MENA Logistics Market Size Report by Model Type (2 PL, 3 PL, 4 PL), Transportation Mode (Roadways, Seaways, Railways, Airways), End Use (Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, and Others), and Country 2026-2034

Market Overview:

MENA logistics market size reached USD 292.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 440.3 Billion by 2034, exhibiting a growth rate (CAGR) of 4.65% during 2026-2034. The diversification of economies, adoption of advanced technologies such as blockchain, Internet of Things (IoT), and artificial intelligence (AI), and the rise of e-commerce sector represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 292.6 Billion |

|

Market Forecast in 2034

|

USD 440.3 Billion |

| Market Growth Rate 2026-2034 | 4.65% |

Access the full market insights report Request Sample

Logistics refers to the intricate process of coordinating and managing the movement of goods, services, and information from their point of origin to the final destination. This complex operation combines the flow of physical items, such as food products, materials, animals, equipment, and liquids, and the related flow of information. The objective of logistics is to ensure that items are transported efficiently, cost-effectively, and in a timely manner while maintaining the quality and condition of the products throughout the entire supply chain. Effective logistics involves the integration of information, transportation, inventory, warehousing, material handling, and packaging. It also frequently necessitates consideration of security, import and export regulations, as well as the handling of hazardous materials. The aim is to meet customer demands and deliver a high level of service while also maintaining cost efficiency. Logistics plays a crucial role in the global economy, where it is essential for businesses to stay competitive, and its importance is only growing as consumer expectations for rapid delivery continue to increase.

MENA Logistics Market Trends:

The strategic geographical positioning of the region, which serves as a bridge between the East and the West, facilitating global trade routes, is driving the Middle East and North Africa (MENA) market. This location advantage is bolstered by substantial investments in infrastructure, such as ports, airports, and road networks. Furthermore, the diversification of economies within the region, with a pronounced shift from oil dependency to a broader array of sectors such as retail, manufacturing, and e-commerce, is providing an impetus to the market. E-commerce, in particular, has seen a rise expedited by digital transformation and increased internet penetration rates, which have propelled demand for sophisticated logistics services that can support the complex requirements of online retailing. Besides, governments in the region are also playing a pivotal role by implementing reforms and policies aimed at trade facilitation and economic diversification, which have created a more favorable business climate for logistics companies. Free zones, economic cities, and trade agreements are several initiatives that have simplified cross-border trade and attracted foreign investment. Moreover, the adoption of advanced technologies such as blockchain, Internet of Things (IoT), and artificial intelligence (AI) in logistics processes is revolutionizing the sector, leading to enhanced efficiency, transparency, and reduced operational costs. These technologies help in managing the supply chain more effectively, from warehousing to last-mile delivery, creating a competitive edge for the MENA logistics market. Additionally, significant events have necessitated robust logistics solutions to support the influx of tourists and goods, further stimulating the market. These events have led to improvements in infrastructure and services that have long-term benefits for the logistics industry.

MENA Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

To get detailed segment analysis of this market Request Sample

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways.

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

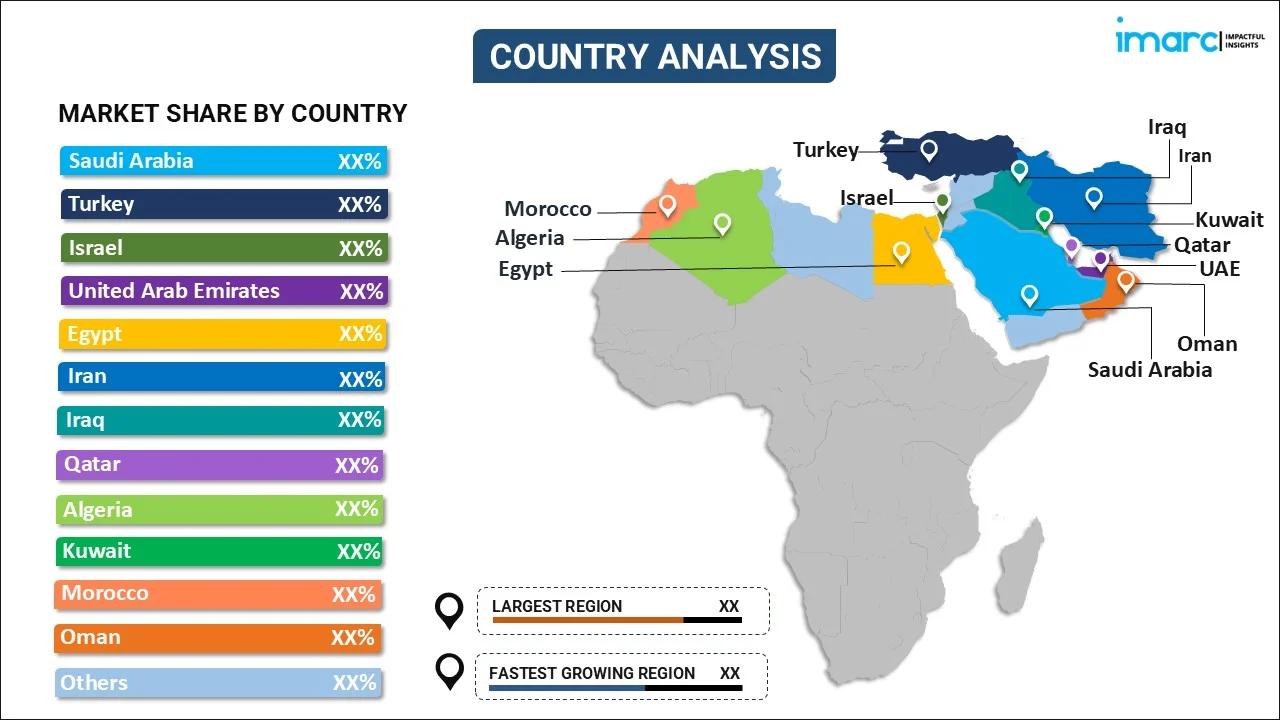

Country Insights:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Egypt

- Iran

- Iraq

- Qatar

- Algeria

- Kuwait

- Morocco

- Oman

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, Turkey, Israel, United Arab Emirates, Egypt, Iran, Iraq, Qatar, Algeria, Kuwait, Morocco, Oman, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

MENA Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Egypt, Iran, Iraq, Qatar, Algeria, Kuwait, Morocco, Oman, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the MENA logistics market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the MENA logistics market?

- What is the breakup of the MENA logistics market on the basis of model type?

- What is the breakup of the MENA logistics market on the basis of transportation mode?

- What is the breakup of the MENA logistics market on the basis of end use?

- What are the various stages in the value chain of the MENA logistics market?

- What are the key driving factors and challenges in the MENA logistics?

- What is the structure of the MENA logistics market and who are the key players?

- What is the degree of competition in the MENA logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the MENA logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the MENA logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the MENA logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)