Medical Device Security Market Size, Share, Trends and Forecast by Device Type, Component, Deployment Mode, End User, and Region, 2025-2033

Medical Device Security Market Size and Trends:

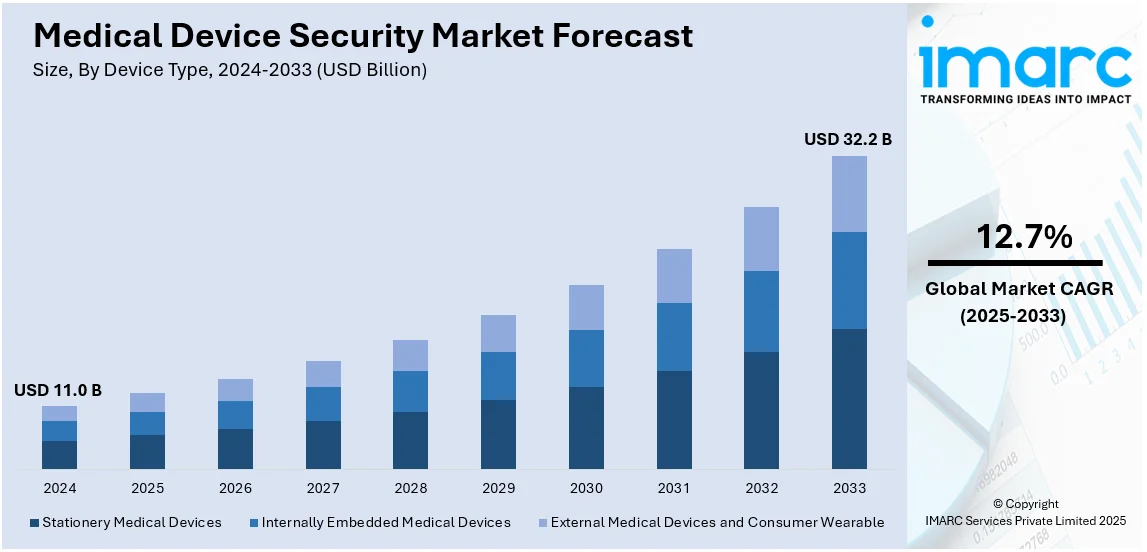

The global medical device security market size was valued at USD 11.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 32.2 Billion by 2033, exhibiting a CAGR of 12.7% from 2025-2033. North America currently dominates the market, holding a market share of over 43.6% in 2024. The medical device security market share is growing due to the increased awareness regarding the importance of advanced security solutions that protect patient data and prevent tampering with devices, the implementation of advanced technologies, and the increasing use of connected medical devices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.0 Billion |

|

Market Forecast in 2033

|

USD 32.2 Billion |

| Market Growth Rate (2025-2033) | 12.7% |

The medical device security market growth is attributed to the integration of healthcare systems with more connected devices. As more medical devices are interconnected and reliant on software, they pose new vulnerabilities to cyberattacks, data breaches, and system failures. The market for securing these devices is expected to grow significantly as the awareness about the risks associated with cyber threats and the necessity of adhering to stringent regulatory requirements increases. Key drivers for the growth of this market are the increase in cyberattacks against healthcare systems, the increasing adoption of IoT-based devices, and the increasing government regulations that demand strong cybersecurity measures. The ever-increasing number of chronic diseases necessitates ongoing monitoring with the help of pacemakers, insulin pumps, and other devices, thereby heightening the demand for effective security solutions. Companies are working toward exploring advanced solutions such as encryption, authentication, and secure communication protocols to minimize the risks linked to vulnerable devices. Healthcare providers and manufacturers are investing in regular software updates, threat detection systems, and risk management frameworks. As cyber threats evolve, the medical device security market will continue to increase in growth, meaning ensuring the safety and privacy of both patients and healthcare providers.

To get more information on this market, Request Sample

The United States has emerged as a key regional market for medical device security due to many connected medical devices and the growing risk of cyberattacks. The vulnerabilities of data breaches and device tampering have been significant concerns in healthcare systems adopting more IoT-enabled devices for patient monitoring and treatment. Healthcare organizations and manufacturers have responded by emphasizing cybersecurity measures to protect sensitive patient data and ensure device integrity. The major drivers in the market include the need for compliance with HIPAA and FDA regulations and growing awareness about the implications of cyber threats on the safety of patients. Advanced security solutions encompassing encryption, secure communications, and real-time detection of threats are becoming the sine qua non of protecting devices such as pacemakers, infusion pumps, and diagnostic equipment. As the medical innovation hub remains in the United States, a huge demand to expand rapidly regarding medical device security is witnessed in enhanced protection mechanisms and continuous monitoring systems.

