Metamaterials Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Metamaterials Market Size and Share:

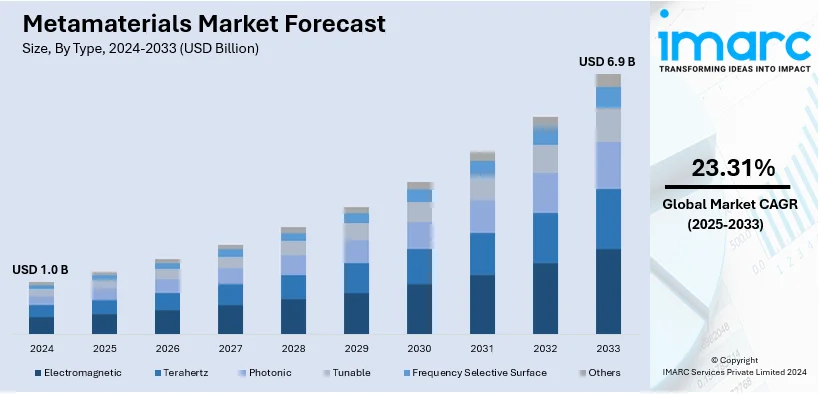

The global metamaterials market size was valued at USD 1.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.9 Billion by 2033, exhibiting a CAGR of 23.31% from 2025-2033. North America currently dominates the market, holding a market share of over 42.2% in 2024. The market is primarily driven by technological advancements in nanotechnology and photonics, increasing demand in wireless communication and defense sectors, expanding applications in healthcare and sustainable solutions, educational and research initiatives, and customization potential across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.0 Billion |

|

Market Forecast in 2033

|

USD 6.9 Billion |

| Market Growth Rate (2025-2033) | 23.31% |

The metamaterials market is expanding due to increasing demand in telecommunications, aerospace, and defense. Their increasing ability to manipulate electromagnetic waves is driving advancements in technologies like 5G, radar, and stealth systems. On September 9, 2024, University of Glasgow engineers unveiled a 0.64mm-thick 2D metamaterial that converts linear to circular polarization, enhancing satellite communication and data reliability across Ku-, K-, and Ka-bands. Rising investments in research and development (R&D), supported by government and private funding, fuel continuous innovation. Additionally, their growing adoption in medical imaging, wearable devices, and renewable energy projects highlights their versatility. Moreover, lightweight, high-performance metamaterials are addressing complex technological challenges, solidifying their importance across diverse industries.

The United States is a key regional market and is expanding due to advancements in telecommunications, aerospace, and healthcare sectors. Demand for high-performance materials in 5G infrastructure, radar, and stealth technology drives growth, alongside rising investments in satellite communication. Metamaterials' applications in medical imaging, such as MRI enhancements, further augment healthcare innovation. On November 20, 2024, MIT researchers advanced ultrasound wave control in microscale acoustic metamaterials, enabling devices like acoustic demultiplexers for medical and communication uses. Their framework links geometry to material properties, improving fabrication methods. Additionally, metamaterials play a growing role in renewable energy solutions, enhancing solar panel efficiency and energy harvesting. These developments, supported by government and industry collaboration, solidify the United States' leadership in metamaterial innovation.

Metamaterials Market Trends:

Advancements in technology and materials science

Emerging innovations in nanotechnology and photonics can create matter with high levels of customization for electromagnetic, acoustic, and thermal properties. Such developments have opened new routes for its applications in telecommunication, healthcare, aerospace, and defense industries. In the telecommunication sector, they are used to generate much compact and efficient antennas operating at frequency ranges that are inevitable for 5G technologies. Ericsson Consumer Lab Global Survey reported that around 31 million smartphone users in India were expected to upgrade to 5G by the end of 2023, which would increase the demand for high-performance metamaterials necessary for optimizing 5G infrastructure. In healthcare, they are being explored for use in advanced imaging systems and sensor technologies. Moreover, ongoing R&D efforts are continuously expanding the capabilities and applications, further propelling market growth.

Increasing demand for wireless communication technologies

As the world becomes more interconnected with the proliferation of smartphones, (Internet of Things) IoT devices, and the advent of 5G networks, there is a growing need for advanced materials that can support these technologies. They play a critical role in this context by enabling the development of high-performance, miniaturized antennas and components that are essential for efficient signal transmission and reception in wireless communication systems. According to research, wireless communication systems, projected to handle 5016 EB/month global traffic by 2030, are critical for changing demands. Beyond 5G, with intelligent slicing and convergence capabilities, enables adaptable, efficient networks. Integrating Wi-Fi and 5G advances smart cities and metamaterial innovation, enhancing spectral efficiency and device connectivity. Their unique properties allow for better manipulation and control of electromagnetic waves, leading to enhanced performance and bandwidth in communication devices. This demand is propelling the market and encouraging investments in research and development to further harness these materials for telecommunications applications.

