Metal Injection Molding Market Size, Share, Trends and Forecast by Material Type, End Use Industry, and Region, 2025-2033

Metal Injection Molding Market Size & Share:

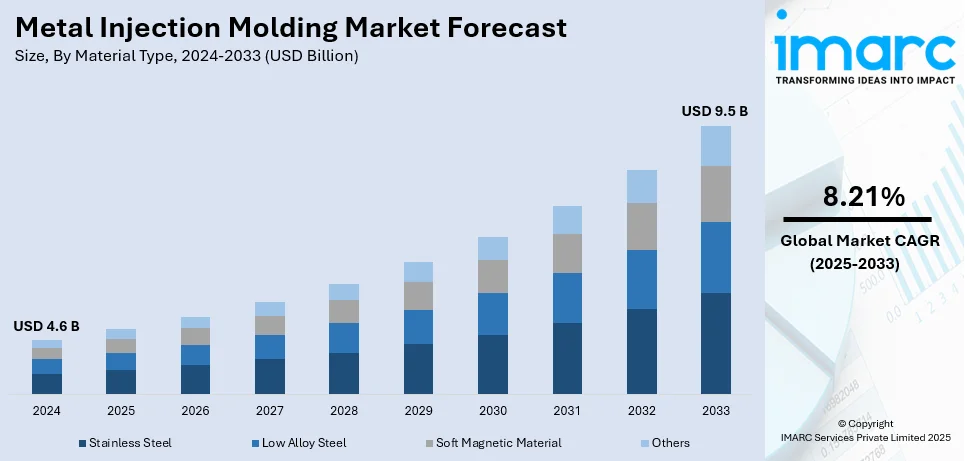

The global metal injection molding market size was valued at USD 4.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.5 Billion by 2033, exhibiting a CAGR of 8.21% from 2025-2033. In 2024, United States accounted for 83.38% of the metal injection modeling market share in North America. The demand is fueled by increasing demand for miniaturized, high-accuracy components in automotive, medical, and electronic industries, along with the increasing trend towards lightweight and robust metal parts. Improvements in metal injection molding technologies, such as various material improvements as well as process automation, are improving production efficiency and complexity management. In addition, the increasing demand for cost-effective, high-volume manufacturing options is driving adoption more quickly, further increasing metal injection molding market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.6 Billion |

|

Market Forecast in 2033

|

USD 9.5 Billion |

| Market Growth Rate (2025-2033) | 8.21% |

The market for metal injection molding (MIM) is experiencing substantial growth with the rising demand for high-performance components in different industries. The process enables the creation of intricate shapes and high precision, making it a vital option for contemporary applications in industries such as automotive, aerospace, and consumer electronics. Increasing technology is contributing to the improvement of molding techniques and materials, which increases the attractiveness of the method for manufacturers. Moreover, the increasing focus on sustainability and reducing wastage is fueling the use of metal injection molding globally, as it significantly reduces wastage of material as opposed to conventional production methods. As more industries seek to achieve higher efficiency and efficacy in their manufacturing processes, the practicability of metal injection molding is increasingly being sought after, adding to its growing presence worldwide as well as market potential.

To get more information on this market, Request Sample

In the United States, the metal injection molding industry is driven by the demand for creative production solutions in the automotive, aerospace, and medical device industries. The latter need precision components with high accuracy, and metal injection molding is an economical solution that is flexible in design as well as efficient. This miniaturization trend is driving manufacturers to adopt this technology, as it allows the production of complicated parts that are not possible with traditional processes. In addition to this, the growing emphasis on lowering production lead times and costs is driving businesses to implement metal injection molding, as it makes the manufacturing process simpler while ensuring high-quality products. Apart from this, government regimes are helping these companies with loans and incentives, leading to business development in the market. For example, in December 2024, the Pennsylvania Industrial Development Authority (PIDA) approved low-interest loans to facilitate business expansion and the creation of employment. Advanced Powder Products, an American metal injection molding and 3D metal printing equipment producer, was provided with USD 2.95 million in loans to construct its facility, finance sophisticated machinery, and establish new employment opportunities. This infusion of sophisticated technology into manufacturing processes sets up the U.S. market for future growth and technological advancements in metal injection molding.

