Medical Foam Market Size, Share, Trends and Forecast by Type, Material, Application, and Region, 2025-2033

Medical Foam Market Size and Share:

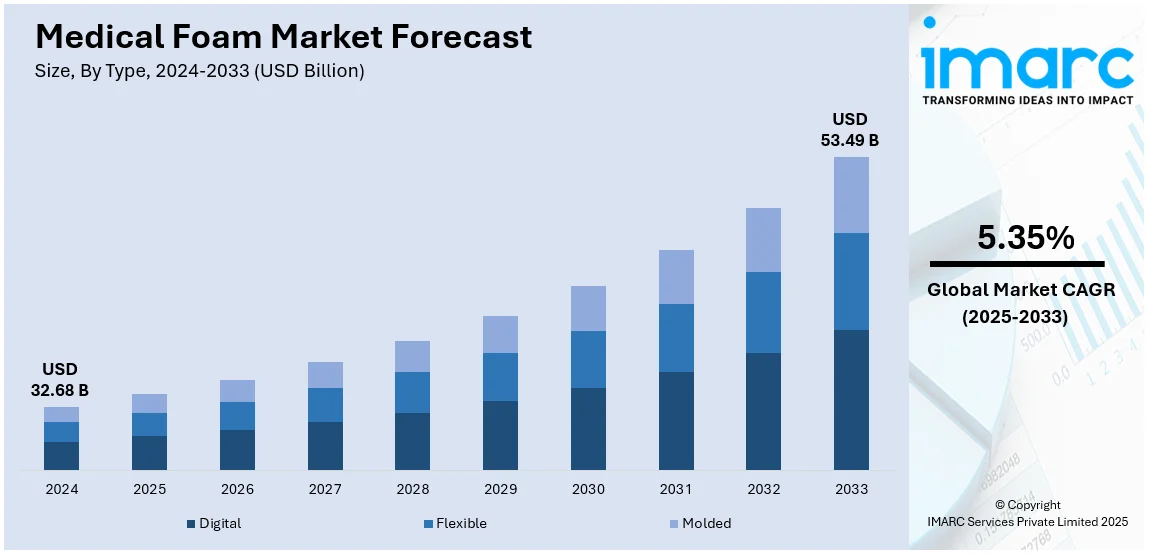

The global medical foam market size was valued at USD 32.68 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 53.49 Billion by 2033, exhibiting a CAGR of 5.35% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 38.6% in 2024. The market is primarily driven by the significant advancements in medical foam technology, increasing regulatory approvals, and growing demand for dermatological treatments ensuring safety compliance, enabling innovative solutions, addressing diverse clinical needs, and enhancing patient comfort and treatment outcomes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 32.68 Billion |

| Market Forecast in 2033 | USD 53.49 Billion |

| Market Growth Rate (2025-2033) | 5.35% |

The global market is majorly driven by the increasing demand for advanced healthcare products among the masses. This can be attributed to the rising prevalence of chronic diseases requiring specialized care. According to an article published by Australian Institute of Health and Welfare, on June 17, 2024, 61% of the population, or 15.4 million people, had at least one chronic condition in 2022. Anxiety and back problems are the most common, with anxiety affecting up to 22% of females and 15% of males and back problems affecting 15% of females and 16% of males. Chronic conditions accounted for 90% of all deaths and 29% of overall healthcare spending, emphasizing their significant health and economic burden. It all necessitates an ambitious effort to provide effective prevention, early detection, and good management of these conditions. The growth of the medical devices sector, coupled with advancements in foam technology, is resulting in a higher product uptake in applications such as wound care, medical packaging, and prosthetics. Considerable rise in the number of geriatric population also propels the demand for comfortable and durable materials in mattresses and cushions for patient care. In line with this, rapid utilization of disposable hygiene and infection-control products, coupled with the growing emphasis on patient safety and comfort in regulatory measures, highlights thepotential of medical foam to enhance healthcare systems, thereby impelling the market. Furthermore, the growing adoption of foam-based solutions across diverse medical applications contributes to advancing healthcare standards and outcomes, which is also acting as a significant growth-inducing factor for the market.

