Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2026-2034

Meat Market Size and Share:

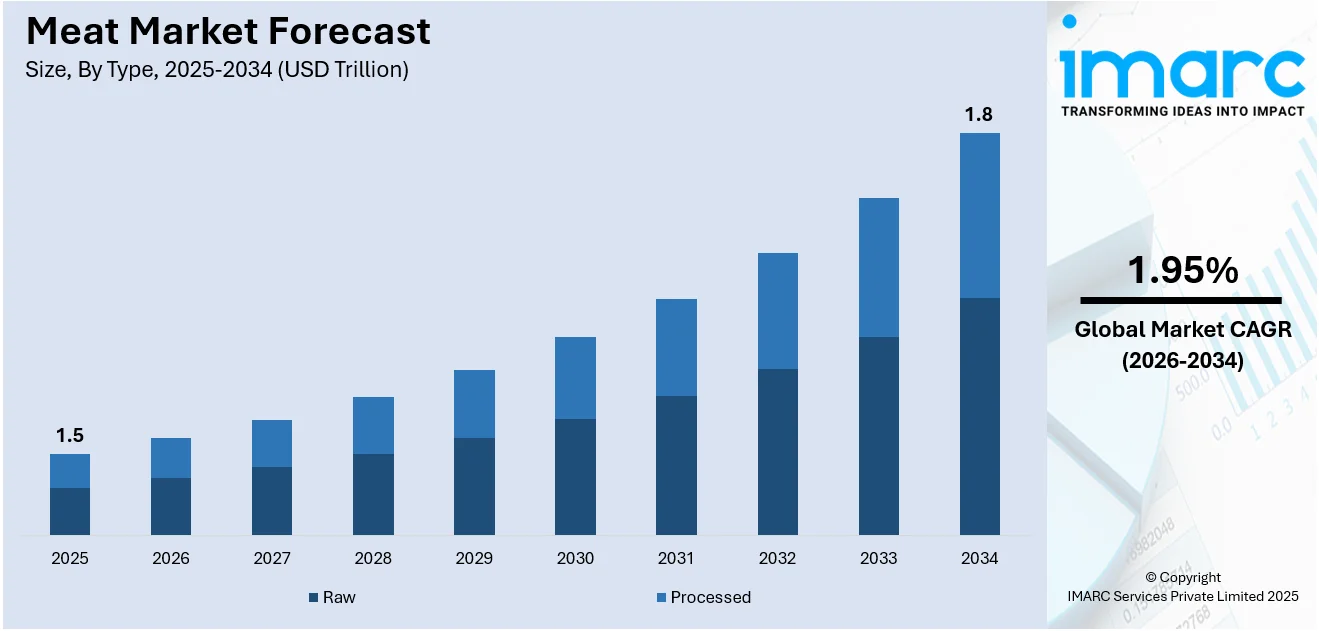

The global meat market size was valued at USD 1.5 Trillion in 2025. Looking forward, IMARC Group estimates the market to reach USD 1.8 Trillion by 2034, exhibiting a CAGR of 1.95% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of 57.8% in 2025. Changing dietary preferences, advancements in meat processing technologies, globalization and trade liberalization, effective marketing and branding, innovations in packaging, the rise of online retail, health and wellness trends promoting leaner meats, and the development of cold chain logistics ensuring safe transport are some of the factors fostering the market growth.

| Report Attribute | Key Statistics |

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.5 Trillion |

| Market Forecast in 2034 | USD 1.8 Trillion |

| Market Growth Rate (2026-2034) | 1.95% |

The growing demand for protein-rich diets in the international market is a primary driver of the meat market share. The growing populations and incomes-especially in the emerging economies-and shifting of dietary choices toward protein-dense food such as meat to fulfil nutritional requirements drive this market. For instance, Coleman All Natural Meats launched a new line of ground pork sausage available in five flavors in July 2024. These sausages cater to consumer demand for convenience and versatility in meals. Furthermore, heightened awareness about the function of protein in developing muscles, providing energy, and in general, health further propels demand. Another critical factor, urbanization has accompanied changes in lifestyles and convenience intake of proteins. The fast increase in population growth and the development of the middle class in Asia-Pacific, Latin America, and the Middle East led to an increase in the consumption of poultry, beef, and seafood. On the other hand, various cultural and festive occasions worldwide involve meat products, and most people tend to increase their intake seasonally. Another development aspect is meat production, processing technology, and a variety of cuts and processed products, catering to changing consumer demands, leading to the steady meat market growth.