Medical Device Security Market Trends:

Increasing awareness about the need for advanced security solutions

Requirements of advanced medical device security solutions in the aerospace and defense sectors largely drives the medical device security demand. These sectors require high-quality coatings that can resist high temperatures, wear, and corrosion. Such coatings provide critical protection for service turbine blades, aircraft engines, landing gear, and other structural parts. An industrial report indicates that global air traffic is expected to grow at a 4.3% CAGR through 2030, thus increasing demand for high-performance coatings. Further, with the rise in defense budgets from USD 842 Billion that is reported to be allocated for U.S. defense in 2024, there is more requirement for strong coatings for the protection of military aircraft helicopters, and naval vessels. These coatings have hugely benefited the aerospace industry as they give better fuel efficiency through advanced barriers that enhance the performance of an engine. Furthermore, the defense segment relies on such coatings for military aircraft, helicopters, and naval vessels to enhance protection against adverse conditions and heavy use, which creates profitable market opportunities.

Integration of advanced technologies

The growing integration of machine learning (ML) and artificial intelligence (AI) in medical devices is influencing the medical device security market trends. These technologies facilitate real-time threat detection, anomaly detection, and predictive analytics. These solutions' capabilities help healthcare organizations identify and mitigate security risks more effectively. For example, Royal Philips, a global leader in health technology, and NYU Langone Health, the top-ranked academic medical center, announced an 8-year strategic partnership on 16 November 2023 that aims to improve patient care through further innovation. By collaborating in this newly developed partnership, NYU Langone Health is looking to transition onto Philips IntelliSite Pathology, enterprise informatics, and the AI-enabled Philips Lumify Handheld Ultrasound diagnostic imaging.

Rising adoption of connected medical devices

There is a surging trend regarding medical devices being connected by bringing the health medical device security market to significant growth. The Internet of Things (IoT) is revolutionizing health care with rising connected medical devices, such as wearable monitors, infusion pumps, and implantable devices. An increase in connected medical devices raises the demand for high-performance medical device security as connectivity increases the need for secure measures. For instance, in July 2023, the cybersecurity company Cynerio collaborated with Check Point Software Technologies to develop comprehensive security protection for healthcare providers' medical Internet of Things. A complete 360, Cynerio's platform gives functionality critical in securing healthcare IoT devices, such as device discovery and patch guidance or micro-segmentation and attack detection.

Medical Device Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical device security market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on device type, component, deployment mode, and end user.

Analysis by Device Type:

- Stationery Medical Devices

- Internally Embedded Medical Devices

- External Medical Devices and Consumer Wearable

Stationary medical devices lead the market with a share of 43.2%. They are fixed in a specific location and are not to be moved often. These include magnetic resonance imaging (MRI) machines, X-ray machines, computed tomography (CT) scanners, linear accelerators, and laboratory analyzers. They are all used for different purposes in healthcare settings and are therefore of great importance in improved patient care. Furthermore, the increasing number of stationary medical devices due to the increasing prevalence of chronic diseases in people is helping the market. According to the National Library of Medicine, 934,509 people died in the United States due to cardiovascular diseases, which include heart disease and stroke, in 2021.

Analysis by Component:

- Solution

- Identity and Access Management Solutions

- Antivirus and Antimalware Solutions

- Encryption Solutions

- Data Loss Prevention Solutions

- Risk and Compliance Management

- Intrusion Detection Systems and Intrusion Prevention Systems

- Disaster Recovery Solutions

- Distributed Denial of Service Solutions

- Others

- Services

The solution dominates the market with a share of 68.2%. It is designed to protect medical devices and the data they handle from cybersecurity threats. Some of the applications of medical device security market solutions include the protection of medical devices, networks, and data. Encryption solutions protect the integrity and confidentiality of patient data. They are used in line with this purpose, reducing the potential risks of a data breach or interception without authorization. According to Statista, 2023 recorded 3,205 cases of data compromises in the United States. Meanwhile, in 2023, it was estimated that more than 353 million people lost sensitive information and/or were affected by data compromise such as breaches, leakage, and exposure.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises account for the largest share of 58.9%. It is the operation of medical device security solutions within the physical infrastructure of a healthcare facility or organization. They provide low-latency access to medical devices and data due to their proximity and prevent outsiders from accessing data and resources within the organization. In addition, the increasing emphasis on keeping sensitive patient data within the own data center of the organization for better data privacy and adherence to regulations is further driving market growth. Cybeats Technologies Corp. partnered with the Health Information Sharing and Analysis Center in November 2023. This is a global organization aimed at improving cyber and physical security in the health sector.

