Malware Analysis Market Size, Share, Trends and Forecast by Component, Deployment Model, Organization Size, Industry Vertical, and Region, 2025-2033

Malware Analysis Market Size and Share:

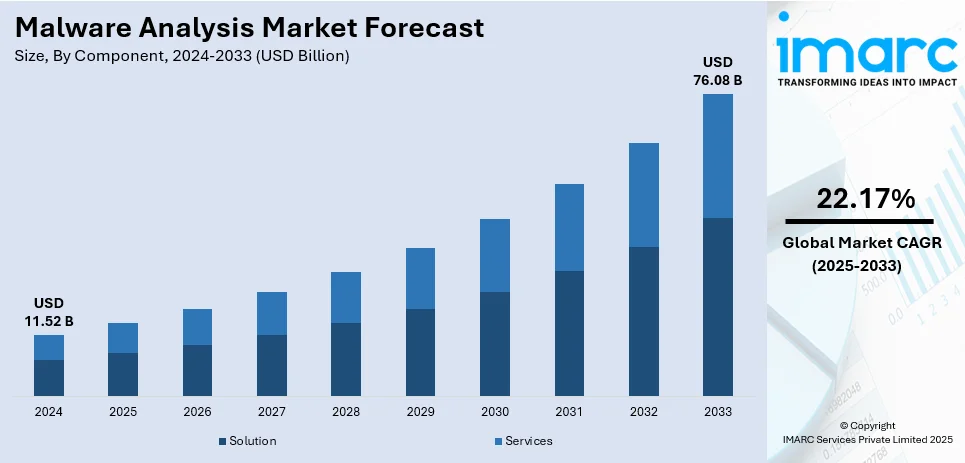

The global malware analysis market size was valued at USD 11.52 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 76.08 Billion by 2033, exhibiting a CAGR of 22.17% from 2025-2033. North America currently dominates the market, holding a market share of over 30.0% in 2024. The market is driven by the development of more sophisticated and evasive malware by cybercriminals, maintaining in-house security infrastructure among companies, and large volumes of sensitive data stored by organizations in the cloud.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.52 Billion |

|

Market Forecast in 2033

|

USD 76.08 Billion |

| Market Growth Rate (2025-2033) | 22.17% |

The global market is expanding as cyber threats become more frequent and sophisticated, driving demand for advanced threat detection. According to the QBE report Connected Business, Digital Dependency, cyber-attacks will increase worldwide by 105% by the end of 2024, with 78% of businesses expressing concern and 51% anticipating an attack within a year. Similarly, the rise of ransomware, zero-day exploits, and advanced persistent threats (APTs) is intensifying the malware analysis market demand. Additionally, regulatory mandates in finance, healthcare, and government necessitate robust malware detection and forensic tools. The rapid expansion of cloud computing and IoT ecosystems increases security vulnerabilities, accelerating the adoption of AI-powered malware analysis. As digital transformation progresses, organizations rely on real-time threat intelligence to safeguard networks and maintain operational resilience.

The United States is a key regional market which is witnessing growth due to the escalation of cybercrime, including state-sponsored attacks, ransomware, and financial fraud. For instance, on October 9, 2024, Kiteworks reported that U.S. cybercrime costs will surpass USD 452 Billion, with Colorado ranking highest in cyberattack risk. BEC attacks have caused USD 1.75 Billion in losses since 2020, while non-payment/non-delivery scams remain the most frequent cyber threats. New York and Nevada face increasing cyber risks, with financial losses increasing 75.7% and 25.2%, respectively. Malware analysis market trends indicate a shift toward AI-driven threat detection, real-time threat intelligence, and behavioral analysis to combat changing threats. Moreover, rising cloud computing, IoT, and remote work adoption have further expanded attack surfaces, increasing demand for advanced malware analysis solutions and stricter compliance under CISA and NIST frameworks.