Rising interest in defense and security applications

They are increasingly being recognized for their potential in defense and security applications, which is a significant factor driving the market growth. For instance, global military spending increased to USD 2443 Billion in 2023, driven by heightened tensions, this increase fosters advancements in metamaterials for cutting-edge defense applications. Their ability to manipulate electromagnetic waves can be applied to create advanced radar and cloaking technologies, making them valuable for stealth operations. They can render objects less detectable to radar, a capability highly sought after in military applications. Additionally, the development hyperbolic metamaterials (HMMs) have implications for thermal imaging and infrared sensors, which are crucial in surveillance and night-vision technologies. Governments and defense agencies are investing in this area, seeking to leverage the strategic advantages offered by these advanced materials.

Metamaterials Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global metamaterials market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

Analysis by Type:

- Electromagnetic

- Terahertz

- Photonic

- Tunable

- Frequency Selective Surface

- Others

Electromagnetic stand as the largest component in 2024, holding around 36.4% of the market. Electromagnetic materials are engineered to manipulate and control electromagnetic waves in unique ways. These materials are designed to interact with a range of electromagnetic waves, including microwaves, radio waves, and light. Their applications are diverse, encompassing areas such as advanced optical lenses, cloaking devices, and improved wireless communication systems. The ability of electromagnetic varieties to bend, shape, and focus electromagnetic waves beyond the capabilities of traditional materials makes them invaluable in sectors, such as defense, telecommunications, and medical imaging.

Analysis by Application:

- Antenna and Radar

- Cloaking Devices

- Super Lens

- Others

Antenna and radar lead the market with around 43.9% of market share in 2024. These materials in antenna and radar applications have revolutionized these technologies. They enable the creation of antennas that are more compact, efficient, and capable of operating over broader frequency ranges, which is crucial in today's wireless communication landscape. In radar systems, they enhance signal detection and imaging capabilities, offering improved resolution and range. These advancements are vital in sectors such as telecommunications, defense, and aerospace, where the demand for sophisticated communication and surveillance systems is continuously growing.

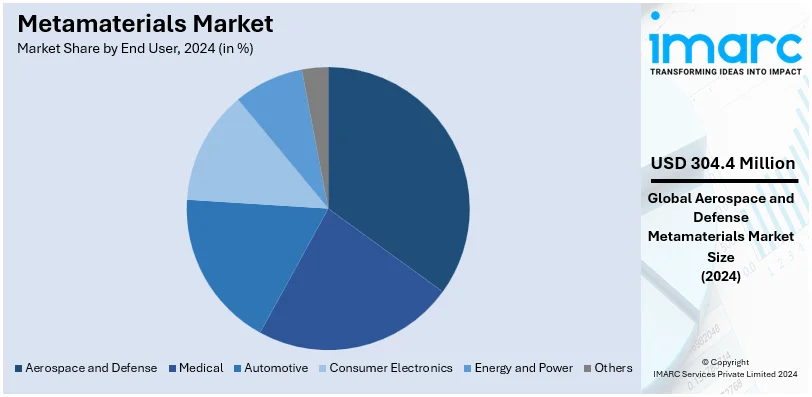

Analysis by End User:

- Aerospace and Defense

- Medical

- Automotive

- Consumer Electronics

- Energy and Power

- Others

Aerospace and defense lead the market with around 29.7% of market share in 2024. The use of meta-materials in aerospace and defense is pivotal. In these industries, these materials enhance the capabilities of communication systems, radar, and stealth technology. Their unique properties enable the development of advanced antennas and radar systems with improved performance, reduced size, and increased frequency bandwidth. They are also crucial in stealth technology, aiding in the development of materials that can effectively reduce the radar cross-section of aircraft and missiles. This application is key for modern defense strategies that rely on minimally detectable technology.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.2%. North America demonstrates strong growth due to its advanced technological infrastructure, significant investments in research and development (R&D), and the presence of key players in industries, such as defense, aerospace, and telecommunications. The United States leads in the adoption and development of technologies, particularly for defense applications and wireless communication advancements. This region's focus on innovation, coupled with substantial government and private sector funding, drives the market forward, fostering new applications and commercialization opportunities.