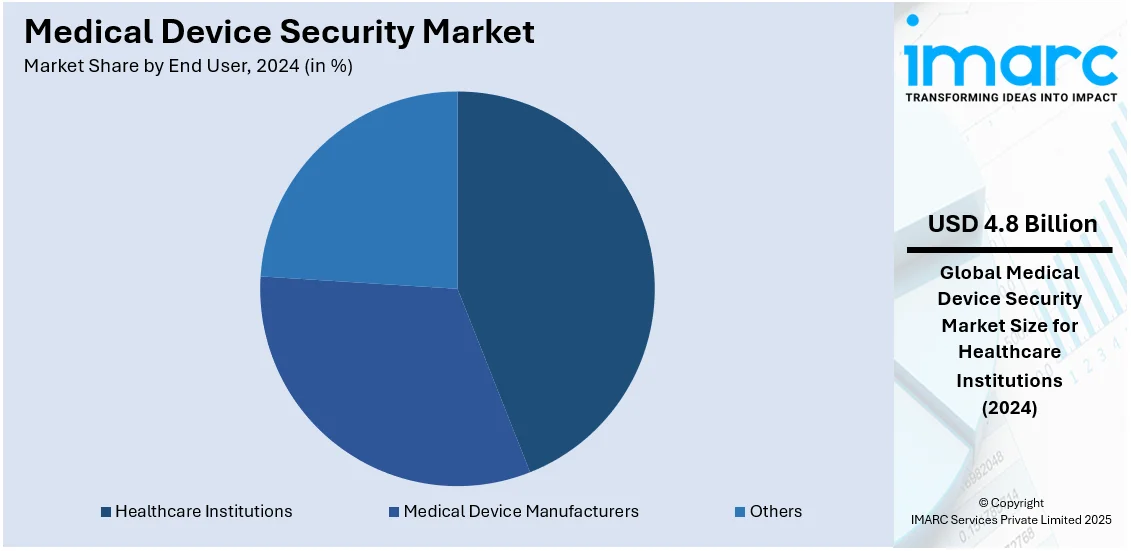

Analysis by End User:

- Healthcare Institutions

- Medical Device Manufacturers

- Others

The health institutions represent the leading segment with a share of 43.8%. These include clinics, hospitals, home health care, long-term care centers, and rehabilitation centers. They ensure security for medical equipment to prevent any breach of the patient's data. According to Statista, healthcare organizations in the United States recorded 715 large-scale data breach cases in 2021. Security solutions assist in minimizing these threats and lowering the risk of financial losses. Apart from this, the rising focus on secure medical device usage to maintain trust among patients is supporting the growth of the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the largest market share of 43.6% as the region has a developed healthcare infrastructure. There are several hospitals, clinics, research institutions, and long-term care facilities. The American Hospital Association reports that there were 6,120 hospitals in the US in the financial year 2022. Out of which, 5,129 were community, 659 were non-federal psychiatric, 207 were federal government, and 125 were others. In addition, the increasing awareness about healthcare facilities about the importance of medical device security to enhance the trust of patients while providing improved care is propelling the growth of the market in the region.

The medical device security market in Europe is experiencing steady growth with the support of stringent regulatory frameworks like the General Data Protection Regulation from the EU and the Medical Device Regulation. Increasing numbers of medical devices are being connected to healthcare, and the increasing rates of cyberattacks raise the demand for more secure solutions. Manufacturers and healthcare providers are implementing multi-factor authentication, encryption, and real-time monitoring to protect patient data. The market is also backed by continuous research and development investment in advanced security technologies.

The Asia Pacific medical device security market is growing rapidly with the adoption of connected healthcare technologies, especially in countries like China, India, and Japan. The increasing prevalence of chronic diseases and the growing adoption of wearable health devices are fueling the demand for secure, reliable medical devices. Regulatory advancements and government efforts to enhance cybersecurity in healthcare are also contributing to the growth of the market. Moreover, the rising number of cyberattacks on healthcare organizations and devices in the region underscores the need for robust security measures.

