Low Voltage Switchgear Market Size, Share, Trends and Forecast by Product Type, Voltage Rating, Installation, Application, and Region, 2025-2033

Low Voltage Switchgear Market Size and Share:

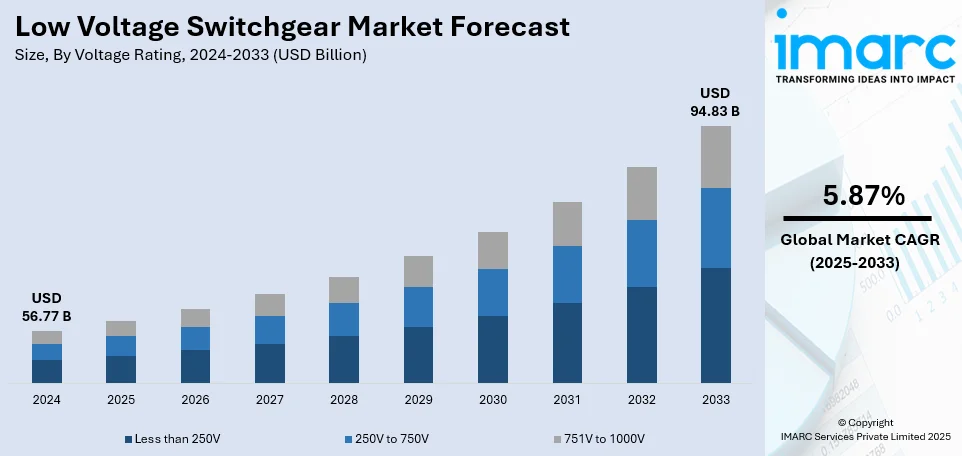

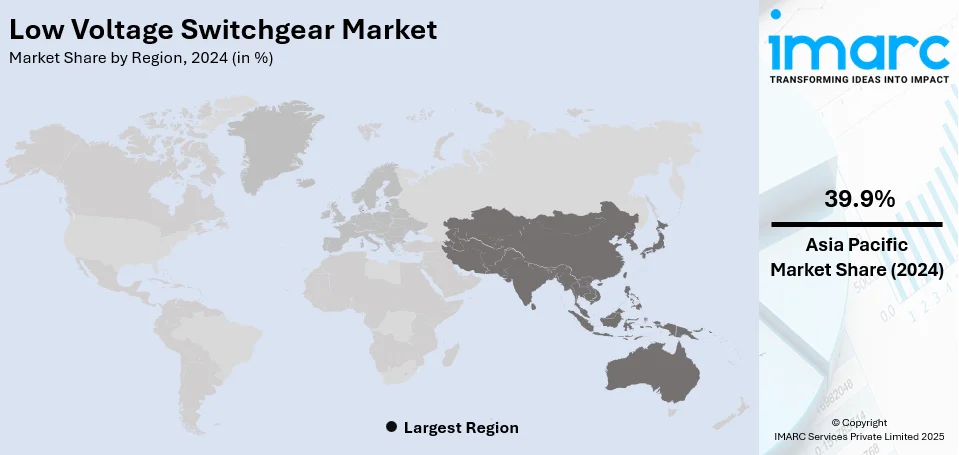

The global low voltage switchgear market size was valued at USD 56.77 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 94.83 Billion by 2033, exhibiting a CAGR of 5.87% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 39.9% in 2024. The growing demand for electricity, the increasing product adoption in electrical distribution systems, rapid technological innovations, increasing infrastructure development projects, and extensive research and development (R&D) activities are some of the key factors driving the low voltage switchgear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 56.77 Billion |

| Market Forecast in 2033 | USD 94.83 Billion |

| Market Growth Rate (2025-2033) | 5.87% |

The low voltage switchgear market is primarily fueled by growing demand for energy-efficient and reliable power distribution across residential, commercial, and industrial sectors. Rapid urbanization, infrastructure development in emerging economies, and the integration of renewable energy and smart grids are driving adoption. Government regulations promoting sustainability and energy efficiency further encourage investments in modern, eco-friendly switchgear. Internet of Things (IoT) and artificial intelligence (AI) advancements enable smart systems with real-time monitoring and predictive maintenance, enhancing reliability and efficiency. For example, Siemens introduced Gridscale X LV Management on May 23, 2024, at Eurelectric’s Power Summit, providing tools for low voltage grid management. This scalable SaaS solution enhances grid flexibility, reduces outages by 30%, and accelerates grid digitalization within 12 weeks, meeting shifting industry needs.

