Meniscus Repair Systems Market Size, Share, Trends and Forecast by Product Type, Clinical Application, End User, and Region, 2025-2033

Meniscus Repair Systems Market Size and Share:

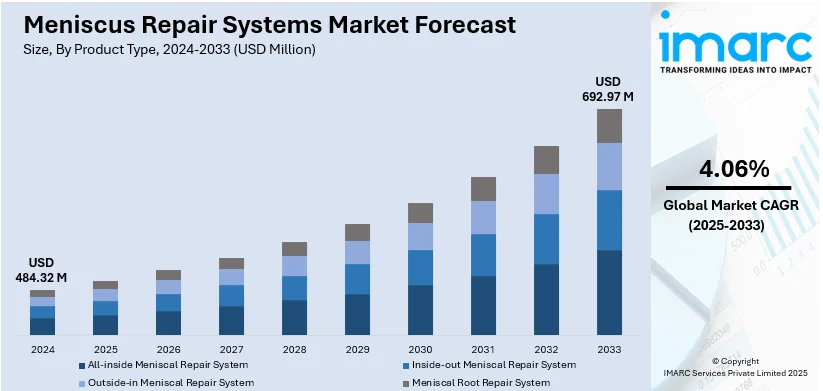

The global meniscus repair systems market size was valued at USD 484.32 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 692.97 Million by 2033, exhibiting a CAGR of 4.06% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.0% in 2024. Significant growth in the healthcare industry, extensive research and development (R&D) activities and rapid technological advancements represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 484.32 Million |

| Market Forecast in 2033 | USD 692.97 Million |

| Market Growth Rate (2025-2033) | 4.06% |

The growth of the market for meniscus repair systems is driven by the increasing rate of sports injuries and the degenerative joint disease osteoarthritis. Arthritis poses a significant health challenge with the CDC estimating that 1 in 5 (53.2 million) adults in the US are affected. Among over 100 types osteoarthritis (OA) is the most prevalent impacting 32.5 million adults leading to substantial societal and personal costs associated with diagnosis and management. The number of people participating in high-impact sports and exercise activities is constantly increasing creating a demand for advanced meniscus repair techniques. These factors are collectively creating a positive meniscus repair systems outlook across the world.

The growing incidence of sports injury, rising number of osteoarthritis and emerging awareness for early meniscus preservation are the key drivers of the United States meniscus repair systems market. The increasing popularity of minimally invasive arthroscopic surgery with the use of bioabsorbable implants and suture-based repair systems is also driving the growth of the market. Robust healthcare infrastructure high healthcare spending and supportive reimbursement policies further boost markets. The rising geriatric population and need for better post-surgical results are driving the uptake of sophisticated meniscus repair systems. According to the data published by Population Reference Bureau, the U.S. population aged 65 and older is projected to rise from 58 million in 2022 to 82 million by 2050 increasing their share from 17% to 23%. By 2050, non-Hispanic whites will make up 60% of older adults down from 75% while children under 18 are 49% non-Hispanic white.

Meniscus Repair Systems Market Trends

Growing Geriatric Population

The rising geriatric population drives the meniscus repair systems market because aging increases the risk of knee-related disorders such as degenerative meniscus tears and osteoarthritis. According to the data published by the World Health Organization (WHO), By 2030 1 in 6 people globally will be aged 60 and over increasing from 1 billion in 2020 to 1.4 billion. By 2050 this group will reach 2.1 billion with 426 million aged 80 or older largely concentrated in low- and middle-income countries. With higher life expectancy and active lifestyles in the elderly population there is a growing demand for effective treatment options to preserve mobility and quality of life. Minimally invasive meniscus repair procedures are increasingly favored to delay or prevent total knee replacements. Advancements in bioabsorbable implants and suture-based techniques also improve surgical outcomes for older patients thus increasing the demand for innovative meniscus repair systems in orthopedic healthcare settings.

Increase in Sports Related Injuries

A higher incidence of sports-related injuries drives the meniscus repair systems market growth since athletes and fitness enthusiasts are at a higher risk of meniscus tears due to sudden twists, high-impact movements and excessive strain on the knee joint. According to industry reports, sports-related orthopedic injuries in adults aged 65 and older are projected to rise 123% from 2021 to 2040 reaching an estimated 207,570 cases. The study identified 772,973 injuries (mean age 73) from 2012 to 2021 with a significant increase from 55,684 in 2012 to 93,221 in 2021. Contact sports like football, basketball and soccer along with running and weightlifting contribute to the rising incidence of knee injuries. Hence, the demand for advanced meniscus repair systems has increased as a result to ensure faster recovery and long-term joint stability.

