Metal Replacement Market Size, Share, Trends and Forecast by Type, End Use Industry, and Region, 2025-2033

Metal Replacement Market Size and Share:

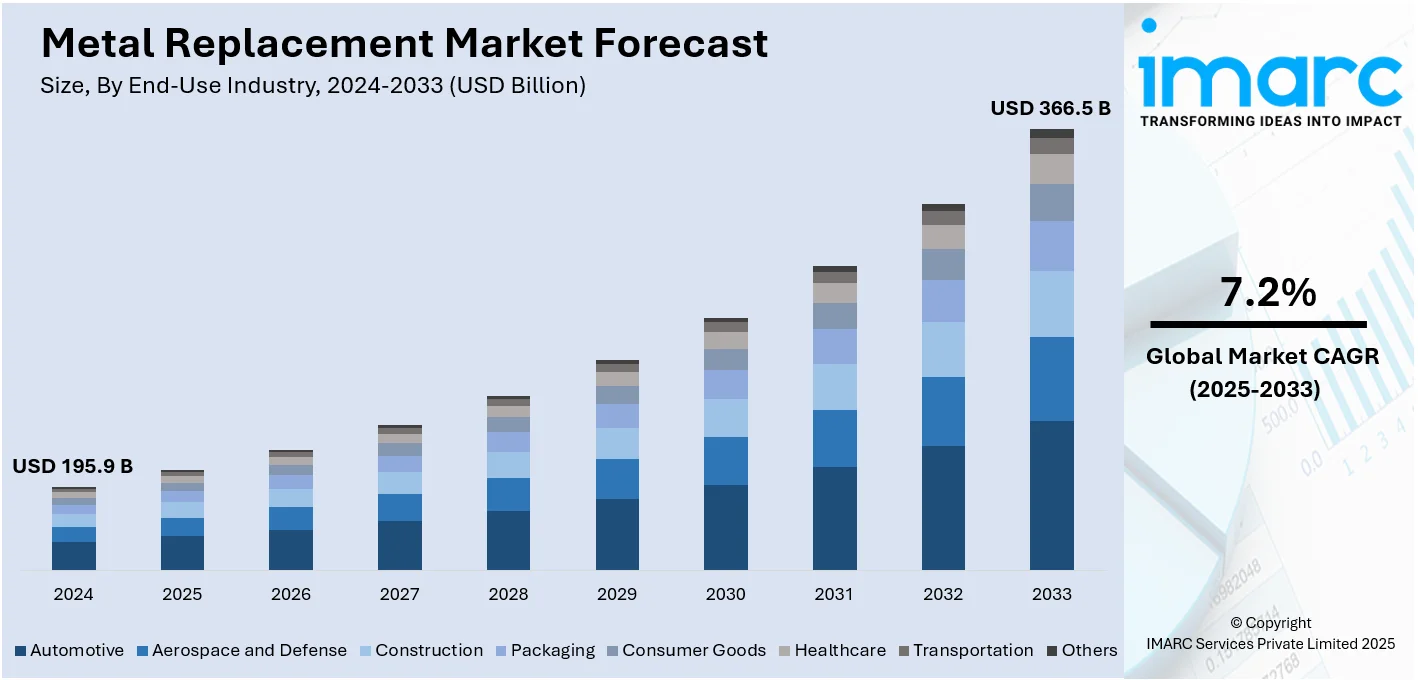

The global metal replacement market size was valued at USD 195.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 366.5 Billion by 2033, exhibiting a CAGR of 7.2% from 2025-2033. North America currently dominates the market, holding 35.0% of the market share due to the growing demand for lightweight materials to improve fuel efficiency in automotive and aerospace sectors, advancements in high-performance composites and polymers offering superior durability and cost-effectiveness, and rising sustainability initiatives encouraging the adoption of recyclable alternatives to reduce environmental impact and comply with stringent regulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 195.9 Billion |

|

Market Forecast in 2033

|

USD 366.5 Billion |

| Market Growth Rate 2025-2033 | 7.2% |

One major driver in the metal replacement market is the growing demand for lightweight materials in the automotive and aerospace industries. Manufacturers increasingly prefer high-performance plastics and composites over metals to reduce vehicle weight, improve fuel efficiency, and lower emissions. Additionally, stringent regulatory standards promoting environmental sustainability further amplify the need for lightweight alternatives. These materials also offer superior resistance to corrosion, ease of manufacturing, and cost-effectiveness compared to metals. With rapid advancements in material science, the development of innovative composites tailored to meet specific performance requirements continues to bolster the adoption of metal-replacing solutions across diverse applications.

