Lyocell Fiber Market Report by Product (Staple Fiber, Cross Linked Fiber), Application (Apparel, Home Textiles, Medical and Hygiene, Automotive Filters, and Others), and Region 2025-2033

Report Overview:

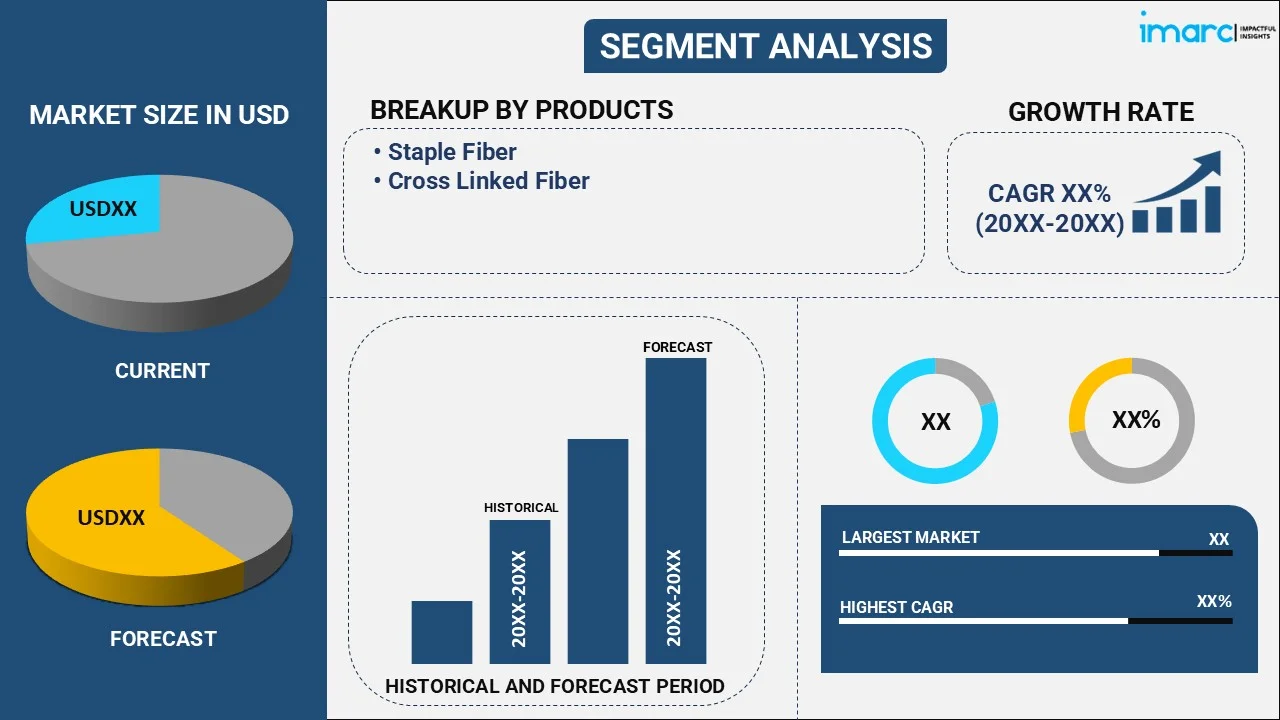

The global lyocell fiber market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.4% during 2025-2033. The rising demand for sustainable and eco-friendly textiles, increasing consumer awareness about the environmental impact of synthetic fibers, and technological advancements are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.4 Billion |

|

Market Forecast in 2033

|

USD 2.2 Billion |

| Market Growth Rate 2025-2033 | 5.4% |

Lyocell fiber is a form of rayon made from dissolving wood pulp, usually sourced from eucalyptus, spruce, or pine trees. It is manufactured using a closed-loop process that recycles nearly all of the chemicals used, making it an eco-friendly option in textile production. Lyocell is known for its natural breathability, high tensile strength, and moisture-wicking properties, making it ideal for a variety of applications ranging from clothing to home textiles. Its smooth texture gives it a luxurious feel, comparable to silk or high-quality cotton. Additionally, its biodegradable nature aligns well with the growing global consumer demand for sustainable and environmentally responsible products. As a result, lyocell fiber is gaining immense traction across the textile industries.

The rising demand for sustainable and eco-friendly textiles will stimulate the growth of the lyocell fiber market during the forecast period. As environmental concerns escalate, consumers are actively seeking out greener options, which has accelerated the adoption of Lyocell, since it is biodegradable and produced through a closed-loop process that minimizes waste and chemical usage. Apart from this, the increasing demand of lyocell due to superior material properties, including high tensile strength, natural breathability, and moisture-wicking capabilities has augmented its demand in various applications, from apparel and home textiles to industrial products. Besides this, the shifting preferences toward Lyocell owing to the heightened consumer awareness regarding the environmental drawbacks of synthetic fibers and conventional textiles is another major growth-inducing factor. Its smooth, silk-like texture adds to its allure, offering a luxurious yet sustainable alternative to traditional fibers. Furthermore, advancements in manufacturing technology that make Lyocell more cost-effective are contributing to market growth.

