Mechanical Ventilators Market Report by Product Type (Intensive Care Ventilators, Portable/Ambulatory Ventilators, and Others), Interface (Invasive Ventilation, Non-Invasive Ventilation), Age Group (Pediatric, Adult, Geriatric), Mode of Ventilation (Combined Mode of Ventilation, Volume Mode of Ventilation, Pressure Mode of Ventilation, and Other Mode of Ventilation), End-Use (Hospitals and Clinics, Home Care, Ambulatory Care Centers, and Others), and Region 2025-2033

Global Mechanical Ventilators Market:

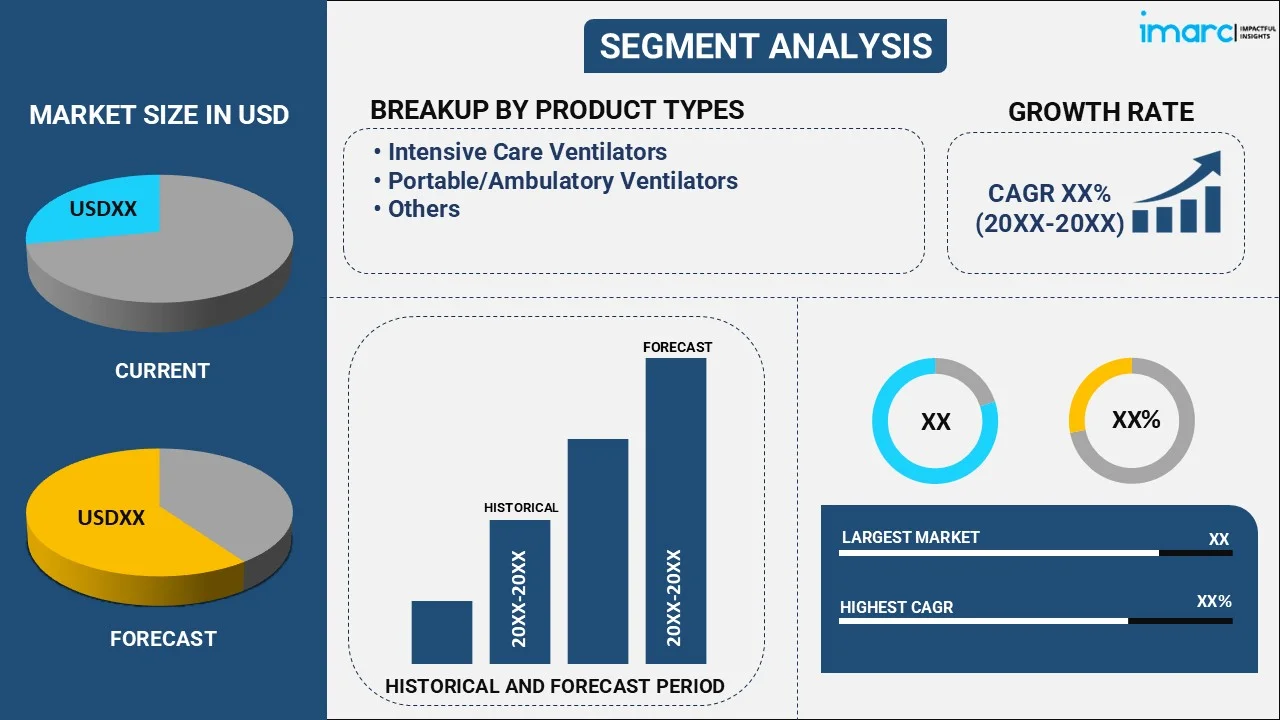

The global mechanical ventilators market size reached USD 5.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.9% during 2025-2033. The market is primarily driven by the rising prevalence of chronic obstructive pulmonary disease (COPD) and respiratory disorders, the elevating number of individuals suffering from hypertension, diabetes, and cardiovascular diseases, and the continuous technological advancements, such as the development of non-invasive and portable mechanical ventilators.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.7 Billion |

|

Market Forecast in 2033

|

USD 8.0 Billion |

| Market Growth Rate 2025-2033 | 3.9% |

Global Mechanical Ventilators Market Analysis:

- Major Market Drivers: The growing prevalence of several respiratory disorders, including COPD, asthma, and pneumonia and the rising geriatric population are catalyzing the mechanical ventilators market growth. Besides this, the ongoing innovations, such as the development of improved ventilator portability, modes, and user interfaces are further stimulating the market expansion.

