Luxury Hotel Market Size, Share, Trends and Forecast by Type, Room Type, Category, and Region, 2026-2034

Luxury Hotel Market Size & Share:

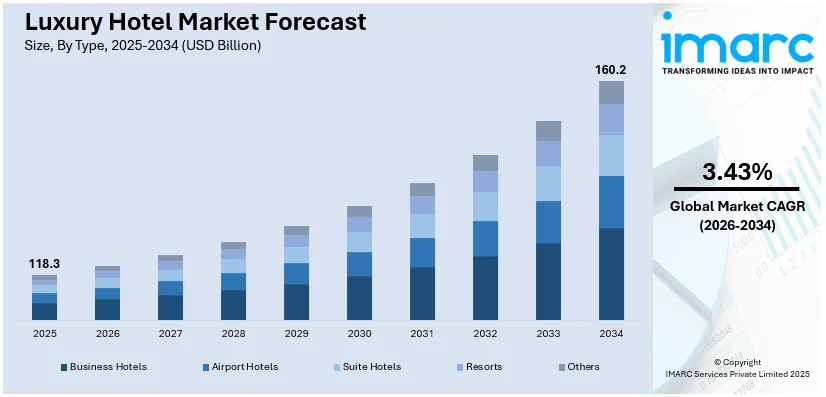

The global luxury hotel market size was valued at USD 118.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 160.2 Billion by 2034, exhibiting a CAGR of 3.43% during 2026-2034. North America currently dominates the market, holding a market share of over 37.1% in 2025. The expanding affluent middle class, especially in emerging economies, rising global tourism and business travel across the globe, and continuous technological advancements with personalized services enhancing guest experiences are driving the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 118.3 Billion |

| Market Forecast in 2034 | USD 160.2 Billion |

| Market Growth Rate (2026-2034) | 3.43% |

Numerous driving forces, such as higher disposable incomes, specifically in developing areas, and lifestyle shifts by consumers, contribute to demand for premium travel experiences and, therefore, influence the global luxury hotel market outlook. As per industry reports, the disposable income of India is projected to be INR 2.14 lakh in 2023-2024. The increasing interest among the affluent in more tailored service and exclusive experiences encourages luxury hotels to innovate and, for instance, tailor a concierge service for visitors, curate experiences tailored to local experiences and tailor wellness programs. International travel has increased significantly, fueled by globalization and better connectivity through advances in transportation infrastructure. Growth of the millennial and Gen Z demographics as a principal consumer segment has fueled technology-enabled services, including smart room features and mobile check-ins, which further promote consumer engagement. The focus on sustainability and the 'green' practice is also catalyzing the luxury hotel market demand, as the incorporation of green initiatives in energy-efficient designs, reduction programs, and locally sourced organic cuisine attracts the growing numbers of environmentally conscious travelers.

To get more information on this market Request Sample

The United States stands out as a key market disruptor, driven by a dynamic domestic and international tourism sector, supported by a stronger economy and significant consumer expenditures on premium travel experiences. The growing demand for a more personalized and unique product, such as luxury spas, fine dining, tailored concierge assistance, has had hotels innovate and create more boutique-like amenities. High-end hotel demand will also be increased by rising business travel and corporate events, especially in urban hotspots such as New York, Los Angeles, and Chicago. In addition, the increasing demand for experiential travel among luxury millennials and Gen Z consumers has motivated high-end hotels to infuse experiences that are part of local culture, art, and food, thus expanding the luxury hotel market share. Moreover, the pervasiveness of digital marketing and social media has increased awareness and accessibility of luxury offerings that impacts the preferences of travelers.

Luxury Hotel Market Trends:

Rising disposable income and affluent middle-class growth

The market is majorly driven by increasing disposable income and growth in the affluent middle class, particularly across emerging economies. According to East Asia Forum, as of 2021, 432 Million Indians are classified as middle class, making up 31% of the population. The growing population inclining toward premium experiences, including luxury accommodation due to the improving wealth distribution, is significantly adding to the luxury hotel market revenue. This is prominent in regions, such as Asia-Pacific, whose rapid economic growth is resulting in a large middle class with a greater propensity for travel and leisure. A strong desire for unique and opulent experiences in travel fuels demand for luxury hotels, wherein consumers are inclined toward high-end services and amenities. Furthermore, such a demographic shift increases domestic and also international travel, thus promoting the luxury hotel market growth.

