Mexico Beauty and Personal Care Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2026-2034

Mexico Beauty and Personal Care Market Summary:

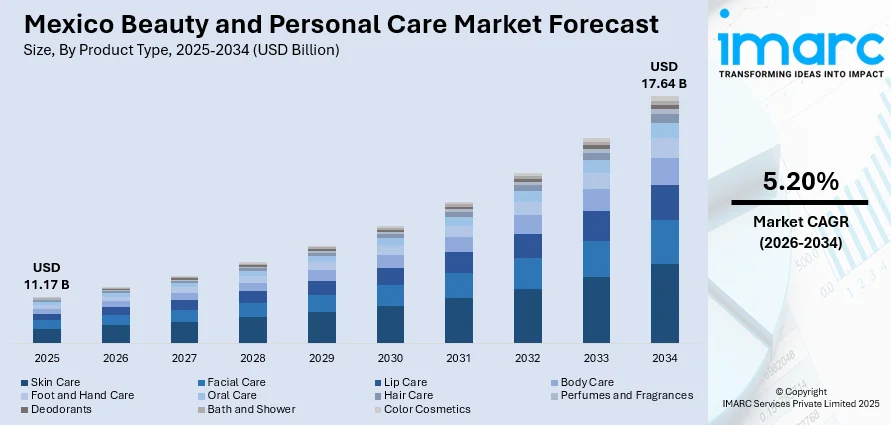

The Mexico beauty and personal care market size was valued at USD 11.17 Billion in 2025 and is projected to reach USD 17.64 Billion by 2034, growing at a compound annual growth rate of 5.20% from 2026-2034.

The market is propelled by increasing consumer awareness about skincare and personal grooming, a growing middle-class population with higher disposable income, and the influence of social media and beauty influencers. The cultural emphasis on appearance and wellness, coupled with rapid urbanization, drives demand for both premium and mass-market beauty products. E-commerce expansion and the entry of international brands through strategic partnerships continue to reshape the Mexico beauty and personal care market share.

Key Takeaways and Insights:

-

By Product Type: Skin care dominates the market with a share of 27% in 2025, driven by increasing consumer focus on preventive skincare routines, anti-aging solutions, and the growing preference for products with natural ingredients. Rising awareness about sun protection and hydration needs across diverse climate zones fuels sustained demand.

- By Category: Mass leads the market with a share of 74% in 2025, owing to widespread accessibility through supermarkets and convenience stores, affordability that appeals to price-conscious consumers, and the availability of trusted household brands that meet daily personal care needs across all income segments.

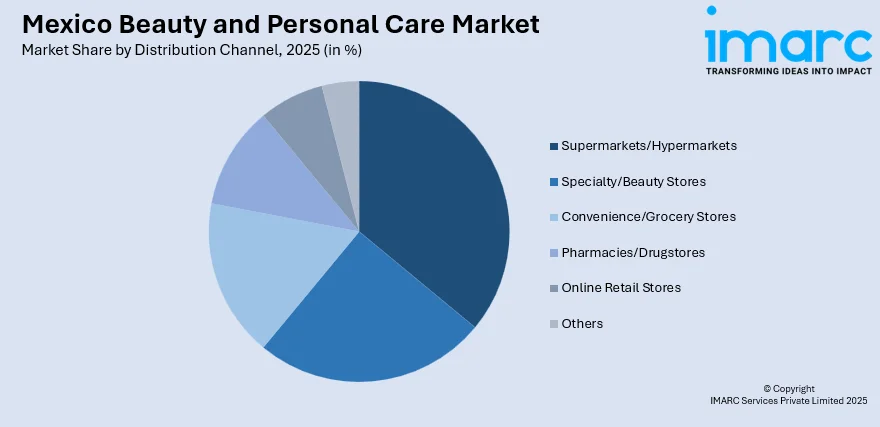

- By Distribution Channel: Supermarkets/Hypermarkets represent the largest segment with a market share of 37% in 2025, reflecting consumer preference for one-stop shopping experiences, competitive pricing through promotional campaigns, and the convenience of accessing diverse product ranges during routine grocery trips.

-

By Region: Central Mexico is the biggest region with 41% share in 2025, driven by the concentration of the country's largest metropolitan area with its high-income households, sophisticated retail infrastructure, and strong penetration of both premium and mass-market beauty channels.

