Medical Nonwoven Disposables Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, and Region, 2025-2033

Medical Nonwoven Disposables Market Size and Share:

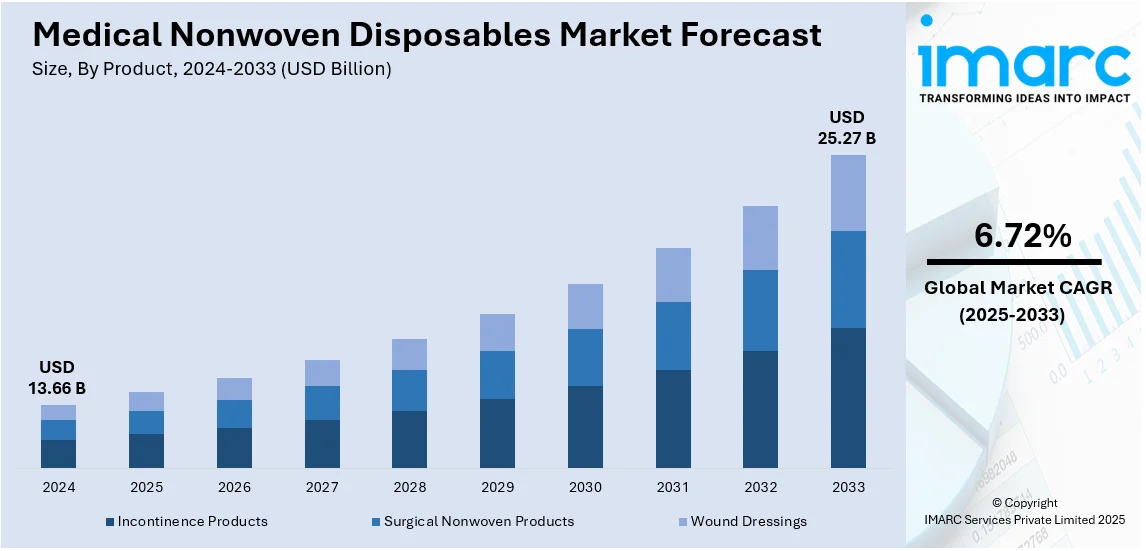

The global medical nonwoven disposables market size was valued at USD 13.66 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.27 Billion by 2033, exhibiting a CAGR of 6.72% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.8% in 2024. In North America, the medical nonwoven disposables market is driven by rising healthcare expenditures, increasing surgeries, strict infection control regulations, and an aging population. The rising hospital-acquired infection concerns, technological advancements, and a strong presence of key market players are fueling the medical nonwoven disposables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.66 Billion |

|

Market Forecast in 2033

|

USD 25.27 Billion |

| Market Growth Rate (2025-2033) | 6.72% |

The market for medical nonwoven disposables is driven by increasing healthcare awareness, rising surgical procedures, and stringent infection control regulations. Hospital-acquired infections (HAIs) have become more common which drives market demand for disposable medical products such as masks and gowns together with drapes. Market growth receives additional support from the aging demographic that demands recurring medical treatment. Enhanced adoption of nonwoven fabrics occurs because technological advancements bring better breathability and fluid resistance together with cost-effectiveness benefits. The market experiences increased need because healthcare professionals use single-use medical supplies to enhance patient safety through better hygiene practices while healthcare infrastructure expansion continues. Moreover, government initiatives promoting infection prevention and the presence of key market players investing in innovative product development further support the growth of the medical nonwoven disposables market.

The market for medical nonwoven disposables in the United States is driven by rising healthcare expenditures, an increasing number of surgical procedures, and strict infection control regulations. According to the American Medical Association (AMA), health expenditures rose by 7.5% from 2022 to 2023, outpacing the 4.6% growth seen from 2021 to 2022. The increase in overall health expenditure from 2022 to 2023 significantly surpasses the average annual growth rate of the 2010s (4.1%). The growing prevalence of hospital-acquired infections (HAIs) has heightened the demand for disposable medical products like masks, gowns, and drapes. Additionally, an aging population requiring continuous medical care boosts market growth. Technological advancements in nonwoven fabrics, along with a strong presence of key industry players, further enhance product adoption. The COVID-19 pandemic also accelerated the use of disposable medical supplies. Government initiatives promoting hygiene and infection prevention continue to support market expansion across healthcare facilities.