Malware Analysis Market Trends:

Rising Demand for Security as a Service (SECaaS) Solution

According to the IMARC Group’s report, the global security as a service market reached USD 16.6 Billion in 2023. Businesses are highly reliable on SECaaS solutions, as they offer scalable and flexible security services, thereby influencing the malware analysis market outlook. This also includes malware analysis, which can be scaled as per the needs of organizations at affordable prices. Maintaining in-house security infrastructure is very important for businesses and SECaaS can reduce the costs associated with this infrastructure. This, in turn, is increasing the adoption of advanced malware analysis tools provided as a service. For malware analysis, SECaaS providers rely on cutting-edge technologies, such as artificial intelligence (AI) and machine learning (ML). These cutting-edge innovations are highly beneficial for organizations, and they do not have to develop them internally. To ensure that organizations are protected against latest threats, SECaaS can be deployed and updated according to these threats.

Growing Number of Cyberattacks

As per an article published in 2024 on the website of the International Monetary Fund (IMF), the financial sector witnessed over 20,000 cyberattacks, resulting in USD 12 Billion losses over the past two decades. There is an increase in the number of cyberattacks, which is expanding the malware analysis market share among organizations to mitigate and identify threats swiftly and effectively. Businesses are investing heavily on proactive malware analysis, as financial and reputation impact of successful cyberattacks can be devastating for them. Healthcare, finance, and energy sectors are highly vulnerable to cyberattacks, and so their reliance on specialized malware analysis tools to protect these high-stakes environments is increasing.

Increasing Reliance on Cloud Computing

As cloud services are being used widely, there is an increased attack surface, which makes cloud environments appealing to cybercriminals. To monitor and secure cloud infrastructures, advanced malware analysis tools are very important. The global cloud security software market size reached USD 32.1 Billion in 2024. The complexity of cloud systems due to their several interrelated services and platforms makes malware analysis highly valuable to negotiate this complexity and guarantee complete security. Organizations and cloud providers are jointly responsible for security. Companies need to safeguard their apps and data while suppliers secure the infrastructure, thereby supporting the malware analysis market growth. Moreover, major companies operating in the cloud computing market are emphasizing on acquisition, mergers, and partnerships to expand their customer base. For instance, in 2023, IBM acquired Agyla SAS, a prominent cloud solutions provider in France, to enhance IBM Consulting’s regional cloud capabilities for clients in France.

Malware Analysis Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global malware analysis market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment model, organization size, and industry vertical.

Analysis by Component:

- Solution

- Services

Solution stands as the largest component in the market in 2024. A whole range of tools and functionalities covering every aspect of malware analysis, ranging from detection and prevention to response and remediation, are frequently offered by solutions. Due to the scalability of solutions, businesses can modify their security capabilities as per their demands, size, and expansion. This is more important for companies that are expanding quicky or that work in dynamic settings. As cyber threats continue to change, businesses are increasingly prioritizing advanced security solutions to safeguard their digital ecosystems.

Analysis by Deployment Model:

- On-premises

- Cloud-based

On-premises leads the market share in 2024. To preserve complete control over their sensitive data and guarantee adherence to stringent data security and privacy laws, organizations frequently favor on-premises solutions. This is particularly important for the government, healthcare, and financial sectors. Meeting these regulatory requirements can be made easier with on-premises implementation. Businesses can further integrate malware analysis solutions with their current systems and customize them to meet their own requirements. Moreover, on-premises deployment ensures greater data control and reduced exposure to external threats, making it a preferred choice for highly regulated industries.

