Marine Adhesive Market Size, Share, Trends and Forecast by Resin Type, Substrate, Application, End Use, and Region, 2025-2033

Marine Adhesive Market Size and Share:

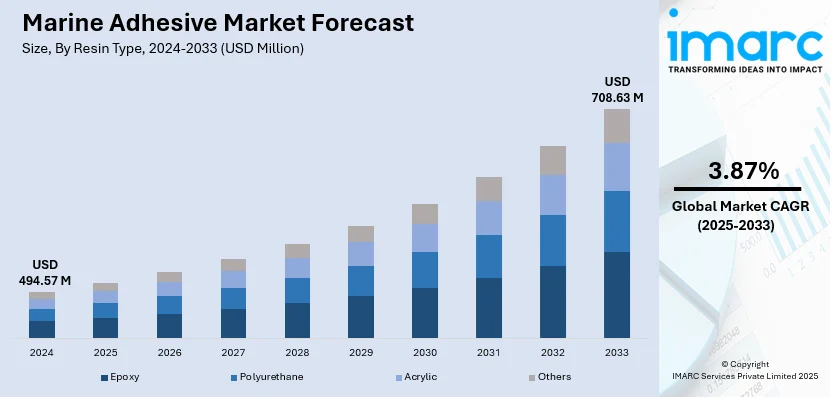

The global marine adhesive market size was valued at USD 494.57 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 708.63 Million by 2033, exhibiting a CAGR of 3.87% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 42.0% in 2024. The expanding due to the rising demand in shipbuilding, repairs and offshore applications; advancements in epoxy, polyurethane and acrylic adhesives; growing naval investments, commercial vessel production and sustainability initiatives are some of the factors that continue shaping marine adhesive market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 494.57 Million |

| Market Forecast in 2033 | USD 708.63 Million |

| Market Growth Rate (2025-2033) | 3.87% |

The marine adhesive market is driven by increasing demand for high-performance bonding solutions in shipbuilding, repair and maintenance. Rising adoption of lightweight materials in marine construction boosts the need for strong and durable adhesives. Advancements in epoxy, polyurethane and acrylic adhesives enhance water resistance, durability and corrosion protection. Stringent environmental regulations drive demand for ecofriendly and solvent-free adhesives. Growth in commercial and recreational boating, offshore structures and naval applications further supports market expansion with manufacturers focusing on high-strength weather-resistant formulations. The Boating Industry Association's 2024 report reveals a $10.12 billion turnover for 2023-24 a 5% increase. Employment in the industry includes 27,500 direct jobs and 8,250 contractors. Notably, 1 in 10 Australians hold a boat license with over 970,000 registered vessels and 85% under 6 meters.

The United States marine adhesive market is driven by growing demand for high-strength and water-resistant bonding solutions in shipbuilding repair and maintenance. Increased use of advanced composites and lightweight materials in naval and commercial vessels boosts adhesive adoption. Stricter environmental regulations promote ecofriendly and low-VOC adhesives. Rising recreational boating and offshore infrastructure projects further drive demand. Technological advancements in epoxy polyurethane and acrylic adhesives enhance durability, flexibility and corrosion resistance. Strong investments in maritime defense and commercial shipping also contribute to market growth. For instance, in April 2024, the U.S. Fish and Wildlife Service announced over $21 million in Boating Infrastructure Grants for 187 new slips and 7,768 feet of docking space across 21 states, Guam and the U.S. Virgin Islands. The funding aims to enhance recreational boating and fishing boosting local economies and access to waterways.

Marine Adhesive Market Trends:

Expansion in Recreational and Commercial Boating

The expansion of recreational and commercial boating is driving demand for marine adhesives as increased vessel production and maintenance require strong and water-resistant bonding solutions. Growth in marine tourism, yacht ownership and leisure boating boosts adhesive consumption in recreational segments. Meanwhile, rising global trade and cargo shipping fuel demand for durable adhesives in commercial vessel construction and repair. For instance, in January 2024, the Indian government announced a ₹45,000 crore investment to boost river cruise tourism expanding from 8 to 26 waterways and increasing cruise circuits from 17 to 80 by 2047. Cruise terminals will rise from 15 to 185. Additionally, ₹15,200 crore is allocated for enhancing cargo trade via inland waterways. Adhesives play a crucial role in enhancing structural integrity, preventing corrosion and improving vessel longevity making them essential in both new builds and refurbishments.

