LPG Tanker Market, Size, Share, Trends, and Forecast by Vessel Size, Refrigeration and Pressurization, and Region, 2025-2033

LPG Tanker Market Size and Share:

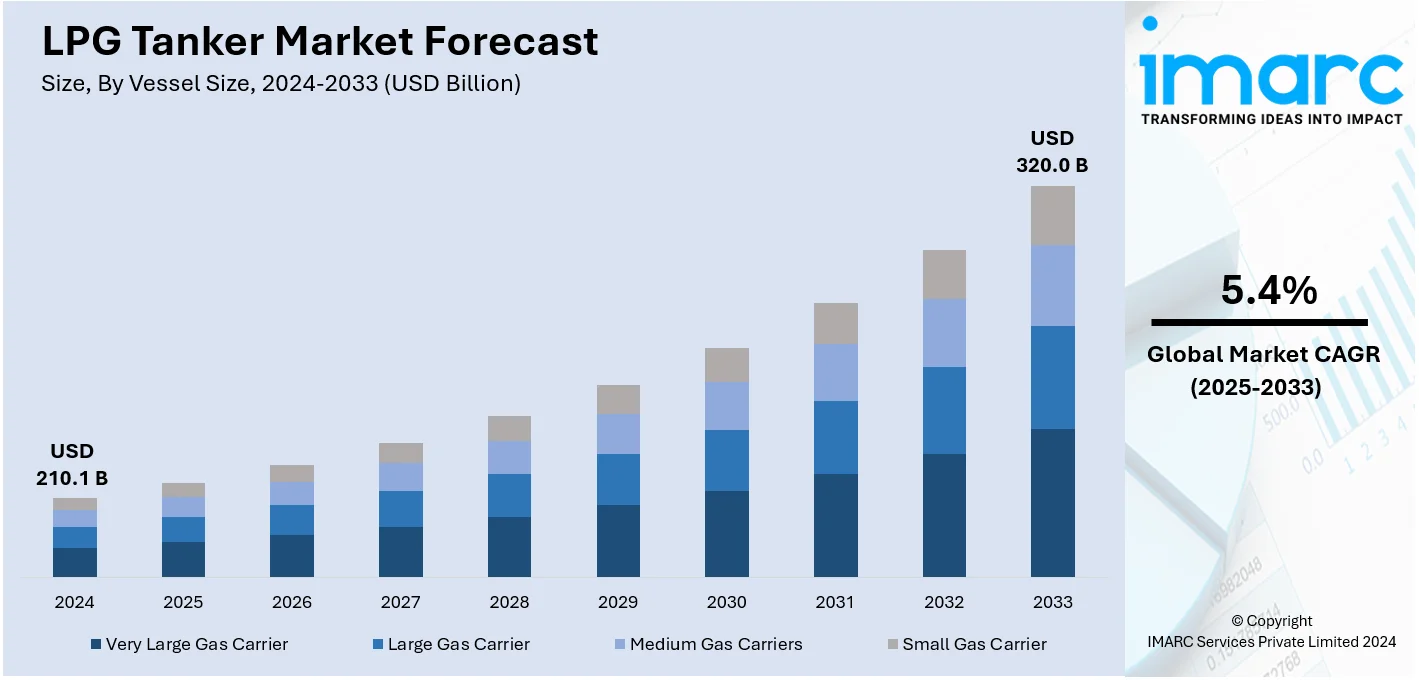

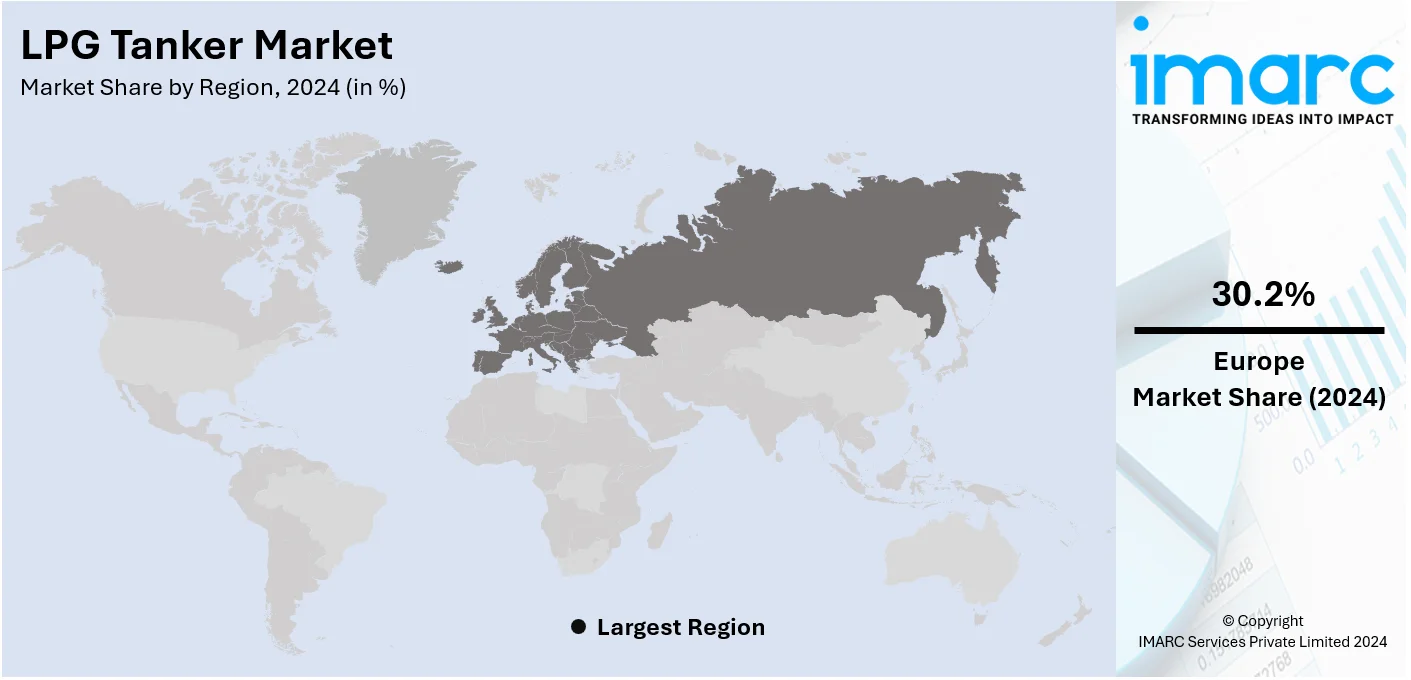

The global LPG tanker market size was valued at USD 210.1 Billion in 2024. The market is projected to reach USD 320.0 Billion by 2033, exhibiting a CAGR of 5.4% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 30.2% in 2024. With fluctuations in crude oil pricing, energy producers are shifting to shale gas, which generates a considerable quantity of LPG as a secondary product. Besides this, improved drilling technologies are increasing the efficiency and prevalence of shale extraction, resulting in an excess of LPG that necessitates international shipping. This is fueling the LPG tanker market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 210.1 Billion |

|

Market Forecast in 2033

|

USD 320.0 Billion |

| Market Growth Rate 2025-2033 | 5.4% |

The LPG tanker market is motivated primarily by global demand for cleaner energy solutions. LPG has surfaced as one of the promising alternatives in this regard when countries and economies are being compelled to cut down carbon footprints with increasing regulatory stringencies regarding environment. For instance, in 2024, Dorian LPG Ltd. announced its commitment to greener practices by applying Hempel’s X7 silicone paint on five VLGCs, resulting in enhanced operational efficiency and increased fuel savings for investors and partners. Consequently, infrastructure investments in shipping capability have increased to deliver LPG around the globe. Increasing usage of LPG in household cooking, heating, and industrial purposes expands the need for LPG tankers. This represents an indication of the immense role that LPG tankers have in the overall energy usage and supply chains in the world.

The United States also plays a fundamental role in the LPG tanker market, mainly resulting from its massive production and export capacity. The United States stands among the biggest producers of natural gas liquids. A growth in U.S. LPG production results from an increase in its shale gas production. Improved extraction technologies have enabled increasing production. This surge in production has placed the U.S. as a major exporter to international markets, thus demanding efficient and sophisticated LPG tanker fleets. For instance, in 2024, US LPG and LNG exports reached record highs, totaling 20.2 million mt from January 1 to April 29, driven by soaring natural gas production and strong export demand. Furthermore, U.S. ports are enhancing their infrastructure to accommodate the growing volume of LPG shipments, ensuring timely delivery and compliance with global shipping standards, thereby strengthening their competitive advantage in the market.

