Manuka Honey Market Size, Share, Trends and Forecast by Type, Nature, Distribution Channel, and Region, 2025-2033

Manuka Honey Market Size and Share:

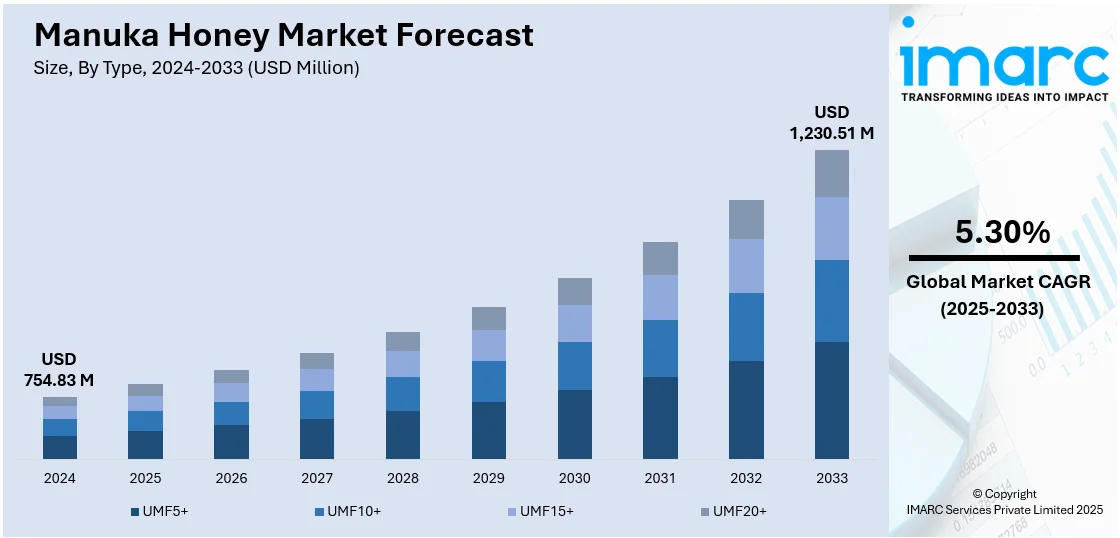

The global manuka honey market size was valued at USD 754.83 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,230.51 Million by 2033, exhibiting a CAGR of 5.30% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 30.3% in 2024. The market is driven by increasing demand for natural health products, supported by its proven antibacterial and anti-inflammatory properties. Growing consumer preference for organic and functional foods increases adoption, while its use in skincare and nutraceuticals is expanding the manuka honey market share. Rising health awareness and disposable incomes, especially in developed regions, further propel demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 754.83 Million |

|

Market Forecast in 2033

|

USD 1,230.51 Million |

| Market Growth Rate 2025-2033 | 5.30% |

The global manuka honey market is driven by growing consumer awareness of its health benefits, including antibacterial, anti-inflammatory, and wound-healing properties. According to a research report, manuka honey is highly sought after due to its unique anti-inflammatory and antimicrobial properties. It is high in essential bioactive components such as methylglyoxal (MGO) (77-444 mg/kg) and phenolic acids (29.4 µg/g) (e.g., gallic acid) and clinical studies for its healing, anti-inflammatory (TNF-α, IL-6), and dry eye (90% reduction) inducing properties. The accelerating demand for natural and organic products, coupled with a growing preference for functional foods, fuels the market growth. The expanding use of manuka honey in cosmetics and pharmaceuticals further improves demand. Additionally, rising disposable incomes and a shift toward preventive healthcare contribute to market expansion. E-commerce growth and strategic marketing by key players also enhance accessibility, driving global sales. These factors are creating a positive manuka honey market outlook.

The United States stands out as a key regional market, primarily driven by its rising popularity as a natural sweetener with superior health benefits compared to conventional honey. Sugar production is a significant agribusiness in the United States, with sugarcane and sugar beets contributing 45 percent and 55 percent of the output, respectively. USDA Sugar and Sweeteners Outlook provides monthly outlook on U.S. and global markets that in turn drive trends for natural sweeteners such as Manuka honey. New analysis has highlighted the differences between the sweetener markets in the U.S. and Mexico, as well as upcoming predictions for global raw sugar costs, all of which are shaping the natural alternatives demand in the United States. Along with this, increased scientific validation of its antimicrobial properties has strengthened consumer trust, particularly among fitness enthusiasts and holistic health advocates. The growing prevalence of antibiotic-resistant infections has also accelerated the demand for natural alternatives. Retail expansion in organic food stores and online platforms has improved availability, while celebrity endorsements and social media influence have amplified its premium positioning. Additionally, the rising incidence of digestive health issues has spurred interest in manuka honey’s gut-healing potential, further accelerating market growth.