Increasing Investments in Naval and Defense Sectors

Increasing investments in naval and defense sectors are driving marine adhesive market demand for high-performance marine adhesives, essential for shipbuilding, repairs, and maintenance. Governments worldwide are allocating higher budgets for naval fleets, submarines and patrol vessels requiring advanced adhesives for structural bonding, sealing and corrosion resistance. Military applications demand durable, water-resistant and impact-resistant adhesives to withstand extreme marine conditions. For instance, in January 2025, the Government of India announced the construction of 60 large Navy ships worth Rs 1.5 trillion expected to generate Rs 3 trillion in economic impact and create 14,000 jobs per vessel. During the commissioning of INS Surat, INS Nilgiri and INS Vaghsheer in Mumbai, the government highlighted India's booming defense production over Rs 1.25 trillion. Technological advancements in polyurethane, epoxy and hybrid adhesives enhance performance supporting the longevity and reliability of defense vessels in harsh operational environments.

Rising Demand for High-Performance Adhesives

The rising demand for high-performance marine adhesives is driven by their critical role in shipbuilding, repairs, and offshore structures. These adhesives offer superior bonding strength, water resistance, and durability, essential for withstanding harsh marine environments. Shipbuilders increasingly prefer advanced epoxy, polyurethane, and acrylic adhesives for their flexibility, impact resistance, and ability to bond diverse materials. In offshore structures, adhesives provide enhanced sealing, corrosion protection, and structural integrity. Growing maritime trade, naval investments, and offshore energy projects further fuel market expansion. These factors are strengthening industry growth and increasing adoption, creating a positive marine adhesive market outlook.

Marine Adhesive Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global marine adhesive market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on resin type, substrate, application, and end use.

Analysis by Resin Type:

- Epoxy

- Polyurethane

- Acrylic

- Others

Epoxy adhesives dominate the marine adhesive market due to their superior strength, durability, and water resistance. They provide excellent bonding for various materials, including metals, composites, and fiberglass, making them ideal for shipbuilding, repairs, and offshore structures. Their chemical resistance and ability to withstand extreme marine conditions enhance vessel longevity and structural integrity. Epoxy adhesives also offer high load-bearing capacity, ensuring strong adhesion in high-pressure environments. As marine construction and maintenance activities increase, epoxy remains the preferred choice for long-lasting, high-performance bonding solutions.

Analysis by Substrate:

- Plastics

- Composites

- Metal

- Others

Plastics dominate the marine adhesive market as they are widely used in shipbuilding, boat manufacturing, and offshore structures. Adhesives designed for plastic materials ensure strong, flexible bonding, crucial for lightweight marine components. The increasing use of advanced composites and polymer-based structures in vessels boosts demand for specialized adhesives that offer water resistance, durability, and impact absorption. Innovations in adhesive formulations enhance adhesion to various plastic surfaces, improving structural integrity. As marine industries shift toward lightweight materials, plastic-compatible adhesives continue leading the market.

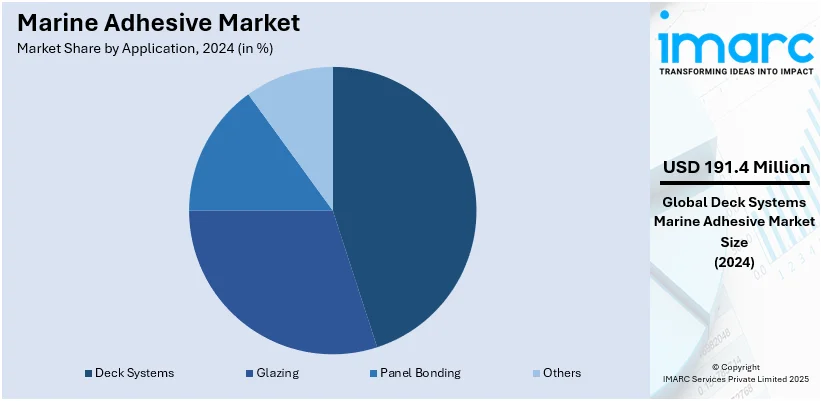

Analysis by Application:

- Deck Systems

- Glazing

- Panel Bonding

- Others

Deck systems lead the market with around 38.7% of market share in 2024. Deck systems lead the marine adhesive market as strong, durable bonding solutions are essential for securing decking materials in boats, ships, and offshore structures. Adhesives used in deck systems provide superior resistance to water, salt, and temperature fluctuations, ensuring long-term structural integrity. These adhesives enhance safety by preventing gaps, reducing vibrations, and minimizing maintenance needs. The increasing use of composite and synthetic decking materials further drives demand for high-performance adhesives. As marine construction advances, deck system adhesives remain crucial for reliability and durability.

Analysis by End Use:

- Cargo Ships

- Passenger Ships

- Boats

- Others

Passenger ships lead the marine adhesive market due to the high demand for durable, flexible, and water-resistant bonding solutions in vessel construction and maintenance. Adhesives are widely used for interior paneling, flooring, deck systems and structural bonding, ensuring safety, comfort, and longevity. With increasing investments in luxury cruises, ferries, and commercial passenger vessels, the need for high-performance adhesives continues to grow. Fire-resistant, lightweight, and eco-friendly adhesives are gaining traction, supporting regulatory compliance and enhancing passenger ship durability and efficiency.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 42.0%. Asia-Pacific holds the largest share in the marine adhesive market due to the region’s expanding shipbuilding industry, growing maritime trade, and increasing naval investments. The demand for high-performance adhesives is rising as countries focus on commercial vessel production, fishing fleets, and offshore energy infrastructure. Rapid industrialization, cost-effective manufacturing, and strong government support for maritime development further boost market growth. The region’s emphasis on lightweight materials and advanced bonding solutions continues to drive innovation, solidifying Asia-Pacific’s position as the dominant market.

Key Regional Takeaways:

North America Marine Adhesive Market Analysis

The growing marine adhesive adoption in North America is driven by increasing naval investments and commercial vessel production, requiring high-performance bonding solutions. Expanding defense budgets and rising shipbuilding activities contribute to the demand for advanced adhesives that enhance structural integrity, corrosion resistance, and durability. The growing marine adhesive adoption is further supported by increasing offshore energy projects, where adhesives play a crucial role in securing and sealing marine infrastructure. Expanding commercial shipping routes and logistics networks fuel adhesive demand for cargo vessel maintenance and repair, ensuring longevity and operational efficiency. The emphasis on lightweight and fuel-efficient vessel construction accelerates marine adhesive integration, reducing reliance on traditional fasteners. As the maritime sector continues evolving, marine adhesive adoption remains critical for improving vessel durability, reducing maintenance costs, and optimizing operational performance.

United States Marine Adhesive Market Analysis

In 2024, the United States accounted for over 78.90% of the marine adhesive market in North America. The growing marine adhesive adoption is driven by the increasing number of cargo ships supporting growing logistics and trade. According to the U.S. Census Bureau, average exports rose by USD 9.8 billion from December 2023. As trade routes expand and consumer demand grows, the need for cargo ships is also increasing, leading to a higher demand for marine adhesives used in shipbuilding and maintenance. The durability and strength of marine adhesive enhance vessel longevity, reducing repair frequency and operational downtime. Growing logistics operations further require advanced bonding solutions, ensuring structural integrity and water resistance in vessels. As cargo ships transport heavier loads over extended distances, marine adhesive adoption becomes crucial for minimizing material degradation. Shipbuilders prioritize efficient bonding techniques to withstand harsh marine environments, fuelling the growing marine adhesive adoption. Expanding transportation networks and trade agreements reinforce cargo ship construction, driving consistent usage of marine adhesive. The growing logistics sector emphasizes vessel performance, amplifying the demand for high-strength adhesive.