LPG Tanker Market Trends:

Increasing utilization of LPG in developing countries

Rising use of LPG, especially in developing countries, is fueling the market growth. As developing nations are seeking affordable and cleaner energy alternatives, LPG is emerging as a practical solution due to its lower price compared to conventional fuels like diesel and kerosene. As per industry reports, in 2024, 22% of India's electricity came from clean energy sources. The portability and ability of LPG to be stored in cylinders or bulk tanks make it ideal for regions with limited energy infrastructure. LPG can be easily transported by road, rail, or sea, allowing access to remote and rural areas. This high demand is creating the need for international LPG shipments, leading to higher deployment of LPG tankers. As more countries are adopting LPG for cooking, heating, and industrial use, the international LPG trade is expanding, stimulating steady growth of the market.

Rising Demand for LPG

The rising demand for liquefied petroleum gas (LPG) is one of the prominent factors driving the growth of the LPG tanker market. For instance, according to an article published by J.M. Baxi Group, LPG demand rose by nearly 2.9% to 28.7 million tons in 2022, following a 1.5% increase in 2021, while it surged by 8.5% per year from 2016 to 2019. LPG is a cleaner and efficient fuel as compared to coal and oil, thus highly popular for domestic, industrial, and transportation purposes. The energy landscape is changing worldwide towards cleaner sources of energy, and therefore LPG consumption is on the rise in those regions which do not have natural gas infrastructure. All these factors are likely to propel the LPG tanker market share in future years.

Expanding Petrochemical Industry

The expanding petrochemical industry is impelling the LPG tanker market growth. For instance, according to IMARC, the global petrochemicals market size reached US$ 616.0 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 949.9 Billion by 2032, exhibiting a growth rate (CAGR) of 4.8% during 2024-2032. Liquefied petroleum gas (LPG) acts as an important feedstock for the manufacture of various petrochemical products such as ethylene, propylene, and butylene, which are used for the production of plastics, synthetic rubber, and other chemical products. This has further led to the support of the positive factors to the LPG tanker market forecast.

Technological Advancements

New innovations in the construction of tankers, including fuel-saving engines and environmentally friendly designs, have made transport cheaper and more efficient, and which has increased the fleets' expansion. The size of the global fleet management system market was USD 28.8 Billion in 2024. For example, in May 2024, Pertamina International Shipping (PIS) commissioned two new eco-friendly very large gas carriers (VLGCs) to its fleet: Pertamina Gas Caspia and Pertamina Gas Dahlia in an effort to transport LPG. Such vessels will be specifically designed to carry Liquefied Petroleum Gas, improving the logistics involved. In turn, this increases operational capacity for the company but adds much more to sustainability. Thus, it will spur the revenues in the LPG tankers market.

LPG Tanker Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global LPG tanker market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on vessel size and refrigeration and pressurization.

Analysis by Vessel Size:

- Very Large Gas Carrier

- Large Gas Carrier

- Medium Gas Carriers

- Small Gas Carrier

Very large gas carrier stand as the largest component in 2024, holding around 28.6% of the market. As the demand for LPG increases globally, the need for more significant vessels that can transport large quantities of LPG over long distances is very high. The massive carrying capacity of VLGCs (usually in the range of 80,000 to 90,000 cubic meters of LPG) enables transportation of high volumes of LPG within a single voyage, thereby satisfying the demand. In such a situation, the likelihood of conveying high volumes in one round voyage will increase, both making the conveyance process more efficient and reducing the shipping cost per unit of LPG delivered. As per the LPG tanker market trends, the shifting energy demands are expanding the market share of VLGCs.

Analysis by Refrigeration and Pressurization:

- Fully Pressurized

- Semi-pressurized

- Fully Refrigerated

- Extra Refrigerated (Ethylene Gas Carriers)

