Medical Transcription Market Size, Share, Trends and Forecast by Service Type, Technology, Mode of Procurement, End User, and Region, 2025-2033

Medical Transcription Market Size and Share:

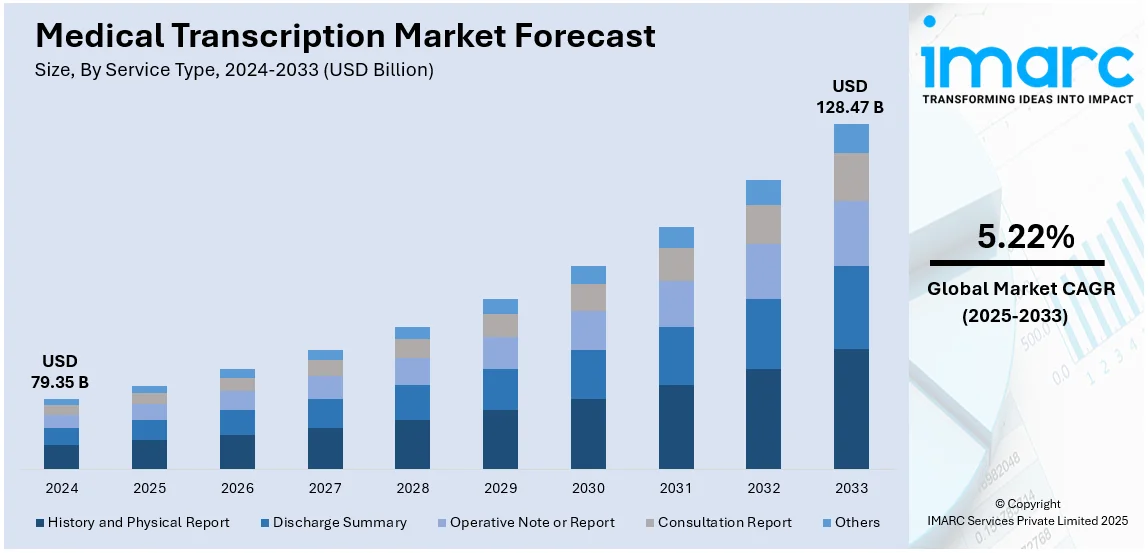

The global medical transcription market size was valued at USD 79.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 128.47 Billion by 2033, exhibiting a CAGR of 5.22% during 2025-2033. North America currently dominates the market, holding a significant market share of over 45.8% in 2024. The rising demand for accurate, real-time clinical documentation, increasing adoption of cloud-based transcription solutions, growing integration of AI-powered speech recognition, expanding telemedicine services, and stringent regulatory compliance requirements are some of the factors positively impacting the medical transcription market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 79.35 Billion |

|

Market Forecast in 2033

|

USD 128.47 Billion |

| Market Growth Rate (2025-2033) | 5.22% |

The market is primarily driven by the growing healthcare IT infrastructure, the high demand for accurate patient documentation, and the increased adoption of speech recognition technology. Compliance requirements stressing electronic health record (EHR) integration and stringent documentation add to the medical transcription market demand. An industry report estimates that the worldwide medical tourism market is at USD 144.5 Billion. This market is expected to grow at 19.08% CAGR between 2025 and 2033, adding up to USD 704.8 Billion in 2033. The boom in medical tourism, particularly in countries with cost-efficient transcription services, is another growth factor in the market. Furthermore, the rise in incidence and occurrences of long-term diseases that require medical documents several times keeps increasing the volume of transcription.

The United States is emerging as a key region in the market as it is witnessing significant growth driven by the increasing healthcare expenditure, stringent regulatory requirements for documentation accuracy, and widespread EHR adoption. Moreover, the shift toward value-based care models, requiring detailed clinical documentation for reimbursement, is enhancing the medical transcription market outlook. A latest industry report predicts that telemedicine is expected to make up 25–30% of all medical visits in the United States by 2026. This rising prevalence of telemedicine and remote patient monitoring is further leading to a greater need for digital transcription services. In addition to this, the shortage of skilled medical coders is increasing reliance on transcription services for accurate clinical records. Also, the presence of well-established healthcare providers and the rising need for outsourcing transcription services to reduce administrative burdens are strengthening market expansion in the United States.