The United States is a key regional market and is driven by the rapid modernization of aging power infrastructure and adoption of renewable energy sources. The integration of decentralized energy systems, such as solar panels and wind turbines, requires advanced switchgear to efficiently manage complex power flows. Regulatory initiatives promoting sustainability and energy efficiency further encourage the adoption of eco-friendly technologies. Smart grid systems and IoT-enabled devices are strengthening demand for intelligent switchgear with real-time monitoring and control capabilities. On September 19, 2024, the Congressional Grid Innovation Expo, hosted by NEMA and GridWise Alliance, showcased cutting-edge technologies for modernizing the U.S. electric grid. Featuring leaders like Reps. Latta and Strickland, the event highlighted innovations in EV charging, energy storage, and resilience. Additionally, rapid urbanization and industrial growth expand the market's applications, supporting diverse energy distribution needs.

Low Voltage Switchgear Market Trends:

Increasing Adoption of Smart Switchgear

Smart low-voltage switchgear, according to Schneider Electric, has been adopted increasingly due to the increasing demand for digital solutions and IoT integration. Such smart switchgear enables real-time monitoring, predictive maintenance, and remote control of the systems to optimize energy efficiency and minimize unplanned downtime. The advanced systems are thus gaining wide adoption in manufacturing, data centers, and utilities. For instance, Schneider Electric's EcoStruxure Power solutions integrate smart switchgear that offers actionable insights through cloud-based platforms, allowing users to monitor energy consumption and enhance performance. Smart switchgear also reduces overall energy costs by identifying inefficiencies and enabling load balancing. With the growing trend of sustainability and energy optimization, smart solutions will continue to gain adoption. Ability to enhance the reliability of a system as well as provide predictive analytics for maintenance puts the smart low-voltage switchgear at the center of this modern electrical infrastructure. Moreover, as reported by IEA news, funding for smart grids must increase more than twofold by 2030 to align with the Net Zero Emissions by 2050 (NZE) Scenario, particularly in emerging markets and developing economies (EMDEs). All these factors will boost the low voltage switchgear market growth.

Rise in Renewable Energy Integration

Increased emphasis on renewable energy is greatly augmenting the low-voltage switchgear market demand for seamless integration within grids. As more use is made of solar, wind power, and other sources of renewables, efficient electrical distribution and grid stability are important measures in maintaining reliability. The International Renewable Energy Agency, IRENA, reported that the renewable energy capacity increased by 9.1% in 2022, which reached 3,385 GW in the whole world, hence emphasizing the need for advanced electrical systems. Examples of low-voltage solutions are ABB's custom low-voltage switchgears designed for specific applications around renewable energy, such as a solar inverter and storage batteries. These solutions ensure safe and reliable power distribution, addressing fluctuations inherent to renewable energy sources. With the scale-up of renewable energy projects globally, there is a growing need for strong and cost-effective switchgear systems to support grid modernization. The integration of advanced protection and automation technologies further enhances the reliability of renewable energy infrastructure. With global initiatives promoting clean energy transitions, low-voltage switchgear will remain important in enabling renewable energy deployment while ensuring safety and efficient power distribution.

Rising Focus on Safety and Compliance

Safety and compliance are crucial drivers boosting the expansion of the low voltage switchgear market share. Numerous industries are exposed to regulations that protect assets, employee lives, and electrical infrastructure as a whole from potential damage through arc faults and short circuits among others. SENTRON low voltage switchgear by Siemens is designed on global safety standards, thus coming with better arc fault protection systems and overload protection. For example, its advanced circuit protection technology minimizes downtime and prevents costly equipment damage. This makes it ideal for high-risk industrial environments. The increasing emphasis on safety at work and compliance with regulation in manufacturing, utilities, and commercial infrastructure is driving the demand for certified low-voltage switchgear. Organizations are also focusing on solutions offering continuous monitoring, fault detection, and predictive maintenance to improve dependability and mitigate risks. As regulatory frameworks become more stringent globally, demand for compliant and technologically advanced low-voltage switchgear will continue to rise across sectors.