Key Regional Takeaways:

United States Metamaterials Market Analysis

In 2024, the United States represented 88.98% of the North America metamaterials market. The United States is experiencing a rise in demand for metamaterials, driven by advanced defense applications and increasing investments in aerospace innovations. For instance, in 2023, U.S. defense spending rose by USD 55 Billion, accounting for nearly 40% of global military expenditures, enhancing opportunities for metamaterials, as rising defense investments foster advanced technologies and innovations. Metamaterials' ability to enhance stealth and radar evasion capabilities makes them vital in next-generation military aircraft and drones. The telecommunications industry benefits significantly, with metamaterials enabling high-performance antennas and 5G signal optimization. Additionally, the renewable energy sector is leveraging metamaterials for more efficient solar panels and wireless power transmission, aligning with the country’s push towards sustainability. The automotive sector is integrating metamaterials to develop lightweight yet strong materials for fuel-efficient vehicles. Healthcare applications, such as non-invasive imaging and targeted drug delivery, are gaining traction with continuous R&D support. Robust public and private funding in nanotechnology and material science fuels innovation, fostering rapid commercialization of metamaterial-based products.

Europe Metamaterials Market Analysis

Europe is witnessing significant advancements in metamaterials, driven by the demand for eco-friendly technologies and stringent regulations for energy efficiency. The aerospace sector capitalizes on metamaterials for noise reduction and advanced aerodynamics. The healthcare sector extensively adopts metamaterials for precise medical imaging techniques and wearable health monitoring devices. According to EU, the growing healthcare sector in the EU, with countries like Germany, France, and Austria leading in healthcare expenditure relative to GDP (12.6%, 11.9%, and 11.2% respectively in 2022), presents significant opportunities for metamaterials. The rapid expansion in healthcare spending, particularly in Latvia, Romania, and other Eastern European nations, enhances demand for advanced technologies, including metamaterials for medical applications. This growth is fostering innovation and creating new avenues for metamaterials to improve healthcare outcomes. In addition, metamaterials find applications in creating sustainable construction materials, catering to Europe’s green building initiatives. The focus on smart cities and urban planning integrates metamaterials in sensor technologies for enhanced infrastructure monitoring. European collaborations among research institutes and multinational corporations foster cutting-edge developments in photonic and acoustic metamaterials.

Asia Pacific Metamaterials Market Analysis

In the Asia-Pacific region, metamaterials are gaining prominence due to rapid industrialization and a booming consumer electronics market. The region’s strong semiconductor manufacturing base is integrating metamaterials to create next-generation chips and components with improved performance. According to reports, China is set to become the world’s leading semiconductor superpower, driving 60% of the industry’s USD 1 Trillion growth by 2030. This increase in semiconductor manufacturing will significantly benefit the development of metamaterials, crucial for advancing IoT and smart environments. The push for high-speed internet has led telecommunications companies to adopt metamaterials for 5G infrastructure. Additionally, the automotive industry is incorporating metamaterials to design advanced safety systems and electric vehicles, aligning with sustainability goals. Research institutions and partnerships between academia and industry are accelerating innovation in optical metamaterials, crucial for virtual and augmented reality devices. Increasing government support and initiatives in emerging economies promote the adoption of metamaterials across diverse applications.

Latin America Metamaterials Market Analysis

In Latin America, the growth of metamaterials is primarily fueled by their use in renewable energy projects and agricultural innovations. Solar energy systems incorporate metamaterials to improve light absorption, increasing efficiency in power generation. For instance, Brazil leads the G20 in renewable electricity, with 89% of its power coming from renewables in 2023, three times the global average. Solar generation grew by 72% in 2023, contributing 7.3% to Brazil's electricity, benefiting metamaterials industries by driving cleaner, more sustainable energy solutions and reducing emissions. In agriculture, metamaterials are used for precision irrigation technologies, optimizing water usage and crop yields. Public-private partnerships focus on adapting metamaterials for cost-effective industrial solutions. Emerging sectors such as wearable technology and telecommunications also contribute to the rising demand for metamaterials.

Middle East and Africa Metamaterials Market Analysis

In the Middle East and Africa, the metamaterials market is driven by the increasing demand for advanced technologies in telecommunications and defense. With a focus on enhancing network capabilities and embracing next-generation wireless technologies like 5G, metamaterials are being explored for their potential to improve signal processing and antenna performance. In addition, the region’s growing emphasis on smart city development and infrastructure modernization created opportunities for the use of metamaterials in sensors, imaging systems, and radar technologies. For instance, The UAE's impressive rise in the IMD Smart City Index 2024, with Abu Dhabi securing 10th and Dubai 12th positions, highlights the rapid growth of smart cities. This development fosters an ideal environment for metamaterials, offering opportunities for advanced technologies that enhance infrastructure, communication, and sustainability. The aerospace sector is also a key player, with metamaterials helping to reduce weight and improve performance in aircraft and other high-tech applications. Furthermore, regional investments in innovation and technological development are fueling the adoption of metamaterials across various industries.

