Metal Forging Market Size, Share, Trends and Forecast by Raw Material, Application, and Region, 2025-2033

Metal Forging Market Size:

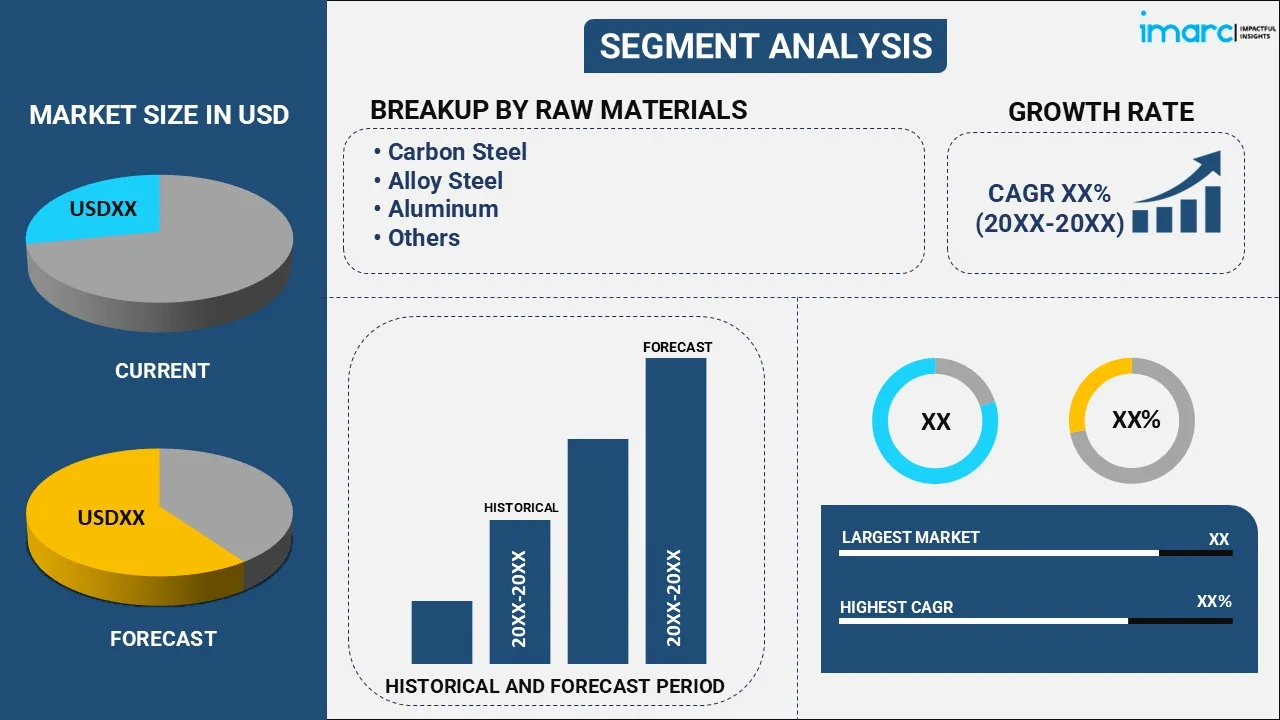

The global metal forging market size reached USD 90.0 Billion in 2024. The market is projected to reach USD 145.4 Billion by 2033, exhibiting a growth rate (CAGR) of 5.44% during 2025-2033. The market growth is attributed to rising demand from the automotive and aerospace sectors, increasing industrialization, advancements in forging technologies, growing investments in infrastructure development, and the need for durable metal parts in heavy machinery, oil, and gas industries

Market Insights:

- Asia Pacific dominated the metal forging market in 2024.

- Based on raw material, the carbon steel segment leads the market in 2024.

- By application, the automotive segment leads the market in 2024.

Market Size & Forecast:

- 2024 Market Size: USD 90.0 Billion

- 2033 Projected Market Size: USD 145.4 Billion

- CAGR (2025-2033): 5.44%

- Asia Pacific: Largest market in 2024

Metal Forging Market Analysis:

- Market Growth and Size: The global market is driven by increasing demands in key sectors and technological innovations. These developments are supported by the wide-ranging applications of forged components, showcasing a substantial increase in the metal forging market share with a positive future outlook.

- Major Market Drivers: Key drivers include the soaring demand from the aerospace and automotive industries for high-strength, reliable components, and the shift towards lightweight materials. The push for renewable energy sources and infrastructural development also significantly propels market growth.