Lyocell Fiber Market Trends/Drivers:

Rising Sustainability and Eco-Friendliness

Lyocell is manufactured using a closed-loop process, where nearly all the chemicals used in production are recycled and reused, thereby minimizing environmental impact. This sustainability factor is becoming increasingly important as consumers become more conscious of the environmental footprint of their purchases. The wood pulp used in Lyocell fiber production is usually sourced from sustainably managed forests, further enhancing its green credentials. With environmental concerns at the forefront of global discourse, the demand for sustainable textiles is escalating. Companies are capitalizing on this by promoting Lyocell's biodegradable and environmentally responsible characteristics, setting it apart from synthetic fibers like polyester, which are derived from fossil fuels and are non-biodegradable.

Increasing awareness about superior material properties

Lyocell fiber offers a unique combination of attributes that make it highly desirable for various applications. Its high tensile strength makes it durable and long-lasting, while its natural breathability and moisture-wicking abilities make it comfortable for wear in a range of climates. These features are especially advantageous in the fashion and apparel sectors, where comfort and durability are highly sought after. Additionally, Lyocell's smooth texture, which is comparable to silk or high-quality cotton, adds a touch of luxury to products. Its versatility extends beyond clothing to home textiles like bedsheets and towels, as well as industrial applications such as automotive filters and specialty papers, thus fostering product demand.

Escalating Consumer Awareness

In recent years, consumer awareness about the environmental consequences of their choices has elevated. People are becoming increasingly educated about the detrimental impact of synthetic and non-biodegradable fibers on the planet. This has led to a noticeable shift toward more sustainable alternatives, including Lyocell. Social media campaigns, educational programs, and endorsements by influencers and celebrities are also contributing to this heightened awareness. As consumers seek to align their purchasing decisions with their values, products made from Lyocell fiber are becoming more appealing. Manufacturers and brands are responding to this trend by offering a wider range of products featuring Lyocell, thereby stimulating its demand and market growth.

Lyocell Fiber Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market report, along with forecasts at the global, and regional levels from 2025-2033. Our report has categorized the market based on product, and application.

Breakup by Product:

- Staple Fiber

- Cross Linked Fiber

Staple fiber represents the most popular product

The report has provided a detailed breakup and analysis of the market based on the product. This includes staple fiber and cross-linked fiber. According to the report, staple fiber represented the largest segment.

Staple fiber refers to fiber of a discrete length, as opposed to filament fiber, which is continuous. Staple fibers can be natural, like cotton or wool, or synthetic. In the context of Lyocell, staple fiber offers specific advantages that are driving its market demand. Lyocell staple fiber is highly versatile and can be easily blended with other fibers, both natural and synthetic, to achieve desired textile properties like improved strength, elasticity, or moisture-wicking abilities. This makes it ideal for a wide range of applications, from clothing to industrial textiles.

Furthermore, Lyocell's staple fiber retains the inherent benefits of the material, such as its eco-friendly production process and biodegradability. The ability to blend Lyocell staple fiber with other materials offers manufacturers a broader scope of application, thereby widening the market potential. Its flexibility and adaptability, combined with its environmental benefits, make Lyocell staple fiber a highly sought-after material in the textile industry.

Breakup by Application:

- Apparel

- Home Textiles

- Medical and Hygiene

- Automotive Filters

- Others

Apparel accounts for the majority of the market share

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes apparel, home textiles, medical and hygiene, automotive filters, and others. According to the report, apparel accounted for the largest market share.

Apparel refers to clothing and garments worn by individuals. It includes a wide range of items such as shirts, pants, dresses, and outerwear. The apparel sector is a major driver for the Lyocell fiber market due to Lyocell's unique combination of benefits that align well with consumer preferences in clothing. Notably, Lyocell fiber offers a luxurious texture similar to silk and high-quality cotton, as well as natural breathability and moisture-wicking properties. These features make Lyocell-based garments comfortable to wear in various climatic conditions.

Additionally, Lyocell's eco-friendly and biodegradable nature appeals to a growing segment of consumers who are increasingly conscious of sustainability. As environmental concerns become more prominent, many fashion brands are switching to sustainable materials like Lyocell to meet consumer demands. The versatility, comfort, and green credentials of Lyocell make it an increasingly popular choice in the apparel sector, thereby driving its demand.

Regional Insights:

.webp)

To get more information on the regional analysis of this market, Request Sample

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Asia Pacific leads the market, accounting for the majority of the lyocell fiber market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, North America, Europe, Middle East and Africa, and Latin America. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific held the biggest market share due to rapid industrialization, burgeoning middle-class population, and increasing focus on sustainability. As one of the world's largest textile manufacturing hubs, the Asia Pacific region offers an expansive market for Lyocell, especially in countries like China, India, and Bangladesh. The rise in disposable incomes among the middle class in this region has led to a heightened demand for quality textiles, including those made from sustainable materials like Lyocell.