Medical Nonwoven Disposables Market Trends:

Rising Prevalence of Hospital-Acquired Infections (HAIs)

The increasing incidence of hospital-acquired infections (HAIs) is a key factor driving the demand for medical nonwoven disposables. According to industry reports, in 2023, California recorded the highest number of HAIs at 8,024 cases, while New York had 5,491 and Texas reported 5,177 cases. The states with the highest number of HAI cases are also the most populated ones in the nation, probably due to their larger patient base that is susceptible to infection. HAIs pose serious health risks, leading to prolonged hospital stays, increased medical costs, and higher mortality rates. To combat these risks, healthcare facilities are adopting disposable nonwoven products such as gowns, masks, and drapes, which offer superior barrier protection against pathogens. Regulatory bodies enforce strict infection control guidelines, further boosting demand. The need for enhanced hygiene, along with growing awareness about infection prevention among healthcare professionals, continues to accelerate the market growth of medical nonwoven disposables worldwide.

Increasing Surgical Procedures and Medical Treatments

The growing number of surgical procedures, both elective and emergency, is creating a positive medical nonwoven disposables market outlook. According to industry reports, each year, low-income and middle-income countries require an additional 143 million surgical procedures to protect lives and avert disability. Out of the 313 million procedures performed globally each year, merely 6% take place in the poorest nations, which are home to more than a third of the world's population. Surgical masks, gowns, and drapes are essential for maintaining a sterile environment and preventing infections during operations. As chronic diseases and lifestyle-related conditions such as obesity and cardiovascular diseases rise, the demand for surgeries continues to increase. Additionally, advancements in minimally invasive procedures further contribute to the need for disposable medical supplies. With hospitals prioritizing patient safety and infection control, the reliance on single-use nonwoven products remains strong, fueling continuous market growth in healthcare settings.

Technological Advancements in Nonwoven Fabrics

Innovations in nonwoven fabric technology are playing a crucial role in the expansion of the medical nonwoven disposables market. Modern nonwoven materials offer enhanced properties such as improved breathability, better moisture resistance, higher durability, and superior filtration efficiency. Advancements in spunbond, meltblown, and composite nonwoven technologies have led to the development of high-performance medical disposables. Additionally, the introduction of eco-friendly and biodegradable nonwoven materials aligns with the growing emphasis on sustainability in healthcare. These technological improvements not only enhance product effectiveness but also encourage wider adoption in hospitals, clinics, and ambulatory care centers. For instance, in August 2024, Manjushree Spntek created a unique collection of hybrid nonwovens specifically for chemotherapy gowns. Hightex monolithic hybrid nonwovens from Manjushree Spntek are produced by integrating a unique polymer-based continuous fiber network with fortified thermoplastic to provide an excellent barrier against chemicals and hazardous drugs (HDs), while also ensuring comfort during procedures, thus protecting healthcare workers. Hightex has received certification from global laboratories to meet the rigorous ASTM F3267-22 and ASTM D6978 criteria. Hightex is created to offer optimal safety from dangerous drugs when compounding, administering, managing waste, or cleaning up spills of chemotherapeutic medications.

Medical Nonwoven Disposables Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical nonwoven disposables market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, material, and distribution channel.

Analysis by Product:

- Incontinence Products

- Disposable Underwear

- Cotton Pads

- Disposable Panty Shields

- Disposable Diapers

- Others

- Surgical Nonwoven Products

- Surgical Masks

- Drape

- Shoe Covers

- Caps

- Gowns

- Swabs

- Others

- Wound Dressings

- Bandage

- Tapes

- Post-Operative Wound Dressing

- Operative Wound Dressing

- Dressing Pad

- Others

Surgical nonwoven products hold the largest share of the market due to their widespread use in hospitals, clinics, and surgical centers. These products, including surgical gowns, drapes, caps, and masks, provide essential infection control, ensuring patient and healthcare worker safety. Their superior barrier properties, breathability, and cost-effectiveness drive demand. Increasing surgical procedures, rising hospital-acquired infection concerns, and stringent hygiene regulations further boost market growth. Additionally, advancements in nonwoven fabric technology enhance product performance, making them indispensable in modern healthcare settings. The growing preference for single-use medical supplies reinforces their dominance in the market.

