Medical Power Supply Market Size, Share, Trends and Forecast by Type, Converter Type, Application, and Region, 2025-2033

Medical Power Supply Market Size and Share:

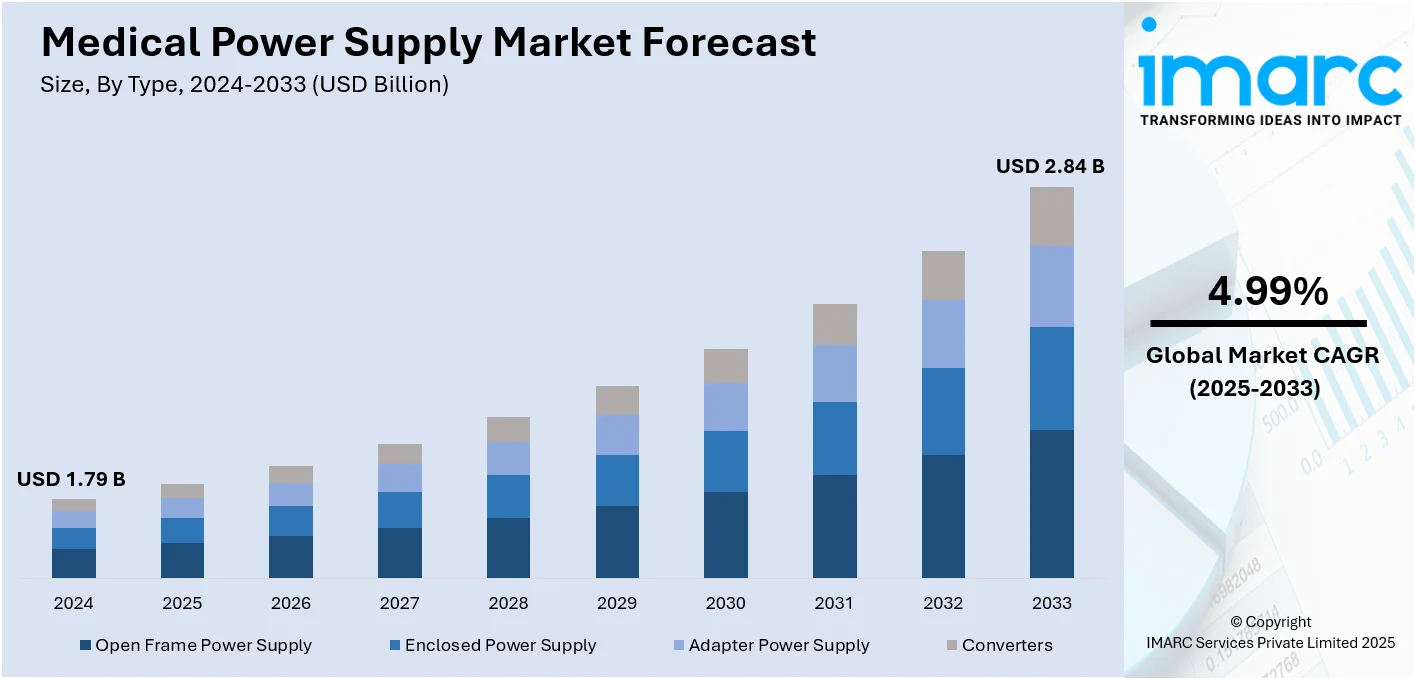

The global medical power supply market size was valued at USD 1.79 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.84 Billion by 2033, exhibiting a CAGR of 4.99% from 2025-2033. North America currently dominates the market. The market is primarily driven by the increasing demand for energy-efficient solutions, the emerging trend of miniaturization of power supplies, and the rising emphasis on enhanced safety and compliance features to meet stringent regulatory standards and ensure patient safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.79 Billion |

