Mexico Aesthetic Device Market Report by Type (Energy-Based Aesthetic Device, Non-Energy-Based Aesthetic Device), Application (Skin Resurfacing and Tightening, Body Contouring and Cellulite Reduction, Hair Removal, Facial Aesthetic Procedures, Breast Augmentation, and Others), End User (Hospital, Aesthetic Centers, Home Settings), and Region 2026-2034

Mexico Aesthetic Device Market Overview:

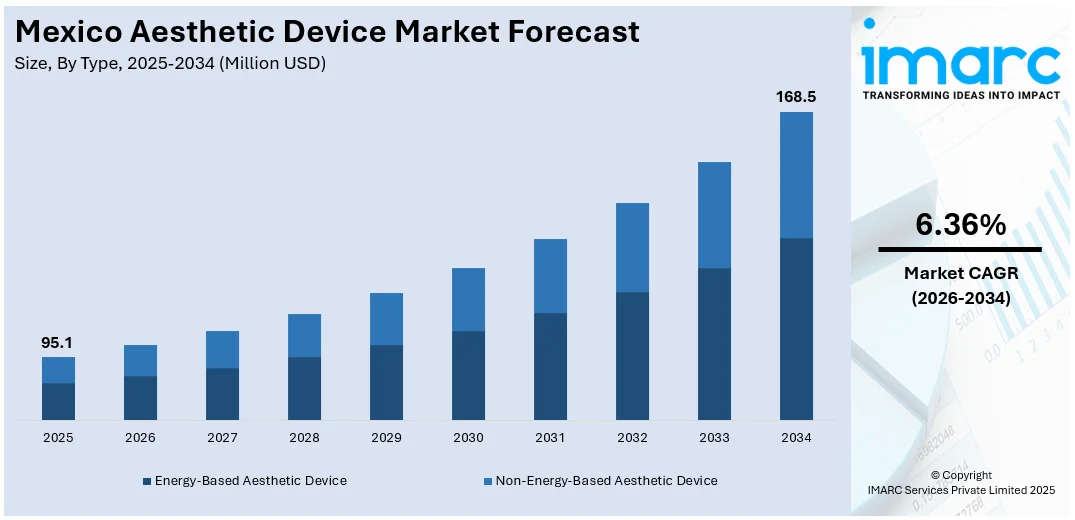

The Mexico aesthetic device market size reached USD 95.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 168.5 Million by 2034, exhibiting a growth rate (CAGR) of 6.36% during 2026-2034. The market is propelled by the increasing demand for minimally invasive procedures, rapidly growing middle-class population with higher disposable income levels, medical tourism and cross-border patient influx, significant advancements in aesthetic technology, increased awareness and acceptance of aesthetic procedures, and aging population seeking aesthetic improvements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 95.1 Million |

| Market Forecast in 2034 | USD 168.5 Million |

| Market Growth Rate 2026-2034 | 6.36% |

Mexico Aesthetic Device Market Trends:

Rising Demand for Minimally Invasive Procedures

A significant driver of the Mexico aesthetic device industry is the growing number of patients seeking less invasive procedures. On account of the less risky, more successful, and less recovery time attributes of these processes, they are becoming more popular. A sizable segment of the population across this region is exhibiting a desire for aesthetic procedures that yield prompt results with minimal recovery time, such as non-surgical fat reduction, laser hair removal, and injectable procedures such as dermal fillers and Botox. Technological developments that have increased accessibility and affordability of minimally invasive procedures have added to their appeal in Mexico. Modern devices with radiofrequency, ultrasonic, and laser technologies are more advanced and produce better results with fewer negative effects. Furthermore, the growing consciousness among consumers in Mexico about the availability and benefits of these procedures has been a significant driver.

To get more information on this market Request Sample

Growing Middle-Class Population with Higher Disposable Income

The market for cosmetic devices is expanding across the region due to the large portion of the middle-class population and the resulting increase in disposable money. Spending on non-essential services, such as cosmetic procedures, has increased significantly as more individuals have access to higher incomes. Investopedia states that 47% of the global middle-class resides in Mexico. This is anticipated to increase, with 3.8 million homes falling into this group by 2030. Furthermore, a larger segment of the public can afford cosmetic operations due to market competition and technological improvements that have made them more affordable. Many clinics make it easier for individuals from different economic situations to pursue aesthetic treatments by providing promotional discounts and flexible payment alternatives. The market for aesthetic gadgets is projected to continue rising due to the rise in disposable income and the trend toward valuing personal aesthetics.

