Medical Suction Devices Market Size, Share, Trends and Forecast by Type, Portability, Application, End User, and Region, 2025-2033

Medical Suction Devices Market Size and Share:

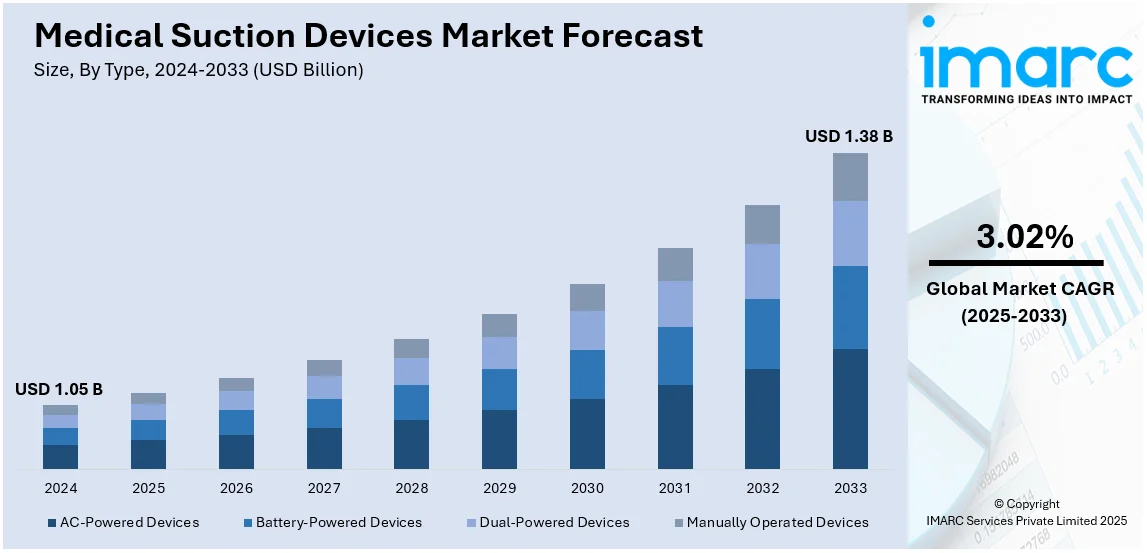

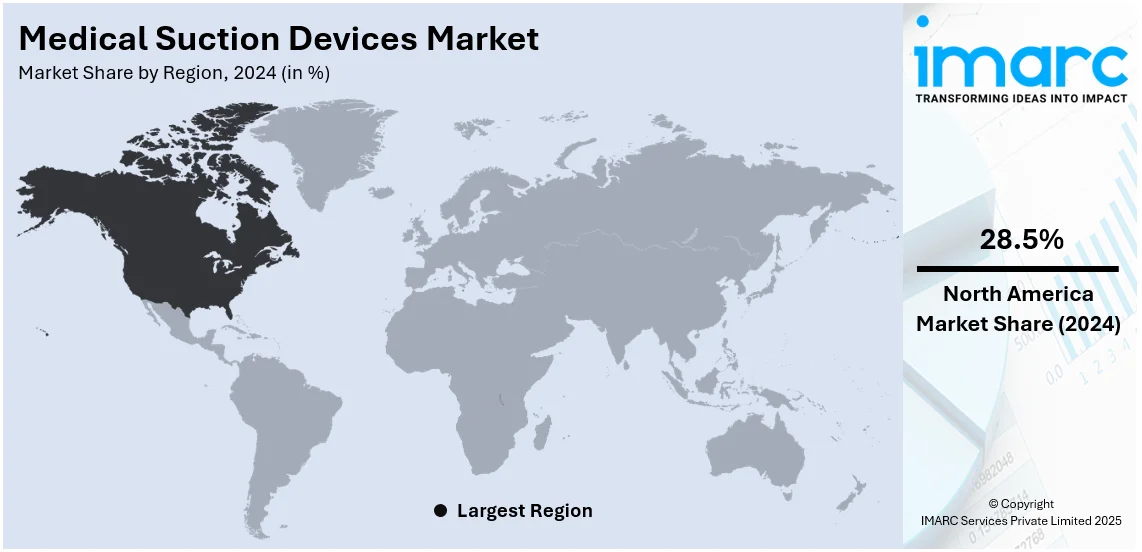

The global medical suction devices market size was valued at USD 1.05 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.38 Billion by 2033, exhibiting a CAGR of 3.02% during 2025-2033. North America currently dominates the market, holding a significant market share of over 28.5% in 2024. The increasing number of surgical procedures, growing geriatric population, and rising respiratory diseases represent some of the key factors driving the medical suction devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.05 Billion |

| Market Forecast in 2033 | USD 1.38 Billion |

| Market Growth Rate (2025-2033) | 3.02% |

The global medical suction devices market is driven by several key factors, including the rising prevalence of chronic respiratory diseases, increasing surgical procedures, and growing demand for emergency and critical care services. Technological advancements in suction devices, such as portable and battery-operated systems, enhance their efficiency and accessibility. The aging population, particularly in developed regions, contributes to a higher demand for healthcare services, including suction devices. The profile of the elderly in the United States is projected to undergo a significant shift. By 2054, an estimated 65 and older individuals are expected to represent 23% of the population, compared to 18% today. There will also be a quadruplication of centenarians. This demographic trend will exert a sizable burden on healthcare and housing systems. As annual nursing home costs exceed USD 116,000, and with a significant caregiver shortage, new approaches provide hope, with including home health technology, senior living communities, and alternative housing arrangements. Thus, the demand for medical suction devices is anticipated to witness significant growth, driven by the growing need for advanced care solutions for the elderly at home as well as in institutions. Additionally, the expansion of healthcare infrastructure in emerging markets and stringent regulations for infection control further propel market growth. The COVID-19 pandemic has also positively influenced the need for effective suction devices in managing respiratory complications, thus enhancing medical suction devices market growth.