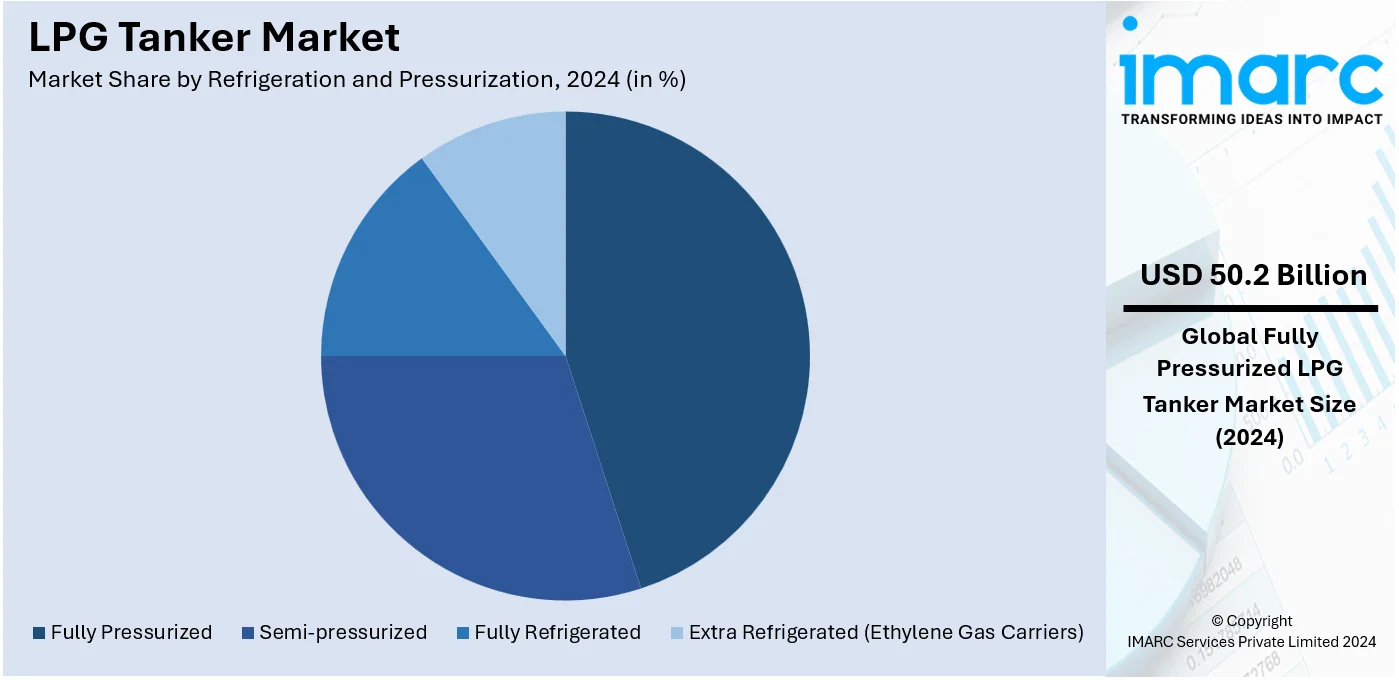

Fully pressurized leads the market with around 23.9% of market share in 2024. Fully pressurized tankers are generally smaller. With a capacity of 3,000 to 11,000 cubic meters or cbm, they will be best suited for operation in narrow and shallow ports that the larger vessels are unable to access. Accordingly, they are often used in transporting LPG to markets that are smaller, at regional ports, and indeed for coastal or inland waterway routes. In addition, the completely pressurized LPG tankers can transport LPG without requiring special cooling or large-scale refrigeration facilities at both loading and unloading ports. This independence from such complex infrastructure is a main advantage in developing regions and smaller ports where such facilities are unavailable.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 30.2%. Europe has actively pursued policies that include carbon emission reduction and energy source change towards cleaner forms of energy. LPG is a lower-carbon alternative to coal and oil, especially in heating and transport, which fits the overall decarbonization goal that Europe has. This push is increasing LPG demand, which requires efficient transportation means, including tankers. In addition, different European countries are phasing out coal and heavy fuel oils for cleaner fuels, such as LPG, in industrial processes and heating. With the replacement of coal and oil by LPG in some sectors, demand for secure LPG supply chains, including tanker shipping, is increasing. For example, according to an article published by the Guardian, more than 16 million people in the EU use LPG, about 4% of the population.

Key Regional Takeaways:

United States LPG Tanker Market Analysis

US accounts for 82.8% share of the market in 2024. The LPG tanker market in the United States is driven by several factors, including increasing domestic demand for liquefied petroleum gas (LPG) as a cleaner fuel alternative and expanding export opportunities due to global supply shortages. A significant number of U.S. households rely on propane for various purposes, with approximately 11 Million using it as a major fuel source and about 42 Million utilizing it for outdoor grilling, as reported by the 2020 Residential Energy Consumption Survey. This widespread adoption of propane, particularly in residential heating and cooking, is propelling the demand for tankers to transport LPG. Further, the U.S. is one of the major producers of LPG, largely because of the shale gas boom, and a substantial quantity is exported, which again increases the demand for tankers. New infrastructure in the form of modern port facilities and transportation routes also helps to boost the market. The U.S. government's focus on clean energy policies and low-carbon emissions, along with the technology developed in the field of transportation efficiency and safety, is also boosting the market. Going ahead, a shift in trends towards LPG as the cleaner fuel option for a wide array of industries would propel further growth in the LPG tanker market.