Analysis by Material:

- Polypropylene

- Polyethylene

- Polyamides and Polyester

- Acrylic

- Others

Polypropylene holds the largest market share due to its superior properties, including lightweight, high durability, cost-effectiveness, and excellent barrier protection against bacteria and fluids. It is widely used in surgical gowns, masks, drapes, and wound dressings due to its breathability and hypoallergenic nature. The material’s ability to be easily processed into spunbond and meltblown fabrics enhances its adoption in healthcare settings. Additionally, increasing concerns over hospital-acquired infections (HAIs) and the rising demand for disposable medical products drive its dominance. Continuous advancements in polypropylene-based nonwoven technology further strengthen its position in the market.

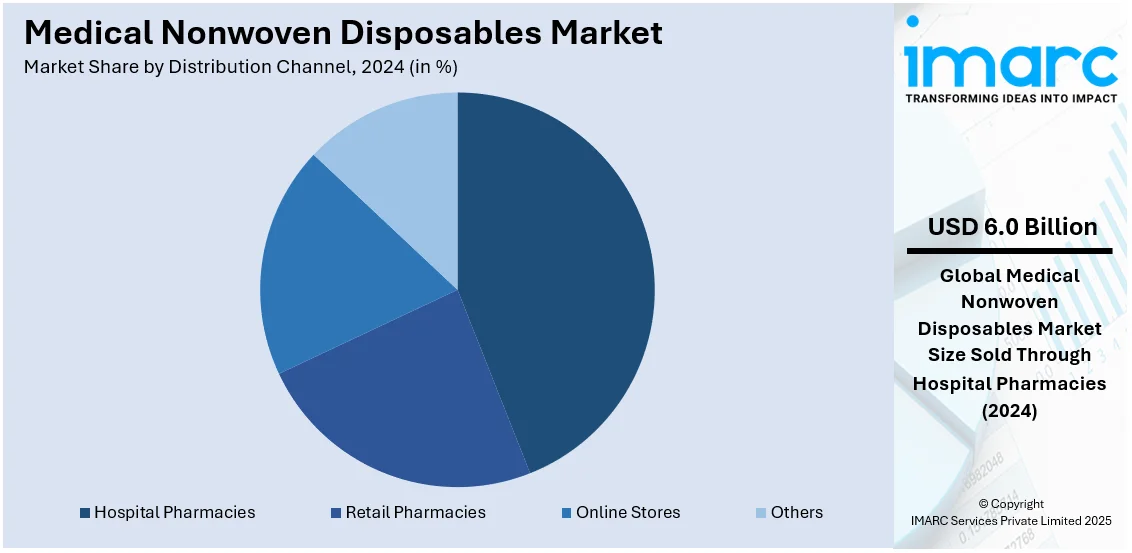

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Stores

- Others

Hospital pharmacies lead the market with around 43.8% of the market share in 2024 due to their direct access to a wide range of essential healthcare products, including surgical masks, gowns, drapes, and wound dressings. As primary suppliers to hospitals and clinics, they ensure a steady demand for disposable medical items to maintain hygiene and infection control. The rising number of surgical procedures, stringent hospital safety regulations, and increasing cases of hospital-acquired infections (HAIs) further drive their dominance. Additionally, bulk purchasing power, faster product availability, and integration with healthcare facilities strengthen their market position, making them the leading distribution channel.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.8%. The market in North America is driven by rising healthcare expenditures, an increasing aging population, and a growing number of surgical procedures. Stringent infection control regulations and heightened awareness of hospital-acquired infections (HAIs) boost demand for disposable medical products. The COVID-19 pandemic further accelerated the adoption of nonwoven disposables like masks and gowns. Technological advancements in nonwoven fabrics enhance product performance, increasing their usage in healthcare settings. Additionally, the strong presence of key market players, expanding hospital infrastructure, and a shift toward single-use medical supplies for improved patient safety contribute to the market’s growth in North America.

