Manganese Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Manganese Price Trend, Index and Forecast

Track the latest insights on manganese price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Manganese Prices Outlook Q2 2025

- USA: US$ 1,180/MT

- China: US$ 850/MT

- Germany: US$ 1,210/MT

- Japan: US$ 980/MT

- Brazil: US$ 1,108/MT

- France: US$ 1,320/MT

Get real-time access to monthly/quaterly/yearly prices, Request Sample

During the second quarter of 2025, manganese prices in the USA reached 1,180 USD/MT in June. Prices reflected steady demand from the steel and battery sectors. However, consistent imports from South Africa and Gabon ensured ample supply, keeping price movements relatively contained. Minor logistics disruptions at certain ports led to temporary adjustments, but the overall market remained balanced, influenced by both global mining trends and domestic consumption.

During the second quarter of 2025, manganese prices in China reached 850 USD/MT in June. Manganese saw mild price fluctuations, driven by variable production rates at key manganese alloy plants and changes in domestic steel output. High inventory levels led to competitive pricing. Additionally, reduced export demand from some Southeast Asian countries and stable ore imports from Africa contributed to controlled price movements.

During the second quarter of 2025, manganese prices in Germany reached 1,210 USD/MT in June. In Germany, prices remained relatively stable, supported by consistent demand from the automotive and steel sectors. Rising energy costs pushed up production expenses, but global oversupply and steady imports from major producers mitigated significant price hikes. Efforts toward supply chain diversification further stabilized market conditions.

During the second quarter of 2025, manganese prices in Japan reached 980 USD/MT in June. Japan's manganese market in Q2 2025 showed moderate stability, driven by consistent demand from specialty steel producers and battery manufacturers. Despite fluctuations in global mining output, long-term supply contracts helped Japanese importers avoid sudden price increases.

During the second quarter of 2025, manganese prices in Brazil reached 1,108 USD/MT in June. Ample domestic production and subdued export demand kept prices under pressure. Steady mining activities contributed to abundant supply, and while inland logistics faced minor issues, the market experienced soft pricing trends with competitive costs for industrial users.

During the second quarter of 2025, manganese prices in France reached 1,320 USD/MT in June. The prices in the region maintained a stable trajectory, driven by consistent demand from the steel sector. Lower activity in some manufacturing industries moderated bulk buying, but imports from Africa and South America ensured sufficient supply. Logistics cost variations led to minor adjustments in pricing.

Manganese Prices Outlook Q1 2025

- USA: US$ 1245/MT

- Japan: US$ 1035/MT

- France: US$ 1290/MT

- Brazil: US$ 1160/MT

- Indonesia: US$ 906/MT

During the first quarter of 2025, the manganese prices in the USA reached 1245 USD/MT in March. The growing adoption of manganese-rich lithium-ion batteries in EVs increased demand for high-purity manganese, contributing to price volatility. This coupled with the interplay of disrupted supply from a major producer caused price fluctuations.

During the first quarter of 2025, the manganese prices in Japan reached 1035 USD/MT in March. As per the manganese price chart, Japan, heavily reliant on manganese imports for its steel and battery industries, felt the impact of global shifts. The combination of supply constraints from major producers and fluctuating demand patterns led to price volatility in the market.

During the first quarter of 2025, the manganese prices in France reached 1290 USD/MT in March. Supply chain disruptions, such as those caused by weather events or geopolitical issues, led to price fluctuations. Besides, the steel industry and other industries that use manganese-based alloys played a crucial role in demand and prices.

During the first quarter of 2025, the manganese prices in Brazil reached 1160 USD/MT in March. The growth of the construction and automobile industries, along with rising demand for aluminum alloys and steel, are major drivers of manganese consumption in Brazil. Moreover, the growing deployment of renewable energy technologies, including lithium-ion batteries, is also increasing the demand for manganese.

During the first quarter of 2025, the manganese prices in Indonesia reached 906 USD/MT in March. The Indonesian government implemented measures to control foreign exchange, which affected the pricing of commodities like manganese by influencing exchange rates and market sentiment. Besides, shifts in demand from the steel and battery sectors influenced the overall pricing trends.

Manganese Prices Outlook Q4 2024

- USA: US$ 1200/MT

- Japan: US$ 980/MT

- France: US$ 1260/MT

- Brazil: US$ 1140/MT

- Indonesia: US$ 920/MT

During the last quarter of 2024, the manganese prices in the USA reached 1200 USD/MT in December. A brief delay in shipments from major mines, along with rising demand in the green energy industry, resulted in price hikes. However, a subsequent reduction in spot buying in China, as well as the impact of weather-related mine interruptions in Australia, all led to a bearish trend in prices.

