Managed Pressure Drilling Services Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2025-2033

Managed Pressure Drilling Services Market Size and Share:

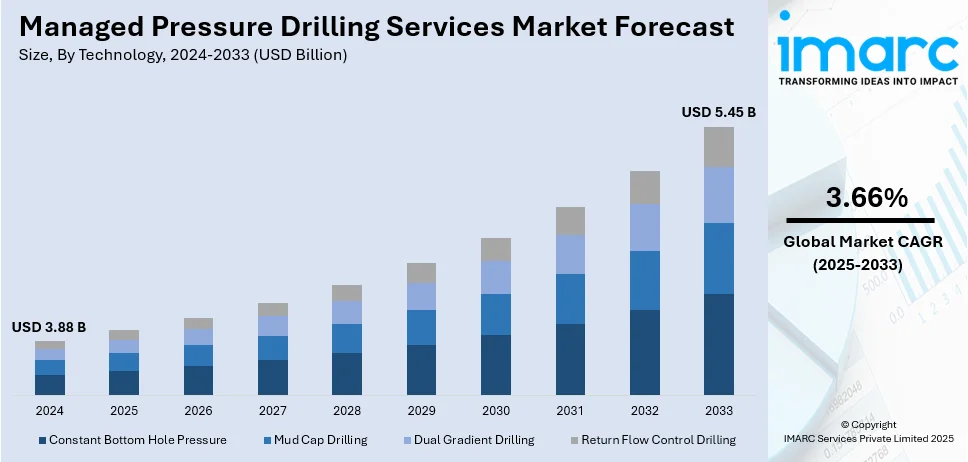

The global managed pressure drilling services market size was valued at USD 3.88 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.45 Billion by 2033, exhibiting a CAGR of 3.66% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.8% in 2024. The increasing demand for drilling in complex environments, rising global energy demand, substantial investments by major oilfield service providers in process upgrades and ongoing technological advancements represent some of the main factors that are impacting the managed pressure drilling services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.88 Billion |

|

Market Forecast in 2033

|

USD 5.45 Billion |

| Market Growth Rate (2025-2033) | 3.66% |

The global market is majorly influenced by the rising complexity of drilling environments, including reservoirs with narrow pressure margins and high-temperature, high-pressure conditions. Additionally, the increasing emphasis on environmental sustainability and compliance with stricter regulations encourages operators to adopt MPD systems, which is providing an impetus to the market. In addition to this, strict regulatory requirements for operational safety and environmental protection are accelerating the adoption of MPD systems. Moreover, continual technological advancements and innovations to enhance operation efficiency is also acting as a significant growth-inducing factor for the market. For instance, on February 27, 2024, ADS Services announced a collaboration with Geolog International to integrate artificial intelligence (AI) into drilling operations. This partnership aims to enhance safety, reduce costs, and mitigate risks by providing real-time monitoring, automated detection, and corrective action recommendations. The combined offering, named "Drilling E.S.P." (Evaluation, Safety, and Performance) for drilling operations, seeks to establish advanced safety protocols and optimize drilling performance through AI-driven data analytics.

The United States stands out as a key regional market, which is experiencing significant growth due to the increased exploration and production in shale formations and unconventional reservoirs. Besides this, the easy availability of advanced drilling infrastructure and significant investments in technological upgrades by leading oilfield service providers is enhancing the market outlook. In line with this, collaborative industry efforts to innovate and optimize drilling efficiency also significantly propel market growth. For instance, on July 19, 2024, Diamond Offshore revealed a contract with BOE Exploration & Production for the Ocean BlackRhino drillship, located in the U.S. Gulf of Mexico. The agreement spans a minimum of 180 days, with work commencing in late Q1 or early Q2 of 2025, and includes two additional option periods. This marks the third consecutive contract for the Ocean BlackRhino, highlighting its strong performance record. The agreement entails a minimum duration of 180 days, valued at approximately USD 89 Million, excluding mobilization and additional services. Operations are slated to commence in late Q1 or early Q2 of 2025, with provisions for two optional extension periods. Furthermore, the push for energy independence and the development of smaller, cost-efficient MPD units tailored for onshore fields uniquely position the U.S. as a leader in the MPD services market.