Key Regional Takeaways:

United States Medical Nonwoven Disposables Market Analysis

In 2024, the United States accounted for over 83.60% of the medical nonwoven disposables market in North America. The U.S. medical nonwoven disposables market is driven by several key factors, including the rising prevalence of chronic diseases, which affect an estimated 129 Million people in the U.S. as per the U.S. Department of Health and Human Services. These conditions, such as heart disease, cancer, diabetes, obesity, and hypertension, create a significant demand for healthcare services and, consequently, disposable medical products like surgical drapes, wound care items, and hygiene products. Furthermore, the aging population is increasing the need for long-term healthcare solutions, where nonwoven disposables offer an efficient and cost-effective option for patient care. The growth in surgical procedures, driven by the increasing incidence of chronic diseases, directly influences the demand for high-quality medical disposables. The emphasis on patient safety, infection control, and hygiene further supports the widespread adoption of nonwoven materials across hospitals, clinics, and outpatient care centers. Technological advancements in nonwoven materials, offering enhanced absorbency, breathability, and comfort, also drive product innovation. In addition, regulatory support and investment in healthcare infrastructure continue to bolster the market's expansion, ensuring a stable demand for nonwoven medical disposables in the U.S.

Asia Pacific Medical Nonwoven Disposables Market Analysis

The APAC medical nonwoven disposables market is experiencing significant growth, driven by demographic shifts and increasing healthcare needs. According to reports, the number of older persons in Asia and the Pacific is projected to more than double, from 630 Million in 2020 to approximately 1.3 Billion by 2050. This aging population is leading to a higher demand for healthcare services, boosting the need for disposable medical products. Furthermore, the region's high cancer incidence, as reported by PubMed Central, with 169.1 cases per 100,000 in 2020, accounting for 49.3% of global cancer cases, contributes to the increased need for nonwoven products in surgical and wound care. As cancers such as lung, breast, and colorectal become more prevalent, the demand for medical disposables in treatments and procedures rises. Additionally, improving healthcare infrastructure, increasing medical tourism, and rising awareness about hygiene and infection control are fostering market growth across APAC, further driving the adoption of nonwoven disposables in hospitals and clinics.

Europe Medical Nonwoven Disposables Market Analysis

The European medical nonwoven disposables market is witnessing substantial growth due to several key factors, including the region's aging population. According to reports, the EU population was estimated at 448.8 Million on 1 January 2023, with over one-fifth (21.3%) aged 65 years and older. This demographic shift increases the demand for healthcare services and medical products tailored to elderly care, including disposable nonwoven items such as surgical drapes, wound care products, and hygiene solutions. The rising incidence of chronic diseases and surgical procedures further fuels market demand. Additionally, increasing awareness about infection prevention and hygiene in healthcare facilities is driving the adoption of nonwoven disposables. The region also benefits from strong regulatory frameworks ensuring product safety and quality, fostering confidence among healthcare providers. Growing medical tourism in countries like Germany and Spain is further contributing to the demand for disposable medical products. Moreover, the rising trend of sustainability is encouraging innovation in eco-friendly nonwoven materials, making them more attractive to healthcare institutions. Overall, the market’s growth is supported by ongoing investments in healthcare infrastructure, advancements in technology, and a focus on reducing healthcare costs through the use of disposable products.

Latin America Medical Nonwoven Disposables Market Analysis

The Latin American medical nonwoven disposables market is expanding due to rising healthcare awareness and the increasing burden of chronic diseases. According to reports, chronic diseases in Brazil are projected to cause 928,000 deaths annually, highlighting the growing need for effective medical treatments. This surge in chronic conditions, along with a growing elderly population, is driving demand for disposable medical products, particularly in wound care, surgical procedures, and hygiene management. Economic improvements, coupled with rising medical tourism, further contribute to the market's growth as healthcare facilities require cost-effective, disposable solutions for patient care.

Middle East and Africa Medical Nonwoven Disposables Market Analysis

The Middle East and Africa medical nonwoven disposables market is growing due to the increasing prevalence of chronic diseases. According to the UAE Health Report, 23% of individuals self-reported chronic conditions, with obesity (12.5%), diabetes (4.2%), and asthma/allergies (3.2%) being the most common. This rising incidence of chronic diseases necessitates higher demand for medical disposables like wound care products, surgical items, and hygiene solutions. Additionally, growing healthcare investments, expanding medical tourism, and a heightened focus on infection control further drive market demand across the region.

Competitive Landscape:

The market is highly competitive, with key players focusing on innovation, quality, and regulatory compliance. Major companies such as Kimberly-Clark, Medline Industries, Mölnlycke Health Care, Cardinal Health, 3M, and Halyard Health dominate the market with extensive product portfolios, including surgical drapes, gowns, masks, and wound dressings. Competitive strategies include technological advancements, eco-friendly product development, and strategic mergers and acquisitions to expand market presence. Strict regulatory standards (FDA, CE, ASTM) shape the industry, influencing product innovation. Additionally, rising demand for infection control solutions and government-driven hygiene awareness campaigns further intensify competition. New entrants are joining the market with affordable and sustainable nonwoven solutions, contributing to the vibrant industry landscape.