During the last quarter of 2024, the manganese prices in Japan reached 980 USD/MT in December. As per the manganese price chart, prices in Japan fluctuated as a result of a complicated combination of supply-side interruptions, demand shifts, and macroeconomic factors. Key drivers included raw material supply constraints, fluctuating price swings in the larger market, and shifts in demand patterns across multiple industries, particularly the steel sector.

During the last quarter of 2024, the manganese prices in France reached 1260 USD/MT in December. Prices fluctuated as a result of global supply chain disruptions, rising energy costs, and shifting demand patterns in the European market. Disruptions to manganese ore shipping, combined with challenges with rail network, had resulted in supply shortages and increased demand. Furthermore, rising energy costs and the impact of French nuclear modification on electricity availability had influenced manganese manufacturing costs and, as a result, the price.

During the last quarter of 2024, the manganese prices in Brazil reached 1140 USD/MT in December. A huge increase in demand for manganese ore, fueled primarily by the battery industry and rising steel prices, pushed prices upward. However, supply-side restrictions such as outages at key manganese mines and geopolitical events contributed to the volatility.

During the last quarter of 2024, the manganese prices in Indonesia reached 920 USD/MT in December. Indonesia's government-imposed restrictions on the export of various minerals, including manganese ore, to control domestic supply and prices, which also influenced prices. Besides, the rising demand for manganese in the battery industry also caused changes in prices.

Manganese Prices Outlook Q4 2023

- China: US$ 2382/MT

- Global Price: US$ 2627/MT

In the fourth quarter of 2023, the price of manganese in China reached 2382 USD/MT by December. Similarly, the global price of manganese reached 2627 USD/MT in the same month.

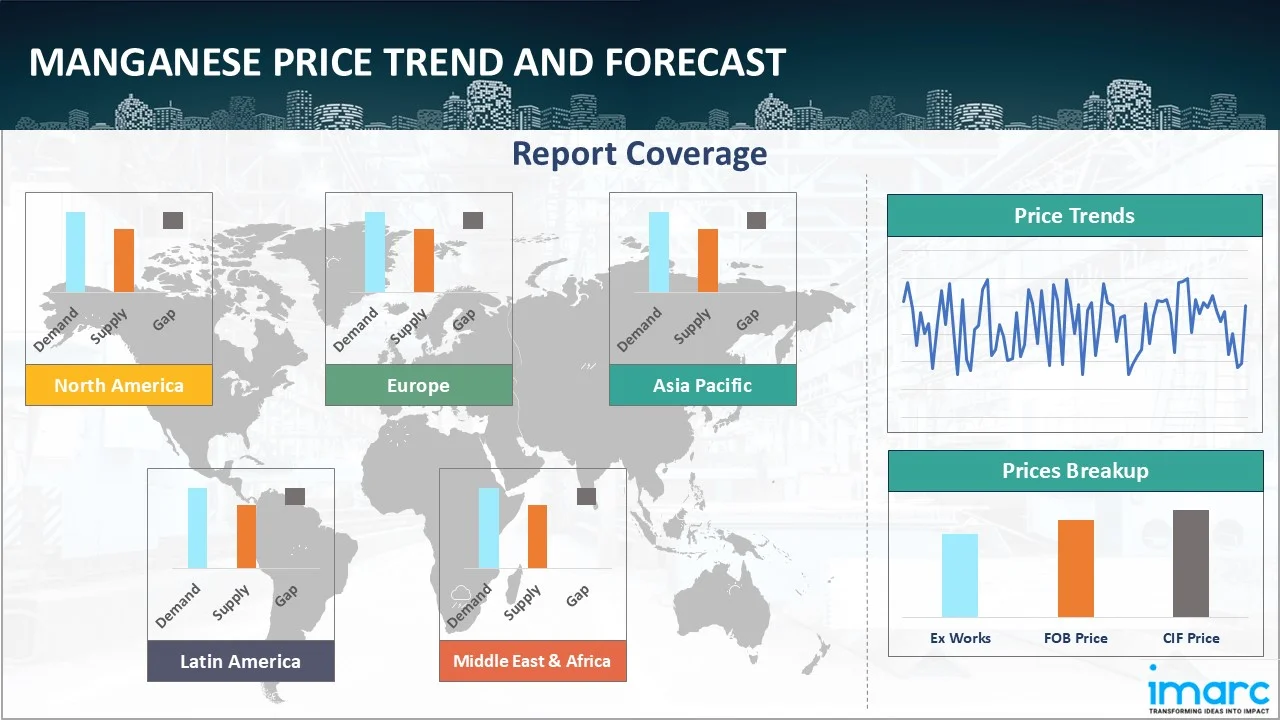

Regional Coverage

The report provides a detailed analysis of the manganese market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of ex-works, FOB, and CIF prices, as well as the key factors influencing the manganese price trend.