- Technological Advancements: Advancements such as automation, precision forging, and the integration of IoT are revolutionizing the metal forging industry, enabling higher efficiency, improved material properties, and the production of complex parts with enhanced reliability and lower waste.

- Industry Applications: The industry heavily caters to aerospace, automotive, defense, and energy sectors, where the durability, strength, and precision of forged parts are crucial. These applications underline the market's dependency on the changing demands of these high-stakes industries.

- Key Market Trends: Key metal forging market trends include the increasing adoption of environmentally friendly forging processes and the shift towards using lightweight materials like aluminum and titanium, driven by the automotive industry's development and the global emphasis on sustainability.

- Geographical Trends: Asia Pacific and North America dominate the market, attributed to their advanced industrial sectors, with Europe also showing significant growth due to industrialization, infrastructural developments, and expanding manufacturing sectors.

- Competitive Landscape: The market is characterized by intense competition with key players focusing on technological innovation, strategic partnerships, and geographic expansion to consolidate their market position and cater to the global demand.

- Challenges and Opportunities: According to the metal forging market report, the industry faces challenges like fluctuating raw material prices and the need for high capital investment. However, opportunities abound in adapting to the changing industrial requirements, expanding in emerging markets, and leveraging technological advancements to develop new forging solutions.

To get more information on this market, Request Sample

Metal Forging Market Trends:

Increasing demand from aerospace and automotive industries

The metal forging market growth is significantly driven by the burgeoning demand from the aerospace and automotive sectors, where the exceptional strength-to-weight ratio, reliability, and structural integrity of forged components are paramount. Aerospace applications, demanding high-performance parts capable of withstanding extreme pressures and temperatures, rely heavily on forging for critical components like landing gear, engine mounts, and fuselage structures. Similarly, the automotive industry's shift towards lightweight materials for enhanced fuel efficiency and lower emissions has amplified the use of forged aluminum and magnesium. Innovations in forging technologies, enabling the production of complex shapes and high-strength parts, align well with the industry's push for more durable, safe, and lightweight vehicles. This trend is further bolstered by the growing electric vehicle market, which also benefits from the lightweight and high-strength characteristics of forged components, making this a pivotal metal forging market growth factor.

Technological advancements in forging processes

Technological advancements in forging processes are a major driving force in the metal forging market, propelling the industry forward by enhancing efficiency, precision, and material properties. Modern developments such as automation, computer-controlled forging, and the integration of IoT have revolutionized traditional forging, enabling mass production with consistent quality and lower lead times. Innovations like isothermal and precision forging are producing parts closer to final dimensions with superior mechanical properties, reducing the need for post-forging machining and material wastage. These advancements are crucial in meeting the stringent requirements of industries such as aerospace, defense, and automotive, which demand parts with high strength, durability, and exacting tolerances. As manufacturers continue to seek cost-effective and reliable components, the ongoing development of forging technologies ensures the market's expansion, catering to complex industrial applications and the increasing demand for high-performance forged products. The technological advancements in the industry further enhance the metal forging market outlook.

Growing focus on renewable energy and infrastructure development

The global shift towards renewable energy and the continuous focus on infrastructure development are significantly contributing to the growth of the metal forging market. Forging plays a vital role in producing durable, high-strength components essential for wind turbines, solar installations, and hydroelectric power facilities. The reliability and longevity of forged parts are crucial in the energy sector, where operational stability and maintenance-free longevity are vital. Additionally, the burgeoning global infrastructure sector, with increasing investments in construction, transportation, and public works, demands the high-strength and durability that forged components offer. These sectors require materials that can withstand harsh conditions, heavy loads, and long-term use, making forged products indispensable. The expansion of these industries, coupled with the shift towards sustainable and eco-friendly energy sources, continues to expand metal forging market size. This trend further highlights critical role metal forging plays in supporting global industrial and energy advancements.

Evolving Trends in the Metal Forging Industry

The market is witnessing substantial growth influenced by the increased demand for high-strength and resistant components in automotive, aerospace, and defense industries. As per industry reports, car production worldwide hit 75.5 million units in 2024, reflecting increased demand for automobile components. The increased manufacturing directly leads to the increased demand for metal forging as the automotive sector relies considerably on high-strength, resistant materials for primary components. Furthermore, technological innovation is also defining the market with the adoption of Industry 4.0 technologies, including automation, robotics, and data analysis. These technologies improve efficiency in production, lower errors, and provide precision in manufacturing. Together with these advancements, sustainability is one of the emerging metal forging market trends. Companies are adopting practices to cut down on energy usage and waste through environmentally friendly means like recycling and reuse. This trend is aligning with the international environmental campaigns that seek to curb emissions and encourage green production practices.

