Men Formal Shoe Market Size, Share, Trends and Forecast by Shoe Type, Leather Type, and Region, 2025-2033

Men Formal Shoe Market Size and Share:

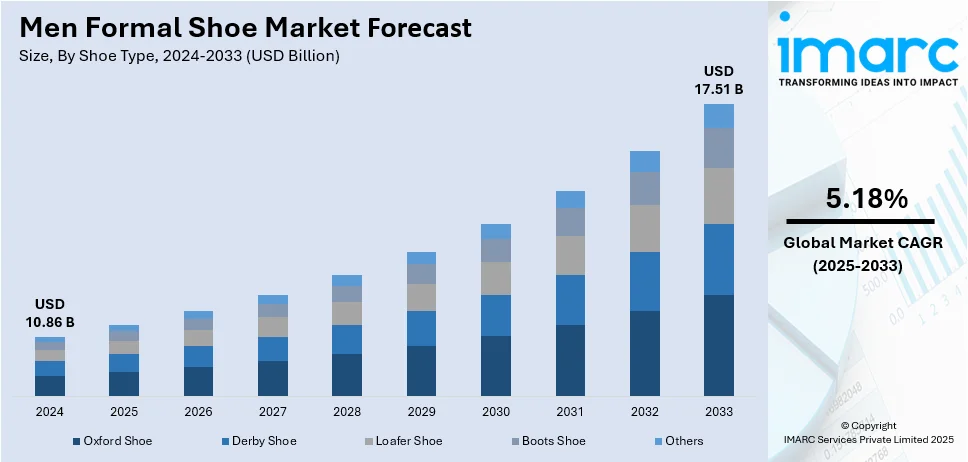

The global men formal shoe market size was valued at USD 10.86 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.51 Billion by 2033, exhibiting a CAGR of 5.18% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 44.3% in 2024. Continual product innovations in design and features, easy product availability across online and offline organized retail channels are propelling the market growth. Besides this, men formal shoe market share is driven by inflating disposable income levels, which increases the purchasing power parity of the masses.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.86 Billion |

|

Market Forecast in 2033

|

USD 17.51 Billion |

| Market Growth Rate (2025-2033) | 5.18% |

People seek personalized formal shoes tailored to their style, fit, and comfort preferences. Customization options, such as choosing materials, colors, and designs, attract high-end customers looking for unique footwear. Bespoke shoe services, offering handcrafting and precise measurements, are gaining traction among fashion-conscious buyers. The demand for eco-friendly materials like vegan leather and recycled fabrics, is contributing to the sales of sustainable footwear. People are now prioritizing sustainability in their purchasing decisions, with eco-conscious brands gaining momentum. Shoe manufacturers are adopting sustainable production methods to reduce waste, water usage, and energy utilization. The use of biodegradable and renewable materials in shoe construction ensures minimal environmental impact. Brands offering transparent, ethical sourcing practices appeal to individuals who care about product origins.

The men formal shoe market demand is driven by the expansion of logistics infrastructure in the United States. Improved transportation networks allow for faster and more efficient delivery of formal shoes across regions. E-commerce platforms benefit from better logistics, enhancing customer experience with quicker shipping and delivery timelines. As fulfillment centers increase, businesses can offer a broader range of shoe styles and sizes nationwide. The expansion ensures timely inventory restocking, preventing stockouts and enhancing market availability. With enhanced logistics, online retailers can reach remote and underserved areas, broadening their customer base. Shoppers enjoy the convenience of doorstep delivery and easy returns, influencing overall sales. The growth of warehouses and distribution centers allows for better product storage and handling, ensuring high-quality deliveries. Retailers benefit from reduced operational costs due to streamlined logistics, which can lower product prices. As regional logistics hubs grow, brands can cater to local tastes more effectively, improving customer satisfaction. In September 2024, Level Shoes, a Dubai-based luxury footwear retailer expanded into the US market by establishing a new logistics hub. This move aims to enhance e-commerce logistics, including warehousing, inventory management, and distribution, to better serve the growing demand for luxury footwear in the country.

