Medical Exoskeleton Market Size, Share, Trends and Forecast by Component, Type, Extremity, Mobility, End User, and Region, 2025-2033

Medical Exoskeleton Market Size and Share:

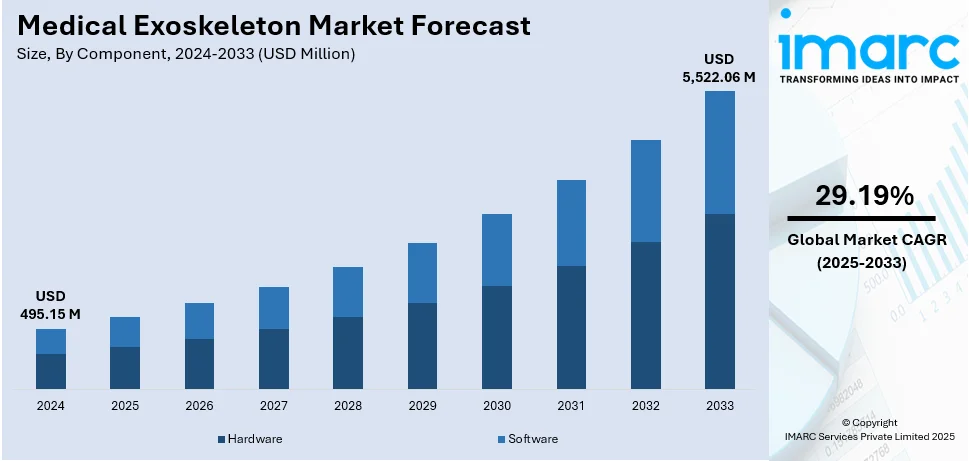

The global medical exoskeleton market size was valued at USD 495.15 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 5,522.06 Million by 2033, exhibiting a CAGR of 29.19% during 2025-2033. North America currently dominates the market, holding a significant market share of 36.5% in 2024. Increased investments and funding drive innovation, making exoskeletons more efficient and accessible. Advancements in artificial intelligence (AI) and sensor technology enhance real-time movement adaptation for better rehabilitation. Regulatory approvals and insurance coverage accelerate medical exoskeleton market share by ensuring safety and affordability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 495.15 Million |

| Market Forecast in 2033 | USD 5,522.06 Million |

| Market Growth Rate (2025-2033) | 29.19% |

The aging population is significantly driving the medical exoskeleton market by increasing demand for mobility assistance. Elderly individuals face higher risks of mobility impairments, requiring advanced solutions for daily movement support. Medical exoskeletons help seniors regain mobility, reducing dependence on caregivers and improving overall quality of life. Rising cases of age-related conditions like arthritis and osteoporosis further catalyzes the demand for wearable exoskeletons. These devices provide enhanced stability and fall prevention, addressing key mobility challenges among older adults. Healthcare providers increasingly recommend exoskeleton-assisted rehabilitation, improving recovery outcomes for elderly patients after injuries. Advancements in lightweight and ergonomic exoskeleton designs enhance comfort, making them suitable for extended use. AI-driven adaptive movement support systems allow personalized assistance, catering to individual mobility needs.

Growing investment in research and development (R&D) is significantly driving the United States medical exoskeleton market demand. Government funding and private sector investments are accelerating the development of innovative exoskeleton technologies. Leading research institutions and universities collaborate with manufacturers, enhancing robotic mobility solutions for rehabilitation. For instance, in February 2025, Wandercraft initiated a pivotal clinical trial for its Personal Exoskeleton, the first self-balancing device for personal use. Designed for individuals with severe mobility impairments, it restores natural walking motions. The trial, underway at the James J. Peters VA Medical Center, will expand to Kessler Institute, evaluating its safety and effectiveness for spinal cord injuries. Moreover, venture capital funding for exoskeleton startups is fostering competition, leading to cost-effective and scalable products. The US Department of Defense invests heavily in exoskeleton research, supporting applications for injured veterans and soldiers. Advancements in AI-driven motion control and biomechanics improve exoskeleton efficiency and adaptive movement support. Medical device companies are focusing on lightweight materials and energy-efficient designs, enhancing user comfort. FDA approvals and regulatory support for wearable exoskeletons ensure faster market entry and increased adoption.

