Mexico Apparel Market Size, Share, Trends and Forecast by Type, Type of Fiber, End User, Distribution Channel, and Region, 2026-2034

Mexico Apparel Market Summary:

The Mexico apparel market size was valued at USD 24.27 Billion in 2025 and is projected to reach USD 38.41 Billion by 2034, growing at a compound annual growth rate of 5.23% from 2026-2034.

The Mexico apparel industry is registering considerable growth owing to the rising disposable incomes and urbanization, as well as the fashion trends among the rising middle class population in Mexico. Along with this, the rising connectivity and social media influence among the population is affecting the consumers' purchase behavior, and the rising offline and online shopping facilities are making it easy for everyone to access this market.

Key Takeaways and Insights:

- By Type: Casual wear dominates the market with a share of 43% in 2025, owing to shifting lifestyle preferences toward comfortable, versatile clothing options suitable for both work-from-home and social settings. Rising urbanization and the influence of global fashion trends are accelerating demand for everyday casual apparel among Mexico's young, fashion-conscious consumers.

- By Type of Fiber: Man-made fibers lead the market with a share of 45% in 2025, driven by their cost-effectiveness, durability, and versatility in apparel manufacturing. Technological advancements in synthetic fabric production and growing demand for performance-oriented athletic and casual wear continue to strengthen the prominence of polyester and nylon blends.

- By End User: Women represent the largest segment with a market share of 43% in 2025, reflecting strong consumer spending patterns and evolving fashion preferences. Increasing workforce participation, rising disposable income, and growing influence of social media fashion trends are driving demand for diverse women's apparel categories across casual, formal, and athleisure segments.

- By Distribution Channel: Offline exhibits a clear dominance in the market with 70% share in 2025, driven by strong consumer preference for physical stores offering tactile product evaluation and immediate purchase gratification. Department stores, specialty retailers, and shopping centers continue to attract consumers seeking personalized service and experiential shopping environments.

- By Region: Northern Mexico represents the largest region with 33% share in 2025, supported by higher income levels in industrial cities like Monterrey and proximity to US trade routes. Strong economic development, manufacturing sector concentration, and modern retail infrastructure position the region as a leading apparel consumption hub.

- Key Players: Key players drive the Mexico apparel market by expanding product portfolios, enhancing fabric technologies, and strengthening nationwide distribution networks. Their investments in omni-channel retail strategies, sustainability initiatives, and strategic partnerships with local retailers boost brand visibility and accelerate market penetration across diverse consumer segments.

The Mexico fashion market is fueled by a number of factors such as urbanization, the burgeoning middle-class lifestyle of luxury, and increased fashion awareness amongst the young generation. Being a textile manufacturing base under the USMCA agreement enhances the country's strengths in the supply chain. With increased use of digital media, consumer buying patterns are quickly shifting towards e-commerce. Fashion trends are largely influenced by social media platforms. Moreover, increased developments in modern retailing like shopping centers contribute towards enhancing product availability. With a greater thrust on athleisure wear due to lifestyle changes, it is observed that omni-channel retailing provides consumers with the convenience of shopping from a variety of channels with uncompromising quality, which together contribute towards Mexico fashion market share.

Mexico Apparel Market Trends:

Rising Demand for Sustainable and Second-Hand Fashion

A growing awareness among consumers about their environmental impact is changing purchasing patterns, with Mexicans choosing to buy increasingly green and sustainably manufactured fashion. The growing trend of cheap fashion imported from Asia has brought an environmentally conscious awareness among consumers, with second-hand fashion and online selling becoming increasingly popular. Second-hand fashion has become increasingly popular among environmentally conscious customers who want to be sustainable without paying sustainable prices. Fashion brands are turning to sustainable practices, including recycled materials, to keep up with changing values.

Athleisure and Comfort-Driven Lifestyle Apparel

The convergence of fitness culture and fashion is driving substantial demand for athleisure wear across Mexico's urban population. Consumers increasingly seek functional clothing offering comfort, style, and versatility for both exercise and everyday activities. The growth of remote work arrangements and fitness-oriented lifestyles has positioned athleisure as a mainstream wardrobe category. In November 2024, Onitsuka Tiger and PATOU introduced a joint apparel and footwear collection in Mexico, highlighting the premium segment's expansion in luxury streetwear.

Cultural Heritage Integration in Contemporary Fashion

Mexican fashion is in a resurgence due to a cultural revival, where there is a blend of traditional crafts with contemporary design. Traditional methods of indigenous textiles, respective embroidery, and heritage patterns are slowly being recognized in Mexico, taking Mexico by storm in international fashion. Large fashion houses are trying to blend traditional methods, along with creating new trends based on heritage patterns, due mainly because there is consumer demand that supports cultural authenticity in clothing, thus adding further support to handmade garments in Mexico.