Metal Forging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on raw material and application.

Breakup by Raw Material:

- Carbon Steel

- Alloy Steel

- Aluminum

- Magnesium

- Stainless Steel

- Titanium

- Others

Carbon steel accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes carbon steel, alloy steel, aluminum, magnesium, stainless steel, titanium, others. According to the report, carbon steel represented the largest segment.

Carbon steel dominates the market in 2024. The segment is known for its strength and versatility, accounts for the majority of the market share in the metal forging industry. This predominance stems from carbon steel's favorable properties, such as high tensile strength, ductility, and wear resistance, making it ideal for a wide range of forged products. Its cost-effectiveness compared to other alloys is a significant factor contributing to its widespread use, especially in industries requiring robust and heavy-duty components. The material's adaptability to various forging techniques and its capacity to maintain structural integrity under stress and high temperatures further solidify its status as the preferred choice in metal forging, catering to demands from sectors like construction, heavy machinery, and automotive, where durability and performance are non-negotiable.

On the other hand, alloy steel represents a significant segment due to its extensive use in industries such as automotive, aerospace, and heavy engineering. Alloy steels are favored for their superior strength, toughness, wear resistance, and ability to withstand fatigue, attributes that are essential for components subjected to high stresses. This segment's growth is propelled by the increasing demand for high-performance materials capable of operating in severe conditions.

Moreover, the shift towards lightweight materials in automotive manufacturing, to enhance fuel efficiency and reduce emissions, significantly fuels the demand for aluminum forgings. In aerospace, the demand for aluminum is driven by the need for materials that reduce aircraft weight and improve fuel efficiency without compromising strength or performance. Aluminum's ability to undergo extensive forming and shaping processes makes it highly versatile for various applications.

Apart from this, the magnesium segment is distinguished by its exceptionally low weight, high strength-to-weight ratio, and excellent machinability, making it increasingly popular in automotive, aerospace, and electronics industries. This segment is gaining traction as industries seek lighter materials to improve energy efficiency, particularly in electric vehicles and lightweight aerospace components. Magnesium's ability to provide weight savings without sacrificing strength or performance aligns with the ongoing industry trends towards sustainability and fuel efficiency.

Additionally, stainless steel is renowned for its corrosion resistance, durability, and high strength, making it an essential material in construction, automotive, aerospace, and medical industries. This segment benefits from the increasing demand for components that require long-term reliability in harsh or corrosive environments, such as marine, chemical processing, and water treatment facilities. Stainless steel forgings are highly valued for their ability to maintain integrity under extreme conditions while offering a high degree of customization in terms of shapes and sizes.

Furthermore, titanium's high strength, coupled with low density, makes it ideal for aerospace components, where weight reduction is crucial for fuel efficiency and performance. In the medical field, titanium is prized for its non-toxicity and ability to integrate with bone and other tissues, making it perfect for implants and prosthetics. The demand for titanium forgings is also bolstered by its resistance to corrosion in saline or chlorine-rich environments, making it suitable for marine and chemical processing applications.

Breakup by Application:

- Automotive

- Aerospace

- Oil and Gas

- Construction

- Agriculture

- Others

Automotive holds the largest share in the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, aerospace, oil and gas, construction, agriculture, and others. According to the report, automotive accounted for the largest market share.

The automotive sector holds the largest share in the market in 2024, describing its critical role in manufacturing durable, reliable components essential for vehicles. This dominance is attributed to the extensive use of forged parts in automobiles, ranging from engine components, chassis structures, to transmission parts. Forging imparts strength, resistance to wear and fatigue, which are paramount in automotive applications, ensuring longevity and safety. The sector's demand is driven by the global automotive industry's growth, technological advancements, and the increasing preference for lightweight materials to enhance fuel efficiency. Moreover, the shift towards electric vehicles (EVs) continues to influence the market dynamics, as forging adapts to accommodate new automotive designs and requirements, maintaining its relevance and pivotal position in the automotive manufacturing process.

On the other hand, the aerospace segment leverages metal forging to manufacture critical, high-strength components essential for aircraft and spacecraft, where material integrity and reliability are non-negotiable. Forged parts are integral in engines, landing gear, and structural components, offering unmatched strength-to-weight ratios, resistance to fatigue, and durability in harsh operational environments. The precision and quality assured by forging are vital for the aerospace industry’s stringent safety and performance standards.