North America LPG Tanker Market Analysis

The North America LPG tanker market is currently growing at a fast rate. Demand for the consumption of liquefied petroleum gas in residential, commercial, and industrial areas is on the rise. It is because of some primary reasons such as infrastructural expansion, growing shale gas production, and increased utilization of cleaner forms of energy. For instance, LPG exports from North America on VLGCs rose 6.7% in Q3 2024, driven by strong production. Upcoming US terminal expansions are projected to sustain growth in high single-digits over the next three years. Tanker technology advancements also improve efficiency and reliability with safety protocols. Strategic market presence has been built in by the major players as they engage in partnerships and investments. However, regulation challenges and fluctuating prices of oil are possible threats that the stakeholders should overcome by constant adaptation and innovation in this changing landscape.

Asia Pacific LPG Tanker Market Analysis

In the Asia-Pacific region, the LPG tanker market is significantly driven by accelerated industrial development and urbanization, primarily in countries like China, India, and Southeast Asia. The growing use of LPG in residential, industrial, and transportation sectors is boosting tanker demand. According to the National Sample Survey Office report for 2020-2021, LPG was the primary energy source for 49.4% of households in rural areas and 89% of urban households across India, highlighting the fuel's widespread adoption. This trend is mirrored in other developing nations within the region, where LPG serves as a key energy solution for cooking, heating, and power generation. The expansion of LPG infrastructure, including refineries, storage facilities, and ports, is further accelerating market growth. Additionally, favorable government policies promoting clean energy, coupled with the adoption of LPG as an alternative fuel in transportation, are contributing to the region's market expansion. These factors, combined with the strategic positioning of APAC countries as LPG import-export hubs, continue to drive demand for LPG tankers.

Europe LPG Tanker Market Analysis

The European LPG tanker market is driven by increasing demand for alternative energy sources to reduce dependence on fossil fuels and lower carbon emissions. LPG, particularly Autogas, has become the most extensively utilized alternative fuel within the EU. According to the European Alternative Fuels Observatory, approximately 8.2 Million passenger cars and 300,000 light commercial vehicles in Europe used Autogas in 2023, supplied through a network of 32,000 filling stations. This widespread adoption of LPG as a vehicle fuel is significantly contributing to tanker demand. Additionally, the growth of LPG consumption in residential heating and cooking further supports the market. Government policies encouraging cleaner fuels, alongside rising environmental awareness, have accelerated the shift towards LPG. The expansion of infrastructure, including storage facilities and enhanced port capabilities for LPG imports and exports, also plays a key role in the region's market growth. With a focus on energy security and the integration of LPG into the European energy mix, the LPG tanker market is poised for continued expansion in the coming years.

Latin America LPG Tanker Market Analysis

In Latin America and the Caribbean, the LPG tanker market is fueled by the widespread adoption of LPG, particularly in residential cooking. According to industry reports, more than 70% of the population in the region relies on LPG for cooking, which significantly boosts demand for LPG transportation. As urbanization and industrialization continue to expand, LPG is increasingly utilized in various sectors, further driving tanker requirements. Additionally, government subsidies and policies promoting cleaner energy solutions facilitate market development. The demand for LPG in countries like Brazil, Mexico, and Argentina is expected to continue rising, ensuring sustained growth in the LPG tanker market across the region.

Middle East and Africa LPG Tanker Market Analysis

In the Middle East and Africa, the LPG tanker market is largely driven by the region's significant LPG production, particularly in countries like Saudi Arabia, Qatar, and the UAE. The UAE construction market, valued at USD 69.5 Billion in 2023, plays a key role in boosting LPG demand for various industrial applications, including heating, power generation, and construction activities. The region's large-scale infrastructure projects, coupled with growing residential and commercial use of LPG, are further fueling tanker demand. Additionally, the development of port and transportation infrastructure supports the continued growth of the LPG tanker market in this region.

Competitive Landscape:

The LPG tanker market has a wide range of players, from large multinational shipping companies to specialized operators. Such leading firms dominate the market through their large fleets and established logistical networks. Other than this, new entrants are entering the market through technological advancements and innovative shipping solutions that improve operational efficiency. The market is also experiencing consolidation trends, and companies are looking for synergistic alliances to optimize the use of allocated resources and improve their service offerings. In addition, regulatory compliance and environmental standards increase competition for companies to be sustainable while still being cost-effective in their operations. For instance, in 2024, BW LPG Limited agreed to acquire 12 modern Very Large Gas Carriers from Avance Gas Holdings Ltd. for a total of $1,050 million.