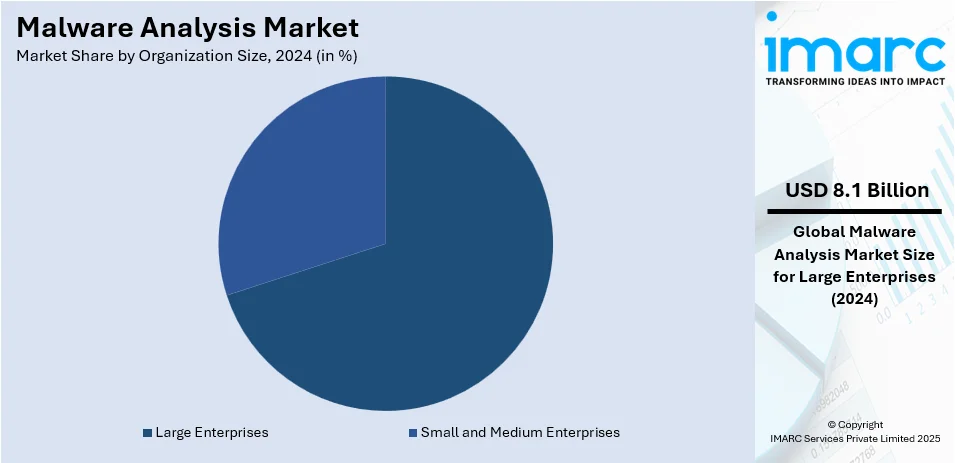

Analysis by Organization Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises lead the market with around 70.0% of market share in 2024. Large enterprises often have intricate and multi-tiered IT infrastructures with plenty of networks, systems, and endpoints. Due to the important information and assets, they possess, cybercriminals frequently target large organizations. So, they heavily invest in sophisticated malware analysis tools as advanced online threats can be very dangerous to them. Furthermore, large enterprises prioritize comprehensive security frameworks that integrate AI-driven threat detection and real-time monitoring to mitigate risks effectively, thereby impelling the market.

Analysis by Industry Vertical:

- Aerospace and Defense

- BFSI

- Public Sector

- Retail

- Healthcare

- IT and Telecom

- Energy and Utilities

- Manufacturing

- Others

BFSI dominates the market share in 2024. The industry handles extremely important and sensitive data, such as financial transactions, private company information, and personal data. Preventing malware attacks on sensitive data is of utmost importance. Strict legal regulations and compliance standards like PCI DSS, GDPR, and SOX, apply to BFSI firms. In the BFSI industry, the need for sophisticated malware analysis solutions is fueled by the rise in the frequency and sophistication of assaults like phishing and ransomware, which is increasing the malware analysis market revenue.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 30.0%. To safeguard themselves from cyberattacks, corporations and government organizations in North America, especially the US, are implementing sophisticated malware analysis tools. The cybersecurity market in the area is well-established and developed, with many top businesses that specialize in malware analysis. This level of maturity encourages the use of cutting-edge security technologies and innovations. Many of the biggest IT infrastructure providers and technology organizations in the world are based in North America, which is why there is a growing need for advanced malware analysis tools to safeguard sensitive data and assets. In addition, prominent organizations in the region are focusing on collaborations and partnerships to accelerate digital transformation. For instance, in 2024, Lenovo and Cisco announced a global strategic alliance to provide comprehensive infrastructure and networking solutions, aimed at driving digital transformation across businesses of all scales.

Key Regional Takeaways:

United States Malware Analysis Market Analysis

In 2024, the United States accounted for 87.60% of the North America malware analysis market driven by the increasing frequency and sophistication of cyberattacks across various industries, including finance, healthcare, and government. Notably, an article by AAG highlights that 53.35 million U.S. residents fell prey to cybercrime in just the first half of 2022, highlighting the urgent need for robust cybersecurity solutions. The proliferation of digital transformation, remote work, and cloud computing expanded the attack surface, prompting organizations to adopt advanced malware detection and prevention technologies. The extensive use of Internet of Things (IoT) devices further exacerbates vulnerabilities, necessitating real-time threat analysis tools. Additionally, stringent regulations such as the Cybersecurity Information Sharing Act (CISA) and global compliance mandates like GDPR compel businesses to strengthen their cybersecurity infrastructure. The escalating risks of ransomware, phishing campaigns, and zero-day exploits emphasize the critical need for comprehensive malware analysis to protect sensitive data, national security, and business operations.

