Metal Recycling Market Size, Share, Trends and Forecast by Metal Type, Type, End Use Industry, and Region, 2025-2033

Metal Recycling Market 2024 Size, Share & Trends:

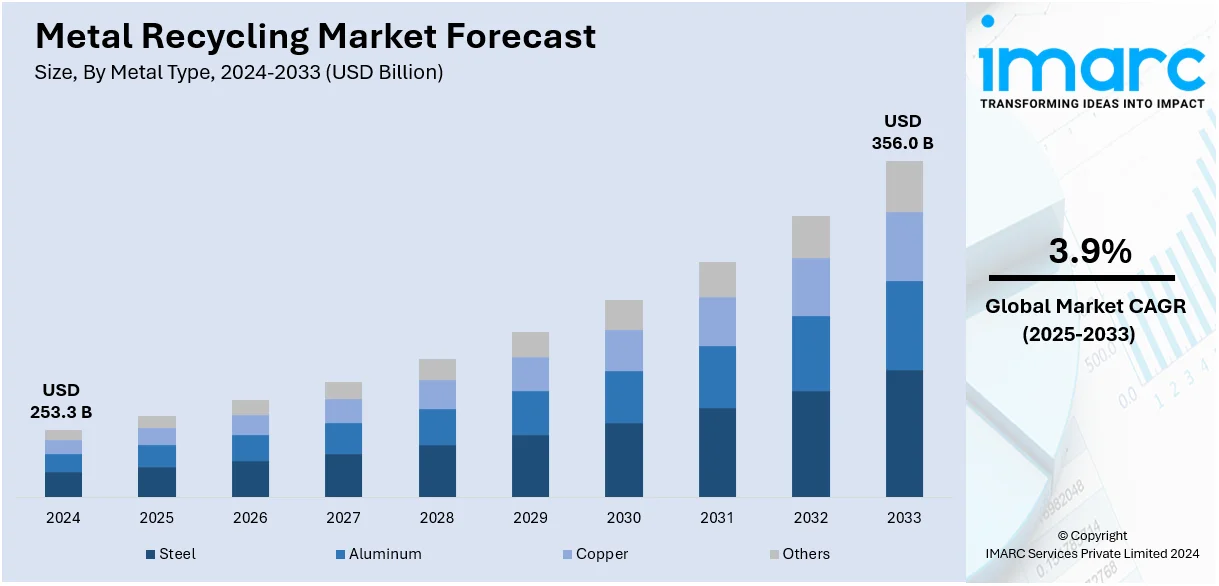

The global metal recycling market size was valued at USD 253.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 356.0 Billion by 2033, exhibiting a CAGR of 3.9% during 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 51.9% in 2024. The market is driven by increasing environmental awareness, escalating industrial growth, rising need for energy conservation, widespread application in the automotive industry, growing demand in the construction sector, and rapid advancements in recycling technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 253.3 Billion |

|

Market Forecast in 2033

|

USD 356.0 Billion |

| Market Growth Rate (2025-2033) | 3.9% |

The rising focus on environmental conservation is fueling the growth of the metal recycling market. People and industries alike are realizing the importance of reducing waste and reusing resources to protect the planet. Recycling metal saves energy reduces greenhouse gas (GHG) emissions, and limits the demand for mining new ores, which can be highly damaging to ecosystems. For instance, recycling aluminum uses 95 percent less energy in comparison to producing it from raw materials. Governments are also stepping in with stricter environmental regulations and policies promoting sustainable practices, making recycling a necessity rather than a choice. Public campaigns and corporate responsibility programs are pushing businesses to adopt green practices, which include recycling their scrap metal. This mindset shift is encouraging everyone, including manufacturers, construction companies, and even households, to take recycling seriously, further boosting the market.

United States is a major market disruptor in North America. Recycled iron and steel scrap is a vital raw material in the country for the production of new steel and cast-iron products. It is said that recycling one ton of steel conserves 1.1 tons of iron ore, and 0.05 ton of limestone, and 0.6 ton of coking coal. Additionally, energy efficiency is a critical concern for industries and the government in the United States. The production of metal from recycled materials uses significantly less energy compared to extracting and refining virgin ores. For example, recycling steel saves up to 72% energy, while recycling copper saves around 85%. This energy efficiency translates into lower production costs, reduced operational emissions, and less strain on energy resources. As energy costs continue to rise in the country and energy demand increases, industries are turning to metal recycling as a way to cut costs and operate more sustainably

Metal Recycling Market Trends:

The Rising Applications in the Automotive Industry

The metal recycling process is gaining extensive traction in the automotive industry, owing to the rising focus of key players on sustainability and minimizing overall environmental impact. Additionally, recycled metals are utilized widely in the manufacturing of vehicle components, including fenders, trunk lids, doors, hoods, etc. For instance, the global automotive industry experienced a significant rise in vehicle production in 2022, with more than 85 million motor vehicles manufactured across the globe. This 6% growth compared to the previous year indicated the escalating demand for automobiles. Moreover, the growth in America's automotive production was particularly notable, with a 10% year-on-year increase in 2022. Mexico, Canada, and the United States all witnessed production expansions, reaching production figures of 3.50 million units, 1.22 million units, and 10.06 million units, subsequently. Similarly, countries, including South Korea, have experienced growth in the manufacturing of automobiles. According to the Korea Automobile Manufacturers Association (KAMA), the country manufactured 3.75 million vehicles in 2022, which represented a notable 9% increase compared to the previous year's production of 3.62 million units. Considering these factors, the rising global vehicle production provides a positive outlook for the metal recycling market's recent opportunities.

The Increasing Scrap Metal Processing Facilities

Metal recycling market companies across countries are emphasizing introducing modern technologies that can identify numerous metals effectively. Consequently, they are extensively investing in developing specialized processing facilities, thereby fueling the global market. For example, in December 2023, Greenwave Technology Solutions, Inc. invested around USD 10 million in its scrap metal processing facilities. This was done to elevate the company's scrap metal processing capacity and boost its margins. Furthermore, leading players are also entering into strategic agreements, which are anticipated to fuel the metal recycling market over the forecasted period. For instance, in December 2022, ArcelorMittal announced signing an agreement to acquire, Zakład Przerobu Złomu (Złomex), the Polish scrap metal recycling business. In line with this, the company also acquired Riwald Recycling (Riwald), a ferrous scrap metal recycling business based in the Netherlands.

The Growing Demand in the Construction Industry

The widespread adoption of recycled metals in the construction sector to minimize the demand for raw materials, reduce carbon emissions levels, conserve energy, etc., is bolstering the metal recycling market's recent price. Continuous growth in this industry is presenting numerous opportunities for metal recycling processes, as they provide efficient usage of resources with no degradation of properties. According to the United States Census Bureau, housing has shown a notable increase in the United States, which indicates the residential construction sector. In addition to this, single-family housing starts also experienced a substantial growth rate of 18.5% in May 2023. As such, these figures indicate the expanding construction industry, thereby stimulating the demand for metal recycling processes in developing residential buildings.

Metal Recycling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global metal recycling market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on metal type, type, and end use industry.

Analysis by Metal Type:

- Steel

- Aluminum

- Copper

- Others

Aluminum leads the market with around 56.6% of market share in 2024. According to the Aluminum Association, aluminum is considered as one of the most recyclable materials. In 2023, US aluminum producers recycled 57pc of beverage can scrap, highlighting its critical role in sustainable practices and nearly 75% of all the aluminum produced in the U.S. is still in use today. Its extensive use across industries such as automotive, construction, and packaging is another major factor propelling its demand. The high recyclability of aluminum, retaining nearly 100% of its quality during the process, makes it a preferred choice for manufacturers aiming to reduce costs and environmental impact.

Analysis by Type:

- Ferrous Metal

- Non-Ferrous Metal

Ferrous metal leads the market with around 62.0% of market share in 2024. Ferrous metals, including iron and steel, represent the largest segment in the metal recycling market, accounting for a substantial share due to their widespread application in construction, automotive, and industrial manufacturing. These metals are favored for their strength, durability, and ability to withstand recycling without loss of quality, making them an essential resource for manufacturers. The recycling process for ferrous metals is highly efficient, allowing for significant energy savings and reducing the need for mining virgin materials, which helps preserve natural resources and minimize environmental degradation. With consistent demand from industries for structural materials, machinery, and transportation components, ferrous metals remain indispensable, and their recycling ensures a steady, sustainable supply chain that benefits both the economy and the environment.