Medical Exoskeleton Market Trends:

Advancements in Wearable Robotics Technology

Continuous advancements in wearable robotics are significantly improving the functionality, comfort, and adaptability of medical exoskeletons. Technological progress is enabling more efficient movement, increased durability, and personalized support for users with mobility impairments. Innovations in lightweight materials, AI-driven motion control, and ergonomic designs enhance user experience, making exoskeletons more practical for rehabilitation and daily use. Engineered to minimize physical strain, modern exoskeletons support muscle engagement while facilitating natural movement patterns. These enhancements contribute to improved rehabilitation outcomes, allowing patients with neurological disorders, spinal cord injuries, and age-related mobility challenges to regain independence. Advanced sensor technology and real-time motion adjustment ensure seamless integration with the user's body movements. In July 2024, Arc'teryx and Skip introduced MO/GO exoskeleton hiking pants, reducing muscle fatigue by 40%, supporting knee joints, and enhancing endurance. This development highlights the broader application of wearable exoskeletons, showcasing their potential for rehabilitation and mobility assistance.

Increasing Demand for Mobility Assistance

Medical exoskeletons provide greater independence, improved mobility, and enhanced quality of life, making them an attractive choice for both rehabilitation centers and personal use. These devices assist users in regaining movement, enabling them to perform daily activities with greater ease. Advanced robotic exoskeletons equipped with AI-driven motion control and sensor-based adaptability further improve user experience. In January 2024, Harvard and Boston University introduced a soft robotic exoskeleton for Parkinson’s patients, reducing falls and eliminating "freezing" episodes. This wearable exoskeleton with cable-driven actuators and movement sensors represents a major advancement in assistive mobility technology for neurological disorders. As age-related disorders such as arthritis, Parkinson’s disease, and stroke become more common, there is a growing need for assistive technologies that enhance movement and reduce dependency.

Regulatory Approvals Driving Market Expansion

Regulatory approvals are crucial for expanding the medical exoskeleton market, ensuring product safety, efficacy, and widespread adoption. Certification from health authorities such as the FDA, CE, and Health Canada validates the performance of exoskeletons, increasing consumer and healthcare provider confidence. As more devices receive regulatory clearance, companies can introduce advanced solutions for rehabilitation and mobility support, strengthening market growth. Approval processes involve rigorous testing, ensuring exoskeletons meet safety standards and deliver effective assistance for users with mobility impairments. Government initiatives and supportive policies further accelerate regulatory approvals, encouraging innovation in wearable robotics for healthcare applications. In September 2024, Human in Motion Robotics secured approval to market XoMotion, the world’s most advanced self-balancing, hands-free medical exoskeleton, in Canada. This breakthrough device is designed to assist patients with spinal cord injuries, stroke, and neurological conditions, representing a significant leap in medical exoskeleton technology.

Medical Exoskeleton Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on component, type, extremity, mobility, and end user.

Analysis by Component:

- Hardware

- Software

Hardware leads the market with 84.0% of market share in 2024. Critical components like sensors, actuators, and power systems contribute significantly to exoskeleton performance and cost. Advanced motion sensors and AI-driven controllers enhance mobility assistance, ensuring precise movement adaptation for users. Lightweight yet durable materials like carbon fiber and titanium improve comfort and long-term usability. High-performance actuators and motors provide necessary force, enabling exoskeletons to assist movement efficiently. Battery advancements play a crucial role, as improved power efficiency extends operational time for continuous mobility support. The high cost of developing and manufacturing hardware makes it the largest revenue-generating segment in the market. Manufacturers focus on hardware improvements, integrating miniaturized components to enhance wearability and comfort. Hardware components undergo rigorous testing and regulatory approvals, further increasing development costs and market share. Innovations in biomechanical engineering ensure seamless interaction between exoskeleton hardware and the human body. Increasing demand for robotic rehabilitation solutions drives continuous improvements in hardware technologies.