Europe Malware Analysis Market Analysis

The European malware analysis market is fueled by the region’s commitment to enhancing cybersecurity in response to the increasing frequency of cyberattacks on enterprises and government entities. According to an article by AAG, 32% of UK businesses reported experiencing a cyberattack or breach in 2023, with the figure rising to 59% for medium-sized businesses and 69% for large businesses, highlighting the growing vulnerability across all sectors. The increasing usage of cloud technologies, Internet of Things (IoT) devices, and remote work models broadened the attack area, prompting organizations to invest in advanced malware detection and prevention tools. Furthermore, the prevalence of ransomware and phishing attacks targeting critical sectors such as healthcare, manufacturing, and financial services making real-time malware identification and mitigation a top priority. Regulatory frameworks like the General Data Protection Regulation (GDPR) and the Network and Information Systems (NIS) Directive further push organizations to implement robust cybersecurity measures. European nations, including Germany, the UK, and France, are increasingly investing in cybersecurity research and development (R&D), fostering collaboration with cybersecurity vendors to strengthen national resilience and safeguard businesses against changing cyber threats.

Asia Pacific Malware Analysis Market Analysis

The Asia-Pacific market is propelled by rapid digitalization, increasing cyber threats, and growing IoT adoption across the region. According to industry report, organizations in Australia lead with a 96% IoT adoption rate, highlighting the region's rapid technological advancement and expanding cyberattack surface. The proliferation of 5G networks, cloud computing, and connected devices amplified vulnerabilities, compelling organizations to invest in advanced malware detection tools. Key industries like BFSI, healthcare, and e-commerce are increasingly prioritizing cybersecurity to counter rising incidents of data breaches and financial fraud. Governments in countries such as India, China, and Singapore are implementing robust cybersecurity frameworks and regulations to mitigate threats, further fueling the demand for malware analysis solutions. Additionally, the escalation of targeted attacks on critical infrastructure and regional cyber warfare emphasizes the need for sophisticated threat detection capabilities to safeguard national and corporate interests.

Latin America Malware Analysis Market Analysis

The Latin American market is driven by the increasing sophistication of cyberattacks targeting vulnerable industries such as banking, telecommunications, and healthcare. The region’s growing adoption of cloud and IoT technologies has expanded the attack surface, prompting businesses to invest in advanced malware detection solutions. Furthermore, the cybersecurity market in Latin America is projected to exhibit a growth rate (CAGR) of 7.30% from 2024 to 2032, reflecting heightened awareness and demand for robust cybersecurity measures. Governments in key countries like Brazil and Mexico are also focusing on cybersecurity reforms, further driving the adoption of malware analysis tools across the region.

Middle East and Africa Malware Analysis Market Analysis

The Middle East and Africa market is witnessing growth due to the increasing prevalence of cyberattacks on critical sectors such as oil and gas, finance, and government. According to reports, 82% of organizations in the Middle East and Türkiye reported experiencing at least one cybersecurity incident between 2022 and 2024, with most facing multiple attacks, highlighting the region's heightened vulnerability. Rapid digital transformation, cloud adoption, and IoT integration have further expanded the attack surface, fueling demand for advanced malware detection solutions. Additionally, regional governments are implementing stringent regulations and national cybersecurity strategies to protect critical infrastructure, driving the market for malware analysis tools.

Competitive Landscape:

Leading companies are actively working to provide cutting-edge defenses against ever-more-advanced cyberthreats. These businesses render significant investments in R&D to improve their malware analysis skills, utilizing cutting-edge tools including behavioral analysis, machine learning, and artificial intelligence (ML). They serve a variety of industries, including technology, government, healthcare, and finance, by concentrating on offering complete solutions that cover malware detection, analysis, and response. In order to guarantee smooth communication with security information and event management (SIEM) systems, endpoint detection and response (EDR) platforms, and various other cybersecurity solutions, key companies also place a strong emphasis on integration with current cybersecurity frameworks. Major companies are also introducing advanced security solutions to detect and identify cyberattacks beforehand, which is positively influencing the malware analysis market value. For instance, in 2024, Palo Alto Networks unveiled a range of advanced security solutions, integrating machine learning (ML), deep learning (DL), and generative AI (GenAI) to provide real-time, AI-driven security, enabling proactive threat prevention and enhanced network and infrastructure protection.

