Meat Snacks Market Size, Share, Trends and Forecast by Product Type, Source, Flavor, Distribution Channel, and Region, 2025-2033

Meat Snacks Market Size and Share:

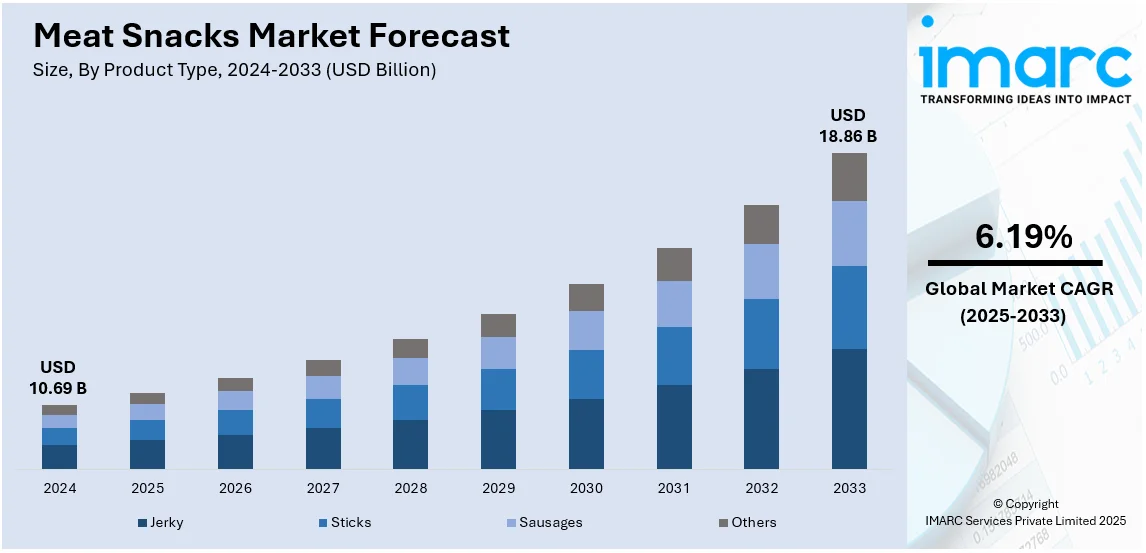

The global meat snacks market size was valued at USD 10.69 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.86 Billion by 2033, exhibiting a CAGR of 6.19% during 2025-2033. North America currently dominates the market, holding a significant market share of over 43.7% in 2024. The growing demand for healthier and protein-rich snack options, introduction of meat snacks in exotic flavors, and their increasing availability across online retail channels are some of the key factors driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.69 Billion |

|

Market Forecast in 2033

|

USD 18.86 Billion |

| Market Growth Rate (2025-2033) | 6.19% |

The global meat snacks industry is boosted by elevating customer shift towards on-the-go, high-protein snacks that cater to the health-aware, active lifestyles. Magnifying awareness regarding clean-label products and intense need for natural ingredient-derived, minimally processed snacks further aid market expansion. Moreover, product reformulations, encompassing healthier options, such as low-sodium or low-fat variants, varied formats, and unique flavors, appeal wide range of customer base. In addition to this, proliferating e-commerce and retail distribution platforms improve product availability, bolstering sales globally. Besides this, revolutionizing dietary habits and escalating disposable incomes in emerging nations contribute to the stable expansion of the global meat snacks segment.

The United States plays a critical role in the global meat snacks market, mainly impacted by robust customer need for convenient or protein-rich food options. The market heavily profits from a highly resilient retail infrastructure, encompassing e-commerce platforms, supermarkets, or convenience stores, guaranteeing comprehensive product accessibility. Moreover, boosting health consciousness has incentivized manufacturers to launch low-sodium and clean-label options, further appealing health-aware customers. Additionally, major players in the U.S. are currently emphasizing on formulating flavors and product diversification to sustain a leading competitive edge. For instance, in March 2024, Jack Link’s announced a strategic collaboration with Dr Pepper to introduce a unique flavor experience through their new Dr Pepper-inspired meat snacks. The range includes Dr Pepper infused beef jerky and Jack Link’s WILD Dr Pepper flavored meat sticks. Featuring the signature sweet and savory notes inspired by Dr Pepper, each bite offers a distinct and exciting taste sensation, blending the bold flavors of both brands in a truly innovative way. Furthermore, the accelerating momentum organic as well as premium meat snacks highlights the nation’s substantial contribution to global market growth.

