Marine Insurance Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, And Region, 2026-2034

Marine Insurance Market Size and Share:

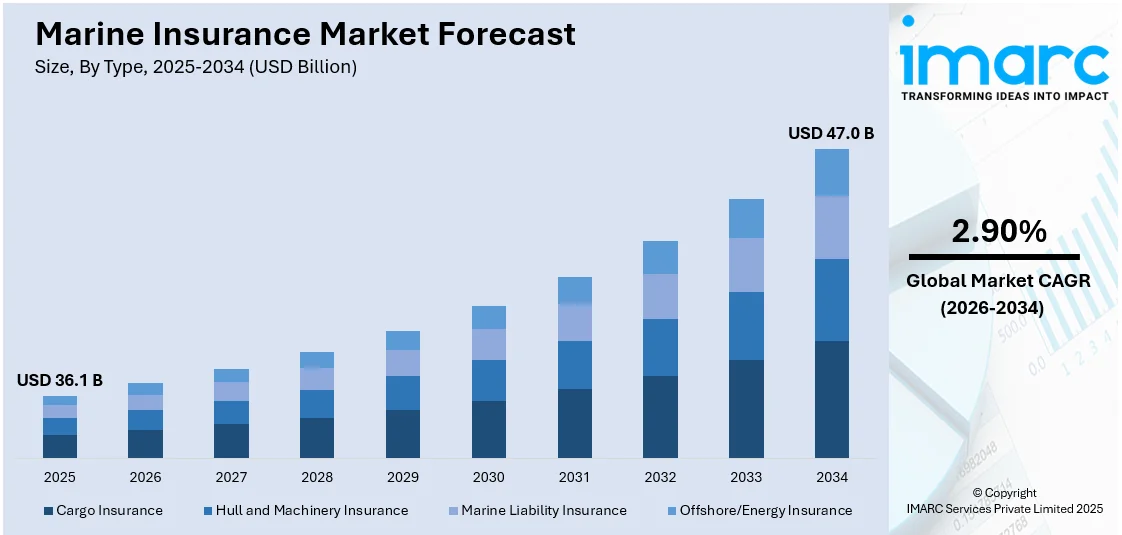

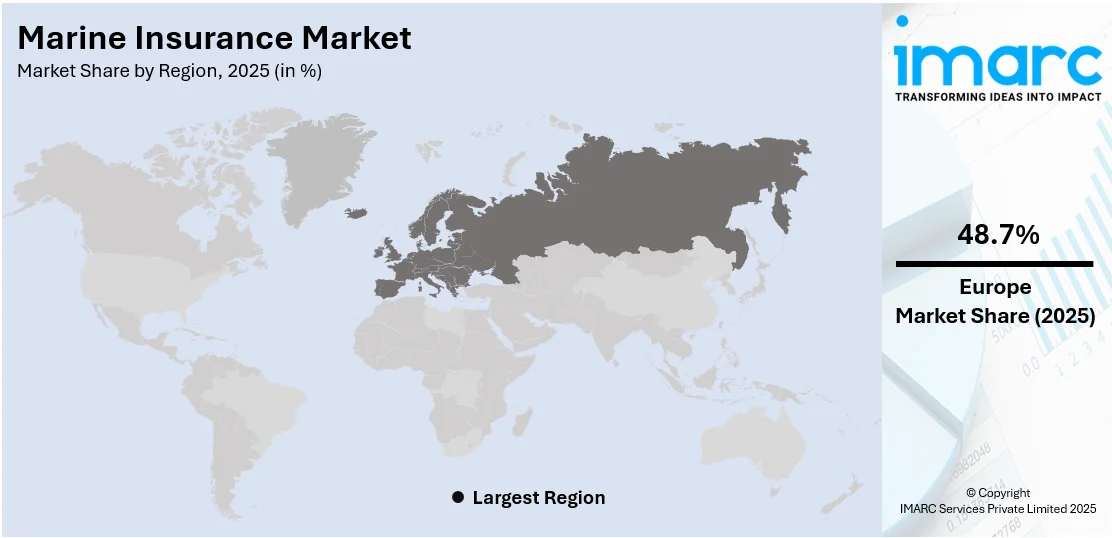

The global marine insurance market size was valued at USD 36.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 47.0 Billion by 2034, exhibiting a CAGR of 2.90% during 2026-2034. Europe currently dominates the market, holding a significant market share of over 48.7% in 2025. There are various factors that are driving the market, which include the growing number of ship accidents, rising trade volume on account of the thriving e-commerce industry, and the increasing need for comprehensive coverage requirements due to geopolitical tensions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 36.1 Billion |