Men Formal Shoe Market Trends:

Growing demand for premium products

The global market is primarily driven by the escalating demand for premium and branded footwear, especially among the male population. Almost half of the buyers pay a 10% or greater for premium product, and among these 7% shoppers are willing to pay over 50% extra. The desire for exclusivity and superior craftsmanship is driving the demand for luxury brands and bespoke designs. With rising disposable incomes, people are more inclined to spend on high-end formal footwear. Premium brands focus on creating unique designs, offering personalization and customization to attract discerning customers. Social media influencers and celebrities often promote luxury formal shoes, driving trends and customer interests. The demand for premium shoes is also driven by the growing corporate culture and professional attire requirements. Men seek formal shoes that not only offer style but also superior comfort and longevity. Limited-edition releases and collaborations with high-profile designers contribute to the growing interest in premium formal footwear. Sustainability is becoming a key factor in premium product offerings, with eco-friendly and ethical production attracting environmentally conscious buyers.

Expansion of e-commerce platforms

The shifting customer preferences towards online shopping due to the convenience and the availability of foreign brands, discounts, and virtual trial rooms are resulting in higher product sales. TIDIO reports that more than 2.14 billion people are shopping online, reflecting a significant increase in recent years. With the global population at 7.9 billion, this means 27% of the world's population is now participating in digital shopping. The market is further propelled by numerous strategies adopted by various key market players, such as new product launches, collaboration and partnerships, and mergers and acquisitions (M&As), to enhance their geographical presence. The growing apparel industry is resulting in the expansion of product warehousing and supply chain, which, in turn, is fueling the market growth. Some of the other factors contributing to the market growth include rapid industrialization, inflating disposable income levels, shifting lifestyle patterns of the customers and extensive research and development (R&D) activities.

Innovation in materials and comfort

Brands are adopting advanced materials like memory foam, breathable linings, and lightweight soles to enhance comfort. These innovations provide superior cushioning and support, reducing foot fatigue during long hours of wear. The use of flexible, soft leather materials ensures a comfortable fit without compromising on style or durability. Technological advancements in shoe construction, such as 3D printing, allow for customized designs that enhance comfort. Shoes designed with moisture-wicking fabrics help maintain freshness, particularly in long, formal events. New Balance launched the 1906L sneaker-loafer hybrid on December 4, 2024. Featuring a breathable mesh upper, loafer-inspired tongue, and N-Ergy midsole technology, it combines comfort and style. Moreover, the integration of ergonomic insoles and arch support is improving overall foot health and comfort for wearers. Comfort-driven designs appeal to both professionals and individuals looking for practical yet stylish formal shoes. Sustainable materials, such as recycled fabrics and eco-friendly leathers, attract environmentally conscious buyers without sacrificing comfort, which is strengthening the market growth.

Men Formal Shoe Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global men formal shoe market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on shoe type and leather type.

Analysis by Shoe Type:

- Oxford Shoe

- Derby Shoe

- Loafer Shoe

- Boots Shoe

- Others

Oxford shoe stand as the largest component in 2024, holding 32.0% of the market. They have closed-lacing system that offers a sleek and sophisticated appearance, making them highly preferred. Professionals, executives, and corporate employees favor oxford shoes for business meetings and formal occasions. Their structured design ensures a polished look, complementing business suits and formal attire effectively. Luxury brands continuously innovate oxford shoes with premium leather and cushioned insoles for enhanced comfort. The demand for handcrafted and customized oxford shoes is rising among high-income and fashion-conscious individuals. Various color options including black and brown, make oxford shoes suitable for multiple formal events. Celebrities and influencers often endorse oxford shoes, reinforcing their status as a premium footwear choice. Online platforms and retail stores prominently feature oxford shoes, driving consistent sales growth worldwide. Their association with luxury, elegance, and prestige strengthens their position as the market leader. Rising disposable incomes and increasing corporate culture further driving demand for high-quality oxford shoes. Wedding trends and formal events also contribute to their continuous demand among men.

