Mainframe Market Report by Type (Z Systems, GS Series, and Others), Industry Vertical (BFSI, IT and Telecom, Government and Public Sector, Retail, Travel and Transportation, Manufacturing, and Others), and Region 2025-2033

Global Mainframe Market:

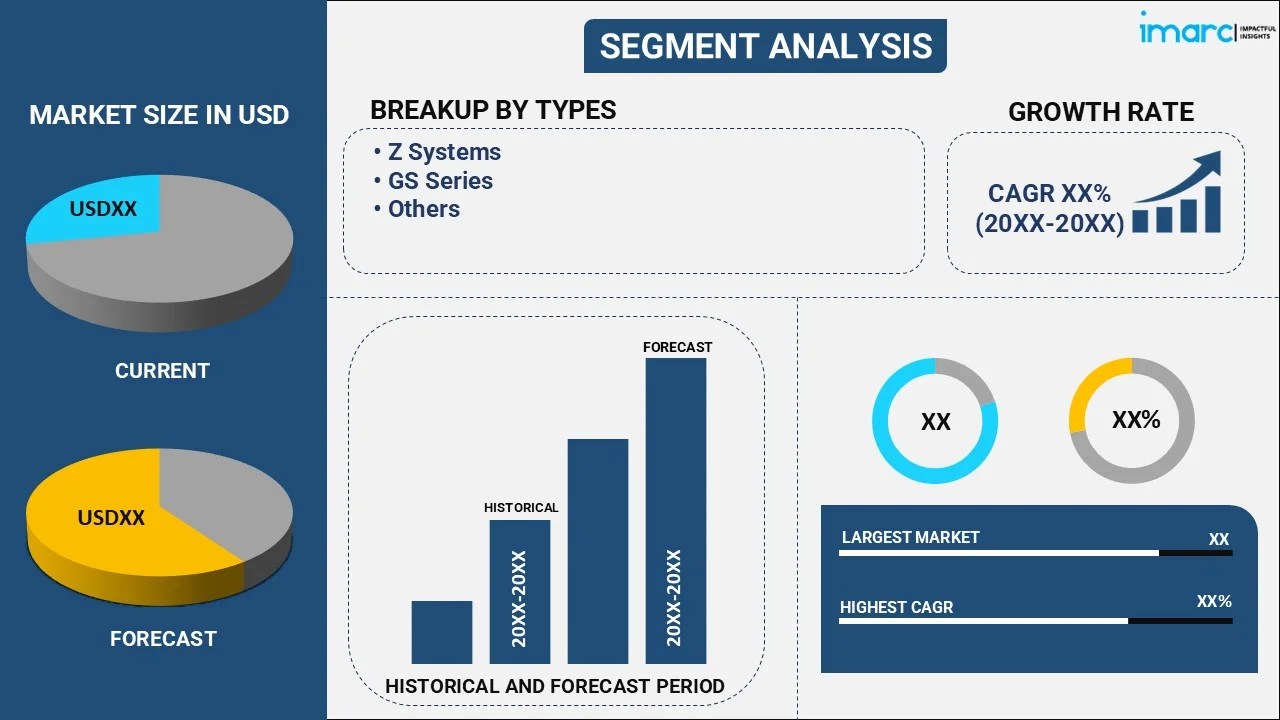

The global mainframe market size reached USD 2.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.7 Billion by 2033, exhibiting a growth rate (CAGR) of 6.11% during 2025-2033. A rising emphasis on continuously re-evaluating enterprise IT strategies to support an evolving marketplace is stimulating the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.7 Billion |

|

Market Forecast in 2033

|

USD 4.7 Billion |

| Market Growth Rate (2025-2033) | 6.11% |

Mainframe Market Analysis:

- Major Market Drivers: The elevating investments in modifying existing core systems for digital transformation and innovation of applications, processes, and IT infrastructure are propelling the market.

- Key Market Trends: The introduction of flexible and multipurpose versions that can dynamically reconfigure hardware and software resources such as CPUs, memory, and device interfaces is one of the factors contributing to the mainframe market growth.

- Competitive Landscape: Some of the major market companies include Atos SE, BMC Software Inc, Broadcom Inc., Dell Technologies Inc., DXC Technology Company, Fujitsu Limited, HCL Technologies Limited (HCL Enterprise), Hewlett Packard Enterprise Company, Infosys Limited, International Business Machines Corporation, NEC Corporation (AT&T Inc.), and Wipro Limited, among many others.