-

Key Players: Key players drive the Mexico beauty and personal care market by expanding distribution networks, investing in digital marketing, and launching products tailored to local consumer preferences. Their focus on natural formulations and sustainable packaging strengthens brand loyalty and market penetration.

To get more information on this market Request Sample

The Mexico beauty and personal care market is experiencing transformative growth driven by evolving consumer behaviors and increased digital engagement. The expanding middle class continues to drive overall demand for both affordable daily essentials and aspirational premium products. Social media platforms have become powerful channels for beauty discovery, with Mexican influencers shaping purchasing decisions among younger demographics who prioritize self-expression through grooming and skincare routines. The country's high urbanization rate creates concentrated demand centers where consumers enjoy greater access to modern retail formats and diverse product offerings. Rising foreign direct investment continues to strengthen the market, with manufacturing facilities expanding to serve both domestic consumption and regional export demand. This positions Mexico as a strategic hub for beauty production in Latin America, benefiting from proximity to major consumer markets and an increasingly sophisticated local consumer base seeking quality personal care solutions.

Mexico Beauty and Personal Care Market Trends:

Rising Demand for Clean and Sustainable Beauty Products

Mexican consumers are increasingly prioritizing clean beauty formulations featuring natural, organic, and cruelty-free ingredients. Environmental consciousness is driving preference for products with recyclable packaging, biodegradable formulas, and eco-friendly production methods. Brands are responding by securing sustainability certifications and launching refill stations in major metropolitan areas. For instance, Mexican skincare brand Aora partnered with RePurpose Global in February 2025 to launch a plastic-free skincare initiative, becoming certified as a plastic-negative brand using recyclable materials like tin and wood in its packaging.

Digital Transformation and Social Commerce Growth

The beauty industry is witnessing accelerated digital adoption as e-commerce platforms and social commerce channels reshape consumer purchasing behaviors. Influencer marketing through Instagram, TikTok, and YouTube significantly impacts product discovery and brand loyalty among millennials and Gen Z consumers. Virtual try-on services and AI-driven skin analysis tools are enhancing online shopping experiences. The February 2025 launch of TikTok Shop in Mexico has enabled beauty brands to achieve double-digit sales increases through promotional livestreams and user-generated content strategies.

Expansion of Men's Grooming and Inclusive Beauty

The men's grooming segment is currently experiencing robust growth as cultural norms around male self-care continue to evolve. Mexican men are increasingly adopting skincare routines and exploring haircare and beard care products, driven by social media influence and celebrity endorsements. Brands are launching gender-neutral products and expanding shade ranges to cater to diverse skin tones. Furthermore, the market is also witnessing growth in inclusive marketing strategies, with brands featuring diverse models and narratives that resonate with Mexico's multicultural consumer base.

Market Outlook 2026-2034:

The Mexico beauty and personal care market is poised for sustained expansion as consumer sophistication increases and distribution channels diversify across the country. Rising disposable incomes among urban households and growing beauty consciousness among younger demographics will continue driving demand across product categories, supported by evolving self-care priorities and increased exposure to global beauty trends. The market generated a revenue of USD 11.17 Billion in 2025 and is projected to reach a revenue of USD 17.64 Billion by 2034, growing at a compound annual growth rate of 5.20% from 2026-2034. International brand expansion, nearshoring of manufacturing facilities, and regulatory improvements by COFEPRIS are expected to strengthen market infrastructure and product innovation capabilities, creating a favorable environment for continued growth.

Mexico Beauty and Personal Care Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Skin Care | 27% |

| Category | Mass | 74% |

| Distribution Channel | Supermarkets/Hypermarkets | 37% |

| Region | Central Mexico | 41% |

Product Type Insights:

- Skin Care

- Facial Care

- Lip Care

- Body Care

- Foot and Hand Care

- Oral Care

- Hair Care

- Perfumes and Fragrances

- Deodorants

- Bath and Shower

- Color Cosmetics

Skin care dominates with a market share of 27% of the total Mexico beauty and personal care market in 2025.

The skin care segment leads the Mexico beauty and personal care market, driven by heightened consumer awareness about skin health and the influence of global beauty trends. Mexican consumers are increasingly adopting comprehensive skincare routines that address specific concerns including anti-aging, hydration, and sun protection. The country's diverse climate zones, ranging from tropical coastal regions to high-altitude urban centers, create varied skincare needs that manufacturers address through targeted product formulations designed to protect against environmental stressors and maintain optimal skin health throughout the year.