- Key Market Trends: The inflating healthcare expenditure, mainly in developing economies, and the escalating demand for user-friendly and portable devices in homecare settings, on account of the emerging trend of home-based medical care, are propelling the medical ventilators market demand. Moreover, the market is continuing to grow as a result of the widespread use of intelligent variations with automated functions and cutting-edge monitoring capabilities.

- Competitive Landscape: Some of the major market players in the mechanical ventilators market share include Allied Healthcare Products, Air Liquide, Asahi Kasei, GE Healthcare Company, Hamilton Medical AG, Maquet GmbH & Co. KG (Gatenge), Medtronic Plc, Mindray Medical International Ltd., Philips Healthcare, ResMed, Smiths Group Plc, and Vyaire Medical Inc., among others.

- Geographical Trends: North America represents a significant driver of the mechanical ventilators market forecast, owing to its advanced healthcare infrastructure and the inflating medical expenditures of individuals. Besides this, the increasing focus of Europe on healthcare quality and patient safety is further catalyzing the market forward. Moreover, in the Asia Pacific region, the rising aging population is positively influencing the market growth. Moreover, the inflating medical care spending by individuals in Latin America and Middle East and Africa and the increasing awareness towards respiratory diseases are augmenting the market expansion.

- Challenges and Opportunities: One of the major challenges of the mechanical ventilators market trends include the shortage of essential medical equipment and regular maintenance and servicing of devices, which is costly and time-consuming. However, the continuous advances in technology, including AI and remote monitoring, and the emerging trend of home-healthcare are presenting significant growth opportunities for the market.

Global Mechanical Ventilators Market Trends:

Increasing Cases of Chronic Respiratory Conditions

The rising cases of chronic respiratory conditions, including asthma, acute obstructive pulmonary disease, and pneumonia are primarily driving the mechanical ventilators market statistics. Moreover, the outbreak of the COVID-19 pandemic across the globe had increased mortality, morbidity, and healthcare costs, which is propelling the market growth forward. Therefore, various medical facilities are focusing highly on control measures and infection prevention to minimize the cases of such respiratory diseases. For instance, the National Council on Aging data indicated that Obstructive Sleep Apnea (OSA), characterized by irregular breathing and reduced oxygen supply to the brain, affected about 39 million adults in the U.S. and an estimated 936 million globally. Additionally, as per the American Lung Association, chronic obstructive pulmonary disease (COPD) is the third leading cause of death by disease in the United States. More than 16.4 million people have been diagnosed with chronic obstructive pulmonary disease.

Technological Advancements

The ongoing technological advances, such as improved ventilator portability, modes, and user interfaces, are augmenting the mechanical ventilators market. Moreover, the growing popularity of portable and user-friendly devices in home settings, on account of the emerging trend of home-based medical care, is catalyzing the global market. Besides this, the introduction of smart mechanical ventilator variants with automated features and advanced monitoring capabilities is also positively influencing the market growth. For example, Max Ventilator introduced non-invasive ventilators featuring humidifiers and oxygen therapy capabilities, demonstrating versatility in applications for adult and neonatal care. Additionally, Nihon Kohden OrangeMed, Inc. received U.S. FDA clearance for the NKV-330 Ventilator System, which is non-invasive and provides respiratory support in emergencies.

Launch of Government Initiatives

The launch of several policies and initiatives by government bodies across countries, including public health campaigns to raise awareness about respiratory illnesses and the importance of early detection and treatment is positively influencing the mechanical ventilators market outlook. In addition to this, the inflating investments by regulatory authorities in research and development efforts for the introduction of the latest and improved mechanical ventilators are also propelling the market expansion. Moreover, the advancing healthcare infrastructures, along with the increasing number of training programs and seminars for medical professionals are further catalyzing the mechanical ventilators market revenue. For instance, CAIRE Inc.’s FreeStyle Comfort portable oxygen concentrator was authorized for reimbursement in France and Germany, enhancing patient access. The company extended its oxygen therapy modalities product portfolio through this launch. Furthermore, CorVent Medical received CE Mark approval and launched commercial use of its RESPOND-19 Ventilator in Europe. The novel system is designed for easy-to-use, flexible expansion of critical care ventilation capacity to allow hospitals to improve the treatment of critically ill patients suffering from acute respiratory distress syndrome (ARDS).