The United States stands out as a key regional market, primarily driven by the rising demand for advanced healthcare solutions and the expansion of healthcare facilities, including hospitals and outpatient care centers. On 30th January 2025, Sagility successfully completed the acquisition of BroadPath Healthcare Solutions, which brings 1,600 employees in the United States and the Philippines, over 30 additional clients, including leading health plans in the U.S. This strategic extension improves Sagility's healthcare services by integrating AI, automation, and analytics to increase efficiency and promote member engagement. Therefore, the demand for advanced girl care services is increasing as healthcare operations continue to expand. Moreover, increasing investments in healthcare infrastructure and the growing emphasis on minimally invasive surgeries drive the medical suction devices market demand. Additionally, the rise in trauma cases and emergency care requirements across the country also enhances the market growth. Government initiatives to improve healthcare access and the rising focus on infection prevention in clinical settings further support the market growth. The development of innovative, user-friendly suction devices tailored for diverse medical applications also plays a significant role in driving market expansion.

Medical Suction Devices Market Trends:

Rising Surgical Procedures Driving Market Demand

The growing number of surgical procedures worldwide is a major driver for the medical suction devices market. These devices play a crucial role in clearing fluids and obstructions during surgeries, ensuring patient safety. With an aging global population, there is an increased prevalence of conditions requiring surgical intervention. Additionally, respiratory diseases such as pneumonia and chronic obstructive pulmonary disease (COPD) are becoming more common. The World Health Organization (WHO) reported that COPD was the fourth leading cause of death globally in 2021, resulting in 3.5 million fatalities, accounting for approximately 5% of all deaths. As surgical and respiratory cases continue to rise, the demand for medical suction devices in hospitals and outpatient facilities is expected to grow steadily.

Expansion of Home Healthcare and Portable Device Adoption

The increasing preference for home healthcare is positively influencing the demand for portable medical suction devices. Many patients with chronic respiratory conditions, such as COPD or those requiring tracheostomy care, benefit from at-home medical suctioning. This trend is driven by the convenience and cost-effectiveness of home-based care, reducing the need for frequent hospital visits. In 2021, noncommunicable diseases (NCDs) were responsible for at least 43 million deaths globally, comprising 75% of non-pandemic-related fatalities, according to WHO. As chronic illnesses continue to rise, the need for portable and easy-to-use suction devices is growing. These advancements allow patients to manage their conditions efficiently while reducing the strain on healthcare facilities.