|

Market Forecast in 2034

|

USD 47.0 Billion |

| Market Growth Rate (2026-2034) | 2.90% |

The marine insurance market is driven by rising global trade, increasing cargo volumes, and expanding maritime transportation networks. Growing risks from natural disasters, piracy, geopolitical tensions, and cyber threats necessitate comprehensive coverage. Stringent international regulations, such as IMO conventions, mandate liability coverage for vessel owners, further fueling demand. Advancements in digitalization, blockchain, and AI-driven risk assessment enhance underwriting efficiency and claims processing. The surge in e-commerce and containerized shipping increases demand for cargo insurance. Sustainability initiatives, including decarbonization efforts and green shipping, introduce new insurance requirements. Additionally, fluctuating fuel prices and operational risks encourage shipowners and traders to secure policies against potential financial losses, reinforcing the market’s steady growth. The factors, collectively, are creating the marine insurance market outlook across the globe.

To get more information on this market Request Sample

The U.S. marine insurance market is driven by high cargo volumes, extensive port infrastructure, and strong international trade activity. Stringent regulatory frameworks, including Jones Act compliance and environmental liability laws, mandate insurance coverage for vessels and cargo, which also represents one of the key marine insurance market trends in the country. Increasing risks from extreme weather events, cyberattacks on shipping systems, and supply chain disruptions further boost demand. Advancements in digital underwriting, blockchain-based policies, and AI-driven risk assessment enhance market efficiency. Growth in offshore wind energy projects and LNG transportation expands marine insurance requirements. Additionally, rising e-commerce shipments, port modernization efforts, and geopolitical uncertainties contribute to sustained demand for comprehensive marine insurance solutions. For instance, in October 2024, QBE International Markets intends to broaden its specialist portfolio in all 50 states by 2025 by launching a new US inland marine product line. The ocean marine and energy divisions of QBE, which were headed by Kristina Bush and had headquarters in Houston, Texas, included the inland marine product.

Marine Insurance Market Trends:

Growing Number of Ship Accidents

The Baltimore Bridge collapsed on March 28, 2024, as a result of a cargo ship colliding with it. This event may result in the highest marine insurance payment ever. Baltimore is the largest port in the US for handling vehicles including automobiles and large farm equipment. A range of USD 2 Billion to USD 4 Billion might be the insured damages. Ship accidents lead to a rise in insurance claims including hull and machinery damage, cargo loss, and third-party liabilities. As a result of the increased payouts, insurers are financially more burdened. In order to guarantee insurers' profitability and adequate reserves to handle big claims, higher premiums are required. Moreover, shipping businesses can be mandated by insurers to establish more comprehensive risk management and safety protocols.

Increasing Trade Volume Due to Thriving E-Commerce Sector

The rising trade volume across the globe due to the thriving e-commerce industry is bolstering the marine insurance market demand. Due to the increased maritime activity, there is a corresponding rise in the need for marine insurance to protect against the dangers involved in moving these commodities. E-commerce platforms offer a vast array of products on a large scale worldwide. This diversification requires specialized insurance policies tailored to different types of goods, thereby expanding the marine insurance market. In contrast to conventional large-scale delivery, e-commerce frequently entails more frequent shipments. Besides this, the logistics of handling numerous smaller shipments introduce complexities and risks that marine insurer address including a higher potential for loss, damage, and delays. According to estimates made by Forbes, the e-commerce market would reach a value of about USD 7.9 Trillion by 2027.

Rising Geopolitical Tensions

Geopolitical tensions have the potential to turn into wars or conflicts, which can disrupt maritime lanes, destroy ships, and result in the loss of cargo. The escalating demand for higher insurance premiums and more comprehensive coverage requirements on account of the increasing risk of hijackings, theft, and crew kidnappings is bolstering the market growth. The global commercial insurance market size was valued at USD 922.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,684.0 Billion by 2033, exhibiting a CAGR of 6.2% from 2025-2033. Increased cybersecurity threats such as cyberattacks on maritime corporations and port infrastructure can also result from geopolitical conflicts. Insurance companies are responding to these new threats by providing cyber insurance solutions designed specifically for the marine sector. Moreover, leading companies are forming alliances to offer improved services and insurance quotes to the marine industry. For instance, AXA XL and Oversea Insurance Agency, an EPIC company, partnered to provide specialized maritime general liability insurance coverage for Marine Artisans in the United States on 20 December 2023. Furthermore, Marine Artisans are contractors that focus on different aspects of building, maintaining, and repairing boats. These aspects involve fiberglass repair, marine carpentry, hull cleaning, electronics installation and repair, marine plumbing, heating, ventilation, and air conditioning (HVAC), and machinery, as well as engine and machinery servicing.