Low Voltage Switchgear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global low voltage switchgear market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, voltage rating, installation, and application.

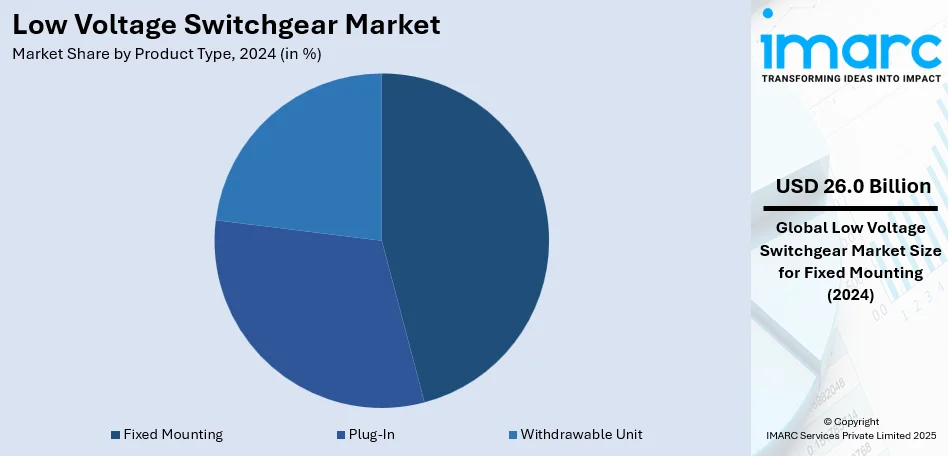

Analysis by Product Type:

- Fixed Mounting

- Plug-In

- Withdrawable Unit

As per the low voltage switchgear market forecast, fixed mounting leads the market with around 45.8% of market share in 2024 due to its cost-effectiveness, simplicity, and widespread adoption across industries. Offering reliable operation and reduced maintenance, it is particularly suited for applications requiring consistent load distribution and minimal reconfiguration. Fixed mounting systems provide enhanced safety, ensuring secure connections and reduced risks of electrical faults. Their compact design and straightforward installation render them ideal for space-constrained environments, including residential, commercial, and industrial settings, further solidifying their position as the leading choice in low voltage switchgear solutions.

Analysis by Voltage Rating:

- Less than 250V

- 250V to 750V

- 751V to 1000V

As per the low voltage switchgear market outlook, the less than 250V segment in the low voltage switchgear market primarily caters to residential and small-scale commercial applications. This voltage range is widely used for powering lighting systems, small appliances, and low-demand electrical devices. Its popularity stems from the growing urbanization and increasing electrification of homes. Compact and cost-effective switchgear solutions in this category offer reliable performance, enhanced safety, and ease of installation, making them a preferred choice for modern residential electrical setups.

The 250V to 750V segment serves diverse applications in industrial, commercial, and medium-scale residential sectors. This range supports machinery, HVAC systems, and other equipment requiring moderate electrical loads. Known for its versatility, switchgear in this category is integral to power distribution networks, ensuring operational efficiency and system reliability. Rising demand for energy-efficient solutions and industrial automation drives the adoption of switchgear within this voltage range.

Switchgear within the 751V to 1000V range caters to high-demand industrial and infrastructure projects, including factories, data centers, and renewable energy installations. This voltage range is critical for ensuring efficient power distribution and protecting systems handling substantial electrical loads. Products in this category are designed to withstand higher stress levels, offering enhanced durability and advanced safety features. The push for renewable energy integration and robust industrial growth further strengthens demand for switchgear in this segment.

Analysis by Installation:

- Indoor

- Outdoor

According to the low voltage switchgear market trends, indoor low voltage switchgear is primarily used in residential, commercial, and industrial settings where equipment is installed within buildings. These systems are designed to offer compact and reliable power distribution, with added protection from environmental factors such as dust, moisture, as well as temperature variations. Indoor switchgear is ideal for space-constrained environments, offering ease of maintenance and installation. Its growing adoption is driven by urbanization, smart building developments, and increasing demand for secure and efficient power management.