Technological Advancements and Increased Awareness

Innovations in medical suction technology are key trends affecting the medical suction devices market outlook positively. Manufacturers are introducing more advanced devices with stronger suction capabilities, better portability, and user-friendly features. These improvements cater to both hospital and home-use applications. Additionally, awareness about the benefits of medical suction devices is increasing among healthcare professionals and patients. The COVID-19 pandemic further accelerated demand, as the virus primarily affects the respiratory system, leading to increased usage of suction devices in intensive care units (ICUs) and emergency departments. With the ongoing focus on respiratory health and medical innovations, the market for medical suction devices is expected to expand, driven by technological enhancements and growing awareness. On 23rd January 2025, Singapore launched a USD 10 Million national research programme to target respiratory health that the NTU’s TARIPH Centre will lead. This initiative, which spans nine institutions over five years, will address chronic lung diseases, including asthma and chronic obstructive pulmonary disease, or COPD. The rising incidences of chronic respiratory diseases globally are also expected to increase the demand for medical suction devices, thereby improving critical care and treatment.

Medical Suction Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical suction devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, portability, application, and end user.

Analysis by Type:

- AC-Powered Devices

- Battery-Powered Devices

- Dual-Powered Devices

- Manually Operated Devices

AC-powered devices stand as the largest component in 2024, holding around 57.5% of the market, primarily due to their widespread use in hospitals, clinics, and other healthcare facilities. These devices offer consistent and reliable suction power, making them ideal for high-demand clinical environments such as operating rooms, emergency departments, and intensive care units. Their ability to handle continuous and heavy-duty applications, coupled with lower maintenance requirements, enhances their appeal. Additionally, AC-powered devices are often more cost-effective for healthcare settings with stable electrical infrastructure. The growing number of surgeries, rising demand for emergency care, and increasing healthcare investments further drive their adoption, solidifying their leading position in the market.

Analysis by Portability:

- Hand-Held Suction Device

- Wall-Mounted Suction Device

Wall-mounted suction device leads the market with around 67.4% of market share in 2024, primarily due to their widespread adoption in hospitals and healthcare facilities. These devices are favored for their fixed installation, which ensures consistent and reliable suction power, making them ideal for high-traffic areas such as operating rooms, emergency departments, and intensive care units. Their space-saving design and ability to integrate seamlessly into existing medical infrastructure enhance their utility. Additionally, wall-mounted devices are cost-effective for facilities with high patient volumes, as they require minimal maintenance and offer uninterrupted performance. The growing emphasis on infection control and the need for efficient patient care further drive their dominance in the market.

Analysis by Application:

- Airway Clearing

- Research and Diagnostics

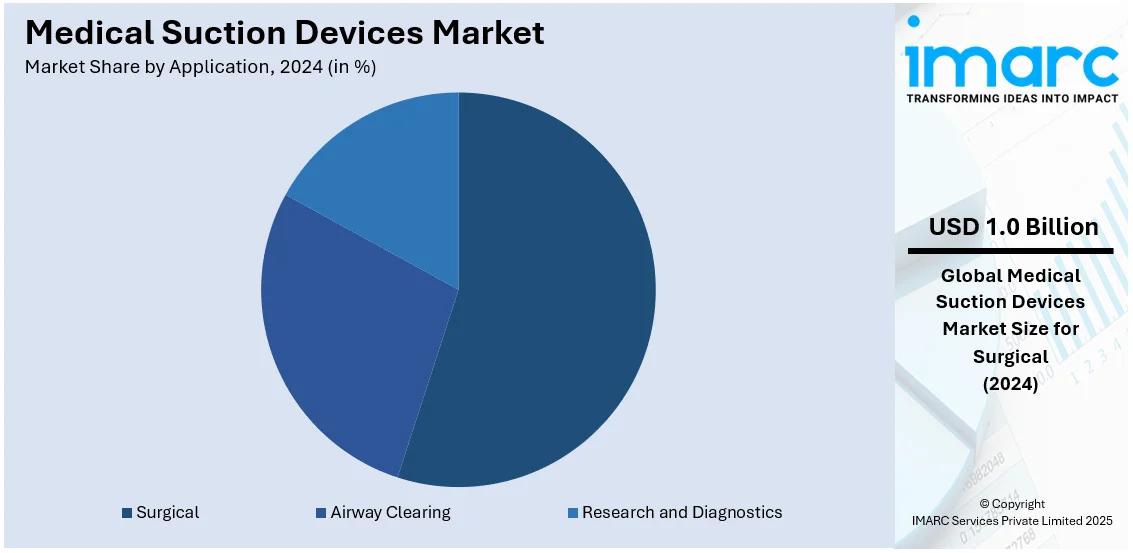

- Surgical

Surgical leads the market with around 55.0% of market share in 2024, driven by the increasing number of surgical procedures worldwide. Medical suction devices are essential in surgeries to remove blood, fluids, and debris, ensuring clear visibility and a sterile operating field. The rise in minimally invasive surgeries, coupled with the growing prevalence of chronic diseases requiring surgical intervention, has significantly enhanced demand. Additionally, advancements in surgical techniques and the expansion of healthcare infrastructure in emerging markets further contribute to this segment's dominance. Hospitals and ambulatory surgical centers rely heavily on suction devices for efficient and safe surgical outcomes, solidifying their position as the leading application segment in the market.

Analysis by End User:

- Hospitals and Clinics

- Home Care

- Others

The hospitals and clinics segment in the market is driven by the high volume of surgical procedures, emergency care, and critical care services they provide. These facilities require reliable and efficient suction devices to manage patient care effectively. The growing prevalence of chronic diseases, increasing surgical volumes, and advancements in healthcare infrastructure further bolster demand. Additionally, stringent infection control regulations in hospitals emphasize the need for advanced suction systems, solidifying their dominance in this segment.

The home care segment is experiencing rapid growth due to the increasing preference for home-based healthcare solutions, especially among the aging population and patients with chronic conditions. Portable and compact suction devices are gaining traction in this segment, as they offer convenience and ease of use for caregivers and patients. The shift towards cost-effective and patient-centric care, along with technological advancements in home-use medical devices, is driving the adoption of suction systems in home care settings.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 28.5%, driven by advanced healthcare infrastructure, high healthcare expenditure, and the presence of leading medical device manufacturers. The region's aging population, coupled with the rising prevalence of chronic respiratory and cardiovascular diseases, fuels the demand for suction devices. Additionally, the increasing number of surgical procedures and the emphasis on infection control in healthcare settings further enhance market growth. Technological advancements, such as portable and battery-operated suction systems, also contribute to their widespread adoption. Supportive government policies and reimbursement frameworks enhance accessibility, while the COVID-19 pandemic has further accelerated demand, solidifying North America's leading position in the market.

Key Regional Takeaways:

United States Medical Suction Devices Market Analysis

The US accounted for around 88.50% of the total North America medical suction devices market in 2024. The medical suction devices market in the United States is driven by advancements in healthcare infrastructure and the increasing demand for surgical and emergency procedures. A significant factor contributing to this growth is the rising prevalence of chronic diseases, with an estimated 129 million individuals in the U.S. suffering from at least one major chronic condition, such as heart disease, cancer, diabetes, obesity, or hypertension, according to the U.S. Department of Health and Human Services. These conditions often require medical suction devices for managing respiratory issues and post-surgical care. Additionally, the aging population and higher hospital admissions due to age-related conditions further enhance market demand. Technological innovations, including portable and battery-operated suction devices, improve convenience and expand usage across clinical and homecare settings. Regulatory support and favorable reimbursement policies also enhance device accessibility, increasing their adoption among healthcare providers. Furthermore, the growing awareness of patient safety and the need for infection prevention in healthcare settings drives demand for advanced, hygienic suction systems. The expansion of minimally invasive surgeries and point-of-care treatments, all of which require specialized suction devices, further accelerates the market's growth in the U.S.

