Managed Mobility Services Market Size, Share, Trends and Forecast by Function, Deployment, Organization Size, End Use Industry, and Region, 2025-2033

Managed Mobility Services Market Size and Share:

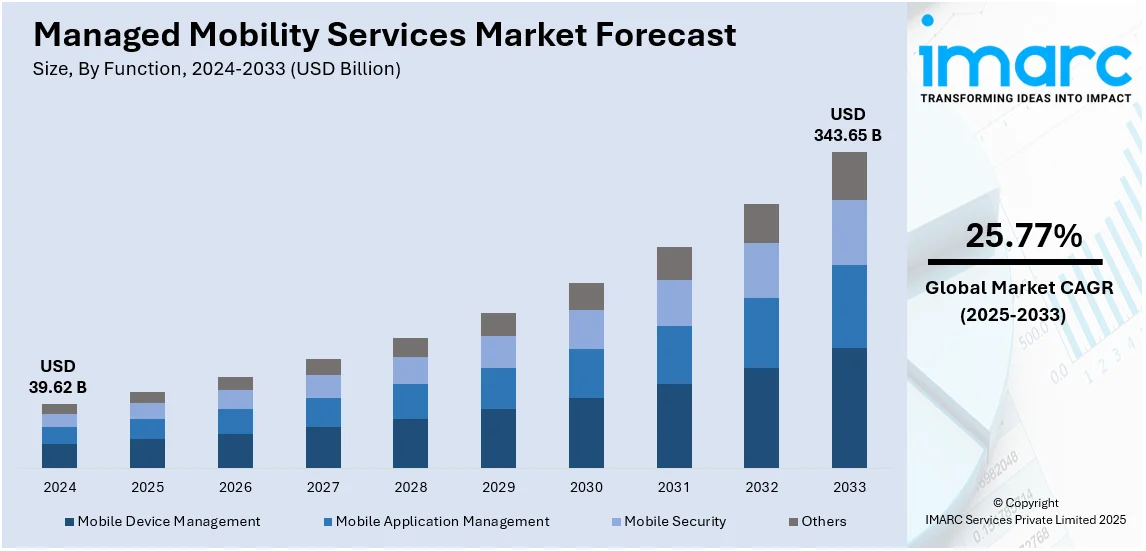

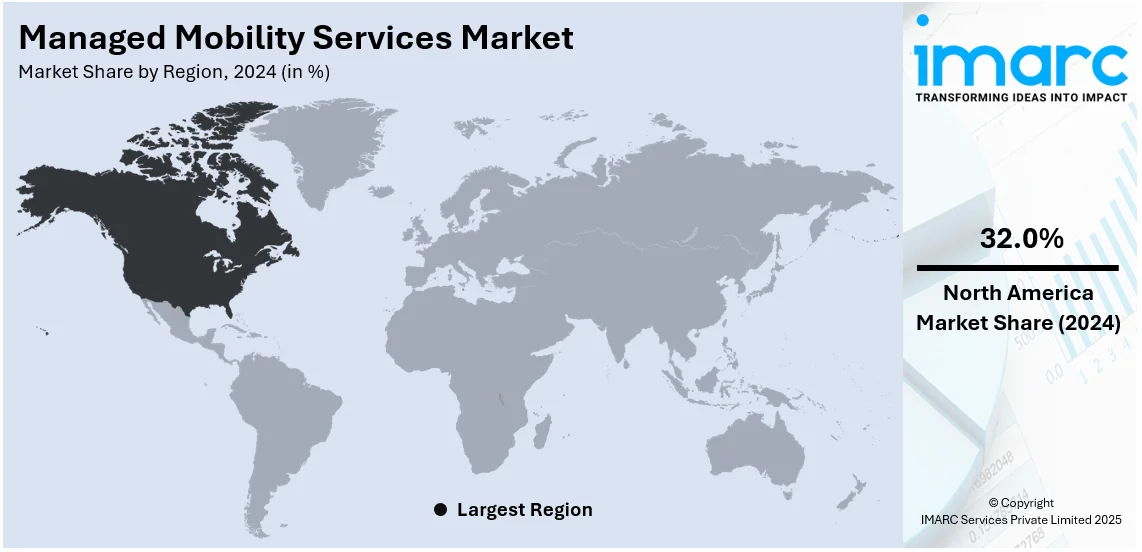

The global managed mobility services market size was valued at USD 39.62 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 343.65 Billion by 2033, exhibiting a CAGR of 25.77% from 2025-2033. North America currently dominates the market, holding a market share of over 32.0% in 2024. The market propelled by strong enterprise mobility adoption, advanced IT infrastructure, and strict regulatory compliance. Additionally, growing hybrid workforces and rising cybersecurity concerns further drive demand for secure mobility solutions.