Metal Injection Molding IndustryTrends:

Growing Demand for Miniaturized Components in Various Industries

The rising demand for miniaturized components across industries like healthcare, electronics, and automotive is majorly driving the metal injection molding (MIM) market growth. It enables the mass production of highly detailed and small components at lower costs and time in comparison to conventional methods like computer numerical control (CNC) machining or casting. Moreover, the growing utilization of MIM in the electronics sector, as devices like smartphones, wearables, and other portable gadgets require intricate and small metal parts is favoring the expansion of the market. As per metal injection molding industry statistics, the growth of India's electronics sector has experienced rapid expansion in recent years, reaching USD 155 Billion in FY23, as per an industrial report. Its production nearly doubled from USD 48 Billion in FY17 to USD 101 Billion in FY23, driven by mobile phones, which account for 43% of total electronics production. The country has also reduced its reliance on smartphone imports from major countries by manufacturing 99% of its produce domestically. This indicated the increased adoption of MIM in the electronics sector, boosting the market growth. The proliferation of portable electronic devices is amplifying the need for compact, high-tolerance components. MIM’s ability to economically produce intricate metal parts at scale is positioning it as the preferred solution in next-gen electronics manufacturing.

Increasing Adoption in the Automotive Sector

The increasing focus of the automotive industry on fuel efficiency, performance, and sustainability is prompting manufacturers to utilize metal injection molding to produce lightweight and sturdy parts. Furthermore, the implementation of several stringent standards governing fuel efficiency and carbon emissions, encouraging automotive manufacturers to lower vehicle weight without sacrificing safety or performance is enhancing the metal injection molding market size. In line with this, the U.S. sale of lightweight vehicles totaled 1273.11500 thousand units in July FY2024. In this context, metal injection molding enables manufacturers to build these high-strength, lightweight metal components that help to reduce overall vehicle weight. Moreover, the growing trend of electric vehicles (EVs) is boosting the adoption of MIM, as EV manufacturers prefer innovative ways to reduce weight, improve energy efficiency, and optimize space within the vehicle structure. Regulatory pressure to meet emission norms is accelerating demand for precision-engineered, lightweight metal parts. MIM’s design flexibility and strength-to-weight advantages are making it essential for electric and hybrid vehicle production lines.

Expanding Use in Medical and Dental Applications

The growing need for MIM in the medical and dental fields for manufacturing various components and tools is positively influencing the metal injection molding market share. Moreover, the strict requirements regarding size, strength, and material composition in medical devices, implants, and instruments make conventional manufacturing methods less feasible for certain applications. MIM provides the precision needed to create tiny and detailed medical components without compromising material strength or biocompatibility. This includes the production of surgical instruments, orthodontic brackets, pacemaker parts, and components for minimally invasive (MI) surgery tools. Moreover, the healthcare industry's continuous efforts in innovations regarding surgical procedures and medical devices are boosting the demand for MIM. For instance, the United States (U.S.) medical and health research and development (R&D) investment reached USD 245.1 Billion in 2020, which is an 11.1% increase from 2019. Surge in demand for minimally invasive surgical tools is increasing reliance on ultra-precise, biocompatible metal parts. MIM's capability to meet strict tolerances while enabling bulk production is critical in scaling up modern medical device manufacturing.

Metal Injection Molding Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global metal injection molding market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material type and end use industry.

Analysis by Material Type:

- Stainless Steel

- Low Alloy Steel

- Soft Magnetic Material

- Others

Stainless steel leads the market with around 51.6% of market share in 2024. Stainless steel is the leading material type in the metal injection molding (MIM) market, widely renowned for its durability, adaptability, and ability to resist corrosion. This material is popular in industries such as medical devices, electronics, and consumer products, where durability and precision are critical. Moreover, stainless steel's ability to withstand harsh environments makes it ideal for producing surgical instruments, dental implants, and various high-precision parts used in demanding applications. As the most preferred material in MIM, stainless steel continues to drive innovation and meet the diverse needs of modern manufacturing.