- Geographical Trends: North America is currently dominating the market due to its legacy system progress, with enterprises upgrading existing mainframe systems. These systems improve performance, security, and compatibility with emerging innovations such as cloud computing and artificial intelligence, which are critical for meeting changing business needs.

- Challenges and Opportunities: The shortage of skilled personnel capable of administering and maintaining these systems is hampering the market. However, investing in worker training and encouraging newer personnel to learn mainframe-specific skills that will ensure long-term operational efficiency will continue to catalyze the market over the forecast period.

To get more information on this market, Request Sample

Mainframe Market Trends:

Rising Emphasis on Modernization of Legacy Systems

Numerous companies are investing in modernizing legacy mainframe systems to connect with modern technologies such as cloud computing and artificial intelligence. This modernization improves performance, scalability, and security while remaining compatible with existing business applications and procedures. In May 2024, Fujitsu announced the launch of its successful modernization automation service, "Fujitsu PROGRESSION," building on a proven track of over 50 global use cases in which it migrated legacy systems to the Fujitsu mainframe "GS21 Series."

Increasing Adoption of Hybrid Cloud

Enterprises are increasingly adopting hybrid cloud setups in which mainframes serve as crucial back-end systems alongside cloud services. This enables enterprises to benefit from the scale of cloud computing while keeping the stability and security of mainframe infrastructure. In June 2024, Kyndryl, the world's largest IT infrastructure services provider, announced the establishment of its first Mainframe Modernization Center of Excellence (CoE) in Malaysia, working with amazon web services (AWS). This largely contributes to the mainframe market share.

Growing Focus on Shortage of Skilled Mainframe Professionals

The industry needs more mainframe professionals. This gap is being filled through focused training programs and initiatives to upskill current IT workers, ensuring that the demand for competent individuals in mainframe management is met. In March 2024, IBM introduced the Mainframe Skills Council during the SHARE conference in Orlando to provide a forum where global organizations would foster a skilled, diverse, and sustainable workforce for the mainframe platform.

Global Mainframe Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the market forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type and industry vertical.

Breakup by Type:

- Z Systems

- GS Series

- Others

Currently, Z systems hold the largest mainframe market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes Z systems, GS series, and others. According to the report, Z systems represented the largest market segmentation.

Z systems are recognized for their high performance, dependability, and security features. These systems are frequently employed in areas, such as finance and government, where they manage large volumes of transactions, essential tasks, and sensitive information.

Breakup by Industry Vertical:

- BFSI

- IT and Telecom

- Government and Public Sector

- Retail

- Travel and Transportation

- Manufacturing

- Others

Among these, BFSI holds the largest mainframe market size

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, IT and telecom, government and public sector, retail, travel and transportation, manufacturing, and others. According to the report, BFSI represented the largest market segmentation.

The BFSI sector remains popular due to consumer preference for safe and high-volume transaction processing and real-time data management. Mainframes provide unparalleled reliability and scalability, making them critical for managing complex operations in this industry.

