Marine Telematics Market Size, Share, Trends and Forecast by Component, Application, and Region, 2025-2033

Marine Telematics Market Size and Share:

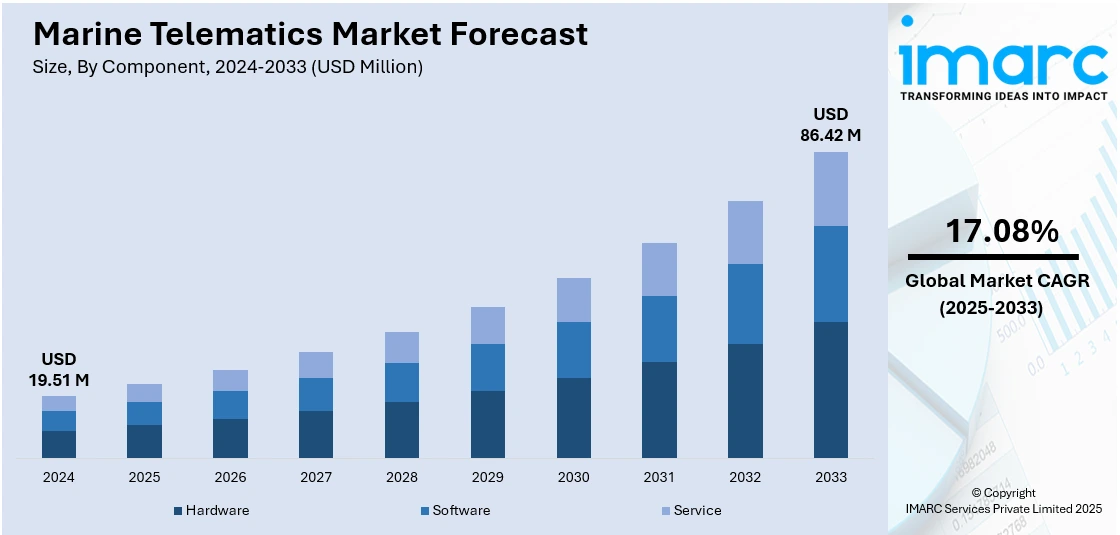

The global marine telematics market size was valued at USD 19.51 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 86.42 Million by 2033, exhibiting a CAGR of 17.08% during 2025-2033. North America currently dominates the market, holding a significant market share of over 38.7% in 2024. The rising international sea trade activities worldwide, strict marine safety norms, and escalating demand for fleet safety and security in the transportation of goods through commercial vessels represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 19.51 Million |

|

Market Forecast in 2033

|

USD 86.42 Million |

| Market Growth Rate 2025-2033 | 17.08% |

The market is primarily driven by the increasing adoption of advanced communication technologies in the maritime sector, which are essential for efficient vessel operations. Moreover, the rising focus on regulatory compliance with international maritime safety standards is prompting the integration of telematics systems to ensure adherence to environmental and operational guidelines. Furthermore, the growing demand for enhanced fleet management solutions, driven by the need for fuel efficiency, route optimization, and predictive maintenance, is contributing to the marine telematics market growth. Additionally, strategic partnerships are enhancing innovations and technological advancements, thereby facilitating market expansion. For instance, on June 27, 2024, Ocean Power Technologies announced an OEM agreement with Teledyne Marine to enhance its product offerings in maritime technology. The partnership combines Teledyne's advanced subsea equipment with OPT's expertise in low-carbon marine power and data solutions, aiming to deliver turnkey systems for ocean monitoring and connectivity. This collaboration reflects a shared commitment to innovation and sustainable maritime operations.

The market in the United States is experiencing significant growth due to the increasing emphasis on national security, and maritime surveillance. In addition to this, the strong presence of well-established shipping and logistics companies in the U.S. is creating the need for innovative solutions to streamline operations and ensure timely delivery, which is providing an impetus to the market. Furthermore, the increase in government investments in modernizing port infrastructure and maritime technologies. For example, on September 20, 2024, the Biden-Harris Administration announced a USD 147.5 Million investment through NOAA to modernize data collection and analysis. The funding will support innovative tools like uncrewed systems and remote sensing to monitor marine ecosystems and adapt to climate impacts. Additionally, the growing interest in renewable energy sources, such as offshore wind projects, necessitates advanced telematics to manage and monitor the vessels supporting these initiatives. Besides this, the U.S.'s significant involvement in international trade is increasing the need for real-time tracking and analytics, which is also a significant growth-inducing factor for the market.