The demand for dermatologically tested and clinically proven products continues to rise as consumers become more ingredient-conscious and seek effective solutions for specific skin concerns. Premium skincare brands are experiencing strong growth in urban markets through department stores and specialty retailers that offer personalized consultation services. In September 2023, Korean beauty conglomerate Amorepacific launched its Laneige skincare brand in Mexico through a partnership with Sephora Mexico, introducing K-beauty innovations to Mexican consumers and demonstrating the market's receptivity to international skincare trends.

Category Insights:

- Mass

- Premium

Mass leads with a share of 74% of the total Mexico beauty and personal care market in 2025.

The mass category dominates the Mexico beauty and personal care market, reflecting the purchasing preferences of a large price-conscious consumer base seeking value without compromising quality. Widespread distribution through supermarkets, hypermarkets, and convenience stores ensures accessibility across urban and semi-urban regions. Mass-market brands benefit from established consumer trust, aggressive promotional campaigns, and the ability to offer complete personal care solutions at competitive price points that align with household budgets.

Major manufacturers operating in the industry continue investing in product innovation within the mass segment, thereby introducing premium-inspired formulations at accessible prices. This strategy enables brands to offer enhanced benefits such as natural ingredients, improved textures, and sophisticated packaging while maintaining affordability. The ongoing improvement in economic conditions across Mexico enhances purchasing power among diverse consumer segments, which is enabling broader access to quality personal care products. This economic momentum supports sustained demand for mass-market offerings while creating opportunities for premiumization within the category as consumers gradually trade up to enhanced formulations.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Specialty/Beauty Stores

- Convenience/Grocery Stores

- Pharmacies/Drugstores

- Online Retail Stores

- Others

Supermarkets/Hypermarkets exhibits a clear dominance with a 37% share of the total Mexico beauty and personal care market in 2025.

Supermarkets/Hypermarkets are consistently maintaining their position as the leading distribution channel for beauty and personal care products in Mexico. Their extensive store networks across urban and semi-urban areas are providing convenient one-stop shopping experiences where consumers can purchase personal care items alongside daily necessities. Strategic store locations near residential areas and transportation hubs maximize consumer accessibility, while organized product displays and self-service formats enhance the shopping experience for time-conscious consumers seeking efficiency.

These retail formats leverage their scale to offer competitive pricing, promotional campaigns, and loyalty programs that attract price-sensitive shoppers seeking maximum value from their purchases. The ability to physically examine products before purchase remains a significant advantage, particularly for categories where texture, fragrance, and shade selection are important considerations influencing buying decisions. Major retailers operating in the industry are responding to digital competition by implementing click-and-collect services, expanding online presence, and introducing exclusive product ranges to maintain consumer engagement and strengthen customer relationships across both physical and digital touchpoints.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico represents the leading segment with a 41% share of the total Mexico beauty and personal care market in 2025.

Central Mexico dominates the national beauty and personal care market, anchored by Mexico City, the country's largest metropolitan area and economic hub. The region's high concentration of affluent households, sophisticated retail infrastructure, and extensive presence of premium department stores create favorable conditions for both mass and luxury beauty segments. Consumers in Central Mexico demonstrate heightened beauty consciousness and greater willingness to experiment with innovative products and international brands that align with evolving beauty standards and self-care priorities.

The region benefits from superior e-commerce infrastructure, with same-day delivery services available across major urban centers and strong penetration of digital beauty platforms that facilitate product discovery and convenient purchasing. Central Mexico serves as the primary market entry point for international brands launching in the country, with flagship stores and exclusive retail partnerships concentrated in premium shopping destinations. Mexico City maintains its position as the dominant contributor to national market performance, supported by a large urban population with high purchasing power and extensive access to diverse distribution channels spanning modern retail and specialty beauty outlets.

Market Dynamics:

Growth Drivers:

Why is the Mexico Beauty and Personal Care Market Growing?

Rising Disposable Income and Middle-Class Expansion

The expansion of Mexico's middle class represents a fundamental driver of beauty and personal care market growth. Increasing disposable incomes enable consumers to transition from basic personal hygiene products to premium skincare, haircare, and cosmetic formulations. Urban households demonstrate growing willingness to invest in quality beauty products that deliver visible results and align with self-care and wellness priorities. The improvement in economic conditions supports aspirational purchasing behaviors, with consumers seeking products that enhance their appearance and confidence. Employment growth across service and manufacturing sectors continues to strengthen purchasing power, particularly among young professionals who prioritize personal grooming and are receptive to global beauty trends promoted through digital channels.