Market Outlook 2026-2034:

The Mexico market forecast in the garments segment shows a positive scenario, thanks to favorable demographics, developing retail infrastructure, and improving consumer spending. It has been observed that government efforts are being made to boost the textile segment by restoring lost employment and improving local material use in finished goods. Enhancing the use of sustainable fashion trends, along with eco-friendly production, aligns well with consumer demand. Urbanization, technology, and foreign investments by international brands in Mexico are expected to boost market growth, while omni-channels are improving market availability in major and secondary urban settings in Mexico. The market generated a revenue of USD 24.27 Billion in 2025 and is projected to reach a revenue of USD 38.41 Billion by 2034, growing at a compound annual growth rate of 5.23% from 2026-2034.

Mexico Apparel Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Casual Wear |

43% |

|

Type of Fiber |

Man-Made Fibers |

45% |

|

End User |

Women |

43% |

|

Distribution Channel |

Offline |

70% |

|

Region |

Northern Mexico |

33% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Formal Wear

- Casual Wear

- Sportswear

- Nightwear

- Others

Casual wear dominates with a market share of 43% of the total Mexico apparel market in 2025.

The casual wear segment maintains strong market dominance driven by evolving lifestyle preferences favoring comfortable, versatile clothing for diverse occasions. Mexico's urbanizing population increasingly seeks apparel that transitions seamlessly between professional remote work settings and social environments. The segment benefits from fast fashion accessibility, with global retailers expanding product offerings to meet demand for trendy, affordable everyday clothing options across all age demographics. Rising influence of social media platforms and celebrity fashion trends continues shaping consumer preferences, while younger generations prioritize self-expression through stylish yet functional casual apparel choices.

Consumer preference for casual apparel reflects broader lifestyle transformations accelerated by changing work patterns and social norms. The influence of social media platforms and celebrity fashion trends continues driving demand for stylish casual clothing among Mexico's young population. In January 2024, Spanish clothing brands Pdpaola, Blue Banana, and Hoff expanded into Mexico, with Hoff opening 15 franchise outlets featuring outdoor-inspired casual fashionwear, indicating strong investor confidence in the segment's growth potential.

Type of Fiber Insights:

- Man-Made Fibers

- Cotton Fibers

- Animal-Based Fibers

- Vegetable Based Fibers

Man-made fibers lead with a share of 45% of the total Mexico apparel market in 2025.

Man-made fibers, including polyester and nylon, maintain market leadership due to their cost-effectiveness, durability, and versatile application across apparel categories. Mexico's textile manufacturing sector produces diverse synthetic fabrics serving both domestic consumption and export markets, particularly automotive textiles requiring high-performance specifications. The fiber type benefits from technological advancements enabling improved comfort, moisture-wicking properties, and sustainable recycled polyester options. Growing demand for performance-oriented sportswear and athleisure apparel requiring technical fabric properties further strengthens synthetic fiber prominence across casual, athletic, and functional clothing segments.

The prominence of synthetic fibers reflects growing demand for performance-oriented sportswear and athleisure apparel requiring technical fabric properties. Mexico's textile industry maintains substantial polyester and nylon production capacity serving diverse manufacturing applications. Manufacturers continue investing in modernizing facilities and expanding capabilities to meet rising domestic and international demand. The sector benefits from strategic geographic positioning enabling efficient supply chain integration with North American markets. Ongoing investments in advanced textile technologies and sustainable production methods demonstrate continued confidence in synthetic fiber manufacturing growth potential.

End User Insights:

- Men

- Women

- Children

Women exhibit a clear dominance with a 43% share of the total Mexico apparel market in 2025.

The women's apparel segment commands market leadership driven by strong purchasing power, diverse fashion preferences, and expanding wardrobe categories including casual, formal, athleisure, and occasion-specific clothing. Increasing female workforce participation and rising disposable income levels enable greater discretionary spending on fashion and personal style expression. Social media influence significantly shapes women's purchasing decisions across both fast fashion and premium segments. Growing emphasis on sustainability and ethical fashion resonates particularly with female consumers seeking brands that align with environmental and social values.

Mexican women demonstrate strong affinity for both international and local fashion brands offering diverse style options. The women's segment particularly drives demand for sustainable fashion alternatives, with young and middle-aged women representing major end-users of second-hand garments. International luxury brands continue expanding their retail presence across Mexico's premium shopping destinations, featuring extensive women's ready-to-wear collections alongside accessories and footwear. This expansion reflects growing demand for premium fashion and the increasing international brand footprint within Mexico's evolving clothing retail environment.

Distribution Channel Insights:

- Online

- Offline

Offline represents the leading segment with a 70% share of the total Mexico apparel market in 2025.