Medical Transcription Market Trends:

Rising Adoption of Artificial Intelligence (AI) and Voice Recognition

The development of artificial intelligence (AI) and voice recognition technologies are significant medical transcription market trends. An AI-powered speech-to-text solution will improve transcription accuracy while minimizing documentation time frames. The latest natural language processing (NLP) models can differentiate medical terminology, dialects, and contextual variations in a way that produces highly accurate transcriptions requiring little human input. According to industrial reports, AI-powered natural language processing (NLP) models can enhance transcription accuracy by up to 95%, significantly reducing human intervention. In addition to this, deep learning algorithms improve their output continuously, making for greater efficiency in transcription. Real-time transcription reduces reliance on manual transcriptionists, where voice recognition technology runs together with medical dictation software. This becomes increasingly relevant to hospitals and clinics working towards efficient workflow processes and reduced overheads. With the projections of AI model developments, the foresight is for ultra-streamlined clinical documentation, thereby enhancing faster, accurate, and cost-efficient medical transcription.

Increasing Demand for Outsourced Transcription Services

Rising cost pressures on healthcare providers are making outsourced medical transcription services further desirable. In their endeavor to lower operational expenses while remaining compliant with the stringent healthcare regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States, many hospitals and clinics have chosen third-party transcription solutions. In this way, healthcare organizations maintain access to skilled transcriptionists and state-of-the-art transcription technologies without all the woes of managing an in-house team. Third-party providers also ensure faster turnaround times, scalability, and specialized expertise capable of addressing complex medical terminologies. The rising telemedicine and remote patient engagement formats only add to the demands for outsourced transcription services. With these providers on an efficiency drive aimed at cost-cutting, the outsourcing of medical transcription remains an expected market trend in the forthcoming years. According to an industry report, the increasing adoption of telehealth services, which surged by 154% during the COVID-19 pandemic, further fuels the demand for outsourced transcription solutions, as virtual consultations require accurate and timely documentation.

Integration with Electronic Health Records (EHRs)

Integration with EHR systems within medical transcription services magnifies the clinical documentation processes, which is supporting the medical transcription market growth. Automatic population of patient records through EHR-integrated transcription solutions helps to avoid manual errors while improving workflow. This ensures that the physician and healthcare professionals work with real-time access to verified patient histories, treatment plans, and diagnostic reports; thus, improving patient care. Transcription services with compatibility across multiple EHR platforms are experiencing a surge in acceptance as healthcare institutions pursue digital transformation. For instance, Universal Health Services implemented a voice transcription system that not only reduced transcription costs by 69% but also enhanced the quality of electronic healthcare records. Meanwhile, such AI-enhanced transcription solutions can draw structured data out from high volumes of medical transcription, thereby aiding the analysis of patient trends and decision-making in healthcare. With pressure from regulators to standardize digital health records in general, EHR-integrated transcription solutions will have a key place in the future of healthcare documentation.

Medical Transcription Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global medical transcription market report, along with forecasts at the global and regional level from 2025-2033. Our report has categorized the market based on service type, technology, mode of procurement, and end user.

Analysis by Service Type:

- History and Physical Report

- Discharge Summary

- Operative Note or Report

- Consultation Report

- Others (Pathology Report, Radiology Report, etc.)

A history and physical report is one of the primary documents used in medical transcription and presents the chronological patient medical history with a description of the patient's present state of health during the time of seeing the patient for an initial evaluation. It contains main complaints, the illness's history, previous medical and surgical records, a review of the systems, the results of the examination, and some initial evaluations. The report helps in the transfer of care of the patient from one team to another, forming a very good basis for diagnosis and proposed treatment. Accurate transcription of H&P reports into medical charts is vital for ensuring these charts serve as a comprehensive document for patient care, insurance claims, and even legal documentation purposes. It can be involved in hospital admission and pre-surgical assessment.