Outdoor low voltage switchgear is designed to withstand harsh environmental conditions, making it suitable for applications in power utilities, renewable energy installations, and industrial plants. Built with robust enclosures, these systems provide protection against weather, corrosion, and contaminants, ensuring reliable performance in demanding settings. Outdoor switchgear is crucial for infrastructure projects requiring high-capacity power distribution. The rising focus on renewable energy generation and rural electrification further fueled the demand for durable and efficient outdoor switchgear solutions.

Analysis by Application:

- Substation

- Distribution

- Power Factor Correction

- Sub-Distribution

- Motor Control

Low voltage switchgear in substations plays a critical role in power distribution networks, ensuring safe and efficient management of electrical loads. These systems protect equipment from overcurrent and short circuits while maintaining operational reliability. Substation switchgear is vital for industrial plants, utilities, and large commercial buildings where stable power distribution is essential. Its demand is driven by the expansion of grid infrastructure, increasing industrialization, and the need for reliable energy transmission and distribution systems.

Distribution low voltage switchgear facilitates the reliable transfer of electricity from substations to end users across residential, commercial, and industrial sectors. These systems manage power flow, ensure safety, and protect against electrical faults. Their versatility and adaptability render them essential for modern distribution networks. Rising urbanization, smart grid integration, and increased electrification in rural areas are key factors driving the demand for distribution switchgear, ensuring efficient energy management and improved system reliability.

Power factor correction low voltage switchgear is crucial for optimizing energy efficiency and reducing electrical losses in power systems. These systems regulate reactive power, improve voltage stability, and lower energy costs by enhancing the power factor. Widely used in industries and large commercial facilities, power factor correction switchgear helps businesses comply with energy efficiency regulations. The growing emphasis on sustainability and cost-effective energy usage significantly increased the adoption of these solutions in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 39.9%. The region holds the largest share attributed to rapid urbanization, industrial growth, and increasing electrification across emerging economies in Southeast Asia like China and India. Expanding infrastructure projects, growing renewable energy adoption, and rising demand for energy-efficient solutions drive the region's dominance. Additionally, supportive government initiatives and significant investments in smart grid technologies enhance market growth. The region's robust manufacturing base, coupled with high population density, further augments the need for reliable low voltage power distribution systems.

Key Regional Takeaways:

United States Low Voltage Switchgear Market Analysis

In 2024, the United States held 87.70% of the North America voltage switchgear market. The U.S. low voltage switchgear market is expanding rapidly, with industrial growth and a rise in construction activities in addition to an increasing need for renewable energy. With increasing numbers of commercial, residential, and industrial projects being undertaken, the requirements for advanced electrical systems that distribute power efficiently and safely have been increasing. Concurrently with this, the renewable energy industry has been making important contributions to the increase in the market. According to IEA (Environmental Impact Assessment), in 2023, renewable energy made up about 9% of overall U.S. energy consumption, or 8.2 quads British thermal units. Approximately 39% of overall renewable energy usage in the U.S. comes from the electric power sector, and renewable sources provided 21% of the electricity generated in the U.S. total. This shift toward cleaner energy has led to increased demand for efficient electrical systems to manage the power distribution. As the solar, wind, and other renewable energy sectors advance, the necessity for good, reliable low voltage switchgear solutions to ensure electrical grid stability and safety increases. The prominent companies in the market, such as Eaton and Schneider Electric, are leading the industry with great innovations to meet the shifting energy trends of the government, that are turning to sustainability and energy efficiency.

Europe Low Voltage Switchgear Market Analysis

The low voltage switchgear market in Europe is growing steadily, mainly due to modernization of infrastructure, increasing adoption of renewable energy, and implementation of stringent energy efficiency regulations. According to the European Commission, renewable energy accounted for approximately 44.7% of the EU's electricity generation in 2023, thereby creating demand for new electrical grid infrastructure, including low voltage switchgear. Leaders like Siemens and ABB are making contributions by advancing solutions related to smart grids. Demand for sustainable and energy-efficient products is further accelerating the European Green Deal. Heavy investment in infrastructure upgrade across Europe is also strengthening demand for these technologies. The major factor driving market expansion is the significant investment in electric vehicle infrastructure. Consequently, the European region remains a highly significant player in the worldwide low voltage switchgear market.