Increasing global tourism and business travel

The growing tourism and business travel across the globe acts as a significant driver, as per the luxury hotel market forecast. The global business travel market size reached USD 1.1 Trillion in 2024. Along with this, the increasing number of international tourist arrivals due to improved connectivity, easier visa norms, and increased middle-class spending power is also favoring the market. Business travel represents a significant segment of good accommodation demand in the form of corporate events, conferences, and meetings. It is within these needs that luxury hotels find a niche through their state-of-the-art facilities and locations, coupled with impeccable service. Moreover, the increasing number of high-net-worth individuals and related expenditure on travel in the pursuit of premium experience is creating a positive luxury hotel market outlook.

Technological advancements and personalized services

The rising consumer demand for seamless and enhanced in terms of tech experiences, such as online booking, mobile check-in, smart room features, and digital concierge services is providing an impetus to the market. The Trends Global Survey reveals that 80% of travelers consider it important to be able to book their entire trip online. Luxury hotels are investing in state-of-the-art technologies to meet and surpass such expectations of guests in order to improve their satisfaction and loyalty. It is also through data analytics that hotels can understand and second-guess the guests' tastes and preferences, hence highly tailoring services for guests to enjoy the accommodation. Furthermore, the ability to deliver customized experiences, including private room settings, and curated dining options is also acting as one of the major luxury hotel market growth drivers.

Luxury Hotel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global luxury hotel market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, room type, and category.

Analysis by Type:

- Business Hotels

- Airport Hotels

- Suite Hotels

- Resorts

- Others

Business hotels stand as the largest component in 2025, with a share of 33.8% of the market. Business hotels are the largest segment of the market. This can be supported by the constant demand for good accommodation with a variety of facilities. Business-class hotels provide numerous facilities to business individuals, such as conference halls, high-speed internet, business centers, smooth connectivity, and significant business locations. According to the luxury hotel market dynamics, this segment is further enhanced by the overall rise in global business travel, itself caused by globalization and the expansion of multinational corporations. Another factor that enhances efficiency and convenience for corporate guests is that business hotels often offer various value-added services tailored to meet their needs, such as express check-in/check-out, meeting planning assistance, and exclusive lounge access. Additionally, the strategic locations of these hotels in city centers, along with their proximity to airports, significantly enhance their appeal. This ensures maximum productivity for business travelers while providing luxurious comfort. Besides this, the escalating demand for business hotels for business meetings and corporate events is positively influencing the luxury hotel market revenue.

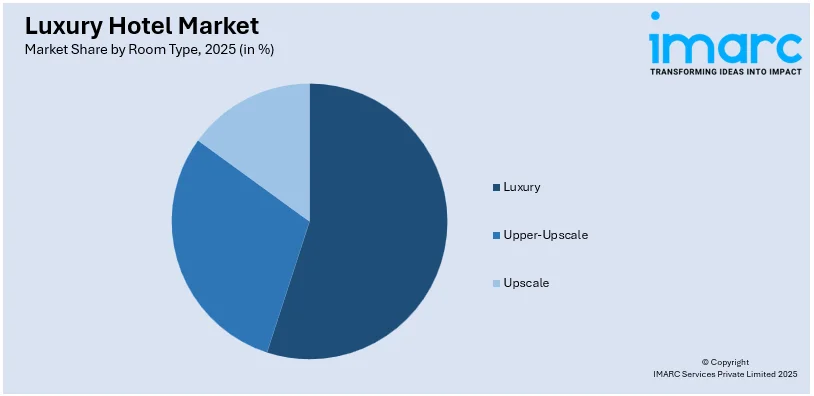

Analysis by Room Type:

Access the comprehensive market breakdown Request Sample

- Luxury

- Upper-Upscale

- Upscale

Luxury accommodations depict extravagance and exclusivity, providing tailored services, upscale furnishings, and unmatched amenities such as private pools, gourmet dining, and spa privileges. This section targets wealthy travelers seeking tailored experiences, featuring concierge support and distinctive cultural activities. High-end pricing showcases their uniqueness and meticulous care.