Medical Tourism and Cross-Border Patient Influx

Medical tourism is a significant driver of the aesthetic device market in Mexico, with the country being a preferred destination for patients seeking affordable yet high-quality aesthetic treatments. The proximity of Mexico to the United States, coupled with significantly lower costs for procedures and a high standard of care, attracts a substantial number of international patients. According to CNN, Mexico, being the second most popular destination for medical tourism globally, treated approximately 1.4 million to 3 million individuals in the year 2020, on account of its economical treatment options. Furthermore, the Mexican government has been supportive of the medical tourism sector, providing incentives for clinics that cater to international patients and promoting the country as a hub for medical and aesthetic treatments. The combination of skilled practitioners, state-of-the-art facilities, and cost-effective pricing has positioned Mexico as a leader in medical tourism, significantly impacting the local aesthetic device market. As medical tourism continues to grow, so does the demand for advanced aesthetic devices that can cater to the diverse needs of both domestic and international patients.

Mexico Aesthetic Device Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Energy-Based Aesthetic Device

- Laser-Based Aesthetic Device

- Radiofrequency (RF) Based Aesthetic Device

- Light-Based Aesthetic Device

- Ultrasound-Based Device

- Non-Energy-Based Aesthetic Device

- Botulinum Toxin

- Dermal Fillers and Aesthetic Threads

- Microdermabrasion

- Implants

The report has provided a detailed breakup and analysis of the market based on the type. This includes energy-based aesthetic device (laser-based aesthetic device, radiofrequency (RF) based aesthetic device, light-based aesthetic device, and ultrasound-based device) and non-energy-based aesthetic device (botulinum toxin, dermal fillers and aesthetic threads, microdermabrasion, and implants).

Application Insights:

Access the comprehensive market breakdown Request Sample

- Skin Resurfacing and Tightening

- Body Contouring and Cellulite Reduction

- Hair Removal

- Facial Aesthetic Procedures

- Breast Augmentation

- Others

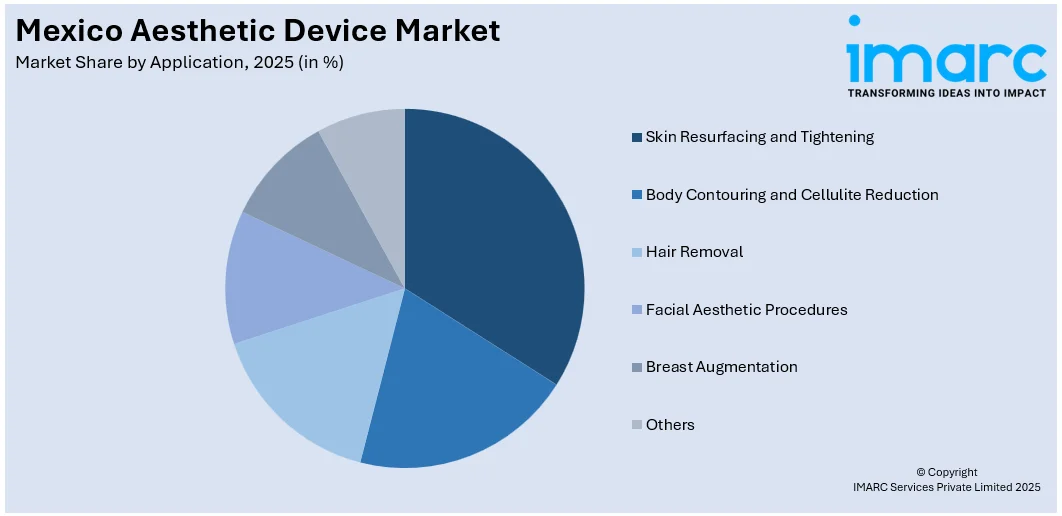

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes skin resurfacing and tightening, body contouring and cellulite reduction, hair removal, facial aesthetic procedures, breast augmentation, and others.

End User Insights:

- Hospital

- Aesthetic Centers

- Home Settings

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospital, aesthetic centers, and home settings.

Regional Insights:

- Northern States

- Central States

- Southern States

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern States, Central States, and Southern States.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Aesthetic Device Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Modes Covered |

|

| Applications Covered | Skin Resurfacing and Tightening, Body Contouring and Cellulite Reduction, Hair Removal, Facial Aesthetic Procedures, Breast Augmentation, Others |

| End Users Covered | Hospital, Aesthetic Centers, Home Settings |

| Regions Covered | Northern States, Central States, Southern States |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico aesthetic device market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Mexico aesthetic device market?

- What is the breakup of the Mexico aesthetic device market on the basis of type?

- What is the breakup of the Mexico aesthetic device market on the basis of application?

- What is the breakup of the Mexico aesthetic device market on the basis of end user?

- What are the various stages in the value chain of the Mexico aesthetic device market?

- What are the key driving factors and challenges in the Mexico aesthetic device?

- What is the structure of the Mexico aesthetic device market and who are the key players?

- What is the degree of competition in the Mexico aesthetic device market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico aesthetic device market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico aesthetic device market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico aesthetic device industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)