Marine Telematics Market Trends:

Increased Adoption of IoT and Big Data

The integration of internet of things (IoT) technology and big data analytics is significantly enhancing the marine telematics market outlook. IoT permits real-time monitoring of vessels, which holds paramount importance in terms of providing insights into operational performance, location, fuel consumption, and environmental factors. It allows operators to connect sensors, devices, and equipment on ships, gathering continuous data on variables like engine health, weather conditions, and sea state, thus supporting informed decision-making. Adopting big data analytics allows the operators to process and analyze large-scale data and enable pattern detection and anomaly identification, supporting predictive maintenance and minimizing any unscheduled breakdowns. According to an industry report, the U.S. Coast Guard oversees more than 436,000 vessels annually, including over 117,000 commercial vessels. These vessels are monitored through technologies like AIS, which provides data on vessel location and performance. In addition, the Coast Guard performs over 25,500 container inspections and 5,000 facility safety and marine pollution inspections every year, underscoring the increasing importance of real-time data for operational effectiveness and security. Additionally, IoT and big data analytics improve the precision of vessel tracking, safety management, and route optimization capabilities while providing more effective operation efficiency and risk reduction. The trend to smart shipping is pushing the demand for IoT systems worldwide, through which the maritime industry can come closer, react faster, and be more data driven. These changes are currently transforming traditional operations in the marine industry into the most advanced and efficient, making them more sustainable.

Rising Demand for Fuel Efficiency and Sustainability

The maritime industry is placing fuel efficiency and sustainability high on its agenda in recent years. The IMO 2020 sulfur cap and carbon intensity reduction initiatives are the result of increased marine telematics market demand due to the growing focus on reducing carbon emissions internationally and stronger environmental regulations. These solutions enable continuous monitoring and optimization of fuel consumption, ensuring vessels operate at peak efficiency. Marine telematics systems track key performance indicators such as engine power output, fuel usage, and speed, enabling operators to identify inefficiencies and adjust operations accordingly. The U.S. Coast Guard’s focus on sustainability is evident in its wide-reaching inspections and boardings. According to industry reports, it responded to over 3,300 pollution incidents and carried out over 6,000 fisheries conservation boardings in a single year, highlighting the industry's growing concern with environmental impact. Telematics data also helps monitor emissions, ensuring compliance with environmental regulations and contributing to greener, more sustainable shipping practices. Telematics solutions also provide predictive maintenance, which reduces downtime and prolongs equipment lifespan, thereby further enhancing fuel efficiency. With the maritime sector working towards a reduction in its environmental footprint, the demand for telematics systems that support sustainability efforts, optimize fuel consumption, and mitigate emissions is increasing.

Growing Usage of Autonomous and Smart Vessels

The growing adoption of autonomous and smart vessels is significantly shaping the marine telematics market trends. Autonomous vessels rely heavily on telematics in order to work efficiently and safely as they are equipped with advanced navigation systems, sensors, and communication tools. Advanced onboard systems allow these vessels to gather and process data in real-time, leading to automated decision-making processes on route planning, navigation, and maintenance. Marine telematics solutions become an integral part of the running of these vessels, providing a means of connection for data interchange, remote monitoring, and fleet management. Using telematics in autonomous vessels allows operators to monitor the vessel's status and track its position and performance through remote monitoring-even in the harsh maritime environment-while also performing predictive maintenance with early identification of problems and avoidance of mechanical failures. According to an industry report, the Coast Guard performed over 1,424 boardings of high-interest vessels, illustrating the need for real-time tracking and smart systems that assist in managing maritime security. The growth in autonomous vessel technology is closely tied to these efforts, offering a way to automate and streamline such operations, improving both efficiency and safety on the waters. The growing development of AI, machine learning, and IoT technologies further accelerates the use of autonomous vessels. The industry's move towards smarter and more automated systems is creating an expanding demand for advanced solutions, thereby significantly augmenting marine telematics market share.

Marine Telematics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global marine telematics market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on component and application.