The United States stands out as a key regional market, primarily driven by the increasing demand for advanced healthcare materials among the growing geriatric population. Notably, as of January 9, 2024, the centenarian population in the U.S. is estimated to rise from 101,000 in 2024 to around 422,000 by 2054, as per the U.S. Census Bureau. . In the same period, centenarians will double as a percentage of older Americans, from 0.2% in 2024 to 0.5% by 2054, illustrating dramatic changes in demographics. Currently, there are 62 million adults aged 65 and older, which is 18% of the population. These numbers will rise to 84 million, or 23%, by 2054. Moreover, the increasing usage of medical foam due to its applications in wound care, medical packaging, and prosthetics, is fostering the market expansion. Additionally, ongoing technology improvements in the production of foam have improved its durability, sterility, and biocompatibility, aligning with the stringent healthcare standards mandated by the healthcare sector, which is impacting the market positively. Moreover, the expansion of home healthcare services and the rising prevalence of chronic diseases are fueling the demand for medical-grade foam. Apart from this, the government initiatives aimed at improved healthcare infrastructure and adoption of lightweight, eco-friendly materials are furthering the growth of the market in the region.

Medical Foam Market Trends

Innovations in Wound Care Technology

Rising advancements in medical foam technology drive the market by improving the efficacy and comfort of wound care products. Additionally, ongoing innovations, such as advanced foam formulations, improve absorption, reduce pain, and streamline application processes, thereby meeting diverse clinical needs and improving patient outcomes in wound management. For instance, in September 2024, Solventum introduced the V.A.C. Peel and Place Dressing, an innovative medical foam solution designed to streamline negative pressure wound therapy. This all-in-one dressing enhances application efficiency, reduces pain, and lowers costs. Thereby, advancing wound care across both acute and post-acute settings. Notably, the IMARC Group reports that the global wound care market is anticipated to reach USD 31.7 Billion by 2032.

Regulatory Approvals Enhancing Market Access

Securing regulatory approvals accelerates the entry of new medical foam products into the market. Apart from this, compliance with stringent regulatory standards ensures product safety and efficacy, thereby increasing trust among healthcare providers and patients. For instance, in July 2024, AMS BioteQ's SIPSIP foam wound dressing received Japan's PMDA first-class medical device permit, marking a significant entry into Japan's market. This innovative cotton-based foam dressing is approved by the FDA and TFDA, thereby addressing rising global wound care needs effectively.

Increased Demand for Advanced Dermatological Treatments

The rising prevalence of skin conditions and a growing focus on effective, non-steroidal treatments foster the demand for specialized medical foams in dermatology. As per the American Academy of Dermatology Association, it is estimated that 200,340 new cases of melanoma, a type of skin cancer, will be diagnosed in the United States in 2024. Advanced foam formulations offer targeted, effective solutions for various skin issues, contributing to the expansion of market opportunities in dermatological care. For instance, in January 2024, Arcutis Biotherapeutics launched the ZORYVE (roflumilast) topical medical foam for seborrheic dermatitis. This innovative, steroid-free medical foam offers rapid, effective treatment with reduced itching, marking a major advancement in dermatological care.

Medical Foam Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical foam market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, material, and application.

Analysis by Type:

- Digital

- Flexible

- Molded

Flexible foam stand as the largest component in 2024, holding around 55.8% of the market share. Flexible medical foam offers versatility and adaptability. It is used in various industries, including textiles, medical devices, and consumer goods, with its flexibility and elasticity. For instance, Ecomaison’s innovative foam solution improves recycling processes for end-of-life polyurethane mattress foams, thereby eliminating waste and ensuring sustainability. Moreover, the growing demand for eco-friendly solutions and increasing environmental awareness are further encouraging the use if flexible foam in a wide variety of products, thereby resulting in significant growth of the segment

Analysis by Material:

- Polymers

- Metals

- Others

Polymers lead the market in 2024, due to their lightweight nature, versatility, and cost-effectiveness. The increasing demand for sustainable and eco-friendly materials also led to the development of bio-based polymers, further propelling the market exdpansion. For instance, Covestro’s new Evocycle technology uses advanced polymers for efficient recycling of polyurethane foam materials. This ongoing shift towards circular economy principles is fostering innovation, reducing waste, and enhancing material recovery processes, positioning polymers as key enablers of sustainable manufacturing across sectors such as automotive, construction, and packaging.