Analysis by End Use Industry:

- Electrical and Electronics

- Automotive

- Medical and Orthodontics

- Consumer Products

- Firearms and Defense

- Others

Consumer products lead the market with around 30.5% of market share in 2024. The metal injection molding market forecast indicates the technique is also widely applied in the consumer products industry for creating durable, high-quality parts used in everyday items such as kitchen appliances, power tools, and fashion accessories. Its versatility allows manufacturers to create complex and aesthetically appealing designs, meeting the growing consumer preference for functional and visually attractive products. Additionally, the cost-effectiveness of MIM supports large-scale production, making it an ideal choice for high-volume manufacturing in the consumer goods industry. This technique continues to gain traction as it combines efficiency, design flexibility, and quality, addressing the diverse needs of the consumer products market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 47.1%. As per the metal injection molding market research report, Asia Pacific is the fastest-growing region fueled by rapid industrialization. Moreover, the region is a major manufacturing hub for electronics, automotive, and consumer goods, which benefit from the cost-efficient, high-volume production capabilities of MIM. The expanding medical sector further boosts demand, with MIM used to manufacture surgical instruments, implants, and other healthcare devices. Increasing adoption of advanced manufacturing technologies and significant investments in infrastructure support the market's growth. Asia Pacific’s robust supply chain, skilled workforce, and cost advantages solidify its position as the dominant region in the global MIM market.

Key Regional Takeaways:

United States Metal Injection Molding Market Analysis

In 2024, United States accounted for 83.38% of the market shares in North America. The US MIM market is growing steadily due to a number of key factors. A significant driver is the demand for complex, high-precision parts in various industries, including electronics, medical devices, automotive, and aerospace. The application of MIM in the automotive sector is increasingly used to create lightweight, high-performance parts. MIM components are widely used by the USD 1 Trillion U.S. automobile sector, especially to produce complex parts like gears, sensors, and connections.

This industry produces high-quality, compact, complex components such as dental gadgets, implants, and surgical instruments. Manufacturers are attracted to MIM because of its ability to produce small, precise parts with less waste and shorter production cycles. Along with breakthrough technology, which includes improved material options and design possibilities, is improving its applications. The market also benefits from consumer electronics getting thinner day by day and the requirement to produce these effectively. To date, the United States has the largest market size globally for MIM as of 2023.

Europe Metal Injection Molding Market Analysis

Germany, France, and Italy are the three largest manufacturers in the European MIM market, which is primarily driven by strong demand from the automotive, medical, and aerospace sectors. Automotive MIM usage is constantly increasing in the industry as producers need to develop tiny, strong, and lightweight parts such as gears, sensors, and connectors required for the production of EVs and other automotive technologies. The EU auto market increased by 13.9% in 2023 from 2022 to 10.5 million vehicles, based on statistics from the European Automobile Manufacturer Association. Europe is the second-largest automotive market globally as of 2023, which aids the market demand.

Another significant driver is the European medical industry, which increasingly uses MIM to manufacture complex dental, orthopedic, and surgical tools. The demand for high-quality medical devices is expected to grow because of a swiftly increasing elderly demographic, particularly in nations such as Germany and Italy. This will increase demand for MIM. MIM has also been applied in producing important components such as valve bodies, brackets, and housings as a result of the push for lighter and fuel-efficient aircraft by the aerospace industry.

Asia Pacific Metal Injection Molding Market Analysis

Metal injection molding (MIM) is among the fastest-growing markets in Asia-Pacific as industrialization has improved strongly within this region, particularly within automotive and electronics. MIM components are significantly used by the automotive sector; China, Japan, and South Korea also remain to be prominent players in this rapid growth. By 2025, statistics from the China Association of Automobile Manufacturers project that its automotive industry is to produce more than 30 million vehicles in a year, thereby highly elevating the demand levels for MIM parts, such as fuel systems, exhausts, and sensors.