A discharge summary describes a patient's stay in the hospital, summarizing the diagnosis, therapy, procedures, and instructions for follow-up care. It included the admission and discharge diagnosis, significant findings, procedures performed, medications prescribed, and recommendations for continuing care. These reports are important in communication among healthcare providers, in the assurance of appropriate care after discharge from the hospital, and in the prevention of preventable readmissions. In medical transcription, precise documentation of discharge summaries is also critical in litigation, billing, and the continuity of clinical care. It facilitates seamless transitions of care-whether to rehabilitation centers, primary care physicians, or home care-making it that much more important as far as patient management is concerned.

An operative note or report provides details regarding the surgical procedures performed, including preoperative diagnosis, anesthesia administered, procedural steps, intraoperative findings, and postoperative instructions. It will also document the progress of the patient, especially regarding anticipated complications, for easy reference for the surgical, anesthesiological, and recovery teams. This document will stand as a legal record of the surgery performed and is significant in support of insurance reimbursement. In medical transcription, accuracy in the operative report is of utmost importance; inaccuracy here has significant implications for treatment in the future. The standardized structure of the report enhances clarity and uniformity in surgical documentation.

Analysis by Technology:

- Electronic Medical Records/Electronic Health Record (EMR/EHR)

- Picture Archiving and Communication System (PACS)

- Radiology Information System (RIS)

- Speech Recognition Technology (SRT)

- Others

The medical transcription market is transforming with EMRs and EHRs by creating easy documentation and easy access to the documentation. Digital systems store data concerning patients, such as their history, treatment plans, test results, and notes from clinicians in an effort to de-emphasize paper records. Medical transcriptionists integrate transcription with EMR/EHR platforms for standardization and structurization in the documentation. This particular technology thereby enhances efficiency, reduces errors, and enables better coordination amongst various healthcare providers. Besides this, voice recognition and natural language processing are changing the ways transcription works with EHRs, leading transcriptionists to devote more effort to editing and quality assurance than typing.

Picture Archiving and Communication Systems (PACS) are vital to radiology, allowing medical imaging data to be stored, retrieved, and shared digitally. Although most of the work done by PACS is concerned with the management of visual data like X-rays, MRIs, and CT scans, these systems take care of the radiologists' dictated reports and transcription work. Medical transcriptionists convert dictated findings into structured reports that can be incorporated into PACS and EHR systems. Radiology reports transcribed from dictation must be accurate for reliable diagnoses, treatment planning, and legal purposes. As PACS are changing, so must the transcriptionists in combining voice recognition systems and structured reporting templates into their work.

Radiology Information System (RIS) is a specialized digital system developed for the administration of imaging workflows, scheduling, and reporting purposes in radiology departments. It operates together with PACS and EHRs, ensuring seamless documentation and correspondence with radiologists, referring physicians, and healthcare teams. Medical transcriptionists work by transcribing voice-recorded rad reports into standardized documents that are stored within RIS. Being precise with these reports is elemental, as they shape diagnosis and treatment decisions. The integration of AI-powered voice recognition tools within RIS has now shifted the job of transcriptionists to reviewing and editing automated transcriptions for industry standards and documentation error reduction.

Analysis by Mode of Procurement:

- Outsourcing

- Offshoring

- Both

Outsourcing is an agreement where medical transcription facilities offer their documentation services to firms outside the medical facilities. This concept helps hospitals and clinics to lessen the burden of administrative work, reduce operational costs, and improve turnover times. For maintained accuracy and compliance with industry regulations these transcription services are outsourced. Many firms work using powerful speech recognition systems and AI-assisted tools and also employ professionals to edit their reports. By outsourcing transcription tasks, healthcare practices are essentially focusing all their attention on patient care while managing accurate and timely documentation without the hassles and burden of keeping an in-house transcription team, which can oftentimes be very costly and providently heavy on resources.

Offshore medical transcription means giving transcription services to providers in another country where labor costs may be lower. India and the Philippines are offshore markets of medical transcription, as they provide cost-efficient yet high-standard services that involve professionals with knowledge of medical terms and compliance requirements. Offshoring facilitates the processing of hefty volumes of transcription for healthcare facilities without compromising on the quality of their work or turnaround time. However, big implications with data security must be implanted to protect the confidentiality of the patient. As AI-assisted tools come into play more in transcription work, the offshoring of transcriptionists is turning into a field focused more on editing and quality assurance than manual transcription.