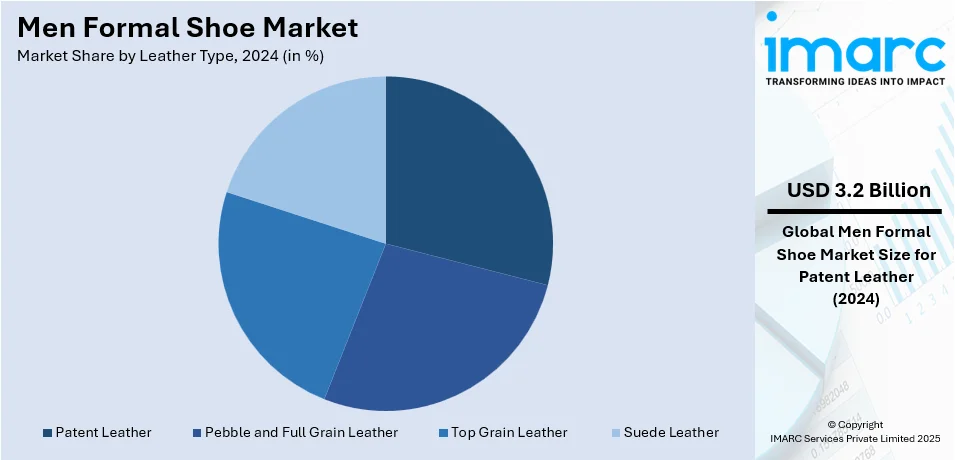

Analysis by Leather Type:

- Patent Leather

- Pebble and Full Grain Leather

- Top Grain Leather

- Suede Leather

Patent leather leads the market with 29.5% of market share in 2024. It offers a shiny surface, which enhances the elegance of formal footwear, making it suitable for special occasions. Men prefer patent leather shoes for weddings, black-tie events, and high-profile business meetings. Luxury brands use patent leather to create premium-quality shoes with superior durability and aesthetic value. The material’s water-resistant properties provide longevity, reducing maintenance efforts and increasing customer preference. Designers frequently incorporate patent leather into classic styles like oxford and derby shoes for formal wear. The global fashion industry continuously promotes patent leather footwear, strengthening its market growth. E-commerce platforms showcase an extensive range of patent leather shoes, influencing online sales and accessibility. Celebrities and social media influencers endorse patent leather shoes, increasing their desirability among fashion-conscious individuals. The men formal shoe market forecast indicates growth, with patent leather continuing to dominate due to its appeal in luxury and high-end formal footwear segments, driven by both user preference and influencer endorsements.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 44.3%. The expanding middle class is in the region is driving the demand for premium and stylish formal footwear. Increasing corporate culture and professional workforce growth contribute significantly to the demand for formal shoes. Countries like China, India, and Japan serve as major markets for men formal footwear. Local and international brands are aggressively expanding their presence to cater to the growing customer base. For instance, in December 2024, Cole Haan appointed HiMaxx as its exclusive distributor in China to strengthen its market presence. HiMaxx will manage over 30 stores across Hong Kong and Mainland China, with plans for expansion. This partnership aims to meet the rising demand for premium footwear in China, with Cole Haan continuing to innovate in both style and performance. Besides this, e-commerce platforms are making formal shoes more accessible, influencing sales across urban and semi-urban regions. Manufacturing hubs in China and India provide cost-effective production, strengthening the region’s supply chain dominance. Rising fashion awareness and western influence contribute to higher adoption of premium formal shoe styles. The growing number of formal events, weddings, and social gatherings further accelerates the market demand. International brands are launching region-specific collections tailored to Asian fashion preferences and cultural requirements.

Key Regional Takeaways:

United States Men Formal Shoe Market Analysis

The United States hold 85.60% of the market share in North America. The market for men formal shoe in the United States is influenced by a combination of factors, including the resurgence of workplace dress codes, a growing emphasis on professional appearance, and an increasing preference for premium footwear. As of January 2018, industry reports show that 66% of the workforce was of male employees, while 54.6% were female, underscoring the notable male presence in corporate environments. This trend is reinforcing the demand for formal shoes, with businesses emphasizing polished, professional looks for employees. Customer preferences are shifting towards high-quality, durable materials like leather, and shoes with advanced comfort features, fueling the market growth for premium formal footwear. The growing influence of fashion trends and the integration of formal shoes into casual settings also supports market growth, as men seek versatile options for various occasions. E-commerce is expanding providing individuals with easy access to a wide variety of styles, further influencing sales. With increased disposable income and a desire for personal grooming, formal footwear continues to be seen as a key element of personal style and status. Brand loyalty and customer confidence in renowned names are playing a key role in driving market expansion. Sustainable fashion trends are also prompting manufacturers to innovate with eco-friendly materials, thereby strengthening men formal shoe market growth.