The electronics industry is also driving the adoption of MIM for the production of tiny, accurate components such as connectors, capacitors, and micro-electromechanical systems (MEMS). In addition, the demand for MIM components is increasing because of miniaturization trends and the rapid development of 5G technology. The medical sector too is influencing the market as more money is being spent by China and India on healthcare, leading to a rise in the demand for high-quality yet affordable MIM solutions for implantable and medical devices.

Latin America Metal Injection Molding Market Analysis

The growth of automobile and medical industries is the factor driving the Latin American metal injection molding market. Mexico and Brazil boast the most advanced automotive industries – in 2023, Mexico manufactured more than four million motor vehicles, whereas Brazil's vehicle production reached approximately 2.3 million units for that year. The demand for MIM parts is increasing in Brazil, the country's largest automobile market, as car makers try to reduce the weight of automobiles and make them more efficient. The demand is highly reliant on MIM's ability to manufacture intricate, strong, and light parts like gears and valves. The medical sector is also on the rise as nations like Brazil and Mexico are spending more on health. MIM's ability to produce implantable and medical device parts of high precision is turning out to emerge as a favored option in the region. Furthermore, investment in state-of-the-art technology and increasing manufacturing capacities in Latin America are facilitating the adoption of MIM as an efficient manufacturing process.

Middle East and Africa Metal Injection Molding Market Analysis

The automotive and healthcare industries are largely driving the market in the Middle East and Africa. As the economy of the Middle East is becoming diversified, more automobile production is taking place there, especially in the United Arab Emirates and Saudi Arabia. For instance, as per industrial report, in September 2024, the Emirates Vehicle Market experienced growth for the 23rd straight month, recording 33,845 new sales (+29.1%). YTD numbers reached 235,610, showing an increase of 15.2% from the previous year. The advanced vehicle development is facilitated by MIM in the production of the lightweight, high-performance automobile components. With nations like South Africa and Egypt increasing their investment in medical equipment and healthcare facilities, even the healthcare industry is propelling market expansion. Growth in the area is being spurred by MIM's ability to produce complex, durable parts for implants and medical equipment. Industrial diversification in the region is also stimulating the adoption of new manufacturing technologies such as MIM.

Leading Metal Injection Modeling Players:

The leading metal injection molding manufacturer are focusing on innovation, capacity expansion, and strategic partnerships to strengthen their market position. They are investing in research and development (R&D) to enhance the efficiency and capabilities of the MIM process, particularly in producing complex, high-precision components. Moreover, these firms are expanding their manufacturing facilities to meet the growing demand from sectors like automotive, medical devices, and electronics. For instance, in November 2024, Continuum Powders opened its new global headquarters in Houston, Texas, featuring advanced plasma atomization technology to convert scrap alloys into ASTM-standard metal powders for application in 3D printing, metal injection molding, and innovative fabrication techniques. The green facility operates with net-zero carbon energy and low-emission systems, enhancing production capacity, supply chain efficiency, and sustainability. Besides this, they are forming collaborations with technology providers and material suppliers to stay competitive by improving material properties and optimizing production techniques.

The report provides a comprehensive analysis of the competitive landscape in the metal injection molding market with detailed profiles of all major companies, including:

- Amphenol Corporation

- ARC Group

- ATW Companies

- CMG Technologies

- Dean Group International

- Ernst REINER GmbH & Co. KG

- GKN Powder Metallurgy

- MPP

- Parmaco Metal Injection Molding AG

- Sintex a/s

- Smith Metal Products

- Tanfel Metal

Latest News and Developments:

- April 2025: OptiMIM, a Form Technologies company, and Vasantha Tool Crafts Pvt. Ltd. announced the formation of a strategic joint venture, "OptiMIM Global," to advance innovation and expand global reach in the Metal Injection Molding (MIM) sector. The partnership integrates OptiMIM’s advanced MIM technology with Vasantha’s expertise in precision mold design, serving industries including automotive, aerospace, and medical devices.

- May 2025: Danish audio equipment manufacturer Ortofon has introduced its new MC X range of phono cartridges, utilizing Metal Injection Molding (MIM) technology to enhance design flexibility and mechanical precision. The cartridges feature a stainless steel honeycomb structure produced via MIM, followed by Physical Vapor Deposition (PVD) surface treatment to improve durability and aesthetics.