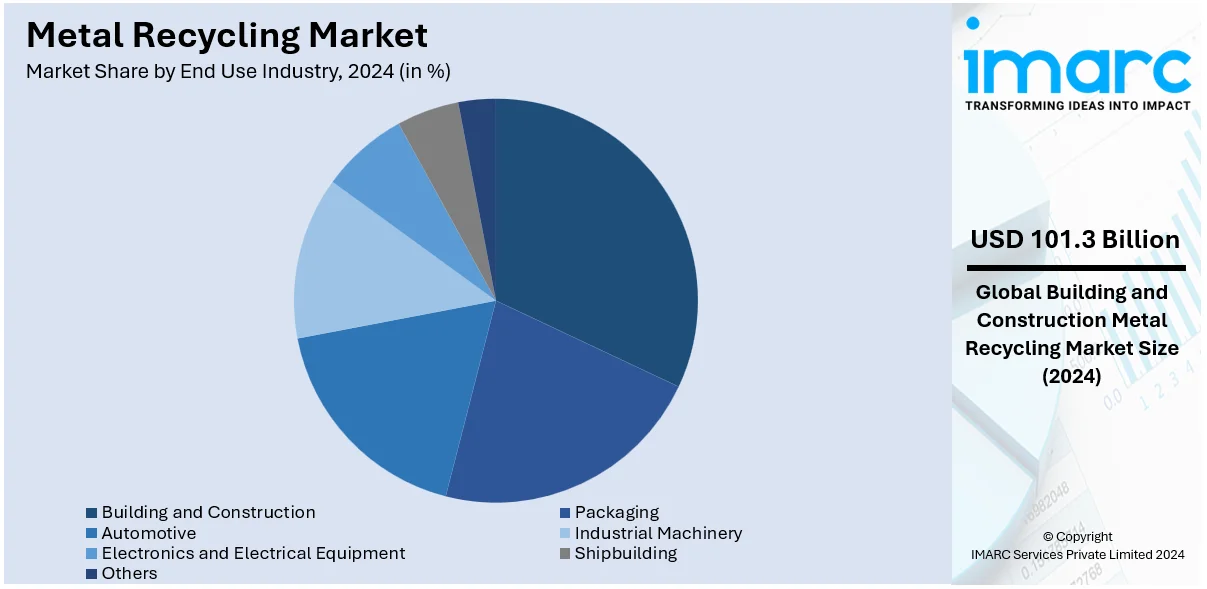

Analysis by End Use Industry:

- Building and Construction

- Packaging

- Automotive

- Industrial Machinery

- Electronics and Electrical Equipment

- Shipbuilding

- Others

Building and construction leads the market with around 40.0% of market share in 2024. The building and construction industry is the largest segment driven by the extensive use of recycled metals like steel and aluminum in infrastructure projects, residential developments, and commercial buildings. Recycled metals are essential for producing beams, columns, roofing materials, and other structural components, offering a cost-effective and environmentally sustainable alternative to virgin materials. The durability and strength of recycled metals make them ideal for withstanding heavy loads and harsh conditions, while their adaptability supports innovative designs in modern architecture. The increasing emphasis on green building certifications and sustainable construction practices further accelerates the demand for recycled metals, as developers and contractors seek to reduce their carbon footprint while maintaining high-quality standards. With ongoing urbanization and infrastructure renewal projects, this segment continues to drive the growth of the metal recycling industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 51.9%. Majorly, the Asia-pacific regions drive a well-established recycling industry that has led to its leading position. For example, 66% of the primary aluminum and 72% of steel produced in the world in 2019 came from Asia Pacific. In the region, a fast pace is set for the development of this industry primarily with the help of industrialization and urbanization. Also, the demand for metals in manufacturing, construction, and the automotive industry has driven the domestic consumption of the countries in the Asia Pacific region. China, India, and Japan are the forerunners in that category as far as countries that recycle most metals per capita are concerned within the region. The driving force behind them is the presence of strict environmental laws combined with a stringent focus on resource conservation. With a large volume of scrap metal, infrastructure building programs at a very large scale, and high production capacities, this region is set for recycled metal consumption. The governments of Asia-Pacific are promoting recycling through policies and incentives to minimize reliance on imported raw materials and reduce environmental degradation. The population in the region is also growing and developing economically, which continues to make this region the largest producer and consumer in the metal recycling industry.

Key Regional Takeaways:

North America Metal Recycling Market Analysis

North America's metal recycling market is led by stringent environmental laws and is characterized by advanced recycling technology and increased awareness of sustainability practices. The region has an established infrastructure network for collecting and processing scrap metals. The US and Canada are among the leaders in terms of recycling rates. Significant key industries depend on recycled metals to ease production costs as well as further contribute to green initiatives. These include industries such as construction, automotive, and manufacturing. Government policies, including tax incentives and landfill bans, also promote recycling tangible materials to guarantee a steady supply of scrap materials. With increasing industrial activities and a focus on circular economy models, the North American metal recycling market remains a critical player in global sustainability efforts.