To get more information on this market Request Sample

The US meat market is growing because of accelerating attention from consumers toward alternative meat options and the raising health awareness among them. Consumers are moving toward plant-based and lab-grown meats, which is changing the market, as these consumers look for healthier and more sustainable sources of protein with a higher ethical standard of production. Major companies have invested significantly in the manufacturing of unique meat alternatives, which has speeded up their popularity in grocery stores and restaurants within the country. For instance, In July 2024, Beyond Meat launched Beyond Sun Sausage™ at Sprouts Farmers Market. Available in Cajun, Pesto, and Pineapple Jalapeño, it's heart-healthy, plant-based, and certified by American Heart Association. Moreover, health-conscious trends also create a demand for leaner cuts of meat and organic, antibiotic-free, and grass-fed products. Rising interest in the traceability and transparency of food origins makes consumers want meat products with transparent labeling and clear certifications as part of the reason behind these ethical and health-related considerations. E-commerce platforms and meal kit delivery services have served to easily open up a wider channel to various meat products for American consumers, with further facilitation of convenience-oriented lifestyles, thereby fuelling market growth in the U.S.

Meat Market Trends:

Increasing Global Population

Currently, there is a rapid increase in the global population, and this is considered to be among the main factors boosting the meat market. According to the current industry reports, the global population is estimated at 7.6 billion is expected to reach 8.6 billion in 2030, 9.8 billion in 2050 and 11.2 billion in 2100. The world population is increasing, which has further surged the need for protein such as meat. This trend is highly observable and is more apparent in the developing nations where population growth rates are on the rise. Moreover, meat is a staple food tradition in most societies as it contains protein, iron, and vitamin in equal measure. As a result, there is a proportional increase in the consumption of meat. Additionally, as populations expand, urban areas also grow, leading to higher meat consumption patterns typically associated with urban lifestyles.

Urbanization and Dietary Changes

Urbanization is a key driver of the global meat market. As people migrate to urban areas, their eating habits change, which has considerably boosted the product demand. Urban life comes with higher disposable income and exposure to more food cultures, which has burgeoned demand for protein rich diets with variety of meat products. According to the United Nations, by 2050, nearly 68% of the global population will live in urban areas, up from 55% in 2018. This trend is likely to significantly boost demand for meat products since the urban consumers tend towards being more protein-intensive. This trend is especially evident in emerging markets where urbanization is transforming traditional diets to include more meat and processed food. Urban areas also provide better access to modern retail channels like supermarkets and online grocery stores, due to which meat products are more accessible to consumers. Apart from this, the shifting consumer preference for convenience, ready to cook or pre-cooked meat products is another growth-inducing factor for the market.

Advancements in Meat Processing Technologies

Technological advancements are fostering the global meat market. Processing innovations have made meat products more efficient, better, and safer for consumers. Modern meat processing technologies include automation, improved slaughter methods, and advanced packaging that extends the life of meat products and keeps them fresh. Automation in meat processing plants increases speed and consistency, reduces costs and minimizes human error, which is further accelerating the market growth. For instance, research from the Danish Meat Research Institute (DMRI) suggests that process optimization during slaughter can lead to substantial economic benefits, with savings of about KRW 7.6 billion (USD 5.62 million) per center per year. Besides this, innovations in packaging like vacuum sealing and modified atmosphere packaging keeps meat fresh for longer, reduces waste and ensures product safety during transport and storage, which is further supporting the market growth.

Meat Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on the type, product, and distribution channel.

Analysis by Type:

- Raw

- Processed

The raw meat segment is driven by the increasing consumer preference for fresh, unprocessed meat, which is perceived as healthier and more natural. Additionally, rising disposable incomes in developing regions enable consumers to afford higher-quality fresh meat products. The growing trend of home cooking and culinary experimentation also fuels demand, as consumers seek raw ingredients for diverse and authentic recipes. Improved cold chain logistics and advancements in refrigeration technology ensure the freshness and safety of raw meat during transport and storage, further boosting its market appeal. Moreover, the popularity of raw diets, particularly among fitness enthusiasts and pet owners, contributes to the segment's growth, emphasizing the importance of fresh, high-quality meat in daily nutrition.