Upper-upscale rooming provides a middle line of luxury and price targeting business travelers and leisure traveler; refined decoration, quality services offered with business centers, and even the presence of a fitness facility. Upper-upscale hotels are located in prominent places, attracting business gatherings and family vacations alike as it focuses on quality without being too exclusive to afford or maintain such as a luxurious stay.

Upscale rooms offer premium comfort and convenience, although at a competitive price tag, targeting mid-level business travelers and families as well. They offer state-of-the-art amenities such as free Wi-Fi, well- equipped rooms, and facilities for dining though do not offer customization to the extent higher segments can. Positioned for ease of access, upscale hotels are commonly found near transportation hubs and suburban areas.

Analysis by Category:

- Chain

- Independent

Chain leads the market in 2025. Chain hotels form the largest category segment in the market, as such establishments can offer better service standards, brand recognition, and expansive global presence. In addition, these chain hotels have well-established reputations for their brands that speak volumes to guests concerning the quality and reliability expected of them, thus becoming the choice for numerous business and leisure travelers. Chain hotels frequently implement extensive loyalty programs that grant special privileges to guests, aiming to ensure repeat visits, a key strategy in the luxury hotel market overview to enhance customer retention. Leveraging their significant resources, these hotels are able to invest substantially in marketing, technology, and staff training. This comprehensive approach enhances the guest experience uniformly across all locations. Having such a large network allows for an effective booking system and better management centered on the operation, thus aiding in making chain hotels at the top of the market. Furthermore, the luxury hotel market forecast indicates that strategic expansions and acquisitions are solidifying this dominance by further consolidating the market position.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America exhibits a clear dominance in the market, with a share of 37.1%. North America accounts for the largest regional segment of luxury hotels due to its strong economy, well-developed tourism infrastructure, and large number of high-net-worth individuals. Cities such as New York, Los Angeles, and Miami have a large volume of tourists. This is creating a steady stream of both business and leisure travelers seeking luxury accommodations. Along with this, the presence of internationally recognized luxury hotel brands with large loyalty programs, to ensure a loyal client base is providing impetus to the market. According to the luxury hotel industry overview, the technological developments in hotel services catering to guest experiences through the personalization of digital concierge services or smart room technologies are driving market growth. Additionally, massive investments in sustainable practices and renovations of a luxurious nature meet a growing demand for eco-friendly, modernly equipped accommodation. Therefore, North America retains its role as a vital player in the market, continuing to cater to the changing preferences of sophisticated travellers.

Key Regional Takeaways:

United States Luxury Hotel Market Analysis

In 2025, the United States accounts for 86.30% of the North America luxury hotel market, driven by rising disposable incomes, an increase in high-net-worth individuals, and a growing preference for exclusive travel experiences. The country remains a top destination for both leisure and business travelers, further bolstered by a strong rise in international tourism. According to the National Travel and Tourism Office (NTTO), the US saw 66.5 Million international visits in 2023, highlighting the booming tourism sector. Affluent travelers are increasingly seeking personalized and high-end experiences, including world-class amenities, spa services, and bespoke travel arrangements. Cities such as New York, Los Angeles, and Miami continue to attract significant demand for luxury accommodations. Additionally, the growing trend of experiential travel is encouraging tourists to explore unique offerings such as eco-friendly and boutique luxury hotels. The expansion of digital platforms for seamless booking and personalized services also makes luxury accommodations more accessible. Major international events, including conferences, cultural festivals, and sports events, further drive demand for premium hotels. The post-pandemic recovery in global travel continues to play a key role in fueling the growth of the luxury hotel sector in the US.