The U.S. metal replacement market is emerging as a leading segment, holding 80.0% of the share driven by advancements in the automotive, aerospace, and construction industries seeking lightweight, durable alternatives to metals. High-performance polymers and composites are widely adopted to improve energy efficiency, comply with stringent emission regulations, and enhance design flexibility. In the week ending December 28, 2024, domestic raw steel production reached 1,658,000 net tons, with a capability utilization rate of 74.7%. This compares to 1,705,000 net tons produced in the same week of 2023, where the capability utilization rate was 74.2%. The nation's robust research and development (R&D) ecosystem fosters the development of innovative materials tailored for specific applications, such as polyamides in automotive components or carbon-fiber composites in aerospace structures. Additionally, increasing sustainability initiatives encourage metal substitution to reduce environmental impact. The U.S. market benefits from a strong manufacturing base and collaborations between material providers and end-use industries, ensuring consistent growth opportunities.

Metal Replacement Market Trends:

Growing Demand for Lightweight Metals

The global aluminum market is likely to increase by approximately 6.1% in terms of the compound annual growth rate (CAGR) during the next forecast period, with estimated massive growth by 2033, an industrial report stated. This is mostly driven by the rising requirement for lightweight materials in these sectors of aerospace, automotive, and manufacturing. In the automobile sector, for instance, its adoption has increased significantly as a material with a high strength-to-weight ratio, which increases the fuel efficiency and decreases the emissions. Aluminum also is playing a significant role in the production of electric vehicles, especially in lightweight energy-efficient vehicles. According to a study carried out by European Aluminum, the average aluminum content of European cars has increased by 18% from 174 kg in 2019 to 205 kg in 2022. The study predicts the trend will continue, and that by 2026 the average aluminum content is set to rise to 237 kg and to 256 kg by 2030. To meet more stringent environmental compliance and to improve vehicle performance, the position of aluminum as a preferred material grows. Along with aluminum, other lightweight metals such as titanium are likely to gain a higher percentage of adoption; this will support sustainability goals from different industries. The continued innovation in material science, including advances in alloy formulations, will likely accelerate this trend and contribute to the expansion of the lightweight metal market in the coming years.

Increased Adoption of Advanced Alloys

Superalloys and the like, magnesium and a broad category of high-performance material products that have found application in space exploration, energy generation and conversion, and automobile designs with advanced alloy components. According to industrial reports, superalloys market globally reached a valuation of about USD 5.59 billion in 2023 and is anticipated to expand at a compound annual growth rate of 7.67% from 2024 to 2030. Superalloys play an important role in maintaining the structural integrity of the engine by tolerating extreme temperatures in the turbines of these engines. Industries strive to deliver superior performance with efficiency, so their demand for such alloys in the aerospace and energy industries will increase. Advances in space travel and energy will only continue increasing the number of commercial orders for aircraft; even so, the demand for high temperature-resistant materials that will rise to meet tougher industrial operational requirements will continue propelling more adoption of these super alloys and other high-end material products in coming years.

Sustainability Focus Driving Recycling of Metals

According to the Bureau of International Recycling, BIR, global crude steel production in the first nine months of 2023 was at 1.407 billion tonnes. Recycled steel usage accounts for nearly 74% of that amount. That is equivalent to more than 1.04 billion tonnes of steel recycled, which increases the importance of recycling within the global metals market. The trend isn't exclusive to steel; the recyclings of other metals including aluminum, copper, and rare earth metals are also on a growing pace. As those involved in the automotive, construction, and electronics sectors are opting to work towards sustainability, demand for recycled metals would remain elevated. Specifically, the development of the electric vehicle industry has created an increase in demand for recycled materials. In essence, metals such as lithium, cobalt, and nickel would be needed to make their batteries. Lithium battery recycling is estimated to continue growing and is projected at $6 billion by the year 2025 globally. This also forms a larger push toward a more circular economy. Governments, companies, and businesses begin to focus on reducing, improving resource efficiency, as well as carbon footprint diminution. Within this, recycling plays a very key role in reducing reliance on the utilization of raw primary materials. The metal recycling industry has been projected to grow massively with this supporting global sustainability goals while reducing environmental impact and feeding into the increasing demand for renewable energy technologies.

Metal Replacement Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global metal replacement market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end use industry.