Analysis by Type:

- Powered Exoskeletons

- Passive Exoskeletons

Powered exoskeletons lead the market with 87.8% of market share in 2024. These systems use electric motors, hydraulics, or pneumatics, providing active support for users with mobility impairments. AI-driven control systems enable real-time movement adjustments, ensuring adaptive support based on user needs. Rehabilitation centers and hospitals prefer powered exoskeletons, as they offer enhanced gait training for patients. Advanced battery technologies improve operational efficiency, reducing downtime and increasing user independence. The increasing prevalence of neurological disorders and spinal cord injuries drives demand for powered exoskeletons. Their ability to generate mechanical force makes them ideal for individuals with severe mobility challenges. Ongoing advancements in robotic exoskeletons continue to improve weight distribution and comfort for extended wear. Rising government support and insurance reimbursements make powered exoskeletons more accessible for medical and personal use. Leading manufacturers focus on developing lightweight, high-performance exoskeletons, expanding their application in healthcare. Wearable robotics innovations enhance energy efficiency, making powered exoskeletons more practical for daily use. The growing demand for automated rehabilitation solutions further cements powered exoskeletons as the leading market segment.

Analysis by Extremity:

- Lower Extremity Medical Exoskeletons

- Upper Extremity Medical Exoskeletons

- Full Body

Lower extremity medical exoskeletons dominate the market with 52.6% of market share in 2024. Patients with spinal cord injuries, stroke, and neuromuscular disorders benefit significantly from lower limb exoskeletons. These devices enhance gait training, allowing individuals to regain walking ability through rehabilitation therapy. Hospitals and rehabilitation centers widely adopt lower extremity exoskeletons, increasing their market demand. Improved biomechanical engineering ensures seamless movement synchronization, enhancing user comfort and efficiency. The rising geriatric population further increases demand for lower limb support solutions. These exoskeletons reduce the risk of falls, improving mobility in elderly and disabled individuals. Technological advancements in motorized knee and hip support enhance functionality and ease of use. AI-driven motion assistance provides personalized support, ensuring adaptive rehabilitation therapy for users. The high cost of lower extremity exoskeletons reflects the complexity of their mechanics and design. Healthcare professionals prioritize lower limb exoskeletons, as walking rehabilitation is a primary focus in physical therapy. Research in lightweight and energy-efficient materials continues to improve lower extremity exoskeleton performance.

Analysis by Mobility:

- Mobile Exoskeletons

- Stationary Exoskeletons

Mobile exoskeletons are gaining traction due to their ability to provide real-time mobility assistance for users. These devices allow individuals with spinal cord injuries, stroke, or neurological disorders to regain independent movement. Advancements in AI-driven motion control and lightweight materials enhance comfort and adaptability. Rehabilitation centers and home users increasingly adopt mobile exoskeletons for daily mobility support. Battery efficiency and wireless connectivity improvements further enhance their practicality.

Stationary exoskeletons are widely used in rehabilitation centers for controlled therapy and muscle reactivation. These devices provide targeted assistance for patients recovering from spinal cord injuries, stroke, or musculoskeletal disorders. Healthcare professionals prefer stationary exoskeletons for supervised gait training and muscle strengthening programs. Advanced robotics and sensor technologies enable precise movement patterns, improving rehabilitation outcomes. Government initiatives and insurance coverage for robotic therapy support market growth. Hospitals and therapy centers continue investing in stationary exoskeletons for structured rehabilitation programs.

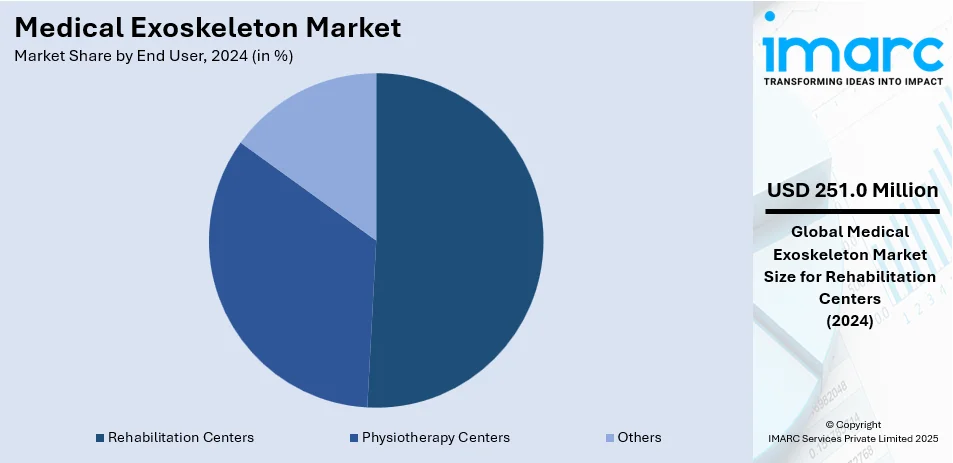

Analysis by End User:

- Rehabilitation Centers

- Physiotherapy Centers

- Others

Rehabilitation centers lead the market with 50.7% of market share in 2024. These facilities integrate exoskeletons into therapy programs, helping patients regain mobility after injuries. Exoskeleton-assisted rehabilitation improves walking ability, making it a preferred solution for physical therapy. Rising cases of spinal cord injuries and stroke-related mobility issues drive demand for rehabilitation services. Medical professionals use exoskeletons for gait training, enhancing patient recovery outcomes. Hospitals and clinics partner with exoskeleton manufacturers, ensuring access to the latest rehabilitation technologies. Government healthcare initiatives support rehabilitation programs, increasing market growth for medical exoskeletons. Advanced AI-driven rehabilitation exoskeletons offer personalized therapy, improving patient progress tracking. Higher insurance reimbursements for exoskeleton-based therapy encourage rehabilitation centers to invest in this technology. Continuous research and development (R&D) in robotic rehabilitation solutions ensures exoskeletons remain an essential part of physiotherapy. The increasing focus on patient-centered care drives the adoption of medical exoskeletons in therapy.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 36.5%. The United States and Canada invest heavily in medical robotics, accelerating exoskeleton research and development (R&D). Government initiatives and funding for assistive technologies fuels the market growth in the region. Leading medical exoskeleton manufacturers are headquartered in North America, strengthening the market landscape. High prevalence of spinal cord injuries and neurological disorders increases demand for mobility assistance solutions. Strong collaborations between research institutions and healthcare providers drive exoskeleton innovation and adoption. Expanding insurance coverage for exoskeleton-assisted rehabilitation enhances patient accessibility in the region. Military and defense research on wearable robotics further contributes to market expansion. Artificial intelligence (AI) and Internet of Things (IoT)-driven advancements in medical robotics position North America as a global leader in exoskeleton technology. Rising geriatric population and mobility impairments increase the demand for advanced rehabilitation solutions. Widespread presence of rehabilitation centers and hospitals accelerates medical exoskeleton integration into therapy. Venture capital investments in healthcare robotics startups fuel market expansion. Continuous technological improvements in wearable robotics strengthen North America’s dominance.

Key Regional Takeaways:

United States Medical Exoskeleton Market Analysis

The United States hold 91.10% of the market share in North America. The rising incidence of spinal cord injuries and work-related musculoskeletal disorders is significantly accelerating the growth of the market. According to the National Spinal Cord Injury Statistical Center (NSCISC), approximately 17,730 new spinal cord injuries are diagnosed annually in the US, with nearly 291,000 individuals currently living with SCIs. These injuries often lead to long-term mobility impairments, increasing the need for effective rehabilitation solutions such as medical exoskeletons. Workplace injuries further contribute to market expansion, with musculoskeletal disorders being a major concern across industries. The US Bureau of Labor Statistics reported 502,380 cases of occupational musculoskeletal disorders in 2022, highlighting the growing demand for assistive mobility technologies to aid recovery. As more workers require advanced rehabilitation solutions, the adoption of medical exoskeletons continues to rise. Market growth is further supported by technological advancements in robotic exoskeletons, favorable insurance policies, and increased healthcare funding. Expanding research efforts, AI-driven innovations, and greater accessibility to rehabilitation technologies are expected to drive significant market expansion. With ongoing developments in wearable robotics and increasing support for mobility assistance, the US medical exoskeleton market outlook is set for substantial growth in the coming years.