Asia Pacific Luxury Hotel Market Analysis

The luxury hotel market in the Asia-Pacific (APAC) region is experiencing robust growth, driven by rising disposable incomes and an expanding affluent middle class, particularly in countries such as China, India, and Japan. According to the Ministry of Tourism, India saw a significant rise in tourism in 2022, with domestic tourist visits reaching 1,731.01 Million, an increase of 155.45% from 677.63 Million in 2021. Foreign tourist visits also increased to 8.59 Million, marking a 714.26% increase from 1.05 Million in 2021. This rise reflects the region’s growing appeal to both leisure and business travelers. Key destinations such as Tokyo, Bali, and Hong Kong are seeing rising demand for luxury accommodations, driven by tourists seeking bespoke experiences. Additionally, the increasing preference for eco-friendly and sustainable luxury hotels is shaping the market, alongside the expansion of hospitality infrastructure catering to affluent travelers. The growing popularity of digital booking platforms and seamless payment systems further enhances accessibility to luxury hotels in the region.

Europe Luxury Hotel Market Analysis

The European luxury hotel market is driven by the region's rich cultural heritage, renowned tourist attractions, and the growing influx of both international and regional travelers. According to Eurostat, in 2022, EU residents spent a significant portion of their tourism budget on both domestic and international trips, with 47% allocated to domestic tourism and 53% to outbound tourism. Key destinations such as Paris, London, and Rome continue to attract affluent travelers seeking high-end services and unique experiences. The demand for experiential travel, including exclusive packages and personalized services, is rising, with luxury hotels offering bespoke experiences, fine dining, and wellness retreats. Additionally, sustainability is increasingly important, with affluent travelers preferring eco-friendly luxury accommodations. The growth of business tourism and major international events such as conferences, conventions, and sports tournaments also contribute to the rising demand for premium hotel services. Innovations in digital platforms, offering personalized booking and enhanced guest experiences, further boost the accessibility and appeal of luxury hotels across Europe. As the region continues to recover post-pandemic, the luxury hospitality sector is poised for further growth, supported by both domestic and international tourism.

Latin America Luxury Hotel Market Analysis

In Latin America, the luxury hotel market is driven by a growing interest in eco-tourism, with travelers increasingly prioritizing sustainability. According to Visa, eco-tourism continues to expand in the region, with Mexican travelers opting for eco-friendly options when costs are comparable to alternatives. In Brazil, 71% of travelers express strong interest in sustainable tourism. These trends are influencing the demand for luxury accommodations that offer sustainable practices and eco-friendly amenities. Key destinations such as Rio de Janeiro and Mexico City are seeing increasing demand for luxury hotels that align with these values, catering to the region’s environmentally conscious travelers.

Middle East and Africa Luxury Hotel Market Analysis

In the Middle East, the luxury hotel market is thriving, driven by the region's growing tourism sector. According to the Government of Dubai, the emirate showcased its tourism strength in 2023, welcoming a record 17.15 Million international visitors, a 19.4% increase compared to 2022 and surpassing the previous benchmark of 16.73 Million set in 2019. This rise in visitors has significantly boosted demand for luxury accommodations, with travelers seeking high-end experiences in world-class hotels and resorts. The region’s continued focus on large-scale infrastructure projects, coupled with international events and luxury tourism offerings, positions the Middle East as a major player in the global hospitality market.

Competitive Landscape:

Major players in the worldwide luxury hotel sector are employing diverse strategies to promote growth and improve their competitive advantage. These initiatives involve broadening their international presence by launching new hotels in sought-after locations, especially in developing markets, to meet the increasing demand for tourism. Numerous hotel chains are concentrating on providing tailored guest experiences by utilizing advanced technology, including mobile check-ins, intelligent room capabilities, and AI-enhanced concierge services. Moreover, luxury hotels are adopting sustainability by implementing eco-friendly initiatives such as energy-efficient designs, waste minimization strategies, and responsible sourcing of food and materials, attracting environmentally aware consumers. An additional strategy includes creating loyalty programs and collaborating with premium brands, enhancing consumer retention and loyalty to the brand.