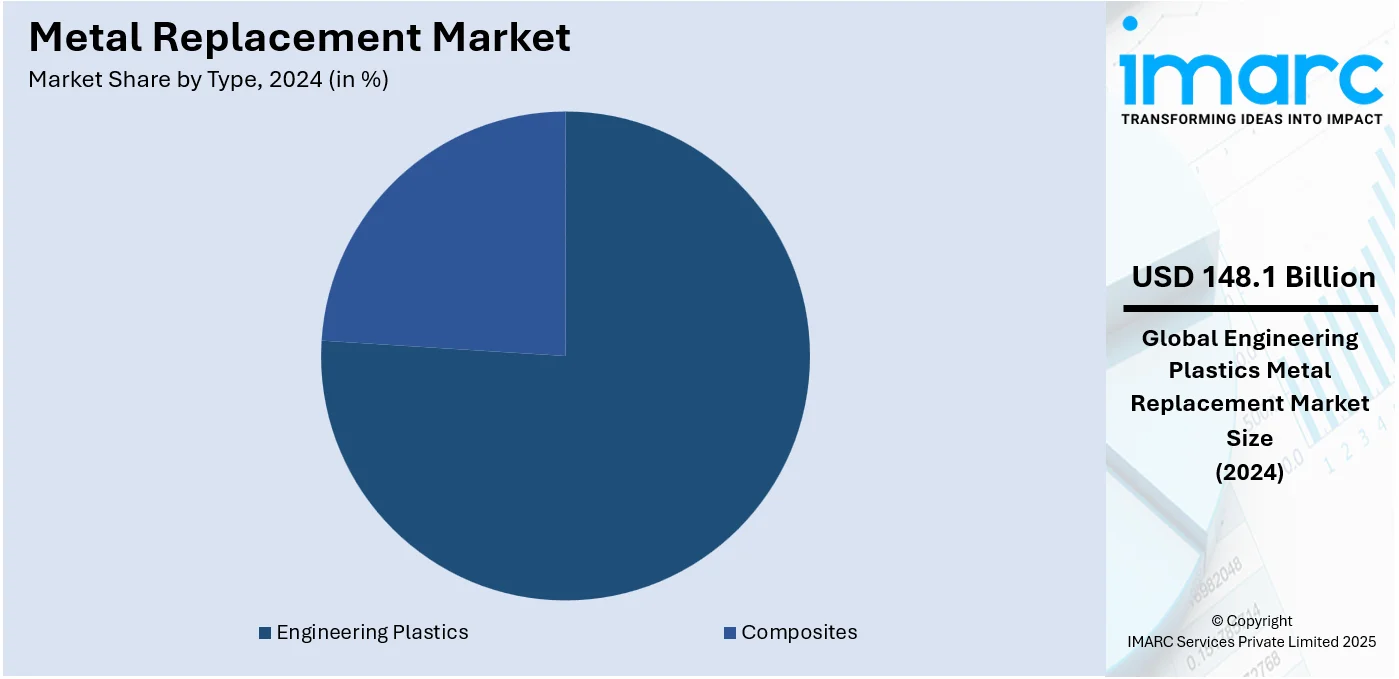

Analysis by Type:

- Engineering Plastics

- Polyamide

- Acrylonitrile Butadiene Styrene (ABS)

- Thermoplastic Polyesters

- Polycarbonates

- Others

- Composites

- Glass Fiber Reinforced Plastic

- Carbon Fiber Reinforced Plastic

Engineering plastics stand as the largest component in 2024, holding around 75.6% of the market owing to their exceptional mechanical properties, lightweight nature, and versatility across industries. These materials, including polyamides, polycarbonates, and PEEK, offer high strength, thermal stability, and chemical resistance, making them ideal for replacing metals in applications such as automotive parts, electrical components, and industrial machinery. Their use is particularly pronounced in the automotive and aerospace sectors, where lightweighting is crucial for fuel efficiency and emissions reduction. The growing demand for durable, cost-effective, and recyclable materials further drives their adoption. Technological advancements have expanded their application range, enabling engineering plastics to outperform traditional metals in terms of performance and sustainability, establishing them as the largest segment in the metal replacement market.

Analysis by End-Use Industry:

- Automotive

- Aerospace and Defense

- Construction

- Packaging

- Consumer Goods

- Healthcare

- Transportation

- Others

Automotive leads the market in 2024, driven by the industry's focus on lightweighting to enhance fuel efficiency and meet stringent emission standards. High-performance plastics and composites are increasingly replacing metals in components such as fuel systems, interior parts, and engine components. These materials not only reduce vehicle weight but also offer superior design flexibility, corrosion resistance, and cost efficiency. The shift toward electric vehicles further accelerates the adoption of metal-replacement materials, as manufacturers prioritize lightweight solutions to extend battery life and performance. Technological advancements in polymers, such as reinforced thermoplastics, enable their application in critical structural parts, solidifying the automotive industry's role as a key driver of the metal replacement market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.0% driven by the region's robust automotive, aerospace, and construction industries. The growing focus on lightweight materials to improve fuel efficiency and reduce emissions significantly bolstered demand. High-performance engineering plastics and composites replaced metals in critical applications, benefiting from advanced manufacturing technologies and a strong R&D ecosystem. Additionally, stringent regulatory standards promoting environmental sustainability further accelerated the adoption of metal-replacement solutions across industries. North America's well-established infrastructure, combined with increasing investments in electric vehicles and renewable energy projects, created lucrative opportunities for market expansion. The region’s leadership in innovation and its ability to meet diverse industry needs solidified its dominant position in the global market.

Key Regional Takeaways:

United States Metal Replacement Market Analysis

Advancements in lightweight materials for the automotive and aerospace sectors are creating an explosion of growth in the U.S. market for metal replacement. As reported by the U.S. Department of Energy, fuel efficiency for vehicles may increase 6–8% when traditional metals are replaced by lightweight composites. National energy conservation goals align with this requirement, and such innovation is encouraged by federal programs, including the Advanced Materials Program, that promote research in high-performance polymers and composites. These materials are adopted in the automotive sector to achieve CAFE standards while aerospace companies seek improved performance coupled with the lowering of their operating cost. Large groups such as DuPont and BASF are spending most on R&D for introducing some sustainable efficient solutions. Besides, incentives for lowering industrial emissions offer government incentive demand for better materials. Initiatives in domestic production under the Inflation Reduction Act also promote growth by lessening reliance on imports, strengthening supply chains, and encouraging U.S.-based manufacturing capabilities.

Europe Metal Replacement Market Analysis

The Europe metal replacement market is witnessing rapid evolution with sustainability goals and rigorous emission reduction norms. The European Environment Agency indicates a transport emission decrease of 0.8% in 2023, attributed to the use of lightweight composites in automobiles. Germany, France, and Italy are at the forefront of this change of direction, driven by R&D initiatives under government back-up. For instance, Germany's High-Tech Strategy invests in R&D in advanced materials which allows the manufacturers to use eco-friendly products. There is an increasing trend on the part of automotive titans to use engineering plastics and composites to gain fuel efficiency and reduce carbon footprints in order to get EU approval. Advanced polymers replace traditional materials in constructions for a sustainable building design in the construction industry. This is mainly led by firms such as Solvay and SABIC, among others. The European Union's Green Deal also focuses on circular economy principles, pushing the advancement of advanced materials across various industries and supporting the growth of the market.

Asia Pacific Metal Replacement Market Analysis

The Asia Pacific metal replacement market is growing rapidly due to growing demand in the automotive and electronics sectors. China's Ministry of Industry and Information Technology states that the use of lightweight materials will reduce energy consumption by 10% in electric vehicles, which will be helpful for this country in achieving its green energy missions. In South Korea, the National Institute of Environmental Research mentions how advanced composites have reduced industrial waste and have increased efficiency in the country. Government policies, such as the "Make in India" program for India, focus on creating native high-performance polymers and composites for developing indigenous industries. The electronics industry in Taiwan and Japan is adopting metal replacements to increase durability and decrease production costs of devices. Lastly, the partnerships between local and international producers have encouraged technological development and brought cutting-edge technologies appropriate to regional needs to market. Overall, supportive policies and increasing investments in R&D are driving the region's market expansion.

Latin America Metal Replacement Market Analysis

The Latin American market for metal replacement is growing with increased demand from the construction and automotive industries. Construction Briefing reports that the construction sector in the region is forecasted to grow by 5.1% to reach a value of USD 128 billion in 2024, which reflects an increase in infrastructure projects. There is an increase in lightweight and advanced polymers as developers look for cost-effective and sustainable solutions. Brazilian auto manufacturers are using engineering plastics to make vehicles more energy-efficient and environmentally friendly. Argentina's National Program for Sustainable Development promotes the integration of high-performance composites in the industrial sector, promoting home-grown technology. Regional companies are partnering with international companies to bring these specific products to the market. These developments, combined with governmental initiatives and increasing awareness over environmental benefits, place Latin America as an emerging market for sustainable materials and an adoption of advanced technology.