|

Market Forecast in 2033

|

USD 2.84 Billion |

| Market Growth Rate 2025-2033 | 4.99% |

The growth of the global market is primarily driven by the increasing adoption of advanced medical technologies like robotic surgeries and telemedicine. In line with this, the rising demand for healthcare services, especially in emerging economies, further boosts the market appeal. Besides this, stringent regulatory standards in the healthcare industry also propel the demand for high-quality, certified power supplies in the market. Additionally, the growing emphasis on patient safety and the need for uninterrupted device performance contribute to market expansion. Moreover, ongoing innovations in energy-efficient power systems and the shift toward portable and wearable medical devices are creating lucrative opportunities in the market. On October 28, 2024, STMicroelectronics introduced the ST1VAFE3BX bio-sensing chip, designed for healthcare wearables. It integrates biopotential sensing, inertial sensing, and AI or enhanced performance with low power consumption, advancing wearable medical monitoring devices like ECG and EEG.

To get more information on this market, Request Sample

The United States stands out as a key regional market and experiences critical progressions in healthcare technologies in terms of diagnostic imaging, patient monitoring, and life support, where it will need effective power solutions. For example, on June 18, 2024, XP Power launched the low-profile 550W AC-DC power supplies CCP550 series. It supports ventilators and patient monitors with high efficiency and excellent thermal performances, as well as offers a wide range of input voltages. In addition, the high rate of chronic diseases and the aging population requires the sophisticated medical devices, which boost demand for efficient power supplies. In addition, adoption of home health care and portable medical devices contributes to the expanding market. Apart from this, stringent government regulations about safety standards, along with high healthcare expenditure, promote the demand for certified power solutions, which would encourage innovation as well as more consumption of the product.

Medical Power Supply Market Trends:

Rapid Integration of Energy-Efficient Solutions

A critical trend in the market includes increased focus on energy-efficient solutions. The advancements in medical devices and healthcare facilities increased the demand for low-energy consumptions in these power supplies without any drops in performance. This is being influenced by reasons such as environmental concerns, cost-cutting measures, and the implementation of stricter energy efficiency regulations. This trend is responding through the use of advanced technologies, including zero voltage switching (ZVS) and high-frequency topologies, to increase power conversion efficiency. For example, on 17 January 2024, Infineon Technologies launched the EZ-PD™ PAG2 chipset, a secondary-side controlled ZVS flyback converter designed for USB-C power delivery. This chipset supports high-efficiency charging with topologies like NCP-ACF and QR-ZVS, ensuring efficient power management for various devices, including medical ones. By reducing energy consumption and extending the lifespan of medical devices, this trend plays a crucial role in the market’s growth.

Rise in the Miniaturization of Power Supplies

Miniaturization is a driving force in the market development. The more the demand for portable, compact medical devices, the more the power supply is needed for small and efficient devices, integrated with many applications. On January 25, 2024, Inventus Power announced a new line of universal power supplies with GaN (gallium nitride) technology that offers higher efficiency and smaller form factors than traditional power supplies. GaN technology contributes towards compact power solutions necessary in applications where device sizes become small, like with wearable medical devices, portable monitors, and home health care systems. This shift is especially important as the adoption of remote patient monitoring and home care devices grows. By reducing power supply size while maintaining performance, miniaturization is enabling the wider use of advanced medical technology, improving patient care, and supporting the trend toward personalized and at-home healthcare.

Enhanced Safety and Compliance Features

The growing focus on safety and regulatory compliance is a key driver in the market. As medical devices contribute to patient health, power supplies must be extremely safe in design and performance standards, such as IEC 60601-1, for secure operation. Companies are now designing their power supplies with advanced safety features, including multiple protection layers against electrical faults, overloads, and thermal issues. For instance, on September 23, 2024, Advanced Energy launched the NCF150 series of high-isolation, low-leakage current AC-DC power supplies that meet the cardiac floating requirements of IEC 60601-1. These compact, off-the-shelf products offer up to 150W output, enhanced isolation, and reliability, making them suitable for critical medical equipment like dialysis machines and cardiac systems. As regulatory standards shift, the medical power supply market is adapting to ensure patient safety while maintaining high levels of performance and compliance.