Asia Pacific Low Voltage Switchgear Market Analysis

The Asia Pacific low voltage switchgear market is experiencing rapid growth; industrialization, urbanization, and investments in the energy sector are key factors. China accounts for the most significant contributor among the nations due to rapidly growing power infrastructure along with an intense focus on renewable energy. According to an industrial report, in 2023, the total installed electric generation capacity in China reached 2.92 TW, of which renewable sources accounted for 1.26 TW, including wind energy at 376 GW, and solar energy at 425 GW. Renewable sources now account for 53.9% of the total generating capacity in the country and, therefore, underscore this increasing demand for efficient systems such as low voltage switchgear to manage the intake and distribution of renewable power. India is also a leader in the growth of market in the region with massive investment in green energy projects and "Make in India" government initiative to augment the domestic manufacturing and infrastructure of the country. The growing rate of urbanization and energy consumption along with developing smart cities add fuel to the requirement for the modern electrical systems in Asia Pacific. Mitsubishi Electric and LS Electric are developing innovative, energy-efficient switchgear solutions in response to the evolving demand of global and regional players. Strong government support, coupled with increased adoption of renewable energy, keeps Asia Pacific as a pivotal player in the global low voltage switchgear market.

Latin America Low Voltage Switchgear Market Analysis

Latin America's low voltage switchgear market is growing, mainly driven by Brazil, where rising energy demand, renewable energy integration, and grid modernization are key drivers. As per an industry report, Brazil's energy policies are creating significant progress, with renewables accounting for 45% of the country's primary energy demand and hydropower accounting for 80% of electricity generation. However, environmental restrictions are now directing attention towards solar PV, wind, natural gas, and bioenergy, and this generated a demand for efficient power distribution systems such as low voltage switchgear. Solar PV is expected to dominate new energy additions, accounting for 70% of upcoming installations, therefore, advanced switchgear shall be critical in ensuring the stability and management of such distributed energy systems. Moreover, Brazil's auction-based contract mechanism for new generation and transmission capacity further promotes infrastructure investment while increasing demand for reliable and sustainable switchgear solutions. In addition, the country's net zero emission by 2050, as well as reducing 50% of carbon in 2030, further emphasizes the need for efficient energy supply through electrical systems as it adopts its power mix. Further increase in the use of decentralized renewable energy sources and smart grid technologies further intensifies the importance of low voltage switchgear in ensuring more energy efficiency, minimum down time, and a smoother delivery of power. The current scenarios present Brazil and Latin American regions as potential markets for manufacturers of low voltage switchgears.

Middle East and Africa Low Voltage Switchgear Market Analysis

The Middle East and Africa low voltage switchgear market is driven by ongoing development of infrastructure, industrialization, and growing energy sectors. According to the International Trade Administration, Saudi Arabia's vision 2030 initiative includes a total investment of over USD 50 Billion in renewable energy projects, which is resulting in the demand for low-voltage switchgear. South Africa, through its mature energy infrastructure, also fuels market growth. The country's power generation totalled 250 terawatt-hours in 2023. Urbanization in the Middle East, especially in the UAE and Qatar, further promotes demand for electrical solutions both in the construction and the industrial sector. Schneider Electric and ABB are expanding their facilities in the region to meet demand. The policies of the government that enhance energy efficiency also enhance the demand for advanced low voltage switchgear technologies.

Competitive Landscape:

The low voltage switchgear market is highly competitive, characterized by the presence of global and regional players focusing on innovation, sustainability, and advanced technologies. Major companies emphasize integrating Internet of Things (IoT), artificial intelligence (AI), and smart systems into their products to enhance safety, efficiency, and operational flexibility. Key players adopt strategies such as mergers, acquisitions, and partnerships to expand their market reach and technological capabilities. Regional manufacturers focus on cost-effective, customized solutions to meet local demand. The market also witnesses growing investment in renewable energy and smart grid technologies, driving the development of eco-friendly and energy-efficient products. Companies are further strengthening their competitive edge by offering tailored solutions for diverse sectors, including residential, commercial, and industrial applications.