Analysis by Product:

- Chicken

- Beef

- Pork

- Mutton

- Others

Chicken leads the market with around 35.0% of market share in 2025. The chicken segment is driven by the increasing demand for affordable and versatile protein sources. Chicken is often priced lower than other meats, making it accessible to a broader consumer base, especially in developing economies. Additionally, its versatility in various cuisines and easy incorporation into diverse dishes make it a staple in many diets worldwide. Health-conscious consumers favor chicken for its lower fat content compared to red meats, aligning with trends towards leaner, healthier protein options. Advancements in poultry farming and production technologies have also increased the efficiency and scale of chicken production, ensuring a steady supply. Furthermore, the growth of quick-service restaurants and fast-food chains, which prominently feature chicken products, fuels demand. Marketing campaigns emphasizing chicken's health benefits and versatility, coupled with the expansion of e-commerce and online grocery shopping, have made chicken more accessible than ever.

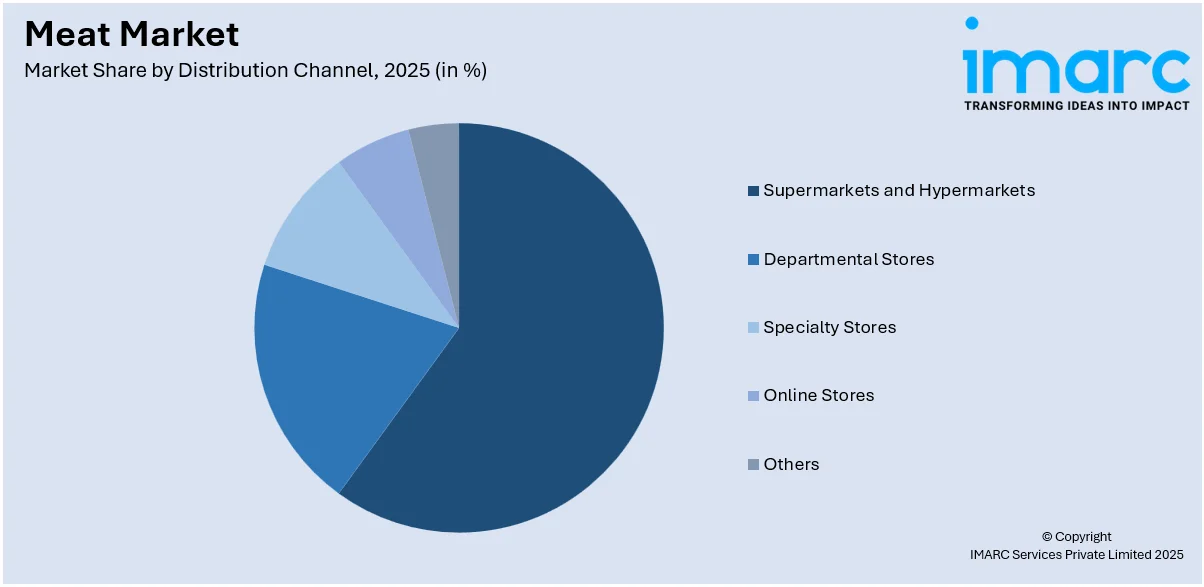

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets leads the market with around 60.0% of market share in 2025. The supermarkets and hypermarkets segment are driven by the increasing demand for convenience and one-stop shopping experiences. Urbanization and the rise in disposable incomes have led consumers to prefer large retail formats that offer a wide variety of products under one roof. Additionally, the growth of private label products, which provide cost-effective alternatives to branded goods, is attracting more customers to these stores. Technological advancements, such as self-checkout systems and digital payment options, enhance the shopping experience, making it more efficient and appealing. Furthermore, supermarkets and hypermarkets are leveraging data analytics to better understand consumer preferences and tailor their product offerings accordingly. Enhanced supply chain management ensures a steady availability of fresh and diverse products, further driving footfall. Promotions, loyalty programs, and the integration of online and offline shopping channels also play a significant role in attracting and retaining customers.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market with around 57.8% of market share in 2025. The regional market is driven by the increasing urbanization and rising disposable incomes, leading to higher meat consumption. Rapid economic growth in countries like China and India has expanded the middle class, boosting demand for protein-rich diets. Additionally, the region's cultural preference for meat in various traditional cuisines fuels market growth. Technological advancements in meat processing and cold chain logistics enhance production efficiency and product quality, supporting market expansion. Government support through favorable policies and subsidies for meat production also plays a significant role. The growing popularity of online retail and e-commerce platforms provides consumers with easier access to a wide variety of meat products. Health and wellness trends in the region are driving demand for leaner and organic meat options. Moreover, globalization and trade agreements facilitate the import and export of meat products, broadening market reach.