Moreover, in the oil and gas industry, forged components are indispensable for their strength and resistance to extreme pressures and corrosive environments. High-performance forged parts, such as flanges, valves, and fittings, are crucial for the safe and efficient operation of exploration, drilling, and processing equipment in this sector, highlighting the importance of forging in ensuring operational reliability and longevity in challenging conditions.

Furthermore, the construction industry relies on metal forging for its ability to produce robust and long-lasting components. Forged parts are essential in heavy machinery and structural applications, where they contribute to the structural integrity and longevity of buildings, infrastructure, and construction equipment, ensuring safety and durability in demanding construction environments.

Apart from this, forged metal parts in agriculture are pivotal for manufacturing durable machinery and equipment. The high strength and resistance to wear provided by forged components, such as gears, levers, and shafts, ensure the reliability and longevity of agricultural machinery, essential for efficient farming operations and long-term durability in the field.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest metal forging market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific leads the market in 2024, driven by the rapid industrialization, expanding automotive sector, and significant investments in infrastructure development across the region. Countries like China, India, and Japan are at the forefront, leveraging their manufacturing capabilities, technological advancements, and substantial industrial base. This is significantly expanding the metal forging market share. Furthermore, the region benefits from the high demand for forged components in various sectors, including automotive, aerospace, construction, and industrial machinery, which is contributing to a higher metal forging industry size. The growth is further fueled by the increasing focus on renewable energy, public infrastructure projects, and the aerospace industry's proliferation, making Asia Pacific a pivotal player in the global metal forging landscape.

North America is a powerhouse, driven by robust aerospace, defense, automotive, and energy sectors. The region's focus on upgrading infrastructure, along with increasing investments in aerospace and defense, fuels the demand for high-quality forged components. North America's stringent regulatory standards regarding emissions and safety continue to push the automotive industry toward lightweight and high-strength materials, significantly benefiting the industry. The presence of key industry players, coupled with technological advancements in forging techniques, supports the market's growth.

Europe's market is distinguished by its strong automotive, aerospace, and industrial machinery sectors. The region's emphasis on reducing carbon emissions and enhancing fuel efficiency has led to a heightened demand for forged components, especially those made from lightweight materials. Europe's advanced manufacturing base, combined with its focus on renewable energy and high-quality standards, ensures a consistent demand for forged products. The presence of leading automotive manufacturers and aerospace companies in the region fuels the innovation and expansion of the forging industry.

Latin America's metal forging market is expanding, with significant contributions from the automotive, construction, and mining sectors. The region benefits from abundant natural resources, which supports the demand for heavy machinery and equipment requiring forged components. The automotive industry in Latin America is a critical driver, as local and international manufacturers invest in the region, impelled by the growing demand for vehicles and the shift towards more fuel-efficient models.

The Middle East and Africa (MEA) region exhibits a growing metal forging market, primarily driven by the construction, oil & gas, and mining sectors. The region's vast oil reserves and the ongoing expansion in infrastructure and industrial projects fuel the demand for high-quality forged components used in pipelines, drilling equipment, and construction machinery. The MEA market benefits from investments in new industrial and energy projects, including renewable energy, which require durable and robust metal forgings.

Leading Key Players in the Metal Forging Industry:

The key players are focusing on technological advancements, expanding their product portfolios, and entering strategic partnerships and acquisitions to enhance their market presence. They are investing heavily in research and development to innovate and improve the quality, precision, and range of their forged products, catering to the demanding requirements of aerospace, automotive, defense, and other critical industries. Apart from this, the growing demand for high-quality, durable components across industries significantly increases market competition, driving the overall metal forging market worth. Emphasizing sustainability, they are also adopting environmentally friendly practices and energy-efficient processes. Moreover, these companies are expanding globally, targeting emerging markets, and optimizing their supply chains to improve efficiency and reduce costs, ensuring they stay ahead in the competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the metal forging market with detailed profiles of all major companies, including:

- Arconic Corp.

- ATI

- Bharat Forge Ltd.

- Bruck GmbH

- China First Heavy Industries

- Ellwood Group Inc.

- Jiangyin Hengrun Heavy Industries Co. Ltd.

- Nippon Steel Corp.