The report provides a comprehensive analysis of the competitive landscape in the malware analysis market with detailed profiles of all major companies, including:

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- FireEye Inc.

- Fortinet Inc.

- Juniper Networks Inc.

- Kaspersky Lab

- McAfee LLC

- Palo Alto Networks Inc.

- Qualys Inc.

- Sophos Ltd. (Thoma Bravo)

- Trend Micro Incorporated

Latest News and Developments:

- January 2025: Inversion6 launched its Incident Response (IR) Service to help organizations manage, mitigate, and recover from cybersecurity incidents. Led by Tyler Hudak, a 25-year industry expert, the service provides rapid response, forensic analysis, and tailored guidance to contain threats and prevent future incidents. Offerings include emergency incident response, malware analysis, and consulting support.

- December 2024: Group-IB launched a new free tool, Malware Reports, providing access to a continuously updated database of publicly available malware reports. This platform allows security professionals to gain insights into malware behavior, development, and its impact on organizations globally.

- July 2024: Appgate launched its Malware Analysis Service to help organizations counter cyberthreats. The service offers two options: Rapid Analysis, which provides automated insights within 30 minutes, and Deep Analysis, which includes expert evaluation with detailed findings in up to three days. Both services deliver comprehensive reports on threats and mitigation strategies, supporting effective security operations.

- April 2024: The Cybersecurity and Infrastructure Security Agency (CISA) unveiled its Malware Next-Gen system, which enables organizations to submit malware samples and suspicious artifacts for analysis. This system automates the analysis of newly identified malware, enhancing CISA’s ability to support cyber defense efforts. Malware Next-Gen offers scalable, advanced analysis and containment capabilities for malicious files and URLs.

- November 2023: Axiado launched the Ransomware Threat Hunting Service (RTHS), a free platform for malware detection and analysis. Powered by AI/ML-based security, it integrates open-source tools to analyze ransomware. Users can submit suspicious files for live analysis, with detailed reports and Indicators of Compromise (IOCs) to help prevent attacks. The platform leverages crowdsourced machine learning datasets to quickly identify ransomware variants and their behaviors.

Malware Analysis Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Models Covered | On-Premises, Cloud-Based |

| Organization Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | Aerospace and Defense, BFSI, Public Sector, Retail, Healthcare, IT and Telecom, Energy and Utilities, Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Broadcom Inc., Check Point Software Technologies Ltd., Cisco Systems Inc., FireEye Inc., Fortinet Inc., Juniper Networks Inc., Kaspersky Lab, McAfee LLC, Palo Alto Networks Inc., Qualys Inc., Sophos Ltd. (Thoma Bravo), Trend Micro Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the malware analysis market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global malware analysis market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the malware analysis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The malware analysis market was valued at USD 11.52 Billion in 2024.

The malware analysis market is projected to exhibit a CAGR of 22.17% during 2025-2033, reaching a value of USD 76.08 Billion by 2033.

The rising frequency of cyberattacks, including ransomware and APTs, is driving demand for advanced malware analysis solutions. Regulatory compliance mandates, increasing cloud and IoT adoption, and the expanding attack surface from digital transformation further augment market growth. AI-powered threat detection and real-time intelligence are also key market drivers.

North America currently dominates the malware analysis market, accounting for a share exceeding 30.0%. This dominance is fueled by high cyberattack incidents, strict regulatory frameworks, widespread cloud adoption, and strong investments in AI-driven cybersecurity solutions.

Some of the major players in the malware analysis market include Broadcom Inc., Check Point Software Technologies Ltd., Cisco Systems Inc., FireEye Inc., Fortinet Inc., Juniper Networks Inc., Kaspersky Lab, McAfee LLC, Palo Alto Networks Inc., Qualys Inc., Sophos Ltd. (Thoma Bravo), and Trend Micro Incorporated, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)