Medical Thawing System Market Size, Share, Trends and Forecast by Product Type, Sample Type, End User, and Region, 2025-2033

Medical Thawing System Market Size and Share:

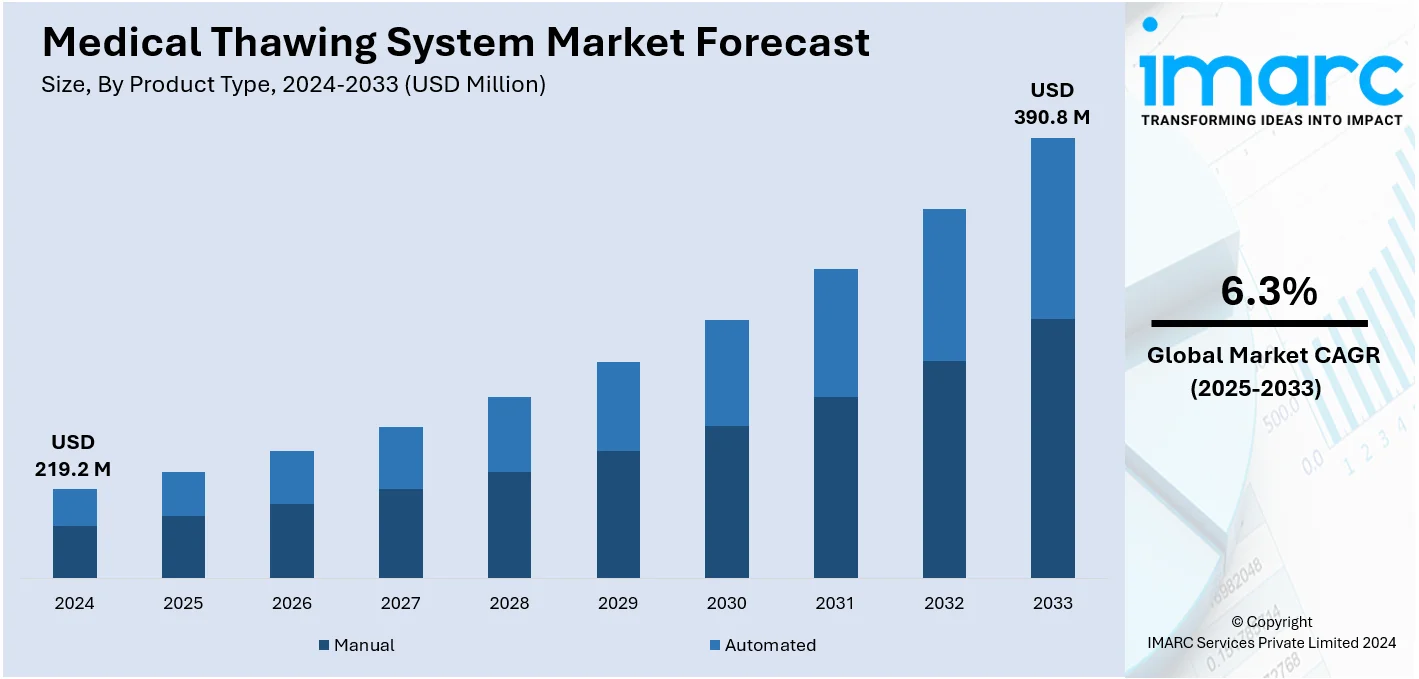

The global medical thawing system market size was valued at USD 219.2 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 390.8 Million by 2033, exhibiting a CAGR of 6.3% during 2025-2033. North America currently dominates the market, holding a significant market share of over 47.3% in 2024. This region’s dominance is driven by advanced healthcare infrastructure, technological innovations, and increasing adoption of biopharmaceutical solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 219.2 Million |

|

Market Forecast in 2033

|

USD 390.8 Million |

| Market Growth Rate 2025-2033 |

6.3%

|

As the healthcare industry continues to move toward personalized medicine and innovative treatment modalities, there is a need for effective and reliable thawing systems. For instance, in August 2024, Cardinal Health recently launched an 8,000 sq. ft. Advanced Therapy Innovation Center in La Vergne, Tennessee, which features cryogenic storage and enhanced capabilities for cell and gene therapy commercialization and logistics, directly addressing the need for precise temperature control during thawing to maintain sample viability. These systems hold a critical position for keeping and processing biological samples including stem cells and tissue grafts, which have to be thawed at an accurately maintained temperature to preserve the samples' viability and functionalities. Moreover, the escalating trend of chronic diseases along with the increased rate of surgeries call for such technologies making these inevitable; therefore, massive investments are made by healthcare facilities and biopharmaceutical companies towards even more advanced thawing technologies.