Expanding Healthcare Infrastructure

Expansion of healthcare infrastructure especially in emerging markets is the primary growth driver for the meniscus repair systems market. Governments and private healthcare providers are investing in advanced orthopedic treatment facilities thereby improving accessibility to specialized surgical procedures. Medical tourism, rising healthcare expenditure and the setting up of high-tech hospitals and orthopedic centers are further increasing market penetration. For instance, in December 2023, Tynor Orthotics announced the launch of a cutting-edge manufacturing facility in Mohali, Punjab with an investment of Rs 800 crore. The 240,000 sq. ft. facility aims to diversify healthcare products, generate 3,000 jobs and empower underprivileged women while employing advanced technologies to enhance product quality and efficiency. Collaborations between medical device manufacturers and healthcare institutions are enabling the adoption of cutting edge meniscus repair technologies.

Meniscus Repair Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global meniscus repair systems market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, clinical application, end user.

Analysis by Product Type:

- All-inside Meniscal Repair System

- Inside-out Meniscal Repair System

- Outside-in Meniscal Repair System

- Meniscal Root Repair System

All-inside Meniscal Repair System stand as the largest product type in 2024, holding around 29.0% of the market. The all-inside meniscal repair system accounts for the largest meniscus repair systems market share because of its minimally invasive approach, decreased surgical complexity and faster recovery times. It does not require additional incisions thus less trauma to surrounding tissues but with accurate placement of sutures. Surgeons prefer all-inside techniques due to their efficiency and improved patient outcomes. The increasing arthroscopic procedures, advancements in bioabsorbable implants and the rising demand for outpatient knee surgeries add to the superiority of this repair system.

Analysis by Clinical Application:

- Radial Tear

- Horizontal Tear

- Flap Tear

- Complex Tear

- Others

Radial tear leads the market with around 27.6% of market share in 2024. Radial tears dominate the meniscal repair systems market due to their high prevalence and the complexity of treatment they require. These tears occurring perpendicular to the meniscus fibers disrupt load distribution in the knee necessitating surgical intervention for optimal recovery. Advances in repair techniques including all-inside and hybrid suture-based approaches have improved treatment outcomes. The rising prevalence of sports-related injuries and the growing trend of conserving the meniscus instead of meniscectomy add to the need for specialized radial tear repair systems.

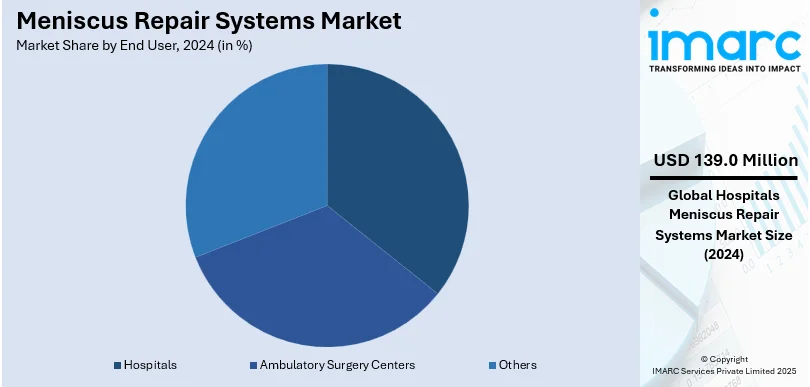

Analysis by End User:

- Hospitals

- Ambulatory Surgery Centers

- Others

Hospitals leads the market with around 28.7% of market share in 2024. Hospitals lead the meniscus repair systems market because of their superior surgical capabilities, the availability of qualified orthopedic surgeons and access to the latest medical technologies. They undertake a high volume of meniscus repair procedures especially complicated cases requiring arthroscopic and minimally invasive techniques. Well-equipped operation theaters, post-surgical rehabilitation programs and insurance coverage make hospitals the first choice for patients. This also includes a growing healthcare infrastructure especially in emerging markets and more investments into orthopedic care with the hospitals maintaining a strong leadership in this sector.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.0%. North America leads the meniscus repair systems market because of the high incidence of sports injuries, increasing prevalence of osteoarthritis and wide use of advanced surgical techniques. This region is further supported by the well-developed healthcare infrastructure, strong presence of leading medical device manufacturers and extensive insurance coverage for orthopedic procedures. The other factors that are driving the North America market include increasing awareness of early meniscus repair, growing demand for minimally invasive surgeries and continuous advancements in bioabsorbable implants.

