Medical Specialty Bags Market Size, Share, Trends and Forecast by Product, End User, and Region, 2025-2033

Medical Specialty Bags Market Size and Share:

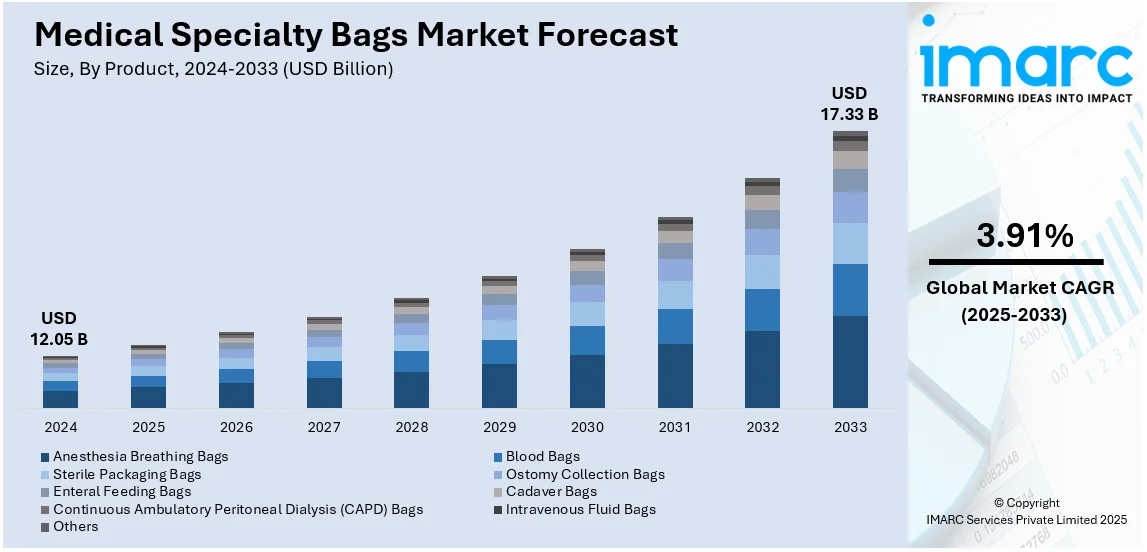

The global medical specialty bags market size was valued at USD 12.05 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.33 Billion by 2033, exhibiting a CAGR of 3.91% from 2025-2033. North America currently dominates the medical specialty bags market share by holding over 32.8% in 2024. The market is driven by advanced healthcare infrastructure, high prevalence of chronic diseases, growing geriatric population, increasing surgical procedures, and favorable reimbursement policies in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.05 Billion |

|

Market Forecast in 2033

|

USD 17.33 Billion |

| Market Growth Rate 2025-2033 | 3.91% |

The growth of the global medical specialty bags market is mainly fueled by the increasing prevalence of chronic diseases like diabetes, kidney disorders, and cancer, which drive the demand for intravenous (IV) therapy, dialysis, and blood transfusion bags. The rising geriatric population requires long-term medical care, which is boosting demand for ostomy and urinary collection bags. Moreover, ongoing advancements in healthcare infrastructure and hospital expansions enhance accessibility to specialized medical products, contributing to the market expansion. For instance, in March 2025, India's Zydus Lifesciences announced plans to acquire an 85.6% stake in France's Amplitude Surgical for €256.8 million, aiming to expand its presence in the global medical devices market, further strengthening the supply chain for medical specialty bags. Besides this, favorable reimbursement policies encourage patient adoption, driving the market growth. Furthermore, the increasing number of surgical procedures globally drives the market demand for sterile medical bags. Also, continuous innovation in eco-friendly and polyvinyl chloride (PVC)-free medical bags aligns with sustainability goals, thus impelling the market growth.

The United States medical specialty bags market demand is currently exhibiting a total share of 90.60% and is driven by various factors. High hospitalization rates due to lifestyle-related diseases, such as obesity and cardiovascular disorders, increase demand for IV and blood transfusion bags, boosting the market growth. In confluence with this, the rising outpatient and home healthcare services drive the need for user-friendly and portable medical bags, which is providing an impetus to the market. Concurrently, stringent Food and Drug Administration (FDA) regulations ensure high-quality, innovative products, encouraging manufacturers to invest in research and development (R&D), and supporting the market growth. For example, in 2024, the Centers for Disease Control and Prevention (CDC) released the 2024 National Healthcare Safety Network (NHSN) Patient Safety Component Manual, guiding infection control practices that involve the use of medical specialty bags. Also, the growing military and veteran healthcare programs expand the demand for specialized medical supplies, providing an impetus to the market. Furthermore, ongoing technological advancements in smart monitoring medical bags improve patient safety, impelling the market demand. Apart from this, the increasing awareness of infection control accelerates the adoption of sterile, single-use medical bags, thereby propelling the market forward.