Manuka Honey Market Trends:

Significant Growth in Food and Beverage Industry

The Manuka honey market is experiencing a surge, closely tied to the robust performance of the global food and beverage (F&B) sector. Circana reported that the industry ended 2024 with a 2.6% rise in dollar sales and a 1.1% volume increase. Forecasts for 2025 suggest continued momentum, with dollar sales expected to grow by 2–4%, price/mix by 1.5–3.5%, and volume by up to 1%. This expansion reflects growing consumer preference for healthier, functional ingredients that go beyond traditional nutrition. Manuka honey fits well into this trend, offering antibacterial and anti-inflammatory properties while serving as a natural sweetener. It is increasingly used in functional beverages, breakfast cereals, yogurt, bakery products, and health-oriented snacks. Product innovation and clean-label demand are also pushing F&B companies to adopt natural alternatives like Manuka honey. As wellness trends continue to shape product development, the F&B sector remains a major growth engine for this niche yet valuable product.

Health Awareness Reshaping Consumer Preferences

The growing awareness of health risks associated with poor dietary habits is significantly reshaping global consumption patterns, driving up demand for functional superfoods like Manuka honey. According to the World Health Organization, noncommunicable diseases (NCDs) caused 43 million deaths in 2021, accounting for 75% of all global non-pandemic-related fatalities. This has triggered a shift toward preventive healthcare, with consumers actively seeking foods that offer proven health benefits. Manuka honey is rich in methylglyoxal (MGO), which gives it strong antibacterial qualities, and it also contains antioxidants that support immunity and reduce inflammation. As a result, it has gained popularity among health-conscious consumers as both a food ingredient and a wellness supplement. The product is commonly used to soothe sore throats, promote digestive health, and support skin healing. Its natural origin and scientifically backed therapeutic potential make it appealing to those seeking alternatives to synthetic supplements, helping it gain traction in the nutraceutical and health food markets.

Rise in Organic and Natural Product Demand

The demand for organically procured honey is accelerating, propelling manuka honey market growth. Consumers are increasingly aware of the adverse effects of chemicals in food, leading to a preference for high-quality, organic bee products. This trend aligns with the rising adoption of organic foods globally, supported by easy product availability through online and offline retail channels. A research report from the IMARC Group indicates that the global organic food market was valued at USD 230.1 Billion in 2024. It is projected to grow to USD 587.0 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 10.42% from 2025 to 2033. Additionally, Manuka honey’s extensive use in pharmaceuticals and personal care products, owing to its healing properties, further enhance its market presence. Rapid industrialization and continuous R&D activities are expanding product applications, solidifying Manuka honey’s role in diverse sectors beyond food.

Manuka Honey Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global manuka honey market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, nature, and distribution channel.

Analysis by Type:

- UMF5+

- UMF10+

- UMF15+

- UMF20+

UMF15+ stands as the largest component in 2024, holding around 35.2% of the market. It is prized for its exceptionally high antibacterial potency. With a Unique Manuka Factor (UMF) rating of 15 or above, it contains elevated levels of methylglyoxal (MGO), making it highly effective for medicinal and therapeutic applications. Consumers increasingly prefer UMF15+ for its proven immune-enhancing, wound-healing, and digestive health benefits, driving the manuka honey market demand in the healthcare and wellness sectors. Its premium quality justifies higher pricing, appealing to affluent, health-conscious buyers. Limited production in New Zealand further enhances its exclusivity, while stringent certification standards ensure authenticity. The growing popularity of superfoods and natural remedies has solidified UMF15+ as the leading segment, with expanding applications in pharmaceuticals, cosmetics, and functional foods reinforcing its market dominance.

Analysis by Nature:

- Organic

- Conventional

Conventional leads the market with around 65.5% of the market share in 2024. Unlike organic variants, conventional manuka honey is more widely available and cost-effective, making it accessible to a broader consumer base. While it undergoes fewer regulatory restrictions than organic honey, reputable producers still adhere to quality standards to ensure purity and potency. Its widespread adoption is driven by strong demand from the food, beverage, and healthcare industries, where its antibacterial and anti-inflammatory properties are highly valued. Despite growing interest in organic options, conventional manuka honey dominates due to its competitive pricing, established supply chains, and proven efficacy, particularly in UMF-graded products. This segment's scalability and consistent availability further reinforce its leading position in the global market.