| Report Attribute | Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 39.62 Billion |

|

Market Forecast in 2033

|

USD 343.65 Billion |

| Market Growth Rate (2025-2033) |

25.77%

|

The managed mobility services (MMS) market is expanding as businesses require enhanced secure management of mobile devices. Remote work trends together with hybrid work models drive MMS solution demand because organizations need connected systems secured through policy enforcement. Companies adopting bring-your-own-device (BYOD) policies require centralized mobility management to safeguard corporate networks. Many organizations are outsourcing IT services for device lifecycle management, reducing internal burdens. Cybersecurity concerns further drive MMS adoption, with businesses prioritizing encryption, remote wipe capabilities, and secure access solutions. As enterprise mobility expands and mobile technology advances, scalable MMS solutions are becoming essential for business operations.

In the United States, MMS adoption is rising as enterprises integrate mobility solutions to support digital workplaces. Secure and compliant MMS solutions have increased in demand because they maintain corporate data protection for hybrid work environments. For instance, as per industry reports, a survey conducted between 2019 and 2024 found that in the second quarter of 2024, 53% of employees were working in a hybrid model, splitting their time between remote and on-site work. Moreover, regulated industries, including healthcare and finance, are key contributors, focusing on MMS to meet data protection requirements. Rising cybersecurity risks push businesses to implement MMS for proactive threat management. Additionally, companies invest in MMS to enhance workforce productivity, streamline operations, and improve real-time monitoring. With evolving enterprise mobility needs, the U.S. MMS market is positioned for sustained growth.

Managed Mobility Services Market Trends:

Rising Digital Transformation and Remote Work Adoption

The growing digital transformation and shift to remote work are significantly driving demand for managed mobility services (MMS). For instance, it has been reported that almost 91% of businesses are engaging in some form of digital activity. Many organizations now implement bring-your-own-device (BYOD) policies, allowing employees to use personal devices for work-related tasks, increasing the need for MMS to ensure secure access and policy enforcement. With the expansion of remote and hybrid work models, companies require seamless mobility management to maintain security and productivity. MMS providers are enhancing their solutions with real-time monitoring and remote management to address enterprise mobility needs effectively.

Expanding Mobile Device Usage and IT Outsourcing

The growing dependence on mobile devices is fueling demand for MMS, as enterprises seek efficient mobility management solutions. According to GSMA, over half (54%) of the global population, some 4.3 billion people now owns a smartphone, further driving the need for secure and scalable mobility services. Organizations increasingly rely on outsourced IT services to handle device lifecycle management, policy enforcement, and security across distributed teams. As businesses scale globally, MMS provides centralized control over mobile infrastructures while ensuring compliance and security. IT outsourcing further supports cost-effective implementation, reducing downtime and improving operational efficiency. As mobile device integration expands, demand for MMS continues to strengthen worldwide.

Growing Cybersecurity Concerns and Advanced Security Features

The rising threat of cyber-attacks and data breaches is accelerating the need for MMS solutions with enhanced security features. According to industry reports, the global average cost of a data breach was recorded at USD 4.88 Million in 2024 which is a 10% increase over last year and the highest total ever. As businesses expand mobile device usage, securing sensitive enterprise data becomes a priority. MMS providers offer encryption, secure access, and remote wipe capabilities to mitigate risks. Companies increasingly adopt MMS to protect against unauthorized access, comply with data security regulations, and ensure seamless mobility. As cybersecurity threats grow, MMS plays a critical role in enterprise risk management.

Managed Mobility Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global managed mobility services market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on function, deployment, organization size, and end use industry.

Analysis by Function:

- Mobile Device Management

- Mobile Application Management

- Mobile Security

- Others

Mobile device management stand as the largest function segment in 2024, holding around 38.7% of the market. The segment is driven by increasing enterprise mobility needs and security concerns. Businesses rely on MDM to oversee device provisioning, security enforcement, and compliance management across corporate and employee-owned devices. The rise of remote and hybrid work models further accelerates demand for MDM solutions that ensure secure access to enterprise systems. The managed mobility services market demand continues to grow as organizations prioritize MDM for data protection, remote monitoring, and policy enforcement, reducing cybersecurity risks. As mobile device adoption increases, MDM remains essential for efficient, secure, and scalable enterprise mobility management.