Marine Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global marine insurance market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, distribution channel, and end user.

Analysis by Type:

- Cargo Insurance

- Hull and Machinery Insurance

- Marine Liability Insurance

- Offshore/Energy Insurance

Cargo insurance stand as the largest component in 2025, holding around 57.9% of the market. Various types of goods are covered by cargo insurance including perishables, high-value items, and completed or raw materials. Companies that engage in moving goods from one place to another are always looking for ways to reduce the risks that come with transportation such as theft, damage, accidents, and natural catastrophes. Furthermore, cargo insurance offers financial protection and peace of mind to companies, which is leading to a positive marine insurance market forecast.

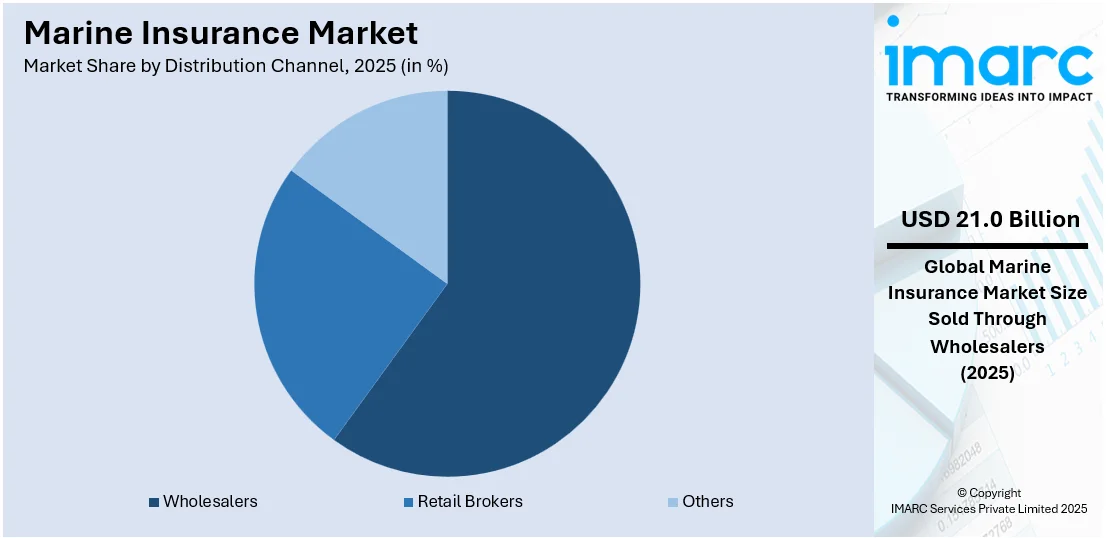

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Wholesalers

- Retail Brokers

- Others

Wholesalers leads the market with around 60.0% of the market share in 2025. Wholesalers usually handle a larger amount of merchandise, both in terms of quantity and value. They are key clients for marine insurance since it is essential to insure these huge shipments to guard against potential losses. High-value products like electronics, machinery, and luxury goods are handled by wholesalers. To reduce potential losses from damage, theft, or other accidents, comprehensive insurance coverage is required due to the financial risk involved in transporting these assets.

Analysis by End User:

- Ship Owners

- Traders

- Others

Traders hold the largest marine insurance market share due to their high exposure to cargo risks across global supply chains. They regularly transport goods via sea, requiring coverage against loss, damage, and delays. Given their volume of shipments, they negotiate comprehensive policies, including cargo insurance, liability coverage, and war risk insurance. Their reliance on maritime transport for international trade drives demand for customized insurance solutions. Additionally, regulatory compliance and financial risk mitigation further encourage traders to secure extensive coverage. Large-scale commodity traders invest heavily in marine insurance to safeguard high-value shipments from unforeseen disruptions.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Europe accounted for the largest market share of over 48.7%. Europe has a long history of maritime trade and commerce. Established shipping routes, ports, and maritime infrastructure contribute to the high demand for marine insurance in the region. Additionally, the high volume of goods being traded necessitates comprehensive marine insurance coverage to protect against potential losses. Besides this, the region has the presence of leading insurance companies and brokers providers. Furthermore, stringent regulations and international trade agreements are bolstering the market growth in the region. On 25 April 2024, Russia’s state-owned reinsurer companies, including Sogaz Insurance, Alfastrakhovanie, and VSK Insurance joined Ingostrakh as insurers recognized by India to provide marine insurance coverage. This is the first time RNRC has provided financial support to three Russian insurers seeking accreditation in India.