The report provides a comprehensive analysis of the competitive landscape in the luxury hotel market with detailed profiles of all major companies, including:

- Accor

- Belmond Ltd. (LVMH Moët Hennessy Louis Vuitton)

- Four Seasons Hotels Limited

- Hyatt Hotels Corporation

- InterContinental Hotels Group plc

- ITC Limited

- Jumeirah International LLC

- Mandarin Oriental Hotel Group Limited

- Marriott International Inc

- Rosewood Hotels and Resorts L.L.C. (Rosewood Hotel Group)

- Shangri-La International Hotel Management Ltd.

- The Indian Hotels Company Limited

Latest News and Developments:

- December 2024: OYO's parent company, supported by SoftBank Group, has launched its luxury hotel brand SUNDAY in international markets, debuting in the UK and UAE. The newly opened SUNDAY Lansbury Heritage in London, a 35-room restored Grade II listed building near Canary Wharf, marks the brand's entry into the UK. The property, steeped in history dating back to 1628, was originally the site of the East India Company's chapel and almshouses. This move aligns with OYO's strategy to expand its premium property portfolio globally.

- October 2024: Radisson Hotel Group has launched Svelte Delhi, part of its Radisson Individuals boutique brand, in the capital city. Located in Select Citywalk, Saket, the 108-room property caters to business and leisure travelers, offering amenities such as meeting spaces, a fitness center, and a rooftop pool. Situated near key landmarks such as Qutub Minar and Humayun’s Tomb, the hotel aims to provide convenient access to Delhi's attractions. Radisson sees this launch as a strategic step in expanding its presence in Tier-1 cities across India.

- September 2024: M3M India and Oravel Stays, the parent company of OYO Hotels & Homes, have entered into an agreement to introduce a premium hotel under the 'SUNDAY' brand in Gurugram. According to M3M, the Memorandum of Understanding outlines plans for a 220-key hotel spanning 1.69 lakh square feet on Southern Peripheral Road (SPR). This project is part of a broader collaboration to develop 15 lakh square feet of luxury hospitality space, comprising 1,000 keys across Gurugram and Noida.

Luxury Hotel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Business Hotels, Airport Hotels, Suite Hotels, Resorts, Others |

| Room Types Covered | Luxury, Upper-Upscale, Upscale |

| Categories Covered | Chain, Independent |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Accor, Belmond Ltd. (LVMH Moët Hennessy Louis Vuitton), Four Seasons Hotels Limited, Hyatt Hotels Corporation, InterContinental Hotels Group plc, ITC Limited, Jumeirah International LLC, Mandarin Oriental Hotel Group Limited, Marriott International Inc, Rosewood Hotels and Resorts L.L.C. (Rosewood Hotel Group), Shangri-La International Hotel Management Ltd., The Indian Hotels Company Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the luxury hotel market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global luxury hotel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the luxury hotel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury hotel market was valued at USD 118.3 Billion in 2025.

The luxury hotel market is projected to exhibit a CAGR of 3.43% during 2026-2034, reaching a value of USD 160.2 Billion by 2034.

The market is majorly driven by rising disposable incomes, growing affluent middle-class populations, increased global tourism and business travel, heightened demand for personalized services, advancements in smart technologies, and a strong preference for sustainability and eco-friendly practices among affluent travelers.

North America currently dominates the luxury hotel market, fueled by a strong economy, robust tourism infrastructure, high disposable incomes, and advanced technological integration.

Some of the major players in the luxury hotel market include Accor, Belmond Ltd. (LVMH Moët Hennessy Louis Vuitton), Four Seasons Hotels Limited, Hyatt Hotels Corporation, InterContinental Hotels Group plc, ITC Limited, Jumeirah International LLC, Mandarin Oriental Hotel Group Limited, Marriott International Inc, Rosewood Hotels and Resorts L.L.C. (Rosewood Hotel Group), Shangri-La International Hotel Management Ltd., and The Indian Hotels Company Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)