Furthermore, environmental regulations and consumer awareness around sustainability are becoming more stringent, propelling the adoption of eco-friendly fibers. Companies in the Asia Pacific region are heavily investing in research and development (R&D) to improve the qualities and production efficiency of Lyocell fibers, thus lowering costs and making it more accessible to a broader customer base. Additionally, the region's robust supply chain infrastructure supports the rapid scaling of Lyocell production, positioning Asia Pacific as the largest regional market for lyocell fiber.

Competitive Landscape:

The market is experiencing steady growth as key players are focusing on innovation to meet growing demands for sustainability and quality. Advanced technologies for producing Lyocell fibers with enhanced characteristics, such as increased tensile strength or specialized finishes, are under development. Some companies are also experimenting with blending Lyocell with other natural or synthetic fibers to achieve specific material properties, like greater elasticity or thermal regulation. Another area of innovation is in the process itself, aiming to further minimize environmental impact through water conservation and reduced chemical usage. These industry leaders are also increasing their efforts to diversify the raw material base by exploring the use of alternative, sustainably sourced cellulose such as agricultural waste. These innovations serve to make Lyocell fibers more versatile and more environmentally friendly, aligning with the growing consumer demand for sustainable products. Overall, innovation in the Lyocell fiber market is vibrant, as key players seek to enhance both the sustainability and performance of their products.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AceGreen Eco-Material Technology Co., Ltd.

- Aditya Birla Management Corporation Pvt. Ltd.

- Baoding Swan Fiber Co. Ltd.

- Jinan Hengtian high tech Material Co., Ltd

- KO-SI d.o.o.

- Lenzing AG

- Sateri

- Smart Fiber AG

Recent Developments:

- In June 2022, Lenzing AG, a leading global manufacturer specializing in wood-based fibers for both textile and nonwoven sectors, joined Together for Sustainability (TfS). This is a significant development as TfS is an initiative focused on improving sustainability practices within the supply chain of the chemical industry. By joining this program, the company is committing to adhere to a set of environmental, social, and governance criteria that aim to make the chemical industry's supply chain more sustainable.

- In March 2022, Aditya Birla Management Corporation Pvt. Ltd., a major player in the man-made cellulosic fiber industry, announced the successful completion of its first pilot-scale spin of an eco-friendly, next-generation Lyocell fiber. Notably, this new fiber incorporates 20% microbial cellulose from Nanollose Limited and is branded as Nullarbor-20™. The inclusion of microbial cellulose represents a significant innovation in the Lyocell fiber market, as it potentially brings enhanced material properties to the product, such as increased tensile strength and moisture absorption.

- In June 2023, Acegreen Eco-Material Technology Co., Ltd., a subsidiary of the Taiwan-based Acelon Chemicals & Fiber Corporation, announced a strategic partnership with Circ to use Circ's cotton pulp in the production of filament lyocell. This move represents a notable step in the development and commercialization of sustainable fibers, as cotton pulp is often considered an eco-friendly raw material. Filament lyocell made from cotton pulp could offer a unique blend of characteristics such as durability, moisture-wicking properties, and a softer texture, potentially widening its application in various industries.

Lyocell Fiber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Staple Fiber, Cross Linked Fiber |

| Applications Covered | Apparel, Home Textiles, Medical and Hygiene, Automotive Filters, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | AceGreen Eco-Material Technology Co., Ltd., Aditya Birla Management Corporation Pvt. Ltd., Baoding Swan Fiber Co. Ltd., Jinan Hengtian high tech Material Co., Ltd, KO-SI d.o.o., Lenzing AG, Sateri, Smart Fiber AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the lyocell fiber market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global lyocell fiber market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the lyocell fiber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global lyocell fiber market was valued at USD 1.4 Billion in 2024.

We expect the global lyocell fiber market to exhibit a CAGR of 5.4% during 2025-2033.

The increasing utilization of lyocell fabric as a substitute for cotton and silk in the production of sportswear, shirts, bed linens, denim, T-shirts, trousers, towels, etc., is currently driving the global lyocell fiber market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in the temporary closure of various end use industries for lyocell fiber.

Based on the product, the global lyocell fiber market has been segregated into staple fiber and cross linked fiber. Currently, staple fiber represents the largest segment.

Based on the application, the global lyocell fiber market can be categorized into apparel, home textiles, medical and hygiene, automotive filters, and others. Among these, apparel currently exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global lyocell fiber market include AceGreen Eco-Material Technology Co., Ltd., Aditya Birla Management Corporation Pvt. Ltd., Baoding Swan Fiber Co. Ltd., Jinan Hengtian high tech Material Co., Ltd, KO-SI d.o.o., Lenzing AG, Sateri, and Smart Fiber AG.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)