Key Regional Takeaways:

North America Meat Market Analysis

The North American meat market is a dynamic industry, primarily influenced by consumer preference for quality, sustainability, and healthy options. Among the leaders of the market is the United States, followed closely by Canada and Mexico. Beef, poultry, and pork have dominated the landscape, fueled by improvements in the efficiency of the supply chain and cold storage. There are indeed trends of consumer changes in favor of organic, grass-fed, and antibiotic-free choices. While there is increasing plant-based alternative use, meat intake is still highly sustained through traditional cultural and culinary traditions. Import/export dynamics will thus be impacted by trade policies, tariffs, and regulations toward major trading partners like Brazil and the European Union. Moreover, growing sustainability pressures call for greener practices among producers, including greenhouse gas emission reductions in livestock production. Overall, the North American meat market is expected to grow steadily, with innovations and changing consumer demands determining its future course.

United States Meat Market Analysis

The U.S. meat market is supported by strong domestic production and a robust export presence. The USDA reports that the U.S. produced around 26.9 billion pounds of beef in 2023, solidifying its leadership position in global meat supply. Exports are a key growth driver, with key markets such as China and Mexico accounting for more than 18% of pork shipments. The need for meat that is more premium, organic, and sustainable influences consumer preferences, pushing industry leaders like Tyson Foods and JBS to keep innovating. In particular, federal investment in process infrastructure will improve production efficiency, while technological advancements such as automation systems continue to optimize production processes. Sustainability programs, including renewable energy and waste reduction, help further reposition the market to long-term sustainability. US producers continue to grow their international business, taking advantage of export markets to gain market share in the world's meat market.

Europe Meat Market Analysis

The European meat market is defined by changing production trends and rigorous welfare regulations. Eurostat reported that the EU produced 20.6 million tonnes of pigmeat in 2023, which was 11.8% lower than the peak year of 2021. Despite declines of 3.9% and 6.3%, Spain (4.9 million tonnes) and Germany (4.2 million tonnes) remained leading producers. Poultry meat output recovered to 13.3 million tonnes in 2023, Poland making up 20.6% of that total. Beef and veal produced came in at 6.4 million tonnes with France alone representing 20.7%. Other farm-to-fork initiatives taken on by the EU are regulatory changes to animal welfare, further increasing quality and sustainability. The leaders in sheepmeat are Spain, France, and Italy producing 62.6% of the 0.4 million tonnes. These trends, coupled with continuous modernization and sustainability efforts, place Europe as a global leader in the meat market.

Asia Pacific Meat Market Analysis

The Asia Pacific meat market is growing rapidly because of increasing demand, strong imports, and changing production strategies. An industrial report has indicated that in 2023, China imported 2.7 million tons of beef, 1.55 million tons of pork, 1.3 million tons of poultry, and 0.4 million tons of mutton and lamb, which signifies increased meat consumption in the country. In 2023, Japan had produced 501.6 thousand tons of beef and 1.29 million tons of pork, with the latter being the most consumed type of meat and poultry. In the last 20 years, the country had experienced a 10% decline in domestic beef production, but still, half of its beef is imported to help satisfy the needs of the rising demand. During 2023, Japanese citizens consumed 13.1 kilograms of pork per capita, while pork and poultry comprise 81% of all meat consumption, as per reports. Innovative efforts, like Aleph Farms' partnership with Mitsubishi Corporation for the introduction of farmed meat, emphasize sustainability. Regional government support, trade collaborations, and technological advances further fuel market expansion.

Latin America Meat Market Analysis

Latin America's meat market is booming, driven by Brazil's record-breaking poultry and pork production. According to ABPA, Brazil will have slaughtered 15 million tonnes of chicken meat in 2024, with 9.7 million tonnes consumed locally and 5.3 million tonnes to be exported. The local export of chicken will see a 3.1% increase, from 2023 statistics. Pork production was at 4.5 million tonnes in 2024, while this is set to increase slightly to 4.6 million tonnes in 2025. Egg production will also have seen a surge with 57.6 billion units in 2024. Per capita chicken consumption stood at 45.6 kilograms in 2024, though an indicator of even higher local consumption. Under further growth projected for 2025, Brazil's meat industry cements its position as a key player in Latin America's dominance of the global meat market. Economic landscape and competitive pricing are galvanizing both local consumption and international market expansion.