Global Manganese Price Trend

The report offers a holistic view of the global manganese pricing trends in the form of manganese price charts, reflecting the worldwide interplay of supply-demand balances, international trade policies, and overarching economic factors that shape the market on a macro level. This comprehensive analysis not only highlights current price of manganese but also provides insights into historical price trends, enabling stakeholders to understand past fluctuations and their underlying causes.

The report also delves into price forecast models, projecting future price movements based on a variety of indicators such as expected changes in supply chain dynamics, anticipated policy shifts, and emerging market trends. By examining these factors, the report equips industry participants with the necessary tools to make informed strategic decisions, manage risks, and capitalize on market opportunities. Furthermore, it includes a detailed manganese demand analysis, breaking down regional variations and identifying key drivers specific to each geographic market, thus offering a nuanced understanding of the global pricing landscape.

Europe Manganese Price Trend

Q2 2025:

In Europe, manganese prices experienced mild fluctuations in the second quarter of 2025, driven by varying supply conditions and dynamics of input costs. Stable demand from the steel and battery industries provided market support, but uncertainties in mining supply chains and shipping logistics occasionally influenced pricing.

Q1 2025:

As per the manganese price index, stricter environmental policies in Europe affected production processes and costs, influencing market prices. Besides, while the steel industry, a primary consumer of manganese, experienced a slowdown, the growing electric vehicle (EV) sector increased demand for manganese in battery production. The European market also faced supply-side challenges, including the suspension of operations at major mines due to weather-related issues. This suspension caused a temporary global shortage of high-grade manganese, leading to price spikes.

Q4 2024:

As per the manganese price index, stricter environmental regulations in Europe, such as those related to mining, processing, or waste management, influenced production costs and contributed to price volatility. Besides, a surge in demand from the steel industry, particularly in the automotive and construction sectors, led to a supply shortage. This imbalance caused price changes.

Q4 2023:

Europe's manganese pricing trends are deeply affected by its stringent environmental regulations and the push towards sustainable and recycled materials. The automotive and aerospace industries in Europe, which demand high-quality specialty metals, further complicate the pricing landscape. Energy costs and the availability of renewable energy sources also significantly influence manganese production costs. Additionally, the region's dependency on manganese imports, coupled with fluctuating currency values, adds another layer of complexity to understanding price trends in this market.

Detailed price information for manganese can also be provided for an extensive list of European countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Manganese Price Trend

Q2 2025:

In North America, manganese prices showed a steady trend during Q2 2025. The steel sector remained the primary consumer, with consistent procurement patterns. Limited domestic production kept the market reliant on imports, particularly from South Africa and Australia. While shipping costs moderated compared to earlier periods, currency exchange rate movements and import conditions impacted short-term pricing adjustments. Overall, the market remained stable with minimal price volatility.

Q1 2025:

In North America, manganese prices experienced fluctuations due to a complex interplay of factors, including technological advancements in extraction and processing, the demand from the defense and technology sectors, trade policies, and the growing green energy and electric vehicle market. The region's emphasis on defense and technology sectors, which require precise and high-grade metals, drives demand variability.

Q4 2024:

Manganese is a key ingredient in steel production, and elevated demand from the steel industry, especially in the latter half of the year, contributed to price changes. Besides, other sectors, such as infrastructure and construction, also experienced increased demand for manganese, further supporting price fluctuations. Moreover, the hike in transportation costs, particularly for shipping manganese ore from mining locations to processing plants, added to the overall cost of production and influenced pricing.

Q4 2023:

In North America, manganese prices are closely tied to technological advancements in extraction and processing techniques, which aim to reduce costs and enhance efficiency. The region's emphasis on defense and technology sectors, which require precise and high-grade metals, drives demand variability. Furthermore, trade policies, particularly those involving major trade partners like Canada and Mexico, heavily influence manganese supply chains and pricing structures. The shift towards green energy and electric vehicles in North America also affects demand patterns for metals.