Meat Snacks Market Trends:

Rising Demand for Convenient Snacking Options

Consumers increasingly favor convenient snacking options on account of their hectic schedules and inflating spending capacities, which is creating a positive outlook for the overall market. Furthermore, the escalating working population requiring ready-to-eat food options, like frozen meat snacks, is also contributing to the market growth. According to Convenience Store Products magazine, meat snacks in 2021 generated approximately USD 2.16 Billion in sales across convenience stores in the United States, with Old Trapper ranking as the third best-selling traditional jerky brand. Additionally, according to IMARC, the global ready-to-eat (RTE) food market size reached USD 181.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 262.4 Billion by 2032, exhibiting a growth rate (CAGR) of 4.18% during 2024-2032. Such a significant growth in the ready-to-eat food market indicates an impelling demand for convenient snacking options like meat snacks, which is anticipated to propel the meat snacks market share.

Increasing Popularity of High Protein Snacks

Consumers are increasingly prioritizing protein-rich diets for various health benefits, including muscle building, weight management, and sustained energy levels. The International Food Information Council Foundation reports that 50% of consumers are interested in incorporating more protein into their diets, and 37% believe that protein aids in weight loss. Meat snacks, such as jerky, offer a convenient and portable source of high-quality protein, appealing to fitness enthusiasts, athletes, and health-conscious individuals alike. This, in turn, is positively impacting the meat snacks market outlook. Consumers are increasingly seeking snacks that are rich in protein and feature traditional meat offerings reimagined with sophisticated flavor profiles and formulations to project a natural product image. For example, in March 2021, Cherkizovo Group introduced a new line of meat snacks under the Cherkizovo Premium brand, available in three categories: pork, chicken, and turkey. These snacks are crafted from cured and dried meats. Moreover, the introduction of less conventional protein sources like turkey, seafood, and game meats, along with the expansion of product offerings such as power packs, bars, and deli bites in the refrigerated section, is revitalizing the category and creating new opportunities for snacking occasions, thereby creating a positive meat snacks market outlook.

Emerging Preferences for Plant-Based Meat Snacks

The growing consumer interest in plant-based alternatives due to health, environmental, and ethical considerations is offering lucrative growth opportunities to the overall market. These snacks offer a meat-like experience without animal-derived ingredients, appealing to vegetarians, vegans, and flexitarians seeking protein-rich options. As a result, various leading manufacturers are now introducing plant-based meat to expand their consumer base and propel sales. For instance, in February 2022, VegaBytz launched its range of plant-based, entirely vegan meat alternatives in India. The product line includes ready-to-eat meals and curry options, such as vegan meat, chicken, and tuna, all crafted exclusively from plant ingredients. In addition to this, several firms active in this market are currently emphasizing on opting for tactical measures to attain a robust foothold in nations that host magnified population with vegan or vegetarian diet. This, in turn, is expected to bolster meat snacks market growth over the forecasted period.

Meat Snacks Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global meat snacks market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, source, flavor, and distribution channel.

Analysis by Product Type:

- Jerky

- Sticks

- Sausages

- Others

Jerky stand as the largest component in 2024, holding around 35.0% of the market. As per the meat snacks market statistics by IMARC, jerky is favored for its long shelf life, making it convenient for storage and on-the-go consumption. Its high protein content appeals to health-conscious consumers looking for nutritious snacking options. In addition to this, the variety of flavors and meat types available in jerky caters to diverse consumer preferences, contributing to its popularity in the market. As a result, numerous manufacturers are including jerky in various flavors in their menus. Besides this, advancements such as organic, grass-fed, and exotic meat options are further solidifying its appeal. The accessibility of jerky through e-commerce platforms has also bolstered availability and requirement. Moreover, its versatile application in meal preparations adds to its elevating market significance.

Analysis by Source:

- Pork

- Beef

- Poultry

- Others

Beef leads the market share in 2024. Beef is widely recognized for its rich flavor and high protein content, appealing to consumers seeking nutritious and satisfying snack options. Moreover, the convenience and portability of beef snacks cater to busy lifestyles, allowing consumers to enjoy protein-rich foods on the go. As a result, various key market players are increasingly launching beef meat snacks to cater to the escalating demand and propel their sales. In addition to this, the launch of high-end beef snacks, encompassing grass-fed and organic options, has further fortified customer interest. Moreover, improved accessibility through e-commerce channels as well as traditional retail channels has expanded market foothold. Besides, the formulation of innovative flavor profiles continues to bolster both customer preference ad engagement for beef-based snacks.

