Medical Display Market Size, Share, Trends and Forecast by Device, Panel Size, Resolution, Technology, Application, End User, and Region, 2025-2033

Medical Display Market Size and Share:

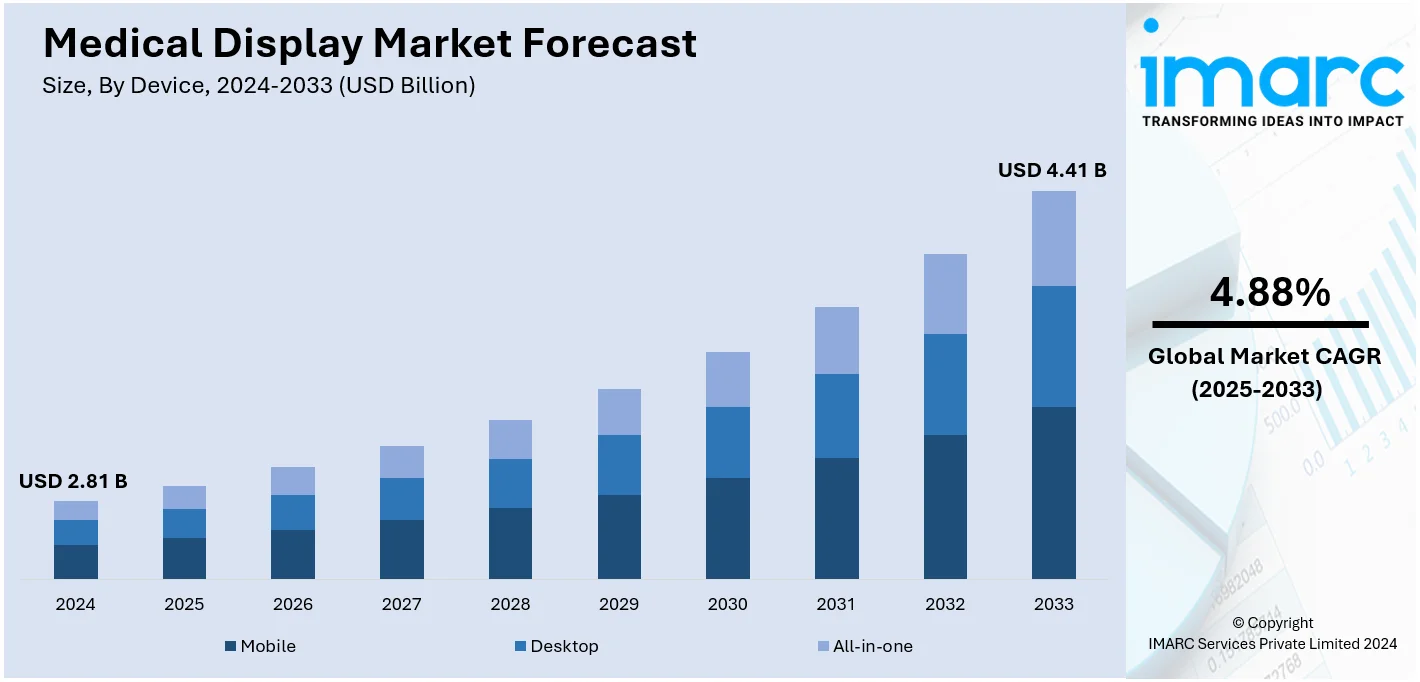

The global medical display market size was valued at USD 2.81 Billion in 2024. Looking forward, the market is forecasted to reach USD 4.41 Billion by 2033, exhibiting a CAGR of 4.88% from 2025-2033. Asia Pacific currently dominates the market with 33.8% in 2024. The medical display market share is primarily driven by the rapid expansion of telemedicine and teleradiology services, recent advancements in medical imaging technology, rising prevalence of chronic diseases and aging population, and increasing regulatory compliance requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.81 Billion |

|

Market Forecast in 2033

|

USD 4.41 Billion |

| Market Growth Rate 2025-2033 | 4.88% |

The expansion of telemedicine and teleradiology is significantly fueling the global medical display market. In 2024, the global telemedicine market was valued at approximately USD 91.5 billion and is projected to grow at a rate of 21.71% from 2025 to 2033, reaching a staggering value of USD 540.0 billion in 2033. Additionally, teleradiology, which involves the remote transmission and interpretation of medical images, has seen substantial growth due to technological advancements and the increasing demand for remote healthcare services. This industry is expected to reach 20.1 billion by 2033, growing at an annual rate of 13.2% between 2025 and 2033. As these services expand, there is an increased demand for high-quality medical displays that ensure precise image reproduction, essential for accurate remote diagnoses. Furthermore, healthcare facilities are investing in advanced medical-grade monitors that comply with stringent standards to support the growing teleradiology and telemedicine infrastructure.