Outsourcing and offshoring together provide flexibly scalable options for medical transcription that balance cost efficiency with quality service. Many healthcare tools are hybrid where outsourcing transcription services and offshore resources with extremely low prices for 24-7 operational facilities. This duality is employed in managing processes in peak work volume at a faster rate with compliance ensured with regulatory standards. AI transcription and cloud platform technology increase efficiency in outsourcing and offshoring. Combining outsourcing and offshoring permits a healthcare organization to streamline documentation workflow with a focus on patient care and operational efficiency.

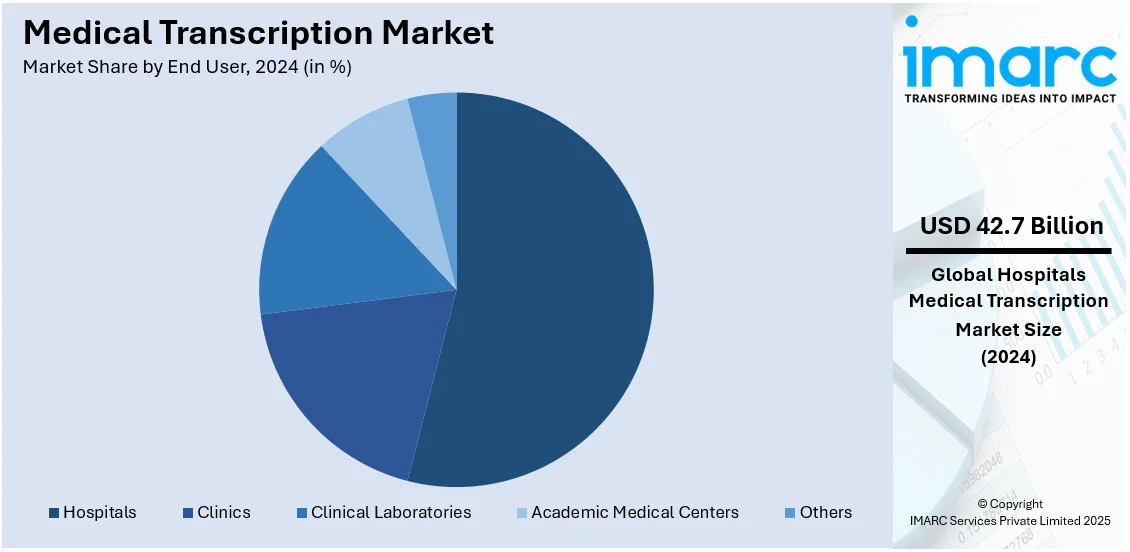

Analysis by End User:

- Hospitals

- Clinics

- Clinical Laboratories

- Academic Medical Centers

- Others

Hospitals leads the market in 2024 driven by the need for accurate patient record documentation and fast turnaround. Hospitals generate vast amounts of medical data that require structured transcripts for patient histories, treatment plans, surgical reports, and discharge summaries due to their high volume of clinician-patient contact. The necessity for secure and efficient transcription solutions is further emphasized by adherence to compliance regulations, including HIPAA in the U.S. and similar frameworks in other parts of the world. Increasingly, hospitals prefer using AI and automated speech recognition technologies to improve their transcription efficiency without compromising accuracy. Additionally, outsourcing transcription services helps hospitals reduce administrative burdens and operational costs, allowing healthcare professionals to focus on patient care. As these hospitals embark upon digital transformation programs, hybrid and fully automated transcription will gain sustained momentum, further propelling the market growth.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 45.8% due to the advanced healthcare infrastructure, broad adoption of electronic health records (EHRs), and the presence of stringent regulatory requirements. Healthcare providers, including hospitals, clinics, and diagnostic centers in the region, are continually looking forward to using transcription services to streamline documentation and ensure compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA). The very high volume of patient data generated in both the U.S. and Canada characterizes the market demand. Moreover, the main contributions driving demand for transcription services in the North include the presence of key players in the market aligned with continuous technological advancements in speech recognition and AI-driven transcription which increases the efficiency of the services. The growing focus on reducing administrative burdens in healthcare further strengthens market expansion in this region.