- Precision Castparts Corp. (Berkshire Hathaway Inc)

- Kovárna Viva

- Larsen & Toubro Limited

- Scot Forge

- Thyssenkrupp AG

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- May 7, 2025: Czech heavy‑industry firm MSV Metal Studénka commenced mass production on a newly commissioned robotic forging line featuring a 4,000‑ton hydraulic press, representing its largest investment in recent years. The upgrade boosts annual output from 14,000 t to over 18,000 t of forged components (weighing 10–22 kg) while integrating automatic cooling technology to eliminate secondary heat treatment and significantly reduce energy consumption. The project further includes investments in CNC machining welding automation and reinforces MSV’s competitive stance in export‑oriented markets.

- April 17, 2025: UNIOR launched its first fully autonomous and robotized forging line, dubbed the L‑6, equipped with seven industrial robots, a 2,000‑ton Clearing mechanical press, and a state‑of‑the‑art lubrication and gripping handling system. The new line is designed to produce over 2 million high‑quality forgings annually while reducing defect rates to below 4%, marking a significant enhancement in production efficiency. Developed in collaboration with technology leaders Fellner GmbH, Bemers GmbH, and Roboteh, the L‑6 project reinforces UNIOR’s position in the global forging industry through advanced automation and innovation.

- April 3, 2025: Bharat Forge Limited, a global metal forging company, inaugurated a state‑of‑the‑art, 300,000 sq ft defense manufacturing facility in Jejuri, near Pune, designed to produce the indigenously developed 155 mm Advanced Towed Artillery Gun Systems (ATAGS) under India’s Aatmanirbhar Bharat initiative. Equipped with flexible multi‑model production lines and integrated testing capabilities, the plant is poised to fulfill large-scale orders from the Ministry of Defence, including exports to allied nations following regulatory clearances.

- September 7, 2023: ATI has been awarded a contract by Bechtel Plant Machinery Inc. (BPMI) to support development of highly engineered part solutions in support of the U.S. Naval Nuclear Propulsion Program. To support the contract, which calls for advanced manufacturing methods including metal additive manufacturing, ATI will establish a dedicated additive manufacturing facility outside Fort Lauderdale, Florida.

- August 18, 2023: Arconic Corporation and Apollo today announced that Apollo Funds have completed the previously announced acquisition of the Company, which includes a minority investment from funds managed by affiliates of Irenic Capital Management (“Irenic”). The Company will continue to operate under the Arconic name and brand.

- July 24, 2023: Bharat Forge Ltd. has earned a prestigious spot on the Financial Times and Statista’s coveted list of Asia-Pacific Climate Leaders 2023. The recognition reflects Bharat Forge's progress in reducing Greenhouse Gas (GHG) emission and its steadfast commitment to combating climate change, underscoring its dedication to environmental stewardship.

Metal Forging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Carbon Steel, Alloy Steel, Aluminum, Magnesium, Stainless Steel, Titanium, Others |

| Applications Covered | Automotive, Aerospace, Oil and Gas, Construction, Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arconic Corp., ATI, Bharat Forge Ltd., Bruck GmbH, China First Heavy Industries, Ellwood Group Inc., Jiangyin Hengrun Heavy Industries Co. Ltd., Nippon Steel Corp., Precision Castparts Corp. (Berkshire Hathaway Inc), Kovárna Viva, Larsen & Toubro Limited, Scot Forge, Thyssenkrupp AG., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the metal forging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global metal forging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the metal forging industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The metal forging market was valued at USD 90.0 Billion in 2024.

The metal forging market is projected to exhibit a CAGR of 5.44% during 2025-2033, reaching a value of USD 145.4 Billion by 2033.

The market is driven by increasing demand from automotive, aerospace, and construction industries, rising focus on lightweight yet durable metal components, technological advancements in forging processes, growth in renewable energy infrastructure, and expanding industrial activities across emerging economies that require high-strength forged parts for critical applications.

Asia Pacific currently dominates the metal forging market in 2024. The dominance is fueled by robust manufacturing activity, rapid urbanization, expanding automotive production, strong demand from construction and industrial sectors, and the presence of large-scale forging facilities in countries like China, India, and Japan, supporting regional supply chain efficiency.

Some of the major players in the metal forging market include Arconic Corp., ATI, Bharat Forge Ltd., Bruck GmbH, China First Heavy Industries, Ellwood Group Inc., Jiangyin Hengrun Heavy Industries Co. Ltd., Nippon Steel Corp., Precision Castparts Corp. (Berkshire Hathaway Inc), Kovárna Viva, Larsen & Toubro Limited, Scot Forge, Thyssenkrupp AG., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)