Analysis by Deployment:

- Cloud based

- On-premises

On-premises leads the market in 2024. This dominance can be attributed to enterprises prioritizing data security, control, and compliance. Businesses in regulated industries, such as healthcare and finance, prefer on-premises solutions to maintain full ownership of sensitive information and meet strict security requirements. This deployment model ensures direct oversight of mobility infrastructure, reducing reliance on third-party cloud services. The managed mobility services market outlook reflects a growing preference for on-premises solutions, particularly among large organizations seeking enhanced customization, integration, and performance optimization. As cybersecurity threats rise, companies continue to invest in on-premises MMS for secure, efficient, and compliant mobility management.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises lead the market with around 65% of market share in 2024. This is due to their extensive mobile infrastructure and complex security needs. These organizations require MMS for device management, security enforcement, and compliance across geographically dispersed workforces. With increasing reliance on remote work and bring-your-own-device (BYOD) policies, large enterprises prioritize MMS to ensure seamless connectivity, data protection, and operational efficiency. High cybersecurity risks further drive adoption, as businesses seek robust mobility solutions with encryption, remote monitoring, and access controls. The managed mobility services market growth is propelled by large corporations investing in scalable, secure, and efficient mobility management solutions.

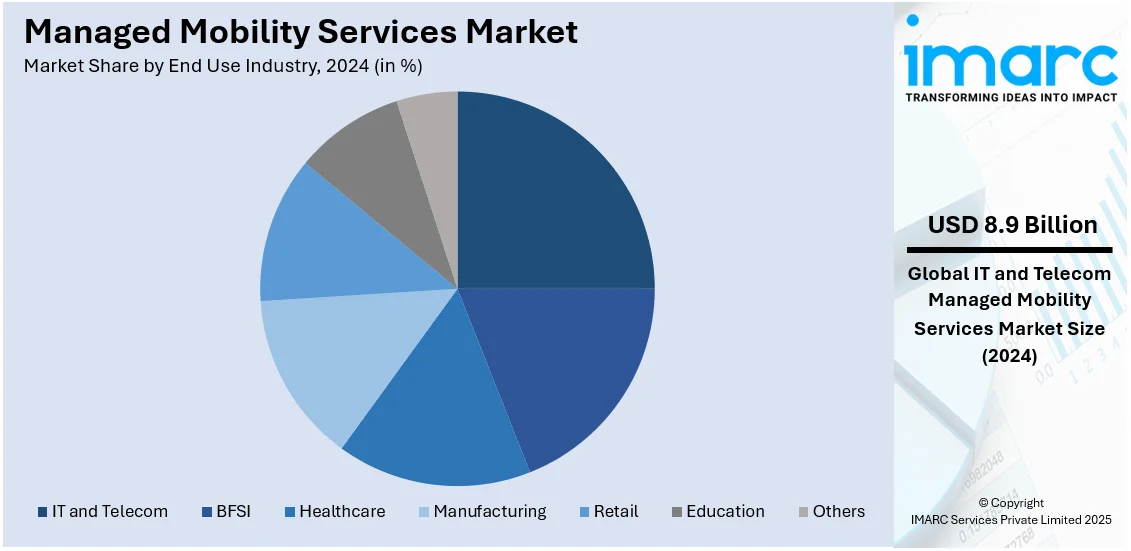

Analysis by End Use Industry:

- IT and Telecom

- BFSI

- Healthcare

- Manufacturing

- Retail

- Education

- Others

IT and telecom lead the market with around 22.5% of market share in 2024. The dominance of the segment is influenced by its high reliance on mobile devices, remote connectivity, and secure data management. These industries require MMS to streamline device provisioning, enforce security policies, and manage large-scale mobile infrastructure. Additionally, with increasing cybersecurity threats and regulatory compliance requirements, IT and telecom companies prioritize MMS for data protection, remote monitoring, and seamless connectivity. Besides this, the growing adoption of 5G and cloud-based solutions further drives demand for MMS, ensuring efficient, secure, and scalable mobility management across global networks and distributed workforces.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 32.0%. The region’s dominance is owing to its advanced IT infrastructure, strong enterprise mobility adoption, and increasing cybersecurity concerns. Businesses across industries prioritize MMS for secure device management, regulatory compliance, and operational efficiency. Moreover, the region’s growing hybrid workforce further drives demand for scalable mobility solutions. Strict data protection regulations encourage enterprises to invest in MMS for security enforcement and risk management. Additionally, rapid technological advancements, including AI-driven mobility solutions and cloud integration, strengthen North America’s managed mobility services market share, making it the dominant region for managed mobility services adoption and innovation.