Global Mechanical Ventilators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, interface, age group, mode of ventilation and end-use.

Breakup by Product Type:

- Intensive Care Ventilators

- Portable/Ambulatory Ventilators

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes intensive care ventilators, portable/ambulatory ventilators, and others.

Intensive care ventilators are developed for usage in critical care settings, such as intensive care units (ICUs) and emergency departments. They are capable of offering an advanced respiratory support to patients with severe respiratory failure or other critical conditions. On the other hand, portable/ambulatory ventilators are designed for use outside of traditional hospital settings, including in-home care, ambulances, or other transport settings. They are smaller, lighter, and more portable than intensive care variants, making them suitable for use in various places.

Breakup by Interface:

- Invasive Ventilation

- Non-Invasive Ventilation

The report has provided a detailed breakup and analysis of the market based on the interface. This includes invasive ventilation and non-invasive ventilation.

Invasive ventilation typically comprises the insertion of a tube into the patient's airway, usually through the mouth or nose (endotracheal tube) or via a surgical opening in the neck (tracheostomy tube). This allows the ventilator to deliver air or oxygen directly into the lungs. Invasive ventilation is generally utilized for patients with severe respiratory failure or who are unable to breathe on their own. Moreover, non-invasive ventilation does not need the insertion of a tube into the airway of the individual. Instead, it uses a mask or similar device to deliver air or oxygen to the patient's lungs. Non-invasive ventilation is often used for patients with less severe respiratory failure or for patients who are able to breathe on their own but require the additional support.

Breakup by Age Group:

- Pediatric

- Adult

- Geriatric

The report has provided a detailed breakup and analysis of the market based on the age group. This includes pediatric, adult, and geriatric.

Pediatric ventilators are specifically created for infants and children. They are smaller in size and have features that cater to the unique respiratory needs of pediatric patients. These devices often include specialized modes and settings to deliver the appropriate level of support for smaller lungs and airways. Besides this, adult ventilators are designed for use in adult patients. They are larger and more robust than pediatric derivatives and are capable of providing the higher tidal volumes and pressures demanded for adult respiratory support. On the other hand, geriatric patients, who are typically older adults, may require ventilator support, owing to age-related respiratory conditions or complications.

Breakup by Mode of Ventilation:

- Combined Mode of Ventilation

- Volume Mode of Ventilation

- Pressure Mode of Ventilation

- Other Mode of Ventilation

The report has provided a detailed breakup and analysis of the mode of ventilation. This includes combined mode of ventilation, volume mode of ventilation, pressure mode of ventilation, and other mode of ventilation.

Combined mode of ventilation, also referred to as dual or hybrid mode, combines the aspects of volume and pressure ventilation. It allows the ventilator to adjust the inspiratory pressure to maintain a set tidal volume, providing a more flexible and adaptable ventilation. Moreover, in volume mode of ventilation, the ventilator supplies a set tidal volume to the patient with each breath. This mode is commonly used in patients with normal lung compliance or when precise control over tidal volume is required, such as in acute respiratory distress syndrome (ARDS). Besides this, in pressure mode of ventilation, the ventilator delivers a set inspiratory pressure to the individual, allowing for a more variable tidal volume based on the lung compliance and resistance of the patient.

Breakup by End-Use:

- Hospitals and Clinics

- Home Care

- Ambulatory Care Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes hospitals and clinics, homecare, ambulatory care centers, and others.

In hospitals and clinics, mechanical ventilators are utilized in intensive care units (ICUs), emergency departments, operating rooms, and general wards to support patients with acute respiratory failure, respiratory distress, or other conditions that require assisted ventilation. Additionally, these devices are increasingly being used in homecare settings to provide long-term respiratory support to patients with chronic respiratory conditions, such as chronic obstructive pulmonary disease (COPD), neuromuscular disorders, or spinal cord injuries. Furthermore, ambulatory care centers, also known as outpatient clinics or day surgery centers, may utilize mechanical ventilators for patients undergoing procedures that require sedation or anesthesia, including endoscopic procedures or minor surgeries.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