Specific manganese historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Manganese Price Trend

Q2 2025:

The report explores the manganese trends and manganese price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

Q4 2023:

The manganese pricing trends in the Middle East and Africa are increasingly impacted by infrastructural developments and investments in the construction and transportation sectors. The region’s political climate and its effect on operational stability and security are also crucial in determining price trends. Additionally, the Middle East's strategic initiatives to diversify away from oil dependency and invest in mining and metal production capabilities are reshaping its market dynamics. In Africa, the availability of resources combined with foreign investment in mining projects heavily influences local and global manganese supply and prices.

Region-wise data and information on specific countries within these regions can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Manganese Price Trend

Q2 2025:

In Asia Pacific, manganese prices experienced moderate stability in Q2 2025, with China maintaining its position as a key producer and consumer. The alloy and battery sectors sustained steady demand, but inventory levels across the region helped prevent any sharp price increases. Variations in raw material supply, particularly ore imports, had some localized impacts. However, regional market sentiment stayed largely firm, supported by continuous infrastructure and industrial activities.

Q1 2025:

China’s manganese ore stocks dropped experiencing a six-year low in early March, due to tightening global supply and stronger-than-expected demand. Although market sentiment has been strong in recent weeks, despite low stocks, it turned bearish in the most recent pricing session in March as purchasers became reluctant to higher market levels as downstream markets declined. Moreover, in March, Mines and Ore India Limited raised the cost of ferro grades with a greater manganese concentration among other grades, further impacting prices.

Q4 2024:

Weakness in the Chinese real estate sector led to decreased demand for steel rebar, impacting the demand for manganese ore. This weakening steel demand put downward pressure on prices as the supply disruption effects began to subside. Besides, trade policies and regulatory changes in mining practices, as well as geopolitical tensions, also played a role in shaping price fluctuations. Moreover, events like the suspension of mines due to cyclones, initially caused panic buying and price spikes.

Q4 2023:

In the Asia Pacific region, manganese pricing dynamics are significantly influenced by robust industrial growth and expanding manufacturing sectors, particularly in China and India. The region's high demand for metals is driven by its active construction industry and increasing investments in infrastructure projects. However, supply disruptions due to geopolitical tensions and regulatory changes in mining practices also play a critical role in shaping price fluctuations. Additionally, trade policies and import-export tariffs continue to impact the cost structures and availability of manganese, making the Asia Pacific market a complex environment for price trend analysis.

This manganese price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Manganese Price Trend

Q2 2025:

In Latin America, manganese prices remained relatively steady throughout Q2 2025. Regional demand, primarily from the steel production sector in Brazil and other manufacturing hubs, helped maintain price stability. Supply chains occasionally faced logistical bottlenecks, particularly in mining and transportation, but these did not lead to major price disruptions. Export activities to global markets continued at a stable

Q1 2025:

As per the manganese price index, the growth of construction and automotive industries in Latin America, alongside a surge in the need for aluminum alloys and steel, fueled demand for manganese. Besides, political instability and inconsistent regulatory frameworks in some Latin American countries introduced volatility in manganese pricing.

Q4 2024:

As per the manganese price index, during the fourth quarter of 2024, manganese prices in Brazil fluctuated due to oversupply, decreased demand from alloy producers, and the impact of global steel market dynamics and production disruptions in major manganese producing countries. Besides, Additionally, factors like geopolitical events in prominent regions, and the impact of the global markets all played a role in the price swings.

Q4 2023:

Latin America's manganese market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in manganese prices. Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, economic fluctuations and currency devaluation are critical factors that need to be considered when analyzing manganese pricing trends in this region.

This comprehensive review can be extended to include specific countries within Latin America.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Manganese Price Trend, Market Analysis, and News

IMARC’s newly published report, titled “Manganese Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” offers an in-depth analysis of manganese pricing, covering an analysis of global and regional market trends and the critical factors driving these price movements.

It encompasses an in-depth review of spot price of manganese at major ports, a breakdown of prices including Ex Works, FOB, and CIF, alongside a region-wise dissection of manganese price trend across North America, Europe, Asia Pacific, Latin America, the Middle East and Africa.

The report examines the elements influencing manganese price fluctuations, such as supply-demand dynamics, geopolitical factors, and industry-specific developments. Additionally, it integrates the latest market news, providing stakeholders with up-to-date information on market shifts, regulatory changes, and technological advancements, thereby offering a comprehensive overview that aids in strategic decision-making and forecasting.