Analysis by Flavor:

- Original

- Peppered

- Teriyaki

- Others

Peppered leads the market share in 2024. As per the meat snacks market overview by IMARC, the demand for peppered meat snacks is primarily driven by consumer preferences for bold and savory flavors. Peppered varieties offer a distinct taste profile that appeals to consumers seeking a more robust snacking experience. This demand is further fueled by trends towards protein-rich and flavorful snack options, as well as the growing popularity of portable and convenient food choices that fit into busy lifestyles. In addition to this, peppered meat snacks often cater to consumers looking for alternatives to traditional snacks, offering both taste satisfaction and nutritional value.

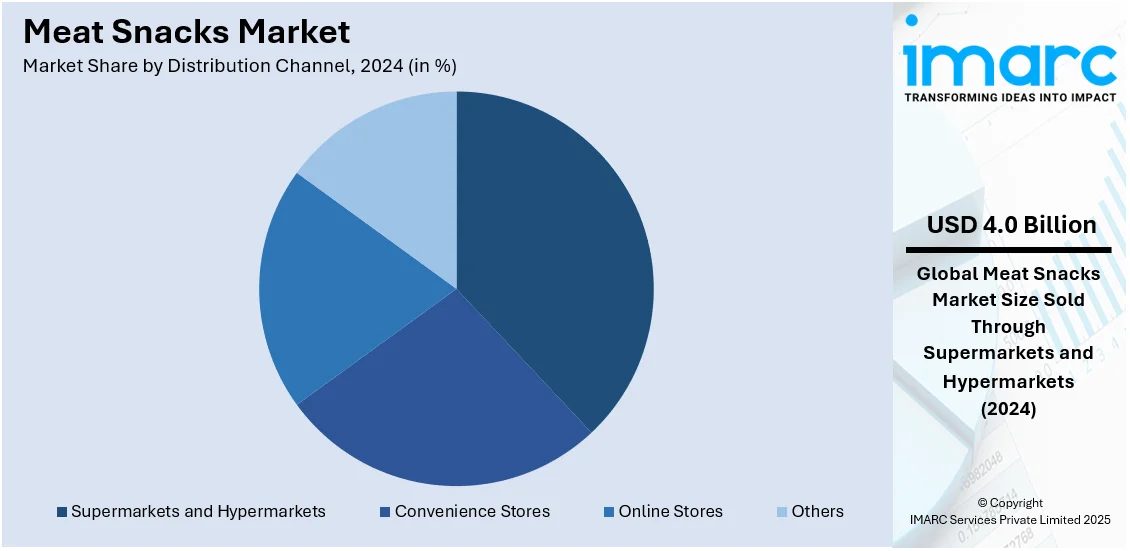

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with around 37.6% of market share in 2024. Supermarkets and hypermarkets play crucial roles in the meat snacks market by offering extensive shelf space and diverse product selections to cater to varying consumer preferences. These retail channels provide convenient access to a wide range of frozen and refrigerated meat snacks, meeting the demand for quick and easy meal solutions. Furthermore, their strategic locations, coupled with promotional activities and competitive pricing, enhance product visibility and consumer awareness. In addition to this, supermarkets and hypermarkets also leverage their robust logistic networks to ensure efficient distribution and consistent availability, making them pivotal in driving sales and market penetration for meat snacks.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 43.7%. The dominance of the North American region in the global market is driven by consumer preferences for portable, convenient, and indulgent snack options. The trend of snacking throughout the day has become habitual across all age groups, with consumers opting for snacks over traditional meals. This trend is driving the increased demand for meat-based snacks as consumers look for healthy options to meet their nutritional requirements. The 2022 Food and Health Survey Spotlight highlighted that approximately 73% of consumers snack daily, with 14% snacking more than twice a day. Additionally, leading industry players are focusing on creating premium offerings aimed at attracting higher-income North American consumers with preservative- and additive-free products. For example, in March 2023, Chomps launched two new beef-based snack flavors in the U.S., Taco Beef and Habanero Beef, each containing 10 grams of protein, 100 calories, and no added sugar. These innovations are expected to drive growth in the meat snacks market over the coming years.