Europe Men Formal Shoe Market Analysis

In Europe, the market is influenced by a combination of traditional style preferences and evolving fashion trends. The strong cultural inclination towards tailored, formal wear in regions such as the UK, Italy, and France continues to drive the demand for men formal shoes. In particular, the office wear culture in corporate sectors remains a key factor inducing growth, as formal shoes are considered essential to a professional appearance. The shift towards comfort and quality is also playing a crucial role, with buyers increasingly seeking shoes that offer both style and practicality, such as cushioned insoles, ergonomic designs, and durable materials. Sustainability is becoming a significant driver in the European market. The European Union reports that over 78% of Europeans believe environmental issues directly impact their daily life and health. This growing awareness is leading manufacturers to prioritize eco-friendly production methods and sustainable materials, which align with the values of European customers. Furthermore, the influence of fashion-forward cities like Milan and Paris continues to shape individual preferences, making men formal footwear a key component of personal style and status. The expansion of e-commerce has made it easier for buyers to access a wider range of formal shoe brands, strengthening the market growth.

Latin America Men Formal Shoe Market Analysis

In Latin America, the market is primarily driven by growing disposable incomes, and the demand for professional attire in business sectors. As more men in countries like Brazil, Mexico, and Argentina enter the workforce, the need for formal footwear has risen. The adoption of western fashion trends, which emphasize quality and style, is significantly influencing customer preferences. Reports indicate that 82% of the adult population in Latin America made an online purchase in 2023, closely aligning with the region's 83% internet access rate. This trend is fueling market growth in e-commerce, particularly in the formal shoe sector.

Middle East and Africa Men Formal Shoe Market Analysis

The market for men formal shoe in the Middle East and Africa is driven by a growing affluent middle class and increasing demand for formal footwear in corporate and professional settings. Countries, such as the UAE and South Africa are witnessing an expansion in business hubs, raising the need for high-quality, stylish shoes that align with professional attire. According to the World Bank, the Middle East and North Africa region is 64% urbanized, which is driving increased demand for formal footwear in urban areas. Additionally, the growing emphasis on luxury goods and rising e-commerce adoption is supporting market growth.

Competitive Landscape:

Key players are continuously improving product quality by using premium materials, enhancing durability and comfort for customers. Strong brand positioning and marketing campaigns are increasing customer awareness about quality products and influencing purchasing decisions worldwide. Companies are expanding their product lines by introducing stylish, ergonomic, and lightweight formal shoes for men. For example, In April 2024, Cole Haan and Hiroshi Fujiwara's fragment design collaborated to introduce new classic loafers. The collection features Penny and Tassel Loafers in premium leather with a modern sole and subtle fragment branding. Besides this, e-commerce integration is allowing key players to reach global customers with attractive discounts and offers. Strategic collaborations with designers and celebrities are improving brand visibility and customer engagement significantly. Investments in research and development (R&D) are leading to advanced manufacturing techniques and sustainable production methods. Customization options, including personalized fits and colors, are attracting high-end customers looking for exclusivity. Expansion into emerging markets is helping brands capitalize on increasing disposable incomes and changing fashion trends. Competitive pricing strategies and seasonal sales are ensuring higher customer retention and repeat purchases. Omnichannel retailing, through physical stores and digital platforms, is strengthening brand presence and accessibility.

The report provides a comprehensive analysis of the competitive landscape in the men formal shoe market with detailed profiles of all major companies, including:

- Alden Shoe Company

- Allen Edmonds Corporation (Caleres Inc.)

- Bruno Magli S.p.A. (Marquee Brands)

- Burberry Group Plc

- C. & J. Clark International Ltd. (C&J Clark (Holdings) Limited)

- Calvin Klein Inc. (PVH Corp.)

- Cole Haan

- Dolce & Gabbana S.r.l.

- Genesco Inc.

- Guccio Gucci S.p.A (Kering Holland NV)

- Hugo Boss AG

- LVMH Moët Hennessy Louis Vuitton

- Prada S.p.A.