Manganese Industry Analysis

The global manganese market size reached 20.28 Million Tons in 2024. By 2033, IMARC Group expects the market to reach 24.4 Million Tons, at a projected CAGR of 2.00% during 2025-2033.

- Manganese is indispensable in steel production, constituting 85-90% of its global consumption. It is a highly sought-after metal in steel production mainly due to its ability to enhance the steel’s strength, hardness, and toughness. According to data published by the World Steel Association, in December 2023, the world crude steel production for 71 countries totaled 135 point 7 million tons. Notably, China's production was 67.4 million tonnes, down 14.9%, and India's production at 12.1 million tonnes, up 9.5%. The European Union produced 9.1 million tonnes, increasing by 2.7%. Africa, Asia and Oceania, and Russia + other CIS countries also contributed to the production figures. The increasing infrastructure projects, automotive manufacturing, and construction activities globally are fueling the steel demand. As countries nowadays are investing heavily in building and upgrading infrastructure, the need for durable and resilient steel grows. The automotive sector also contributes significantly, requiring robust steel for vehicle manufacturing. This widespread demand for steel directly boosts the manganese market, as it remains a vital element in producing superior steel products for various industries.

- The automotive sector also heavily relies on manganese for producing high strength steel essential for vehicle manufacturing. As consumers and regulations nowadays are pushing for lightweight, fuel efficient and safer vehicles the demand for manganese enriched steel is on the rise. This specialized steel improves vehicle performance and safety while reducing the weight which further contributes to better fuel efficiency. Consequently, the increasing production of modern vehicles drives the overall manganese market underscoring its important role in advancing automotive technology and meeting evolving industry standards.

- Industry is witnessing a significant rise in manganese demand due to the rise of electric vehicles and renewable energy storage solutions. Manganese is a crucial component in lithium-ion batteries and newer formulations such as lithium- manganese- oxide (LMO) batteries which offer enhanced energy density and stability. According to the data published by IEA, in 2022, the global demand for automotive lithium-ion (Li-ion) batteries surged by 65% to 550 GWh in 2022, from about 330 GWh in 2021, mainly because of growth in electric passenger car sales along with new registrations increasing by 55% in 2022 relative to 2021. Notably, China saw a 70% increase while the United States experienced an 80% rise in battery demand. The rising demand for critical materials such as lithium, cobalt and nickel has also escalated due to the electric vehicle (EV) battery production.

Manganese News

The report covers the latest developments, updates, and trends impacting the global manganese industry, providing stakeholders with timely and relevant information. This segment covers a wide array of news items, including the inauguration of new production facilities, advancements in manganese production technologies, strategic market expansions by key industry players, and significant mergers and acquisitions that impact the manganese price trend.

Latest developments in the manganese industry:

- In February 2024, Angelo American acquired the high-quality iron ore resource Serra da Serpentina from Vale SA adding 4.3 billion tons of iron ore to its Minas-Rio mine in Brazil. The acquisition includes a 15% shareholding for Vale in the expanded operation with potential for further expansion and increased production. The partnership aims to leverage synergies between the two companies’ operations and logistics to meet the growing demand for high quality iron ore.

- In November 2023, Ningxia Tianyuan Manganese Industry Group Company Limited announced their plans to establish Ghana's first manganese refinery, aiming to add value to the country's manganese resources. Minister of Lands and Natural Resources Samuel Abu Jinapor expressed the government's commitment to adding value to minerals and securing London Bullion Marketing Association (LBMA) certification for gold refinement.

Product Description

Manganese is a chemical element with the symbol Mn and atomic number 25. It is a hard and brittle metal that occurs in various oxidation states. Manganese is not found as a free element in nature; instead, it occurs in minerals such as pyrolusite and rhodochrosite. It is a crucial component in steel production mainly due to its effectiveness in improving hardness, stiffness, and strength when alloyed with iron. Beyond its industrial applications, manganese is also important for biological functions. It acts as a cofactor for various enzymes involved in health issues although it is generally rare. Major sources of manganese include South Africa, Australia, and China. Its diverse applications span from steel manufacturing to batteries and fertilizers highlighting its significance in both industrial and biological contexts.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Manganese |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Manganese Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of manganese pricing, covering global and regional trends, spot prices at key ports, and a breakdown of ex-works, FOB, and CIF prices.

- The study examines factors affecting manganese price trend, including supply-demand shifts and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The manganese price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)