Analysis by Component:

- Hardware

- Software

- Service

- Safety and Security

- Information and Navigation

- Entertainment

- Diagnostics

Hardware leads the market with around 43.8% of market share in 2024. Hardware is critical in data collection, processing, and transmission in marine telematics. The basic components include a GPS device, sensors, antennas, onboard computers, and communication modules. These devices enable accurate monitoring of the performance and navigation of the vessels, plus environmental conditions. Advanced sensors collect data on fuel consumption, engine health, and weather patterns. GPS and communication systems ensure precise tracking and full connectivity. Robust hardware design is essential to withstand harsh marine environments, including saltwater corrosion, extreme temperatures, and vibration. Integration of durable and high-performance hardware is very important for efficient operation, safety, and compliance with regulations. As the market grows, innovation in internet of things (IoT) enabled devices and satellite communication hardware will continue to improve real-time data transmission, thus allowing fleet managers to optimize routes, reduce fuel costs, and improve overall maritime logistics.

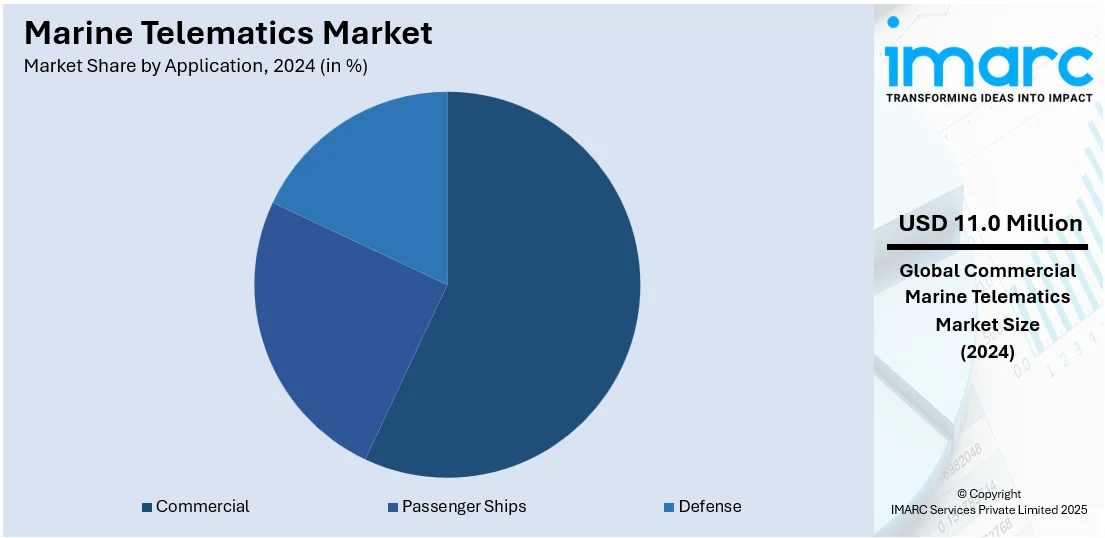

Analysis by Application:

- Commercial

- Passenger Ships

- Defense

Commercial leads the market with around 56.5% of market share in 2024. The commercial application of marine telematics supports the efficient operation of shipping fleets, fishing vessels, and other maritime businesses. Telematics systems in commercial settings enable real-time tracking of vessels, route optimization, and fuel consumption monitoring, helping businesses reduce operational costs and improve profitability. These systems also enhance safety by providing alerts for adverse weather conditions, mechanical issues, or potential collisions. For industries like cargo shipping, marine telematics ensures regulatory compliance by monitoring emissions and maintaining records required for environmental standards. The commercial sector benefits from insights gained through data analytics, enabling better decision-making and predictive maintenance. As global trade and maritime logistics continue to expand, the demand for reliable, data-driven solutions ensures that telematics will remain indispensable for enhancing productivity, minimizing risks, and achieving sustainability goals.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.7% due to the adoption of advanced technologies, robust maritime trade, and stringent regulatory frameworks. Telematics solutions enhance vessel monitoring, operational efficiency, and compliance with safety standards in the region's well-established shipping and logistics industries. The major presence of ports in the regions of Los Angeles, Long Beach, and New York increases the requirement for innovative ways to handle this increased trade. North America leads in integrating satellite communication with IoT-enabled systems in support of the real-time sharing of data for optimization of fleet management. The regulations set by enforcement agencies such as the U.S. Coast Guard push the demand forward by emphasizing safety and emissions standards. Investment in research and development (R&D) activities and partnerships between technology providers and maritime companies makes North America a major market contributor to the growth and innovation of marine telematics globally.

