mLLDPE Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

mLLDPE Price Trend and Forecast

Track real-time and historical mLLDPE prices across global regions. Updated monthly with market insights, drivers, and forecasts.

mLLDPE Prices January 2026

| Region | Price (USD/KG) | Latest Movement |

|---|---|---|

| Northeast Asia | 1.22 | Unchanged |

| Europe | 1.3 | 3.2% ↑ Up |

| North America | 1.17 | -3.3% ↓ Down |

mLLDPE Price Index (USD/KG):

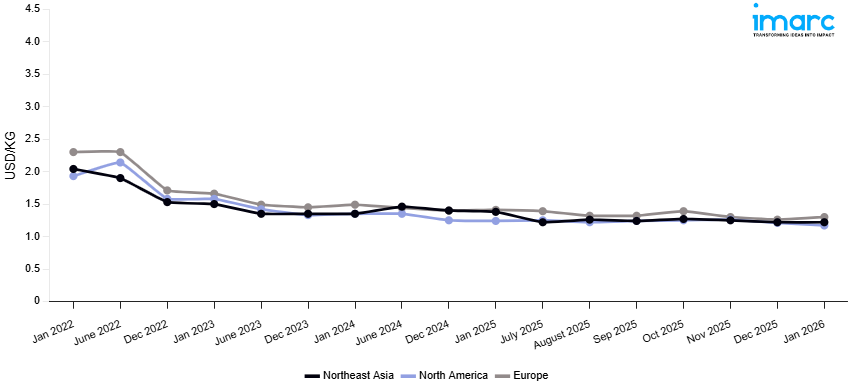

The chart below highlights monthly mLLDPE prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Northeast Asia: Northeast Asia experienced notable price volatility. The region's pricing trends were primarily influenced by robust demand from the packaging and automotive sectors, particularly in China and South Korea. Supply-side constraints emerged due to scheduled maintenance shutdowns at major petrochemical facilities across the region, creating temporary supply bottlenecks that supported price increases. The cost structure was further impacted by elevated naphtha feedstock prices, which rose due to crude oil price fluctuations and regional refinery maintenance activities. International shipping costs remained elevated, affecting import logistics from Middle Eastern and North American suppliers. Port congestion in key Chinese ports, including Shanghai and Ningbo, added additional handling costs and delivery delays.

Europe: Europe witnessed a contrasting trend with mLLDPE prices. This downward pressure stemmed from weakened demand across key consuming industries, particularly in Germany and France, where economic uncertainties affected packaging and automotive manufacturing activities. Supply-side dynamics showed improved availability as European producers ramped up production following earlier maintenance cycles, while imports from North America increased due to competitive pricing and favorable exchange rates. The cost structure benefited from moderating energy prices, as natural gas costs stabilized after the volatility experienced in previous quarters. However, compliance costs related to environmental regulations, including the EU's extended producer responsibility schemes and carbon pricing mechanisms, continued to add margin pressure for regional suppliers. International shipping rates from North American suppliers decreased due to improved container availability and including Rotterdam and Antwerp, reducing logistics bottlenecks.

North America: North America recorded the most competitive pricing, positioning the region as a cost-effective supplier in the global market. Demand-side factors showed mixed signals, with strong performance in e-commerce packaging and food packaging applications offsetting weakness in industrial and construction-related segments. Supply chain optimization initiatives by major producers resulted in improved production yields and reduced manufacturing costs. Feedstock advantages continued to benefit North American producers, with competitive natural gas liquids pricing providing cost benefits over naphtha-based production systems. International shipping costs to export markets remained manageable due to established logistics networks and improved container availability at Gulf Coast ports. Port handling efficiency at key terminals, including Houston and Los Angeles, contributed to competitive export pricing.

mLLDPE Price Trend, Market Analysis, and News

IMARC's latest publication, “mLLDPE Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the mLLDPE market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of mLLDPE at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed mLLDPE prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting mLLDPE pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

mLLDPE Market Analysis

The global mLLDPE industry size reached 2,435.49 Thousand Tons in 2025. By 2034, IMARC Group expects the market to reach 3,843.50 Thousand Tons, at a projected CAGR of 4.94% during 2026-2034. The market is driven by the expanding flexible packaging from e-commerce and convenience trends, rising automotive use of lightweight materials, advanced agricultural films for food security, infrastructure-driven construction applications, and growing medical needs.

Latest developments in the m-LLDPE industry:

- February 2025: ExxonMobil started up its 730,000 t/yr linear low-density polyethylene (LLDPE) No. 1 unit in Huizhou, China. The unit successfully produced on-spec material using purchased ethylene feedstock. Commercial operations were scheduled between late February and March, following the startup of the company’s 1.6 mn t/yr cracker. While initial output focused on conventional LLDPE, ExxonMobil planned to shift toward metallocene linear low-density polyethylene (mLLDPE) production after several months, highlighting the company’s strategy to strengthen its position in high-performance polyethylene markets.

- October 2024: Chemicals giant SABIC joined forces with frozen potato producer Lamb Weston and packaging innovator Opackgroup to develop lightweight, sustainable packaging for Lamb Weston’s frozen products, utilizing a thin coextrusion film structure. A key feature of the packaging is the integration of SUPEER mLLDPE (metallocene linear low-density polyethylene) alongside SABIC HDPE (high-density polyethylene), both produced from biorenewable feedstock sourced from used cooking oil (UCO) collected at Lamb Weston’s Eagle, Idaho production facility.

Product Description

Metallocene linear low-density polyethylene (mLLDPE) is a high-performance thermoplastic polymer produced using metallocene catalyst technology, representing a significant advancement in polyethylene production. This advanced polyethylene variant exhibits superior mechanical properties, including enhanced tensile strength, puncture resistance, and optical clarity compared to conventional LLDPE. mLLDPE occupies a premium position in the global polyethylene market due to its uniform molecular structure and controlled branching distribution. Its primary applications span flexible packaging films, where it provides excellent sealability and barrier properties for food and consumer goods packaging. The automotive industry utilizes mLLDPE for fuel tanks, interior components, and protective films due to its chemical resistance and durability. Agricultural applications include greenhouse films and mulch films that benefit from its UV resistance and mechanical strength, while industrial applications encompass geomembranes and specialty films requiring high-performance characteristics.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | m-LLDPE |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, m-LLDPE Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of m-LLDPE pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting m-LLDPE price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The m-LLDPE price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The mLLDPE prices in January 2026 were 1.22 USD/Kg in Northeast Asia,1.3 USD/Kg in Europe, and 1.17 USD/Kg in North America.

The mLLDPE pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for mLLDPE prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)