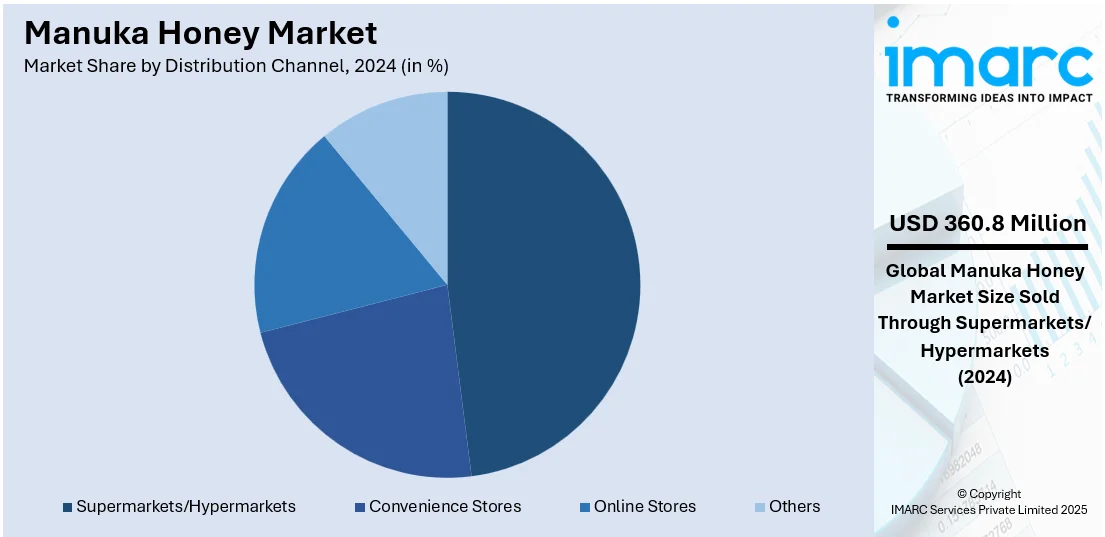

Analysis by Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with around 47.8% of market share in 2024, offering unparalleled accessibility and consumer trust. These retail giants provide a one-stop shopping experience, attracting a broad customer base seeking convenience and competitive pricing. Their extensive shelf space allows for prominent product visibility, while in-store promotions and discounts further drive impulse purchases. Supermarkets and hypermarkets also cater to diverse consumer segments by stocking multiple brands and UMF grades, from entry-level to premium options. Additionally, their established supply chains ensure consistent availability, particularly in urban centers where demand is highest. The credibility of large retail chains reassures buyers of product authenticity, a critical factor given concern over counterfeit manuka honey. This widespread retail presence, combined with strategic merchandising, solidifies supermarkets and hypermarkets as the leading distribution channel globally.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 30.3%, driven by rising health consciousness and disposable incomes in key economies such as China, Japan, and Australia. The region's strong cultural affinity for natural remedies and functional foods fuels demand, particularly for high-UMF grades with proven health benefits. Expanding middle-class populations and growing retail infrastructure, including e-commerce and premium supermarkets, enhance accessibility. Additionally, increasing prevalence of lifestyle-related diseases has spurred interest in manuka honey's therapeutic properties. Local production in Australia complements imports from New Zealand, ensuring steady supply. Strategic marketing by brands highlighting purity and efficacy further accelerates adoption, making Asia Pacific the dominant market for manuka honey consumption and growth.

Key Regional Takeaways:

United States Manuka Honey Market Analysis

In 2024, the US accounted for around 83.00% of the total North America manuka honey market. The United States manuka honey market is primarily driven by the growing inclination towards natural health products. In line with this, the increasing awareness about manuka honey’s antimicrobial and immune-enhancing properties, particularly as part of the functional food and beverage sector, is impelling the market. In the U.S., sales of functional foods and beverages reached USD 92.1 Billion in 2023 and are projected to grow to USD 106.9 Billion by 2026, according to Nutrition Business Journal. Furthermore, the rising integration of honey in dietary supplements and wellness products is propelling market growth. The expansion of e-commerce platforms, facilitating direct-to-consumer sales of manuka honey and international brand penetration is also stimulating the market appeal. Additionally, growth in clinical research on manuka honey’s wound-healing and antibacterial benefits, strengthening its use in medical-grade products and pharmaceuticals, is encouraging higher adoption of the product. Moreover, consumers are increasingly prioritizing organic and sustainably sourced honey, stimulating ethical beekeeping and eco-friendly packaging innovations, thereby bolstering the market. Apart from this, major retail chains are expanding their manuka honey offerings, increasing mainstream consumer adoption and solidifying their position in the market.