Key Regional Takeaways:

United States Meat Snacks Market Analysis

In 2024, United States accounted for 87.60% of the market share in North America. The US meat snacks industry shows remarkable growth rates because consumers demand snacks rich in protein and convenient food choices. The wider convenience food market at USD 115.33 Billion in 2023 functions as a key factor behind this market growth. Industry projections released by IMARC Group indicate that the market will expand to USD 165.58 Billion by 2032 at a compound annual growth rate (CAGR) of 3.50% throughout the period 2024-2032. Furthermore, high-protein low-carb alternatives such as jerky and sausages are experiencing increased demand because consumers have become more health conscious. Clean-label consumption trends and increasing demand for premium meat snacks featuring organic and grass-fed products enable the market's development. Prior commitments and urban sprawl have increased the number of people who snack between meals which drives the growing demand for ready-to-eat meat snacks. In addition, population expansion together with innovations in snack formats and packaging design, along with a wider selection of superior snack tastes has driven the market’s growth trajectory. Future projections show strong growth potential for the meat snacks market because of rising demand for protein-based snacks together with rising incomes.

Asia Pacific Meat Snacks Market Analysis

The growing middle-class population and rising disposable incomes in APAC are driving demand for convenient, protein-rich snack options. As reported by the World Bank, East Asia and the Pacific is the world’s most rapidly urbanizing region, with an average annual urbanization rate of 3%. This urbanization, along with shifting consumer lifestyles, is significantly contributing to the rising popularity of meat snacks. Consumers in the region are increasingly turning to meat-based snacks as an alternative to traditional snacks, driven by a desire for more protein-packed, healthy options. Western food trends are also making their mark, with products like jerky and other processed meats gaining popularity. Health-conscious individuals are seeking snacks that align with high-protein, low-carb diets, further boosting demand. With rapid urban growth and a shift in dietary preferences, the APAC meat snacks market is poised for continued expansion, particularly in countries like China, Japan, and India.

Europe Meat Snacks Market Analysis

The European meat snacks market is experiencing robust growth, driven by shifting consumer preferences and evolving dietary trends. Poultry is the most commonly consumed animal meat in the region, with 60% of European consumers including it in their meals at least once a week, according to industry reports. This preference for poultry, along with a growing demand for high-protein, low-carb snacks, is fueling the rise of meat snacks. In addition, approximately 40% of Europeans consume fish, beef, or pork at least once a week, which further supports the expansion of meat-based snack options. The demand for convenient, ready-to-eat solutions, coupled with the increasing popularity of clean-label and premium products, continues to shape the market. Consumers are increasingly seeking healthier alternatives, such as organic and grass-fed meat snacks, alongside a growing interest in local and sustainable sourcing. Innovation in flavors and packaging formats is also playing a crucial role in market growth, as manufacturers cater to the diverse tastes and preferences of European consumers. With these trends, the meat snacks sector is well-positioned for sustained growth across the region, particularly in countries like the UK, Germany, and France.

Latin America Meat Snacks Market Analysis

The growing demand for convenient, protein-rich snack options in Latin America is being driven by rising disposable incomes and shifting consumer preferences. Urbanization is a key factor, with reports noting that around 80% of the population in Latin American countries now live in urban areas, a higher rate than most other regions. This urban growth has led to an increasing preference for on-the-go solutions, further fueling the meat snacks market. Consumers are also seeking healthier alternatives and local flavor options, contributing to the sector’s expansion. As urbanization continues, particularly in countries like Brazil and Mexico, the market is expected to grow substantially.

Middle East and Africa Meat Snacks Market Analysis

The Middle East and North Africa (MENA) region, according to the World Bank, has already reached 64% urbanization, and this figure is expected to rise further. As urbanization progresses, demand for convenient, protein-rich snack options has surged. The growing urban population, coupled with higher disposable incomes, is driving the consumption of meat snacks. Western food trends are influencing the market, and a young, dynamic population continues to seek on-the-go snack solutions. These factors collectively support the expansion of the meat snacks sector across MENA, fostering market growth in this region.