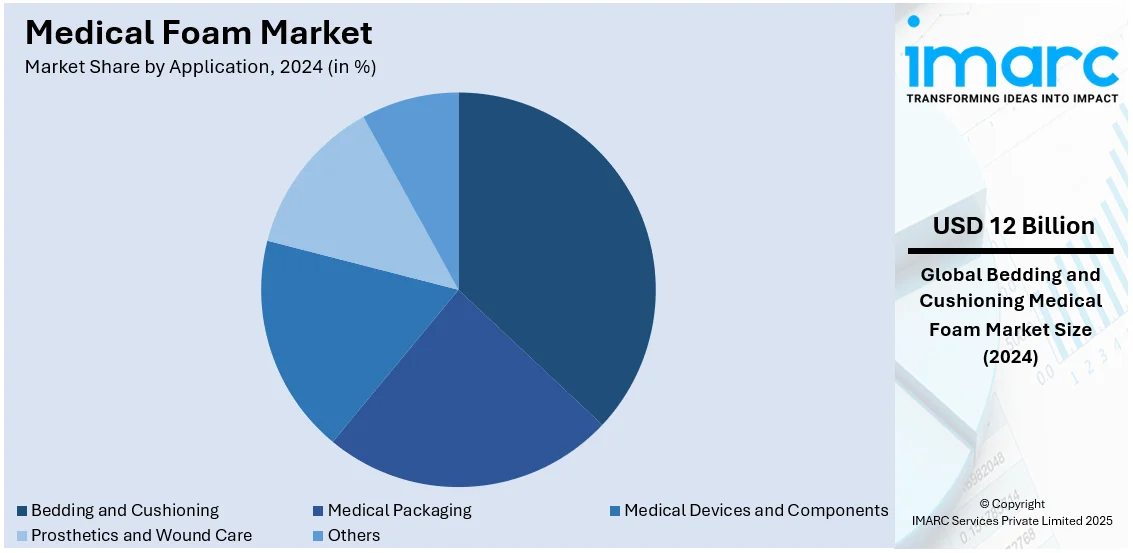

Analysis by Application:

- Bedding and Cushioning

- Medical Packaging

- Medical Devices and Components

- Prosthetics and Wound Care

- Others

Bedding and cushioning leads the market with around 36.7% of market share in 2024, as their demand for comfortable and supportive products in the hospitality, healthcare, and residential sectors is increasing. This includes mattresses, pillows, and cushions, where materials like foams, textiles, fillers, etc., are extensively used. Moreover, the growing demand for quality sleep experiences from consumers and new developments in hypoallergenic and eco-friendly materials are propelling market growth. Furthermore, the increasing wellness and self-care trend is fueling demand for premium bedding and cushioning products in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 38.6%, due to its rapid healthcare expansion, substantial investments, and innovations in medical technologies. For instance, South Korea's development of specialized antimicrobial foam dressings showcases the leadership of the country in integrating advanced, high-performance materials into diverse medical applications, which is escalating the market appeal. In addition to this, the region's growing aging population and increasing prevalence of chronic conditions are further driving demand for medical foam products in healthcare settings.

Key Regional Takeaways:

United States Medical Foam Market Analysis

The market in the United States is driven by the rising need for advanced healthcare products. With increasing infection control standards, and proper hygiene practices associated with health centers, usage levels of medical foams are accelerating in wound management, surgical applications, and even cushioning properties. The versatility of medical foam, which can be tailored for properties such as antimicrobial resistance, breathability, and durability, makes it essential in meeting the diverse needs of healthcare providers and patients. Besides this, the expanding elderly population further fuels the market, as aging individuals require more medical interventions, thereby fostering demand for foam in prosthetics, orthotics, and other patient care products. According to the Population Reference Bureau, by 2050, it is estimated that 82 Million Americans will be over 65 years of age. Moreover, advancement in foam technology allows for innovation in materials to create memory foam and polyurethane. One of the significant drivers of the market is the escalating demand for home health care services where light, portable, and economical materials are paramount. Medical foam meets such requirements and sees wide usage within home medical products, including mattresses, cushions, and mobility assistive devices, which in turn is supporting the market. In addition to this, strict regulation that helps to encourage better and greener materials is improving investment in ecologically friendly as well as biobased-based foam solutions.