Competitive Landscape:

Most market players are adopting with different strategies that help strengthen the position of the company in the market. Among them, companies are researching a lot with new developments in their R&D processes to innovate and improve the functionalities of the material so as to create more efficient, versatile, and cheaper products. They are also forging strategic partnerships and collaborations with the academic institutions, research organizations, and other companies in order to share expertise and resources with each other, thus making advancement of technology as well as its applications possible in any field. Moreover, these leaders of the market are establishing their presence across the world through mergers and acquisitions and new facility setups and are trying to penetrate newly emerging markets and also fulfill growing demands for high-tech material in various industries.

The report provides a comprehensive analysis of the competitive landscape in the metamaterials market with detailed profiles of all major companies, including:

- Acoustic Metamaterials Group Ltd

- Echodyne Corp

- Fractal Antenna Systems Inc.

- JEM Engineering LLC

- Kymeta Corporation

- Metamagnetics Inc

- Metamaterial Technologies Inc.

- MetaShield LLC

- Nanoscribe GmbH & Co. KG (Cellink AB)

- Plasmonics Inc.

- TeraView Limited

Latest News and Developments:

- April 2024: BASF Venture Capital (BVC) invested in Phomera Metamaterials Inc., a company specializing in photonic crystal metamaterials. This funding was part of Phomera's Series A round and aims to augment the company's production capacity. The investment will support the company in exploring new markets and enhancing its product range.

- February 2024: Metalenz, Inc. collaborated with Samsung Electronics to incorporate the ISOCELL Vizion 931 global-shutter NIR image sensor. This collaboration enables the use of polarization-sorting imaging technology for enhanced, fast, and secure facial recognition. The innovation reduces image size and cost by half compared to traditional methods.

- August 2022: Fractal Antenna Systems Inc. was granted a patent for technology that can detect invisibility cloaks, preventing hostile military assets from evading radar detection. This breakthrough in stealth metamaterials helps reduce the risks of undetected military operations, contributing to global peace and security. The innovation aims to decrease the chances of sparking conflicts by improving detection and tracking capabilities.

- July 2022: TeraView Limited introduced the EOTPR 4500, a high-performance probing tool designed to meet the growing demands of advanced IC packaging. Featuring innovative auto prober technology, it enhances probe tip placement accuracy to +/- 0.5 µm, allowing for precise probing of chip-let devices with minuscule contact sizes. This new tool also supports large substrate sizes of up to 150mm x 150mm, catering to next-generation semiconductor applications.

- July 2021: MetaShield LLC received a patent for MetaShieldCLEAN, a nanotechnology-based coating that protects surfaces from dust and dirt accumulation. This coating is specifically designed for poly-based materials and has numerous applications where maintaining cleanliness is critical, such as in industrial machinery as well as electronic devices. It ensures longer-lasting surface integrity by reducing the need for frequent cleaning or maintenance.

Metamaterials Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electromagnetic, Terahertz, Photonic, Tunable, Frequency Selective Surface, Others |

| Applications Covered | Absorber, Antenna and Radar, Cloaking Devices, Super Lens, Others |

| End Users Covered | Aerospace And Defense, Medical, Automotive, Consumer Electronics, Energy and Power, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acoustic Metamaterials Group Ltd, Echodyne Corp, Fractal Antenna Systems Inc., JEM Engineering LLC, Kymeta Corporation, Metamagnetics Inc, Metamaterial Technologies Inc., MetaShield LLC, Nanoscribe GmbH & Co. KG (Cellink AB), Plasmonics Inc., TeraView Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the metamaterials market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global metamaterials market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the metamaterials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global metamaterials market was valued at USD 1.0 Billion in 2024.

IMARC estimates the metamaterials market to exhibit a CAGR of 23.31% during 2025-2033, reaching USD 6.9 Billion by 2033.

The metamaterials market is driven by advancements in nanotechnology and photonics, growing demand in telecommunications and defense sectors, expanding applications in healthcare and renewable energy, and increased R&D investments fueled by government and private funding.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the market with over 42.2% market share in 2024.

Some of the major players in the metamaterials market include Acoustic Metamaterials Group Ltd, Echodyne Corp, Fractal Antenna Systems Inc., JEM Engineering LLC, Kymeta Corporation, Metamagnetics Inc, Metamaterial Technologies Inc., MetaShield LLC, Nanoscribe GmbH & Co. KG (Cellink AB), Plasmonics Inc., and TeraView Limited., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)