Key Regional Takeaways:

United States Managed Mobility Services Market Analysis

In 2024, United States accounted for 84.50% of the market share in North America. The increasing reliance on cloud-based platforms has become a key catalyst for the expansion of managed mobility services. According to survey, over 51% of businesses now leverage cloud services. The ongoing integration of cloud technology has allowed businesses to enhance their mobility infrastructures, providing seamless connectivity, scalability, and security for a growing mobile workforce. As businesses embrace flexible working models, the demand for efficient management of mobile devices, applications, and data also rises. With organizations shifting to cloud-based solutions, they require reliable services to ensure smooth transitions, data security, and better control over mobile assets. This adoption is fuelled by the desire to streamline operations, lower it costs, and improve employee productivity, all while maintaining a high level of security and compliance. As mobility continues to evolve, cloud technology serves as the backbone for organizations seeking to optimize and manage their mobility strategies effectively, ensuring a competitive edge in an increasingly digital world.

Europe Managed Mobility Services Market Analysis

The growing adoption of managed mobility services within the banking, financial services, and insurance (BFSI) sector is driven by the need for improved security, compliance, and mobility management. According to reports, there were 784 foreign bank branches in the EU in 2021, of which 619 were from other EU Member States and 165 from third countries. Financial institutions are increasingly relying on mobile devices for communication, transaction processing, and client interactions, creating a need for enhanced mobile device management and security solutions. As regulations become stricter and financial data breaches continue to rise, the need for secure, compliant mobility solutions is paramount. Managed services help these organizations efficiently manage large fleets of mobile devices while ensuring that they are in line with regulatory requirements and cybersecurity protocols. These services also facilitate the integration of mobile technologies into existing it infrastructures, offering enhanced control, real-time monitoring, and risk management capabilities to safeguard sensitive financial data, ensuring business continuity and operational efficiency.

Asia Pacific Managed Mobility Services Market Analysis

The adoption of managed mobility services is being propelled by the rapid rise of small and medium-sized enterprises (SMEs). According to India Brand Equity Foundation, the number of MSMEs in the country is projected to grow from 6.3 crore to around 7.5 crore at a CAGR of 2.5%. SMEs in this region increasingly seek to streamline operations, improve productivity, and enhance security using mobile technologies. As these businesses embrace mobile solutions for customer engagement, internal communications, and operational efficiency, they require robust managed services to handle the complexities of device management, security, and application deployment. These enterprises benefit from outsourcing their mobility management to reduce costs associated with in-house it departments. By leveraging external expertise, SMEs can focus on their core competencies while ensuring their mobile workforce operates efficiently and securely, all within a flexible, cost-effective model tailored to their needs.

Latin America Managed Mobility Services Market Analysis

The adoption of managed mobility services is also growing due to the expanding demand in the retail and healthcare sectors. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), of Brazil’s 7,191 hospitals, 62% are private. Both industries are experiencing rapid digital transformation, with mobile technologies playing an essential role in improving operational efficiencies, customer experience, and patient care. Retailers are increasingly using mobile devices for inventory management, point-of-sale transactions, and customer service, while healthcare providers rely on mobile devices for telemedicine, patient monitoring, and electronic health record (ehr) management. As a result, these industries need secure and efficient management of mobile devices, applications, and data. By adopting managed mobility services, these organizations can ensure a seamless, secure, and compliant mobile environment that enhances productivity and maintains high levels of security, ultimately improving service delivery and operational performance.

Middle East and Africa Managed Mobility Services Market Analysis

The growing it and telecom sectors in this region are driving the adoption of managed mobility services. For instance, overall spending on information and communications technology (ICT) across the Middle East, Türkiye, and Africa (META) will top USD 238 Billion this year, an increase of 4.5% over 2023. As mobile technologies continue to shape business operations, organizations in these industries increasingly rely on managed mobility services to streamline device management, optimize performance, and improve security. With mobile solutions playing a central role in network management, customer support, and infrastructure monitoring, these organizations require effective management of mobile devices, applications, and data to ensure operational efficiency. Managed mobility services provide a scalable, flexible solution to meet the demands of this fast-paced sector, allowing businesses to focus on innovation while ensuring secure, efficient, and compliant mobility practices.