Medical Specialty Bags Market Trends:

Aging Population and Chronic Disease Prevalence

The increasing health consciousness due to the rising prevalence of various chronic diseases, mostly amongst the rising geriatric population, represents one of the prime factors currently driving the medical specialty bags market growth. According to the World Health Organization (WHO), projections estimate that 1 out of 6 worldwide population will reach age 60 years and above by 2030. This is further supported by the increasing need for customer-focused products and services, which, in turn, is facilitating widespread product adoption across the globe. Additionally, the growing demand for long-term care solutions, continuous advancements in home healthcare, and improved accessibility to high-quality medical supplies are strengthening the medical specialty bags market share. Moreover, these technological innovations in medical specialty bags, including lightweight, leak-proof, and eco-friendly designs, are enhancing their usability among aging patients with chronic conditions.

Government Initiatives and Healthcare Infrastructure Enhancement

Numerous favorable initiatives undertaken by the government bodies of several countries for strengthening the healthcare infrastructure and enhancing the medical standards through the employment of improved reimbursement packages are acting as major growth-inducing factors. According to the American Hospital Association, in 2025, there are approximately 6,093 hospitals in the United States. Additionally, increased government funding for advanced medical technologies, expansion of healthcare facilities in rural areas, and policies promoting local manufacturing of medical devices are driving the market growth. Furthermore, public-private partnerships and regulatory reforms aimed at ensuring patient safety and accessibility to high-quality medical specialty bags are enhancing the medical specialty bags market outlook.

Material Innovation and Increasing Demand for IV Therapy Bags

The escalating demand for PVC bags in the healthcare sector on account of their versatility, affordability, and recyclability qualities is influencing the medical specialty bags market trends. In line with this, the extensive utilization of IV therapy bags in several applications, such as surgeries, providing nutrition to patients, sustaining basal hydration levels, and maintaining the correct electrolyte balance, is propelling the market growth. For instance, Australia secured a $40 million deal to expand onshore manufacturing of IV saline fluids, aiming to produce at least 80 million units annually by 2027, reducing reliance on international supplies. Besides this, factors such as strategic collaborations between key players and continuous investments in R&D activities in the field of medical science for introducing advanced medical tools and accessories, are creating a positive outlook for the market. Additionally, the rising preference for non-PVC alternatives, increased demand for single-use medical bags to prevent infections, and the growing adoption of smart IV bags with monitoring features are driving innovation and contributing to the market expansion.

Medical Specialty Bags Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical specialty bags market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and end user.

Analysis by Product:

- Anesthesia Breathing Bags

- Blood Bags

- Sterile Packaging Bags

- Ostomy Collection Bags

- Enteral Feeding Bags

- Cadaver Bags

- Continuous Ambulatory Peritoneal Dialysis (CAPD) Bags

- Intravenous Fluid Bags

- Others

Ostomy collection bags hold the largest market share, accounting for 27.5% in 2024. This segment is driven by the rising prevalence of colorectal cancer, inflammatory bowel diseases, and a growing geriatric population requiring ostomy procedures. In addition to this, ongoing technological advancements in ostomy care products such as skin-friendly adhesives and odor control technologies are improving patient comfort and adoption rates. Moreover, the growing awareness, better reimbursement policies, and ostomy patient support programs are fostering the market growth. Concurrently, growth in home healthcare services and demand for low-key, easy-to-use products support the dominance of the segment. Furthermore, the emphasis by producers on light, long-lasting, and environmentally friendly materials, fuels innovation, thereby strengthening the market share.