Key Regional Takeaways:

United States Marine Telematics Market Analysis

The United States holds a substantial share of the North America smart crop monitoring market with 80.00% in 2024.TThe U.S. marine telematics market remains on a steady growth trend. Driven by the robust performance of the marine economy, the market has maintained a sharp upswing over the last two years. According to the U.S. Bureau of Economic Analysis, the marine economy contributed USD 476.2 Billion, or 1.8% of the nation's GDP in 2022 - up from USD 424.2 Billion in 2021. Gross output of the marine economy stands at USD 776.9 Billion, or 1.7% of current-dollar output. This growth is due to the expanding importance of the maritime sector, including shipping, port operations, and recreational boating. With these changes, the need for telematics solutions increases, particularly on fleet management, tracking, and safety systems. Telematics technology is also fundamental in modernizing the commercial fleet of the United States and the improvement of its port infrastructure as it is instrumental in ensuring improved operational efficiency while being in accordance with the appropriate regulations. The growth in autonomous shipping and predictive maintenance solutions is further driving market growth, with companies investing in innovative telematics solutions to stay competitive and ensure sustainability in the maritime industry.

Europe Marine Telematics Market Analysis

Europe's market for marine telematics is becoming very strong driven by stiff maritime regulations and increased focus on digitalization. The European Maritime Safety Agency (EMSA) allocated about EUR 100 Million (USD 110.5 Million) to the agency's budget in 2023, which covers several initiatives to enhance maritime safety and improve fleet efficiency across commercial fleets. Countries like the UK, Germany, and the Netherlands are employing marine telematics solutions in commercial vessels to have operational efficiency, but also abide by international maritime regulations, which includes the safety rules of the International Maritime Organization. Telematics in Europe is additionally boosted by its recreational boating culture, most specifically in the Mediterranean regions. Such large companies as Fleet Complete and Marine Traffic dominate the space with their fleet management solution that offers both GPS tracking and vessel performance monitoring. Along with these advancements and ongoing R&D and investments in 5G technology, Europe is sure to be one of the top marine telematics markets.

Asia Pacific Marine Telematics Market Analysis

The Asia Pacific marine telematics market is likely to grow at a robust pace, driven by the expansion of maritime industries and the increasing adoption of advanced technologies. According to the Transport Planning and Research Institute of China's Ministry of Transport's Analysis Report on Chinese Port Operations 2024, China's foreign trade volume through maritime transport accounted for 30.1% of the world's marine shipping in 2023, increasing 2.2 percentage points annually. 4.96 billion tons of international trade cargo were handled by Chinese coastal ports in 2023, a 9.6% increase over the previous year. These figures reflect the magnitude by which China has been expanding its maritime trade, thereby increasing the demand for telematics solutions in fleet management. The volume of China and India's growing maritime trade will also be the core of the marine telematics market since they embrace telematics in line with improvements in the tracking of vessels as well as attaining decreased operational costs. The increasing number of the leisure sailors in Australia and Japan is also the main driver that is growing the market in the personal vessel segment. The local and international telematics companies are also partnering each other for innovation, further proliferating their market in this region.

Latin America Marine Telematics Market Analysis

Latin America's marine telematics market is on an upward trajectory, supported by the region's increasing trade activities and modernization of its maritime fleet. In 2023, Brazil's maritime trade balance saw a significant growth of 41.9%, reaching an FOB value of USD119.1 Billion. As an example, digital transformation in Brazil reached R$ 186.6 Billion (USD 38.4 Billion), as per an industry report. Key areas for focus include semiconductors, industrial robotics, advanced technologies like artificial intelligence and Internet of Things, and others. Along with a significant coastline, growth in port infrastructure has placed Brazil at the head of market expansion. Government regulations related to the safety of shipping at sea, along with its environmental impact, have also generated interest in the commercial shipping segment in the area of telematics solutions. The growth in recreational boating in Argentina and Chile is similarly adding to the market in the personal vessel segment. Regional players such as C3S Tecnologia are leveraging local demand for fleet management and tracking systems. Government and private initiatives to improve logistics and shipping have helped gather momentum for telematics adoption, bolstering the outlook in the entire region.

