 26-product collection of the brand is now available to Mexican consumers after launching on the Sephora App, website, and retail stores.

Mexico Beauty Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Facial Care, Makeup-remover, Hand care, Depilatories, Skin Care Products, Hair Care Products, Makeup and Perfume |

| Distribution Channels Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico beauty products market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Mexico beauty products market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico beauty products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The beauty products market in Mexico was valued at USD 8.1 Billion in 2025.

The increasing disposable income and spending power, growing demand for natural and organic beauty products, rising awareness about skincare and personal grooming, expansion of e-commerce platforms, and influence of beauty influencers and social media trends are the primary factors driving the growth of the Mexico beauty products market.

IMARC estimates the beauty products market in Mexico to exhibit a CAGR of 5.54% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)