The medical display market in the United States is experiencing significant growth, driven by various key factors. The adoption of advanced imaging technologies, such as 3D and 4K displays, enhances diagnostic accuracy and efficiency. These innovations are essential for applications like radiology and digital pathology, where high-resolution imaging is critical. Additionally, the increasing prevalence of chronic diseases and rising geriatric population have led to a higher demand for diagnostic imaging services. This surge necessitates the adoption of high-quality medical displays to support accurate diagnostics. Furthermore, the growth of telemedicine and remote diagnostic services has accelerated the need for reliable and high-resolution medical displays. These displays are crucial for healthcare professionals to precisely interpret medical images during virtual consultations.

Medical Display Market Trends:

Advancements in Medical Imaging Technology

With the continuous developments in medical imaging technologies like MRI, CT scans, and X-rays, the demand for high-resolution medical displays is increasing. These displays have a crucial role in the correct interpretation of complex medical images. The increased need for advanced medical monitors with enhanced resolution, color accuracy, and durability is also supported by the aging population of the world. By projecting the number of people aged 65 and over to double by the next 30 years to 1.6 billion, the United Nations Population Division can see that it will be up to 2050. Such a large aging population would need constant medical imaging with regard to diseases, thus upping the need for high quality medical displays. This demographic shift, coupled with advancements in imaging technology, will fuel significant growth in the medical display market, ensuring the development of monitors capable of supporting the increasingly complex healthcare needs of aging populations.

Rising Prevalence of Chronic Diseases and Aging Populations

Rising cases of chronic conditions like cancer, cardiovascular diseases (CVDs) and neurological disorders have significantly boosted the demand for high-resolution diagnostic equipment. Accurate evaluation of these complex conditions calls for the right medical display. With the world's aging population, health providers are relying on these high-resolution displays more and more to enhance diagnostics and patient care. According to the WHO, around 3.6 billion diagnostic tests are performed around the world each year, out of which approximately 350 million are pediatric-related. As medical needs continue to rise, along with the older population requiring periodic check-ups, the need for high-quality medical displays that promote accurate diagnosis and improved patient results will keep going up, meaning steady growth for the medical display market.

Regulatory and Technological Compliance Requirements

The FDA regulations and CE certification are some of the healthcare regulatory requirements that ensure higher standards are met in the medical display devices. These regulations also require accurate and reliable imaging; therefore, people are developing medical-grade displays and adopting them due to enhanced features such as good color consistency, brightness, and ergonomic designs. In line with these changing expectations, medical imaging companies are adopting new technologies as a way to meet regulatory standards and market needs. For instance, Canon Medical's Vantage Galan 3T / Supreme Edition introduced in April of 2024 is a monumental step forward for MRI technology. This cutting-edge system features Canon-exclusive components- a new, real-time platform and superior magnet technology, engineered in Japan. Such innovations in imaging technology are driving the demand for medical displays that can accurately interpret high-resolution images, thus ensuring continued growth in the medical display market as healthcare standards evolve globally.

Medical Display Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical display market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on device, panel size, resolution, technology, application, and end user.

Analysis by Device:

- Mobile

- Desktop

- All-in-one

Desktop medical displays lead the market due to their widespread use in diagnostic imaging, teleradiology, and telemedicine. Their high resolution, enhanced brightness, and precise image quality make them indispensable for radiologists and other healthcare professionals. Desktop displays are often integrated with DICOM-compliant calibration tools, ensuring consistency in image interpretation. Additionally, their cost-effectiveness and versatility in hospital and clinical settings contribute to their dominance. The rise in telehealth services has further bolstered demand for desktop displays, as they are crucial for remote consultations and image analysis. Leading manufacturers focus on improving desktop display ergonomics and energy efficiency, which adds to their appeal in clinical environments.