The report provides a comprehensive analysis of the competitive landscape in the low voltage switchgear market with detailed profiles of all major companies, including:

- ABB Ltd

- Alfanar Group

- Chint Group Co. Ltd.

- Eaton Corporation plc

- Fuji Electric Co. Ltd.

- General Electric Company

- Hyosung Corporation

- Larsen & Toubro Ltd

- Mitsubishi Electric Corporation

- Rittal GmbH & Co. KG

- Schneider Electric SE

- Siemens AG

- Terasaki Electric Co. Ltd.

Latest News and Developments:

- November 2024: CHINT Global, Shanghai Baoye announced that they have signed a strategic cooperation agreement focusing on electric power, new energy, and industrial sectors. The companies aim to maximize complementary resources, promote high-quality development, and create mutual benefits, especially in low-carbon and sustainable solutions worldwide.

- November 2024: Eaton announced that they launched the xEnergy Elite low voltage switchgear and motor control and power distribution center designed for loads up to 7500 A and 690 VAC. The solutions offer industrial safety, efficiency, and uptime. They have incorporated advanced arc flash protection, reduced maintenance costs, and supported Super Premium Efficiency motors (IE4) for critical environments.

- August 2024: Mitsubishi Electric and Siemens Energy announced that they have partnered to co-develop DC Switching Stations and DC Circuit Breaker specifications, further enhancing Multi-terminal HVDC systems to improve the efficiency of large-scale renewable energy and global efforts at decarbonization.

- June 2024: Siemens announced that it has invested Euro 100 million (USD 104.99 Million) in the expansion of its Frankfurt switchgear plant, increasing SF6-free 8DAB blue GIS medium-voltage switchgear production. The business will start operations in 2025, aiming to fill global supply gaps driven by high demand for electrical equipment.

- May 2024: L&T Switchgear, now branded as Lauritz Knudsen, committed INR 850 crore (USD 100.11 Million) investment for expanding capabilities in renewable energy and e-mobility solutions. The initiative strengthens its commitment to sustainable power generation through 70 years of legacy.

Low Voltage Switchgear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fixed Mounting, Plug-In, Withdrawable Unit |

| Voltage Ratings Covered | Less than 250V, 250V to 750V, 751V to 1000V |

| Installations Covered | Indoor, Outdoor |

| Applications Covered | Substation, Distribution, Power Factor Correction, Sub-Distribution, Motor Control |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Alfanar Group, Chint Group Co. Ltd., Eaton Corporation plc, Fuji Electric Co. Ltd., General Electric Company, Hyosung Corporation, Larsen & Toubro Ltd, Mitsubishi Electric Corporation, Rittal GmbH & Co. KG, Schneider Electric SE, Siemens AG, Terasaki Electric Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the low voltage switchgear market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global low voltage switchgear market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the low voltage switchgear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Low voltage switchgear refers to a collection of electrical devices designed to regulate, protect, and isolate low voltage power systems (up to 1,000V). It includes components like circuit breakers, fuses, and switches, ensuring safe power distribution in residential, commercial, and industrial applications while protecting equipment from electrical faults.

The low voltage switchgear market was valued at USD 56.77 Billion in 2024.

IMARC Group estimates the market to reach USD 94.83 Billion by 2033, exhibiting a CAGR of 5.87% from 2025-2033.

The global market is primarily driven by rising electricity demand, renewable energy integration, infrastructure development, technological advancements in IoT and AI, and increasing adoption of energy-efficient solutions. Supportive government policies promoting sustainability and investments in smart grid technologies further bolster market growth.

In 2024, fixed mounting represented the largest segment by product type, driven its cost-effectiveness, reliability, and ease of installation.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia-Pacific currently dominates the global market.

In 2024, Asia Pacific accounted for the largest market share of over 39.9%.

Some of the major players in the global low voltage switchgear market include ABB Ltd, Alfanar Group, Chint Group Co. Ltd., Eaton Corporation plc, Fuji Electric Co. Ltd., General Electric Company, Hyosung Corporation, Larsen & Toubro Ltd, Mitsubishi Electric Corporation, Rittal GmbH & Co. KG, Schneider Electric SE, Siemens AG, and Terasaki Electric Co. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)