To get more information on this market, Request Sample

The United States is increasingly playing a significant role in the medical thawing system market by providing state-of-the-art equipment and technology to healthcare facilities and laboratories. With growing demands for efficient and accurate thawing systems, US manufacturers are continuously innovating for the needs of the medical industry. US companies are dedicated to the provision of high-quality thawing systems with precise control and reliable performance for the safe and efficient thawing of biological samples and medical products. Furthermore, US businesses are at the forefront in the global medical thawing system market, providing solutions that enhance patient care and advance medical research through research and development. For example, as of August 2024, more than 114,000 people are on the U.S. national transplant waiting list, and nearly 6,000 of them die every year without receiving an organ, so there is a dire need for advanced medical technologies such as thawing systems since efficient thawing technologies can have a direct impact on the preservation and viability of transplant organs.

Medical Thawing System Market Trends:

Rising Demand in Biopharmaceutical and Regenerative Medicine Applications

The growing use of biopharmaceuticals and regenerative medicine is driving the demand for effective medical thawing solutions. These industries need to follow accurate thawing protocols in order to maintain the integrity and viability of biological samples such as cell therapies, stem cells, and gene therapy products. The growing number of patients with chronic diseases and viral and bacterial infections is one of the main drivers for the market. This is in line with the fact that the propensity to opt for organ transplants is increasing, the number of organ donors are also on the rise with a rising demand for transfusion of blood. The raising need for regenerative medicines has been fueling the desire to thaw stem cells, tissue and other biological samples safety and efficiently, which therefore leads to the growth in this market. The global regenerative medicine market size reached USD 26.7 Billion in 2024.

Expansion of Blood Banks and Cryopreservation Facilities

The global expansion of blood banks and cryopreservation facilities is significantly contributing to the growth of the medical thawing market. For instance, in September 2024, the San Diego Blood Bank and SeaWorld San Diego partnership resulted in 17,000 blood product donations from over 11,000 donors, saving 34,000 lives and boosting local health infrastructure. The rising demand for frozen blood products, including plasma and red blood cells, highlights the critical role of thawing systems in emergency and routine medical procedures. Furthermore, the growing focus on cryopreservation for organ transplants, fertility treatments, and stem cell banking underscores the need for reliable thawing solutions. The deployment of advanced thawing equipment in these facilities ensures the rapid and safe preparation of samples, aligning with healthcare industry standards and fueling market expansion.

Growing Need for Thawing Solutions Driven by an Aging Population

The aging population is emerging as a significant factor influencing the medical thawing market. The UN projects that the global population aged 65 and above will rise from 10% in 2022 to 16% by 2050, growing faster than those below that age. There is an increasing prevalence of age-related conditions, such as cardiovascular diseases, diabetes, and cancer, which require advanced medical treatments. These treatments often rely on biopharmaceuticals, cryopreserved blood products, and regenerative therapies, all of which necessitate precise and efficient thawing processes. Moreover, the demand for frozen plasma, stem cells, and organ preservation solutions is growing, driven by the need to support advanced therapies and surgical procedures for older patients. Medical thawing systems equipped with precise temperature controls and rapid processing capabilities are crucial for ensuring the integrity and efficacy of these treatments.

Medical Thawing System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical thawing system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, sample type, and end user.

Analysis by Product Type:

- Manual

- Automated

Manual stand as the largest component in 2024, holding around 56.5% of the medical thawing system market share. This dominance reflects the continued reliance on manual thawing systems due to their simplicity, cost-effectiveness, and widespread use in various healthcare and laboratory settings. Manual systems are particularly favored in smaller facilities and resource-constrained environments where advanced automated solutions may not be feasible. Their ability to provide precise control during thawing processes, combined with ease of operation and maintenance, makes them a practical choice for many applications. As the demand for blood products, cryopreserved samples, and biological therapies continues to grow, the manual component remains an integral part of the global thawing market landscape.