Key Regional Takeaways:

United States Meniscus Repair Systems Market Analysis

In 2024, the United States captured 80.00% of revenue in the North American market. The United States is experiencing significant growth in meniscus repair systems adoption because of the rising incidence of knee injuries resulting from the increasing participation in sports and physical activities. For example, in 2023 there were 242 million active participants in sports and fitness in the U.S. A record, a 12.1% increase from the total of 215.8 million participants recorded in 2016. An increase in the number of young and adult people participating in high-impact sports like basketball, football, and soccer has caused an increase in meniscus tears, which require such advanced repair techniques. Awareness about the early intervention among the athletes and fitness-conscious people, which will have increased the requirement for meniscus repair systems. Technological advancement in minimally invasive procedures also contributed to the market growth. Established healthcare infrastructure, high per capita healthcare spending, and continuous product innovation from the key players have also driven the industry. The other key driver for increasing demand is the geriatric population prone to knee injuries because of degeneration that comes with aging. The increasing prevalence of obesity and sedentary lifestyles have further contributed to the knee-related issues that drive the long-term growth of meniscus repair systems in the U.S.

Asia Pacific Meniscus Repair Systems Market Analysis

In the Asia-Pacific region increased meniscus repair systems uptake is highly determined by the increased rates of obesity that contribute to a rise in knee injuries. Industry reports show that in India more than 100 million people are experiencing obesity-related challenges. In India, 40% of women and 12% of men are abdominally obese. A sedentary lifestyle combined with poor eating habits has led to increasing cases of obesity in key economies such as China, India and Japan. Excess weight puts extra pressure on knee joints raising the risk of meniscus injury and osteoarthritis thus fueling demand for meniscus repair systems. In addition, enhancing healthcare accessibility and increasing medical tourism in the region have prompted the use of advanced orthopedic procedures. Governments and private healthcare organizations are investing more in advanced surgical procedures underpinning the development of meniscus repair systems. The growing sport culture especially for cricket, badminton and soccer has also contributed to the increase in sport-related knee injuries further driving the market for meniscus repair systems in the Asia-Pacific region.

Europe Meniscus Repair Systems Market Analysis

In Europe the growing meniscus repair systems adoption is primarily driven by the rising geriatric population prone to knee injuries and degenerative conditions such as osteoarthritis. According to WHO, the population of individuals aged 60 and above is increasing swiftly in the WHO European Region. In 2021 this demographic numbered 215 million. Projections indicate that this figure will rise to 247 million by 2030 and exceed 300 million by 2050.With an increasing number of elderly individuals suffering from joint degeneration there is a growing need for effective surgical interventions to improve mobility and quality of life. Osteoarthritis which significantly affects the aging population has resulted in a surge in meniscus-related procedures fuelling the demand for meniscus repair systems. European countries with advanced healthcare systems such as Germany, the UK and France are witnessing higher adoption rates due to greater access to specialized orthopedic treatments. The growing awareness about early meniscus repair as a preferred alternative to total knee replacement has also contributed to market expansion. Furthermore, continuous advancements in bioabsorbable implants and minimally invasive surgical techniques are enhancing treatment outcomes driving further growth in meniscus repair systems across Europe.

Latin America Meniscus Repair Systems Market Analysis

In Latin America the growing meniscus repair systems adoption is strongly linked to rising expenditure capacities of consumers enabling greater access to advanced orthopedic treatments. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. With improving economic conditions an increasing number of individuals are opting for surgical procedures to restore knee function and mobility. The rising prevalence of knee injuries coupled with a growing sports culture in countries like Brazil, Argentina and Mexico is fuelling the demand for meniscus repair systems. Healthcare infrastructure advancements and greater investments in orthopedic surgical technologies are enhancing accessibility to meniscus repair procedures. The increasing penetration of private healthcare providers and insurance coverage expansion is further facilitating market growth. As Latin American consumers continue to prioritize health and well-being the demand for meniscus repair systems is expected to rise supporting the region’s long-term market expansion.

Middle East and Africa Meniscus Repair Systems Market Analysis

The growing meniscus repair systems adoption in the Middle East and Africa is being driven by growing healthcare facilities which are improving access to advanced orthopedic treatments. The Dubai Healthcare City Authority's report indicates that the healthcare sector in Dubai experienced significant growth with 4,482 private medical facilities and 55,208 licensed professionals recorded by 2022. This trend is expected to continue in 2023 with anticipated increases of 3-6% in the number of facilities and 10-15% in licensed professionals. Increased government investments in healthcare infrastructure particularly in countries like the UAE, Saudi Arabia and South Africa have facilitated the expansion of specialized orthopedic centers and hospitals. This has enabled more patients to undergo meniscus repair procedures reducing the burden of untreated knee injuries. The rising prevalence of sports-related injuries combined with growing medical tourism in the Gulf region is further boosting the demand for meniscus repair systems. As healthcare accessibility continues to improve the Middle East and Africa are expected to witness steady market growth with a higher number of patients benefiting from advanced knee repair solutions.