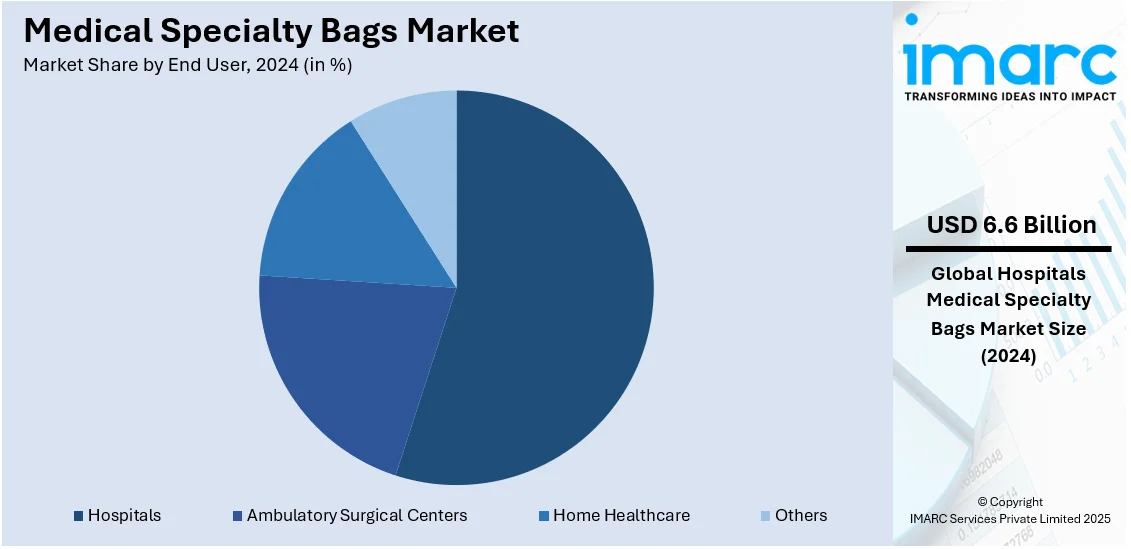

Analysis by End User:

- Hospitals

- Ambulatory Surgical Centers

- Home Healthcare

- Others

Hospitals lead the medical specialty bags market with a share of 55.0% in 2024. This segment is driven by the increasing number of surgical procedures, rising hospital admissions due to chronic diseases, and the growing geriatric population requiring long-term medical care. In line with this, having a well-developed healthcare infrastructure, hospitals are central locations for IV therapy, dialysis, blood transfusions, and ostomy care, all of which depend on specialty medical bags. The demand is also driven by infection control needs, strict regulatory requirements, and hospital-acquired infection (HAI) prevention protocols, to ensure the utilization of high-quality, sterile medical bags. Besides this, government efforts to upgrade healthcare facilities, positive reimbursement policies, and improvements in hospital-based medical technologies are supporting the market growth. Moreover, the growing use of single-use, environment-friendly, and recyclable medical bags to ensure patient safety and sustainability further supports the leadership of hospitals in the global market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest share of the medical specialty bags market by holding a significant share of 32.8%. The demand in this region is fueled by a well-developed healthcare infrastructure, a high incidence of chronic conditions, and an increasing elderly population necessitating long-term medical therapy. Additionally, strong government support, favorable reimbursement policies, and cutting-edge medical technologies strengthen demand for products of IV therapy, blood transfusions, and ostomy care. In conjunction with this, the availability of top-ranking medical device firms, steady investment in R&D, and expanding hospital admissions are bolstering the market growth. However, challenges such as supply chain disruptions have also impacted the industry. For example, in 2024, Hurricane Helene severely damaged Baxter International's North Carolina facility, responsible for 60% of U.S. IV fluid production, leading to nationwide shortages. To tackle this, Baxter initiated phased restorations of its affected plant, aiming to meet 90-100% of customer needs by year's end. Concurrently, the company planned to import 18,000 tons of IV products from international sites, utilizing around 200 Boeing 747 flights. Furthermore, the increasing knowledge related to infection prevention and a tendency towards eco-compliant single-use medical bags supplement growth is significantly propelling the market forward.