Key Regional Takeaways:

United States Medical Transcription Market Analysis

The United States holds a substantial share of the North American medical transcription market at 92.50%. The medical transcription market in the United States is expanding on account of the increased demand for accurate documentation in healthcare as well as regulatory compliance. According to the Centers for Medicare & Medicaid Services, healthcare spending in the United States reached around USD 4.9 trillion in 2023, which has further enhanced the demand for transcription services. Electronic health records (EHRs) towards ease of transcript production and speech recognition technology have been key facilitators for this market growth. Large players such as M*Modal and Nuance Communications have pioneered the use of AI in the industry-creating efficiency. Also, the trend of outsourcing to offshore vendors keeps costs down while domestic companies focus on compliance with HIPAA in their work. Increasing medical documentation requirements along with automation will further help propel the U.S. medical transcription market.

Europe Medical Transcription Market Analysis

There is a boom in the European medical transcription market catalyzed by stringent rules on documentation and the transformation of healthcare to digital formats. Eurostat reports that, in 2022, the European Union's healthcare expenditure per inhabitant was around €3,685 (USD 3,805), which accounts for 10.4% of the EU's GDP. Countries like Germany, the United Kingdom, and France are key contributors, as their healthcare systems prioritize structured data for patient management and insurance processing. These countries are also leading due to a host of patient volume and state-of-art healthcare IT infrastructure. AI-enabled transcription tools have emerged as an important tool in the common practice of medical documentation. Initiatives by the European Commission for standardized digital health records will keep adding to the growth of the market. The cloud-based transcription solution is becoming a preferred choice due to the data protection allowed under the GDPR. The emergence of multi-lingual transcription services tailored to various patient pools further strengthens the market.

Asia Pacific Medical Transcription Market Analysis

The market for medical transcription in the Asia Pacific is witnessing an upsurge owing to healthcare industries digitizing and increased patient volumes. The budget documents of the Ministry of Health and Family Welfare report that the total allocation to the Department of Health and Family Welfare for the fiscal year 2023-24 is INR 86175 crore (over USD 10.5 Billion). According to the Economic Survey 2023-24, government health expenditure stood at 1.9% of India's GDP in 2023-24. India and China emerge as leaders in the market chiefly because of the government initiatives towards the modernization of healthcare facilities. There is a growing demand for AI transcription services within the region. Companies such as Augnito and Nuance Communications are establishing a leading presence in the area. Multi-lingual needs are facilitating further growth in the market. The adoption of EHRs and regulatory measures with regard to security are increasing the dimension of the market.

Latin America Medical Transcription Market Analysis

Recent developments in the market for Latin American medical transcription incorporate the growth of healthcare investments and increased digital adoption levels. Recent records suggest health spending constituted nearly 10% of Brazil's GDP in the year 2021. Brazil, Mexico, and Argentina are in charge of market growth largely due to government-sponsored healthcare modernization initiatives. Telemedicine and electronic health records (EHRs) continue to bolster the demand for transcription services. Therefore, companies like Auralink and Verbatim Transcription Solutions are expanding their presence. Data privacy concerns also affect market growth, as organizations must comply with evolving healthcare data protection laws, will encourage secure transcription solutions. Also, the increasing focus on reducing administrative burdens for healthcare professionals continues to drive demand for transcription services. Outsourcing medical transcription to cost-effective providers in the region is gaining traction, with many companies offering bilingual transcription services, thereby enhancing the market potential.

Middle East and Africa Medical Transcription Market Analysis

Over time, the Middle East and Africa medical transcription market evolves with developing healthcare infrastructures and digital health. According to the report released by the UAE government, the country allocated a budget of AED 4.25 Billion for healthcare in 2022, which is equivalent to around USD 1.16 Billion, encouraging the requirement for digital transcription services. Saudi Arabia's Vision 2030 focuses on healthcare digitization and thus stimulates AI-enabled adoption. The growing private health sectors in South Africa now use cloud-based solutions for efficient documentation. The government's allocation towards telemedicine and electronic health records will see market growth. Data security regulations are on the market, and the demand for multi-lingual transcription services also adds to the market. Some of the new developments in this area have been - government initiatives for increasing telemedicine, electronic health records, etc. Data security regulations on the market and the demand for multi-lingual transcription services are also favorable for market growth.