Physical retail channels maintain strong market dominance reflecting Mexican consumers' preference for tactile product evaluation, immediate purchase gratification, and in-store shopping experiences. Leading department store chains serve as anchor retailers for apparel distribution nationwide, offering diverse product selections and trusted shopping environments. The offline segment benefits from ongoing retail infrastructure expansion across metropolitan and secondary cities. Shopping centers and specialty stores continue attracting consumers seeking personalized service, curated product assortments, and experiential retail environments that enhance brand engagement and customer loyalty.

Traditional brick-and-mortar retailers are implementing innovative omni-channel strategies to enhance customer engagement and compete with growing e-commerce penetration. Shopping centers and specialty stores offer experiential environments combining personalized service with diverse product selections. In June 2024, TJX entered the Mexican apparel market through a joint venture with Grupo Axo, acquiring a 49% stake in off-price retail operations encompassing over 200 stores under Promoda, Reduced, and Urban Store banners.

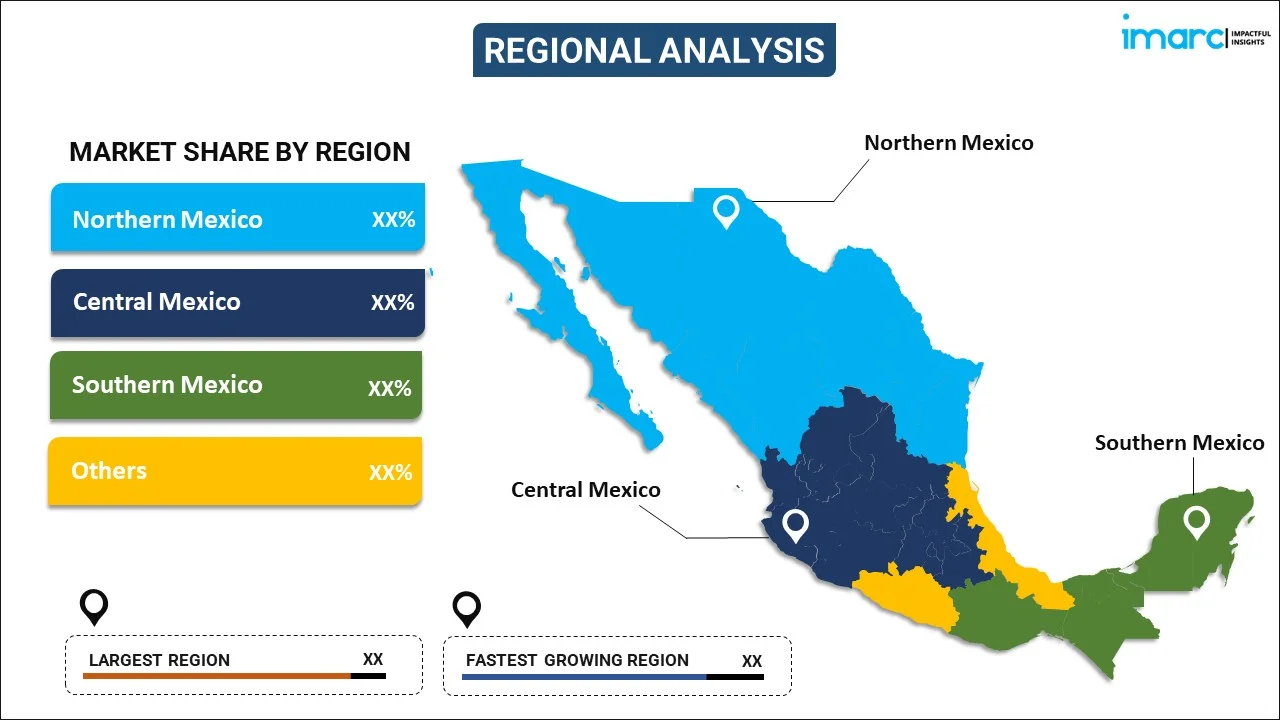

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico holds the largest share with 33% of the total Mexico apparel market in 2025.

Northern Mexico's market leadership reflects the region's higher income levels, industrial economic base, and modern retail infrastructure concentrated in cities like Monterrey. The region benefits from proximity to US trade routes under USMCA, supporting both domestic consumption and textile manufacturing activities. Strong manufacturing sector employment generates substantial consumer purchasing power for apparel products across casual, formal, and premium segments. The presence of multinational corporations and thriving export-oriented industries further bolsters regional economic prosperity and consumer spending on fashion apparel.

The region's textile industry presence includes major manufacturing hubs producing synthetic fabrics and automotive textiles for domestic and export markets. Monterrey serves as a strategic logistics center enabling efficient distribution of imported and domestically manufactured apparel. The area's well-developed transportation infrastructure and proximity to border crossings facilitate rapid supply chain operations and reduced delivery times. Nearshoring trends continue attracting international brands seeking manufacturing advantages, positioning Northern Mexico as a preferred destination for apparel production and distribution activities serving North American markets.