Analysis by Sample Type:

- Blood

- Plasma

- Stem Cells

- Whole Blood

- Platelets

- Embryo

- Ovum

- Semen

Blood leads the market with around 53.2% of market share in 2024. This dominance underlines how important blood products are in modern-day healthcare, where efficient thawing systems are necessary for preparing plasma, red cells, and other components of blood for emergency and routine medical use. The growing occurrence of chronic diseases, greater surgical procedures, and the necessity of transfusions in cases of trauma and critical care are major drivers of this requirement. Advances in blood storage and preservation also increase the need for effective thawing technologies in ensuring that these products are safe and effective. In turn, this growing dependency further cements the segment's role in facilitating life-saving medical therapies.

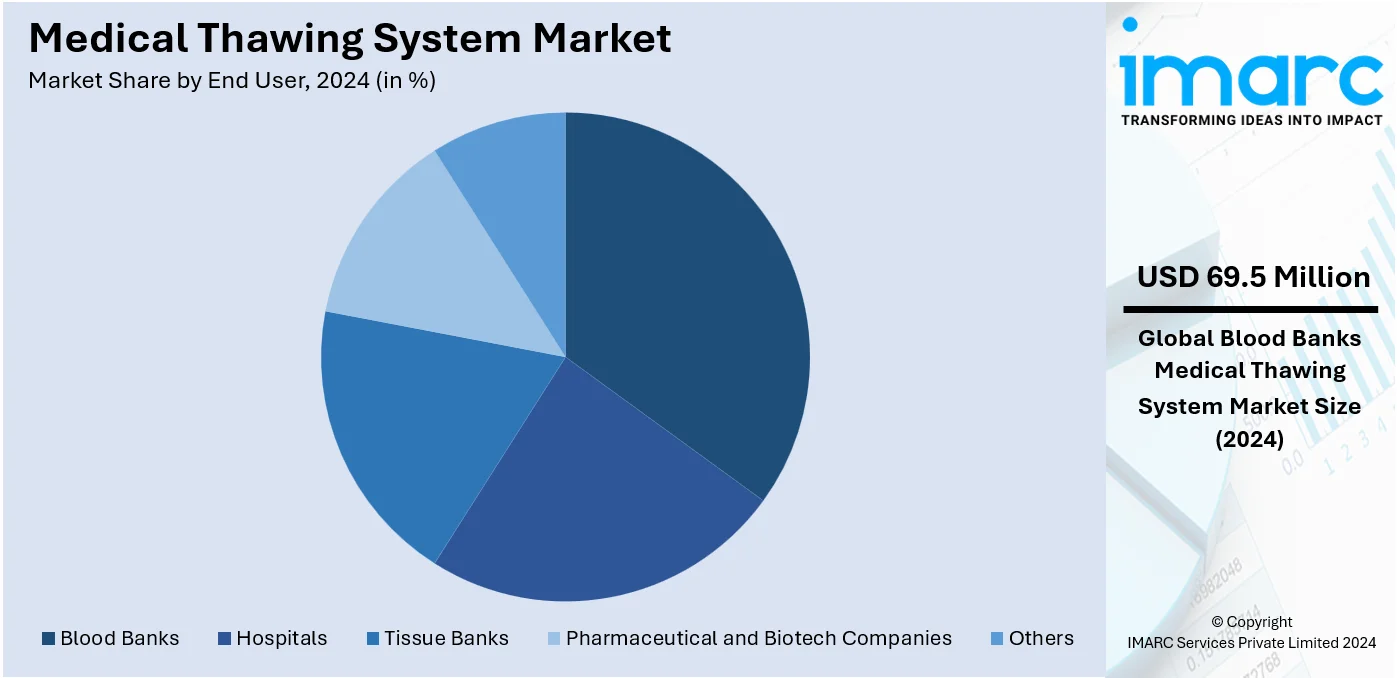

Analysis by End User:

- Blood Banks

- Hospitals

- Tissue Banks

- Pharmaceutical and Biotech Companies

- Others

Blood Banks leads the market with around 31.7% of market share in 2024. This leadership reflects the critical role blood banks play in the healthcare ecosystem, where efficient thawing systems are essential for preparing blood products such as plasma and red blood cells for emergency and routine medical procedures. The growing prevalence of chronic conditions and the increasing frequency of surgeries and trauma cases have amplified the demand for thawed blood products. Additionally, advancements in blood preservation techniques and the expansion of blood bank networks globally have driven the adoption of advanced thawing systems. These systems ensure rapid, precise, and safe thawing, aligning with healthcare standards and supporting the seamless delivery of life-saving treatments.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 47.3%. This dominance is attributed to the region's advanced healthcare infrastructure, widespread adoption of innovative medical technologies, and significant investment in biopharmaceutical research. The growing prevalence of chronic diseases, coupled with the rising demand for cell and gene therapies, has further fueled the need for efficient medical thawing systems. Additionally, the expansion of blood banks, cryopreservation facilities, and regenerative medicine practices has amplified the demand for precise and reliable thawing equipment. North America's focus on stringent healthcare standards and regulatory compliance continues to drive innovation and market growth, solidifying its position as a global leader in this sector.