The report provides a comprehensive analysis of the competitive landscape in the LPG tanker market with detailed profiles of all major companies, including:

- BW Group

- Dorian LPG Ltd.

- EXMAR

- Hyundai Heavy Industries Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- Kuwait Oil Tanker Company S.A.K

- Mitsubishi Heavy Industries Ltd

- StealthGas Inc.

- STX Corporation (Afc Mercury Co. Ltd)

- The Great Eastern Shipping Co. Ltd

Latest News and Developments:

- June 2025: Confidence Petroleum India Limited unveiled the commissioning of eight Auto LPG Dispensing Stations at different locations in the nation. With this accomplishment, the firm became the second-largest operator of auto LPG stations in the country, with a total operational network of 295 stations. It employed a fleet of around 690 cars and tankers as part of its logistics infrastructure to move its goods.

- June 2025: B International Shipping & Logistics, a division of Dubai-based energy trader BGN, and Abu Dhabi's Al Seer Marine established a new LPG and product tanker joint venture with an emphasis on mid-sized vessels. Two 22,000 cu m semi-refrigerated LPG tankers, Alkaid and Alcor, were acquired to begin operations.

- June 2025: A massive ship carrying 5,000 Tons of Delta LPG Limited's liquefied petroleum gas (LPG) raw materials anchored at a jetty at Mongla Port, in line with the arrival of LPG tanker ‘Serenity Gas’. In order to accommodate ships with more capacity, the port planned to enhance the capacity of the draft.

- March 2025: BW LPG India revealed plans to grow its fleet by spending USD 150 Million on two brand-new and extremely huge gas tankers. The fleet was operated and flown to support commercial activities in accordance with the Atmanirbhar Bharat (self-reliant India) initiative.

- January 2025: CF Industries and Trafigura announced the successful completion of the first-ever co-loaded ammonia and LPG shipment operation. The Green Power Medium Gas Carrier (MGC) shipped these products in different tanks on a single trip from the United States to Europe.

LPG Tanker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vessel Sizes Covered | Very Large Gas Carrier, Large Gas Carrier, Medium Gas Carriers, Small Gas Carrier |

| Refrigeration and Pressurizations Covered | Fully Pressurized, Semi-pressurized, Fully Refrigerated, Extra Refrigerated (Ethylene Gas Carriers) |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BW Group, Dorian LPG Ltd., EXMAR, Hyundai Heavy Industries Co. Ltd., Kawasaki Heavy Industries Ltd., Kuwait Oil Tanker Company S.A.K, Mitsubishi Heavy Industries Ltd, StealthGas Inc., STX Corporation (Afc Mercury Co. Ltd), The Great Eastern Shipping Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the LPG tanker market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global LPG tanker market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the LPG tanker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Liquefied Petroleum Gas carrier is a specialized ship design for carrying liquefied petroleum gas in bulk quantity. The tankers used are built to ensure LPG can be safely shipped under pressure at low temperature, thereby ensuring safe as well as efficient transport over long distances across the sea to meet global energy consumption.

The global LPG tanker market was valued at USD 210.1 Billion in 2024.

The LPG tanker market is projected to exhibit a CAGR of 5.4% during 2025-2033, reaching a value of USD 320.0 Billion by 2033.

The global LPG tanker market is led by some key factors. The ever-increasing demand for LPG as a cleaner source of energy and the expansion of international trade of LPG due to better transport logistics is enhancing market dynamics. Moreover, investment in LPG infrastructure and storage facilities increases capacity. Shifts in regulations toward environmental sustainability make industries opt for cleaner fuels, which enhances the demand for LPG.

According to the report, very large gas carrier represented the largest segment by vessel size, driven by their ability to transport significant volumes of LPG efficiently, which helps meet the growing global demand for liquefied petroleum gas and supports international trade routes.

Fully pressurized leads the market by refrigeration and pressurization as it offers a cost-effective and energy-efficient solution for transporting gases at high pressures, thereby ensuring safety and maintaining the integrity of the cargo during transit.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global LPG Tanker market include BW Group, Dorian LPG Ltd., EXMAR, Hyundai Heavy Industries Co. Ltd., Kawasaki Heavy Industries Ltd., Kuwait Oil Tanker Company S.A.K, Mitsubishi Heavy Industries Ltd., StealthGas Inc., STX Corporation (Afc Mercury Co. Ltd), The Great Eastern Shipping Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)