Medical Power Supply Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical power supply market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, converter type, and application.

Analysis by Type:

- Open Frame Power Supply

- Enclosed Power Supply

- Adapter Power Supply

- Converters

Enclosed power supply stand as the largest type in 2024, driven by the rising demand for reliable, safe, and efficient power solutions for critical medical devices. Enclosed power supplies offer superior protection against electrical hazards, making them ideal for use in medical equipment such as patient monitoring systems, diagnostic tools, and life-support machines. As healthcare technologies advance, the need for high-performance, secure power systems that comply with stringent industry regulations continues to increase, further contributing to the dominance of the segment. Additionally, the growing emphasis on patient safety, the adoption of more sophisticated medical devices, and the demand for durable, long-lasting power solutions will continue to drive the adoption of enclosed power supplies in the sector.

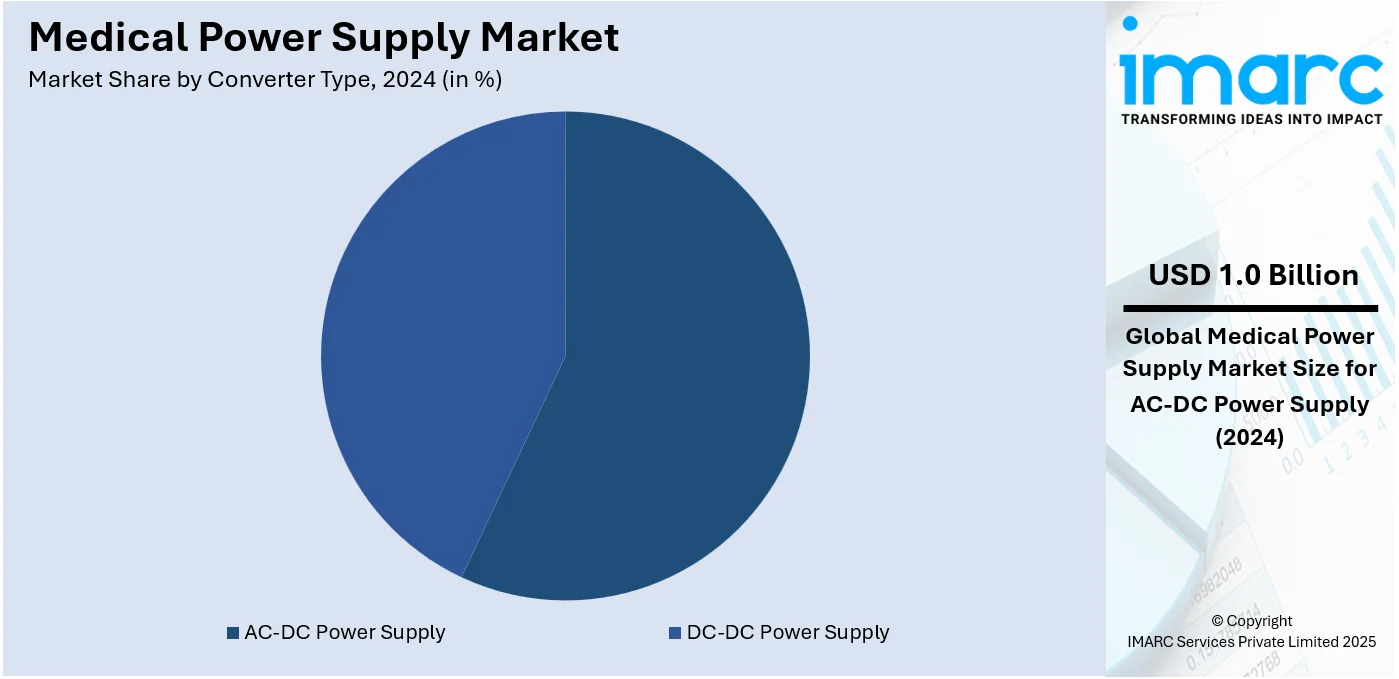

Analysis by Converter Type:

- AC-DC Power Supply

- DC-DC Power Supply

AC-DC power supply currently leads the market share, due to its versatility, reliability, and widespread application in critical medical devices. AC-DC converters efficiently transform alternating current (AC) into direct current (DC), which is essential for powering most modern medical equipment such as diagnostic devices, patient monitoring systems, and life-support machines. These power supplies are known for their stability, precision, and ability to meet the stringent safety standards required in the healthcare sector. The increasing demand for high-performance medical devices, coupled with the need for continuous, uninterrupted power, further drives the adoption of AC-DC power supplies. Their efficiency, compact design, and adaptability to various voltage and current requirements render them the preferred choice in the medical industry.

Analysis by Application:

- Diagnostic, Imaging and Monitoring Equipment

- Surgical Equipment

- Home Medical Equipment

- Others

Diagnostic, imaging, and monitoring equipment holds dominance in the market due to their critical role in healthcare settings. These devices, such as MRI machines, X-ray systems, CT scanners, and patient monitors, require reliable and continuous power to ensure accurate diagnoses and patient safety. As medical technologies advance, the demand for high-performance, energy-efficient, and safe power supplies to support these sophisticated systems has grown. Additionally, the increasing prevalence of chronic diseases and an aging population is leading to a higher need for diagnostic and monitoring equipment, further driving market growth. The stringent regulatory requirements in the medical sector also necessitate the use of reliable power supplies to maintain operational efficiency and adhere to safety standards, reinforcing the dominance of this segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share driven by its advanced healthcare infrastructure, with a high concentration of state-of-the-art medical facilities that require reliable and efficient power solutions. The increasing demand for sophisticated medical devices, such as diagnostic imaging equipment, patient monitoring systems, and life-support machines, is a significant driver. Additionally, North America has a well-established regulatory framework that ensures medical power supplies meet stringent safety and performance standards, further fostering market expansion. The growing prevalence of chronic diseases, an aging population, and high healthcare expenditures contribute to the demand for high-quality, uninterrupted power solutions. The presence of leading manufacturers and innovative technology providers in the region also supports its market dominance.

Key Regional Takeaways:

United States Medical Power Supply Market Analysis

The increasing demand for healthcare services and advancements in medical technology is bolstering the market growth. As the aging population grows, there is a heightened need for medical devices that require reliable, consistent power to function efficiently. As per the Population Reference Bureau, the number of Americans aged 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050. In addition, the continuous development of healthcare technology also plays a crucial role. Innovations in medical equipment, including portable devices and wearables, require compact, efficient, and high-performance power supplies. These devices are increasingly being used for monitoring chronic diseases, providing immediate medical assistance, and improving patient outcomes. Besides this, there is a rise in the demand for power supplies for various medical devices at home, such as oxygen concentrators and home dialysis machines. Another significant market driver is the ongoing regulatory requirements in the healthcare sector. Stringent standards set by organizations like the FDA ensure that medical devices operate with a constant and reliable power supply to prevent any interruptions that could affect patient health. Apart from this, the increasing adoption of green technologies in medical devices is catalyzing the demand for eco-friendly and efficient power supply systems.

Europe Medical Power Supply Market Analysis

The European market is driven by several significant factors, largely shaped by the region's advanced healthcare infrastructure, regulatory standards, and growing demand for innovative medical technologies. One of the primary drivers is the increasing demand for sophisticated medical devices across hospitals, clinics, and home healthcare settings. As the aging population in Europe continues to rise, there is an escalating need for reliable medical equipment, such as life-support machines, diagnostic devices, and wearable health technologies, all of which require efficient and stable power supplies to ensure safety and optimal performance. On 1 January 2023, the EU population was estimated at 448.8 million people and more than one-fifth (21.3 %) of it was aged 65 years and over, as per statistics by the European Commission. Besides this, technological advancements play a crucial role in driving the market. The development of new and cutting-edge medical devices, such as portable monitoring systems, telemedicine solutions, and minimally invasive (MI) surgery equipment, requires specialized and compact power supplies to support their operation. As these devices become more integrated into patient care, especially in remote or home healthcare environments, the need for high-performance medical power supplies continues to grow. Additionally, strict regulatory requirements in Europe also drive the demand for quality medical power supplies.