Key Regional Takeaways:

United States Medical Thawing System Market Analysis

US accounts for 84.4% share of the market share in North America in 2024. The medical thawing market in the United States is primarily driven by the growing demand for advanced medical treatments, such as stem cell therapies, organ transplantation, and fertility treatments, all of which require precise thawing of biological samples. According to the Organ Procurement and Transplantation Network (OPTN), a total of 46,632 organ transplants were performed in 2023, from both living and deceased donors, highlighting the increasing need for effective organ preservation and thawing technologies. Additionally, the rapid growth in biotechnology and healthcare sectors, supported by innovations in cryopreservation techniques, is fueling the market. Technological advancements in thawing equipment, including automated systems that ensure uniform temperature control and reduce human error, are expected to drive adoption in hospitals and laboratories. The US government's support for medical research through grants and funding further boosts market growth. Moreover, the aging population in the US, which requires more organ transplants, contributes to the demand for effective thawing solutions. As healthcare providers seek to maintain the integrity of biological samples during thawing, the need for state-of-the-art systems to meet safety standards is growing, driving the expansion of the medical thawing market.

Asia Pacific Medical Thawing System Market Analysis

The medical thawing market in the Asia Pacific (APAC) region is experiencing growth driven by increasing healthcare investments and the rising prevalence of non-communicable diseases (NCDs). According to the World Health Organization, 55% of all deaths in South-East Asia are due to NCDs, equating to nearly 8 Million deaths annually. This escalating health burden is fueling the demand for advanced medical treatments, including organ transplants and stem cell therapies, which require effective thawing technologies. Additionally, the growing biotechnology and pharmaceutical industries, along with rising healthcare spending in countries like China, India, and Japan, further drive the adoption of thawing systems. The expanding number of fertility clinics and stem cell research centers is also contributing to market growth. As healthcare policies and infrastructure continue to improve, the demand for efficient, high-precision thawing solutions is expected to rise across the region.

Europe Medical Thawing System Market Analysis

The medical thawing market in Europe is driven by the increasing demand for advanced medical treatments, particularly in fertility clinics, organ transplants, and regenerative medicine. With an aging population across European countries, the demand for organ transplants is on the rise, leading to a greater need for efficient thawing solutions to maintain the integrity of tissues and organs. According to Eurostat, as of January 1, 2023, the EU population was estimated at 448.8 Million, with over one-fifth (21.3%) aged 65 years and older, further contributing to the rising demand for organ transplants. Additionally, the growing number of stem cell research and cryopreservation services across Europe is fueling market growth. The regulatory frameworks set by authorities such as the European Medicines Agency (EMA) play a significant role in ensuring safe and standardized thawing practices, encouraging the use of advanced thawing equipment in medical facilities. Furthermore, significant investment in healthcare research, alongside the presence of well-established healthcare providers, supports the adoption of high-precision thawing systems. As the healthcare sector continues to evolve, the demand for medical thawing solutions in Europe is set to expand, driven by advancements in medical technologies and the increasing need for biologically preserved tissues.

Latin America Medical Thawing System Market Analysis

In Latin America, the medical thawing market is driven by increasing investments in healthcare infrastructure and advancements in biotechnology and medical research. According to PubMed Central, in Brazil alone, approximately 928,000 deaths annually are attributed to chronic diseases, creating a growing demand for treatments such as organ transplants and stem cell therapies, which require reliable thawing systems. The expanding number of fertility clinics and research centers further supports market growth. Additionally, rising healthcare expenditures and government initiatives to improve healthcare access are contributing to the market’s expansion, fostering greater demand for medical thawing solutions in the region.