Key Regional Takeaways:

North America Marine Insurance Market Analysis

The North American marine insurance market is driven by increasing trade volumes, port expansions, and a strong logistics network. Strict regulatory frameworks, including the Jones Act, environmental liability laws, and international maritime conventions, mandate comprehensive vessel and cargo insurance. Rising climate risks, including hurricanes and flooding, heighten demand for protection against natural disasters. Cybersecurity threats in shipping systems and digital freight platforms further drive specialized coverage. Growth in offshore energy projects, including offshore wind and LNG transport, expands insurance needs. The surge in e-commerce and containerized shipping fuels cargo insurance demand. Additionally, technological advancements in AI-driven risk assessment, blockchain for claims processing, and IoT-based tracking enhance underwriting efficiency, supporting market growth across ocean and inland marine segments.

United States Marine Insurance Market Analysis

In 2025, the United States accounted for the largest market share of over 86.80% in North America. The U.S. marine insurance market is primarily driven by expanding global trade and the growth of the e-commerce sector. With increasing shipping volumes, particularly in high-value goods like electronics, the demand for cargo insurance is rising. The U.S. remains a key player in industries such as oil, gas, and chemicals, further driving the need for specialized marine insurance products. The integration of advanced technologies in shipping, including automation, has improved operational efficiency and risk management. According to the GAO, all 10 largest U.S. container ports have adopted automation technology to varying degrees, enhancing the overall logistics process. This trend increases the attractiveness of insurance offerings by streamlining risk mitigation strategies and claims processing. Environmental concerns, driven by climate change, are also fueling demand for coverage related to environmental liabilities, particularly in offshore operations. Political factors such as trade disputes and tariffs elevate the need for insurance coverage against shipping disruptions. The highly developed U.S. insurance infrastructure and regulatory frameworks provide a stable environment for marine insurance providers. Furthermore, the growing cybersecurity risks in the maritime industry have led to higher demand for cyber insurance, addressing digital vulnerabilities in shipping operations.

Asia Pacific Marine Insurance Market Analysis

The APAC marine insurance market is driven by rapid industrialization in key countries like China and India, along with a surge in international trade. The region’s growing maritime traffic and port developments significantly boost demand for cargo and vessel insurance. Additionally, the expanding e-commerce market, particularly in Southeast Asia, further contributes to market growth. The Southeast Asian e-commerce sector is projected to grow at a CAGR of 19.40% between 2024 and 2032, increasing shipping and logistics activities that require insurance coverage. Environmental risks, including natural disasters, also elevate the need for comprehensive insurance solutions. As awareness of risk management continues to rise, businesses are increasingly turning to marine insurance to mitigate potential disruptions.

Latin America Marine Insurance Market Analysis

Latin America's marine insurance market is driven by increased exports, particularly in agriculture, mining, and energy sectors. According to UNCCD, nearly 31 Million young people aged 15 to 29 live in rural areas across the 20 countries of Latin America, with about 9.6 Million working in agriculture. These industries, along with the region's growing maritime infrastructure, fuel the demand for cargo insurance. Additionally, rising awareness of risk management and increased trade activities further support the market. As the region develops its logistics and port capabilities, the need for comprehensive marine insurance solutions continues to grow.

Middle East and Africa Marine Insurance Market Analysis

The Middle East and Africa marine insurance market benefits from strategic shipping routes and significant oil exports. OPEC member countries in MENA hold 840 Billion barrels of proven crude oil reserves, driving the demand for marine insurance solutions in the oil and gas sector. Increased regional trade, port developments, and rising infrastructure investments further boost insurance demand. Additionally, political instability and piracy risks in certain areas heighten the need for comprehensive coverage. As shipping activity continues to grow in these vital trade routes, the demand for reliable and specialized marine insurance services remains strong across the region.