Asia Pacific Medical Suction Devices Market Analysis

The APAC medical suction devices market is expanding due to rising healthcare expenditure, improving infrastructure, and increasing incidences of chronic diseases. According to reports, the number of older persons in the region is projected to more than double, from 630 million in 2020 to approximately 1.3 billion by 2050, significantly driving demand for healthcare solutions. Additionally, cancer incidence in Asia, at 169.1 per 100,000 in 2020, accounted for 49.3% of global cancer cases, with lung, breast, and colorectal cancers being the most prevalent, further fueling the need for medical suction devices in both clinical and homecare settings. Technological advancements, such as portable and user-friendly devices, are also contributing to market growth. With an aging population and rising healthcare awareness, the region is seeing greater adoption of medical suction devices, particularly in the management of respiratory conditions and critical care scenarios. The growing demand for homecare services is also a key factor supporting the market expansion.

Europe Medical Suction Devices Market Analysis

In Europe, the medical suction devices market is driven by a combination of technological advancements, a growing geriatric population, and the increasing prevalence of respiratory disorders. Chronic diseases such as COPD and asthma are prevalent, raising the demand for suction devices used in emergency and therapeutic treatments. According to report, as of January 2023, the EU's population was estimated at 448.8 million, with over one-fifth (21.3%) aged 65 years and older. This demographic shift emphasizes the growing need for healthcare solutions, including medical suction devices, particularly in managing age-related conditions. Europe’s robust healthcare systems, supported by public and private health insurance, make these devices more accessible, contributing to their widespread adoption. Furthermore, the rise in minimally invasive surgeries and increased awareness of infection control measures in healthcare settings fuel demand for advanced suction devices that reduce the risk of complications and improve patient outcomes. Additionally, the focus on reducing hospital stays, improving homecare services, and enhancing the quality of care further drives the need for portable and user-friendly suction systems. As healthcare technology continues to transform, the market for medical suction devices in Europe is expected to expand, with increasing investment in modern healthcare infrastructure and a growing emphasis on meeting the needs of an aging population.

Latin America Medical Suction Devices Market Analysis

The Latin American medical suction devices market is growing due to the rising incidence of chronic diseases, which, in Brazil, are expected to cause 928,000 deaths annually, underscoring the demand for improved treatments such as stem cell therapies. Additionally, the aging population and advancements in healthcare infrastructure drive market growth. The increasing focus on patient safety and infection control further enhances the demand for efficient suction devices. As healthcare systems in countries including Brazil and Mexico improve, the push for advanced medical technologies, including suction devices, becomes more pronounced.

Middle East and Africa Medical Suction Devices Market Analysis

In the Middle East and Africa, the medical suction devices market is driven by rising healthcare spending, improving infrastructure, and a growing prevalence of chronic diseases. According to the UAE health report, 23% of the population self-reports chronic conditions, with obesity (12.5%), diabetes (4.2%), and asthma/allergies (3.2%) being the most common. This trend increases the demand for effective medical suction solutions. Additionally, there is a growing focus on modernizing healthcare facilities and expanding access to advanced medical technologies, benefiting both hospital and homecare settings.

Competitive Landscape:

The competitive landscape of the medical suction devices market is characterized by intense rivalry among key players, who are focusing on innovations, strategic partnerships, and geographic expansion to strengthen their market position. Companies are investing heavily in research and development to introduce advanced, user-friendly, and portable suction devices tailored to diverse medical applications. Mergers, acquisitions, and collaborations are common strategies to enhance product portfolios and expand market reach. Additionally, players are emphasizing regulatory compliance and obtaining certifications to ensure product safety and reliability. Marketing efforts are increasingly targeted at emerging markets, while customer-centric approaches, such as offering training and support, are being adopted to build brand loyalty and gain a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the medical suction devices market with detailed profiles of all major companies, including:

- Allied Healthcare Products Inc.