Competitive Landscape:

The meniscal repair systems market is highly competitive driven by continuous advancements in surgical techniques and implant technologies. Companies are focusing on developing innovative and minimally invasive repair solutions to enhance patient outcomes and reduce recovery times. The market is characterized by strong research and development efforts aimed at improving bioabsorbable implants, suture-based repair devices and arthroscopic instrumentation. Strategic partnerships, mergers and acquisitions are common as firms seek to expand their product portfolios and global reach. Regulatory approvals and compliance with stringent healthcare standards play a crucial role in market positioning.

The report provides a comprehensive analysis of the competitive landscape in the meniscus repair systems market with detailed profiles of all major companies, including:

- Arcuro Medical Ltd.

- Arthrex Inc.

- CONMED Corporation

- Depuy Synthes (Johnson & Johnson)

- Double Medical Technology Inc.

- Smith & Nephew PLC

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

Latest News and Developments:

- January 2025: OrthoPreserve's Defender meniscus replacement implant has attained FDA Breakthrough Device Designation and TAP enrollment marking a significant advancement for orthopedic technology. This implant aims to fill the treatment gap stemming from inadequate outcomes associated with partial meniscectomy. Its innovation has the potential to revolutionize knee pain management and lessen the dependence on more invasive surgical options.

- October 2024: Regenity Biosciences has achieved FDA 510(k) clearance for RejuvaKnee™ a collagen-based meniscal implant designed to promote the regeneration of native tissue rather than simply replacing it. A 12-month study on animals indicated that RejuvaKnee™ allowed full weight-bearing within three months demonstrating notably better tissue regeneration when compared to traditional meniscectomy. With an expected market value of over USD 900 Million this development broadens Regenity's offerings in sports medicine.

- August 2024: Arcuro Medical Ltd. reported surpassing 4,000 surgical cases worldwide and achieving over 1,000 in the U.S. with its SuperBall™ Meniscal Repair System. Launched in 2022 and enhanced in 2023 this system caters to various meniscus tear patterns.

- July 2024: Georgia Tech alumnus Jonathan Schwartz founded OrthoPreserve a startup dedicated to creating bio-inspired meniscus implants aimed at helping patients avoid total knee replacements. These implants seek to tackle the long-term issues associated with meniscus injuries, which are prevalent among both athletes and older adults. OrthoPreserve's goal is to prevent degeneration due to meniscus tears thus providing a valuable solution to a common knee problem.

- July 2024: The team from Conemaugh Health System's Western PA Orthopedics successfully carried out the first meniscal transplant at Conemaugh Memorial Medical Center. Dr. Richard Goodrich Jr. led the surgery with assistance from Darren Lester and Louis Koharchik, on a teenage patient with a knee deficient in meniscus. This achievement signifies a notable enhancement in the orthopedic services offered by the hospital.

Meniscus Repair Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment: ·

|

| Product Types Covered | All-inside Meniscal Repair System, Inside-out Meniscal Repair System, Outside-in Meniscal Repair System, Meniscal Root Repair System |

| Clinical Applications Covered | Radial Tear, Horizontal Tear, Flap Tear, Complex Tear, Others |

| End Users Covered | Hospitals, Ambulatory Surgery Centers, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arcuro Medical Ltd., Arthrex Inc., CONMED Corporation, Depuy Synthes (Johnson & Johnson), Double Medical Technology Inc., Smith & Nephew PLC, Stryker Corporation, Zimmer Biomet Holdings Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the meniscus repair systems market from 2019-2033.

- The meniscus repair systems market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the meniscus repair systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The meniscus repair systems market was valued at USD 484.32 Million in 2024.

IMARC estimates the meniscus repair systems market to reach USD 692.97 Million by 2033, exhibiting a CAGR of 4.06% during 2025-2033.

The meniscus repair systems market is driven by the rising prevalence of sports-related knee injuries, increasing adoption of minimally invasive surgical techniques, and advancements in arthroscopic repair technologies. Additionally, growing awareness about preserving knee function and the expanding geriatric population prone to degenerative meniscus tears further propel market growth.

In 2024, North America accounted for the largest market share of over 35.0%, driven by a high incidence of sports injuries, advanced healthcare infrastructure, and the widespread adoption of minimally invasive surgical procedures. Strong presence of key market players and increasing awareness about early meniscus repair further contribute to regional dominance.

Some of the major players in the meniscus repair systems market include Arcuro Medical Ltd., Arthrex Inc., CONMED Corporation, Depuy Synthes (Johnson & Johnson), Double Medical Technology Inc., Smith & Nephew PLC, Stryker Corporation, Zimmer Biomet Holdings Inc., etc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)