- January 2025: Ares Management has acquired a majority stake in Form Technologies, injecting approximately USD 304 million in new equity capital to support deleveraging and drive the company’s long-term strategic growth. Known for its expertise in precision-engineered components, Form Technologies offers diversified services including die casting, investment casting, and Metal Injection Molding (MIM), serving nearly 2,000 customers globally.

- October 2024: The Texas-based contract manufacturer Biomerics, which specializes in interventional medical devices, has started offering vertically integrated metal injection molding (MIM) services. The fabrication of intricate, high-performing parts needed in the medical device sector—especially for surgical and interventional applications—can now be streamlined thanks to this advancement.

- April 2024: HP and Indo-MIM, a world leader in metal injection molding (MIM), have teamed up to increase India's capacity for metal 3D printing. HP's Metal Jet 3D printing technology, which is renowned for its accuracy and effectiveness in producing intricate components, will be used in this partnership to increase the production of metal parts. The collaboration focusses on using 3D printing's scalability and affordability to serve sectors like industrial production, healthcare, and automotive.

- October 2023: Cadence, Inc., a leading provider of design, development, and contract manufacturing services to the medical device, drug delivery, and diagnostics markets, announced that it has acquired the Florida location of ARC Group Worldwide. By adding MIM to the Cadence portfolio, the company is planning to expand its vertical manufacturing platform with a cost-effective method to increase volume production as products reach scale.

- July 2023: CMG Technologies U.K. was acquired by Indo-MIM, a supplier of metal injection molding and metal additive manufacturing components. The acquisition of CMG aims to further expand Indo-MIM's penetration of European defense, medical, and consumer markets by providing on-shore manufacturing supported by a robust overseas supply chain that encompasses all key aspects of the MIM process. It also aims to bolster Indo-MIM's current manufacturing presence in India and the USA through this added presence in the U.K.

Metal Injection Molding Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Stainless Steel, Low Alloy Steel, Soft Magnetic Material, Others |

| End Use Industries Covered | Electrical and Electronics, Automotive, Medical and Orthodontics, Consumer Products, Firearms and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amphenol Corporation, ARC Group, ATW Companies, CMG Technologies, Dean Group International, Ernst REINER GmbH & Co. KG, GKN Powder Metallurgy, MPP, Parmaco Metal Injection Molding AG, Sintex a/s, Smith Metal Products, Tanfel Metal, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the metal injection molding market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global metal injection molding market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the metal injection molding industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The metal injection molding market was valued at USD 4.6 Billion in 2024.

The metal injection molding market is projected to exhibit a CAGR of 8.21% during 2025-2033, reaching a value of USD 9.5 Billion by 2033.

The market is driven by rising demand for high-precision, complex components across industries such as automotive, healthcare, and electronics. MIM's cost-effectiveness, design flexibility, and ability to produce lightweight, durable parts drive adoption. Growing focus on miniaturization and advancements in material innovation further enhances market appeal.

Asia Pacific currently dominates the metal injection molding market, accounting for a share of 47.1% in 2024. The dominance is fueled by rapid industrialization, growing automotive and electronics sectors, cost-effective manufacturing, and increasing demand for high-performance metal components.

Some of the major players in the metal injection molding market include Amphenol Corporation, ARC Group, ATW Companies, CMG Technologies, Dean Group International, Ernst REINER GmbH & Co. KG, GKN Powder Metallurgy, MPP, Parmaco Metal Injection Molding AG, Sintex a/s, Smith Metal Products, and Tanfel Metal, among others.

The future of metal injection molding (MIM) is marked by sustained growth driven by rising demand for high-precision, miniaturized components in advanced sectors such as electric vehicles, medical devices, and consumer electronics. Innovations in material science, increasing automation in manufacturing, and the integration of MIM with additive technologies like metal 3D printing are enhancing production efficiency and design capabilities. As industries prioritize lightweight, complex components at scale, MIM is expected to play a pivotal role in modern manufacturing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)