United States Metal Recycling Market Analysis

The U.S. metal recycling market is surprisingly resilient, driven by the demand of industries and also sustainability efforts. According to Bureau of International Recycling (BIR), in 2023, the U.S. recycled steel usage reached at 56.8 million tonnes, up by 0.4% from the previous year whereas crude steel production rose up by 1.1% to 81.4 million tonnes. As per the growing focus on the "green" steelmaking of the U.S., the world's metal recycling is headed again by the U.S. The total value of recycled metals in the U.S. has been recorded at USD 50.4 Billion for 2022. Major players, such as Nucor and Commercial Metals Company, are driving this growth by investing in new recycling technologies. Furthermore, the U.S. exports significant volumes of recycled steel, with exports growing 8% to 5.1 million tonnes in 2023, as a result of strong demand from countries such as Turkey and Vietnam. This positive trend indeed indicates a continued shift towards sustainable production and recycling in the U.S. metal industry.

Europe Metal Recycling Market Analysis

The market for metal recycling in Europe is growing, pushed by high industrial demand and sustainable regulations. In 2023, the EU-27 recycled 74.8 million tonnes of steel, falling by 5.7% compared to the previous year, as per an industrial report. This fall was attributed to the overall decline in the production of steel, which was down by 7.4% to 126.4 million tonnes. Even so, the EU is the world's leading exporter of recycled steel with exports increasing 9.2% to 19.2 million tons. Major contributors to these sales are Germany, France, and Netherlands whose steel sales improved 18.2%. Increased reliance of a circular economy and decrease in carbon footprints contribute to this demand in Europe for recycled metals. Europe's rising interest in recycling electronics and construction material is further fuelling market growth. The EU, due to its policies on recycling boosters, is likely to become the largest producer of metals worldwide through sustainable production.

Asia Pacific Metal Recycling Market Analysis

The Asia Pacific metal recycling market is booming with rapid industrialization and rising environmental awareness. According to Bureau of International Recycling, China, the world's largest user of recycled steel, used 213.7 million tonnes in 2023, though down 0.8% from the previous year. India saw a sharp 11.5% increase in recycled steel usage, reaching 29 million tonnes. Worldsteel states that Asia's crude steel produced had stood at 1.395 billion tons and increased by 0.9% compared to 2022. This shows increased recycling material demand. The regions governments are moving towards sustainable development and encouraging their nations to invest highly in metal recycling technologies. Vietnam has also emerged as an important player, and its position as the third-largest importer of recycled steel rose 19.6% to 5.14 million tonnes in 2023. This growth is driven by demand from the construction and automotive sectors, as well as green manufacturing in the region.

Latin America Metal Recycling Market Analysis

The recycling metal space in Latin America is burgeoning just as regional economies have begun focusing on the areas of sustainable growth and industrial development. According to Bureau of International Recycling (BIR), Brazil is the largest recycler in the region, as it processed 3 million metric tons of metal in 2023. The amount of crude steel produced in the region dropped by 5.5 % and amounted to 41.6 million tonnes worldwide, as per the report by worldsteel. However, the demand for recycled metal is rising in various countries, including Mexico and Argentina, which are investing in advanced recycling technologies to boost the automotive and construction industries. In 2023, the leading company was Companhia Brasileira de Cartuchos (CBC) of Brazil, which dramatically ramped up export to over 100 countries. Mexico also saw huge growth in imports of recycled steel, which grew by 56.3% to 2.5 million tonnes from North America and Europe. Government-sponsored recycling programs, infrastructure development efforts, and other circular economy initiatives remain dominant forces in this region.

Middle East and Africa Metal Recycling Market Analysis

The metal recycling market in the Middle East and Africa is gaining ground. Saudi Arabia, Egypt, and South Africa have emerged as major contributors. According to worldsteel data, Africa's crude steel production has risen by 5.1% in 2023 to 24.2 million tonnes. Similarly, in the Middle East, it rose by 0.6% to 54.5 million tonnes. The biggest catalyst for the increased push toward the region's desire to recycle and produce more green steel would be Saudi Arabia's Vision 2030. But Egypt also led with amazing growth in recycling metal and exported 26.1% more compared to previous years, a total of 1.76 million tons. Turkey maintained its leadership position by being the global importer of recycled steel, increasing their import rate from India and North America by 40.4%. Areas of focus in the region include sustainability and technological investments into recycling. The growth story, however, is supported by the increasing demand for metals from the construction and the automotive sectors.