Asia Pacific Medical Foam Market Analysis

Expansion of healthcare infrastructure along with the improvement in healthcare expenditures and growing consciousness about advanced materials in medical sector is propelling the Asia Pacific medical foam market. Additionally, rapidly urbanizing economy and developing counties such as China, India and Southeast Asian are investing heavily on healthcare facilities, as a result, heightened demand arises for medical foams in terms of surgical devices, wound caring products, as well as mattress in hospitals. According to the Press Information Bureau, by 2030, it is estimated that over 40% of the population in India will reside in urban regions. Moreover, the growing rate of chronic diseases and aging population in the region is driving the demand for medical foam in prosthetics, orthotics, and patient-support products. Healthcare providers are focusing on patient comfort and safety, and this is raising the demand for medical foam due to its versatility and features such as antimicrobial properties, breathability, and pressure-relief. In addition, home healthcare services are gaining momentum in Asia Pacific due to the increasing number of elderly consumers requiring long-term care. Medical foam is widely used in home medical devices, such as cushions, mattresses, and mobility aids, due to its lightness and versatility. Apart from this, the increasing need for eco-friendly and biodegradable foam solutions is providing a favorable market scenario.

Europe Medical Foam Market Analysis

Factors such as aging population, rising demand for advanced healthcare infrastructure, and the growing requirement for new and innovative medical materials are helping drive the growth in the market in Europe. Countries such as Germany, France, and the United Kingdom have long-established healthcare systems that have the high standard of patient care. Medical foam applications include wound care, medical devices, and hospital bedding. Additionally, an increasing aging population across Europe contributes significantly to this potential, as it increases the demand for medical products including prosthetics, orthotics, and cushioning materials that are always used to support and enhance the comfort of patients. According to the reports, the EU population accounted for 448.8 million people on 1 January 2023 and more than one-fifth (21.3%) of it aged 65 years and over. Chronic diseases and problems of mobility linked to aging increase the demand for medical foam in therapeutic mattresses, cushions, and rehabilitation devices. In addition, ongoing technological innovation in foam manufacture enables the generation of high-performance materials designed according to specific needs in healthcare. Properties such as antimicrobial resistance, breathability, and pressure-relief qualify medical foam for infection control and patient care purposes. Further, the region's stringent regulations and commitment to reducing carbon footprints is catalyzing the demand for eco-friendly and biodegradable foam solutions. Manufacturers are innovating to meet these requirements, in line with the European Green Deal and other sustainability goals.

Latin America Medical Foam Market Analysis

The Latin America medical foam market is mainly driven by growing investments in healthcare infrastructure, an increasing amount of healthcare expenditure, and the growing prevalence of chronic diseases. As per a research article, around 70% of Brazilians acquire at least one chronic disease by age 60 years, thereby showing a high load of several chronic diseases. Countries such as Brazil, Mexico, and Argentina are investing in healthcare, which increases demand for advanced materials, such as medical foam for wound care, surgical tools, and patient-support products. Ongoing technological advancements and affordable foam solutions also support the price-sensitive market of the region. Additionally, heightened awareness of infection control, especially post-pandemic, is increasing the adoption of medical foam in personal protective equipment (PPE) and medical packaging, ensuring its continued relevance in the healthcare sector.

Middle East and Africa Medical Foam Market Analysis

The Middle East and Africa medical foam market is driven by expanding healthcare infrastructure, increasing investment in medical services, and a growing focus on patient care. As per the industry report, healthcare spending in the GCC regions is likely to grow to USD 135.5 Billion by 2027. Along these lines, urbanization and economic growth in the UAE, Saudi Arabia, and South Africa is fostering the demand for sophisticated healthcare materials such as medical foam for use in surgical instruments, wound care products, and hospital mattresses. Moreover, the increase in chronic diseases and an aging population are raising the demand for foam in orthotics, prosthetics, and cushioning applications. In addition, the rise in home healthcare solutions, encouraged by cost savings and convenience, supports the demand for foam in portable medical devices and mobility aids.