Competitive Landscape:

The marine insurance market is dominated by global insurers, specialty underwriters, and Lloyd’s syndicates. Key players include Allianz Global Corporate & Specialty, AXA XL, Zurich Insurance, AIG, Chubb, and QBE, alongside major reinsurers like Munich Re and Swiss Re. Lloyd’s of London remains a leading marketplace for ocean marine policies. Firms compete on coverage customization, risk assessment technology, and claims efficiency. Digitalization, blockchain, and AI-driven underwriting are differentiators, improving risk modeling and fraud detection. Rising climate risks, cyber threats, and geopolitical uncertainties push insurers toward innovative solutions. Regional players focus on port expansions, offshore energy, and cargo logistics, while global insurers dominate large-scale shipping, fleet, and hull insurance markets. M&A activity remains active, reshaping competitive dynamics.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Allianz SE

- American International Group Inc.

- Aon plc

- Arthur J. Gallagher & Co.

- AXA S.A, Beazley plc

- Brown & Brown Inc.

- Chubb Group Holdings Inc

- Lloyd's of London

- Lockton Companies

- Marsh & McLennan Companies Inc.

- QBE Insurance Group Ltd

- Swiss Re Ltd

- Willis Towers Watson plc

- Zurich Insurance Group Ltd.

Latest News and Developments:

- January 2025: Policybazaar For Business (PBFB) has introduced Enroute, a digital platform streamlining marine and transit insurance operations. The platform automates certificate generation and declaration filing, reducing manual processes for domestic and international trade insurance.

- September 2024: Sompo has launched a national marine insurance proposition in the UK, expanding beyond London to offer Marine Cargo and Transport & Logistics policies nationwide. The Marine Cargo UK policy provides all-risks coverage with simplified terms, while Transport & Logistics UK offers a comprehensive package, including freight liability, employer and public liability, and property coverage.

- May 2024: Allianz Commercial and Rokstone have introduced a USD 10 Million marine cargo facility, enhancing wholesale marine distribution and underwriting capabilities. This collaboration allows Rokstone to underwrite direct and reinsurance cargo business globally with full binding authority from London. It complements Rokstone’s existing USD 25 Million facility for North American marine operations.

- April 2023: Chubb, a global P&C insurer, declared that it is expanding its marine business in Asia by appointing a new Head of Marine in Malaysia and launching a comprehensive range of insurance products and services in the Philippines. The move in the Philippines will effectively expand Chubb's marine insurance footprint in ten Asian nations, including Korea, China, Hong Kong, Taiwan, Vietnam, Thailand, Malaysia, Singapore, Indonesia, and Japan.

- March 2024: Marsh McLennan, the world's largest professional services organization in risk, strategy, and people, announced a significant expansion of its Unity insurance facility in collaboration with the Ukrainian government and Lloyd's. Unity currently offers inexpensive war risk insurance for ships transporting non-military goods such as iron ore, steel, and containerized shipping, as well as supporting Ukraine's larger marine export ecology.

Marine Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cargo Insurance, Hull and Machinery Insurance, Marine Liability Insurance, Offshore/Energy Insurance |

| Distribution Channels Covered | Wholesalers, Retail Brokers, Others |

| End Users Covered | Ship Owners, Traders, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allianz SE, American International Group Inc., Aon plc, Arthur J. Gallagher & Co., AXA S.A, Beazley plc, Brown & Brown Inc., Chubb Group Holdings Inc, Lloyd's of London, Lockton Companies, Marsh & McLennan Companies Inc., QBE Insurance Group Ltd, Swiss Re Ltd, Willis Towers Watson plc, Zurich Insurance Group Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the marine insurance market from 2020-2034.

- The marine insurance market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the marine insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The marine insurance market was valued at USD 36.1 Billion in 2025.

The marine insurance market is projected to exhibit a CAGR of 2.90% during 2026-2034, reaching a value of USD 47.0 Billion by 2034.

The marine insurance market is driven by rising global trade, increasing cargo volumes, and regulatory compliance. Growing climate risks, cyber threats, and geopolitical tensions boost demand. Advancements in AI-driven underwriting, blockchain, and IoT-based risk assessment enhance efficiency. Expanding offshore energy projects, e-commerce logistics, and port modernization further propel market growth.

Europe currently dominates the marine insurance market, accounting for a share of 48.7%. Strict regulations, rising trade volumes, climate risks, offshore wind expansion, cyber threats, digitalization, port investments, and evolving maritime security concerns.

Some of the major players in the marine insurance market include Allianz SE, American International Group Inc., Aon plc, Arthur J. Gallagher & Co., AXA S.A, Beazley plc, Brown & Brown Inc., Chubb Group Holdings Inc, Lloyd's of London, Lockton Companies, Marsh & McLennan Companies Inc., QBE Insurance Group Ltd, Swiss Re Ltd, Willis Towers Watson plc, Zurich Insurance Group Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)