Key Regional Takeaways:

United States Medical Specialty Bags Market Analysis

The United States is experiencing a surge in medical specialty bags demand, fueled by substantial investment in the healthcare sector. According to reports, in the US pharmaceutical industry, there were 25 private equity deals announced in Q3 2024, worth a total value of USD 2.3 Billion. The expansion of hospitals, clinics, and outpatient centers is increasing the need for advanced storage, collection, and fluid management solutions. Rising healthcare spending is accelerating technological advancements, leading to the development of improved designs that cater to diverse medical requirements. Growing focus on patient care and infection control measures is driving the usage of specialized products across surgical, home care, and diagnostic applications. Favorable reimbursement policies and regulatory approvals are further strengthening the adoption of disposable and reusable solutions, ensuring hygiene and efficiency in medical procedures. Increasing awareness among healthcare professionals regarding the benefits of high-quality materials and leak-proof designs is propelling market growth. Advancements in medical research and innovation in biopharmaceuticals are also contributing to the expansion of applications, making these products an essential part of modern healthcare.

Europe Medical Specialty Bags Market Analysis

Europe is witnessing a rising demand for medical specialty bags, driven by the increasing geriatric population. According to WHO, the population aged 60 and older is rapidly growing in the WHO European Region. Research shows that the global diabetic population reached 215 Million in 2021 and forecasts a projected growth to 247 Million by 2030 before surpassing 300 Million by 2050. Aging individuals require advanced healthcare solutions for chronic conditions, post-surgical recovery, and long-term treatments, boosting the need for effective fluid management and collection products. The growing prevalence of age-related disorders, including urological and cardiovascular conditions, is leading to a higher adoption of specialized drainage and storage solutions. Healthcare providers are prioritizing sterile, disposable, and reusable options to enhance patient care and reduce infection risks. The demand for home care solutions is rising, as elderly individuals prefer convenient and reliable medical support outside hospital settings. Innovations in material technology and manufacturing processes are improving product durability and patient comfort. The expansion of specialized clinics and rehabilitation centers is fostering the need for high-quality solutions tailored to geriatric healthcare.

Asia Pacific Medical Specialty Bags Market Analysis

Asia-Pacific is witnessing rapid growth in medical specialty bags demand, supported by expanding healthcare infrastructure. For instance, India has nearly 70,000 operational hospitals, 63% privately owned; the remaining 37% are government-owned. Continuous investment in new hospitals, diagnostic centers, and surgical facilities is creating opportunities for advanced fluid collection and drainage solutions. Governments and private organizations are actively enhancing medical service accessibility, contributing to the increasing adoption of cost-effective and high-quality products. Rising awareness about hygiene and safety in medical procedures is pushing hospitals and clinics to prioritize disposable and sterile options. The development of emergency care units and specialized treatment centers is strengthening demand across surgical and chronic disease management applications. Technological advancements and localization of manufacturing processes are improving product availability, making these solutions more affordable and accessible. Increasing focus on modernizing healthcare services and integrating high-efficiency medical equipment is driving innovations in material composition and design.

Latin America Medical Specialty Bags Market Analysis

Latin America is seeing an increase in medical specialty bags usage due to urbanization and rising disposable income. For instance, 85.2 % of the Latin America population is urban (565,084,260 people in 2024). Expanding metropolitan areas are strengthening access to healthcare services, leading to a higher demand for surgical and diagnostic solutions. Economic growth is enabling individuals to invest in quality medical treatments, increasing the adoption of advanced fluid collection and drainage systems. Improved access to private healthcare services is also supporting demand, as hospitals and clinics prioritize efficient and hygienic patient care. Increasing awareness of infection control practices is further promoting the use of single-use and sterilized solutions in healthcare settings.

Middle East and Africa Medical Specialty Bags Market Analysis

Middle East and Africa are witnessing growing adoption of medical specialty bags due to expanding healthcare facilities. According to the Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with 4,482 private medical facilities and 55,208 licensed professionals by 2022, projected to expand further by 3-6% in facilities and 10-15% in professionals in 2023. New hospitals, surgical centers, and diagnostic labs are driving demand for reliable storage and drainage products. Increasing government and private sector investments in healthcare infrastructure are enhancing accessibility to medical treatments, contributing to market expansion. The need for high-quality patient care and infection control measures is supporting the usage of sterile and disposable solutions.