The report provides a comprehensive analysis of the competitive landscape in the medical nonwoven disposables market with detailed profiles of all major companies, including:

- Ahlstrom-Munksjö Oyj

- Berry Global Inc.

- Cardinal Health Inc.

- Cypress Medical Products LLC (Mckesson Corporation)

- Domtar Corporation

- Dynarex Corporation

- Freudenberg & Co. KG

- Georgia-Pacific (Koch Industries)

- Kimberly-Clark Corporation

- Medline Industries Inc.

- Paul Hartmann AG

- Unicharm Corporation

Latest News and Developments:

- December 2024: Seattle startup Singletto has introduced pathogen-killing face masks, recently approved by the U.S. Food and Drug Administration. These masks feature methylene blue, a chemical known to kill viruses, bacteria, and fungi, providing an added layer of protection beyond traditional masks. CEO John Bjornson described the technology as a significant advancement, comparing it to an airbag complementing a seatbelt.

- June 2024: PBE has expanded its Tranquility® line with a 3XL size for its disposable products, including the Tranquility Premium OverNight™ and Tranquility Essential® Underwear – Heavy. These new 3XL versions cater to individuals requiring plus-sized, superabsorbent products, offering a waistline fit up to 95 inches and body weights over 250 lbs. The upgraded products feature a higher-rising waist panel, longer side seams, and an enhanced absorbent core for improved leakage control.

- May 2024: Medicare Hygiene Limited, known for its medical bandages and surgical non-woven disposable products, has entered the cosmetics market with the launch of Earthika Eco-friendly Wet Wipes. This marks the first step in the company's expansion, with plans for additional cosmetic products in the near future.

- October 2023: Manjushree Group announces the launch of Manjushree Ventures, a strategic shift from its legacy in rigid plastics to start-up financing, real estate, and manufacturing. The flagship entity, Manjushree Spntek, will focus on producing high-quality spunmelt fabrics for the growing market of disposable medical and hygiene products.

- August 2023: Hartmann, a healthcare and hygiene products manufacturer, continues to enhance its nonwoven medical product range, including drapes, gowns, and masks, with a focus on patient protection. In light of increased concerns over infective pathogens and chemical agents in healthcare settings, the company emphasizes the importance of PPE in preventing healthcare-associated infections (HAIs).

Medical Nonwoven Disposables Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Materials Covered |

Polypropylene, Polyethylene, Polyamides and Polyester, Acrylic, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ahlstrom-Munksjö Oyj, Berry Global Inc., Cardinal Health Inc., Cypress Medical Products LLC (Mckesson Corporation), Domtar Corporation, Dynarex Corporation, Freudenberg & Co. KG, Georgia-Pacific (Koch Industries), Kimberly-Clark Corporation, Medline Industries Inc., Paul Hartmann AG, Unicharm Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical nonwoven disposables market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global medical nonwoven disposables market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical nonwoven disposables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical nonwoven disposables market was valued at USD 13.66 Billion in 2024.

The medical nonwoven disposables market is projected to exhibit a CAGR of 6.72% during 2025-2033, reaching a value of USD 25.27 Billion by 2033.

The market is driven by rising healthcare awareness, increasing surgical procedures, and stringent infection control regulations. The growing prevalence of hospital-acquired infections (HAIs), an aging population, and advancements in nonwoven fabric technology further boost demand. Additionally, the shift toward single-use medical products for enhanced hygiene and safety fuels market growth.

North America currently dominates the market due to the rising healthcare spending, increasing surgeries, infection control regulations, an aging population, hospital-acquired infection concerns, and technological advancements.

Some of the major players in the medical nonwoven disposables market include Ahlstrom-Munksjö Oyj, Berry Global Inc., Cardinal Health Inc., Cypress Medical Products LLC (Mckesson Corporation), Domtar Corporation, Dynarex Corporation, Freudenberg & Co. KG, Georgia-Pacific (Koch Industries), Kimberly-Clark Corporation, Medline Industries Inc., Paul Hartmann AG, Unicharm Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)