Competitive Landscape:

Competitive forces in the managed mobility services (MMS) market stem from technology providers alongside telecom companies and IT service firms that provide complete mobility solutions. Key market participants direct their efforts toward security solutions, device management, and regulatory requirements for enterprise acceptance. Companies differentiate through automation, AI-driven analytics, and customized mobility strategies. Strategic partnerships, mergers, and acquisitions strengthen market presence, expanding service portfolios. For instance, in March 2024, Ericsson and Mobily extended their managed services agreement for three years. The partnership will use AI, ML, and automation to improve operations, enhance service quality, increase efficiency, and support Mobily’s digital transformation. Moreover, increasing cybersecurity threats push providers to enhance encryption, remote access controls, and threat detection capabilities. The demand for scalable solutions in hybrid work environments intensifies competition. Furthermore, as enterprise mobility grows, providers innovate to deliver secure, cost-effective, and flexible MMS solutions.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- Accenture PLC

- AT&T Inc.

- Deutsche Telekom AG

- Fujitsu Limited

- HP Development Company L.P.

- International Business Machines Corporation

- Orange S.A.

- Samsung Electronics Co. Ltd.

- Telefónica S.A.

- Unisys Corporation

- Vodafone Idea Limited

- Wipro Limited

Latest News and Developments:

- September 2024, TCS, in collaboration with Google Cloud, launched two AI-powered cybersecurity solutions, Managed Detection and Response (MDR) and Secure Cloud Foundation. These solutions aim to enhance threat detection, response, and cloud security governance across hybrid environments.

- September 2024, DXC Technology and Dell formed a partnership to create Enterprise Intelligence Services (EIS). This service combines AI, data analytics, and cloud technology to improve managed services, helping organizations streamline operations and enhance customer experiences, solidifying DXC's leadership in multi-cloud solutions.

- September 2024, IBM and NTT DATA launched SimpliZCloud a fully managed cloud service for financial institutions. Built on IBM’s LinuxONE platform, the service enhances infrastructure performance, lowers costs, and enables AI/ML-powered applications with a subscription-based model promoting sustainability and hybrid cloud use.

- September 2024, Accenture acquired NaviSite to bolster its managed services offerings, particularly in application and infrastructure management. This acquisition enhances Accenture's capabilities to support digital infrastructure modernization for US and Canadian clients, focusing on AI, cloud, and data-driven solutions.

- August 2024, Stratix Corporation announces its continued partnership with Omnissa to enhance Managed Mobility Services (MMS). The collaboration utilizes generative AI and cloud-based computing to streamline endpoint management, improving operational efficiency. Stratix leverages Omnissa's Workspace One Unified Endpoint Management for secure device management across enterprises. The partnership aims to deliver superior value by automating complex tasks and enhancing the end-user experience.

- March 2024, Dynamic Digital Transformation (DDT), a joint venture between DMI and Dynamic Solutions Technology, has secured a USD 14.5 Million contract with the U.S. Treasury. The contract involves providing enterprise mobility management services (EMMS) to the Office of the Comptroller of the Currency (OCC). This partnership aims to enhance the bureau's mobility solutions. DMI, a global leader in managed mobility services, continues to expand its footprint in the enterprise mobility space.

Managed Mobility Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Mobile Device Management, Mobile Application Management, Mobile Security, Others |

| Deployments Covered | Cloud based, On-premises |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Use Industries Covered | IT and Telecom, BFSI, Healthcare, Manufacturing, Retail, Education, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture PLC, AT&T Inc., Deutsche Telekom AG, Fujitsu Limited, HP Development Company L.P., International Business Machines Corporation, Orange S.A., Samsung Electronics Co. Ltd., Telefónica S.A., Unisys Corporation, Vodafone Idea Limited, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the managed mobility services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global managed mobility services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the managed mobility services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The managed mobility services market was valued at USD 39.62 Billion in 2024.

IMARC estimates the global managed mobility services market to reach USD 343.65 Billion in 2033, exhibiting a CAGR of 25.77% during 2025-2033.

The managed mobility services market is primarily driven by the increasing demand for cost-efficient mobility solutions, the growing adoption of mobile devices in business operations, and the need for enhanced security and device management. Additionally, the rise in remote work and the focus on operational efficiency further fuel market growth, as organizations seek to streamline their mobile strategies.

North America currently dominates the market, holding a market share of over 32% in 2024. This dominance can be attributed to high enterprise adoption of mobility solutions, a robust IT infrastructure, and increasing remote workforce demand. Moreover, advanced 5G deployment, stringent data security regulations, and strong presence of major technology providers further drive market growth, with the United States leading digital transformation initiatives across industries.

Some of the major players in the managed mobility services market include Accenture PLC, AT&T Inc., Deutsche Telekom AG, Fujitsu Limited, HP Development Company L.P., International Business Machines Corporation, Orange S.A., Samsung Electronics Co. Ltd., Telefónica S.A., Unisys Corporation, Vodafone Idea Limited, Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)