Analysis by Panel Size:

.webp)

- Up to-22.9-inch

- 23.0–26.9-inch

- 27.0–41.9-inch

- Above-42-inch

Medical displays within the 27.0-41.9 inch range dominate with a share of 37.0%. It is driven due to their balanced size, providing sufficient screen real estate for detailed image visualization without compromising desk space. These displays are ideal for applications such as radiology and surgical imaging, where multi-monitor setups or large, high-resolution displays are often required. The size range supports high pixel density and multiple viewing angles, ensuring precision and comfort for medical professionals. The growing trend toward multi-modality imaging, where various imaging outputs are reviewed simultaneously, has driven demand for larger panel sizes in this category.

Analysis by Resolution:

- Up to 2MP

- 2.1 to 4MP

- 4.1 to 8MP

- Above 8MP

Displays with 2.1 to 4MP dominate the market because they provide an optimal balance between image detail and affordability. These resolutions are sufficient for most medical imaging applications, including radiology, pathology, and surgery. They offer high grayscale precision and excellent color accuracy, essential for diagnostic purposes. Manufacturers prioritize this segment, providing advanced features such as AI-enhanced visualization, automated calibration, and glare reduction. The dominance of this resolution range reflects the growing demand for cost-effective solutions that meet strict regulatory and performance standards.

Analysis by Technology:

- Light Emitting Diode (LED)

- Backlit Liquid Crystal Display

- Organic Light Emitting Diode (OLED) Display

- Cold Cathode Fluorescent Light (CCFL)

- Others

Light-emitting diode (LED) displays dominate due to their brightness, energy efficiency, and durability. Backlit liquid crystal displays (LCDs) remain popular for their affordability and wide application range, particularly in diagnostic imaging. Organic LED (OLED) displays, known for superior color accuracy and contrast, are gaining traction in advanced imaging fields such as pathology and surgery. Meanwhile, cold cathode fluorescent light (CCFL) displays, though largely phased out, persist in some budget-sensitive markets. The integration of AI and 4K/8K technology across these categories further boosts demand.

Analysis by Application:

- Digital Pathology

- Multi-modality

- Surgical

- Radiology

- Mammography

- Others

Digital pathology is a pivotal segment, fueled by the transition from traditional microscopy to digital ones. Pathologists rely on color-accurate, high-resolution displays to analyze digital slides for disease diagnosis, particularly in cancer pathology. Radiology, a cornerstone of diagnostic imaging, demands displays that offer high-resolution, DICOM-compliant performance for interpreting X-rays, CT scans, MRIs, and PET images. These displays ensure accurate grayscale and color representation, enabling radiologists to detect minute abnormalities. Surgical imaging is another critical application, where displays are used in operating rooms for minimally invasive and robotic surgeries, and multi-modality imaging, which integrates data from multiple imaging techniques. Mammography, requiring ultra-high resolution and contrast, also remains a vital segment.

Analysis by End User:

- Hospitals

- Diagnostic Centres

- Community Healthcare

Diagnostic centers are the leading end users due to their high reliance on imaging technologies for disease diagnosis and monitoring. These centers invest heavily in advanced displays to meet the demands of radiologists and pathologists for precision and efficiency. The proliferation of diagnostic imaging in preventive healthcare and the expansion of standalone diagnostic centers in emerging markets further drive this dominance. Partnerships between diagnostic centers and technology providers ensure continuous upgrades in display technology.

Analysis by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific is the fastest-growing region with a share of 33.8% in the medical display market, driven by rising healthcare expenditures, expanding diagnostic infrastructure, and increasing adoption of advanced imaging technologies. Countries like China, India, and Japan are investing heavily in healthcare modernization, creating significant demand for medical-grade displays. The implementation of various government incentives to enhance rural healthcare access and telemedicine adoption have further accelerated growth. The region's growing population base and rising prevalence of chronic diseases make it a lucrative market for medical display manufacturers.

Key Regional Takeaways:

North America Medical Display Market Analysis

The medical display market in North America is experiencing significant growth, driven by a combination of technological advancements, healthcare infrastructure, and increasing demand for high-quality medical imaging. Technological innovation is a key driver, with companies in the region leading the development of high-resolution, AI-powered displays designed for diagnostic imaging, surgical procedures, and digital pathology. The integration of artificial intelligence (AI) and machine learning (ML) in imaging systems has heightened the need for precise and reliable displays to ensure accurate image interpretation. The region's advanced healthcare infrastructure supports the adoption of cutting-edge medical devices, including premium medical-grade displays. Government and private sector investments in modernizing hospitals and diagnostic centers further bolster demand. The rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions necessitates frequent diagnostic imaging, fueling the need for high-performance displays.