Market Dynamics:

Growth Drivers:

Why is the Mexico Apparel Market Growing?

Rising Disposable Income and Middle-Class Expansion

Economic development and expanding middle-class households are significantly boosting consumer spending on apparel across Mexico. Rising disposable income enables consumers to explore both international and local fashion brands, creating diversified demand for various clothing styles and price segments. Industry data indicates Mexican consumer spending reached 1.257 Trillion US dollars in 2023, representing a 21.8% increase from 2022. This economic improvement directly translates into higher clothing expenditure as consumers prioritize fashion as a form of personal expression and social status indicator. The growth of formal employment and service sector jobs continues strengthening household purchasing power for discretionary consumer goods including apparel.

Digital Transformation and E-commerce Expansion

Rapid digital adoption is transforming apparel purchasing behaviors across Mexico's consumer landscape. The country's robust internet infrastructure supports growing e-commerce penetration, with clothing ranking among the most popular online purchase categories. Mexico e-commerce market size reached USD 54.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 175.8 Billion by 2034, exhibiting a growth rate (CAGR) of 13.92% during 2026-2034. Mobile commerce particularly accelerates market growth, with smartphones accounting for over two-thirds of all e-commerce purchases. Digital platforms enable consumers to access broader product selections from both domestic and international retailers.

International Brand Expansion and Retail Investment

International fast-fashion brands are gradually recognizing the market potential existing in Mexico and are entering Mexico to expand their retail presence nationwide. The rising number of international brands entering Mexico improves the product varieties and competencies available to customers due to better quality and pricing mechanisms. Collaborations between international brands and domestic distributors to promote their products are also improving market presence and tailoring to the preferences of Mexico’s customers. High-end and fast-fashion brands are also entering Mexico through the opening of flagship stores, franchises, or joint ventures indicating continuous faith in Mexico’s fast-growing fast-fashion market.

Market Restraints:

What Challenges the Mexico Apparel Market is Facing?

Intense Competition from Low-Cost Asian Imports

The influx of inexpensive apparel from Asian manufacturing countries creates significant pricing pressure on domestic producers and retailers. Chinese e-commerce platforms have gained substantial market traction, challenging local brands and established retailers competing on price-sensitive consumer segments. This competition constrains profit margins and complicates market positioning for manufacturers focusing on quality differentiation.

Economic Uncertainty and Consumer Spending Volatility

Macroeconomic fluctuations and inflation pressures periodically impact consumer discretionary spending on apparel products. Economic uncertainties prompt consumers to prioritize essential purchases and seek value-oriented alternatives, affecting premium segment growth. Exchange rate volatility influences import costs and retail pricing strategies across the market, compelling brands to adjust positioning and promotional approaches.

Supply Chain and Infrastructure Challenges

Logistics infrastructure limitations in certain regions affect distribution efficiency and market accessibility for apparel retailers. Rising raw material costs and global supply chain disruptions create operational challenges for domestic manufacturers. Labor availability for skilled textile production and regulatory compliance requirements add complexity to market expansion efforts.

Competitive Landscape:

The Mexico apparel market depicts a fragmented competitive structure wherein international fashion conglomerates, regional retailers, and local manufacturers focus on diverse segments of consumers. International brands penetrate deep into the marketplace with large retail networks and brand equity. National department store chains also have significant market shares each and thus act as important distribution points for many apparel brands. Participants in this market are focusing on expansion through omni-channel retail, sustainability initiatives, and localized product offerings to reinforce their competitive positioning. Through strategic partnerships, franchise agreements, and direct-to-consumer models, brands have greater depth in market penetration across metropolitan and secondary city markets.

Mexico Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Formal Wear, Casual Wear, Sportswear, Nightwear, Others |

| Types of Fiber Covered | Man-Made Fibers, Cotton Fibers, Animal-Based Fibers, Vegetable Based Fibers |

| End Users Covered | Men, Women, Children |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico apparel market size was valued at USD 24.27 Billion in 2025.

The Mexico apparel market is expected to grow at a compound annual growth rate of 5.23% from 2026-2034 to reach USD 38.41 Billion by 2034.

Casual wear dominated the market with a share of 43%, driven by evolving lifestyle preferences toward comfortable, versatile clothing suitable for both professional and social settings.

Key factors driving the Mexico apparel market include rising disposable incomes, rapid urbanization, expanding e-commerce penetration, increasing fashion consciousness among youth, and international brand expansion.

Major challenges include intense competition from low-cost Asian imports, economic uncertainty affecting consumer spending, supply chain constraints, rising raw material costs, and infrastructure limitations in certain regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)