Managed Pressure Drilling Services Market Trends:

Growing Oil and Gas Industry

The growing oil and gas industry is one of the major managed pressure drilling services market trends that are creating lucrative opportunities in the market. For instance, according to IMARC, the global oil and gas market size reached USD 17.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 65.8 Billion by 2032, exhibiting a growth rate (CAGR) of 15.84% during 2024-2032. As global demand for oil and gas continues to rise, the industry is focusing on exploring and developing more challenging and unconventional reservoirs such as deepwater, ultra-deepwater, shale, and tight gas formations. MPD techniques offer precise pressure control, enabling operators to drill safely and efficiently in complex environments, thus raising the managed pressure drilling services market demand. These factors are expected to propel the managed pressure drilling services to market share in the coming years.

Increasing Offshore Drilling Projects

MPD systems are especially beneficial in addressing issues like riser gas handling and drilling fluid optimization, common in offshore settings. Also, there is a growing number of offshore drilling projects, particularly in deepwater and ultra-deepwater regions. For instance, in September 2024, Transocean Ltd. RIG, an offshore drilling contractor and provider of drilling management services headquartered in Switzerland, received the Dhirubhai Deepwater KG1 project offshore with Reliance Industries Limited, a global conglomerate in India, headquartered in Mumbai. MPD services are crucial for controlling narrow pressure windows and avoiding wellbore instability in these projects. These factors further positively influence the managed pressure drilling services market outlook.

Technological Innovations

Modern MPD systems are equipped with advanced sensors that provide real-time data on subsurface pressure, flow rates, and other critical parameters. For instance, in October 2024, B3 launched a Subsurface Interval Pressure (SIP) solution that addresses a major difficulty in the oil and gas industry: managing subsurface pressure. SIP uses artificial intelligence to generate accurate subsurface formation pressure estimates at a scale. It gives reliable information about present pressure and how pressure conditions change throughout wastewater disposal formations, thereby providing a boost to the managed pressure drilling services market growth. The integration of cloud-based platforms with MPD equipment facilitates real-time collaboration between on-site and remote teams, ensuring seamless operations.

Managed Pressure Drilling Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global managed pressure drilling services market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on technology and application.

Analysis by Technology:

- Constant Bottom Hole Pressure

- Mud Cap Drilling

- Dual Gradient Drilling

- Return Flow Control Drilling

Constant bottom hole pressure leads the market with around 48.7% of market share in 2024. Constant bottom hole pressure (CBHP) technology increases operational efficiency and safety by ensuring that pressure at the wellbore is maintained consistently during drilling, thus eliminating risks such as kicks, losses, and wellbore instability. The accuracy allows operators to work with narrow-pressure windows in difficult environments, including deepwater and high-pressure, high-temperature wells. It serves to minimize unproductive time while enhancing drilling performance. It saves on costs. Real-time monitoring ensures that pressure fluctuation adjustments can be made instantly, thus improving well integrity and environmental safety.

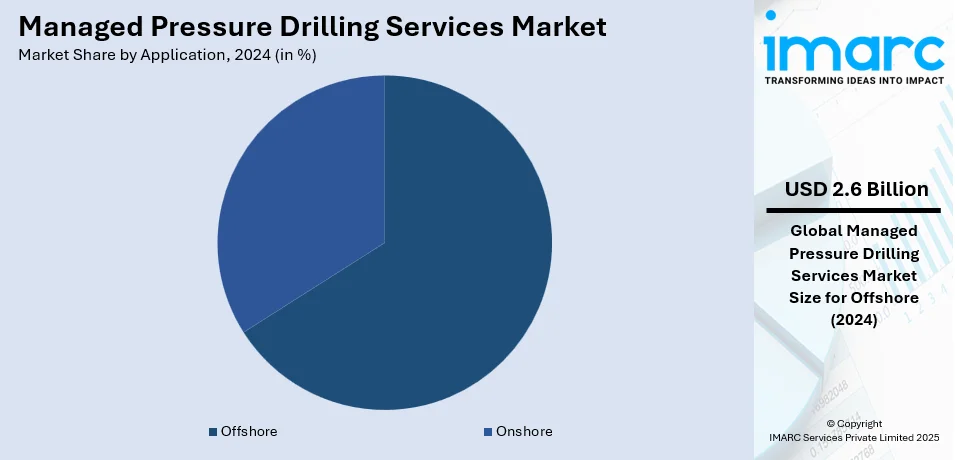

Analysis by Application:

- Onshore

- Offshore

Offshore leads the market with around 66.5% of market share in 2024 due to the challenges posed by deepwater and ultra-deepwater drilling. There is strict pressure control required in such environments to tackle narrow drilling windows, risks associated with kicks, as well as formation damage. Advanced technologies for MPD, such as automated systems and real-time monitoring, help maintain the stability of the wellbore and enhance offshore operations' safety. As exploration shifts to more remote and technically challenging locations, MPD reduces non-productive time and ensures cost-effective operations, even in high-pressure, high-temperature wells. Offshore projects often involve significant investment and environmental sensitivities, making MPD indispensable for risk management and regulatory compliance.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.8%, driven by the wide array of onshore and offshore explorations and production activities. There are immense reserves of shale resources, unconventional sources, and deepwater fields within the Gulf of Mexico that increase the demand for enhanced drilling technologies in the region. MPD plays a strategic role in optimizing drilling operations within these tough environments. Since it is based on pressure control and increases performance while reducing the risks of kicks, instability, and losses, MPD has become critical in successfully drilling within the wellbore. The high intent of cost savings and higher operational efficiency that North America maintains makes it attract MPD systems. Robust infrastructure, technological advancements, and skilled workers make it a hub for innovation in MPD services. Additionally, strict environmental and safety regulations are forcing operators to adopt MPD for better performance and compliance. This further reinforces North America's dominant position in the global MPD market.

Key Regional Takeaways:

United States Managed Pressure Drilling Services Market Analysis

The United States is a significant region in the North America managed pressure drilling services market, with a market share of 82.70%, primarily due to the growing relevance of shale gas in the energy sector of the country. The U.S. Energy Information Administration has forecasted that by 2025, shale gas would account for half of the domestic gas supply in the U.S. Thus, it shows the critical relevance of shale for the country to meet its energy requirements. Because shale gas production often occurs in complex, high-pressure formations, MPD technologies are significant for optimizing drilling operations, ensuring well stability, and minimizing the risks of blowouts. The ability of MPD to manage pressure fluctuations, control wellbore stability, and improve drilling efficiency is very important for shale gas extraction. The demand for natural gas rises and technology in drilling practices improves in the U.S. These services are expected to be crucial in MPD, increasing the market for solutions that enhance operational safety and reduce the costs of drilling. The focus by the companies toward shale gas development and the need for technical advancement in drilling further drives the growth of the market in the region.

Europe Managed Pressure Drilling Services Market Analysis

The European MPD services market is growing at a fast pace, as the region is enhancing its dependence on natural gas, which requires more developed drilling technologies. The International Energy Agency reports that Russia accounted for 32% of the total gas demand in the European Union and the United Kingdom in 2021, compared to 25% in 2009. This increased dependence on natural gas calls for efficient and safe drilling practices, especially in challenging offshore and onshore gas fields. MPD services play an important role in the management of pressure during drilling operations, stabilization of wellbore stability, and preventing blowouts especially in complex reservoirs. In view of Europe's concentration on energy supplies and improvement of drilling efficiency, there will be increased demand for MPD services. In addition to this, the drive for energy security and the transition towards more sustainable and efficient sources of energy further supports the growth of MPD services across the region.

Asia Pacific Managed Pressure Drilling Services Market Analysis

The Asia Pacific MPD services market is expected to grow significantly, with the increased exploration activities in key regions such as Malaysia. Industry reports suggest that Malaysia will drill around 30 exploration wells in 2024 and 35 in 2025, which is a big increase from only eight wells in 2021. This denotes a sharp rise in the number of wells being drilled in the region, indicating an increased interest in increasing oil and gas reserves to meet increasing energy demands. MPD services are crucial in the region as they improve drilling efficiency, manage pressure in challenging formations, and ensure operational safety. Malaysia leads the way for all other Asia Pacific nations as they increase exploration activities through the support of technologies such as advanced MPD drilling. Moreover, the region's focus on offshore developments and deepwater exploration, where MPD services are of utmost importance, is likely to further boost market growth, and Asia Pacific is likely to become a prime location for MPD service adoption.

Latin America Managed Pressure Drilling Services Market Analysis

The Latin America managed pressure drilling (MPD) services market is expected to grow at a robust pace, driven by the resurgence in oil production in the region. Since 2023, Latin America's crude oil output has increased by more than 9%, reversing an earlier seven-year decline that resulted in a 25% drop, largely driven by challenges in Venezuela and Mexico, as per reports. This recovery is essentially contributed by enormous surges in Guyana and Brazil production and will continue apace for the rest of the decade. The industry will have more regional growth, especially concerning exploration and development in deeper waters and deepwater and ultra-deepwater, for which drilling techniques like MPD are even more in demand. By using MPD services, the operators can control pressure in complex reservoirs, enhance safety, and have an operation efficiency. The region will see a hike in the adoption of MPD with further investment from countries such as Brazil and Guyana in increasing their oil reserves.