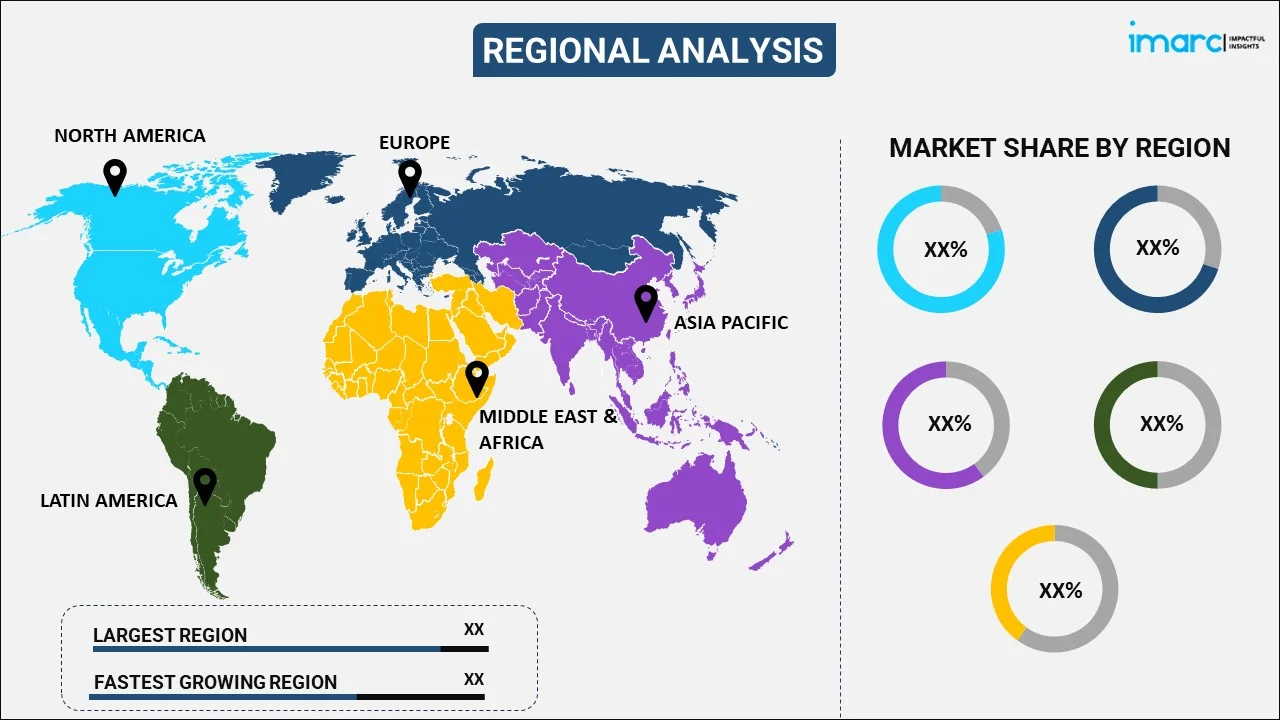

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads in the mainframe market growth

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest mainframe market share.

North America exhibits a clear dominance in the market driven by a substantial need in the banking and government sectors, where mainframes are essential for safe data processing and large-scale transactions. These sectors place a premium on dependability and compliance, investing continuously in the maintenance and enhancement of their mainframe infrastructure.

Competitive Landscape:

The report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- Atos SE

- BMC Software Inc

- Broadcom Inc.

- Dell Technologies Inc.

- DXC Technology Company

- Fujitsu Limited

- HCL Technologies Limited (HCL Enterprise)

- Hewlett Packard Enterprise Company

- Infosys Limited

- International Business Machines Corporation

- EC Corporation (AT&T Inc.)

- Wipro Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Mainframe Market Recent Developments:

- June 2024: Kyndryl, the world's largest IT infrastructure services provider announced the establishment of its first Mainframe Modernization Center of Excellence (CoE) in Malaysia working with amazon web services (AWS).

- May 2024: Fujitsu announced the launch of its successful modernization automation service, "Fujitsu PROGRESSION," building on a proven track of over 50 global use cases in which it migrated legacy systems to the Fujitsu mainframe "GS21 Series."

- March 2024: IBM introduced the Mainframe Skills Council during the SHARE conference in Orlando, to provide a forum where global organizations would foster a skilled, diverse, and sustainable workforce for the mainframe platform.

Mainframe Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Z Systems, GS Series, Others |

| Industry Verticals Covered | BFSI, IT and Telecom, Government and Public Sector, Retail, Travel and Transportation, Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atos SE, BMC Software Inc, Broadcom Inc., Dell Technologies Inc., DXC Technology Company, Fujitsu Limited, HCL Technologies Limited (HCL Enterprise), Hewlett Packard Enterprise Company, Infosys Limited, International Business Machines Corporation, NEC Corporation (AT&T Inc.), Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mainframe market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global mainframe market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mainframe industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global mainframe market was valued at USD 2.7 Billion in 2024.

We expect the global mainframe market to exhibit a CAGR of 6.11% during 2025-2033.

The introduction of flexible and multipurpose versions of the mainframe that can dynamically reconfigure the hardware and software resources, such as processors, memory, and device connections, is primarily driving the global mainframe market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing demand for mainframes to maintain flexibility and data security during the remote and Bring-Your-Own-Device (BYOD) models.

Based on the type, the global mainframe market has been segregated into Z systems, GS series, and others. Among these, Z systems currently hold the largest market share.

Based on the industry vertical, the global mainframe market can be bifurcated into BFSI, IT and telecom, government and public sector, retail, travel and transportation, manufacturing, and others. Currently, BFSI exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global mainframe market include Atos SE, BMC Software Inc, Broadcom Inc., Dell Technologies Inc., DXC Technology Company, Fujitsu Limited, HCL Technologies Limited (HCL Enterprise), Hewlett Packard Enterprise Company, Infosys Limited, International Business Machines Corporation, NEC Corporation (AT&T Inc.), and Wipro Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)