Middle East and Africa Metal Replacement Market Analysis

The Middle East and Africa is seeing a consistent rise in the metal replacement market. Construction and automotive advancement is leading the market growth. Saudi Arabia's Vision 2030 consists of investments across different sectors, which include manufacturing and sustainability. Over USD 3.5 billion will be invested by the Kingdom in developing advanced materials and technologies in the near future in line with the diversification goals of the Kingdom (Arab News). Additionally, the Saudi Ministry of Finance committed USD 20.4 billion to infrastructure projects in 2023 focused on sustainable construction practices and the development of new, high-performance materials in buildings (Saudi Press Agency). Such measures further enhance the overall trend of advanced composites use in regions such as automotive, aerospace, and construction fields. The automotive industry in South Africa has also been following this trend with increased usages of lightweight materials with the support of some government initiatives for sustainable production. Regional investments in technological innovation are placing the Middle East and Africa at the center of the global metal replacement market.

Competitive Landscape:

The metal replacement market is characterized by intense competition among key players focusing on material innovation and application development. Companies are investing heavily in research and development to produce advanced polymers and composites that offer superior mechanical properties, durability, and heat resistance. Strategic partnerships with end-user industries such as automotive, aerospace, and electronics drive tailored solutions to meet specific needs. The market also sees continuous improvements in manufacturing processes, enabling cost-effective production of lightweight alternatives. Regional players emphasize localized solutions to cater to unique market demands, while global players focus on expanding their footprints through acquisitions and capacity enhancements. Sustainability and recyclability initiatives further intensify competition as companies strive to address growing environmental concerns and regulatory compliance.

The report provides a comprehensive analysis of the competitive landscape in the metal replacement market with detailed profiles of all major companies, including:

- A.K. Industries Inc.

- Asahi Kasei Corporation

- Aztec Plastic Company

- BASF SE

- Celanese Corporation

- China Jushi Co.Ltd.

- DOMO Chemicals GmbH

- DuPont de Nemours Inc.

- SGL Carbon SE

- Solvay S.A.

- Toray Industries Inc.

- Victrex plc.

Latest News and Developments:

- In December 2024, BASF unveiled a new portfolio of PA and PPA blends called Ultramid T7000, the new, advanced metal replacement solution. These grades are optimized for structural parts under moisture and provide improved, consistent mechanical properties.

- In October 2024, DOMO Chemicals and BRANO announced that they successfully combined their efforts to replace a die-cast aluminum in a new heavy truck model's pedal support plate by using TECHNYL polyamides, saving up to 27% weight and 60% in costs. Predictive simulation ensured the part would actually pass durability tests, giving the company improved efficiency in addition to reduced CO2 emissions.

- In January 2024, Toray Industries, Inc., said they developed a polyethylene film having tensile strength comparable to that of stainless steel (1,200 MPa). The processing difficulty is overcome by creating a film using nanostructure technology, and it also gives high strength, lightness, and flexibility. This can be used for superconductivity, space, and cryogenics, which can provide superior thermal conductivity.

Metal Replacement Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Use Industries Covered | Automotive, Aerospace and Defense, Construction, Packaging, Consumer, Goods, Healthcare, Transportation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A.K. Industries Inc., Asahi Kasei Corporation, Aztec Plastic Company, BASF SE, Celanese Corporation, China Jushi Co.Ltd., DOMO Chemicals GmbH, DuPont de Nemours Inc., SGL Carbon SE, Solvay S.A., Toray Industries Inc., Victrex plc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the metal replacement market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global metal replacement market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the metal replacement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Metal replacement involves substituting traditional metals with advanced materials like high-performance plastics, composites, and ceramics. These alternatives offer benefits such as reduced weight, corrosion resistance, enhanced durability, and cost efficiency. Widely used in industries like automotive, aerospace, and electronics, metal replacement drives innovation and supports sustainability through energy efficiency and recyclability.

The global metal replacement market was valued at USD 195.9 Billion in 2024.

IMARC estimates the global metal replacement market to exhibit a CAGR of 7.2% during 2025-2033.

Key factors driving the global metal replacement market include increasing demand for lightweight materials to enhance fuel efficiency in automotive and aerospace sectors, advancements in durable and cost-effective composites and polymers, growing emphasis on sustainability and recyclability, and regulatory mandates promoting reduced emissions and environmentally friendly manufacturing practices across industries.

In 2024, engineering plastics represented the largest segment by type, driven by the offering superior strength, durability, and versatility for diverse applications.

Automotive leads the market by end use industry owing to the growing demand for lightweight materials to improve fuel efficiency and reduce emissions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global metal replacement market include A.K. Industries Inc., Asahi Kasei Corporation, Aztec Plastic Company, BASF SE, Celanese Corporation, China Jushi Co.Ltd., DOMO Chemicals GmbH, DuPont de Nemours Inc., SGL Carbon SE, Solvay S.A., Toray Industries Inc., Victrex plc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)