Asia Pacific Medical Power Supply Market Analysis

The Asia-Pacific medical power supply market is expanding due to rising urbanization and increasing cases of respiratory diseases like asthma and bronchitis. According to research report, an estimated 35 million people are suffering from asthma in 2023 in India. Apart from this, the escalating air pollution in densely populated cities is contributing to the prevalence of respiratory disorders. This is further driving the demand for advanced healthcare solutions among patients. Additionally, a growing middle-class population, along with inflating income levels, is contributing to the market growth. In line with this, governing agencies in countries such as India and China are investing in healthcare infrastructure and promoting digital health solutions to address the region's healthcare challenges. Furthermore, the integration of medical devices with mobile applications for real-time monitoring, improving patient adherence and disease management is bolstering expansion in the market. Moreover, stricter standards for medical device safety and reliability across Asia Pacific compel manufacturers to provide power solutions that meet international quality standards. Furthermore, there is an emerging trend of energy-efficient and eco-friendly solutions, with increasing emphasis on sustainability in medical equipment, is further driving the adoption of advanced power supply technologies. These factors, combined with increasing healthcare spending, render the market a dynamic and expanding industry.

Latin America Medical Power Supply Market Analysis

The increasing healthcare demand, particularly in countries like Brazil, Mexico, and Argentina, is supporting the market growth. The aging population in the region contributes to the rising demand for medical devices, such as diagnostic tools, life-support systems, and home healthcare products, all of which require reliable and efficient power supplies. The IBGE Population Projections show that, from 2000 to 2023, the population of elderly persons (aged 60 or over) in the Brazilian population almost doubled, rising from 8.7% to 15.6%. Additionally, the expansion of healthcare infrastructure and the modernization of hospitals and clinics across Latin America is catalyzing the demand for high-quality power solutions. Apart from this, technological advancements in medical devices, including portable and wearable health technologies, also drive the market as these devices require compact, efficient, and safe power sources. Furthermore, stringent regulatory requirements and the growing emphasis on energy-efficient and sustainable solutions are encouraging the development and adoption of reliable and eco-friendly medical power supplies in the region.

Middle East and Africa Medical Power Supply Market Analysis

The Middle East and Africa medical power supply market is primarily driven by the expanding healthcare sector and increasing demand for advanced medical devices. As countries in the region invest in modern healthcare infrastructure, particularly in the Gulf Cooperation Council (GCC) countries, the need for reliable power supplies to support critical medical equipment, such as diagnostic tools, life-support machines, and portable health devices, is growing. The healthcare expenditure in the Gulf Cooperation Council (GCC) is predicted to reach USD135.5 Billion by 2027. Additionally, technological advancements in power supply design, including higher energy efficiency, compact sizes, and compliance with stringent safety standards, is bolstering the market demand. Additionally, the rise of private sector investments in the healthcare sector are contributing to the adoption of advanced medical devices, which require robust power systems.

Competitive Landscape:

This market has a level playing field in competitive terms as it has many significant key players in the market who have dominated through technological innovation, strategic partnerships, and a focus on quality and safety standards. Major companies in the market offer a range of reliable, efficient, and compliant power supply solutions that would fit the medical application. These companies are working on expanding their product lines with advanced features like compact designs, improved energy efficiency, and protection against electrical hazards. Strategic collaboration, acquisition, and regional expansion are also other common strategies for strengthening market positions. As demand for high-performance medical devices continues to grow, competition increases and forces companies to innovate and respond to the ever-changing regulatory and customer needs in the healthcare sector.