Europe Marine Adhesive Market Analysis

The growing marine adhesive adoption is fuelled by growing packaging due to rising fuel cost, necessitating lightweight and durable bonding solutions. Since 2020, the most significant price hikes were recorded in June 2022, with diesel prices rising by 45.2% and petrol prices by 35.7%. As shipping companies seek fuel-efficient vessels, marine adhesive adoption rises to optimize structural integrity while reducing overall weight. Growing packaging requirements for cargo transport necessitate advanced sealing and bonding solutions, reinforcing marine adhesive usage. The shift toward lightweight vessel construction enhances fuel efficiency, amplifying the importance of marine adhesive in shipbuilding processes. Rising fuel cost prompts manufacturers to prioritize adhesive technology, reducing dependency on traditional fasteners and welds. The demand for cost-effective ship assembly techniques drives innovation in adhesive formulations, improving vessel durability and longevity. Growing packaging processes require secure bonding solutions, ensuring structural stability in marine environments. With increasing fuel expenses, marine adhesive adoption becomes essential for achieving optimal weight-to-performance ratios in vessels. Expanding sustainability initiatives in marine construction further encourage the shift toward advanced adhesive solutions.

Latin America Marine Adhesive Market Analysis

The growing marine adhesive adoption is propelled by growing global trade and passenger ships as means of transport, increasing the need for advanced bonding solutions. Reports indicate that exports from Latin America and the Caribbean increased by approximately 4.1% in 2024, bouncing back from a 1.6% decline in the year 2023. Expanding maritime trade routes require durable and flexible marine adhesive, ensuring vessel longevity and maintenance efficiency. Passenger ships as means of transport necessitate reliable bonding materials for enhanced structural integrity and operational safety. With trade expansion, shipbuilders prioritize marine adhesive for secure vessel assembly, reducing repair costs and enhancing durability. The reliance on passenger ships for inter-regional connectivity further accelerates the demand for high-performance marine adhesive. Increased vessel production highlights the importance of innovative adhesive formulations, supporting corrosion resistance and waterproofing. Growing global trade continues to fuel the shipbuilding sector, increasing marine adhesive integration in construction and refurbishment.

Middle East and Africa Marine Adhesive Market Analysis

The growing marine adhesive adoption is driven by growing boats for tourism, elevating the demand for strong and weather-resistant bonding solutions. Expanding coastal tourism encourages increased boat production, necessitating durable marine adhesive for structural reinforcement. For example, from January to October 2024, Dubai saw 14.96 million overnight visitors, which represents an 8% increase compared to the same timeframe in 2023, showcasing robust tourism growth. The rising preference for leisure and recreational boating amplifies the need for high-performance adhesive, ensuring vessel longevity. Boats for tourism require efficient sealing and bonding solutions to withstand harsh marine conditions, reinforcing adhesive adoption. Increased investments in tourism infrastructure promote the production of lightweight boats, strengthening marine adhesive demand. The emphasis on vessel durability and performance fosters advancements in adhesive technology. Growing boats for tourism accelerate marine adhesive integration in construction and maintenance. The demand for high-strength bonding materials rises as boat manufacturers prioritize durability and efficiency. Expanding water-based tourism activities further enhance marine adhesive applications, ensuring long-lasting structural integrity.

Competitive Landscape:

The marine adhesive market is highly competitive, driven by innovation, material advancements, and expanding marine construction activities. Companies focus on developing high-performance adhesives with superior water resistance, flexibility, and durability to meet the evolving demands of shipbuilding, repairs, and offshore applications. Increasing regulatory requirements push manufacturers toward eco-friendly, low-VOC, and solvent-free formulations. Market players compete through product differentiation, enhanced bonding solutions, and strategic partnerships with shipbuilders and marine component manufacturers. Expanding distribution networks, strong R&D investments, and advanced adhesive technologies further intensify competition. Growing demand for lightweight and corrosion-resistant solutions continues to shape the market, driving continuous product advancements.

The report provides a comprehensive analysis of the competitive landscape in the marine adhesive market with detailed profiles of all major companies, including:

- 3M Company

- Bostik SA

- Gurit AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC (Huntsman Corporation)

- Illinois Tool Works

- Parson Adhesives Inc.