Middle East and Africa Marine Telematics Market Analysis

In the Middle East and Africa, the marine telematics market is growing significantly with increasing trade volumes and investment in port infrastructure with technology. According to the General Authority for Statistics (GASTAT), incoming and outbound container traffic in Saudi Arabia's ports increased by 14.6% in 2023 over the previous year. The total ship traffic at Saudi ports increased by 33.8% in 2023 with 19,082 ships passing through them, which is indicative of the importance this region plays for global trade- especially the case with the trade passing through Jeddah and King Abdullah Ports. As the maritime infrastructure continues to modernize itself, investments are flowing into telematics and IoT solutions in enhancing efficiency and, above all, safety within shipping. Countries like UAE and Egypt too, are embracing telematics in fleet management and navigation services and this aspect alone is paving a way towards growing market in the region.

Competitive Landscape:

The market is highly competitive, driven by innovation and efficiency needs in vessel operation. The dominant players focus majorly on solutions that incorporate the Internet of Things (IoT) and data analytics in innovative ways to maximize maritime safety, reduce fuel consumption, and follow world regulations. The companies are also investing their resources into research and development (R&D) activities to come up with innovative, high-end telematics systems with real-time monitoring and predictive maintenance. Strategic partnerships and collaborations further enhance service provisions. The competition is also due to the increasing adoption of commercial shipping, defense, and recreational boating. Other factors that push the market competition include growing regulatory pressure and rising demand from customers for environmental solutions.

The report provides a comprehensive analysis of the competitive landscape in the marine telematics market with detailed profiles of all major companies, including:

- Applied Satellite Technology Ltd

- Cybernetica AS

- Ki2 Infotech

- Metocean Telematics

- Navis (Accel-KKR)

- Sentinel Marine

- Technoton

- Traxens

- Verizon

- Viatrax Automation Corporation

Recent Developments:

- August 2024: Siren Marine’s Siren 3 Pro IoT device will be standard equipment on select 2025 Pursuit boat models 32 feet and longer. The partnership aims to enhance the boating experience by providing remote connectivity, security, and monitoring through smartphones.

- July 2024: Siren Marine announced that its Siren 3 Pro marine telematics product will now ship as a standard with all multi-engine Yamaha Helm Master EX kits. This integration brings Connected Boat technology to a broader audience, enhancing premium boat offerings for Yamaha boat builders and dealers.

- April 2024: Hapag-Lloyd has chosen ORBCOMM’s newest dry marine container telematics solution to enhance supply chain visibility. This technology aims to improve operational efficiencies and customer satisfaction, marking Hapag-Lloyd as the first to implement ORBCOMM’s innovative dry container IoT solution.

- January 2024: Yamaha and Siren Marine unveiled the Siren Connected Boat mobile app, combining real-time vessel security, boat monitoring, tracking, and remote digital switching. It is an application that works together with Yamaha outboards, bringing users personalized boat management, maintenance reminders, and extended battery life.

- October 2023: According to ORBCOMM, its new dry container telematics solution is now commercially available, offering operational visibility and traceability for dry marine containers in complex global supply chains. The solution is showcased at Intermodal Europe 2023, held from October 10-12 in Amsterdam.

Marine Telematics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Commercial, Passenger Ships, Defense |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Applied Satellite Technology Ltd, Cybernetica AS, Ki2 Infotech, Metocean Telematics, Navis (Accel-KKR), Sentinel Marine, Technoton, Traxens, Verizon, Viatrax Automation Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the marine telematics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global marine telematics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the marine telematics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The marine telematics market was valued at USD 19.51 Million in 2024.

The marine telematics market is projected to exhibit a CAGR of 17.08% during 2025-2033, reaching a value of USD 86.42 Million by 2033.

The key factors driving the market include increasing need for real-time vessel tracking, enhanced maritime safety regulations, advancements in IoT and AI technologies, and growing demand for fuel efficiency and operational optimization in shipping operations.

North America currently dominates the marine telematics market, accounting for a share of 38.7% in 2024. The dominance is fueled by extensive maritime trade, technological innovation, and stringent safety and environmental compliance measures.

Some of the major players in the market include Applied Satellite Technology Ltd, Cybernetica AS, Ki2 Infotech, Metocean Telematics, Navis (Accel-KKR), Sentinel Marine, Technoton, Traxens, Verizon, and Viatrax Automation Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)