United States Medical Display Market Analysis

With the increased prevalence of chronic diseases like cancer, the demand for medical display will further expand in the U.S. market. Accordingly, estimated new cases of cancer were 1,958,310 and 609,820 estimated cancer deaths in 2023 in the United States, whereas the U.S. National Center for Health Statistics reported the need for such precise and timely diagnostic tools in present times. Indeed, high-resolution medical displays have become the tool of choice in the accurate interpretation of imaging from modalities such as MRI, CT scans, mammography in early detection and in the treatment plan. Due to the increased use of advanced imaging systems by health care providers in upgrading patient outcomes, that demand for specialized medical-grade displays with higher resolution, color accuracy, and long durability is ever increasing. This increasing focus on precision diagnostics, along with advances in imaging technologies, positions the U.S. medical display market for sustained growth in addressing complex healthcare challenges.

Europe Medical Display Market Analysis

The Europe medical display market growth can be described through the demand based on the region's evolution in medical healthcare, and an increase for patients with respiratory disease. Statistics on chronic respiratory diseases in EU-27 between 1990 and 2015 show the trend of dropping to about a 20% rate, before there was moderate increment until the year 2021, as per reports. These fluctuations indicate rising pressure for superior diagnostics and follow-up systems. High-resolution medical displays are an important part of proper interpretation of advanced diagnostic equipment images, such as CT scans and X-rays, which are highly essential in respiratory disease diagnosis and management. Other factors driving adoption include Europe's aging population and rising healthcare costs. Together with the regulatory directives on precision and efficiency in health care services, the demand for medical-grade displays with superior imaging capabilities is at an all-time high, strengthening their position to enhance patient care and diagnostic accuracy in the region.

Asia Pacific Medical Display Market Analysis

The Asia Pacific medical display market is growing at a high rate due to the increased demand for advanced surgical displays, especially in countries like Japan. According to a study published by NCBI in March 2023, the adoption of minimally invasive surgeries for managing endometrial cancer increased to 34% in Japan, showing the growing preference for precise and less invasive medical procedures. This trend is further amplified by Japan's aging population, projected to increase nearly two out of every five individuals 65 years or older by 2050. Given that the elderly are frequently more in need of medical interventions, the demand for high-quality surgical displays is accelerating. This shift is motivating the key players in this market to invest further in the development of technologically advanced and cost-effective medical displays. These innovations play an important role in improving the accuracy of surgeries and supporting an ever-increasing number of minimally invasive procedures conducted within the region.

Latin America Medical Display Market Analysis

The Latin America market for medical displays will show a growth prospect as the region has such high cancer incidence and mortality rates. As per ESMO's 2022 report, it is estimated that an approximate 1.5 million people develop new cases of cancer, and 700,000 die from cancer annually in Latin America and the Caribbean. The incidence and mortality rates of cancer in the region are 186.5 and 86.6 per 100,000, respectively, and hence, the region is in dire need of advanced diagnostic and treatment solutions. The most common cancers in 2020 were prostate (15%), breast (14%), colorectal (9%), lung (7%), and stomach (5%), which need advanced imaging technologies for accurate detection and management. The increasing prevalence of cancer, coupled with high-resolution medical display capabilities to augment diagnostic accuracy and support complex therapies, is one of the growth drivers for such a market. Advanced imaging technologies will be leading the way forward as healthcare organizations continue to upgrade their imaging platforms.

Middle East and Africa Medical Display Market Analysis

The Middle East and Africa medical display market is growing, as the region has a high prevalence of cardiovascular diseases. In 2021, the United Arab Emirates had the highest age-standardized prevalence rate of CVD, with 11,066.8 cases per 100,000 people, according to BMC Cardiovascular Disorders. This alarming statistic focuses on the critical need for improved diagnostic and monitoring solutions across the region. Accurate and timely diagnosis of CVD depends on many occasions on advanced imaging technologies such as echocardiography and angiography, which demand very high-resolution medical displays for proper interpretation. Rising cases of CVD have made governments and healthcare providers spend money on state-of-the-art diagnostic equipment, thereby fueling the demand for medical-grade displays with higher resolution, color accuracy, and reliability. Advanced medical displays will be a significant enabler for the region to overcome its healthcare challenges and, therefore, diagnostic capabilities and improved patient outcomes will be the major drivers for the growth of this market.