Competitive Landscape:

To increase their market position, key firms are using innovative technology, competent acquisitions, and sustainable practices. Companies are investing in new sorting and processing technology, such as AI-powered systems, to improve efficiency and quality. Numerous businesses are expanding their recycling plants to accommodate the increased demand for recovered metals in areas such as construction, electronics and automotive. Furthermore, strategic acquisitions and alliances are influencing the industry, as top competitors seek to expand their geographic reach and scrap sourcing networks. For example, mergers with local recycling companies improve access to raw materials while also helping regional sustainability goals. In addition, businesses are aligning their operations with environmental norms, concentrating on lowering their carbon impact and supporting circular economy principles.

The report provides a comprehensive analysis of the competitive landscape in the metal recyling market with detailed profiles of all major companies, including:

- ArcelorMittal

- Aurubis AG

- Commercial Metals Company

- Dowa Holdings Co. Ltd.

- European Metal Recycling Ltd (Ausurus Group Ltd)

- Nucor Corporation

- OmniSource LLC (Steel Dynamics Inc.)

- Schnitzer Steel Industries Inc.

- Sims Limited

- Tata Steel Limited

Latest News and Developments:

- October 2024: Aurubis and COFICAB have renewed their multi-year contract for the supply of sustainably sourced copper wire rods for the automotive sector. The partnership emphasizes recycling, decarbonization, and carbon neutrality by 2050 to support electrification and sustainability goals. COFICAB and Aurubis focus on reducing emissions and enhancing circularity across the value chain.

- October 2024: Harsco Environmental, part of Enviri Corp., signed a 10-year contract with Nucor Steel Kingman, Arizona, starting 2025. The services will be slag recovery, scrap yard management, and sales of eco-products that improve the sustainability of steel production.

- May 2024: EMR announced that they have invested in Australia-based Renewable Metals to set up a demonstration-scale EV battery recycling plant in Birmingham, UK. This innovative facility will extract critical minerals such as nickel, cobalt, and lithium through an efficient, low-waste process from Renewable Metals. It supports EMR's sustainability targets and will be in production by 2025.

- January 2024: Metals recycling trade groups, including the Düsseldorf, Germany-based Federal Association of German Steel Recycling and Waste Management Companies (BDSV) and the Berlin-based Association of German Metal Traders and Recyclers (VDM), issued a circular economy report that pointed to the role of scrap metals in minimizing emissions levels.

- January 2024: GreenSpark Software announced the funding of US$ 9.4 Million to expand its modern operating system for the metal recycling industry.

- December 2023: Caterpillar, a leading player in construction equipment, invested a total of USD 44 Million in Series B and non-dilutive financing in Massachusetts-based recycling company Nth Cycle, which specializes in critical metals refining.

Metal Recycling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Metal Types Covered | Steel, Aluminum, Copper, Others |

| Types Covered | Ferrous Metal, Non-Ferrous Metal |

| End Use Industries Covered | Building and Construction, Packaging, Automotive, Industrial Machinery, Electronics and Electrical Equipment, Shipbuilding, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ArcelorMittal, Aurubis AG, Commercial Metals Company, Dowa Holdings Co. Ltd., European Metal Recycling Ltd (Ausurus Group Ltd), Nucor Corporation, OmniSource LLC (Steel Dynamics Inc.), Schnitzer Steel Industries Inc., Sims Limited and Tata Steel Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the metal recycling market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global metal recycling market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the metal recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Metal recycling refers to the process of collecting, processing, and reusing scrap metals to create new products. This eco-friendly practice conserves natural resources, reduces energy consumption, and minimizes environmental impact by repurposing metals like steel, aluminum, and copper instead of extracting and refining raw materials.

The metal recycling market was valued at USD 253.3 Billion in 2024.

IMARC estimates the global metal recycling market to exhibit a CAGR of 3.9% during 2025-2033.

The global metal recycling market is driven by the rising environmental awareness, cost-efficiency of recycled materials, strict government regulations, rapid industrial growth, and energy conservation benefits.

According to the report, aluminum represented the largest segment by metal type, due to its high recyclability, lightweight properties and widespread applications.

Ferrous metal leads the market by type as metals like iron and steel are extensively used in construction, automotive, and manufacturing industries due to their strength and durability.

Building and construction is the leading segment by end use industry, as this sector heavily relies on recycled metals for structural components, roofing, and infrastructure projects.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global metal recycling market include ArcelorMittal, Aurubis AG, Commercial Metals Company, Dowa Holdings Co. Ltd., European Metal Recycling Ltd (Ausurus Group Ltd), Nucor Corporation, OmniSource LLC (Steel Dynamics Inc.), Schnitzer Steel Industries Inc., Sims Limited and Tata Steel Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)