The report provides a comprehensive analysis of the competitive landscape in the medical power supply market with detailed profiles of all major companies, including:

- Advanced Energy

- AstrodyneTDI

- Bel Fuse Inc.

- Chroma Systems Solutions, Inc.

- Cosel Co. Ltd.

- Delta Electronics, Inc.

- FRIWO Gerätebau GmbH

- GlobTek Inc.

- MEAN WELL Enterprises Co., Ltd.

- SynQor Inc.

- TDK-Lambda (TDK Corporation)

- Wall Industries, Inc.

- XP Power

Latest News and Developments:

- October 2024: FSP Group showcased its latest advancements in medical power supply solutions at the COMPAMED 2024 exhibition, demonstrating the company’s dedication to expanding its range of dependable power supplies for important medical applications.

- November 2023: Delta, one of the leading companies in power and thermal management, presented high-efficiency and dependable medical power supplies at MEDICA 2023, the world’s leading medical trade fair. Delta’s power supplies, known for their efficiency and safety, are applicable across a variety of devices, including CT scanners, ultrasound machines, CPAP machines, medical displays, and in vitro diagnostic instruments.

- April 2024: TDK Corporation unveiled new output voltage models for its 250W-rated TDK-Lambda CUS250M series of power supplies, now offered in the standard 2” x 4” size. The updated range offers 12V, 15V, 18V, 24V, 28V, 36V, and 48V options, all certified to comply with IEC 62368-1 and IEC 60601-1 safety standards for both industrial and medical applications.

- March 2024: Advanced Energy Industries, Inc. introduced Evergreen™, its next-generation modular high-power platform, which includes two new air-cooled Vento™ products. Evergreen provides enhanced AC-DC conversion with quick system setup, allowing for seamless customization and scalable power. Its versatility and performance make it ideal for applications ranging from industrial and medical systems to semiconductor manufacturing, hyperscale computing, test and measurement, and defense.

Medical Power Supply Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Open Frame Power Supply, Enclosed Power Supply, Adapter Power Supply, Converters |

| Converter Types Covered | AC-DC Power Supply, DC-DC Power Supply |

| Applications Covered | Diagnostic, Imaging and Monitoring Equipment, Surgical Equipment, Home Medical Equipment, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Energy, AstrodyneTDI, Bel Fuse Inc., Chroma Systems Solutions, Inc., Cosel Co. Ltd., Delta Electronics, Inc., FRIWO Gerätebau GmbH, GlobTek Inc., MEAN WELL Enterprises Co., Ltd., SynQor Inc., TDK-Lambda (TDK Corporation), Wall Industries, Inc., XP Power, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical power supply market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global medical power supply market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical power supply industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global medical power supply market was valued at USD 1.79 Billion in 2024.

The market is estimated to reach USD 2.84 Billion by 2033, exhibiting a CAGR of 4.99% from 2025-2033.

The growth of the global market is driven by the increasing adoption of advanced medical technologies, rising demand for energy-efficient solutions, miniaturization of devices, enhanced safety and compliance features, and the expanding healthcare infrastructure in emerging economies.

North America currently dominates the medical power supply market. The market is primarily driven by the increasing demand for energy-efficient solutions, the emerging trend of miniaturization of power supplies, and the rising emphasis on enhanced safety and compliance features to meet stringent regulatory standards and ensure patient safety.

Some of the major players in the global medical power supply market include Advanced Energy, AstrodyneTDI, Bel Fuse Inc., Chroma Systems Solutions, Inc., Cosel Co. Ltd., Delta Electronics, Inc., FRIWO Gerätebau GmbH, GlobTek Inc., MEAN WELL Enterprises Co., Ltd., SynQor Inc., TDK-Lambda (TDK Corporation), Wall Industries, Inc. and XP Power, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)