Asia Pacific Medical Exoskeleton Market Analysis

The Asia Pacific market is expanding rapidly, driven by technological advancements and growing collaborations in assistive mobility solutions. In June 2022, CYBERDYNE Inc. partnered with Malaysia’s Social Security Organization (SOCSO) to expand Cybernics Treatment using its Hybrid Assistive Limb (HAL) exoskeleton. This initiative has increased access to robotic rehabilitation for SOCSO-insured patients, accelerating the adoption of medical exoskeletons across Southeast Asia. India’s health tech sector is also advancing in robotic exoskeleton development, contributing to regional market growth. In 2020, GenElek Technologies, a New Delhi-based startup, introduced an advanced robotic exoskeleton designed to assist individuals with mobility impairments. The rising prevalence of spinal cord injuries, neurological disorders, and workplace-related musculoskeletal conditions is further driving demand. Increasing government support, healthcare investments, and the expansion of rehabilitation facilities integrating exoskeleton technology are strengthening the market growth. Innovations in AI-driven mobility solutions and improvements in affordability are making exoskeletons more accessible across the region.

Europe Medical Exoskeleton Market Analysis

The rising prevalence of neurological diseases is a key driver of the Europe market, fueling demand for assistive mobility solutions. According to the European Academy of Neurology (EAN), one in three people worldwide experience a neurological disorder in their lifetime. Conditions such as stroke, multiple sclerosis, Parkinson’s disease, and spinal cord injuries significantly impact mobility, increasing the need for advanced rehabilitation technologies in Europe. Medical exoskeletons enhance mobility and independence, playing a vital role in neurological rehabilitation and long-term care. European governments and healthcare providers are heavily investing in robotic-assisted therapy, recognizing its benefits for patient recovery. Advancements in AI-powered exoskeletons and wearable robotics are further driving innovation and adoption across the region. Supportive reimbursement policies and growing integration of exoskeletons in hospitals and rehabilitation centers are strengthening market expansion. As neurological disorders continue to rise, the demand for cutting-edge medical exoskeletons is expected to grow. With continuous technological progress and increased healthcare funding, the Europe medical exoskeleton market is poised for substantial long-term growth.

Latin America Medical Exoskeleton Market Analysis

The rapidly aging population in Latin America is a major driver inducing growth in the medical exoskeleton market. Industry reports show that Brazil’s population aged 65 and older grew by 57%, increasing from 14.1 million in 2010 to 22.2 million in 2022. This demographic now comprises 11% of the total population, with another 10 million individuals aged 60–65 requiring mobility assistance. Age-related conditions such as stroke, arthritis, and neurodegenerative disorders are further driving demand for assistive robotic exoskeletons. Governments and healthcare providers in Brazil, Mexico, and Argentina are investing in advanced rehabilitation technologies to enhance mobility solutions for elderly individuals. Expanding healthcare infrastructure and rising public awareness are contributing to greater adoption of wearable exoskeletons. AI-powered robotics and smart rehabilitation systems are further revolutionizing elderly care, making exoskeletons more effective and accessible.

Middle East and Africa Medical Exoskeleton Market Analysis

The Middle East and Africa region market is expanding due to rising investments in robotic technologies and healthcare applications. The growing adoption of exoskeletons in rehabilitation centers and hospitals is propelling market growth across the region. In February 2021, Paramount Group and Sarcos Robotics signed an agreement to introduce advanced robotic systems for defense and industrial use. This initiative has paved the way for integrating exoskeleton technology into medical and assistive mobility solutions. The increasing prevalence of spinal cord injuries, stroke, and musculoskeletal disorders has intensified the need for robotic rehabilitation devices. Governments in the region are investing in healthcare infrastructure and promoting awareness of assistive technologies, further accelerating market expansion. International collaborations with leading exoskeleton manufacturers are enhancing accessibility to cutting-edge wearable robotics. As technological advancements continue, medical exoskeleton adoption is expected to rise across the Middle East and Africa.