Middle East and Africa Meat Market Analysis

Increased imports and domestic production shape the meat market in the Middle East and Africa. For example, according to the USDA Foreign Agricultural Service, Saudi Arabia imported over USD 1.5 billion in agricultural products from the United States alone in 2022, an all-time record. The trend of rising disposable incomes and focus on food security is also enhancing demand for better-quality meat products across the region. The governments of countries like the UAE are investing in food processing infrastructure to reduce import dependence. South Africa has a strong meat processing industry and is actively engaged in efforts for halal certification for both local and export markets. Regional players are also employing advanced cold chain logistics to maintain the quality and freshness of meats. With further investments and collaborations, the Middle East and Africa will continue to be significant contributors to the global meat market growth curve.

Competitive Landscape:

The key players in the global meat market are increasingly expanding their operations and innovating to capture a larger market share. They are investing heavily in advanced meat processing technologies to enhance production efficiency and ensure high-quality products. They are developing a range of ready-to-cook and pre-cooked meat products to meet the rising consumer demand for convenience. They have placed significant emphasis on sustainability, embracing greener ways and elevating standards concerning animal welfare. Marketing and branding efforts are heightened to gain powerful brand loyalty while increasing the presence in markets by forming strategic partnerships and alliances. They also explore e-commerce avenues to widen reach and enable the consumer with accessibility to an extensive range of meat products. Leaner and organic meat options are also being provided in order to respond to the rising demand for healthier diets. Together, these strategies collectively allow key players to remain competitive and grow within the dynamic meat market.

The report provides a comprehensive analysis of the competitive landscape in the meat market with detailed profiles of all major companies, including:

- BRF Global

- Cargill, Incorporated

- Clemens Food Group

- Conagra Brands Inc.

- Hormel Foods Corporation

- JBS S.A.

- Minerva Foods SA

- NH Foods Ltd.

- OSI Group

- Sysco Corporation

- Tyson Foods, Inc.

- Vion Group

- WH Group Limited

Latest News and Developments:

- November 2024: Brazilian meat processor BRF has concluded a binding deal to buy a processing food plant in China's central Henan province for USD 43 million. The company will invest USD 36 million in expanding the plant, with the goal of doubling capacity to 60,000 metric tonnes per year. Operations are expected to begin under BRF management in Q1 of 2025.

- October 2024: Sysco GB acquired Scotland-based Campbell’s Prime Meat, which employs 325 staff at its Linlithgow site and supplies meat, fish, and deli products across the UK.

- October 2024: Minerva Foods finalized its acquisition of the Brazilian assets from Marfrig for USD 1.53 billion, acquiring 13 slaughter and deboning facilities, plus one distribution center. Minerva thereby expands its slaughter capacity to 22,336 heads per day spread over 21 Brazilian plants while cementing itself as South America's second-biggest beef producer.

- September 2024: Clemens Food Group, the fifth-largest pork producer in the U.S., acquired Kunzler & Co. Inc., based in Lancaster, PA. This acquisition adds three processing facilities, enhancing Clemens' capacity to meet demand. Financial terms were undisclosed, but the move aligns with the company’s goals to support Pennsylvania’s agriculture.

- August 2024: Cargill has acquired two case-ready meat plants in North Kingstown, RI, and Camp Hill, PA, from Infinity Meat Solutions. The plants produce beef, pork, and value-added products for U.S. grocery stores. This acquisition strengthens Cargill’s partnership with Ahold Delhaize USA, with a focus on increasing high-quality products for retail customers.

Meat Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Trillion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BRF Global, Cargill, Incorporated, Clemens Food Group, Conagra Brands Inc., Hormel Foods Corporation, JBS S.A., Minerva Foods SA, NH Foods Ltd., OSI Group, Sysco Corporation, Tyson Foods, Inc., Vion Group, WH Group Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the meat market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global meat market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The meat market was valued at USD 1.5 Trillion in 2025.

IMARC estimates the meat market to exhibit a CAGR of 1.95% during 2026-2034.

The key drivers in the meat market are rising demand for protein-enriched diets, increasing acceptance of convenience food, growing health awareness of good-quality meats, advancements in food processing technologies, and the ever-increasing adoption of clean-label products. Other factors that continue to fuel this market are consumer preference for high-quality premium meat and sustainably sourced meat.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the meat market include BRF Global, Cargill, Incorporated, Clemens Food Group, Conagra Brands Inc., Hormel Foods Corporation, JBS S.A., Minerva Foods SA, NH Foods Ltd., OSI Group, Sysco Corporation, Tyson Foods, Inc., Vion Group, WH Group Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)