Competitive Landscape:

The global medical specialty bags market is highly competitive, with key players focusing on product innovation, strategic mergers, and geographic expansion to strengthen their market presence. Companies are investing in R&D to introduce advanced, patient-friendly, and eco-conscious medical bags, such as PVC-free and biodegradable alternatives. Partnerships with hospitals and healthcare providers are increasing to enhance product accessibility. Additionally, regulatory approvals and compliance with stringent healthcare standards remain crucial for market players. Major companies are expanding production facilities and enhancing supply chain efficiency to meet rising demand. Also, digitalization, automation in manufacturing, and smart monitoring solutions for IV and ostomy bags are emerging trends shaping the competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the medical specialty bags market with detailed profiles of all major companies, including:

- Ambu A/S

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton Dickinson and Company

- Coloplast A/S

- ConvaTec Group PLC

- Hollister Incorporated

- Macopharma

- Medline Industries LP

- Nolato AB

- Pall Corporation (Danaher Corporation)

- SB-Kawasumi Laboratories Inc. (Sumitomo Bakelite Co. Ltd.)

- Terumo Corporation

Latest News and Developments:

- November 2024: Berry Global and Amcor announced a merger, forming a global leader in consumer and healthcare packaging solutions. The combined company will enhance its portfolio, including medical specialty bags, by leveraging advanced flexible and converted film technologies. This merger aims to drive innovation, sustainability, and growth while delivering significant value to stakeholders.

- July 2024: Amneal Pharmaceuticals received FDA approval for its potassium phosphates in 0.9% sodium chloride injection IV ready-to-use bags, streamlining phosphorus replacement therapy. These medical specialty bags reduce compounding steps, enhancing clinician efficiency and patient safety. This marks Amneal’s third 505(b)(2) launch in 2024, following PEMRYDI RTU® and FOCINVEZ®.

- February 2024: Xheme partnered with the Vitalant Research Institute to develop innovative medical specialty bags free from PVC and toxic materials. This breakthrough enhances blood storage and transfusion safety by reducing health risks linked to traditional PVC-based bags. The collaboration marks a significant step toward safer and more sustainable medical specialty bags.

- January 2024: Cherwell introduced Redipor® BetaBags to enhance the safe transfer of sterile media in pharmaceutical manufacturing. These medical specialty bags support contamination-free transfer, reducing risk, cost, and time in environmental monitoring. Fully validated for Getinge Alpha Ports, they optimize productivity in sterile medicinal product manufacturing.

- April 2023: Vonco Products LLC acquired Genesis Plastics Welding to enhance its medical specialty bags portfolio, including fluid bags and specialty pouches. This acquisition strengthens Vonco’s focus on quality and innovation in medical packaging solutions. The expansion aims to meet growing healthcare demands with advanced, high-performance medical bags.

Medical Specialty Bags Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Anesthesia Breathing Bags, Blood Bags, Sterile Packaging Bags, Ostomy Collection Bags, Enteral Feeding Bags, Cadaver Bags, Continuous Ambulatory Peritoneal Dialysis (CAPD) Bags, Intravenous Fluid Bags, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Home Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ambu A/S, B. Braun Melsungen AG, Baxter International Inc., Becton Dickinson and Company, Coloplast A/S, ConvaTec Group PLC, Hollister Incorporated, Macopharma, Medline Industries LP, Nolato AB, Pall Corporation (Danaher Corporation), SB-Kawasumi Laboratories Inc. (Sumitomo Bakelite Co. Ltd.), Terumo Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical specialty bags market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global medical specialty bags market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical specialty bags industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical specialty bags market was valued at USD 12.05 Billion in 2024.

IMARC estimates the medical specialty bags market to exhibit a CAGR of 3.91% during 2025-2033, expecting to reach USD 17.33 Billion by 2033.

The medical specialty bags market is driven by the rising prevalence of chronic diseases, an aging population, increasing surgical procedures, and continuous advancements in healthcare infrastructure. Additionally, growing demand for intravenous (IV) therapy, government initiatives, improved reimbursement policies, and the adoption of cost-effective, recyclable materials like polyvinyl chloride (PVC) further propel the market growth.

North America currently dominates the market, accounting for a share exceeding 32.8%. This dominance is fueled by a well-established healthcare infrastructure, high chronic disease prevalence, advanced medical technologies, and favorable government reimbursement policies.

Some of the major players in the medical specialty bags market include Ambu A/S, B. Braun Melsungen AG, Baxter International Inc., Becton Dickinson and Company, Coloplast A/S, ConvaTec Group PLC, Hollister Incorporated, Macopharma, Medline Industries LP, Nolato AB, Pall Corporation (Danaher Corporation), SB-Kawasumi Laboratories Inc. (Sumitomo Bakelite Co. Ltd.), Terumo Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)