Social Media Influence and Digital Beauty Culture

Social media platforms have transformed how Mexican consumers discover, evaluate, and purchase beauty products. Influencer marketing through Instagram, TikTok, and YouTube creates powerful channels for brand awareness and product education, particularly among younger demographics who trust peer recommendations over traditional advertising. Beauty tutorials, product reviews, and trend-driven content shape consumer preferences and drive demand for specific formulations and brands featured by popular content creators. The cultural significance of personal appearance in Mexican society amplifies the impact of digital beauty culture, with consumers increasingly viewing grooming routines as essential elements of self-expression. In August 2025, Ulta Beauty opened its first stores in Mexico through partnership with Grupo Axo, demonstrating the market's receptivity to new retail concepts.

Growing Preference for Natural and Organic Products

Consumer awareness about synthetic chemicals and their potential side effects is driving substantial demand for natural, organic, and clean beauty formulations. Mexican consumers increasingly scrutinize ingredient lists and seek products featuring plant-based components, traditional remedies, and locally sourced materials that align with cultural preferences for authenticity. The country's rich biodiversity provides access to indigenous plants and herbs that resonate with consumers seeking connections to Mexican heritage through their beauty choices. Brands are responding by reformulating products, securing organic certifications, and highlighting sustainable sourcing practices in their marketing communications. This preference extends to packaging considerations, with environmentally conscious consumers favoring recyclable materials, refillable containers, and brands committed to reducing plastic waste throughout their value chains.

Market Restraints:

What Challenges is the Mexico Beauty and Personal Care Market Facing?

Counterfeit Products and Gray Market Distribution

The proliferation of counterfeit beauty products and unauthorized distribution channels poses significant challenges to market integrity and consumer safety. Fraudulent cosmetics lacking proper quality control expose consumers to potential health risks including skin irritation and allergic reactions. Gray market goods undermine brand value and reduce consumer confidence in product authenticity, particularly in premium segments where counterfeiting is prevalent.

Economic Uncertainty and Price Sensitivity

Global economic fluctuations and trade policy uncertainties impact consumer spending behaviors and market growth trajectories. Economic slowdowns prompt consumers to adopt more conservative purchasing patterns, potentially down-trading from premium to mass-market products. Currency volatility affects import costs for international brands, creating pricing pressures that may limit accessibility and reduce demand for imported formulations.

Regulatory Compliance and Raw Material Costs

Evolving regulatory requirements from COFEPRIS necessitate ongoing investment in compliance infrastructure and product reformulation. Rising raw material costs and water tariffs increase production expenses, particularly for rinse-off products and formulations requiring specialized ingredients. Supply chain constraints and logistics challenges can disrupt product availability and impact pricing strategies across distribution channels.

Competitive Landscape:

The Mexico beauty and personal care market exhibits a moderately concentrated competitive structure featuring established multinational corporations alongside emerging local brands. Major international players leverage their global expertise, extensive brand portfolios, and sophisticated distribution networks to maintain market leadership across multiple categories. Companies compete through continuous product innovation, strategic marketing investments, and expansion of digital engagement capabilities to capture evolving consumer preferences. Local manufacturers differentiate through culturally relevant formulations, competitive pricing, and deep understanding of regional consumer needs. The market is witnessing increased investment in manufacturing infrastructure as nearshoring trends position Mexico as a strategic production hub for serving North American demand.

Mexico Beauty and Personal Care Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Categories Covered | Mass, Premium |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Specialty/Beauty Stores, Convenience/Grocery Stores, Pharamcies/Drugstores, Online Retail Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico beauty and personal care market size was valued at USD 11.17 Billion in 2025.

The Mexico beauty and personal care market is expected to grow at a compound annual growth rate of 5.20% from 2026-2034 to reach USD 17.64 Billion by 2034.

Skin care dominated the market with a share of 27%, driven by increasing consumer focus on preventive skincare routines, anti-aging solutions, and growing preference for natural ingredient formulations across diverse skin types.

Key factors driving the Mexico beauty and personal care market include rising disposable incomes among the expanding middle class, growing influence of social media and beauty influencers, increasing preference for natural and organic products, and the entry of international brands through strategic partnerships.

Major challenges include counterfeit products and gray market distribution undermining brand integrity, economic uncertainty affecting consumer spending behaviors, rising raw material and compliance costs, and regulatory complexities requiring ongoing investment in product reformulations and certifications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)