Competitive Landscape:

The global medical transcription market is extremely competitive, with various service providers offering a complete spectrum of solutions ranging from boring old-fashioned manual transcription to the latest state-of-the-art artificial intelligence (AI) driven system services. All companies are competing on different dimensions such as accuracy, turnaround, adherence to health care specific regulations, and integration into EHR systems. Advancements in speech recognition and natural language processing has shifted the face of the industry in terms of efficiency performance with automation. Pricing strategies, data security, and customization are important in playing a role in establishing a company there. Outsourcing to low-cost labor regions is still a very common strategy, while cloud-based transcription services have steadily grown in use as a choice for scalability and accessibility. Compliance with regulations, especially concerning data privacy and confidentiality of the patients, will remain a major differentiator and influence strategic collaborations with health organizations and spur advancements in technology.

The report provides a comprehensive analysis of the competitive landscape in the medical transcription market with detailed profiles of all major companies, including:

- Acusis LLC

- Transcend Services

- Nuance Communications, Inc.

- MModal IP LLC

- iMedX Information Services Private Limited

- Global Medical Transcription LLC

- nThrive Revenue Systems LLC

- MTBC, Inc.

- MediScript Plus LLC

- TransTech Medical Solutions LLC

Recent Developments:

- October 2024: A study by Cornell University found that OpenAI’s transcription tool, Whisper, produces hallucinations, generating false text, including imagined medical treatments. Experts warn that such inaccuracies pose risks as the tool is widely used for medical, legal, and consumer applications.

- August 2024: iMedX and Pallas AI have merged to enhance AI-driven health information management and revenue cycle solutions. Operating as iMedX Australia & New Zealand, the partnership integrates Pallas' AI Companion Suite, with Mike Smith appointed CTO. The merger aims to optimize healthcare operations globally.

Medical Transcription Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | History and Physical Report, Discharge Summary, Operative Note or Report, Consultation Report, Others (Pathology Report, Radiology Report, etc.) |

| Technologies Covered | Electronic Medical Records/Electronic, Health Record (EMR/EHR), Picture Archiving and Communication System (PACS), Radiology Information System (RIS), Speech Recognition Technology (SRT), Others |

| Modes of Procurement Covered | Outsourcing, Offshoring, Both |

| End Users Covered | Hospitals, Clinics, Clinical Laboratories, Academic Medical Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Acusis LLC, Transcend Services, Nuance Communications, Inc., MModal IP LLC, iMedX Information Services Private Limited, Global Medical Transcription LLC, nThrive Revenue Systems LLC, MTBC, Inc., MediScript Plus LLC, TransTech Medical Solutions LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical transcription market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global medical transcription market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the medical transcription industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical transcription market was valued at USD 79.35 Billion in 2024.

The medical transcription market is projected to exhibit a CAGR of 5.22% during 2025-2033, reaching a value of USD 128.47 Billion by 2033.

The market is driven by growing adoption of electronic health records (EHRs), the increasing demand for accurate and timely medical documentation, and advancements in speech recognition and AI-powered transcription tools. Rising healthcare expenditures, regulatory compliance requirements, and the need to reduce administrative burdens on healthcare professionals further contribute to market growth.

North America currently dominates the medical transcription market, accounting for a share of 45.8% in 2024. The dominance is fueled by well-established healthcare infrastructure, widespread digitalization of medical records, stringent regulatory mandates for accurate documentation, and the presence of leading transcription service providers in the region.

Some of the major players in the medical transcription market include Acusis LLC, Transcend Services, Nuance Communications, Inc., MModal IP LLC, iMedX Information Services Private Limited, Global Medical Transcription LLC, nThrive Revenue Systems LLC, MTBC, Inc., MediScript Plus LLC, and TransTech Medical Solutions LLC, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)