Competitive Landscape:

The medical foam market is highly competitive, driven by increasing demand for advanced wound care, infection prevention, and medical packaging. It is fueled by rising healthcare expenditure, technological advancement, and a need for lightweight, durable, and biocompatible materials. The market can be segmented based on type, namely flexible, rigid, and spray foam, as well as applications such as prosthetics, wound care, and medical devices. Key players focus on innovation, product customization, and regulatory compliance to gain market share. Emerging economies and an aging population further drive demand, which intensifies competition and fosters continuous research and development. .

The report provides a comprehensive analysis of the competitive landscape in the medical foam market with detailed profiles of all major companies, including:

- Advanced Medical Solutions Group Plc

- BASF SE

- Draka Interfoam B.V.

- Foamtec Medical

- Freudenberg Performance Materials

- FXI

- General Plastics Manufacturing Company Inc.

- Global Medical Foam Inc.

- Inoac Corporation

- Recticel NV

- Rogers Corporation

- SEKISUI CHEMICAL CO. LTD.

- Ufp Technologies Inc.

Latest News and Developments:

- July 2024: AMS BioteQ, a Taiwanese biotech firm, received a first-class medical device sales permit from Japan's PMDA for its SIPSIP Foam Wound Dressing, marking its entry into the Japanese market. This innovative product, designed for wound care in the elderly and diabetic populations, boasts excellent anti-adhesion and absorbency properties. With plans to launch additional products and expand into Southeast Asia and MENA, AMS BioteQ aims to address the rising global demand for chronic wound care.

- January 2024: Arcutis Biotherapeutics launched ZORYVE® (roflumilast) topical foam, 0.3%, in the U.S. for treating seborrheic dermatitis in individuals aged 9 and older. This steroid-free foam is the first new treatment for this condition in over 20 years, offering a once-daily application with a unique water-based formulation suitable for various skin types. Clinical trials showed significant efficacy, with over half of participants achieving complete clearance. ZORYVE also includes patient support programs to assist with access and affordability.

- June 2023: Tristel's high-level disinfectant, Tristel ULT, received approval from the U.S. Food and Drug Administration (FDA). This disinfectant foam is designed for use with ultrasound probes, including endocavity transvaginal and transrectal probes, as well as skin surface transducers that may contact non-intact skin. Notably, Tristel ULT boasts a rapid disinfection contact time of just 2 minutes, making it the fastest FDA-approved high-level disinfectant available for these applications.

- May 2023: Probo Medical announced the completion of acquisition of Creative Foam, Inc.’s MRI coil repair operation. In addition to its repair capabilities in other diagnostic imaging modalities, the acquisition enables Probo Medical to provide a greater range of intricate MRI coil repairs internally. Additionally, Probo and Creative Foam have partnered for a long time to re-foam MRI coils, a service that Creative Foam will continue to offer to its clients.

Medical Foam Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rigid, Flexible, Molded |

| Materials Covered | Polymers, Metals, Others |

| Applications Covered | Bedding and Cushioning, Medical Packaging, Medical Devices and Components, Prosthetics and Wound Care, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Medical Solutions Group Plc, BASF SE, Draka Interfoam B.V., Foamtec Medical, Freudenberg Performance Materials, FXI, General Plastics Manufacturing Company Inc., Global Medical Foam Inc., Inoac Corporation, Recticel NV, Rogers Corporation, SEKISUI CHEMICAL CO. LTD., Ufp Technologies Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical foam market from 2019-2033.

- The medical foam market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical foam industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global medical foam market was valued at USD 32.68 Billion in 2024.

The medical foam market is projected to exhibit a CAGR of 5.35% during 2025-2033, reaching a value of USD 53.49 Billion by 2033.

The market is majorly driven by the increasing demand for wound care solutions, advanced healthcare products, and the rising prevalence of chronic diseases. Additionally, the aging population and advancements in foam technology contribute to market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market, holding over 38.6% of the market share in 2024.

Some of the major players in the global medical foam market include Advanced Medical Solutions Group Plc, BASF SE, Draka Interfoam B.V., Foamtec Medical, Freudenberg Performance Materials, FXI, General Plastics Manufacturing Company Inc., Global Medical Foam Inc., Inoac Corporation, Recticel NV, Rogers Corporation, SEKISUI CHEMICAL CO. LTD., and Ufp Technologies Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)