Competitive Landscape:

The global market exhibits extensive competitive, with leading players actively emphasizing on clean-label product lines, product enhancements, variety of flavor profiles, to appeal a broad range of customers, including the one with high health-consciousness. Major firms dominate through their robust brand recognition and comprehensive distribution networks. In addition to this, emerging as well as regional players also facilitate meat snacks market demand by addressing the localized preferences or tastes. Tactical collaborations, mergers, or acquisitions are highly prevalent deployed to improve product portfolios and proliferate market foothold. For instance, in May 2024, Western Smokehouse Partners, a prominent meat snack firm, announced strategic acquisition of Golden Valley Natural, a meat snack producer, to tactically proliferate its market presence as well as product lines. Besides this, innovations in preservation as well as packaging technologies have facilitated manufacturers to expand shelf life while sustaining quality, further magnifying competition in this rapidly transforming market.

The report provides a comprehensive analysis of the competitive landscape in the meat snacks market with detailed profiles of all major companies, including:

- Bridgford Foods Corporation

- Conagra Brands Inc.

- General Mills Inc.

- Hormel Foods Corporation

- Jack Link's LLC

- Monogram Food Solutions LLC

- Nestlé S.A.

- Meatsnacks Group Ltd. (New World Foods Europe Limited)

- Tyson Foods Inc.

- Werner Gourmet Meat Snacks Inc.

Latest News and Developments:

- March 2024: Country Archer Provisions, a purveyor of premium, high-protein snacking, unveiled its latest offerings at Natural Products Expo West 2024. The company introduced two new additions, Ancestral Beef Blend Meat Sticks and the Pasture-Raised Bison Jerky, to the brand's lineup of real ingredient snacks.

- March 2024: Pork Farms’ Pork Meatballs, Maple Bacon, Frankfurters, and Bratwurst launched a range of ready-to-eat snacks that can also be eaten hot as part of a variety of meal occasions.

- February 2024: Whisps, a prominent snack and cheese provider, launched Whisps Protein Snackers, its new high-protein snack with high shelf-stability. The latest product innovation comes in snack trays with multi-compartments, combining high-quality salami, Whisps baked cheese bites, and dried fruit. Designed for convenience, these snacks require no refrigeration.

- October 2023: Meati Foods has launched its first plant-based meat snack—shelf-stable jerky in original, peppered, and sweet chile flavors. Made from the brand’s MushroomRoot, oat fiber, and chickpea flour, the jerky is crafted from production leftovers, supporting Meati’s zero-waste approach. The product is available through Meati’s direct-to-consumer platform, with future improvements based on consumer feedback.

- April 2023: Doki Foods, a Delhi-based startup, has launched as India’s first meat snack brand, offering products like chicken chips and buffalo jerky in flavors such as teriyaki, gochujang, and smoky masala. Founded by Bharat Kaushish (BK) and Bharat Dhody (Dhody), the brand aims to introduce a unique range of meaty snacks to the Indian market.

Meat Snacks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Jerky, Sticks, Sausages, Others |

| Sources Covered | Pork, Beef, Poultry, Others |

| Flavors Covered | Original, Teriyaki, Peppered, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bridgford Foods Corporation, Conagra Brands Inc., General Mills Inc., Hormel Foods Corporation, Jack Link's LLC, Monogram Food Solutions LLC, Nestlé S.A., Meatsnacks Group Ltd. (New World Foods Europe Limited), Tyson Foods Inc., Werner Gourmet Meat Snacks Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the meat snacks market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global meat snacks market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the meat snacks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The meat snacks market was valued at USD 10.69 Billion in 2024.

IMARC estimates the market to reach USD 18.86 Billion by 2033, exhibiting a CAGR of 6.19% during 2025-2033.

Key factors boosting the market expansion encompass accelerating need for high-protein, convenient snacks, amplifying health awareness among customers, and increase in popularity of both natural and clean-label ingredient products. Furthermore, product advancements with varied formats and flavors, combined with proliferating e-commerce and retail channels, bolsters market growth.

North America currently dominates the meat snacks market, accounting for a share exceeding 43.7%. This dominance is fueled by due escalated customer need for protein-rich snacks, comprehensive product enhancements, and the establishment of leading industry players with robust distribution networks.

Some of the major players in the meat snacks market include Bridgford Foods Corporation, Conagra Brands Inc., General Mills Inc., Hormel Foods Corporation, Jack Link's LLC, Monogram Food Solutions LLC, Nestlé S.A., Meatsnacks Group Ltd. (New World Foods Europe Limited), Tyson Foods Inc., Werner Gourmet Meat Snacks Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)