North America represents a significant region of the mechanical ventilators market overview, owing to its advanced healthcare infrastructure and the inflating medical expenditures of individuals. Besides this, the increasing focus of Europe on healthcare quality and patient safety is further catalyzing the market forward. Moreover, in the Asia Pacific region, the rising aging population is positively influencing the market growth. Besides this, the inflating medical care spending by individuals in Latin America and Middle East and Africa and the increasing awareness towards respiratory diseases are augmenting the market expansion. For instance, according to a report published by the Centers for Disease Control and Prevention (CDC), out of all the hospitalizations caused by COVID-19, over 53% of patients were admitted to the intensive care unit. Additionally, based on a research study by Silvio A. Ñamendys-Silva et al., published in Critical Care, in Mexico, about 15.3% of hospitalized patients require invasive mechanical ventilation (IMV), and 70.8% of patients receive invasive mechanical ventilation (IMV) outside the ICU.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the major market players in the Mechanical Ventilators industry include:

- Allied Healthcare Products

- Air Liquide

- Asahi Kasei

- GE Healthcare Company

- Hamilton Medical AG

- Maquet GmbH & Co. KG (Gatenge)

- Medtronic Plc

- Mindray Medical International Ltd.

- Philips Healthcare

- ResMed

- Smiths Group Plc

- Vyaire Medical Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Mechanical Ventilators Market Recent Developments:

- February 2024: Getinge, a renowned global leader in medical technology, launched its latest innovation, the Servo-c mechanical ventilator, in India. The mechanical ventilator is crafted to offer lung-protective therapeutic tools, catering to the evolving demands of the healthcare landscape in the country.

- October 2023: Concern Radio-Electronic Technologies completed the factory test of Mobivent Oxy mechanical ventilator, in Russia. Mobivent Oxy made by Urals Instrument-Making Plant is designed for high-flow oxygen therapy in children and adults. This is an adjunct treatment method that is suitable only for patients capable of spontaneous inhale breathing.

- September 2023: The mechanical engineering professors at Villanova University in the U.S. received a patent to develop a new type of affordable mechanical ventilator called NovaVent. Built using widely accessible components, NovaVent offers continuous mandatory ventilation (CMV) for individuals who cannot breathe on their own.

Mechanical Ventilators Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Intensive Care Ventilators, Portable/Ambulatory Ventilators, Others |

| Interface Covered | Invasive Ventilation, Non-Invasive Ventilation |

| Age Groups Covered | Pediatric, Adult, Geriatric |

| Mode of Ventilation Covered | Combined Mode of Ventilation, Volume Mode of Ventilation, Pressure Mode of Ventilation, Other Mode of Ventilation |

| End Uses Covered | Hospitals and Clinics, Home Care, Ambulatory Care Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allied Healthcare Products, Air Liquide, Asahi Kasei, GE Healthcare Company, Hamilton Medical AG, Maquet GmbH & Co. KG (Gatenge), Medtronic Plc, Mindray Medical International Ltd., Philips Healthcare, ResMed, Smiths Group Plc, Vyaire Medical Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mechanical ventilators market from 2025-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global mechanical ventilators market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mechanical ventilators industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mechanical ventilators market was valued at USD 5.7 Billion in 2024.

The mechanical ventilators market is projected to exhibit a CAGR of 3.9% during 2025-2033, reaching a value of USD 8.0 Billion by 2033.

An aging worldwide population with higher susceptibility to respiratory conditions is driving the demand for ventilatory support. Technological advancements in ventilator design, such as portability, ease of use, and integration with monitoring systems, are also contributing to the market growth. Moreover, the expansion of intensive care units (ICUs) and increased healthcare spending are strengthening hospital infrastructure and encouraging adoption.

North America currently dominates the mechanical ventilators market due to its sophisticated healthcare system, substantial healthcare investments, and prominent presence of major medical device companies. The region also has a large aging population and high prevalence of respiratory diseases, driving consistent demand for ventilators in hospitals and home care settings.

Some of the major players in the mechanical ventilators market include Allied Healthcare Products, Air Liquide, Asahi Kasei, GE Healthcare Company, Hamilton Medical AG, Maquet GmbH & Co. KG (Gatenge), Medtronic Plc, Mindray Medical International Ltd., Philips Healthcare, ResMed, Smiths Group Plc, Vyaire Medical Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)