Competitive Landscape:

Major companies are spending immensely in research and development (R&D) to improve exoskeleton efficiency, comfort, and functionality. Strategic partnerships between medical device firms and technology companies accelerate advancements in AI-driven mobility solutions. Moreover, AI-powered exoskeletons are transforming rehabilitation by enhancing mobility for individuals with spinal cord injuries and neurological conditions. To expand the horizon of AI integration, Ekso Bionics hosted a webinar in November 2024. Katherine Strausser, Principal Controls Engineer, joined the AI for Good webinar, "AI-powered Exo skeletons Revolutionizing Rehabilitation and Mobility". The session discusses advancements in exoskeleton technology and its impact on medical rehabilitation. Interested participants can register online. Additionally, major manufacturers are focusing on lightweight materials and ergonomic designs, enhancing user experience and long-term wearability. Continuous product innovation by key players ensures medical exoskeletons meet evolving rehabilitation and mobility assistance needs. Collaborations with healthcare providers and rehabilitation centers expand exoskeleton accessibility for patients with mobility impairments. Key players prioritize regulatory compliance and safety standards, ensuring approval from government agencies like FDA and CE. Expanding production capabilities and distribution networks allow companies to penetrate emerging markets and increase adoption. Investments in AI and sensor technology enhance real-time movement adaptation, providing personalized support for users.

The report provides a comprehensive analysis of the competitive landscape in the medical exoskeleton market with detailed profiles of all major companies, including:

- B-Temia Inc.

- Cyberdyne Inc.

- Ekso Bionics Holdings Inc.

- ExoAtlet Global S.A.

- GOGOA Mobility Robots

- Hocoma AG (DIH International Limited)

- Myomo Inc.

- ReWalk Robotics Ltd

- Rex Bionics Ltd.

- suitX Inc. (Ottobock SE & Co. KGaA)

- Wandercraft

- Wearable Robotics Srl

Latest News and Developments:

- September 2024: Human in Motion Robotics has obtained regulatory approval in Canada to commercialize XoMotion, the world’s most advanced self-balancing, hands-free medical exoskeleton. Designed for rehabilitation, it assists patients recovering from spinal cord injuries, strokes, and neurological disorders, enhancing mobility and independence.

- July 2024: Arc'teryx and Skip introduced the MO/GO exoskeleton hiking pants, designed to reduce muscle fatigue by 40%, provide knee support, and enhance hiking endurance.

- January 2024: Harvard and Boston University developed a soft robotic exoskeleton for Parkinson's patients, enhancing walking and preventing falls by eliminating "freezing" episodes.

Medical Exoskeleton Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Types Covered | Powered Exoskeletons, Passive Exoskeletons |

| Extremities Covered | Lower Extremity Medical Exoskeletons, Upper Extremity Medical Exoskeletons, Full Body |

| Mobilites Covered | Mobile Exoskeletons, Stationary Exoskeletons |

| End Users Covered | Rehabilitation Centers, Physiotherapy Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B-Temia Inc., Cyberdyne Inc., Ekso Bionics Holdings Inc., ExoAtlet Global S.A., GOGOA Mobility Robots, Hocoma AG (DIH International Limited), Myomo Inc., ReWalk Robotics Ltd, Rex Bionics Ltd., suitX Inc. (Ottobock SE & Co. KGaA), Wandercraft, Wearable Robotics Srl, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, medical exoskeleton market outlook, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global medical exoskeleton market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the medical exoskeleton industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical exoskeleton market was valued at USD 495.15 Million in 2025-2033.

The medical exoskeleton market is projected to exhibit a CAGR of 29.19% during 2025-2033, reaching a value of USD 5,522.06 Million by 2033.

The medical exoskeleton market growth is driven by increasing demand for mobility assistance, rising cases of spinal cord injuries, and an expanding aging population. Advancements in AI-powered robotics, lightweight materials, and battery efficiency are improving functionality and adoption. Expanding rehabilitation programs and healthcare investments support market growth, alongside favorable regulatory approvals and insurance reimbursements.

North America currently dominates the medical exoskeleton market, accounting for a share of 36.5% in 2024. The rising prevalence of spinal cord injuries, neurological disorders, and workplace musculoskeletal conditions drives demand for rehabilitation technologies. Favorable insurance policies, regulatory approvals, and increased R&D investments in wearable robotics further drives market expansion.

Some of the major players in the medical exoskeleton market include B-Temia Inc., Cyberdyne Inc., Ekso Bionics Holdings Inc., ExoAtlet Global S.A., GOGOA Mobility Robots, Hocoma AG (DIH International Limited), Myomo Inc., ReWalk Robotics Ltd, Rex Bionics Ltd., suitX Inc. (Ottobock SE & Co. KGaA), Wandercraft, Wearable Robotics Srl, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)