- Anand Medicaids Private Limited

- ATMOS MedizinTechnik GmbH & Co. KG

- Laerdal Medical

- Medela AG

- Medical Depot Inc.

- Medicop d.o.o.

- MG Electric (Colchester) Ltd.

- Olympus Corporation

- Precision Medical Inc.

- SSCOR Inc.

- WEINMANN Emergency Medical Technology GmbH + Co. KG

- ZOLL Medical Corporation (Asahi Kasei Corporation)

Latest News and Developments:

- October 2024: Therapy Equipment announced that its Diamond Range Suction Units have achieved CE Mark certification, meeting the highest European safety and quality standards for medical devices. The units conform to ISO 10079-3, the international standard for healthcare suction equipment. Key features include hydrophobic filter protection, color-coded suction levels, easy connectivity, energy efficiency with an On/Off tap, and durable design.

- July 2024: Dr. Stephen Kalhorn, a neurosurgeon at MUSC Health, introduced the VORTEX system by VayuClear in June during a lumbar procedure. The device quickly proved valuable, being used five times in the first hour. Kalhorn, frustrated with frequent suction line clogs during surgery, developed the VORTEX system after eight years of testing and collaboration with the MUSC Zucker Institute for Innovation Commercialization.

- March 2024: AW Technologies has partnered with Asahi Kasei Medical for the exclusive distribution of its TrachFlush™ device in Japan. Currently undergoing medical device registration, the TrachFlush is set for market launch in fiscal 2024. Developed to improve patient comfort and ease healthcare professionals' workload during tracheal suctioning, the device features a unique cuff pressure control system.

- April 2023: Defibtech has unveiled the ARM XR, an advanced automated CPR device designed for emergency medical professionals treating cardiac arrest patients. Building on the original ARM device, the ARM XR features a suction cup piston for generating compressions and chest wall recoil, improved frame design for easier patient application, and enhanced battery life for prolonged use. It is designed to assist emergency responders, allowing operation by smaller teams and reducing fatigue, especially amid staffing shortages.

Medical Suction Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | AC-Powered Devices, Battery-Powered Devices, Dual-Powered Devices, Manually Operated Devices |

| Portabilities Covered | Hand-Held Suction Device, Wall-Mounted Suction Device |

| Applications Covered | Airway Clearing, Research and Diagnostics, Surgical |

| End Users Covered | Hospitals and Clinics, Home Care, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allied Healthcare Products Inc., Anand Medicaids Private Limited, ATMOS MedizinTechnik GmbH & Co. KG, Laerdal Medical, Medela AG, Medical Depot Inc., Medicop d.o.o., MG Electric (Colchester) Ltd., Olympus Corporation, Precision Medical Inc., SSCOR Inc., WEINMANN Emergency Medical Technology GmbH + Co. KG, ZOLL Medical Corporation (Asahi Kasei Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical suction devices market from 2019-2033.

- The medical suction devices market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical suction devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical suction devices market was valued at USD 1.05 Billion in 2024.

IMARC estimates the medical suction devices market to exhibit a CAGR of 3.02% during 2025-2033, reaching a value of USD 1.38 Billion by 2033.

The market is driven by the increasing prevalence of chronic respiratory diseases, the growing number of surgical procedures, and the rising demand for emergency and critical care services. Additionally, technological advancements, an aging population, and the expansion of healthcare infrastructure in emerging markets further contribute to market growth.

North America currently dominates the medical suction devices market, accounting for a share exceeding 28.5% in 2024. This dominance is fueled by advanced healthcare infrastructure, increasing surgical procedures, rising respiratory disease cases, and strong investments in medical technology.

Some of the major players in the medical suction devices market include Allied Healthcare Products Inc., Anand Medicaids Private Limited, ATMOS MedizinTechnik GmbH & Co. KG, Laerdal Medical, Medela AG, Medical Depot Inc., Medicop d.o.o., MG Electric (Colchester) Ltd., Olympus Corporation, Precision Medical Inc., SSCOR Inc., WEINMANN Emergency Medical Technology GmbH + Co. KG, and ZOLL Medical Corporation (Asahi Kasei Corporation), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)