Top 11 Medical Display Manufacturers:

Leading players in the medical display market are focusing on strategic partnerships, latest innovations and geographic expansion to maintain a competitive edge. Companies are investing in research and launch of high-resolution, energy-efficient, and AI-integrated medical displays. These innovations serve to diverse applications such diagnostic imaging, diagnostic imaging, surgical monitoring, and telemedicine. Strategic collaborations with hospitals, diagnostic centers, and technology providers enable these companies to enhance their offerings and address specific customer needs. For instance, partnerships with AI firms help integrate advanced image processing capabilities into displays, improving diagnostic accuracy and workflow efficiency. Moreover, sustainability is becoming a priority. Many companies are adopting eco-friendly production practices and introducing energy-efficient displays to align with global environmental standards.

The report provides a comprehensive analysis of the competitive landscape in the medical display market with detailed profiles of all major companies, including:

- Advantech Co. Ltd.

- Axiomtek Co. Ltd.

- Barco NV

- BenQ Medical Technology

- Dell Technologies Inc.

- EIZO Corporation

- LG Electronics Inc.

- Novanta Inc.

- Siemens AG

- Sony Corporation

- Steris Corporation

Latest News and Developments:

- March 2024: Visualization technology leader Barco is working with NVIDIA and SoftAcuity to add AI, powered by NVIDIA Holoscan, into its Nexxis video-over-IP platform. This will support digital operating rooms and interventional suites. According to the press release, Barco will include two AI-enabled products in its Nexxis series, utilizing the NVIDIA Jetson Orin and IGX Orin system-on-modules.

- April 2023: LG Electronics announced the 32HQ713D-B, which it claims is a high-resolution medical monitor at 8MP. This device consists of an impressive 1000 nits as well as LG's proprietary IPS Black panel technology, which promises an enhanced 2,000:1 contrast ratio in addition to deep blacks. Additional upgraded features include the integration of an on-board sensor and accompanying software that handles automated color calibration for the medical professional.

- February 2023: Eizo introduced a 21.3-inch, 2-megapixel (1200 x 1600 pixels) color monitor appropriate for hospital and clinics. It's useful for reading patient's charts and reviewing diagnostic imaging; it's clear and high-functioning enough for medical applications.

Medical Display Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Devices Covered | Mobile, Desktop, All-in-one |

| Panel Sizes Covered | Up to-22.9-inch, 23.0–26.9-inch, 27.0–41.9-inch, Above-42-inch |

| Resolutions Covered | Up to 2MP, 2.1 to 4MP, 4.1 to 8MP, Above 8MP |

| Technologies Covered | Light Emitting Diode (LED), Backlit Liquid Crystal Display, Organic Light Emitting Diode (OLED) Display, Cold Cathode Fluorescent Light (CCFL), Others |

| Applications Covered | Digital Pathology, Multi-modality, Surgical, Radiology, Mammography, Others |

| End Users Covered | Hospitals, Diagnostic Centres, Community Healthcare |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advantech Co. Ltd., Axiomtek Co. Ltd., Barco NV, BenQ Medical Technology, Dell Technologies Inc., EIZO Corporation, LG Electronics Inc., Novanta Inc., Siemens AG, Sony Corporation, Steris Corporation., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical display market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global medical display market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A medical display is a specialized monitor designed for use in healthcare environments to display medical images with high precision, accuracy, and consistency. These displays are essential for diagnostic imaging, surgical procedures, and other clinical applications where detailed visualization is crucial.

The medical display market was valued at USD 2.81 Billion in 2024.

IMARC estimates the global medical display market to exhibit a CAGR of 4.88% during 2025-2033.

The rapid expansion of telemedicine and teleradiology services, recent advancements in medical imaging technology, rising prevalence of chronic diseases and aging population, and increasing regulatory compliance requirements, are some of the important factors propelling the market.

In 2024, desktop represented the largest segment by device type due to their widespread use in diagnostic imaging, teleradiology, and telemedicine.

27.0-41.9-inch leads the market by panel size owing to their balanced size, providing sufficient screen real estate for detailed image visualization without compromising desk space.

The 2.1 to 4MP is the leading segment by resolution because they provide an optimal balance between image detail and affordability.

The diagnostic centres are the leading segment by end user due to their high reliance on imaging technologies for disease diagnosis and monitoring.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global medical display market include Advantech Co. Ltd., Axiomtek Co. Ltd., Barco NV, BenQ Medical Technology, Dell Technologies Inc., EIZO Corporation, LG Electronics Inc., Novanta Inc., Siemens AG, Sony Corporation, Steris Corporation., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)