Middle East and Africa Medical Thawing System Market Analysis

In the Middle East, the medical thawing market is driven by the increasing prevalence of chronic diseases and a growing demand for advanced treatments such as organ transplants and fertility therapies. In the UAE, as part of its multi-year fiscal plan for 2022-2026, the government has allocated USD 1.56 Billion (AED 5.74 Billion) for healthcare and community prevention services, reflecting a 10.4% increase from the 2024 budget. This investment is expected to boost healthcare infrastructure and adoption of advanced medical thawing technologies. The region’s growing focus on biotechnology and stem cell research further supports the market’s expansion.

Competitive Landscape:

The market is characterized by intense competition among players striving to gain a larger medical thawing system market share. Major participants in the market are concentrating on product innovation, strategic partnerships, mergers and acquisitions, as well as expanding geographically to enhance their presence in the market. Market participants are also making considerable investments in research and development efforts to improve their product ranges and maintain a competitive edge. The competitive environment of the medical thawing system market is anticipated to become more intense as new companies enter with groundbreaking technologies. For instance, in March 2024, Biolife Solutions patented a method for consistent thawing of frozen samples in bag-format vessels, utilizing temperature measurement, qualified sensors, and multiple heater banks for accurate, efficient thawing.

The report provides a comprehensive analysis of the competitive landscape in the medical thawing system market with detailed profiles of all major companies, including:

- Barkey GmbH & Co. KG

- BioLife Solutions, Inc.

- Boekel Scientific

- Cardinal Health

- FreMon Scientific, Inc.

- Helmer Scientific Inc.

- KW Apparecchi Scientifici srl

- Labcold

- QED Scientific Ltd

- Sarstedt AG & Co. KG

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- December 2024: SERB Pharmaceuticals announced the commercial availability of Aurlumyn™ (iloprost) Injection, the first FDA-approved treatment for severe frostbite in adults, aimed at reducing digit amputation risks. Launched at the ASHP Midyear Clinical Meeting, Aurlumyn™ is a prostacyclin mimetic that acts as a vasodilator and is effective within 72 hours post-thawing. This treatment is particularly crucial for high-risk groups like winter sports enthusiasts and military personnel.

- September 2024: Broadband Infrared Diagnostics, focused on early cancer detection using advanced metrology, reports the use of the SPL Guard Arizona to improve and speed up the thawing of stored samples. The company, specializing in molecular plant pathology, genetics, and cancer biology, processes human plasma, serum, and urine samples stored at -80°C.

- January 2024: SCHOTT Pharma's EVERIC® freeze vials are designed for deep-cold storage at temperatures down to -80°C, ensuring the safe transport of gene therapy and mRNA drugs. These vials reduce breakage during freezing and thawing, preventing drug loss and downtimes. Ideal for treating infectious diseases, cancer, and CNS disorders, they maintain container closure integrity (CCI) at low temperatures.

- June 2022: Azenta, Inc. has agreed to acquire Barkey Holding GmbH, a provider of controlled rate thawing devices for the medical and biotech industries. Barkey's thawing solutions, including the FDA-approved plasmatherm, support the safe thawing of cryopreserved samples, including blood and stem cells. The acquisition strengthened Azenta's cold chain capabilities and expands its presence in the growing cell and gene therapy sector.

Medical Thawing System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Manual, Automated |

| Sample Types Covered |

|

| End Users Covered | Blood Banks, Hospitals, Tissue Banks, Pharmaceutical and Biotech Companies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Barkey GmbH & Co. KG, BioLife Solutions, Inc., Boekel Scientific, Cardinal Health, FreMon Scientific, Inc., Helmer Scientific Inc., KW Apparecchi Scientifici srl, Labcold, QED Scientific Ltd, Sarstedt AG & Co. KG, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical thawing system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global medical thawing system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical thawing system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global medical thawing system market was valued at USD 219.2 Million in 2024.

IMARC Group estimates the market to reach USD 390.8 Million by 2033, exhibiting a CAGR of 6.3% during 2025-2033.

Key factors driving the global medical thawing system market include the rising demand for cryopreserved biological materials, advancements in biopharmaceuticals and regenerative medicine, increasing prevalence of chronic diseases, and the expansion of blood banks and cryopreservation facilities. Additionally, the need for precise, reliable thawing solutions supports market growth across healthcare and research sectors.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Medical Thawing System market include Barkey GmbH & Co. KG, BioLife Solutions, Inc., Boekel Scientific, Cardinal Health, FreMon Scientific, Inc., Helmer Scientific Inc., KW Apparecchi Scientifici srl, Labcold, QED Scientific Ltd, Sarstedt AG & Co. KG, Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)