Europe Manuka Honey Market Analysis

The Europe manuka honey market is growing due to increasing consumer interest in natural health solutions. Similarly, the rising demand for natural remedies, augmenting manuka honey’s use in functional nutrition and therapeutic applications, is propelling the market growth. The growing burden of lifestyle-related health issues, particularly digestive disorders, is further accelerating demand in the market. According to United European Gastroenterology (UEG), over 332 million individuals in Europe suffer from digestive disorders, many requiring lifelong management. Apart from this, growth in regulatory support for natural and organic products is facilitating the entry of certified brands, increasing market confidence. The expansion of premium and specialty food retail in Germany, France, and the UK is improving product visibility in the market. Furthermore, the growing demand for sugar alternatives encouraging its use in health-conscious diets is enhancing the market appeal. In addition to this, numerous sustainable sourcing initiatives attracting eco-conscious consumers and reinforcing ethical beekeeping practices are encouraging the higher adoption of manuka honey. Moreover, rising imports and strategic partnerships with European distributors are enhancing market penetration, ensuring greater consumer accessibility and sustained growth.

Asia Pacific Manuka Honey Market Analysis

The Asia Pacific market is witnessing a rise, propelled by the rising health consciousness and disposable incomes. Justdial, an Indian search engine, reported a 23% rise in healthcare-related searches in India from January-October 2024, with non-metropolitan cities seeing 25% growth, reflecting the shifting healthcare priorities among Indians. In accordance with this, increasing awareness of traditional and alternative medicine, driving manuka honey’s use in holistic wellness and immune support, is fostering market development. Furthermore, expanding retail and e-commerce channels, particularly in China, Japan, and South Korea, are improving accessibility and market appeal. Moreover, favorable government initiatives promoting natural and organic foods are augmenting consumer trust in the market. The growing use of manuka honey in infant nutrition due to its antimicrobial and digestive benefits is expanding its market scope. Apart from this, strategic collaborations between local distributors and international brands are strengthening supply chains, ensuring consistent availability and meeting growing regional demand, thereby positively influencing the market for manuka honey in the region.

Latin America Manuka Honey Market Analysis

The Latin America manuka honey market is expanding as the demand for natural immune enhancers grows, driving its use in functional foods and wellness products. In addition to this, the rise of specialty health stores and organic markets in Brazil, Mexico, and Argentina is improving product accessibility. According to a study, Brazil is Latin America’s largest organic market, Brazil’s organic retail sales reached BRL 4 billion in 2022, reflecting a strong preference for premium and natural products. This trend is fostering demand for high-quality manuka honey, particularly among health-conscious urban consumers. Moreover, expanding trade agreements and import regulations are facilitating the entry of international brands, thereby strengthening distribution networks and ensuring wider product availability across the region.

Middle East and Africa Manuka Honey Market Analysis

The Middle East and Africa market is escalating due to the rising consumer awareness of medicinal honey varieties. In accordance with this, the expansion of high-end retail chains and luxury food markets, particularly in the UAE and Saudi Arabia, is enhancing market appeal. Furthermore, growth in halal-certified health products, driving the inclusion of manuka honey in dietary supplements and wellness formulations, is bolstering market demand. Apart from this, favorable government initiatives supporting beekeeping and honey imports are facilitating expansion in the market and improving regional supply chains. The Abu Dhabi Agriculture and Food Safety Authority (ADAFSA) helped in strengthening the UAE’s beekeeping sector by distributing 2,283 ninth-generation queen bees to local beekeepers and aimed at producing 5,300 queens in 2024.

Competitive Landscape:

The global manuka honey market features fierce competition as leading players implement strategic initiatives to maintain dominance. Various players are expanding production capacity through sustainable beekeeping practices while securing exclusive access to premium honey sources. Companies are heavily investing in authentication technologies and quality certifications to differentiate genuine products in a market plagued by adulteration. There is a significant focus on product innovation, with introductions of value-added formats including chewables, skincare lines, and medical-grade honey products. Brands are aggressively pursuing geographical expansion, particularly in high-growth Asian markets through localized marketing and e-commerce partnerships. Competitive pricing strategies range from economic offerings to ultra-premium positioning for high-UMF grades. Marketing emphasis remains on clinical research validating health benefits, while some players are acquiring smaller brands to broaden product portfolios. Retail distribution networks are being strengthened, alongside direct-to-consumer channels through subscription models and online platforms.