- Scott Bader Company Ltd.

- Sika Services AG (Sika AG)

Latest News and Developments:

- November 2024: Arxada announced its plans to showcase its cutting-edge Omadine® technology for marine antifouling at ChinaCoat 2024 in Guangzhou from December 3-5. The focus will be on solutions that enhance the performance of marine coatings, minimize leaching, and promote sustainability. Additionally, Arxada will display its adhesive additives which are designed to improve durability and environmental advantages in coatings. Attendees can visit Booth 2.1 B15 to explore these innovations.

- November 2024: Henkel announced its partnership with Celanese to create adhesives utilizing captured CO2 emissions, promoting sustainability in emulsion manufacturing. This collaboration employs carbon capture technology to mitigate environmental impacts while delivering high-performance adhesive options. By recycling industrial CO2, this initiative supports circularity throughout the value chain, highlighting a commitment to innovation in sustainable adhesive production.

- September 2024: Bostik introduced Fast Glue Ultra+, a high-performance adhesive composed of 60% bio-based materials. This development enhances sustainability within the adhesive sector while ensuring strong bonding capabilities. Utilizing a patented synthesis method, it showcases Bostik’s expertise in instant adhesives and reinforces Arkema’s leadership in eco-friendly adhesive solutions.

- September 2024: BioBond Adhesives, Inc. has established its headquarters and development laboratories in Lafayette, Indiana, to advance its plant-based, biodegradable adhesives. The company aims to promote the commercialization of eco-friendly marine adhesives, catering to the marine industry’s need for alternatives to conventional adhesives. BioBond’s innovations emphasize environmentally responsible bonding for boats and marine structures.

- May 2024: 3M is enhancing its facility in Valley, Nebraska, with a $67 million investment to add 90,000 square feet and create 40 new jobs. The expansion will introduce new production lines and equipment, aimed at boosting manufacturing capacity. A primary focus is addressing the increasing demand for marine adhesives, reinforcing 3M’s position in the industry. This investment underscores 3M’s 45-year dedication to Nebraska’s business landscape.

- February 2024: Henkel has finalized an agreement to acquire Seal for Life Industries, a U.S.-based expert in protective coatings and sealing solutions. This acquisition will bolster Henkel’s marine adhesive portfolio and expand its maintenance, repair, and operations (MRO) platform with advanced protective technologies. Seal for Life’s offerings enhance sustainable asset longevity across the marine, oil & gas, and infrastructure sectors, contributing to Henkel’s Adhesive Technologies business and driving growth in high-demand marine applications.

Marine Adhesive Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Resin Types Covered | Epoxy, Polyurethane, Acrylic, Others |

| Substrates Covered | Plastics, Composites, Metal, Others |

| Applications Covered | Deck Systems, Glazing, Panel Bonding, Others |

| End Uses Covered | Cargo Ships, Passenger Ships, Boats, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Bostik SA, Gurit AG, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC (Huntsman Corporation), Illinois Tool Works, Parson Adhesives Inc., Scott Bader Company Ltd., Sika Services AG (Sika AG), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the marine adhesive market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global marine adhesive market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the marine adhesive industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The marine adhesive market was valued at USD 494.57 Million in 2024.

IMARC estimates the marine adhesive market to reach USD 708.63 Million by 2033, exhibiting exhibit a CAGR of 3.87% during 2025-2033.

The marine adhesive market is driven by increasing shipbuilding activities, rising demand for lightweight and fuel-efficient vessels, and advancements in adhesive technology. Growing offshore energy projects, naval investments, and sustainability initiatives further support market growth.

Asia Pacific leads the marine adhesive market due to its strong shipbuilding industry, growing maritime trade, and increasing naval investments. The region's demand for durable, water-resistant adhesives is driven by expanding commercial vessel production, offshore energy projects, and rising defense budgets.

Some of the major players in the marine adhesive market include 3M Company, Bostik SA, Gurit AG, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC (Huntsman Corporation), Illinois Tool Works, Parson Adhesives Inc., Scott Bader Company Ltd., Sika Services AG (Sika AG), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)