The medical device security market is now emerging in Latin America as digitized and interconnected healthcare systems start to take off. The adoption of medical IoT devices and the growing demand for telemedicine solutions as a result of the COVID-19 pandemic increased cybersecurity concerns in the region. Regional governments introduce regulations to improve these issues while encouraging investments in secure medical devices and systems. Brazil, Mexico, and Argentina lead the pack by emphasizing data encryption, secure network protocols, and complete threat detection systems to maintain patient privacy and functional device capability among healthcare providers.

The market for medical device security is slowly gaining in the Middle East and Africa. As the infrastructure of healthcare increases its digital orientation, the adoption of more complex medical devices makes cybersecurity a challenge that is ever-growing in terms of hospitals and clinics. Region-specific governments are taking an interest in healthcare cybersecurity, along with putting into place regulatory guidelines to ensure that patient data and devices remain safe. Increased prevalence of chronic diseases and geriatric population and expanding healthcare networks require secure medical devices in the respective regions.

Key Regional Takeaways:

United States Medical Device Security Market Analysis

In 2024, the United States held a market share of 87.60% due to healthcare digitization in the region. As published by the U.S. Department of Health and Human Services, there were over 500,000 connected medical devices reported across healthcare organizations in 2023, raising cybersecurity concerns. More usage of IoTs and remote monitoring systems by the patients will further emphasize the requirement of security measures. Significantly, the United States Department of Health and Human Services is set to start an initiative that invests USD 50 Million in cybersecurity tools and technologies for security against such hacks. Major players such as Johnson & Johnson and Medtronic are enhancing their security systems to prevent cyberattacks on devices. Some of the innovative features include secure data encryption protocols and real-time monitoring systems. The regulatory frameworks, such as HIPAA, further fuel the demand for a strong security system. This market is expected to grow with the increasing interconnectivity of medical devices, thus improving patient care and device functionality.

Europe Medical Device Security Market Analysis

The medical device security market in Europe is growing mainly due to a rise in cyber threats and increasingly stringent regulations. According to the European Commission, the healthcare sector has had the most attacks this year. In 2023, the member states experienced as many as 309 important cybersecurity hits on health facilities. It is the most hacked critical sector within the EU - attacks against healthcare providers have increased more dramatically compared with other sectors. The European Union's Medical Device Regulation mandates adherence to cybersecurity for medical devices under its rules, which obligates manufacturers to switch to the most advanced system of security. Among the biggest spenders are Germany and France - the emphasis is on preserving data and the integrity of the devices. The market is further boosted by the processing of digital transformation, with the increasing number of telemedicine consultations. Companies such as Siemens Healthineers are working on embedded security features in the medical devices themselves, thereby ensuring conformity to EU laws and the leadership of the European region on medical device innovation in cybersecurity.

Asia Pacific Medical Device Security Market Analysis

The market for medical device security in Asia Pacific is emerging at a pretty fast pace. This is concerning spending on healthcare and connectivity through devices is increasing. Industrial reports state that in 2023, China's health budget was pegged at USD 240 Billion with a huge amount allocated to cybersecurity infrastructure to secure medical devices. India's Ministry of Electronics and Information Technology observes that cybercrime has been increasing in the health sector, and people have finally woken up to securing devices. It has tried to emphasize that aspect of cybersecurity, beginning with national standardization in medical devices. Large Japanese manufacturing companies, such as Fujifilm, have adopted security technologies in-house, starting to implant security deep into the devices themselves. Furthermore, better protection measures are needed in healthcare, mainly due to the increased usage of IoT and AI. The market in this region is likely to grow due to investments in digital healthcare solutions and collaborations with global players to strengthen the cybersecurity framework.

Latin America Medical Device Security Market Analysis

Latin America is changing medical device security as more digitization of the healthcare sector and increasing cyberattacks fuel increased demand. According to the industry report, Brazil is now investing $6.7 Billion into digital health solutions in 2023, which incorporates many measures that strengthen medical device security. As cyberattack cases rise in the healthcare sector, countries such as Mexico and Argentina are working on strengthening their protocols of device security as required by international norms. The region's changing health infrastructure and increased adoption of connected medical devices are driving the demand for secure medical technologies. Local companies such as Acesita and multinationals collaborate to develop advanced security systems, data encryption, and secure cloud-based solutions. Going forward, the trend is expected to continue growth in the Latin American market with governments investing significantly in securing health technology across the region.