Latest News and Developments:

- August 2024: Allen Edmonds announced the launch of its luxury Reserve Collection, featuring eight handcrafted men's shoe styles priced between $800 and $3,000. This exclusive line highlights American craftsmanship and timeless quality, with designs including brogues, loafers, and derby boots.

- April 2024: Stuart Weitzman launched its first men's shoe collection, now available at select stores like Saks, Nordstrom, and online. The collection includes a range of formal footwear, such as loafers, oxfords, and derbies, designed for both special occasions and everyday wear. These styles cater to the luxury segment, combining sophistication with craftsmanship.

- November 2024: Radhamani Textiles’ flagship brand, Rare Rabbit, is expanded its presence in Gujarat with the launch of Rare’z, a new premium men’s footwear brand. The first physical store, situated at Rajhans Ornate in Surat, showcases a curated selection of casual and formal footwear. Highlights include metallic silver sneakers featuring a monogram ‘R’ and a premium leather collection named ‘Sauron.’

- March 2024: Italian bespoke shoe brand Santoni plans to expand its presence in India by opening two luxury boutiques in Mumbai and Hyderabad by 2026. Currently operating through its store at Delhi's Emporio Mall, the brand aims to strengthen its position in the premium formal footwear segment. Santoni’s India partner, Luxerati Retail Pvt. Ltd., is also considering launching a dedicated online platform for the Indian market by 2026. Since achieving profitability in 2021, the business has seen steady growth and remains focused on meeting the demand for high-end formal footwear.

- February 2024: Thomas Crick, the British heritage shoe brand founded in 1830, launched in the Indian market. The brand introduces a premium range of men’s leather footwear, blending classic craftsmanship with contemporary design. Its collection features dark tan five-eyelet wing cap brogues, Chelsea boots, and monk shoes. Covering formal, casual, and trainer categories, the brand focuses on delivering both elegance and comfort in every style.

Men Formal Shoe Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Shoe Types Covered | Oxford Shoe, Derby Shoe, Loafer Shoe, Boots Shoe, Others |

| Leather Types Covered | Patent Leather, Pebble and Full Grain Leather, Top Grain Leather, Suede Leather |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alden Shoe Company, Allen Edmonds Corporation (Caleres Inc.), Bruno Magli S.p.A. (Marquee Brands), Burberry Group Plc, C. & J. Clark International Ltd. (C&J Clark (Holdings) Limited), Calvin Klein Inc. (PVH Corp.), Cole Haan, Dolce & Gabbana S.r.l., Genesco Inc., Guccio Gucci S.p.A (Kering Holland NV), Hugo Boss AG, LVMH Moët Hennessy Louis Vuitton, Prada S.p.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the men formal shoe market from 2019-2033.

- The men formal shoe market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the men formal shoe industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The men formal shoe market was valued at USD 10.86 Billion in 2024.

The men formal shoe market is projected to exhibit a CAGR of 5.18% during 2025-2033, reaching a value of USD 17.51 Billion by 2033.

The men formal shoe market growth is driven by rising demand for premium products and increasing number of corporate events. E-commerce expansion allows broader access to formal footwear, enhancing convenience and reach. Innovations in materials and comfort, such as ergonomic insoles and breathable leather, are attracting individuals seeking both style and comfort.

Asia Pacific currently dominates the men formal shoe market, accounting for a share of 44.3% in 2024. The expanding middle class in countries like China, India, and Japan drives demand for high-quality formal footwear. Rising corporate culture and professional events increase the need for formal shoes in the region. E-commerce platforms further enhance accessibility, making formal shoes available to a broader audience.

Some of the major players in the men formal shoe market include Alden Shoe Company, Allen Edmonds Corporation (Caleres Inc.), Bruno Magli S.p.A. (Marquee Brands), Burberry Group Plc, C. & J. Clark International Ltd. (C&J Clark (Holdings) Limited), Calvin Klein Inc. (PVH Corp.), Cole Haan, Dolce & Gabbana S.r.l., Genesco Inc., Guccio Gucci S.p.A (Kering Holland NV), Hugo Boss AG, LVMH Moët Hennessy Louis Vuitton, Prada S.p.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)