The report provides a comprehensive analysis of the competitive landscape in the manuka honey market with detailed profiles of all major companies, including:

- Airborne Honey Ltd

- Apihealth NZ Ltd.

- Arataki Honey

- Comvita

- Egmont Honey

- Honey Australia Pty Ltd

- Manuka Honey USA LLC

- Nature’s Way Products LLC.

- Oha Honey

- Wedderspoon

Latest News and Developments:

- May 2025: Firsthoney, a skin and wound care brand featuring medical-grade Mānuka honey from New Zealand, launched nationwide in Whole Foods Market stores across the United States. The brand offers clean, clinically backed products free from antibiotics, parabens, and artificial additives, designed to support skin recovery and protect against minor wounds, burns, dryness, and sensitive skin. Their product range includes Mānuka Healing Ointment, Burn Salve, Skin Therapy Cream, Foot Rescue Cream, and Mānuka Bandages. Firsthoney emphasizes natural healing combined with scientific rigor and quality assurance through independent lab testing.

- April 2025: Wedderspoon Organic Group, one of North America's leading sellers of New Zealand Manuka Honey, expanded its MGO-rated Manuka Honey collection on Amazon and its website. New offerings include MGO 50+, 400+, 850+, and 1100+, each independently lab-verified for methylglyoxal content, preserving natural enzymes and antioxidants. These honeys support immunity, digestion, energy, and skin health. The range caters to varied wellness needs-from daily indulgence to potent healing-empowering consumers to incorporate Manuka Honey into their routines for holistic benefits.

- March 2025: Manuka South launched the world’s highest UMF 35+ (MGO 2190+) Manuka Honey, with only 1,020 jars available. This luxury limited reserve honey, meticulously matured over 1,400 days, is framed in handcrafted walnut cases and independently certified for unmatched potency, purity, and exclusivity.

- March 2025: Lucas Meyer Cosmetics by Clariant has launched Melicica™, a natural, honey-based skin repair ingredient derived from Australian Manuka honey. Melicica™ is scientifically proven to boost skin’s natural healing, reduce inflammation, oxidative stress, and scar appearance, while enhancing collagen production and keratinocyte migration. Suitable for all ages and skin types-including sensitive and baby skin-it is eco-friendly, free from preservatives and parabens, and certified for natural origin and safety.

- March 2025: 1770 introduced Manuka Honey Soda, featuring fresh flavors like Pear, Lemon, and Pineapple, naturally sweetened with health-beneficial Manuka honey. This launch aligns with rising consumer demand for clean, naturally sweetened beverages and functional ingredients. The product also highlights eco-friendly, user-friendly packaging innovations, signaling shifts in the beverage, health, and sustainable packaging industries toward artisanal, wellness-focused, and sustainable solutions.

- November 2024: Mountain Gold introduced Manuka Honey UMF 15+ and Propolis Lozenges, combining antimicrobial Manuka honey and immune-enhancing propolis for throat and wellness support. Made with natural ingredients, these lozenges offer soothing relief and on-the-go convenience.

Manuka Honey Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | UMF5+, UMF10+, UMF15+, UMF20+ |

| Natures Covered | Organic, Conventional |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Airborne Honey Ltd, Apihealth NZ Ltd., Arataki Honey, Comvita, Egmont Honey, Honey Australia Pty Ltd, Manuka Honey USA LLC, Nature’s Way Products LLC., Oha Honey and Wedderspoon, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the manuka honey market from 2019-2033.

- The manuka honey market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the manuka honey industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The manuka honey market was valued at USD 754.83 Million in 2024.

IMARC estimates the manuka honey market to exhibit a CAGR of 5.30% during 2025-2033, reaching a value of USD 1,230.51 Million by 2033.

The market is driven by rising demand for natural health products, increasing health awareness, growing preference for organic and functional foods, expanding use in skincare and nutraceuticals, and the surge in e-commerce sales.

Asia-Pacific currently dominates the Manuka honey market, accounting for a share exceeding 30.3%. This dominance is fueled by strong health consciousness, rising disposable incomes, and cultural affinity for natural remedies in countries such as China, Japan, and Australia.

Some of the major players in the manuka honey market include Airborne Honey Ltd, Apihealth NZ Ltd., Arataki Honey, Comvita, Egmont Honey, Honey Australia Pty Ltd, Manuka Honey USA LLC, Nature’s Way Products LLC., and Oha Honey and Wedderspoon, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)