Middle East and Africa Medical Device Security Market Analysis

The medical device security market is growing in the Middle East and Africa with increased investments in healthcare infrastructure and growing threats of cyberattacks. Medical device manufacturers here in South Africa are employing advanced encryption to help protect these devices against cyber threats. Focusing by countries like Saudi Arabia on digitalizing their healthcare will keep the growth of the market up, as the government earlier promised to invest USD 1.5 Billion in digital transformation programs and healthcare information technology, and the market shall remain the fastest-growing digital health market in the region. Local regulations continue pushing forward the need for compliance with international cybersecurity standards and driving government-backed initiatives. Now, global companies will enter this market to make innovative cybersecurity products that help make the medical equipment of the region safe.

Competitive Landscape:

The key players in the market are collaborating and engaging in partnerships to develop advanced security solutions for medical devices and to identify reasonably foreseeable cybersecurity issues while offering a crucial source of evidence to inform risk management. This is contributing to increased revenue for companies in the medical device security market. For example, according to PR Newswire, on 12 June 2023, MedCrypt, Inc. announced that the proactive cybersecurity solutions provider for medical device manufacturers is partnering with Stratigos Security. This company focuses on penetration testing and independent security assessments. The company offers a suite of third-party assessment and advisory services that include specialized penetration tests for medical device makers. These are conducted to assure the safety and effectiveness of their devices. These efforts create a positive medical device security market outlook.

The report provides a comprehensive analysis of the competitive landscape in the global medical device security market with detailed profiles of all major companies, including:

- Armis Inc.

- Check Point Software Technologies Ltd

- Cisco Systems, Inc.

- ClearDATA

- Crothall Healthcare

- Cynerio

- Forescout

- GE HealthCare

- Medcrypt

- ORDR

- Palo Alto Networks

- Synopsys, Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- December 2024: A global medical device company implemented Fortinet's FortiSASE to secure 7,000 users with bidirectional traffic flows and operational efficiency. The solution replaced an outdated SSE system, reducing complexity and costs while saving USD 50,000 annually. FortiManager's centralized management streamlined security oversight.

- May 2024: Experis collaborated with ClearDATA to enhance healthcare cloud security. Under the partnership, Experis obtained reseller rights to ClearDATA's CyberHealth™ Platform for HIPAA-compliant CSPM and MDR solutions to combat data breaches, minimize cyber risks, and provide regulatory compliance for AWS, Azure, and Google Cloud.

- August 2023: Medcrypt, Inc., the top cybersecurity solution business for medical device manufacturers (MDMs), said today that it has partnered with NetRise, a business that provides detailed insight into the global XIoT security issue.With this collaboration, MDMs will have a software bill of materials (SBOM) lifecycle management solution to help makers of devices proactively discover and counter possible security risks while ensuring the safety and integrity of their medical devices.

- December 2022: Cylera has also integrated with Cisco's Identity Services Engine (ISE) to provide enhanced healthcare IoT and medical device security. Through this partnership, the company will fill gaps within NAC solutions by providing device discovery, risk assessment, and threat intelligence that will ensure comprehensive cybersecurity for IoMT environments.

- May 2021: ClearDATA® expanded its partnership with BioIntelliSense to remote care and analysis of rich, high-frequency vital sign data for patients and their medical care teams. The collaboration showcases the promise of the cloud in healthcare and provides a secure and compliant digital care experience with sophisticated security and compliance automation in place.

Medical Device Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Stationery Medical Devices, Internally Embedded Medical Devices, External Medical Devices and Consumer Wearable |

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| End Users Covered | Healthcare Institutions, Medical Device Manufacturers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Armis Inc., Check Point Software Technologies Ltd, Cisco Systems, Inc., ClearDATA, Crothall Healthcare, Cynerio, Forescout, GE HealthCare, Medcrypt, ORDR, Palo Alto Networks, Synopsys, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical device security market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global medical device security market.

- The study maps the leading, and the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical device security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical device security market was valued at USD 11.0 Billion in 2024.

The medical device security market is estimated to exhibit a CAGR of 12.7% during 2025-2033.

The medical device security market is driven by the increased awareness regarding the importance of advanced security solutions that protect patient data and prevent tampering with devices, the implementation of advanced technologies, and the increasing use of connected medical devices.

North America currently dominates the market due to robust healthcare infrastructure, including numerous hospitals, clinics, research institutions, and long-term care facilities.

Some of the major players in the medical device security market include Armis Inc., Check Point Software Technologies Ltd, Cisco Systems, Inc., ClearDATA, Crothall Healthcare, Cynerio, Forescout, GE HealthCare, Medcrypt, ORDR, Palo Alto Networks, Synopsys, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)