Middle East and Africa Managed Pressure Drilling Services Market Analysis

The Middle East and Africa MPD services market is expected to increase with the status of the UAE as one of the world's leading oil-producing countries. According to the ITA 2023 report, the UAE has approximately 100 billion barrels of proven oil reserves, of which 96% are located in Abu Dhabi, ranking the country sixth in the world in oil reserves. The country averages at 3.2 million barrels of petroleum and liquids per day, indicating its critical role in the global energy market. Increasing exploration and production activities in the region, particularly in complex onshore and offshore reservoirs, increase the demand for advanced drilling technologies such as MPD. MPD services assist operators in handling challenging pressure conditions, enhancing drilling efficiency, and minimizing operational risks. More broadly, as other countries in the region, particularly Saudi Arabia and the UAE, intensify efforts to maintain leadership in the energy sector globally, the adoption of MPD technologies is expected to increase, with further growth potential for the Middle East and African markets.

Competitive Landscape:

The competitive landscape of the managed pressure drilling (MPD) services market is marked by intense competition among key players as they try to improve their market presence through innovation and strategic partnerships. Companies are heavily investing in research and development (R&D) activities to introduce advanced MPD technologies, focusing on improving operational efficiency, safety, and cost-effectiveness. The market also experiences strong competition for service offerings. Providers strive to deliver customized solutions tailored to drilling conditions. Moreover, there is a requirement for MPD services in high-pressure-high-temperature and deepwater environments, which pushes technological advances and, thereby, competition intensifies. This adds complexity to regulatory compliance and drives toward more sustainable drilling practices, resulting in the use of eco-friendly solutions and digitalization strategies by the market participants to get a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the managed pressure drilling services market with detailed profiles of all major companies, including:

- Air Drilling Associates Inc.

- Blade Energy Partners Ltd.

- Enhanced Well Technologies AS

- Ensign Energy Services Inc.

- Exceed (XCD) Holdings Ltd.

- Global MPD Services Inc.

- Halliburton Company

- Nabors Industries Ltd.

- Nov Inc.

- Pruitt Tool & Supply Co Inc.

- Schlumberger Limited

- Weatherford International plc

Recent Developments:

- September 2024: Seadrill Limited, a global oil and gas offshore drilling company, and Oil States International, Inc., a global provider of manufactured products and services to customers in the energy, industrial, and military sectors, collaborated to increase the safety and efficiency of offshore MPD operations.

- August 2024: Archer, an oilfield services firm, collaborated with Air Drilling Associates to acquire its managed pressure drilling (MPD) subsidiary ADA Argentina.

- January 2024: KCA Deutag and Pruitt signed an agreement to collaborate on managed pressure drilling (MPD) opportunities globally.

Managed Pressure Drilling Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Constant Bottom Hole Pressure, Mud Cap Drilling, Dual Gradient Drilling, Return Flow Control Drilling |

| Applications Covered | Onshore, Offshore |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Drilling Associates Inc., Blade Energy Partners Ltd., Enhanced Well Technologies AS, Ensign Energy Services Inc., Exceed (XCD) Holdings Ltd., Global MPD Services Inc., Halliburton Company, Nabors Industries Ltd., Nov Inc., Pruitt Tool & Supply Co Inc., Schlumberger Limited, Weatherford International plc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the managed pressure drilling services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global managed pressure drilling services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the managed pressure drilling services industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The managed pressure drilling services market was valued at USD 3.88 Billion in 2024.

The managed pressure drilling services market is projected to exhibit a CAGR of 3.66% during 2025-2033.

The managed pressure drilling services market is driven by the need for enhanced drilling efficiency, safety, and cost reduction in complex reservoir environments. Rising offshore and deepwater exploration activities, along with technological advancements in pressure control systems, are key factors. Additionally, the demand for wellbore stability and environmental protection boosts market growth.

North America currently dominates the market driven by the complexity of these resources, including narrow drilling margins and high pressures.

Some of the major players in the managed pressure drilling services market include Air Drilling Associates Inc., Blade Energy Partners Ltd., Enhanced Well Technologies AS, Ensign Energy Services Inc., Exceed (XCD) Holdings Ltd., Global MPD Services Inc., Halliburton Company, Nabors Industries Ltd., Nov Inc., Pruitt Tool & Supply Co Inc., Schlumberger Limited, Weatherford International plc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)